98f1650bdb732a0fc9e0f021c1fbfdb8.ppt

- Количество слайдов: 24

Smiths Group Dr. KW Capital Goods Conference London, Thursday 30 March 2006 www. smiths-group. com/ir Presentation by: Alan Thomson, Financial Director Register here to receive regular information

Smiths Group Dr. KW Capital Goods Conference London, Thursday 30 March 2006 www. smiths-group. com/ir Presentation by: Alan Thomson, Financial Director Register here to receive regular information

Smiths Group: Interim Results 2006 ( for six months ended 31 January) (£m) 2006 2005 Sales 1, 590 1, 338 Headline operating profit +19% 194 158 +22% Headline pre-tax profit 183 155 +18% Headline EPS 24. 4 p 20. 4 p +18% Interim dividend 9. 85 p 9. 25 p +6. 5% Margin 12. 2% 11. 8% Smiths is now in its second year of strong growth Smiths Group Dr. KW 2006 2

Smiths Group: Interim Results 2006 ( for six months ended 31 January) (£m) 2006 2005 Sales 1, 590 1, 338 Headline operating profit +19% 194 158 +22% Headline pre-tax profit 183 155 +18% Headline EPS 24. 4 p 20. 4 p +18% Interim dividend 9. 85 p 9. 25 p +6. 5% Margin 12. 2% 11. 8% Smiths is now in its second year of strong growth Smiths Group Dr. KW 2006 2

Full Potential score card: How are we doing on the fundamental strengths? 1 Operating in sectors of high growth 2 Delivering constant improvement 3 Reaching deep into global markets 4 Developing technology to help customers succeed 5 Improving our business mix 6 Doing business the right way Smiths Group Dr. KW 2006 3

Full Potential score card: How are we doing on the fundamental strengths? 1 Operating in sectors of high growth 2 Delivering constant improvement 3 Reaching deep into global markets 4 Developing technology to help customers succeed 5 Improving our business mix 6 Doing business the right way Smiths Group Dr. KW 2006 3

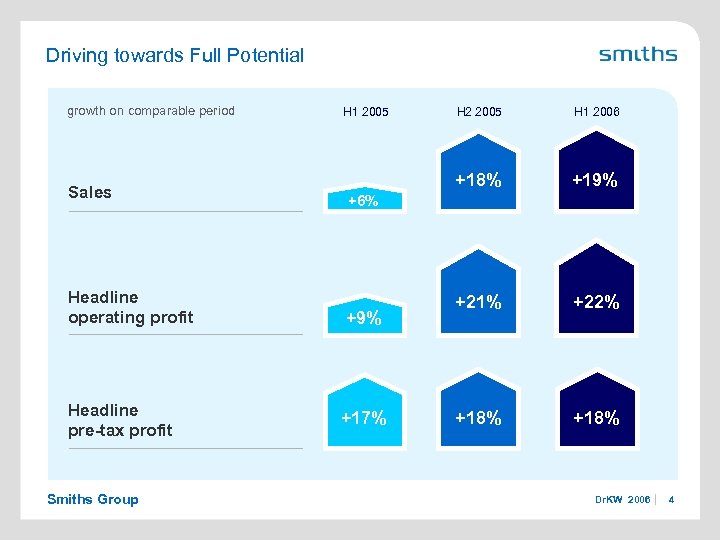

Driving towards Full Potential growth on comparable period Sales Headline operating profit Headline pre-tax profit Smiths Group H 1 2005 H 2 2005 H 1 2006 +18% +19% +21% +22% +18% +6% +9% +17% Dr. KW 2006 4

Driving towards Full Potential growth on comparable period Sales Headline operating profit Headline pre-tax profit Smiths Group H 1 2005 H 2 2005 H 1 2006 +18% +19% +21% +22% +18% +6% +9% +17% Dr. KW 2006 4

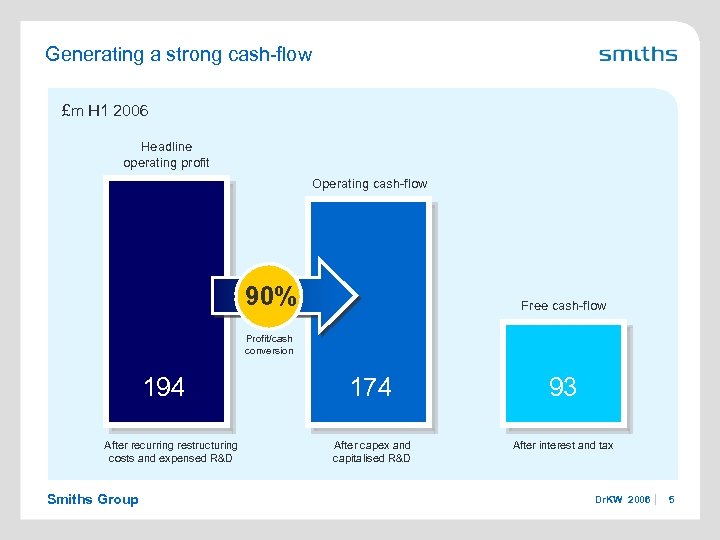

Generating a strong cash-flow £m H 1 2006 Headline operating profit Operating cash-flow 90% Free cash-flow Profit/cash conversion 194 After recurring restructuring costs and expensed R&D Smiths Group 174 93 After capex and capitalised R&D After interest and tax Dr. KW 2006 5

