9468059da7387e37f18cc9e8456ec8f6.ppt

- Количество слайдов: 33

Slide 9 -1 CHAPTER 9 Foreign Currency Transactions and Hedging Foreign Exchange Risk Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -1 CHAPTER 9 Foreign Currency Transactions and Hedging Foreign Exchange Risk Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -2 Foreign Exchange Markets Each country uses its own currency for internal economic transactions. l To make transactions in another country, units of that country’s currency must be acquired. l The cost of those currencies is called the exchange rate. l Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -2 Foreign Exchange Markets Each country uses its own currency for internal economic transactions. l To make transactions in another country, units of that country’s currency must be acquired. l The cost of those currencies is called the exchange rate. l Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -3 Exchange Rate Mechanisms Prior to 1973, currency values were generally fixed. The US $ was based on the Gold Standard. l Since 1973, exchange rates have been allowed to fluctuate. l Several valuation models exist. l Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -3 Exchange Rate Mechanisms Prior to 1973, currency values were generally fixed. The US $ was based on the Gold Standard. l Since 1973, exchange rates have been allowed to fluctuate. l Several valuation models exist. l Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -4 Foreign Exchange Markets As the relative strength of a country’s economy changes. . . the exchange rate of the local currency relative to other currencies also fluctuates. Mc. Graw-Hill/Irwin ¥ = $? © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -4 Foreign Exchange Markets As the relative strength of a country’s economy changes. . . the exchange rate of the local currency relative to other currencies also fluctuates. Mc. Graw-Hill/Irwin ¥ = $? © The Mc. Graw-Hill Companies, Inc. , 2001

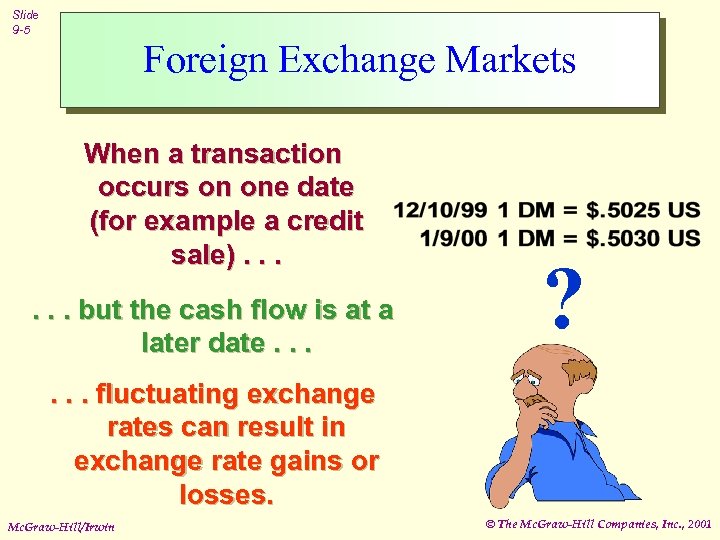

Slide 9 -5 Foreign Exchange Markets When a transaction occurs on one date (for example a credit sale). . . but the cash flow is at a later date. . . ? . . . fluctuating exchange rates can result in exchange rate gains or losses. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -5 Foreign Exchange Markets When a transaction occurs on one date (for example a credit sale). . . but the cash flow is at a later date. . . ? . . . fluctuating exchange rates can result in exchange rate gains or losses. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

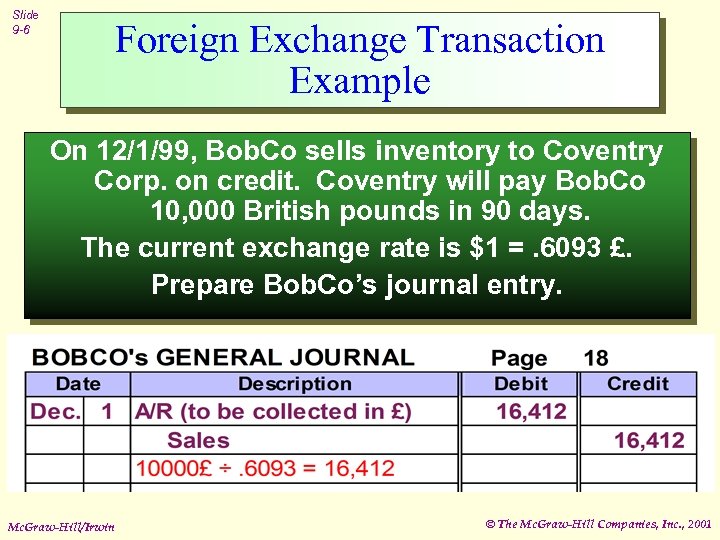

Slide 9 -6 Foreign Exchange Transaction Example On 12/1/99, Bob. Co sells inventory to Coventry Corp. on credit. Coventry will pay Bob. Co 10, 000 British pounds in 90 days. The current exchange rate is $1 =. 6093 £. Prepare Bob. Co’s journal entry. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -6 Foreign Exchange Transaction Example On 12/1/99, Bob. Co sells inventory to Coventry Corp. on credit. Coventry will pay Bob. Co 10, 000 British pounds in 90 days. The current exchange rate is $1 =. 6093 £. Prepare Bob. Co’s journal entry. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

