d0caa6bed052cde0130e53f1a9c2045a.ppt

- Количество слайдов: 16

SMEG-AIG Presentation April 01. ppt EXPLORATION STRATEGIES : Simple Observations, Significant Implications John R Parry Executive General Manager - Exploration WMC Resources Ltd SMEDG – AIG Symposium : Sydney : April 27, 2001

SMEG-AIG Presentation April 01. ppt EXPLORATION STRATEGIES : Simple Observations, Significant Implications John R Parry Executive General Manager - Exploration WMC Resources Ltd SMEDG – AIG Symposium : Sydney : April 27, 2001

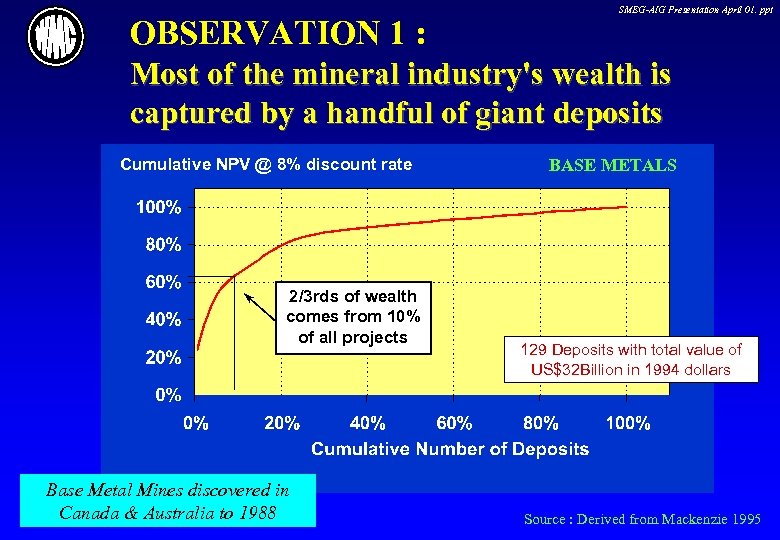

OBSERVATION 1 : SMEG-AIG Presentation April 01. ppt Most of the mineral industry's wealth is captured by a handful of giant deposits Cumulative NPV @ 8% discount rate 2/3 rds of wealth comes from 10% of all projects Base Metal Mines discovered in Canada & Australia to 1988 BASE METALS 129 Deposits with total value of US$32 Billion in 1994 dollars Source : Derived from Mackenzie 1995

OBSERVATION 1 : SMEG-AIG Presentation April 01. ppt Most of the mineral industry's wealth is captured by a handful of giant deposits Cumulative NPV @ 8% discount rate 2/3 rds of wealth comes from 10% of all projects Base Metal Mines discovered in Canada & Australia to 1988 BASE METALS 129 Deposits with total value of US$32 Billion in 1994 dollars Source : Derived from Mackenzie 1995

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : Giant Deposits For Junior Companies • Small deposits can give good IRRs, but NPV will be small • Finding a giant deposit can be a “Company-Maker” (ie as the Carlin District was for Barrick and Newmont) For Major Companies • Need to focus on finding giant deposits, as only these : – Are of the right scale to make a significant impact on the company’s business – Provide a sufficiently large return to pay for ongoing exploration costs

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : Giant Deposits For Junior Companies • Small deposits can give good IRRs, but NPV will be small • Finding a giant deposit can be a “Company-Maker” (ie as the Carlin District was for Barrick and Newmont) For Major Companies • Need to focus on finding giant deposits, as only these : – Are of the right scale to make a significant impact on the company’s business – Provide a sufficiently large return to pay for ongoing exploration costs

