127b258728cd4b5f94e77d00a219387a.ppt

- Количество слайдов: 35

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /1 “Su Casita” and the Mexican Housing Story Gonzalo Palafox March 2008 Abuja, Nigeria 1

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /2 Contents 1. Mexican Housing Overview 2. Company Overview 3. Housing Sector's Financing Scheme 4. HSC´s Funding Diversification Strategy 5. Financial Overview 6. Su Casita’s Existing Ratings 2

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /3 1. Mexican Housing Overview 3

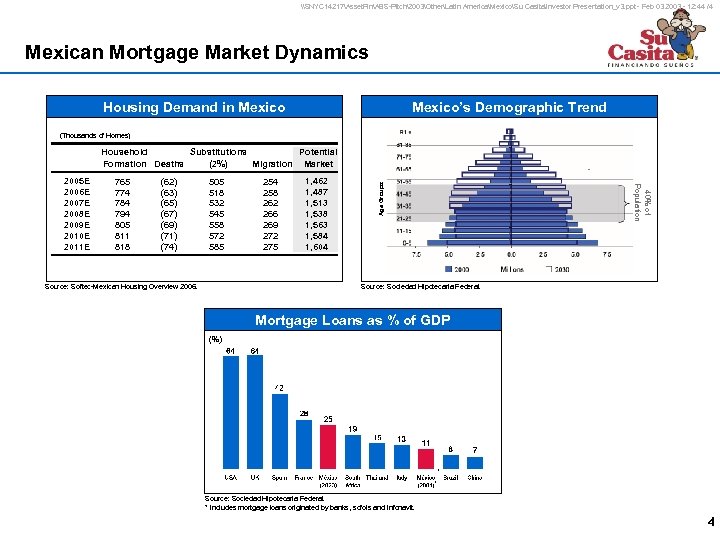

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /4 Mexican Mortgage Market Dynamics Housing Demand in Mexico’s Demographic Trend (Thousands of Homes) 765 774 784 794 805 811 818 (62) (63) (65) (67) (69) (71) (74) 505 518 532 545 558 572 585 Source: Softec-Mexican Housing Overview 2006. 254 258 262 266 269 272 275 1, 462 1, 487 1, 513 1, 538 1, 563 1, 584 1, 604 40% of Population 2005 E 2006 E 2007 E 2008 E 2009 E 2010 E 2011 E Age Groups Household Substitutions Potential Formation Deaths (2%) Migration Market Source: Sociedad Hipotecaria Federal. Mortgage Loans as % of GDP (%) * Source: Sociedad Hipotecaria Federal. * Includes mortgage loans originated by banks, sofols and Infonavit. 4

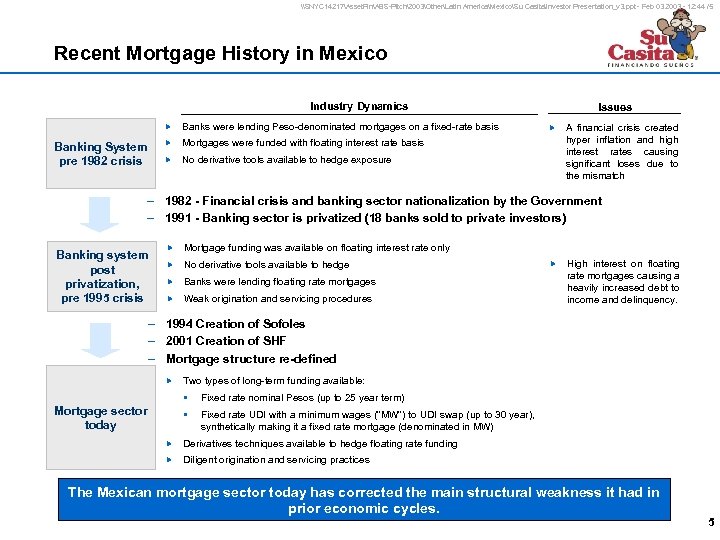

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /5 Recent Mortgage History in Mexico Industry Dynamics Mortgages were funded with floating interest rate basis Banking System pre 1982 crisis Banks were lending Peso-denominated mortgages on a fixed-rate basis Issues No derivative tools available to hedge exposure A financial crisis created hyper inflation and high interest rates causing significant loses due to the mismatch – 1982 - Financial crisis and banking sector nationalization by the Government – 1991 - Banking sector is privatized (18 banks sold to private investors) Banking system post privatization, pre 1995 crisis Mortgage funding was available on floating interest rate only No derivative tools available to hedge Banks were lending floating rate mortgages Weak origination and servicing procedures High interest on floating rate mortgages causing a heavily increased debt to income and delinquency. – 1994 Creation of Sofoles – 2001 Creation of SHF – Mortgage structure re-defined Two types of long-term funding available: § § Mortgage sector today Fixed rate nominal Pesos (up to 25 year term) Fixed rate UDI with a minimum wages (“MW”) to UDI swap (up to 30 year), synthetically making it a fixed rate mortgage (denominated in MW) Derivatives techniques available to hedge floating rate funding Diligent origination and servicing practices The Mexican mortgage sector today has corrected the main structural weakness it had in prior economic cycles. 5

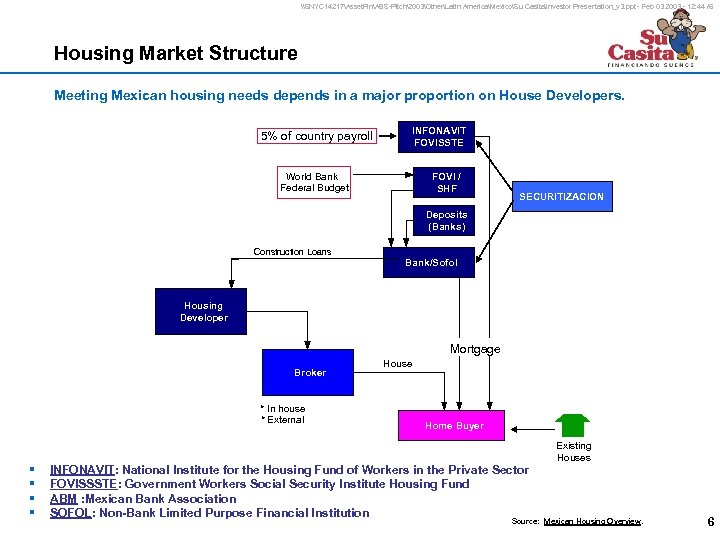

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /6 Housing Market Structure Meeting Mexican housing needs depends in a major proportion on House Developers. 5% of country payroll INFONAVIT FOVISSTE FOVI / SHF World Bank Federal Budget SECURITIZACION Deposits (Banks) Construction Loans Bank/Sofol Housing Developer Mortgage Broker * In house * External § § House Home Buyer INFONAVIT: National Institute for the Housing Fund of Workers in the Private Sector FOVISSSTE: Government Workers Social Security Institute Housing Fund ABM : Mexican Bank Association SOFOL: Non-Bank Limited Purpose Financial Institution Existing Houses Source: Mexican Housing Overview. 6