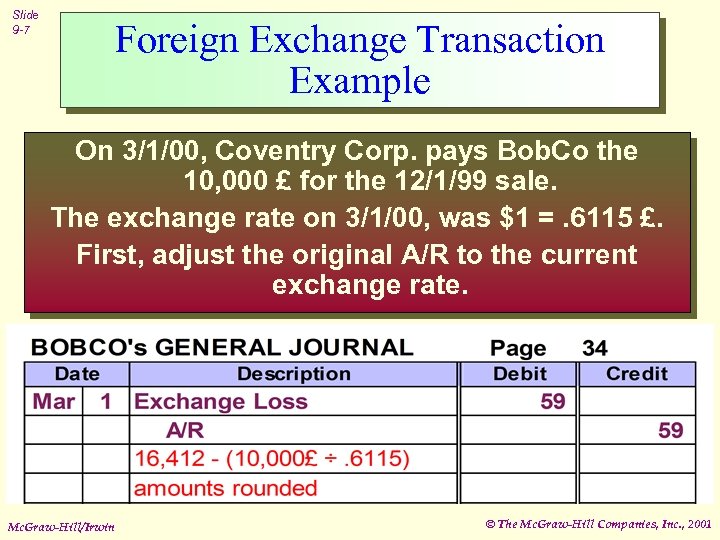

Slide 9 -7 Foreign Exchange Transaction Example On 3/1/00, Coventry Corp. pays Bob. Co the 10, 000 £ for the 12/1/99 sale. The exchange rate on 3/1/00, was $1 =. 6115 £. First, adjust the original A/R to the current exchange rate. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -7 Foreign Exchange Transaction Example On 3/1/00, Coventry Corp. pays Bob. Co the 10, 000 £ for the 12/1/99 sale. The exchange rate on 3/1/00, was $1 =. 6115 £. First, adjust the original A/R to the current exchange rate. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

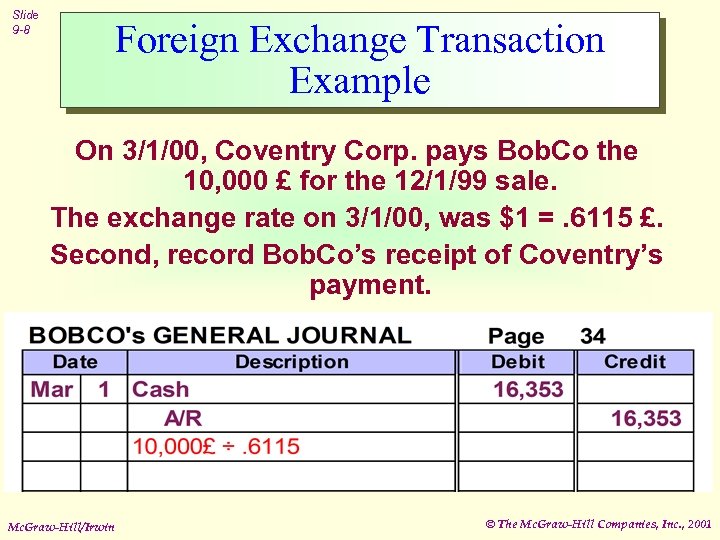

Slide 9 -8 Foreign Exchange Transaction Example On 3/1/00, Coventry Corp. pays Bob. Co the 10, 000 £ for the 12/1/99 sale. The exchange rate on 3/1/00, was $1 =. 6115 £. Second, record Bob. Co’s receipt of Coventry’s payment. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -8 Foreign Exchange Transaction Example On 3/1/00, Coventry Corp. pays Bob. Co the 10, 000 £ for the 12/1/99 sale. The exchange rate on 3/1/00, was $1 =. 6115 £. Second, record Bob. Co’s receipt of Coventry’s payment. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -9 Foreign Exchange Rates Spot Rates l The exchange rate that is available today. Forward Rates l The exchange rate that can be locked in today for an expected future exchange transaction. l The actual spot rate at the future date may differ from today’s forward rate. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -9 Foreign Exchange Rates Spot Rates l The exchange rate that is available today. Forward Rates l The exchange rate that can be locked in today for an expected future exchange transaction. l The actual spot rate at the future date may differ from today’s forward rate. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -10 Foreign Exchange Options Contracts A forward contract requires the purchase of currency units at a future date at the contracted exchange rate. This forward contract allows us to purchase 1, 000 ¥ at a price of $. 0080 US in 30 days. Mc. Graw-Hill/Irwin But if the spot rate is $. 0069 US in 30 days, we still have to pay $. 0080 US and we lose $1, 100! © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -10 Foreign Exchange Options Contracts A forward contract requires the purchase of currency units at a future date at the contracted exchange rate. This forward contract allows us to purchase 1, 000 ¥ at a price of $. 0080 US in 30 days. Mc. Graw-Hill/Irwin But if the spot rate is $. 0069 US in 30 days, we still have to pay $. 0080 US and we lose $1, 100! © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -11 Foreign Exchange Options Contracts An options contract gives the holder the option of buying the currency units at a future date at the contracted “strike” price. An alternative is an option contract to purchase 1, 000 ¥ at $. 0080 US in 30 days. But it costs $. 00002 per ¥. Mc. Graw-Hill/Irwin That way, if the spot rate is $. 0069 in 30 days, we only lose the $20 cost of the option contract! © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -11 Foreign Exchange Options Contracts An options contract gives the holder the option of buying the currency units at a future date at the contracted “strike” price. An alternative is an option contract to purchase 1, 000 ¥ at $. 0080 US in 30 days. But it costs $. 00002 per ¥. Mc. Graw-Hill/Irwin That way, if the spot rate is $. 0069 in 30 days, we only lose the $20 cost of the option contract! © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -12 Hedging To control for the risk of exchange rate fluctuation, a forward contract for currency can be purchased. Mc. Graw-Hill/Irwin Hedging effectively eliminates the gain or loss exposure. © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -12 Hedging To control for the risk of exchange rate fluctuation, a forward contract for currency can be purchased. Mc. Graw-Hill/Irwin Hedging effectively eliminates the gain or loss exposure. © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -13 Accounting for Hedges Often a transaction involving a credit sale/purchase is denominated in a foreign currency. l On the transaction date, the foreign currency receivable/payable is recorded. l If a forward contract is entered into to hedge the transaction, SFAS No. 133 requires the forward contract be carried at FAIR VALUE. l Mc. Graw-Hill/Irwin ? © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -13 Accounting for Hedges Often a transaction involving a credit sale/purchase is denominated in a foreign currency. l On the transaction date, the foreign currency receivable/payable is recorded. l If a forward contract is entered into to hedge the transaction, SFAS No. 133 requires the forward contract be carried at FAIR VALUE. l Mc. Graw-Hill/Irwin ? © The Mc. Graw-Hill Companies, Inc. , 2001