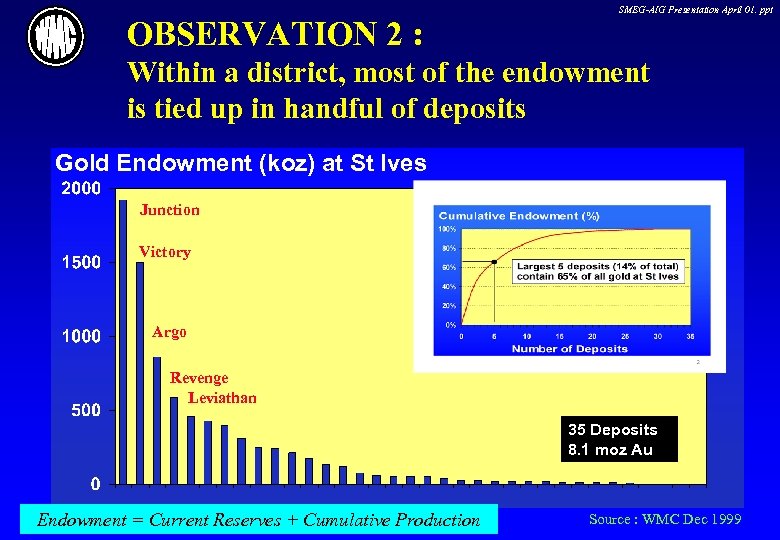

OBSERVATION 2 : SMEG-AIG Presentation April 01. ppt Within a district, most of the endowment is tied up in handful of deposits Gold Endowment (koz) at St Ives Junction Victory Argo Revenge Leviathan 35 Deposits 8. 1 moz Au Endowment = Current Reserves + Cumulative Production Source : WMC Dec 1999

OBSERVATION 2 : SMEG-AIG Presentation April 01. ppt Within a district, most of the endowment is tied up in handful of deposits Gold Endowment (koz) at St Ives Junction Victory Argo Revenge Leviathan 35 Deposits 8. 1 moz Au Endowment = Current Reserves + Cumulative Production Source : WMC Dec 1999

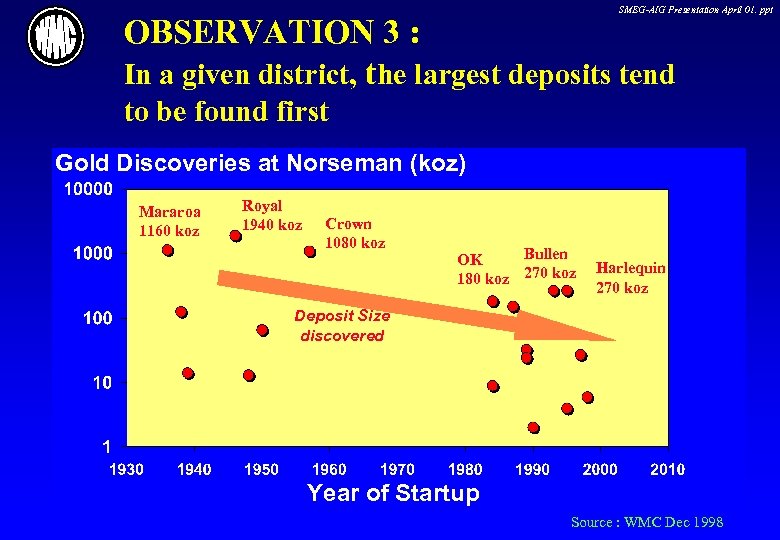

SMEG-AIG Presentation April 01. ppt OBSERVATION 3 : In a given district, the largest deposits tend to be found first Gold Discoveries at Norseman (koz) Mararoa 1160 koz Royal 1940 koz Crown 1080 koz Bullen OK 180 koz 270 koz Harlequin 270 koz Deposit Size discovered Year of Startup Source : WMC Dec 1998

SMEG-AIG Presentation April 01. ppt OBSERVATION 3 : In a given district, the largest deposits tend to be found first Gold Discoveries at Norseman (koz) Mararoa 1160 koz Royal 1940 koz Crown 1080 koz Bullen OK 180 koz 270 koz Harlequin 270 koz Deposit Size discovered Year of Startup Source : WMC Dec 1998

