SNOWSPORT final.pptx

- Количество слайдов: 14

SNOWSPORT MEETING Annecy Nov 16 th 2015

SNOWSPORT MEETING Annecy Nov 16 th 2015

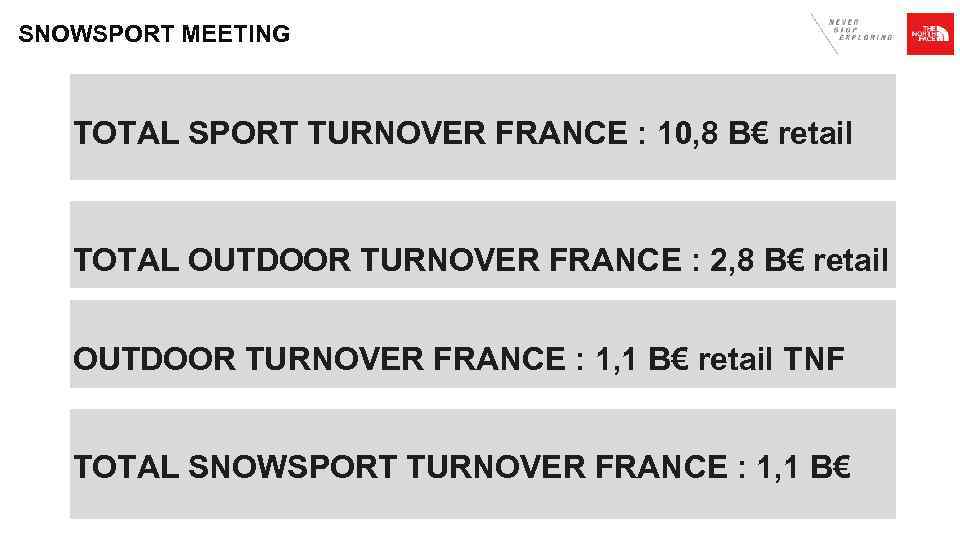

SNOWSPORT MEETING TOTAL SPORT TURNOVER FRANCE : 10, 8 B€ retail TOTAL OUTDOOR TURNOVER FRANCE : 2, 8 B€ retail OUTDOOR TURNOVER FRANCE : 1, 1 B€ retail TNF TOTAL SNOWSPORT TURNOVER FRANCE : 1, 1 B€

SNOWSPORT MEETING TOTAL SPORT TURNOVER FRANCE : 10, 8 B€ retail TOTAL OUTDOOR TURNOVER FRANCE : 2, 8 B€ retail OUTDOOR TURNOVER FRANCE : 1, 1 B€ retail TNF TOTAL SNOWSPORT TURNOVER FRANCE : 1, 1 B€

SNOWSPORT MEETING TOTAL SNOWSPORT TURNOVER FRANCE : 1, 1 B€ retail TOTAL HARD GOOD TURNOVER FRANCE : 800 M€ retail TOTAL APPAREL TURNOVER FRANCE : 300 M€ retail

SNOWSPORT MEETING TOTAL SNOWSPORT TURNOVER FRANCE : 1, 1 B€ retail TOTAL HARD GOOD TURNOVER FRANCE : 800 M€ retail TOTAL APPAREL TURNOVER FRANCE : 300 M€ retail