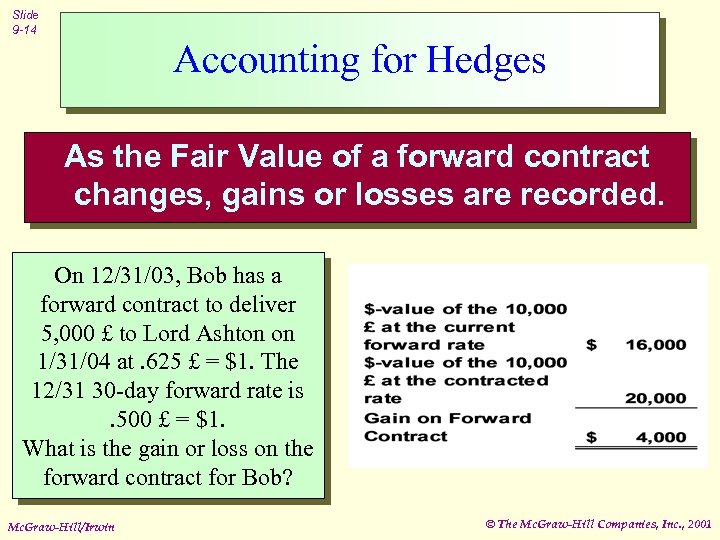

Slide 9 -14 Accounting for Hedges As the Fair Value of a forward contract changes, gains or losses are recorded. On 12/31/03, Bob has a forward contract to deliver 5, 000 £ to Lord Ashton on 1/31/04 at. 625 £ = $1. The 12/31 30 -day forward rate is. 500 £ = $1. What is the gain or loss on the forward contract for Bob? Mc. Graw-Hill/Irwin ? © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -14 Accounting for Hedges As the Fair Value of a forward contract changes, gains or losses are recorded. On 12/31/03, Bob has a forward contract to deliver 5, 000 £ to Lord Ashton on 1/31/04 at. 625 £ = $1. The 12/31 30 -day forward rate is. 500 £ = $1. What is the gain or loss on the forward contract for Bob? Mc. Graw-Hill/Irwin ? © The Mc. Graw-Hill Companies, Inc. , 2001

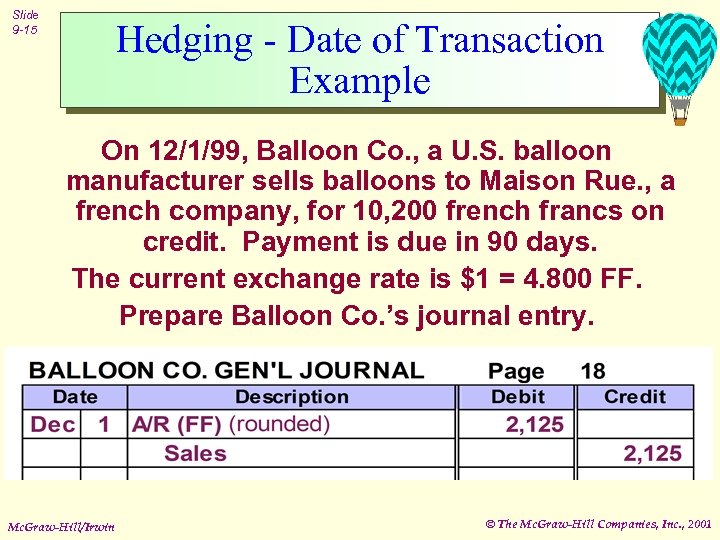

Slide 9 -15 Hedging - Date of Transaction Example On 12/1/99, Balloon Co. , a U. S. balloon manufacturer sells balloons to Maison Rue. , a french company, for 10, 200 french francs on credit. Payment is due in 90 days. The current exchange rate is $1 = 4. 800 FF. Prepare Balloon Co. ’s journal entry. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -15 Hedging - Date of Transaction Example On 12/1/99, Balloon Co. , a U. S. balloon manufacturer sells balloons to Maison Rue. , a french company, for 10, 200 french francs on credit. Payment is due in 90 days. The current exchange rate is $1 = 4. 800 FF. Prepare Balloon Co. ’s journal entry. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