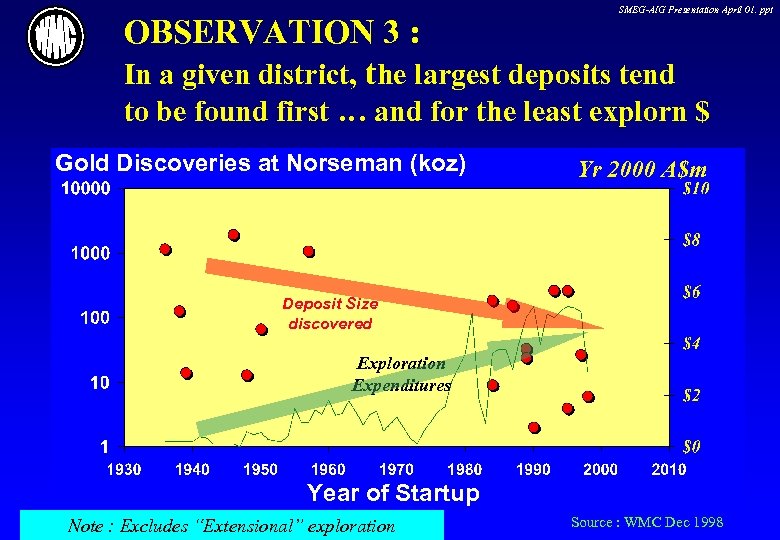

SMEG-AIG Presentation April 01. ppt OBSERVATION 3 : In a given district, the largest deposits tend to be found first … and for the least explorn $ Gold Discoveries at Norseman (koz) Yr 2000 A$m Deposit Size discovered Exploration Expenditures Year of Startup Note : Excludes “Extensional” exploration Source : WMC Dec 1998

SMEG-AIG Presentation April 01. ppt OBSERVATION 3 : In a given district, the largest deposits tend to be found first … and for the least explorn $ Gold Discoveries at Norseman (koz) Yr 2000 A$m Deposit Size discovered Exploration Expenditures Year of Startup Note : Excludes “Extensional” exploration Source : WMC Dec 1998

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : Big deposits are found first For Major Companies • Avoid grassroots exploration in mature districts. If you are not first or second, you are probably too late • Need to continuously assess the maturity of the district (a good indicator is the discovery cost per unit of metal). At some point in time, brownfields exploration for medium-sized deposits becomes uneconomic

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : Big deposits are found first For Major Companies • Avoid grassroots exploration in mature districts. If you are not first or second, you are probably too late • Need to continuously assess the maturity of the district (a good indicator is the discovery cost per unit of metal). At some point in time, brownfields exploration for medium-sized deposits becomes uneconomic

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : Deposit size-frequency For Major Companies • Should have a large tenement package as this : – Raises the probability that the largest deposit is on your tenement – Facilitates incremental discoveries – even smaller mines feeding into a large central mill can be financially attractive For Junior Companies • Small deposits are often found near giants and there a lot more of them to find • Small discoveries may end up being sold to a larger operator next door (key issue – will you get a fair price ? ) or operated on their own

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : Deposit size-frequency For Major Companies • Should have a large tenement package as this : – Raises the probability that the largest deposit is on your tenement – Facilitates incremental discoveries – even smaller mines feeding into a large central mill can be financially attractive For Junior Companies • Small deposits are often found near giants and there a lot more of them to find • Small discoveries may end up being sold to a larger operator next door (key issue – will you get a fair price ? ) or operated on their own