Generating a strong cash-flow £m H 1 2006 Headline operating profit Operating cash-flow 90% Free cash-flow Profit/cash conversion 194 After recurring restructuring costs and expensed R&D Smiths Group 174 93 After capex and capitalised R&D After interest and tax Dr. KW 2006 5

Reaching into global markets Aerospace: China, Poland Medical: Mexico, Malaysia John Crane: Czech Republic, India, Mexico, China Flex-Tek: Malaysia Interconnect: China, Costa Rica John Crane has the most significant presence in India of all Smiths’ businesses. • • 185 employees by financial year-end New 45, 000 sq ft facility in Bangalore Design, manufacture, service Local market and export Smiths Group Dr. KW 2006 6

Reaching into global markets Aerospace: China, Poland Medical: Mexico, Malaysia John Crane: Czech Republic, India, Mexico, China Flex-Tek: Malaysia Interconnect: China, Costa Rica John Crane has the most significant presence in India of all Smiths’ businesses. • • 185 employees by financial year-end New 45, 000 sq ft facility in Bangalore Design, manufacture, service Local market and export Smiths Group Dr. KW 2006 6

Developing technology to help customers succeed Research & Development 2006 of sales £m (for six months ended 31 January) 2005 of sales Company-funded Charged to P&L 62 58 Added to Balance Sheet 33 14 95 6% 72 5% 70 4% 63 5% 165 10% 135 10% Customer-funded No impact on P&L Total R&D increased in line with sales Smiths Group Dr. KW 2006 7

Developing technology to help customers succeed Research & Development 2006 of sales £m (for six months ended 31 January) 2005 of sales Company-funded Charged to P&L 62 58 Added to Balance Sheet 33 14 95 6% 72 5% 70 4% 63 5% 165 10% 135 10% Customer-funded No impact on P&L Total R&D increased in line with sales Smiths Group Dr. KW 2006 7

Improving our business mix: acquisitions in H 1 2006 Spend Millitech Microwave components £ 19 m Spec. Eng. Lorch Microwave filters £ 15 m Spec. Eng. Livewave Wide-area sensor networking £ 9 m Detection Farnam Heating elements Smiths Group £ 4 m Spec. Eng. Dr. KW 2006 8

Improving our business mix: acquisitions in H 1 2006 Spend Millitech Microwave components £ 19 m Spec. Eng. Lorch Microwave filters £ 15 m Spec. Eng. Livewave Wide-area sensor networking £ 9 m Detection Farnam Heating elements Smiths Group £ 4 m Spec. Eng. Dr. KW 2006 8

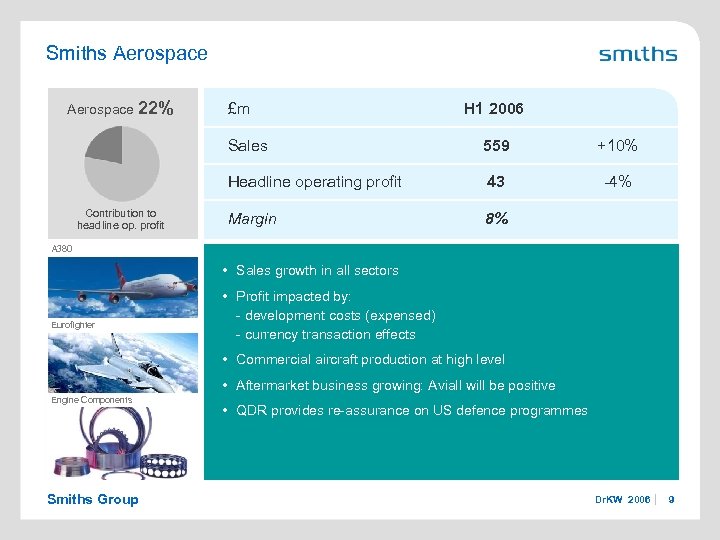

Smiths Aerospace 22% £m H 1 2006 Sales +10% Headline operating profit Contribution to headline op. profit 559 43 -4% Margin 8% A 380 • Sales growth in all sectors Eurofighter • Profit impacted by: - development costs (expensed) - currency transaction effects • Commercial aircraft production at high level • Aftermarket business growing: Aviall will be positive Engine Components Smiths Group • QDR provides re-assurance on US defence programmes Dr. KW 2006 9