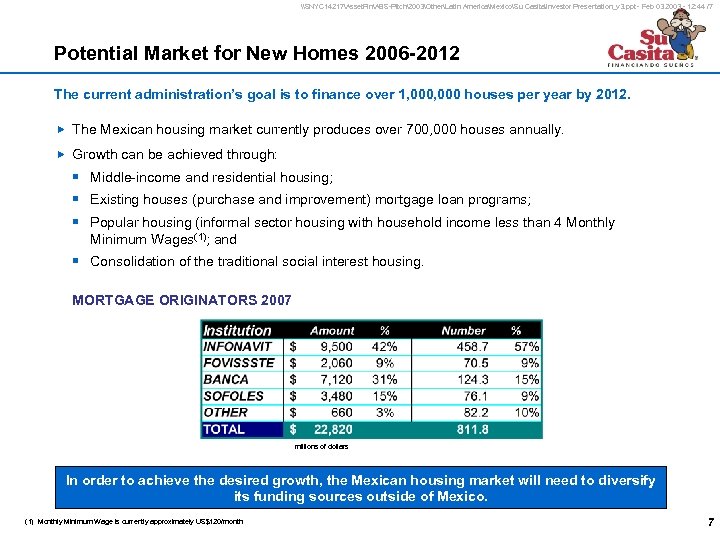

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /7 Potential Market for New Homes 2006 -2012 The current administration’s goal is to finance over 1, 000 houses per year by 2012. The Mexican housing market currently produces over 700, 000 houses annually. Growth can be achieved through: § Middle-income and residential housing; § Existing houses (purchase and improvement) mortgage loan programs; § Popular housing (informal sector housing with household income less than 4 Monthly Minimum Wages(1); and § Consolidation of the traditional social interest housing. MORTGAGE ORIGINATORS 2007 millions of dollars In order to achieve the desired growth, the Mexican housing market will need to diversify its funding sources outside of Mexico. (1) Monthly Minimum Wage is currently approximately US$120/month. 7

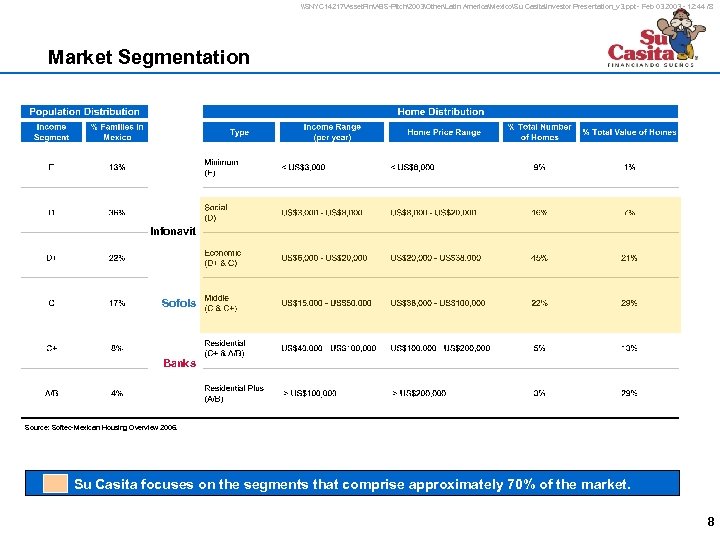

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /8 Market Segmentation Infonavit Sofols Banks Source: Softec-Mexican Housing Overview 2006. Su Casita focuses on the segments that comprise approximately 70% of the market. 8

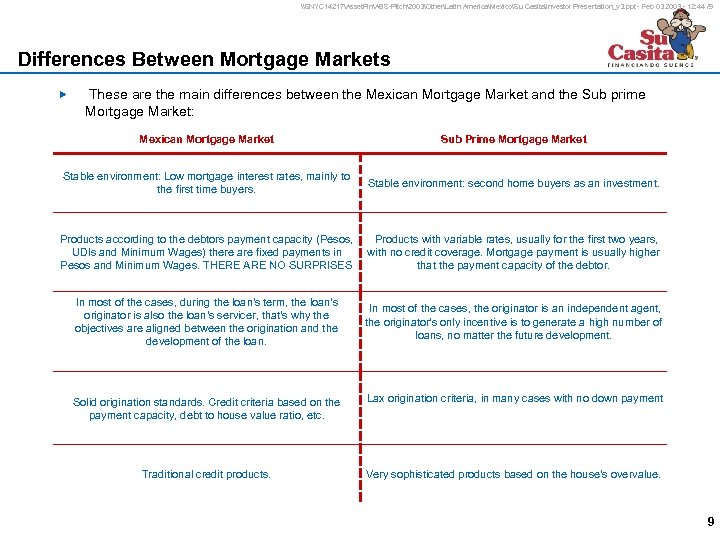

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /9 Differences Between Mortgage Markets These are the main differences between the Mexican Mortgage Market and the Sub prime Mortgage Market: Mexican Mortgage Market Sub Prime Mortgage Market Stable environment: Low mortgage interest rates, mainly to the first time buyers. Stable environment: second home buyers as an investment. Products according to the debtors payment capacity (Pesos, UDIs and Minimum Wages) there are fixed payments in Pesos and Minimum Wages. THERE ARE NO SURPRISES Products with variable rates, usually for the first two years, with no credit coverage. Mortgage payment is usually higher that the payment capacity of the debtor. In most of the cases, during the loan's term, the loan's originator is also the loan's servicer, that's why the objectives are aligned between the origination and the development of the loan. In most of the cases, the originator is an independent agent, the originator's only incentive is to generate a high number of loans, no matter the future development. Solid origination standards. Credit criteria based on the payment capacity, debt to house value ratio, etc. Lax origination criteria, in many cases with no down payment Traditional credit products. Very sophisticated products based on the house's overvalue. 9