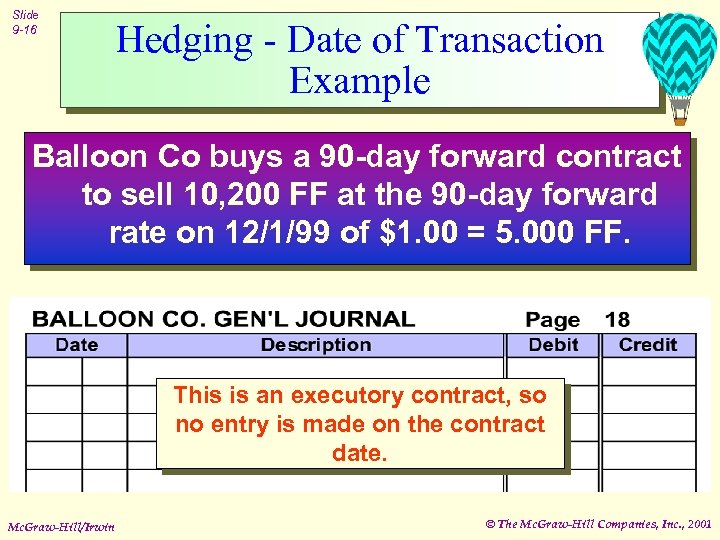

Slide 9 -16 Hedging - Date of Transaction Example Balloon Co buys a 90 -day forward contract to sell 10, 200 FF at the 90 -day forward rate on 12/1/99 of $1. 00 = 5. 000 FF. This is an executory contract, so no entry is made on the contract date. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -16 Hedging - Date of Transaction Example Balloon Co buys a 90 -day forward contract to sell 10, 200 FF at the 90 -day forward rate on 12/1/99 of $1. 00 = 5. 000 FF. This is an executory contract, so no entry is made on the contract date. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

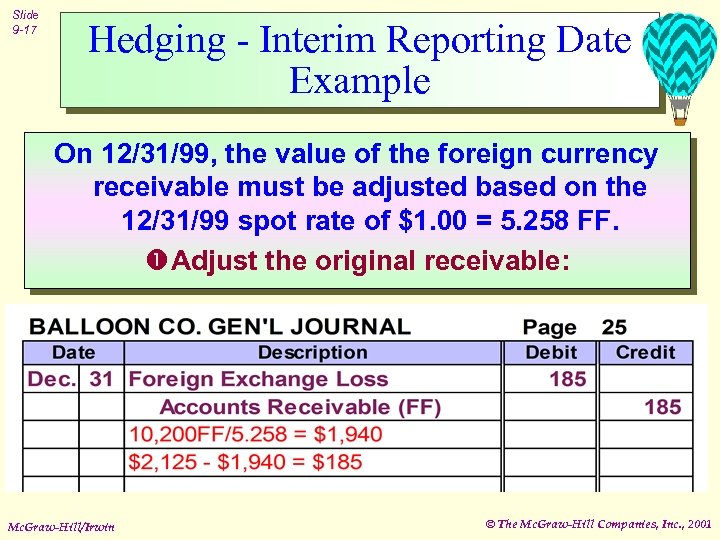

Slide 9 -17 Hedging - Interim Reporting Date Example On 12/31/99, the value of the foreign currency receivable must be adjusted based on the 12/31/99 spot rate of $1. 00 = 5. 258 FF. Adjust the original receivable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -17 Hedging - Interim Reporting Date Example On 12/31/99, the value of the foreign currency receivable must be adjusted based on the 12/31/99 spot rate of $1. 00 = 5. 258 FF. Adjust the original receivable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

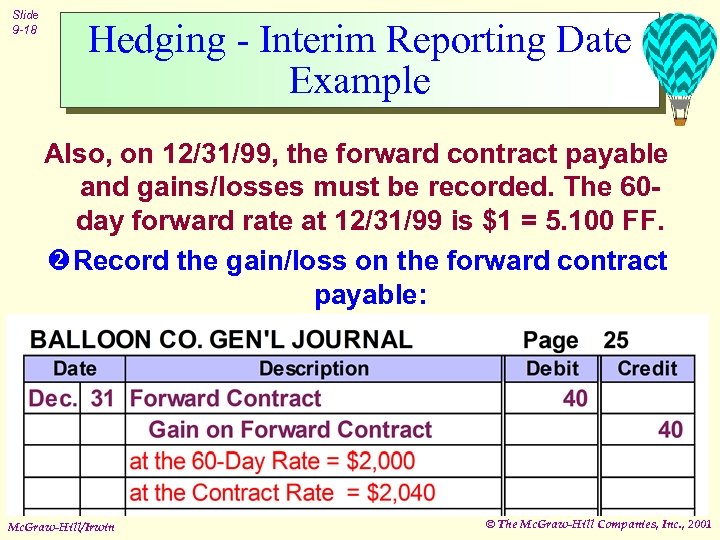

Slide 9 -18 Hedging - Interim Reporting Date Example Also, on 12/31/99, the forward contract payable and gains/losses must be recorded. The 60 day forward rate at 12/31/99 is $1 = 5. 100 FF. Record the gain/loss on the forward contract payable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -18 Hedging - Interim Reporting Date Example Also, on 12/31/99, the forward contract payable and gains/losses must be recorded. The 60 day forward rate at 12/31/99 is $1 = 5. 100 FF. Record the gain/loss on the forward contract payable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

