13d7f6d01581c8b4c90d4ee50283f25a.ppt

- Количество слайдов: 17

Smiths Aerospace Meetings with investors, Farnborough Airshow July 17 -19, 2006 Senior management at the show: www. smiths-group. com/ir Smiths Aerospace Keith Butler-Wheelhouse, Chief Executive, Smiths Group John Ferrie, President, Smiths Aerospace Alan Thomson, Financial Director, Smiths Group John Langston, Finance Director Designate, Smiths Group Oliver Towers, VP Strategy, Smiths Aerospace Russell Plumley, Director, Investor Relations, Smiths Group Register here to receive regular information Farnborough 2006 1

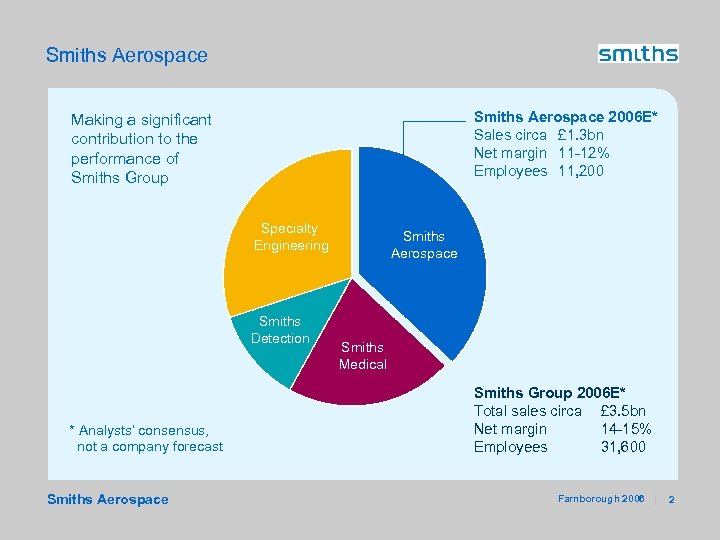

Smiths Aerospace 2006 E* Sales circa £ 1. 3 bn Net margin 11 -12% Employees 11, 200 Making a significant contribution to the performance of Smiths Group Specialty Engineering Smiths Detection * Analysts’ consensus, not a company forecast Smiths Aerospace Smiths Medical Smiths Group 2006 E* Total sales circa £ 3. 5 bn Net margin 14 -15% Employees 31, 600 Farnborough 2006 2

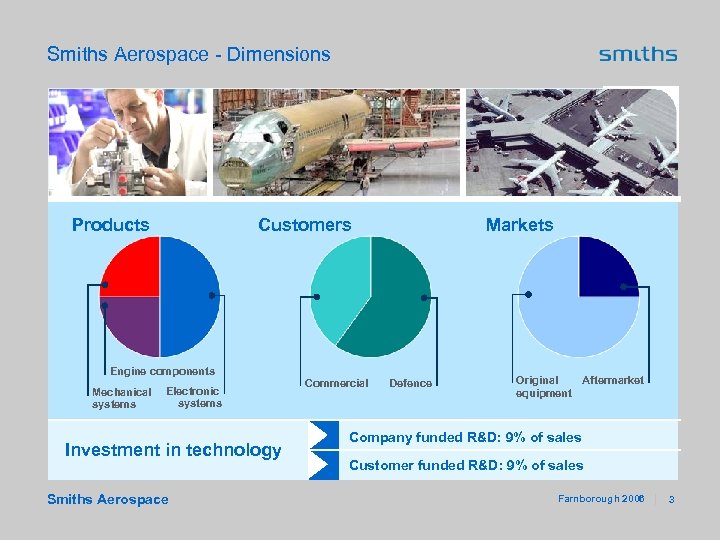

Smiths Aerospace - Dimensions Products Customers Engine components Mechanical systems Electronic systems Investment in technology Smiths Aerospace Commercial Markets Defence Original Aftermarket equipment Company funded R&D: 9% of sales Customer funded R&D: 9% of sales Farnborough 2006 3

Why is aerospace an attractive sector? Global defence activity remains high US defence procurement levelling off later than expected Commercial aerospace growth continues Strong underlying demand for air travel despite oil prices Tier 1 leaders are benefiting from supply chain rationalisation Smiths Aerospace Farnborough 2006 4