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /10 2. Company Overview 10

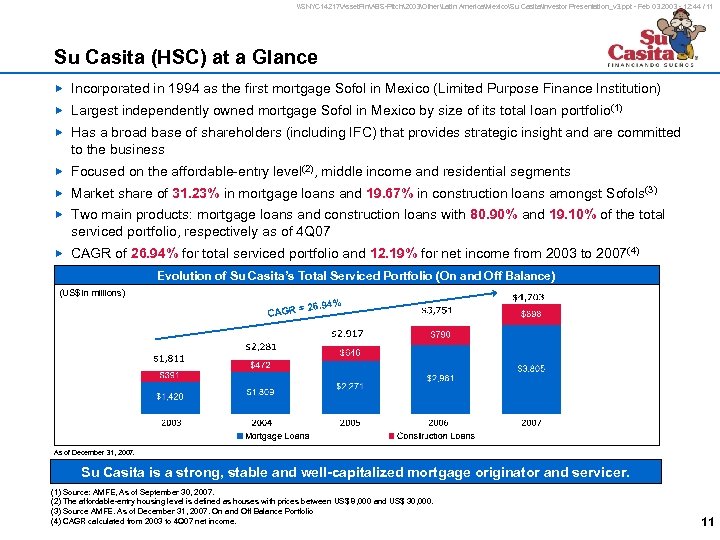

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /11 Su Casita (HSC) at a Glance Incorporated in 1994 as the first mortgage Sofol in Mexico (Limited Purpose Finance Institution) Largest independently owned mortgage Sofol in Mexico by size of its total loan portfolio (1) Has a broad base of shareholders (including IFC) that provides strategic insight and are committed to the business Focused on the affordable-entry level(2), middle income and residential segments Market share of 31. 23% in mortgage loans and 19. 67% in construction loans amongst Sofols(3) Two main products: mortgage loans and construction loans with 80. 90% and 19. 10% of the total serviced portfolio, respectively as of 4 Q 07 CAGR of 26. 94% for total serviced portfolio and 12. 19% for net income from 2003 to 2007(4) Evolution of Su Casita’s Total Serviced Portfolio (On and Off Balance) (US$ in millions) CAGR % = 26. 94 As of December 31, 2007. Su Casita is a strong, stable and well-capitalized mortgage originator and servicer. (1) Source: AMFE, As of September 30, 2007. (2) The affordable-entry housing level is defined as houses with prices between US$ 8, 000 and US$ 30, 000. (3) Source AMFE. As of December 31, 2007. On and Off Balance Portfolio (4) CAGR calculated from 2003 to 4 Q 07 net income. 11

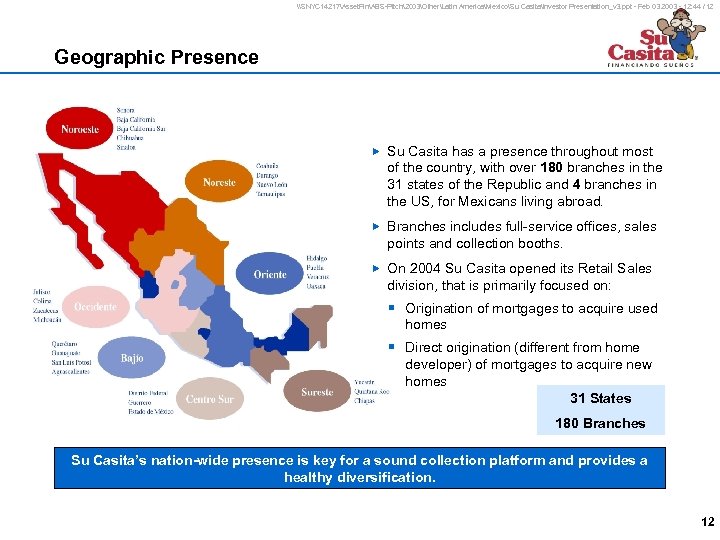

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /12 Geographic Presence Su Casita has a presence throughout most of the country, with over 180 branches in the 31 states of the Republic and 4 branches in the US, for Mexicans living abroad. Branches includes full-service offices, sales points and collection booths. On 2004 Su Casita opened its Retail Sales division, that is primarily focused on: § Origination of mortgages to acquire used homes § Direct origination (different from home developer) of mortgages to acquire new homes 31 States 180 Branches Su Casita’s nation-wide presence is key for a sound collection platform and provides a healthy diversification. 12

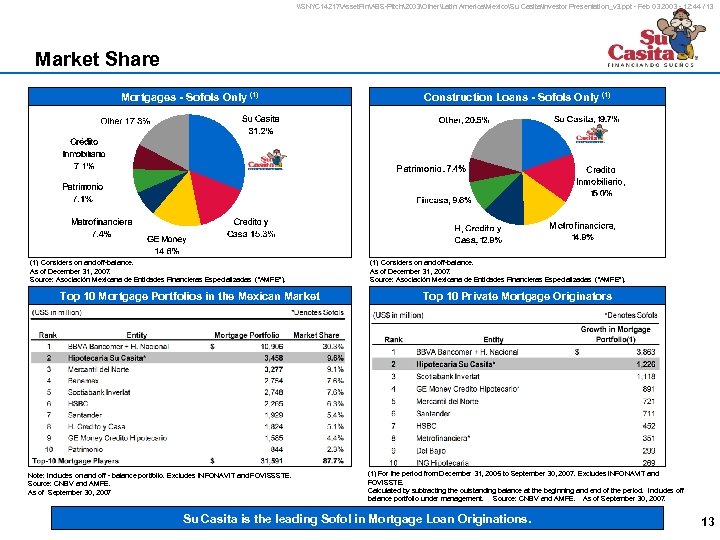

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /13 Market Share Mortgages - Sofols Only (1) Considers on and off-balance. As of December 31, 2007. Source: Asociación Mexicana de Entidades Financieras Especializadas (“AMFE”). Top 10 Mortgage Portfolios in the Mexican Market Note: Includes on and off - balance portfolio. Excludes INFONAVIT and FOVISSSTE. Source: CNBV and AMFE. As of September 30, 2007 Construction Loans - Sofols Only (1) Considers on and off-balance. As of December 31, 2007. Source: Asociación Mexicana de Entidades Financieras Especializadas (“AMFE”). Top 10 Private Mortgage Originators (1) For the period from December 31, 2005 to September 30, 2007. Excludes INFONAVIT and FOVISSTE. Calculated by subtracting the outstanding balance at the beginning and end of the period. Includes off balance portfolio under management. Source: CNBV and AMFE. As of September 30, 2007. Su Casita is the leading Sofol in Mortgage Loan Originations. 13