Smiths Aerospace 22% £m H 1 2006 Sales +10% Headline operating profit Contribution to headline op. profit 559 43 -4% Margin 8% A 380 • Sales growth in all sectors Eurofighter • Profit impacted by: - development costs (expensed) - currency transaction effects • Commercial aircraft production at high level • Aftermarket business growing: Aviall will be positive Engine Components Smiths Group • QDR provides re-assurance on US defence programmes Dr. KW 2006 9

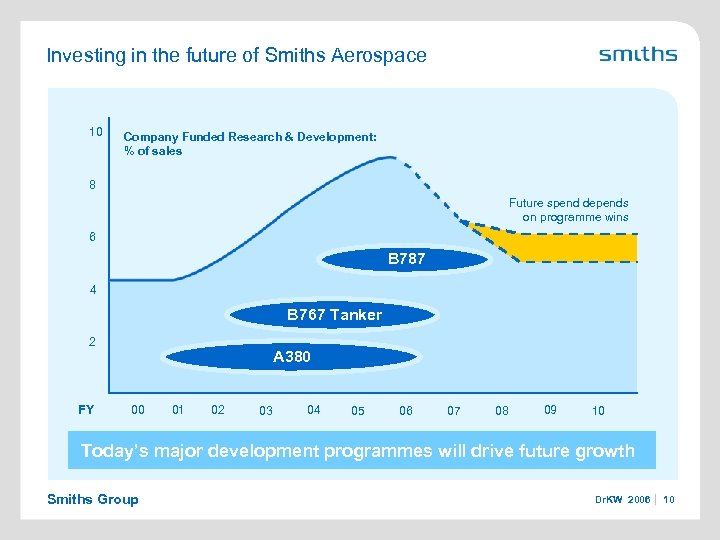

Investing in the future of Smiths Aerospace 10 Company Funded Research & Development: % of sales 8 Future spend depends on programme wins 6 B 787 4 B 767 Tanker 2 FY A 380 00 01 02 03 04 05 06 07 08 09 10 Today’s major development programmes will drive future growth Smiths Group Dr. KW 2006 10

Investing in the future of Smiths Aerospace 10 Company Funded Research & Development: % of sales 8 Future spend depends on programme wins 6 B 787 4 B 767 Tanker 2 FY A 380 00 01 02 03 04 05 06 07 08 09 10 Today’s major development programmes will drive future growth Smiths Group Dr. KW 2006 10

Significant investment in new programmes • • Smiths supplies landing gear actuation and high-lift systems New category of aircraft, incremental business for Smiths • • • Smiths supplies refuelling system and mission management Scope change payments received from Boeing in H 1 2006 RAND study confirmed USAF needs to acquire new tankers US defence budget includes initial funding Development costs are being expensed Development completed this year Firm orderbook: development has been capitalised A 380 B 767 Tanker B 787 Dreamliner Smiths Group • Smiths supplies common core system, landing gear actuation and high-lift systems • Meeting Boeing’s milestones • Scope of CCS is being extended • Firm orderbook: development being capitalised • CCS has opportunities on other aircraft Dr. KW 2006 11

Significant investment in new programmes • • Smiths supplies landing gear actuation and high-lift systems New category of aircraft, incremental business for Smiths • • • Smiths supplies refuelling system and mission management Scope change payments received from Boeing in H 1 2006 RAND study confirmed USAF needs to acquire new tankers US defence budget includes initial funding Development costs are being expensed Development completed this year Firm orderbook: development has been capitalised A 380 B 767 Tanker B 787 Dreamliner Smiths Group • Smiths supplies common core system, landing gear actuation and high-lift systems • Meeting Boeing’s milestones • Scope of CCS is being extended • Firm orderbook: development being capitalised • CCS has opportunities on other aircraft Dr. KW 2006 11

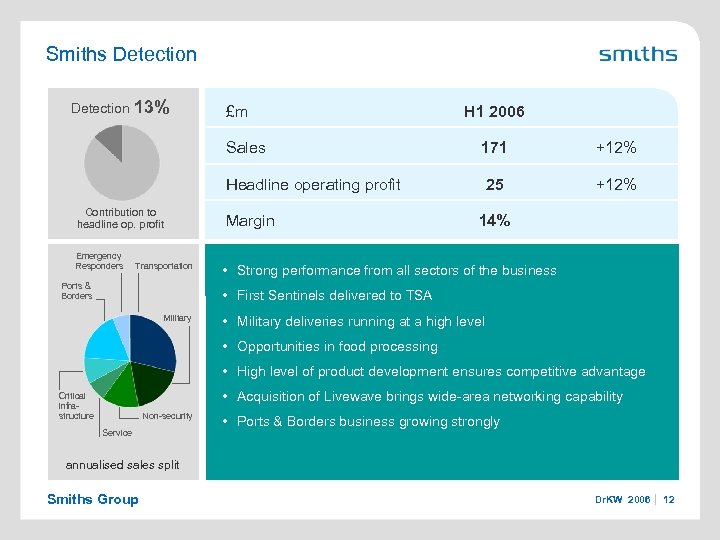

Smiths Detection 13% £m H 1 2006 Sales Emergency Responders Transportation Ports & Borders +12% Headline operating profit Contribution to headline op. profit 171 25 +12% 14% Margin • Strong performance from all sectors of the business • First Sentinels delivered to TSA Military • Military deliveries running at a high level • Opportunities in food processing • High level of product development ensures competitive advantage • Acquisition of Livewave brings wide-area networking capability Critical infrastructure Non-security Service • Ports & Borders business growing strongly annualised sales split Smiths Group Dr. KW 2006 12