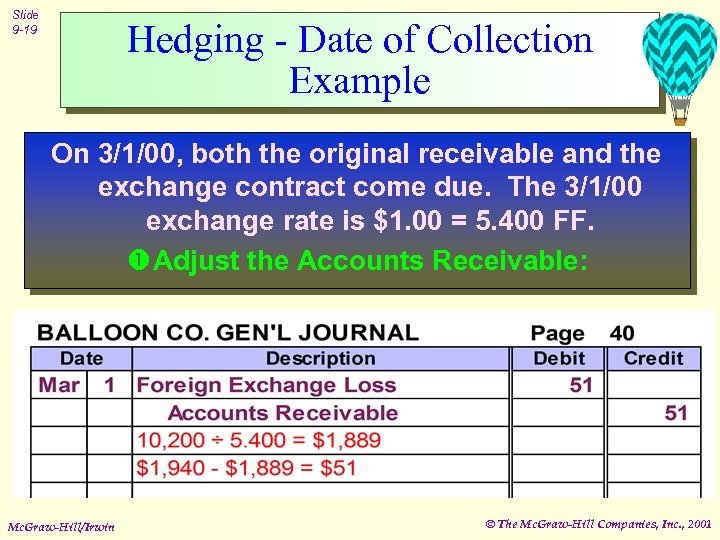

Slide 9 -19 Hedging - Date of Collection Example On 3/1/00, both the original receivable and the exchange contract come due. The 3/1/00 exchange rate is $1. 00 = 5. 400 FF. Adjust the Accounts Receivable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -19 Hedging - Date of Collection Example On 3/1/00, both the original receivable and the exchange contract come due. The 3/1/00 exchange rate is $1. 00 = 5. 400 FF. Adjust the Accounts Receivable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

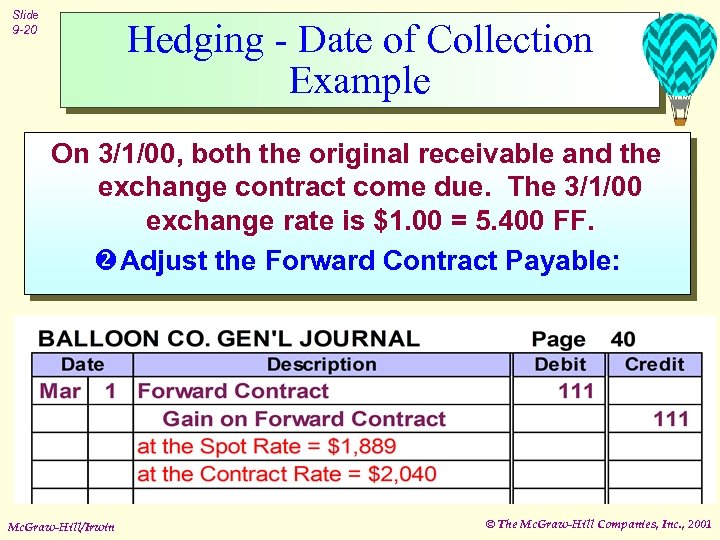

Slide 9 -20 Hedging - Date of Collection Example On 3/1/00, both the original receivable and the exchange contract come due. The 3/1/00 exchange rate is $1. 00 = 5. 400 FF. Adjust the Forward Contract Payable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -20 Hedging - Date of Collection Example On 3/1/00, both the original receivable and the exchange contract come due. The 3/1/00 exchange rate is $1. 00 = 5. 400 FF. Adjust the Forward Contract Payable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

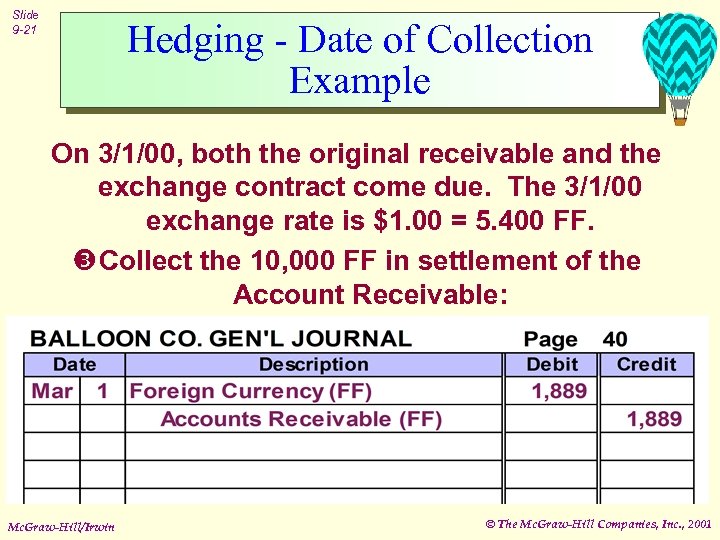

Slide 9 -21 Hedging - Date of Collection Example On 3/1/00, both the original receivable and the exchange contract come due. The 3/1/00 exchange rate is $1. 00 = 5. 400 FF. Collect the 10, 000 FF in settlement of the Account Receivable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -21 Hedging - Date of Collection Example On 3/1/00, both the original receivable and the exchange contract come due. The 3/1/00 exchange rate is $1. 00 = 5. 400 FF. Collect the 10, 000 FF in settlement of the Account Receivable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