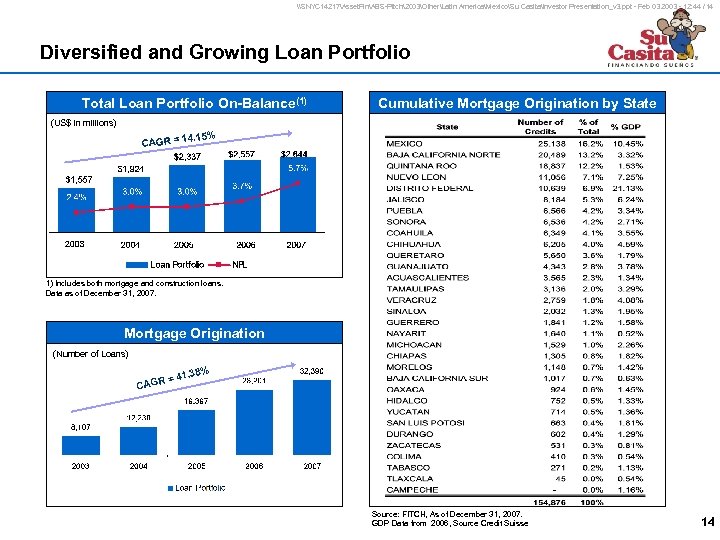

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /14 Diversified and Growing Loan Portfolio Total Loan Portfolio On-Balance(1) Cumulative Mortgage Origination by State (US$ in millions) 4. 15% CAGR = 1 1) Includes both mortgage and construction loans. Data as of December 31, 2007. Mortgage Origination (Number of Loans) = CAGR % 41. 38 Source: FITCH, As of December 31, 2007. GDP Data from 2006, Source Credit Suisse 14

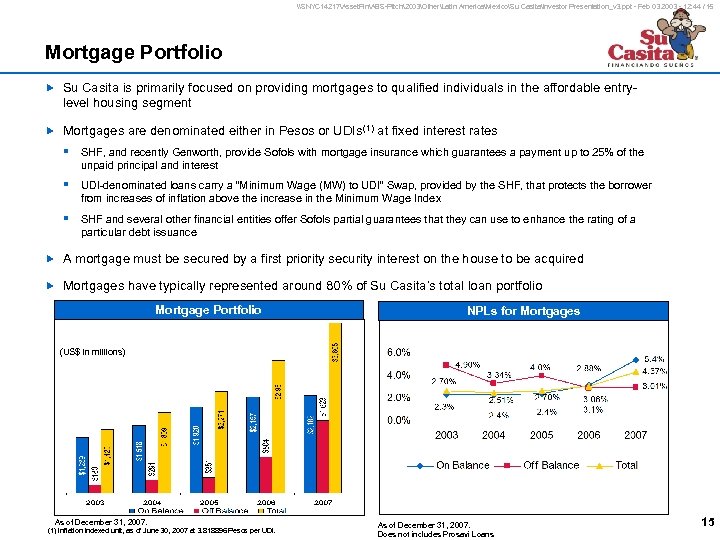

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /15 Mortgage Portfolio Su Casita is primarily focused on providing mortgages to qualified individuals in the affordable entry- level housing segment Mortgages are denominated either in Pesos or UDIs (1) at fixed interest rates § SHF, and recently Genworth, provide Sofols with mortgage insurance which guarantees a payment up to 25% of the unpaid principal and interest § UDI-denominated loans carry a “Minimum Wage (MW) to UDI” Swap, provided by the SHF, that protects the borrower from increases of inflation above the increase in the Minimum Wage Index § SHF and several other financial entities offer Sofols partial guarantees that they can use to enhance the rating of a particular debt issuance A mortgage must be secured by a first priority security interest on the house to be acquired Mortgages have typically represented around 80% of Su Casita’s total loan portfolio Mortgage Portfolio NPLs for Mortgages (US$ in millions) As of December 31, 2007. (1) Inflation indexed unit, as of June 30, 2007 at 3. 818896 Pesos per UDI. As of December 31, 2007. Does not includes Prosavi Loans 15

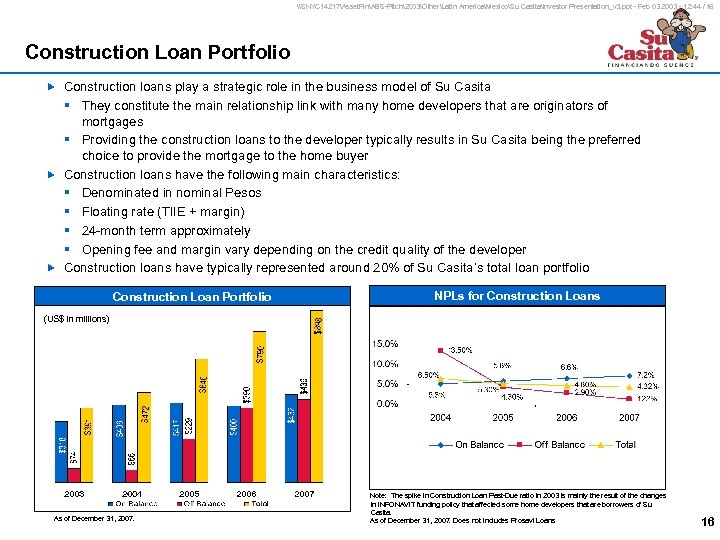

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /16 Construction Loan Portfolio Construction loans play a strategic role in the business model of Su Casita § They constitute the main relationship link with many home developers that are originators of mortgages § Providing the construction loans to the developer typically results in Su Casita being the preferred choice to provide the mortgage to the home buyer Construction loans have the following main characteristics: § Denominated in nominal Pesos § Floating rate (TIIE + margin) § 24 -month term approximately § Opening fee and margin vary depending on the credit quality of the developer Construction loans have typically represented around 20% of Su Casita’s total loan portfolio Construction Loan Portfolio NPLs for Construction Loans (US$ in millions) As of December 31, 2007. Note: The spike in Construction Loan Past-Due ratio in 2003 is mainly the result of the changes in INFONAVIT funding policy that affected some home developers that are borrowers of Su Casita. As of December 31, 2007. Does not includes Prosavi Loans 16

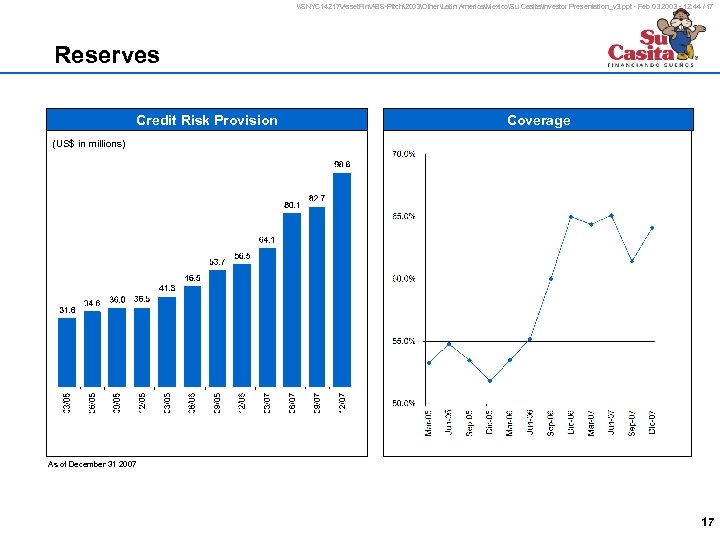

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /17 Reserves Credit Risk Provision Coverage (US$ in millions) As of December 31 2007 17