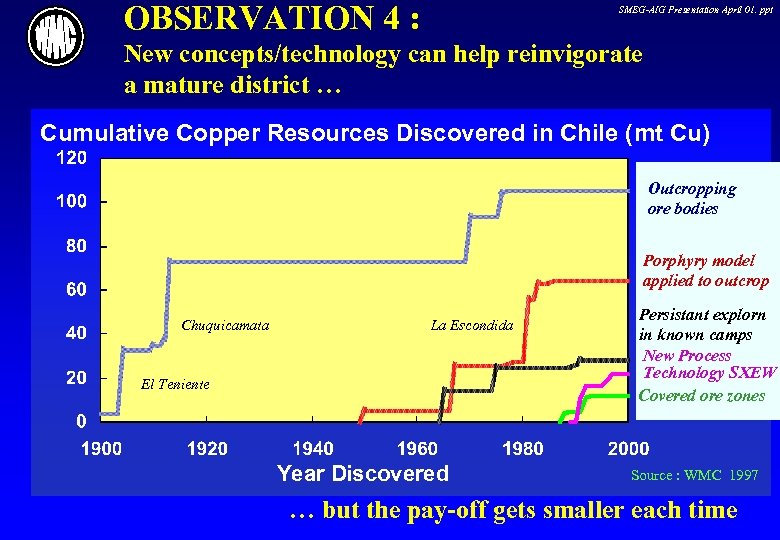

OBSERVATION 4 : SMEG-AIG Presentation April 01. ppt New concepts/technology can help reinvigorate a mature district … Cumulative Copper Resources Discovered in Chile (mt Cu) Outcropping ore bodies Porphyry model applied to outcrop Chuquicamata La Escondida El Teniente Year Discovered Persistant explorn in known camps New Process Technology SXEW Covered ore zones Source : WMC 1997 … but the pay-off gets smaller each time

OBSERVATION 4 : SMEG-AIG Presentation April 01. ppt New concepts/technology can help reinvigorate a mature district … Cumulative Copper Resources Discovered in Chile (mt Cu) Outcropping ore bodies Porphyry model applied to outcrop Chuquicamata La Escondida El Teniente Year Discovered Persistant explorn in known camps New Process Technology SXEW Covered ore zones Source : WMC 1997 … but the pay-off gets smaller each time

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : Be Innovative • Innovation can be in several forms : – New search methods (Airborne Gravity) – New conceptual models (Olympic Dam) – New process technologies (SXEW for Cu, Heap Leaching for Au) – New financing methods (gold loans, project finance) – Strong relationships with local communities & governments For Major Companies • Remember that Observations 1 to 3 still apply • In a mature district, must have a new concept/technology to be a “new” first mover For Junior Companies • Can be a fast follower, but must understand the strategic implications/limitations

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : Be Innovative • Innovation can be in several forms : – New search methods (Airborne Gravity) – New conceptual models (Olympic Dam) – New process technologies (SXEW for Cu, Heap Leaching for Au) – New financing methods (gold loans, project finance) – Strong relationships with local communities & governments For Major Companies • Remember that Observations 1 to 3 still apply • In a mature district, must have a new concept/technology to be a “new” first mover For Junior Companies • Can be a fast follower, but must understand the strategic implications/limitations