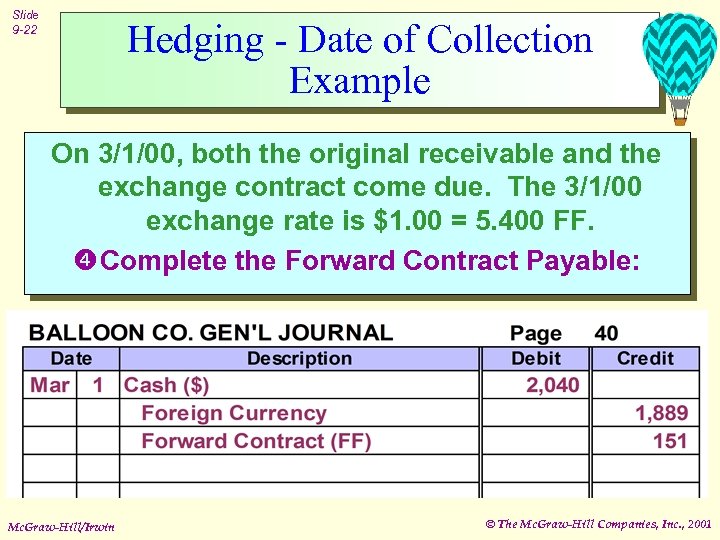

Slide 9 -22 Hedging - Date of Collection Example On 3/1/00, both the original receivable and the exchange contract come due. The 3/1/00 exchange rate is $1. 00 = 5. 400 FF. Complete the Forward Contract Payable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -22 Hedging - Date of Collection Example On 3/1/00, both the original receivable and the exchange contract come due. The 3/1/00 exchange rate is $1. 00 = 5. 400 FF. Complete the Forward Contract Payable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -23 Using a Foreign Currency Option as a Hedge An option is a contract that allows you to exercise a predetermined exchange rate if it is to your advantage. l Options carry a cost. l Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -23 Using a Foreign Currency Option as a Hedge An option is a contract that allows you to exercise a predetermined exchange rate if it is to your advantage. l Options carry a cost. l Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

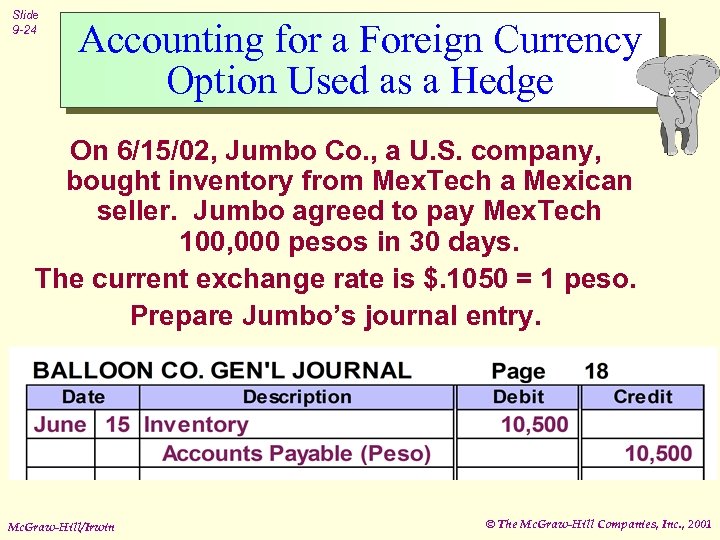

Slide 9 -24 Accounting for a Foreign Currency Option Used as a Hedge On 6/15/02, Jumbo Co. , a U. S. company, bought inventory from Mex. Tech a Mexican seller. Jumbo agreed to pay Mex. Tech 100, 000 pesos in 30 days. The current exchange rate is $. 1050 = 1 peso. Prepare Jumbo’s journal entry. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -24 Accounting for a Foreign Currency Option Used as a Hedge On 6/15/02, Jumbo Co. , a U. S. company, bought inventory from Mex. Tech a Mexican seller. Jumbo agreed to pay Mex. Tech 100, 000 pesos in 30 days. The current exchange rate is $. 1050 = 1 peso. Prepare Jumbo’s journal entry. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

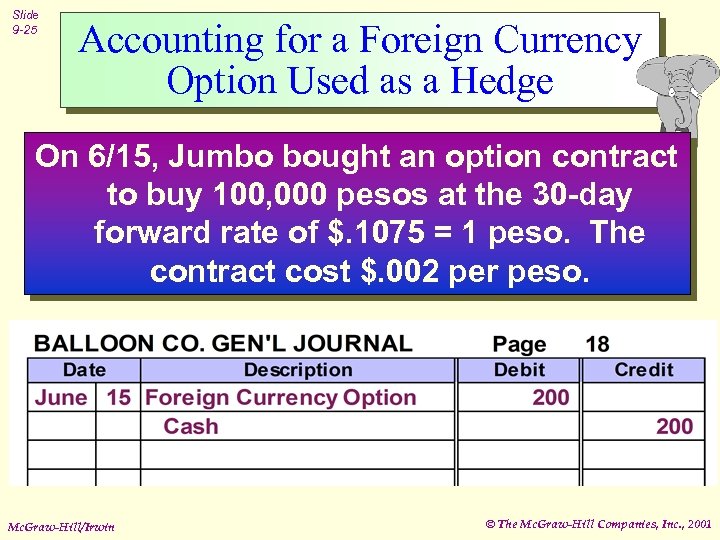

Slide 9 -25 Accounting for a Foreign Currency Option Used as a Hedge On 6/15, Jumbo bought an option contract to buy 100, 000 pesos at the 30 -day forward rate of $. 1075 = 1 peso. The contract cost $. 002 per peso. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -25 Accounting for a Foreign Currency Option Used as a Hedge On 6/15, Jumbo bought an option contract to buy 100, 000 pesos at the 30 -day forward rate of $. 1075 = 1 peso. The contract cost $. 002 per peso. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