Smiths Detection 13% £m H 1 2006 Sales Emergency Responders Transportation Ports & Borders +12% Headline operating profit Contribution to headline op. profit 171 25 +12% 14% Margin • Strong performance from all sectors of the business • First Sentinels delivered to TSA Military • Military deliveries running at a high level • Opportunities in food processing • High level of product development ensures competitive advantage • Acquisition of Livewave brings wide-area networking capability Critical infrastructure Non-security Service • Ports & Borders business growing strongly annualised sales split Smiths Group Dr. KW 2006 12

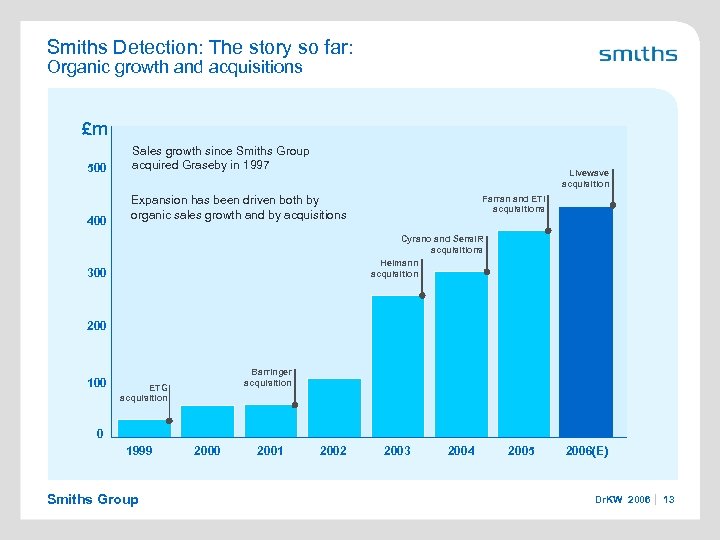

Smiths Detection: The story so far: Organic growth and acquisitions £m 500 400 Sales growth since Smiths Group acquired Graseby in 1997 Livewave acquisition Expansion has been driven both by organic sales growth and by acquisitions Farran and ETI acquisitions Cyrano and Sens. IR acquisitions Heimann acquisition 300 200 100 Barringer acquisition ETG acquisition 0 1999 Smiths Group 2000 2001 2002 2003 2004 2005 2006(E) Dr. KW 2006 13

Smiths Detection: The story so far: Organic growth and acquisitions £m 500 400 Sales growth since Smiths Group acquired Graseby in 1997 Livewave acquisition Expansion has been driven both by organic sales growth and by acquisitions Farran and ETI acquisitions Cyrano and Sens. IR acquisitions Heimann acquisition 300 200 100 Barringer acquisition ETG acquisition 0 1999 Smiths Group 2000 2001 2002 2003 2004 2005 2006(E) Dr. KW 2006 13

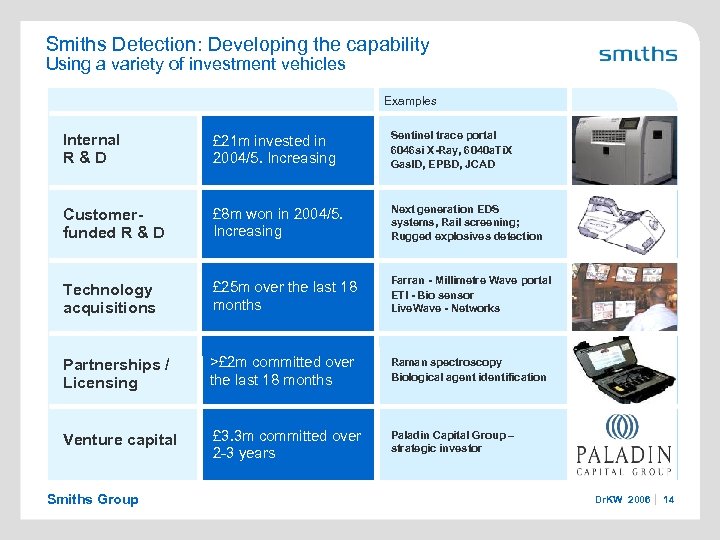

Smiths Detection: Developing the capability Using a variety of investment vehicles Examples Internal R&D £ 21 m invested in 2004/5. Increasing Sentinel trace portal 6046 si X-Ray, 6040 a. Ti. X Gas. ID, EPBD, JCAD Customerfunded R & D £ 8 m won in 2004/5. Increasing Next generation EDS systems, Rail screening; Rugged explosives detection Technology acquisitions £ 25 m over the last 18 months Farran - Millimetre Wave portal ETI - Bio sensor Live. Wave - Networks Partnerships / Licensing >£ 2 m committed over the last 18 months Raman spectroscopy Biological agent identification Venture capital £ 3. 3 m committed over 2 -3 years Paladin Capital Group – strategic investor Smiths Group Dr. KW 2006 14