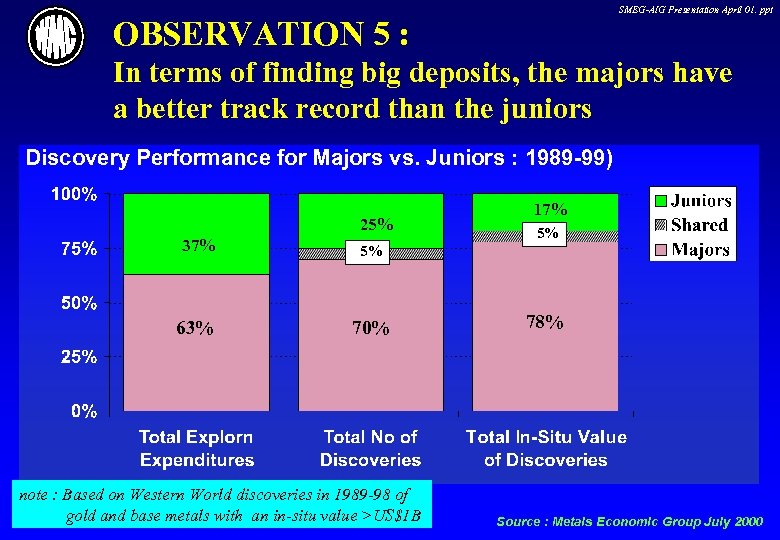

SMEG-AIG Presentation April 01. ppt OBSERVATION 5 : In terms of finding big deposits, the majors have a better track record than the juniors Discovery Performance for Majors vs. Juniors : 1989 -99) 25% 37% 70% 5% 5% 63% 17% note : Based on Western World discoveries in 1989 -98 of gold and base metals with an in-situ value >US$1 B 78% Source : Metals Economic Group July 2000

SMEG-AIG Presentation April 01. ppt OBSERVATION 5 : In terms of finding big deposits, the majors have a better track record than the juniors Discovery Performance for Majors vs. Juniors : 1989 -99) 25% 37% 70% 5% 5% 63% 17% note : Based on Western World discoveries in 1989 -98 of gold and base metals with an in-situ value >US$1 B 78% Source : Metals Economic Group July 2000

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : On average, perception doesn’t match reality for large deposits For Junior Companies • Success of juniors in finding “small” deposits has led to a false impression with respect to large discoveries For Major Companies • Risky to rely on juniors to be your de facto exploration team – As always, the right partner is critical

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : On average, perception doesn’t match reality for large deposits For Junior Companies • Success of juniors in finding “small” deposits has led to a false impression with respect to large discoveries For Major Companies • Risky to rely on juniors to be your de facto exploration team – As always, the right partner is critical

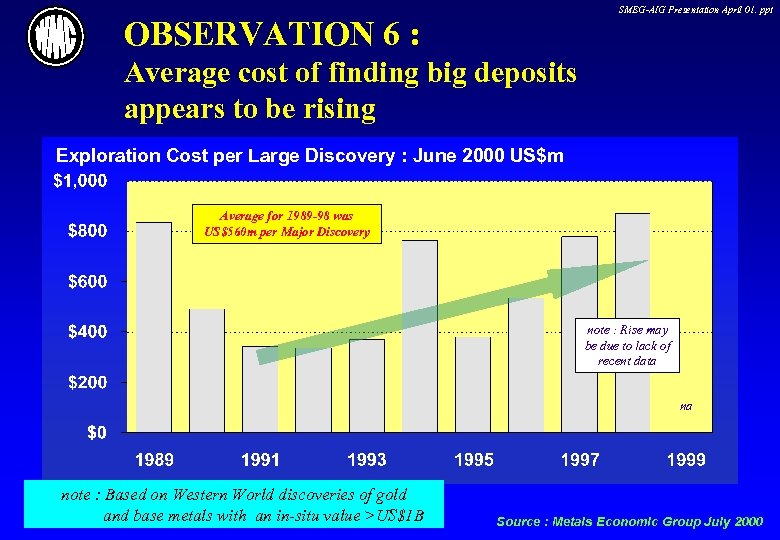

SMEG-AIG Presentation April 01. ppt OBSERVATION 6 : Average cost of finding big deposits appears to be rising Exploration Cost per Large Discovery : June 2000 US$m Average for 1989 -98 was US$560 m per Major Discovery note : Rise may be due to lack of recent data na note : Based on Western World discoveries of gold and base metals with an in-situ value >US$1 B Source : Metals Economic Group July 2000

SMEG-AIG Presentation April 01. ppt OBSERVATION 6 : Average cost of finding big deposits appears to be rising Exploration Cost per Large Discovery : June 2000 US$m Average for 1989 -98 was US$560 m per Major Discovery note : Rise may be due to lack of recent data na note : Based on Western World discoveries of gold and base metals with an in-situ value >US$1 B Source : Metals Economic Group July 2000