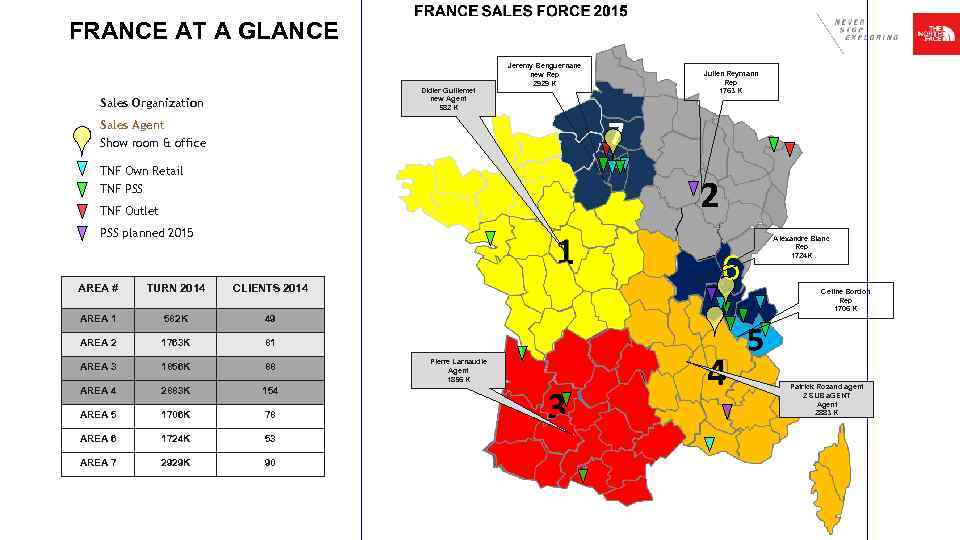

FRANCE AT A GLANCE Didier Guillemet new Agent 582 K Sales Organization Jeremy Benguernane new Rep 2929 K Julien Reymann Rep 1763 K Sales Agent Show room & office TNF Own Retail TNF PSS TNF Outlet PSS planned 2015 Alexandre Blanc Rep 1724 K AREA # TURN 2014 CLIENTS 2014 AREA 1 582 K 49 AREA 2 1763 K 81 AREA 3 1856 K 88 AREA 4 2883 K 154 AREA 5 1706 K 78 AREA 6 1724 K 53 AREA 7 2929 K 90 Celine Bordon Rep 1706 K Pierre Larnaudie Agent 1856 K Patrick Rozand agent 2 SUB a. GENT Agent 2883 K

FRANCE AT A GLANCE Didier Guillemet new Agent 582 K Sales Organization Jeremy Benguernane new Rep 2929 K Julien Reymann Rep 1763 K Sales Agent Show room & office TNF Own Retail TNF PSS TNF Outlet PSS planned 2015 Alexandre Blanc Rep 1724 K AREA # TURN 2014 CLIENTS 2014 AREA 1 582 K 49 AREA 2 1763 K 81 AREA 3 1856 K 88 AREA 4 2883 K 154 AREA 5 1706 K 78 AREA 6 1724 K 53 AREA 7 2929 K 90 Celine Bordon Rep 1706 K Pierre Larnaudie Agent 1856 K Patrick Rozand agent 2 SUB a. GENT Agent 2883 K