Smiths Detection: Developing the capability Using a variety of investment vehicles Examples Internal R&D £ 21 m invested in 2004/5. Increasing Sentinel trace portal 6046 si X-Ray, 6040 a. Ti. X Gas. ID, EPBD, JCAD Customerfunded R & D £ 8 m won in 2004/5. Increasing Next generation EDS systems, Rail screening; Rugged explosives detection Technology acquisitions £ 25 m over the last 18 months Farran - Millimetre Wave portal ETI - Bio sensor Live. Wave - Networks Partnerships / Licensing >£ 2 m committed over the last 18 months Raman spectroscopy Biological agent identification Venture capital £ 3. 3 m committed over 2 -3 years Paladin Capital Group – strategic investor Smiths Group Dr. KW 2006 14

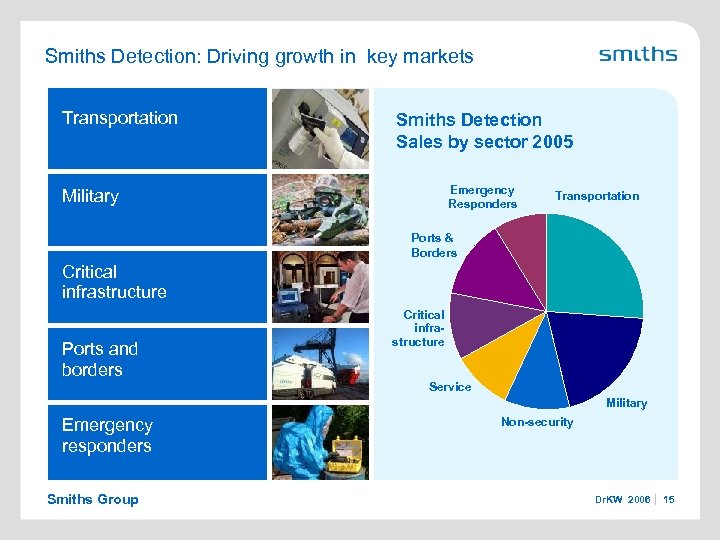

Smiths Detection: Driving growth in key markets Transportation Smiths Detection Sales by sector 2005 Emergency Responders Military Transportation Ports & Borders Critical infrastructure Ports and borders Critical infrastructure Service Military Emergency responders Smiths Group Non-security Dr. KW 2006 15

Smiths Detection: Driving growth in key markets Transportation Smiths Detection Sales by sector 2005 Emergency Responders Military Transportation Ports & Borders Critical infrastructure Ports and borders Critical infrastructure Service Military Emergency responders Smiths Group Non-security Dr. KW 2006 15

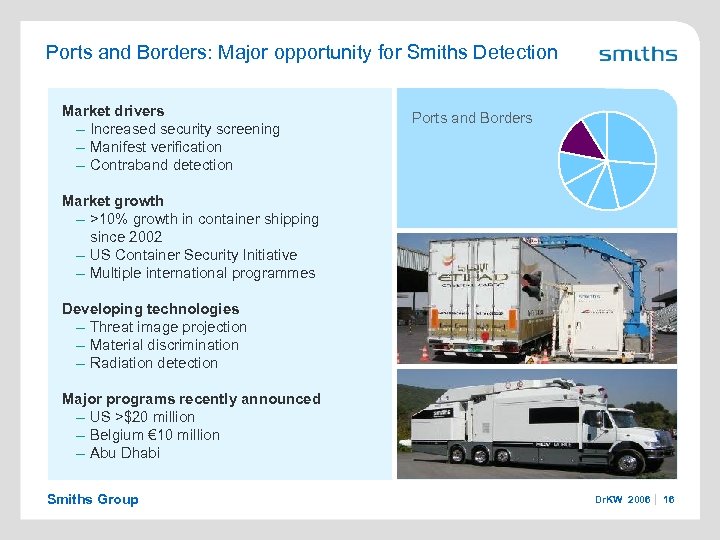

Ports and Borders: Major opportunity for Smiths Detection Market drivers – Increased security screening – Manifest verification – Contraband detection Ports and Borders Market growth – >10% growth in container shipping since 2002 – US Container Security Initiative – Multiple international programmes Developing technologies – Threat image projection – Material discrimination – Radiation detection Major programs recently announced – US >$20 million – Belgium € 10 million – Abu Dhabi Smiths Group Dr. KW 2006 16