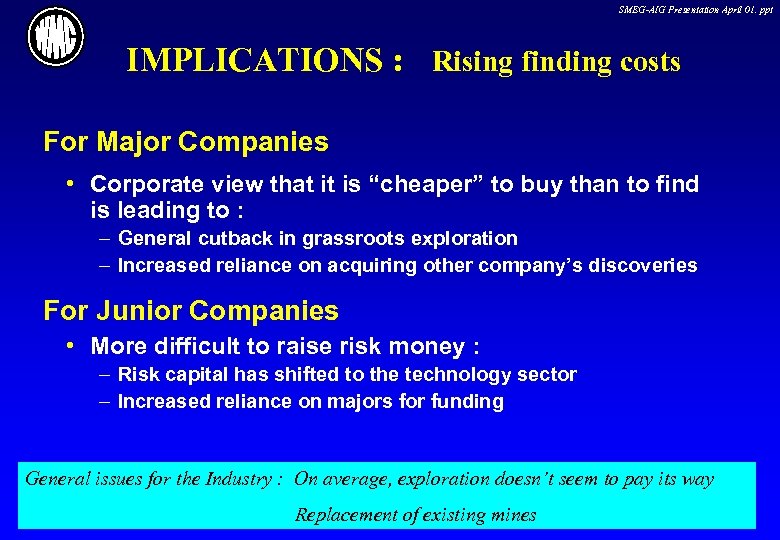

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : Rising finding costs For Major Companies • Corporate view that it is “cheaper” to buy than to find is leading to : – General cutback in grassroots exploration – Increased reliance on acquiring other company’s discoveries For Junior Companies • More difficult to raise risk money : – Risk capital has shifted to the technology sector – Increased reliance on majors for funding General issues for the Industry : On average, exploration doesn’t seem to pay its way Replacement of existing mines

SMEG-AIG Presentation April 01. ppt IMPLICATIONS : Rising finding costs For Major Companies • Corporate view that it is “cheaper” to buy than to find is leading to : – General cutback in grassroots exploration – Increased reliance on acquiring other company’s discoveries For Junior Companies • More difficult to raise risk money : – Risk capital has shifted to the technology sector – Increased reliance on majors for funding General issues for the Industry : On average, exploration doesn’t seem to pay its way Replacement of existing mines

SMEG-AIG Presentation April 01. ppt SUMMARY : Simple Observations • Most of the minerals industry’s wealth is captured by a handful of giant deposits • Within a district, most of the endowment Is tied up in handful of deposits • In a given district, the largest deposits tend to be found first … and for the least exploration cost • New concepts can help reinvigorate a mature district • In terms of finding giant deposits, the majors have a better track record than the juniors • Average cost of finding giant deposits appears to be rising

SMEG-AIG Presentation April 01. ppt SUMMARY : Simple Observations • Most of the minerals industry’s wealth is captured by a handful of giant deposits • Within a district, most of the endowment Is tied up in handful of deposits • In a given district, the largest deposits tend to be found first … and for the least exploration cost • New concepts can help reinvigorate a mature district • In terms of finding giant deposits, the majors have a better track record than the juniors • Average cost of finding giant deposits appears to be rising

SMEG-AIG Presentation April 01. ppt CONCLUSIONS : Significant Implications The observation is that there are plenty of options, however …. • A strategy based on exceptions will fail on average • There is more than one good strategy • If you have a strategy but don’t follow it, you don’t have a strategy • Can’t afford to be “average” at exploration • Majors must focus on exploring for (and developing) world-class deposits For a given Company the “correct” exploration strategy will depend upon : Relationships with others Technical capabilities Time horizon Financial resources Existing operations Attitude to risk

SMEG-AIG Presentation April 01. ppt CONCLUSIONS : Significant Implications The observation is that there are plenty of options, however …. • A strategy based on exceptions will fail on average • There is more than one good strategy • If you have a strategy but don’t follow it, you don’t have a strategy • Can’t afford to be “average” at exploration • Majors must focus on exploring for (and developing) world-class deposits For a given Company the “correct” exploration strategy will depend upon : Relationships with others Technical capabilities Time horizon Financial resources Existing operations Attitude to risk