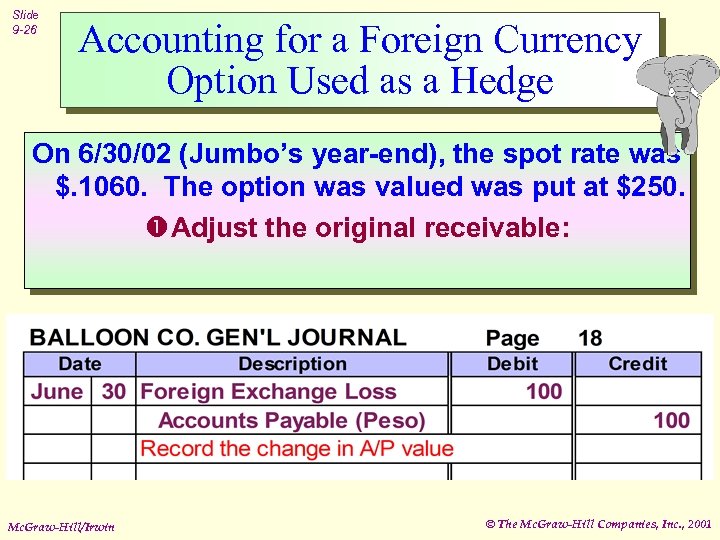

Slide 9 -26 Accounting for a Foreign Currency Option Used as a Hedge On 6/30/02 (Jumbo’s year-end), the spot rate was $. 1060. The option was valued was put at $250. Adjust the original receivable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -26 Accounting for a Foreign Currency Option Used as a Hedge On 6/30/02 (Jumbo’s year-end), the spot rate was $. 1060. The option was valued was put at $250. Adjust the original receivable: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

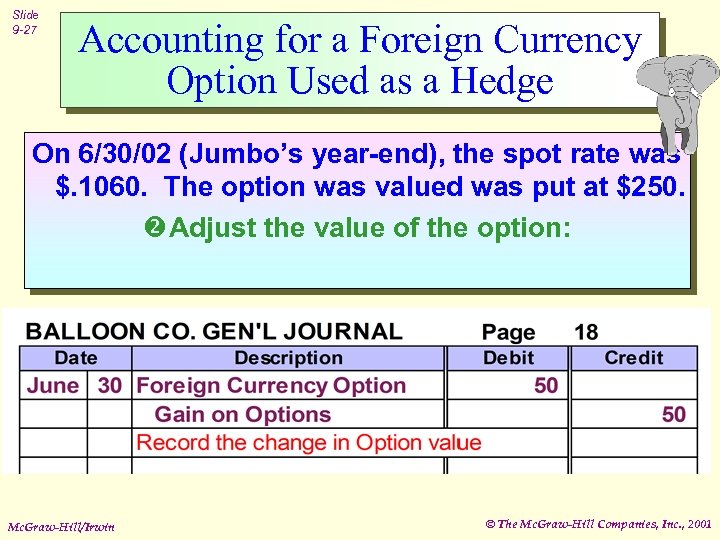

Slide 9 -27 Accounting for a Foreign Currency Option Used as a Hedge On 6/30/02 (Jumbo’s year-end), the spot rate was $. 1060. The option was valued was put at $250. Adjust the value of the option: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -27 Accounting for a Foreign Currency Option Used as a Hedge On 6/30/02 (Jumbo’s year-end), the spot rate was $. 1060. The option was valued was put at $250. Adjust the value of the option: Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

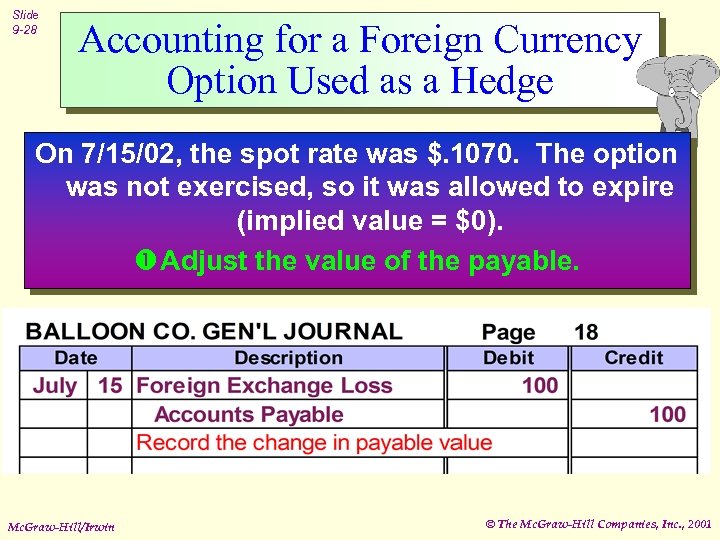

Slide 9 -28 Accounting for a Foreign Currency Option Used as a Hedge On 7/15/02, the spot rate was $. 1070. The option was not exercised, so it was allowed to expire (implied value = $0). Adjust the value of the payable. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -28 Accounting for a Foreign Currency Option Used as a Hedge On 7/15/02, the spot rate was $. 1070. The option was not exercised, so it was allowed to expire (implied value = $0). Adjust the value of the payable. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