Ports and Borders: Major opportunity for Smiths Detection Market drivers – Increased security screening – Manifest verification – Contraband detection Ports and Borders Market growth – >10% growth in container shipping since 2002 – US Container Security Initiative – Multiple international programmes Developing technologies – Threat image projection – Material discrimination – Radiation detection Major programs recently announced – US >$20 million – Belgium € 10 million – Abu Dhabi Smiths Group Dr. KW 2006 16

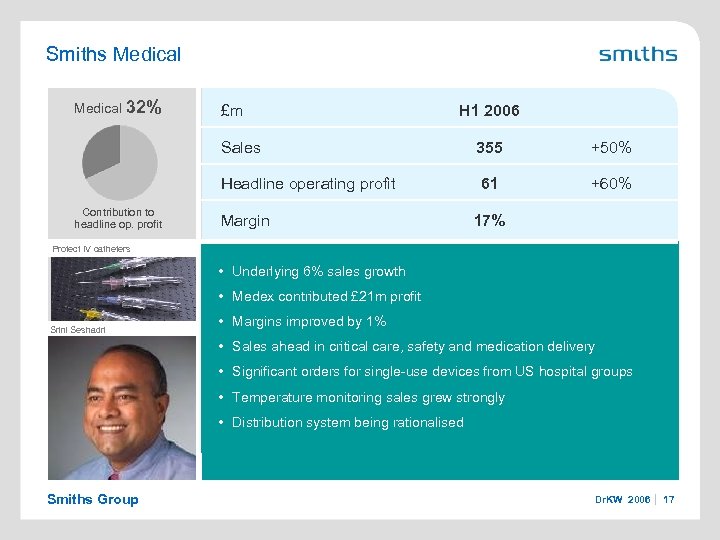

Smiths Medical 32% £m H 1 2006 Sales +50% Headline operating profit Contribution to headline op. profit 355 61 +60% 17% Margin Protect IV catheters • Underlying 6% sales growth • Medex contributed £ 21 m profit Srini Seshadri • Margins improved by 1% • Sales ahead in critical care, safety and medication delivery • Significant orders for single-use devices from US hospital groups • Temperature monitoring sales grew strongly • Distribution system being rationalised Smiths Group Dr. KW 2006 17

Smiths Medical 32% £m H 1 2006 Sales +50% Headline operating profit Contribution to headline op. profit 355 61 +60% 17% Margin Protect IV catheters • Underlying 6% sales growth • Medex contributed £ 21 m profit Srini Seshadri • Margins improved by 1% • Sales ahead in critical care, safety and medication delivery • Significant orders for single-use devices from US hospital groups • Temperature monitoring sales grew strongly • Distribution system being rationalised Smiths Group Dr. KW 2006 17

The integration of Medex is on track Sales & marketing integrated Back office functions transferred to a single shared-services centre for US Financing and tax synergies achieved Closure of two US and one large UK plant announced Pace of integration steps up in second half Synergy benefits across Smiths Medical: - rising to £ 25 m per annum by end of 2008 Medex integration costs: - total expected to be £ 50 m - £ 13 m charged to date Smiths Group Dr. KW 2006 18

The integration of Medex is on track Sales & marketing integrated Back office functions transferred to a single shared-services centre for US Financing and tax synergies achieved Closure of two US and one large UK plant announced Pace of integration steps up in second half Synergy benefits across Smiths Medical: - rising to £ 25 m per annum by end of 2008 Medex integration costs: - total expected to be £ 50 m - £ 13 m charged to date Smiths Group Dr. KW 2006 18

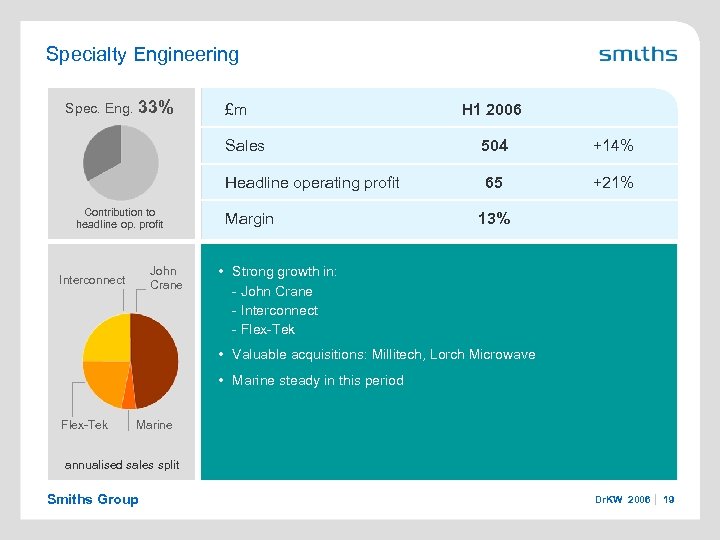

Specialty Engineering Spec. Eng. 33% £m H 1 2006 Sales John Crane Interconnect +14% Headline operating profit Contribution to headline op. profit 504 65 +21% 13% Margin • Strong growth in: - John Crane - Interconnect - Flex-Tek • Valuable acquisitions: Millitech, Lorch Microwave • Marine steady in this period Flex-Tek Marine annualised sales split Smiths Group Dr. KW 2006 19