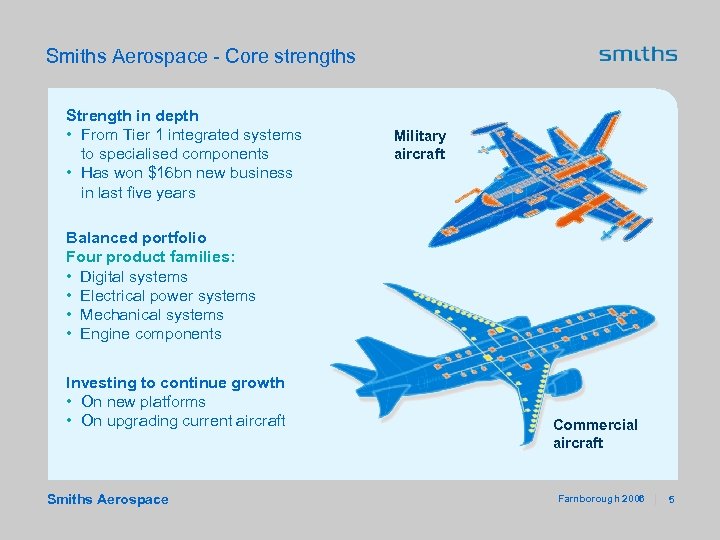

Smiths Aerospace - Core strengths Strength in depth • From Tier 1 integrated systems to specialised components • Has won $16 bn new business in last five years Military aircraft Balanced portfolio Four product families: • Digital systems • Electrical power systems • Mechanical systems • Engine components Investing to continue growth • On new platforms • On upgrading current aircraft Smiths Aerospace Commercial aircraft Farnborough 2006 5

Digital systems and Electrical power systems % sales Customers Common core computing systems CCS Displays & Navigation systems ‘Smart’ display’ Applications: Information systems B 787 F-35 (JSF) B 737 B 777 Typhoon A 400 M C-130 J & C-130 AMP Voice & data recorder Power distribution, generation & conversion VS/CF generator Smiths Aerospace F-18 E/F KC-767 Global Tanker AH-64 D Key competitors: Rockwell Collins Honeywell Hamilton Sundstrand Goodrich Thales L-3 Farnborough 2006 6

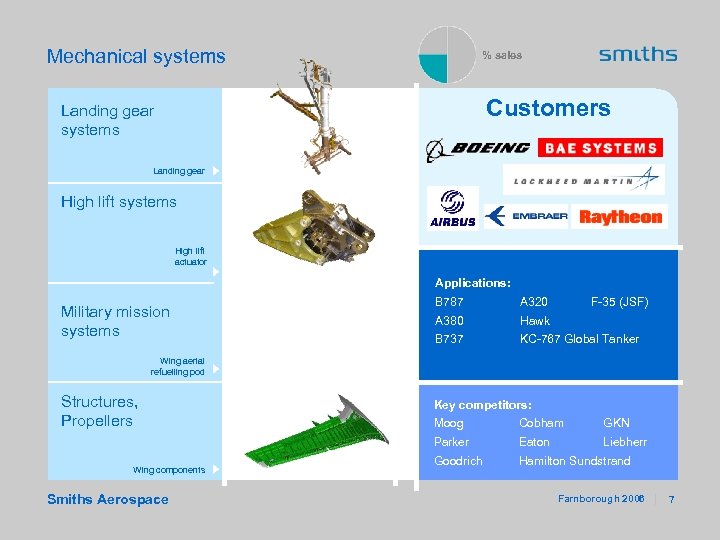

Mechanical systems % sales Customers Landing gear systems Landing gear High lift systems High lift actuator Applications: Military mission systems B 787 A 320 F-35 (JSF) A 380 Hawk B 737 KC-767 Global Tanker Wing aerial refuelling pod Structures, Propellers Key competitors: Smiths Aerospace Cobham GKN Parker Wing components Moog Eaton Liebherr Goodrich Hamilton Sundstrand Farnborough 2006 7

Engine components % sales Customers Rings Flash-welded rings Complex machined parts Applications: GEnx CFM-56 CF-34 Trent 500, 900, 1000 Machined shafts F 119 Complex fabrications GE-90 F 135 PW 600 ‘Smart’ display Key competitors: GKN Magellan Combustor Smiths Aerospace Barnes Group Doncasters Firth Rixson Primes’ in-house capabilities Farnborough 2006 8

Major commercial programmes: Tier 1 capabilities are winning new business Boeing 787: Common Core System, Landing Gear systems, High Lift actuation, Engine components, Aerostructures Major assembly underway Orders: 350 plus 240 options First flight: Summer 2007 EIS: 2008 Smiths Aerospace Airbus A 380 High Lift actuation, Landing Gear systems, Cockpit video, Engine components, Aerostructures Flight testing in progress, with production equipment deliveries Orders: 159 plus options First a/c delivery: end 2006 Farnborough 2006 9

Major military programmes: Tier 1 capabilities are winning new business Boeing KC-767 Global Tanker: LM F-35 (JSF): Electrical Power Management system, Remote Input/Output units, Thrust Vectoring and Lift Actuators, Engine components Mission Control system, Refuelling system including wing pod, boom control and power Long Lead funding for 5 C-TOL aircraft for USAF: 8 aircraft on order for Italy and Japan: First flight: Q 4, 2006 (C-TOL) EIS: 2012/13 First a/c delivery: end 2006 USAF contract award: mid/late 2007 Smiths Aerospace Farnborough 2006 10

Aftermarket: A flexible approach from Smiths % sales Focus on added value services that improve operator performance and reduce through-life costs. Leading provider of Performance Based Logistics (PBL) services Total Support Services (TSS) partnership Globally providing aircraft operators with high performance support. Partnership with Aviall for civil spares Smiths Aerospace Farnborough 2006 11

