Smart Growth Makes Money: Transit Oriented Development

Smart Growth Makes Money: Transit Oriented Development

![Smart Growth Adds Value to Real Estate Around Transit Stations • [Picture of TOD] Smart Growth Adds Value to Real Estate Around Transit Stations • [Picture of TOD]](https://present5.com/presentation/6b4a567d7b0d4126c8a17503bb37b83f/image-2.jpg) Smart Growth Adds Value to Real Estate Around Transit Stations • [Picture of TOD] Portland Streetcar & Mixed-use TOD Ballston Metro Station in Arlington, VA 1 Images courtesy of EPA Smart Growth

Smart Growth Adds Value to Real Estate Around Transit Stations • [Picture of TOD] Portland Streetcar & Mixed-use TOD Ballston Metro Station in Arlington, VA 1 Images courtesy of EPA Smart Growth

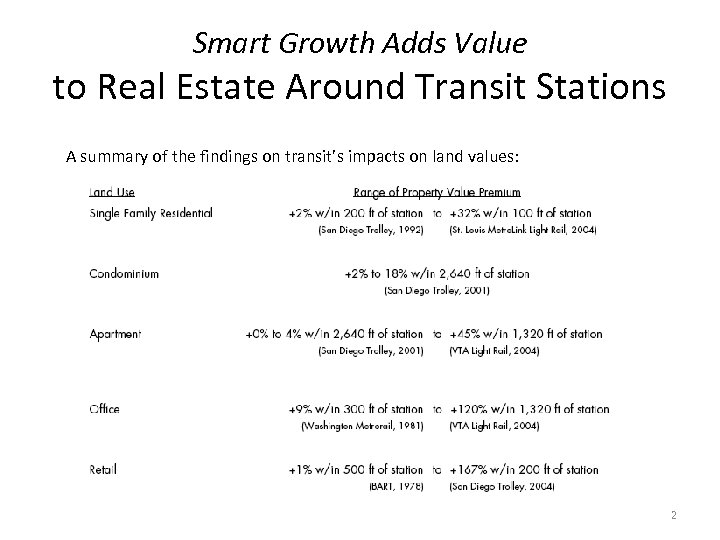

Smart Growth Adds Value to Real Estate Around Transit Stations A summary of the findings on transit’s impacts on land values: 2

Smart Growth Adds Value to Real Estate Around Transit Stations A summary of the findings on transit’s impacts on land values: 2

Denver, CO: Home Values Increase near Transit 3

Denver, CO: Home Values Increase near Transit 3

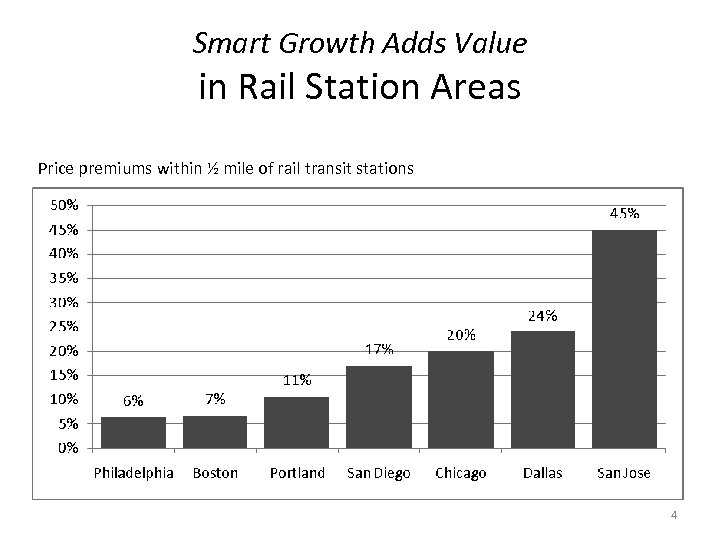

Smart Growth Adds Value in Rail Station Areas Price premiums within ½ mile of rail transit stations 4

Smart Growth Adds Value in Rail Station Areas Price premiums within ½ mile of rail transit stations 4