Specialty Engineering Spec. Eng. 33% £m H 1 2006 Sales John Crane Interconnect +14% Headline operating profit Contribution to headline op. profit 504 65 +21% 13% Margin • Strong growth in: - John Crane - Interconnect - Flex-Tek • Valuable acquisitions: Millitech, Lorch Microwave • Marine steady in this period Flex-Tek Marine annualised sales split Smiths Group Dr. KW 2006 19

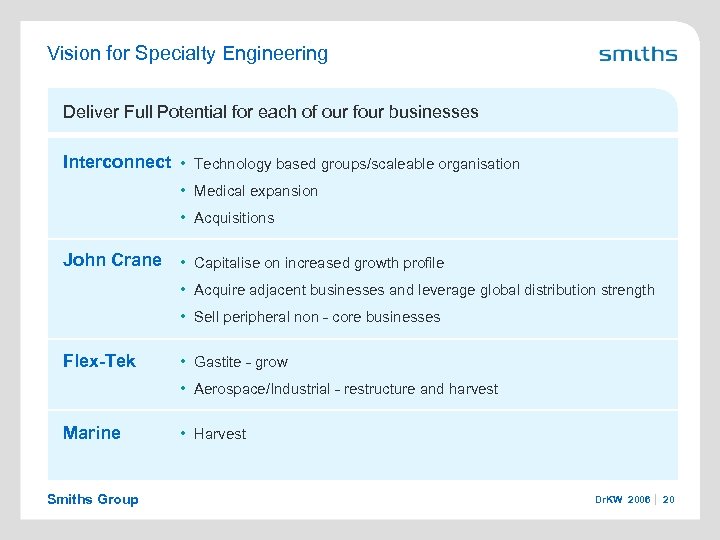

Vision for Specialty Engineering Deliver Full Potential for each of our four businesses Interconnect • Technology based groups/scaleable organisation • Medical expansion • Acquisitions John Crane • Capitalise on increased growth profile • Acquire adjacent businesses and leverage global distribution strength • Sell peripheral non - core businesses Flex-Tek • Gastite - grow • Aerospace/Industrial - restructure and harvest Marine Smiths Group • Harvest Dr. KW 2006 20

Vision for Specialty Engineering Deliver Full Potential for each of our four businesses Interconnect • Technology based groups/scaleable organisation • Medical expansion • Acquisitions John Crane • Capitalise on increased growth profile • Acquire adjacent businesses and leverage global distribution strength • Sell peripheral non - core businesses Flex-Tek • Gastite - grow • Aerospace/Industrial - restructure and harvest Marine Smiths Group • Harvest Dr. KW 2006 20

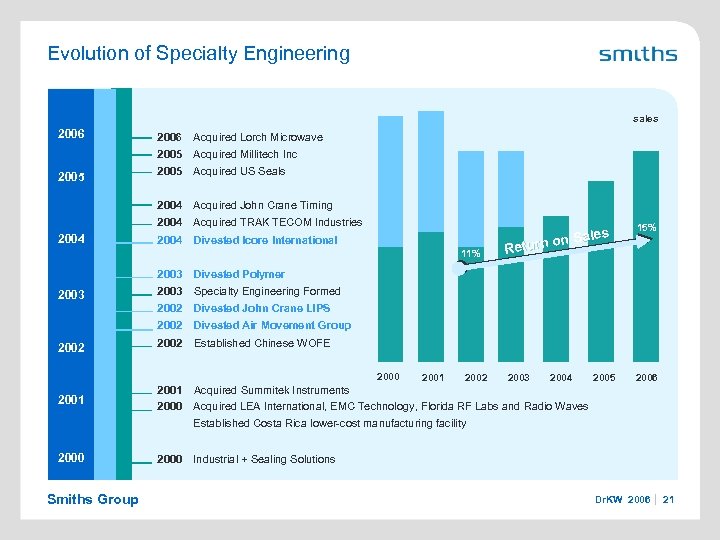

Evolution of Specialty Engineering sales 2006 Acquired Millitech Inc 2005 Acquired US Seals 2004 Acquired John Crane Timing 2004 Acquired Lorch Microwave 2005 2006 Acquired TRAK TECOM Industries 2004 Divested Icore International 11% Sales turn on Re 15% 2003 2006 2003 Divested Polymer 2003 Specialty Engineering Formed 2002 Divested John Crane LIPS 2002 Divested Air Movement Group 2002 Established Chinese WOFE 2001 Acquired Summitek Instruments 2000 Acquired LEA International, EMC Technology, Florida RF Labs and Radio Waves 2003 2000 2001 2002 2004 2005 Established Costa Rica lower-cost manufacturing facility 2000 Smiths Group 2000 Industrial + Sealing Solutions Dr. KW 2006 21

