c9c864a058806fe41d8619a413a1b6fa.ppt

- Количество слайдов: 28

Slide 5. 1 Chapter 5 Accounting information for service businesses Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 1 Chapter 5 Accounting information for service businesses Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

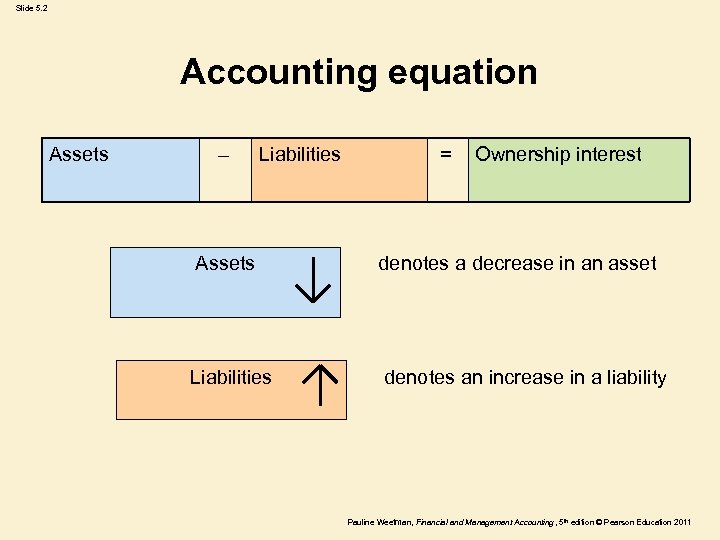

Slide 5. 2 Accounting equation Assets – Liabilities = Ownership interest Assets denotes a decrease in an asset Liabilities denotes an increase in a liability Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 2 Accounting equation Assets – Liabilities = Ownership interest Assets denotes a decrease in an asset Liabilities denotes an increase in a liability Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

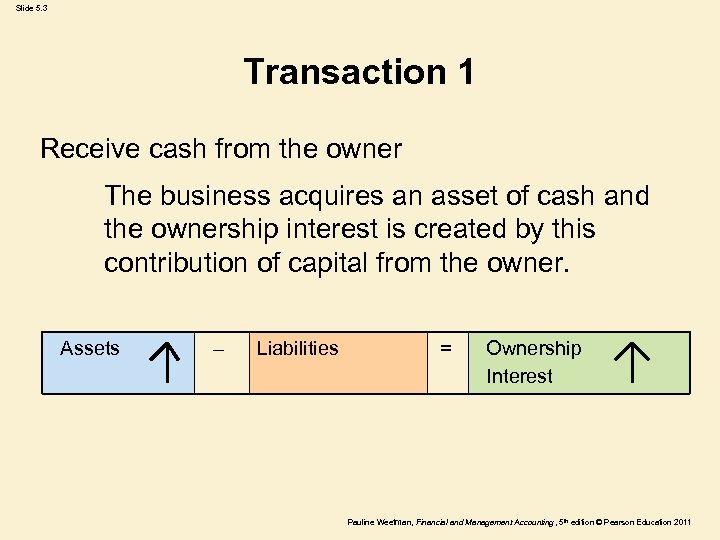

Slide 5. 3 Transaction 1 Receive cash from the owner The business acquires an asset of cash and the ownership interest is created by this contribution of capital from the owner. Assets – Liabilities = Ownership Interest Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 3 Transaction 1 Receive cash from the owner The business acquires an asset of cash and the ownership interest is created by this contribution of capital from the owner. Assets – Liabilities = Ownership Interest Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