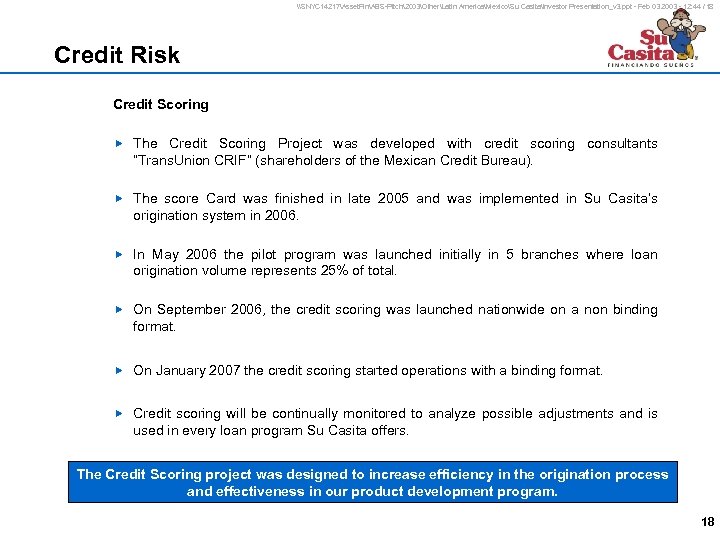

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /18 Credit Risk Credit Scoring The Credit Scoring Project was developed with credit scoring consultants “Trans. Union CRIF” (shareholders of the Mexican Credit Bureau). The score Card was finished in late 2005 and was implemented in Su Casita’s origination system in 2006. In May 2006 the pilot program was launched initially in 5 branches where loan origination volume represents 25% of total. On September 2006, the credit scoring was launched nationwide on a non binding format. On January 2007 the credit scoring started operations with a binding format. Credit scoring will be continually monitored to analyze possible adjustments and is used in every loan program Su Casita offers. The Credit Scoring project was designed to increase efficiency in the origination process and effectiveness in our product development program. 18

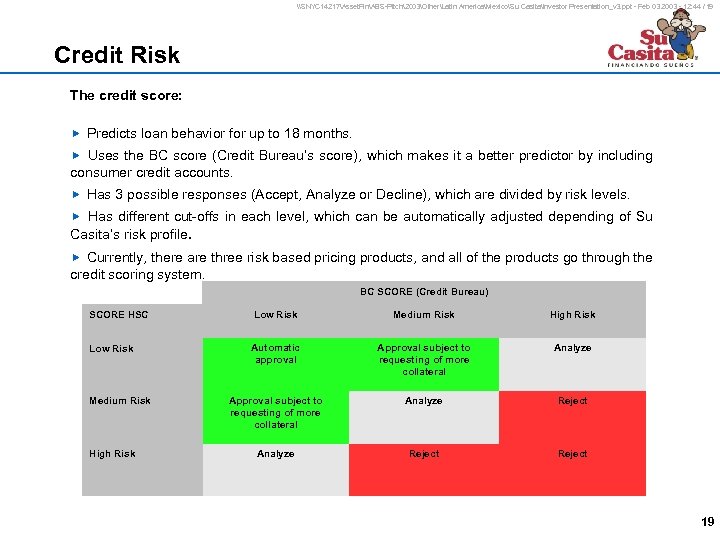

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /19 Credit Risk The credit score: Predicts loan behavior for up to 18 months. Uses the BC score (Credit Bureau’s score), which makes it a better predictor by including consumer credit accounts. Has 3 possible responses (Accept, Analyze or Decline), which are divided by risk levels. Has different cut-offs in each level, which can be automatically adjusted depending of Su Casita’s risk profile. Currently, there are three risk based pricing products, and all of the products go through the credit scoring system. BC SCORE (Credit Bureau) SCORE HSC Low Risk Medium Risk High Risk Low Risk Automatic approval Approval subject to requesting of more collateral Analyze Reject Medium Risk High Risk 19

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /20 Highlights summary Mexican housing sector has very solid fundamentals § Strong demand for housing § Low mortgage penetration as percentage of GDP § Favorable demographic trends Strong, stable and well-positioned company § Largest independently owned Sofol in the country by size of loan portfolio § Strong growth rates, with total serviced loan portfolio CAGR of 26. 94% and number of mortgage loans origination CAGR of 41. 38% since 2003 § Only Sofol with a STRONG servicer rating by S&P, SQ 2 servicer rating from Moody’s and AAFC 1 -(mex) by Fitch (ratings on the global scale) § Achieved critical mass: 156, 209 serviced loans as of 4 Q 07, which provide stable fee income § Nationwide distribution (network of 169 branches as of 4 Q 07) Well-capitalized Sofol § 20. 51% capital adequacy ratio(1), above the regulatory capital requirement(2) § Accurate match (term, currency and type of rate) between loans and funding Best-managed independent Sofol with significant strategic investor § Highly-experienced and capable management team (average of 19 years of experience in the Mexican mortgage sector) § Diversified base of shareholders that provide strategic insight, including Caja Madrid, Grupo Sadasi and Corporacion GEO § Senior management is aligned through a 11. 8% equity stake in the Company Proven access to capital markets with diversified funding § 26. 50% of Su Casita’s outstanding funding is derived from Sociedad Hipotecaria Federal (SHF), as of 4 Q 07 § 67. 2% of mortgage loan portfolio as of 4 Q 07 has been funded through market sources (non-SHF) § First-ever MBS deal in Mexico, first-ever cross-border construction loan securitization, first-ever cross-border mortgage loan securitization, firstever fixed pesos securitization, first-ever structure with a subordinated tranche, first ever time tranching structure (1) (2) As of December 2007 Capital Adequacy Ratio = Total Eligible Capital / Risk Weighted Assets. Definition according to proposed covenant package. Requirement from the Senior Notes Issuance due 2016 20

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /21 3. Housing Sector’s Financing Scheme 21