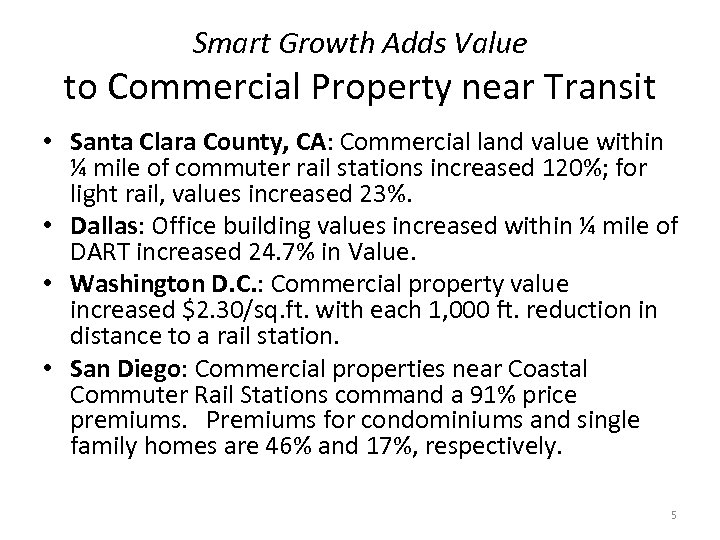

Smart Growth Adds Value to Commercial Property near Transit • Santa Clara County, CA: Commercial land value within ¼ mile of commuter rail stations increased 120%; for light rail, values increased 23%. • Dallas: Office building values increased within ¼ mile of DART increased 24. 7% in Value. • Washington D. C. : Commercial property value increased $2. 30/sq. ft. with each 1, 000 ft. reduction in distance to a rail station. • San Diego: Commercial properties near Coastal Commuter Rail Stations command a 91% price premiums. Premiums for condominiums and single family homes are 46% and 17%, respectively. 5

Smart Growth Adds Value to Commercial Property near Transit • Santa Clara County, CA: Commercial land value within ¼ mile of commuter rail stations increased 120%; for light rail, values increased 23%. • Dallas: Office building values increased within ¼ mile of DART increased 24. 7% in Value. • Washington D. C. : Commercial property value increased $2. 30/sq. ft. with each 1, 000 ft. reduction in distance to a rail station. • San Diego: Commercial properties near Coastal Commuter Rail Stations command a 91% price premiums. Premiums for condominiums and single family homes are 46% and 17%, respectively. 5

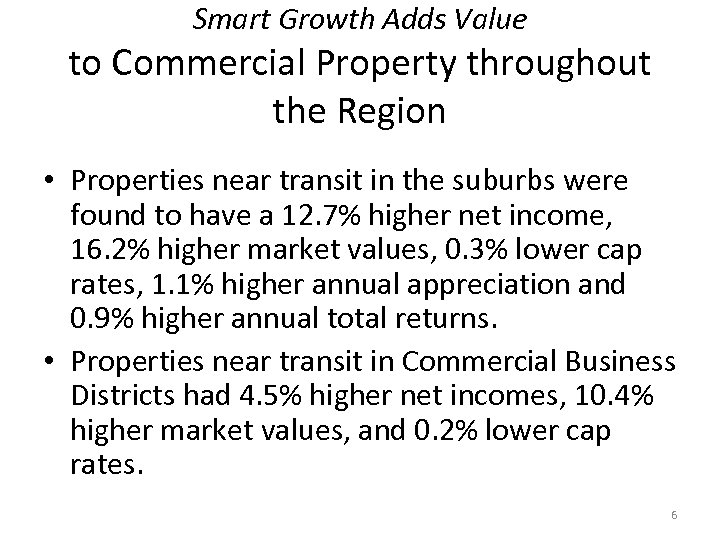

Smart Growth Adds Value to Commercial Property throughout the Region • Properties near transit in the suburbs were found to have a 12. 7% higher net income, 16. 2% higher market values, 0. 3% lower cap rates, 1. 1% higher annual appreciation and 0. 9% higher annual total returns. • Properties near transit in Commercial Business Districts had 4. 5% higher net incomes, 10. 4% higher market values, and 0. 2% lower cap rates. 6

Smart Growth Adds Value to Commercial Property throughout the Region • Properties near transit in the suburbs were found to have a 12. 7% higher net income, 16. 2% higher market values, 0. 3% lower cap rates, 1. 1% higher annual appreciation and 0. 9% higher annual total returns. • Properties near transit in Commercial Business Districts had 4. 5% higher net incomes, 10. 4% higher market values, and 0. 2% lower cap rates. 6