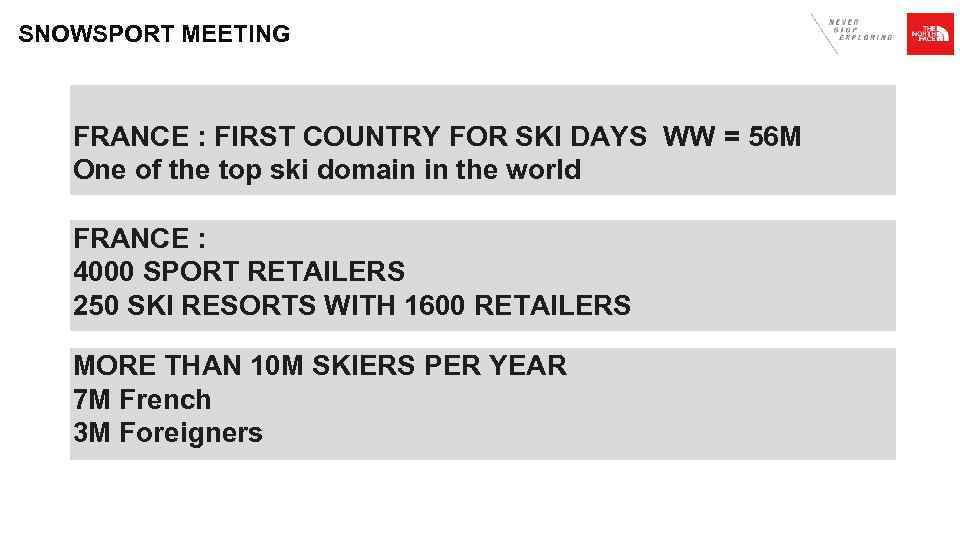

SNOWSPORT MEETING FRANCE : FIRST COUNTRY FOR SKI DAYS WW = 56 M One of the top ski domain in the world FRANCE : 4000 SPORT RETAILERS 250 SKI RESORTS WITH 1600 RETAILERS MORE THAN 10 M SKIERS PER YEAR 7 M French 3 M Foreigners

SNOWSPORT MEETING FRANCE : FIRST COUNTRY FOR SKI DAYS WW = 56 M One of the top ski domain in the world FRANCE : 4000 SPORT RETAILERS 250 SKI RESORTS WITH 1600 RETAILERS MORE THAN 10 M SKIERS PER YEAR 7 M French 3 M Foreigners

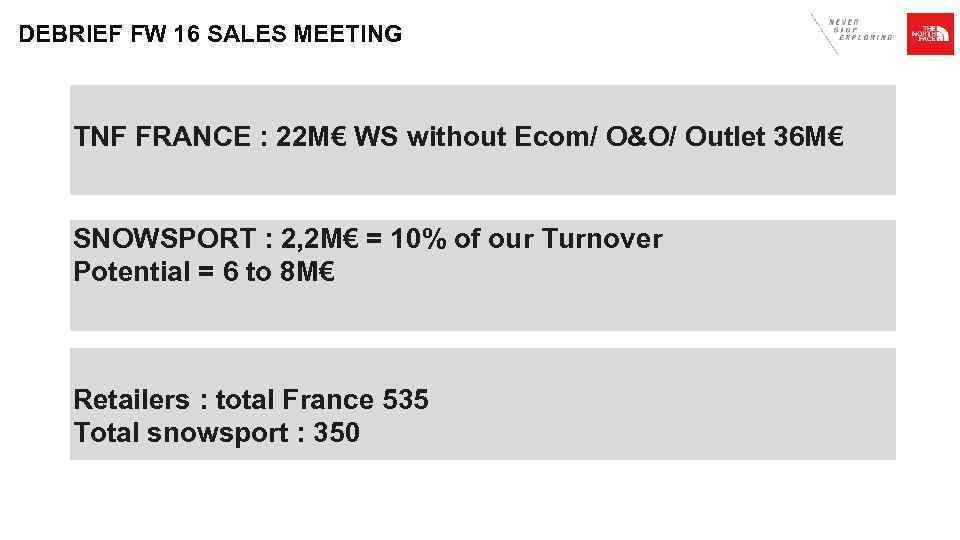

DEBRIEF FW 16 SALES MEETING TNF FRANCE : 22 M€ WS without Ecom/ O&O/ Outlet 36 M€ SNOWSPORT : 2, 2 M€ = 10% of our Turnover Potential = 6 to 8 M€ Retailers : total France 535 Total snowsport : 350

DEBRIEF FW 16 SALES MEETING TNF FRANCE : 22 M€ WS without Ecom/ O&O/ Outlet 36 M€ SNOWSPORT : 2, 2 M€ = 10% of our Turnover Potential = 6 to 8 M€ Retailers : total France 535 Total snowsport : 350

SNOWSPORT MEETING TNF FRANCE : STRONG PSS NETWORK WITH 21 STORES 30% of total turnover LOCATED IN THE MAIN CITIES 16 including key alps cities LOCATED IN THE MAIN PREMIUM SKI RESORT 5 Val d’Isere/ Val Thorens/ Les Arcs/ Tignes / La Clusaz 10 PSS to come in ski resort 20 PSS in scond cities