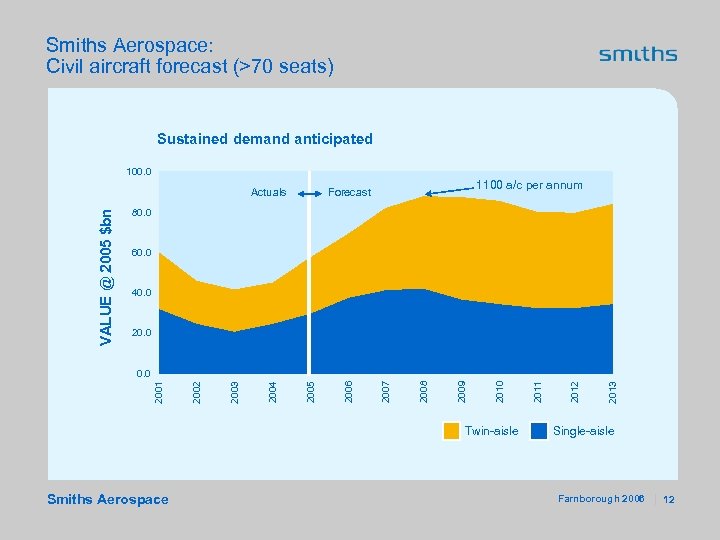

Smiths Aerospace: Civil aircraft forecast (>70 seats) Sustained demand anticipated 100. 0 VALUE @ 2005 $bn Actuals 1100 a/c per annum Forecast 80. 0 60. 0 40. 0 20. 0 Twin-aisle Smiths Aerospace 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 0. 0 Single-aisle Farnborough 2006 12

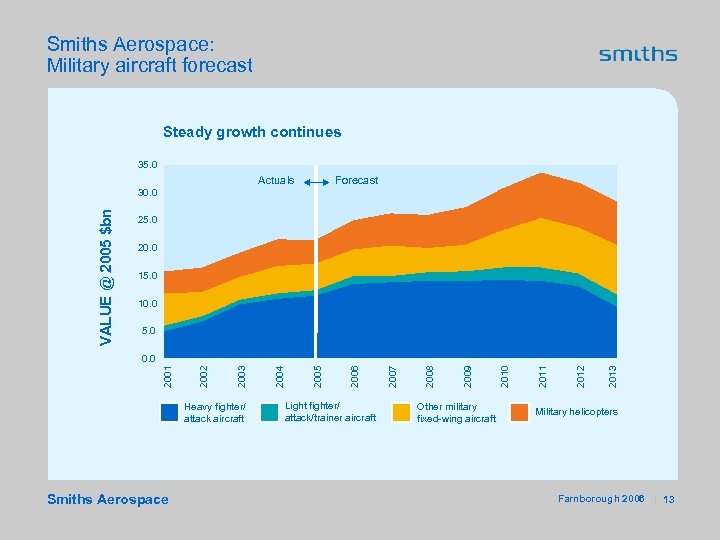

Smiths Aerospace: Military aircraft forecast Steady growth continues 35. 0 Actuals Forecast VALUE @ 2005 $bn 30. 0 25. 0 20. 0 15. 0 10. 0 5. 0 Heavy fighter/ attack aircraft Smiths Aerospace Light fighter/ attack/trainer aircraft Other military fixed-wing aircraft 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 0. 0 Military helicopters Farnborough 2006 13

Smiths Aerospace: Market opportunities for sustained growth Secure momentum base business In production: B 737, B 777, A 320, A 330/A 340, F-15, F-16, F-18 E/F, F-22, C-17, C-27, C-130 J, T-50, Hawk, Typhoon, BA 609, V-22, EH-101, AH-64 D, Chinook, Regional aircraft, Business jets, Aftermarket support of wide range of civil and military platforms Future growth secured In development: JSF, A 380, B 787, C-130 AMP, KC-767 Global Tanker, VH-71, P-8 A, Future Lynx Similar growth opportunity again on new platforms In evaluation: New narrow bodies, A 350 XWB, New military programmes/Upgrades Smiths Aerospace Farnborough 2006 14

Smiths Aerospace: well-positioned for future business Tier 1 status increases opportunities on future narrow-bodies Leading open architecture solution with CCS on B 787 A 350 XWB prospects improved as design evolves C-130 AMP experience sets important precedent for upgrades Strong relationship with primes on UAV demonstrators USAF tanker recapitalisation: Smiths established on KC-767 Gaining market share from investment in advanced manufacturing for engine components Smiths Aerospace Farnborough 2006 15

Why is Smiths Aerospace so confident? Strong platform positions – $16 bn of new business won over last 5 years Integrated Systems solutions well suited to future market needs Engine Components business delivering planned growth Sustained drive on all aspects of cost US defence procurement levelling off later than expected Commercial aerospace growth continues Smiths Aerospace Farnborough 2006 16

Smiths Aerospace www. smiths-group. com/ir Meetings with investors, Farnborough Airshow July 17 -19, 2006 Register here to receive regular information Farnborough 2006

13d7f6d01581c8b4c90d4ee50283f25a.ppt