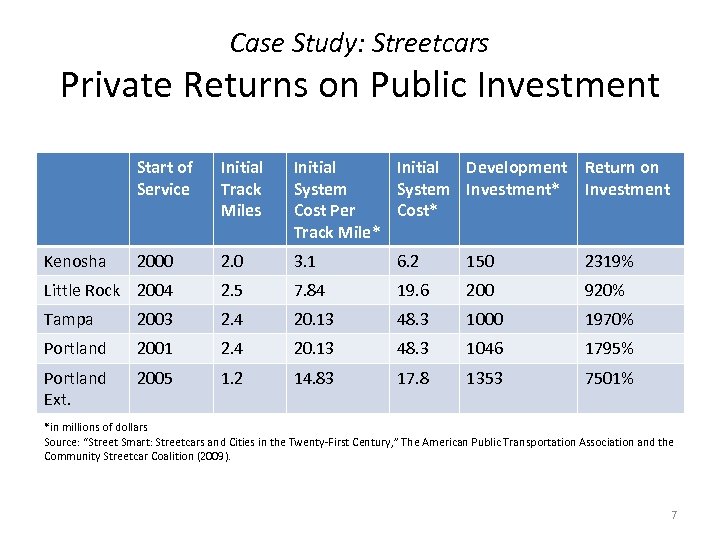

Case Study: Streetcars Private Returns on Public Investment Start of Service Initial Track Miles Initial Development Return on System Investment* Investment Cost Per Cost* Track Mile* 2000 2. 0 3. 1 6. 2 150 2319% Little Rock 2004 2. 5 7. 84 19. 6 200 920% Tampa 2003 2. 4 20. 13 48. 3 1000 1970% Portland 2001 2. 4 20. 13 48. 3 1046 1795% Portland Ext. 2005 1. 2 14. 83 17. 8 1353 7501% Kenosha *in millions of dollars Source: “Street Smart: Streetcars and Cities in the Twenty-First Century, ” The American Public Transportation Association and the Community Streetcar Coalition (2009). 7

Case Study: Streetcars Private Returns on Public Investment Start of Service Initial Track Miles Initial Development Return on System Investment* Investment Cost Per Cost* Track Mile* 2000 2. 0 3. 1 6. 2 150 2319% Little Rock 2004 2. 5 7. 84 19. 6 200 920% Tampa 2003 2. 4 20. 13 48. 3 1000 1970% Portland 2001 2. 4 20. 13 48. 3 1046 1795% Portland Ext. 2005 1. 2 14. 83 17. 8 1353 7501% Kenosha *in millions of dollars Source: “Street Smart: Streetcars and Cities in the Twenty-First Century, ” The American Public Transportation Association and the Community Streetcar Coalition (2009). 7

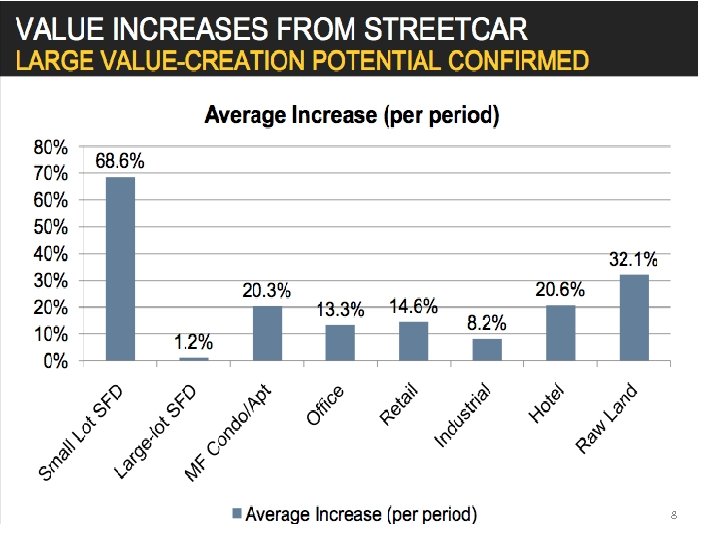

Case Study: Streetcar All Types of Properties Gain Value 8

Case Study: Streetcar All Types of Properties Gain Value 8

Smart Growth Adds Value Transit in Rural Areas • • The estimated annual impact of rural public transportation on the national economy as of 1998 was over $1. 2 billion. Rural counties with public transportation service were found to have 11 percent greater average growth of net earnings compared with counties without it. 9

Smart Growth Adds Value Transit in Rural Areas • • The estimated annual impact of rural public transportation on the national economy as of 1998 was over $1. 2 billion. Rural counties with public transportation service were found to have 11 percent greater average growth of net earnings compared with counties without it. 9