SNOWSPORT MEETING TNF FRANCE : STRONG PSS NETWORK WITH 21 STORES 30% of total turnover LOCATED IN THE MAIN CITIES 16 including key alps cities LOCATED IN THE MAIN PREMIUM SKI RESORT 5 Val d’Isere/ Val Thorens/ Les Arcs/ Tignes / La Clusaz 10 PSS to come in ski resort 20 PSS in scond cities

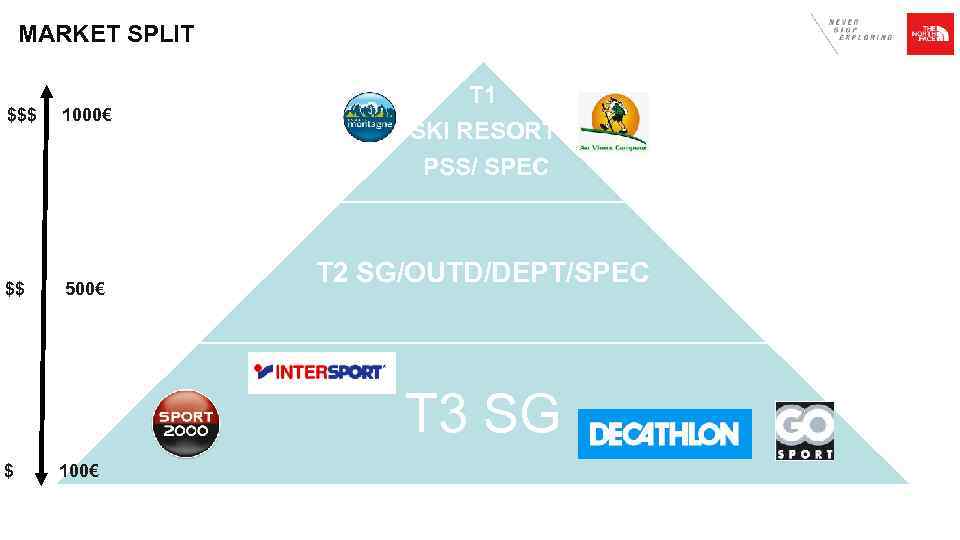

MARKET SPLIT $$$ 1000€ $$ 500€ T 1 SKI RESORT PSS/ SPEC T 2 SG/OUTD/DEPT/SPEC T 3 SG $ 100€

MARKET SPLIT $$$ 1000€ $$ 500€ T 1 SKI RESORT PSS/ SPEC T 2 SG/OUTD/DEPT/SPEC T 3 SG $ 100€

SNOWSPORT MEETING Key Highlights • • • • Huge potential for this category Missing clear development in steep to compet again main Freeski brands Missing clear range breakdown base on technology and features Missing female range with feminine detail Focus needed on attention to details and perceived value Alpine should be splited in 3 parts ( racing / Classic / Modern) Missing Goretex models, more stretch fabric The main topic for us is the design differenciation between a 299 and 499 model Our alpin line looks the same to really enable us to get the best business out of the due to overlaps Missing top price point between 400€ and 800€ in Alpine Kid and Junior missing but we need to be at teh right price High end but not outpriced Ascential is also key for all our stores , Our offer is not competitive anymore Under performing KA’s and startegic account very price sentitive Fit has to be considered as an absolute need even more in Women Missing industry program Trade brands development( Wedze, Mac Kinley, Wanabee etc)

SNOWSPORT MEETING Key Highlights • • • • Huge potential for this category Missing clear development in steep to compet again main Freeski brands Missing clear range breakdown base on technology and features Missing female range with feminine detail Focus needed on attention to details and perceived value Alpine should be splited in 3 parts ( racing / Classic / Modern) Missing Goretex models, more stretch fabric The main topic for us is the design differenciation between a 299 and 499 model Our alpin line looks the same to really enable us to get the best business out of the due to overlaps Missing top price point between 400€ and 800€ in Alpine Kid and Junior missing but we need to be at teh right price High end but not outpriced Ascential is also key for all our stores , Our offer is not competitive anymore Under performing KA’s and startegic account very price sentitive Fit has to be considered as an absolute need even more in Women Missing industry program Trade brands development( Wedze, Mac Kinley, Wanabee etc)