Evolution of Specialty Engineering sales 2006 Acquired Millitech Inc 2005 Acquired US Seals 2004 Acquired John Crane Timing 2004 Acquired Lorch Microwave 2005 2006 Acquired TRAK TECOM Industries 2004 Divested Icore International 11% Sales turn on Re 15% 2003 2006 2003 Divested Polymer 2003 Specialty Engineering Formed 2002 Divested John Crane LIPS 2002 Divested Air Movement Group 2002 Established Chinese WOFE 2001 Acquired Summitek Instruments 2000 Acquired LEA International, EMC Technology, Florida RF Labs and Radio Waves 2003 2000 2001 2002 2004 2005 Established Costa Rica lower-cost manufacturing facility 2000 Smiths Group 2000 Industrial + Sealing Solutions Dr. KW 2006 21

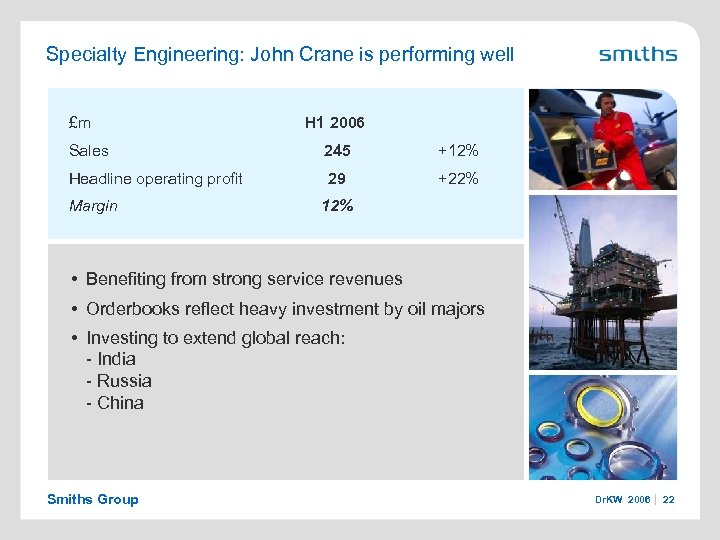

Specialty Engineering: John Crane is performing well £m H 1 2006 Sales 245 +12% Headline operating profit 29 +22% Margin 12% • Benefiting from strong service revenues • Orderbooks reflect heavy investment by oil majors • Investing to extend global reach: - India - Russia - China Smiths Group Dr. KW 2006 22

Specialty Engineering: John Crane is performing well £m H 1 2006 Sales 245 +12% Headline operating profit 29 +22% Margin 12% • Benefiting from strong service revenues • Orderbooks reflect heavy investment by oil majors • Investing to extend global reach: - India - Russia - China Smiths Group Dr. KW 2006 22

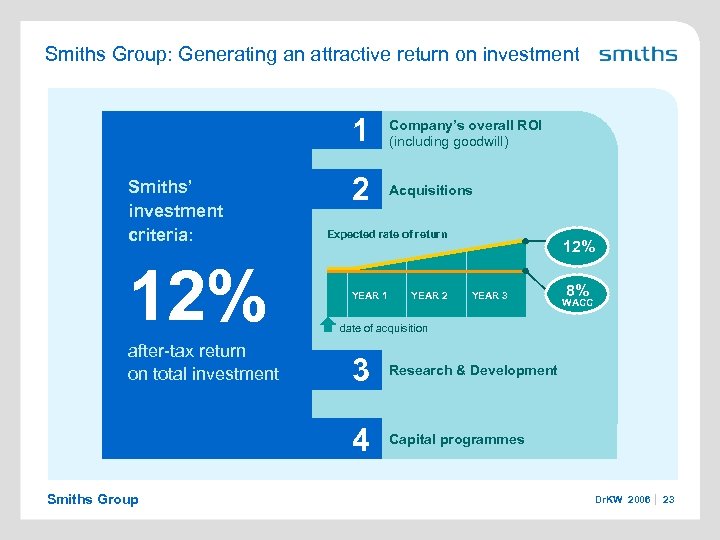

Smiths Group: Generating an attractive return on investment 1 Smiths’ investment criteria: 12% after-tax return on total investment Company’s overall ROI (including goodwill) 2 Acquisitions Expected rate of return YEAR 1 YEAR 2 12% YEAR 3 date of acquisition 3 Research & Development 4 Smiths Group 8% WACC Capital programmes Dr. KW 2006 23

Smiths Group: Generating an attractive return on investment 1 Smiths’ investment criteria: 12% after-tax return on total investment Company’s overall ROI (including goodwill) 2 Acquisitions Expected rate of return YEAR 1 YEAR 2 12% YEAR 3 date of acquisition 3 Research & Development 4 Smiths Group 8% WACC Capital programmes Dr. KW 2006 23

Smiths Group Dr. KW Capital Goods Conference www. smiths-group. com/ir Questions and answers Register here to receive regular information

Smiths Group Dr. KW Capital Goods Conference www. smiths-group. com/ir Questions and answers Register here to receive regular information