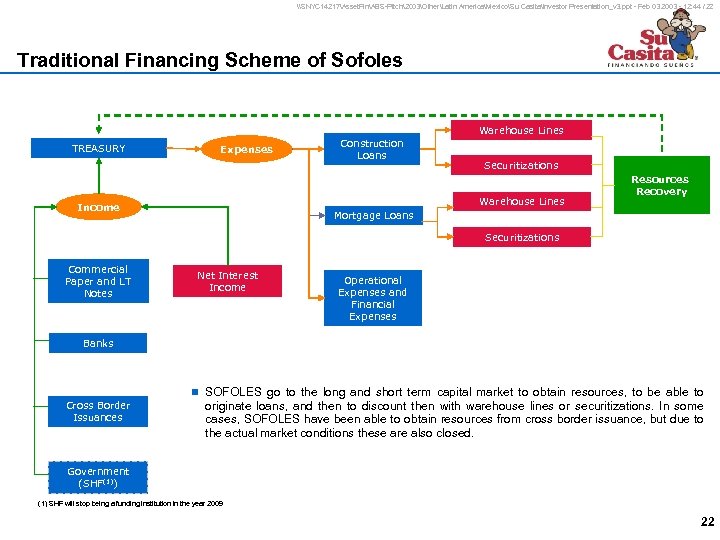

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /22 Traditional Financing Scheme of Sofoles Warehouse Lines TREASURY Expenses Construction Loans Securitizations Warehouse Lines Income Resources Recovery Mortgage Loans Securitizations Commercial Paper and LT Notes Net Interest Income Operational Expenses and Financial Expenses Banks n Cross Border Issuances SOFOLES go to the long and short term capital market to obtain resources, to be able to originate loans, and then to discount then with warehouse lines or securitizations. In some cases, SOFOLES have been able to obtain resources from cross border issuance, but due to the actual market conditions these are also closed. Government (SHF(1)) (1) SHF will stop being a funding institution in the year 2009 22

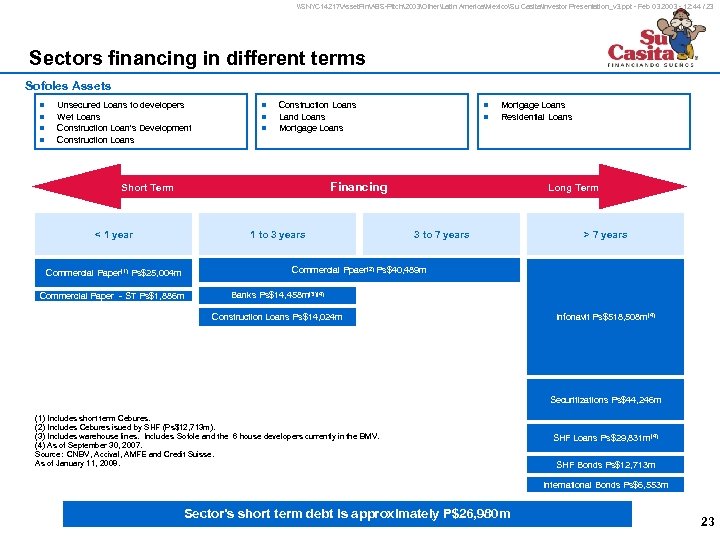

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /23 Sectors financing in different terms Sofoles Assets n n Unsecured Loans to developers Wet Loans Construction Loan's Development Construction Loans n n n Construction Loans Land Loans Mortgage Loans n n Mortgage Loans Residential Loans Financing Short Term < 1 year 1 to 3 years Long Term 3 to 7 years > 7 years Commercial Ppaer(2) Ps$40, 489 m Commercial Paper(1) Ps$25, 004 m Commercial Paper - ST Ps$1, 886 m Banks Ps$14, 458 m(3)(4) Construction Loans Ps$14, 024 m Infonavit Ps$518, 508 m(4) Securitizations Ps$44, 246 m (1) Includes short term Cebures. (2) Includes Cebures isued by SHF (Ps$12, 713 m). (3) Includes warehouse lines. Includes Sofole and the 6 house developers currently in the BMV. (4) As of September 30, 2007. Source: CNBV, Accival, AMFE and Credit Suisse. As of January 11, 2008. SHF Loans Ps$29, 831 m(4) SHF Bonds Ps$12, 713 m International Bonds Ps$6, 553 m Sector's short term debt is approximately P$26, 980 m 23

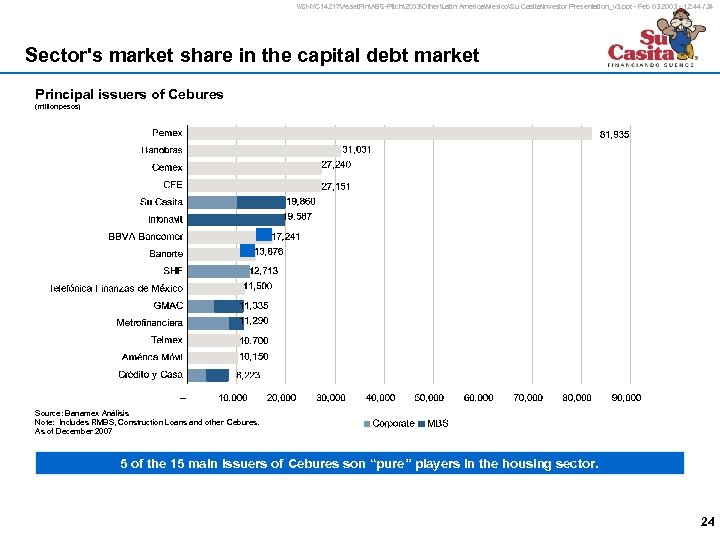

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /24 Sector's market share in the capital debt market Principal issuers of Cebures (million pesos) Source: Banamex Análisis Note: Includes RMBS, Construction Loans and other Cebures. As of December 2007 5 of the 15 main issuers of Cebures son “pure” players in the housing sector. 24

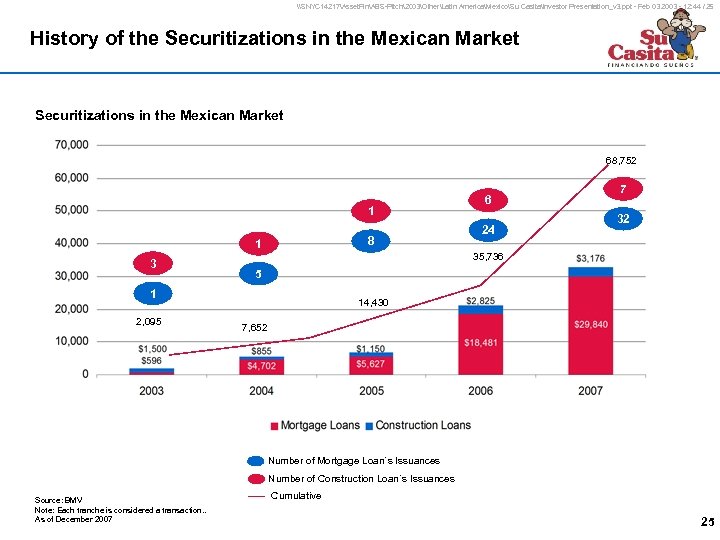

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /25 History of the Securitizations in the Mexican Market 68, 752 1 8 1 3 24 7 32 35, 736 5 1 2, 095 6 14, 430 7, 652 Number of Mortgage Loan´s Issuances Number of Construction Loan´s Issuances Source: BMV Note: Each tranche is considered a transaction. . As of December 2007 Cumulative 25