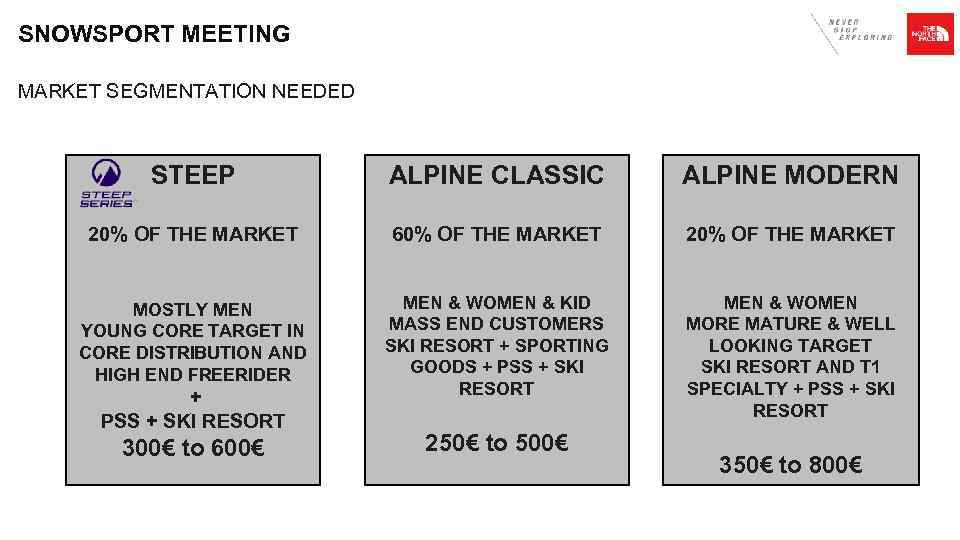

SNOWSPORT MEETING MARKET SEGMENTATION NEEDED STEEP ALPINE CLASSIC ALPINE MODERN 20% OF THE MARKET 60% OF THE MARKET 20% OF THE MARKET MOSTLY MEN YOUNG CORE TARGET IN CORE DISTRIBUTION AND HIGH END FREERIDER MEN & WOMEN & KID MASS END CUSTOMERS SKI RESORT + SPORTING GOODS + PSS + SKI RESORT MEN & WOMEN MORE MATURE & WELL LOOKING TARGET SKI RESORT AND T 1 SPECIALTY + PSS + SKI RESORT 300€ to 600€ 250€ to 500€ 350€ to 800€

SNOWSPORT MEETING MARKET SEGMENTATION NEEDED STEEP ALPINE CLASSIC ALPINE MODERN 20% OF THE MARKET 60% OF THE MARKET 20% OF THE MARKET MOSTLY MEN YOUNG CORE TARGET IN CORE DISTRIBUTION AND HIGH END FREERIDER MEN & WOMEN & KID MASS END CUSTOMERS SKI RESORT + SPORTING GOODS + PSS + SKI RESORT MEN & WOMEN MORE MATURE & WELL LOOKING TARGET SKI RESORT AND T 1 SPECIALTY + PSS + SKI RESORT 300€ to 600€ 250€ to 500€ 350€ to 800€