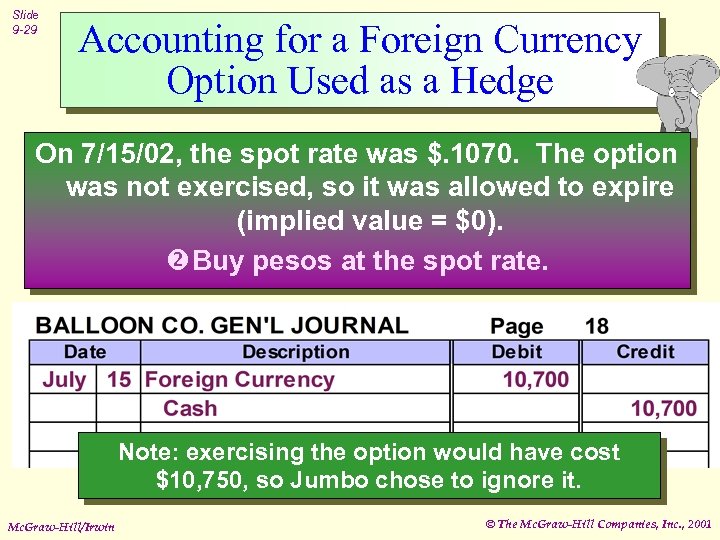

Slide 9 -29 Accounting for a Foreign Currency Option Used as a Hedge On 7/15/02, the spot rate was $. 1070. The option was not exercised, so it was allowed to expire (implied value = $0). Buy pesos at the spot rate. Note: exercising the option would have cost $10, 750, so Jumbo chose to ignore it. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -29 Accounting for a Foreign Currency Option Used as a Hedge On 7/15/02, the spot rate was $. 1070. The option was not exercised, so it was allowed to expire (implied value = $0). Buy pesos at the spot rate. Note: exercising the option would have cost $10, 750, so Jumbo chose to ignore it. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

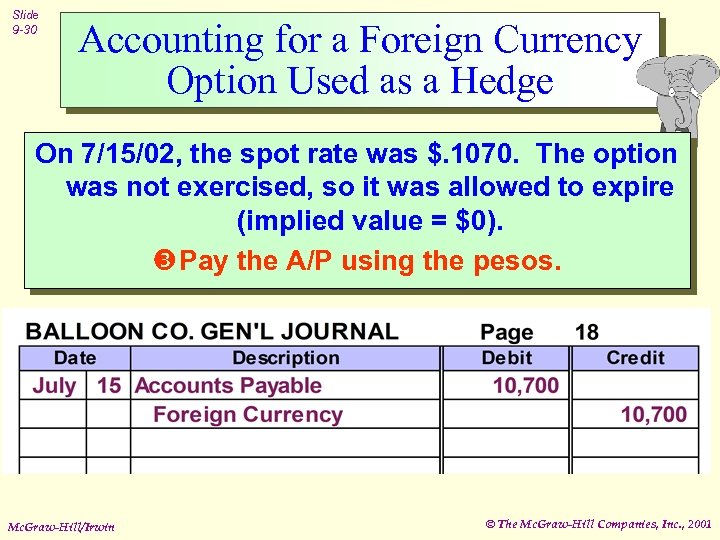

Slide 9 -30 Accounting for a Foreign Currency Option Used as a Hedge On 7/15/02, the spot rate was $. 1070. The option was not exercised, so it was allowed to expire (implied value = $0). Pay the A/P using the pesos. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -30 Accounting for a Foreign Currency Option Used as a Hedge On 7/15/02, the spot rate was $. 1070. The option was not exercised, so it was allowed to expire (implied value = $0). Pay the A/P using the pesos. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

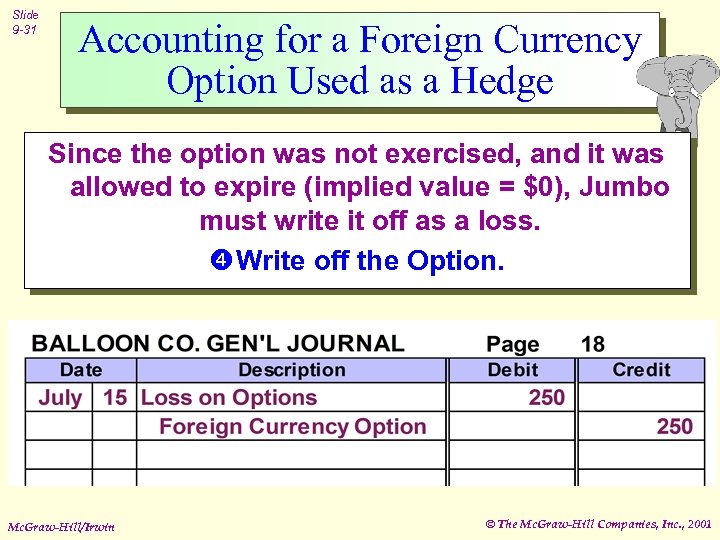

Slide 9 -31 Accounting for a Foreign Currency Option Used as a Hedge Since the option was not exercised, and it was allowed to expire (implied value = $0), Jumbo must write it off as a loss. Write off the Option. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -31 Accounting for a Foreign Currency Option Used as a Hedge Since the option was not exercised, and it was allowed to expire (implied value = $0), Jumbo must write it off as a loss. Write off the Option. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -32 Hedge of a Future Foreign Currency Commitment Occurs when a company hedges a transaction that has yet to take place. Example Ruff Wood orders a 1, 000 board feet of lumber from Brazil. Ruff Wood enters the hedge contract on the same day as the order is placed. Mc. Graw-Hill/Irwin Hedge accounting is only allowed under 2 conditions: 1. There is formal documentation of the hedge. 2. The hedge is expected to be highly effective. © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -32 Hedge of a Future Foreign Currency Commitment Occurs when a company hedges a transaction that has yet to take place. Example Ruff Wood orders a 1, 000 board feet of lumber from Brazil. Ruff Wood enters the hedge contract on the same day as the order is placed. Mc. Graw-Hill/Irwin Hedge accounting is only allowed under 2 conditions: 1. There is formal documentation of the hedge. 2. The hedge is expected to be highly effective. © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -33 The End. . . sort of Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001

Slide 9 -33 The End. . . sort of Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2001