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /26 4. HSC’s Funding Diversification Strategy 26

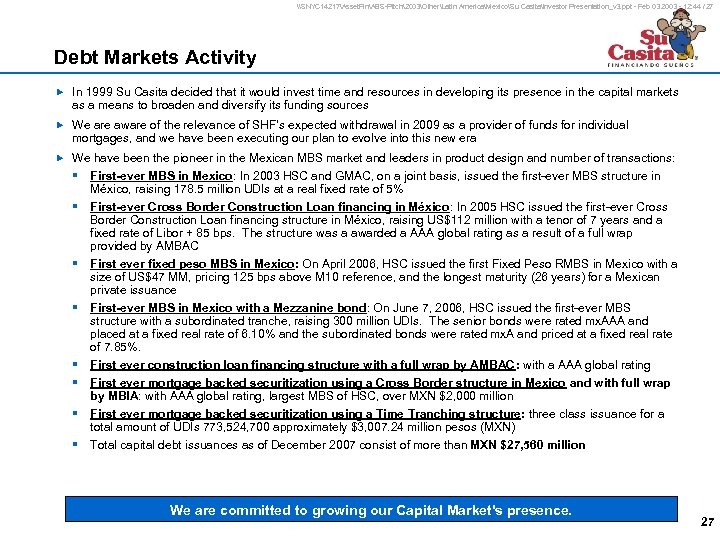

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /27 Debt Markets Activity In 1999 Su Casita decided that it would invest time and resources in developing its presence in the capital markets as a means to broaden and diversify its funding sources We are aware of the relevance of SHF’s expected withdrawal in 2009 as a provider of funds for individual mortgages, and we have been executing our plan to evolve into this new era We have been the pioneer in the Mexican MBS market and leaders in product design and number of transactions: § First-ever MBS in Mexico: In 2003 HSC and GMAC, on a joint basis, issued the first-ever MBS structure in § § § § México, raising 178. 5 million UDIs at a real fixed rate of 5% First-ever Cross Border Construction Loan financing in México: In 2005 HSC issued the first-ever Cross Border Construction Loan financing structure in México, raising US$112 million with a tenor of 7 years and a fixed rate of Libor + 85 bps. The structure was a awarded a AAA global rating as a result of a full wrap provided by AMBAC First ever fixed peso MBS in Mexico: On April 2006, HSC issued the first Fixed Peso RMBS in Mexico with a size of US$47 MM, pricing 125 bps above M 10 reference, and the longest maturity (26 years) for a Mexican private issuance First-ever MBS in Mexico with a Mezzanine bond: On June 7, 2006, HSC issued the first-ever MBS structure with a subordinated tranche, raising 300 million UDIs. The senior bonds were rated mx. AAA and placed at a fixed real rate of 6. 10% and the subordinated bonds were rated mx. A and priced at a fixed real rate of 7. 85%. First ever construction loan financing structure with a full wrap by AMBAC: with a AAA global rating First ever mortgage backed securitization using a Cross Border structure in Mexico and with full wrap by MBIA: with AAA global rating, largest MBS of HSC, over MXN $2, 000 million First ever mortgage backed securitization using a Time Tranching structure: three class issuance for a total amount of UDIs 773, 524, 700 approximately $3, 007. 24 million pesos (MXN) Total capital debt issuances as of December 2007 consist of more than MXN $27, 560 million We are committed to growing our Capital Market's presence. 27

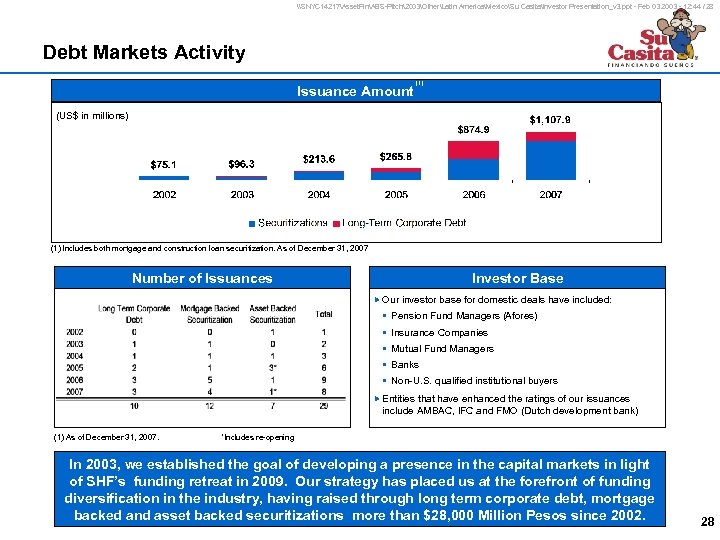

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /28 Debt Markets Activity Issuance Amount (1) (US$ in millions) (1) Includes both mortgage and construction loan securitization. As of December 31, 2007 Number of Issuances Investor Base Our investor base for domestic deals have included: § § § Pension Fund Managers (Afores) Insurance Companies Mutual Fund Managers Banks Non-U. S. qualified institutional buyers Entities that have enhanced the ratings of our issuances include AMBAC, IFC and FMO (Dutch development bank) (1) As of December 31, 2007. *Includes re-opening In 2003, we established the goal of developing a presence in the capital markets in light of SHF’s funding retreat in 2009. Our strategy has placed us at the forefront of funding diversification in the industry, having raised through long term corporate debt, mortgage backed and asset backed securitizations more than $28, 000 Million Pesos since 2002. 28