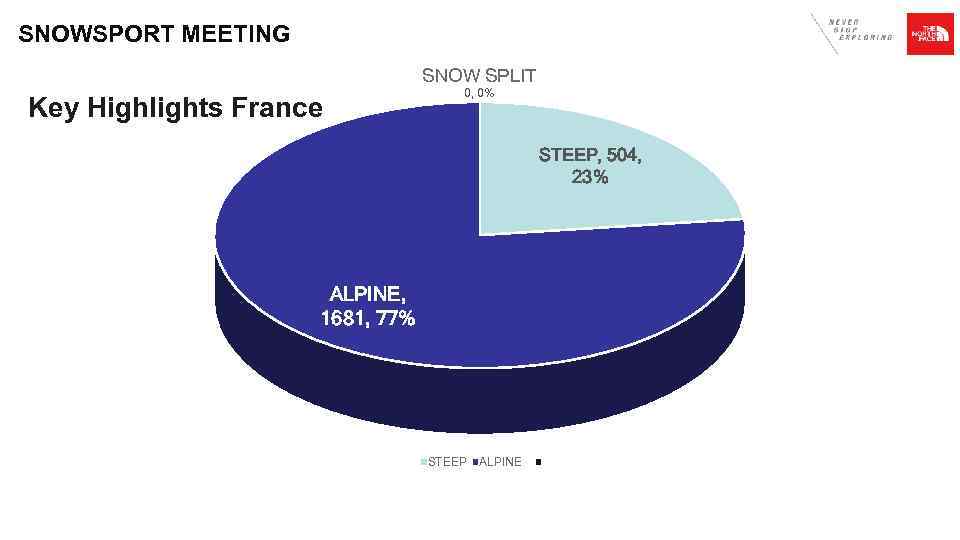

SNOWSPORT MEETING SNOW SPLIT Key Highlights France 0, 0% STEEP, 504, 23% ALPINE, 1681, 77% STEEP ALPINE

SNOWSPORT MEETING SNOW SPLIT Key Highlights France 0, 0% STEEP, 504, 23% ALPINE, 1681, 77% STEEP ALPINE

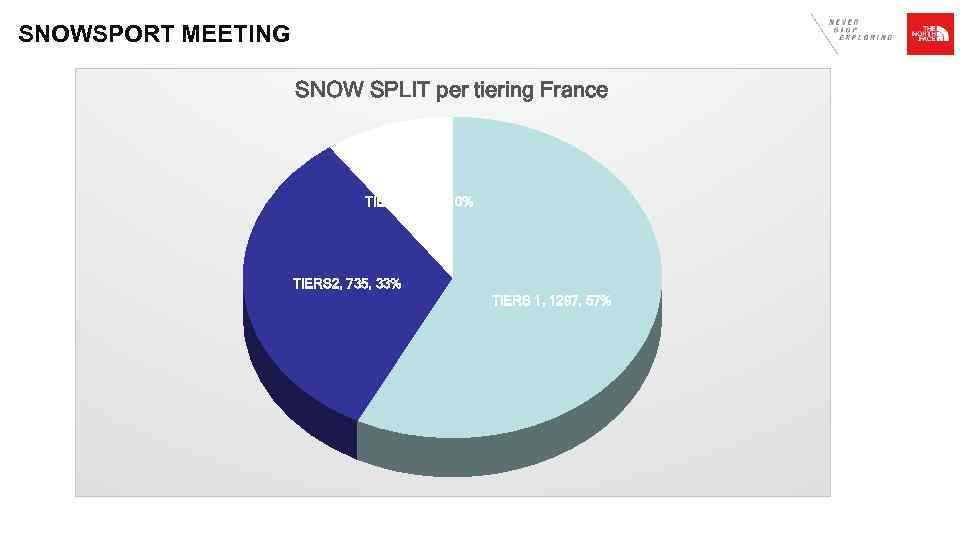

SNOWSPORT MEETING Key Highlights SNOW SPLIT per tiering France TIERS 3, 224, 10% TIERS 2, 735, 33% TIERS 1, 1297, 57%

SNOWSPORT MEETING Key Highlights SNOW SPLIT per tiering France TIERS 3, 224, 10% TIERS 2, 735, 33% TIERS 1, 1297, 57%