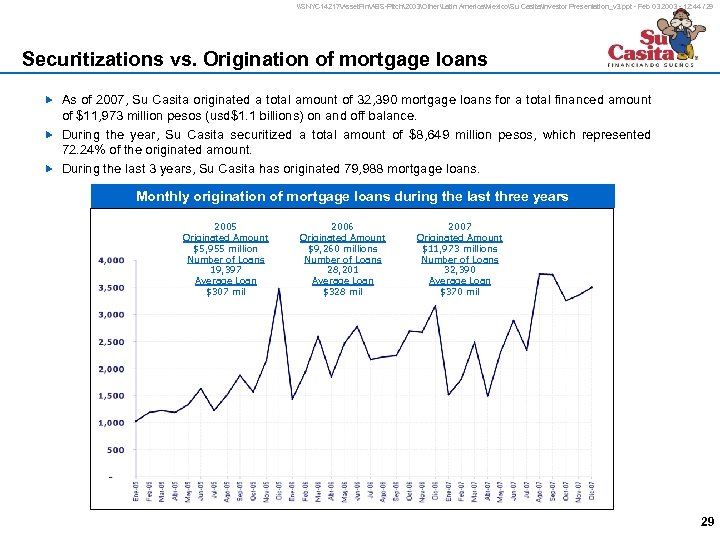

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /29 Securitizations vs. Origination of mortgage loans (1) As of 2007, Su Casita originated a total amount of 32, 390 mortgage loans for a total financed amount of $11, 973 million pesos (usd$1. 1 billions) on and off balance. During the year, Su Casita securitized a total amount of $8, 649 million pesos, which represented 72. 24% of the originated amount. During the last 3 years, Su Casita has originated 79, 988 mortgage loans. Monthly origination of mortgage loans during the last three years 2005 Originated Amount $5, 955 million Number of Loans 19, 397 Average Loan $307 mil 2006 Originated Amount $9, 260 millions Number of Loans 28, 201 Average Loan $328 mil 2007 Originated Amount $11, 973 millions Number of Loans 32, 390 Average Loan $370 mil 29

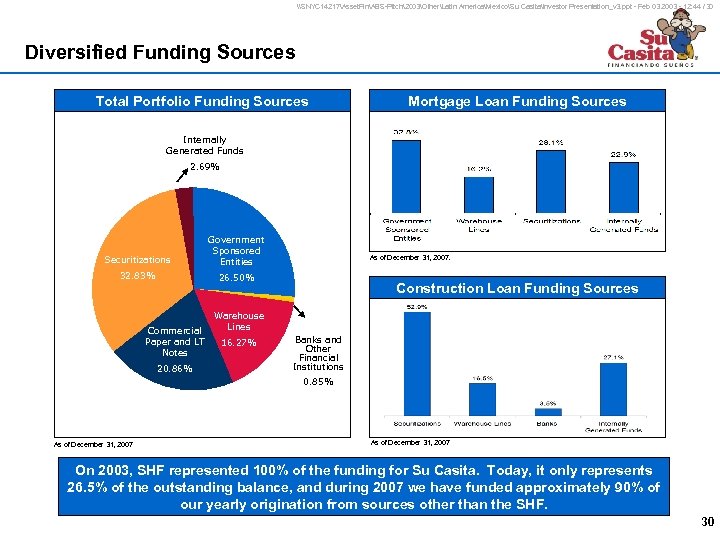

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /30 Diversified Funding Sources Total Portfolio Funding Sources Mortgage Loan Funding Sources Internally Generated Funds 2. 69% Securitizations Government Sponsored Entities 32. 83% 26. 50% Commercial Paper and LT Notes 20. 86% As of December 31, 2007. Construction Loan Funding Sources Warehouse Lines 16. 27% Banks and Other Financial Institutions 0. 85% As of December 31, 2007 On 2003, SHF represented 100% of the funding for Su Casita. Today, it only represents 26. 5% of the outstanding balance, and during 2007 we have funded approximately 90% of our yearly origination from sources other than the SHF. 30

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /31 5. Financial Overview 31

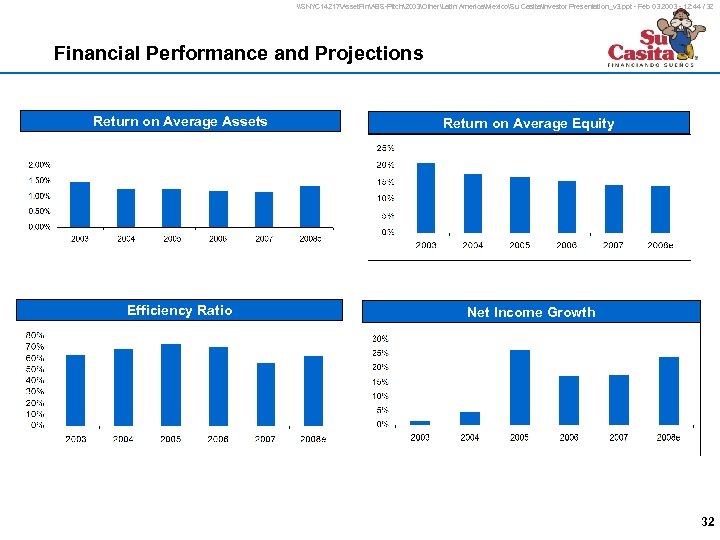

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /32 Financial Performance and Projections Return on Average Assets Return on Average Equity Efficiency Ratio Net Income Growth 32

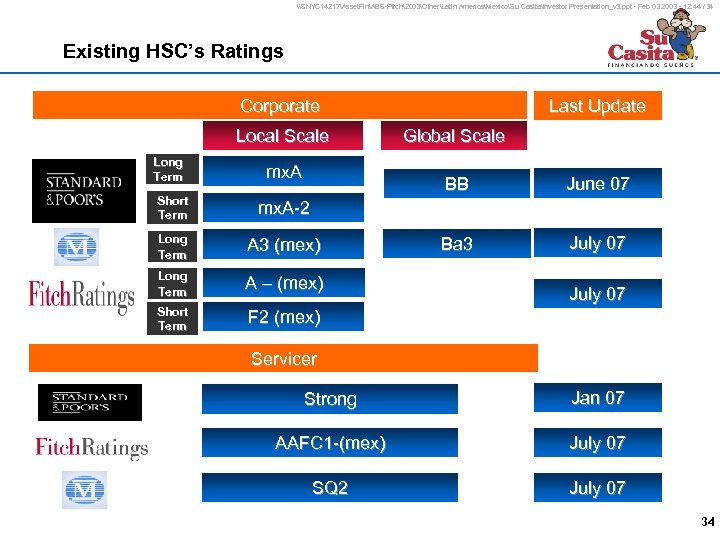

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /33 6. Existing Ratings 33

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /34 Existing HSC’s Ratings Last Update Corporate Local Scale Long Term mx. A Global Scale BB Short Term A 3 (mex) Long Term A – (mex) Short Term Ba 3 July 07 mx. A-2 Long Term June 07 F 2 (mex) July 07 Servicer Strong Jan 07 AAFC 1 -(mex) July 07 SQ 2 July 07 34

\SNYC 14217Asset. FinABS-Pitch2003OtherLatin AmericaMexicoSu CasitaInvestor Presentation_v 3. ppt - Feb 03 2003 - 12: 44 /35 35

127b258728cd4b5f94e77d00a219387a.ppt