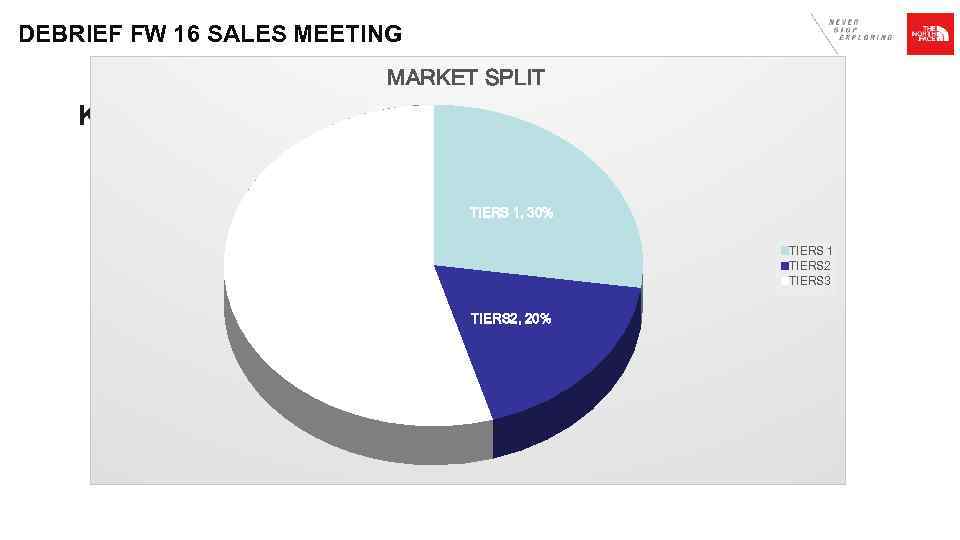

DEBRIEF FW 16 SALES MEETING MARKET SPLIT Key Highlights TIERS 1, 30% TIERS 1 TIERS 2 TIERS 3, 60% TIERS 2, 20%

DEBRIEF FW 16 SALES MEETING MARKET SPLIT Key Highlights TIERS 1, 30% TIERS 1 TIERS 2 TIERS 3, 60% TIERS 2, 20%

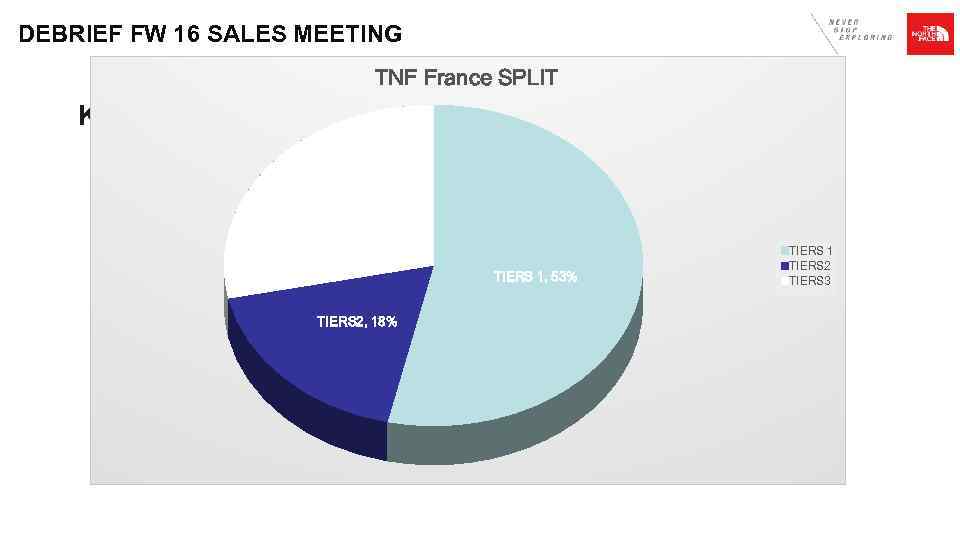

DEBRIEF FW 16 SALES MEETING TNF France SPLIT Key Highlights TIERS 3, 28% TIERS 1, 53% TIERS 2, 18% TIERS 1 TIERS 2 TIERS 3

DEBRIEF FW 16 SALES MEETING TNF France SPLIT Key Highlights TIERS 3, 28% TIERS 1, 53% TIERS 2, 18% TIERS 1 TIERS 2 TIERS 3