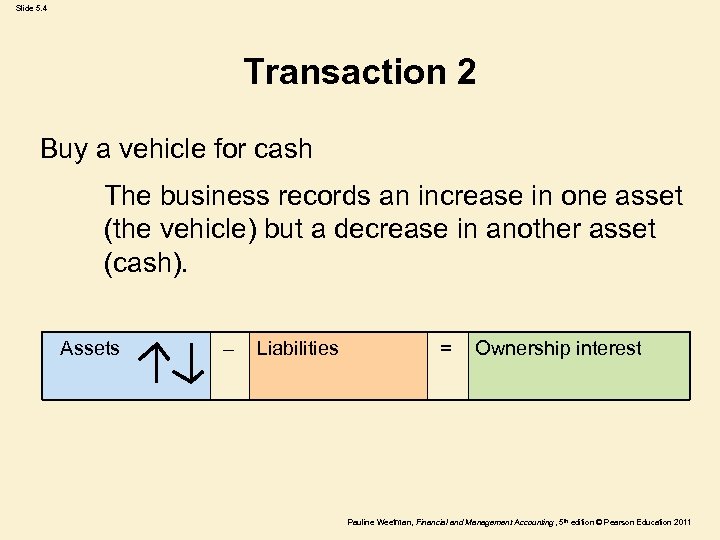

Slide 5. 4 Transaction 2 Buy a vehicle for cash The business records an increase in one asset (the vehicle) but a decrease in another asset (cash). Assets – Liabilities = Ownership interest Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 4 Transaction 2 Buy a vehicle for cash The business records an increase in one asset (the vehicle) but a decrease in another asset (cash). Assets – Liabilities = Ownership interest Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 5 Transactions (Continued) See chapter for further illustrations of the effect of transactions on the accounting equation. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 5 Transactions (Continued) See chapter for further illustrations of the effect of transactions on the accounting equation. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

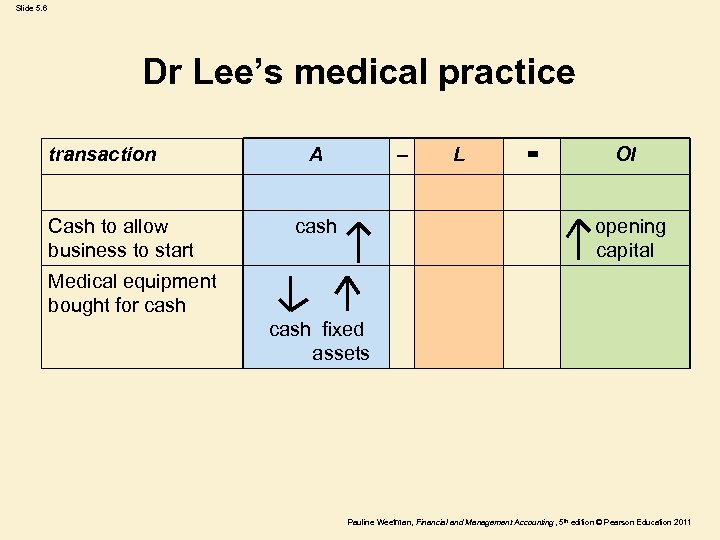

Slide 5. 6 Dr Lee’s medical practice transaction Cash to allow business to start A – cash L = OI opening capital Medical equipment bought for cash fixed assets Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 6 Dr Lee’s medical practice transaction Cash to allow business to start A – cash L = OI opening capital Medical equipment bought for cash fixed assets Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

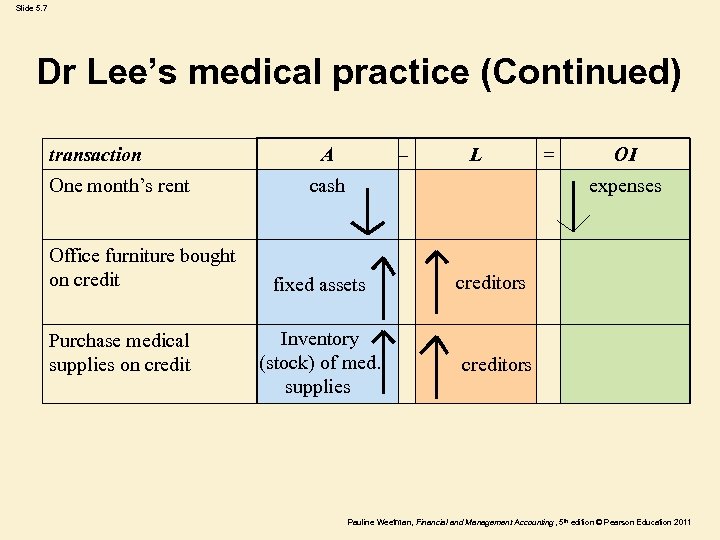

Slide 5. 7 Dr Lee’s medical practice (Continued) transaction One month’s rent Office furniture bought on credit Purchase medical supplies on credit A – L cash = OI expenses fixed assets Inventory (stock) of med. supplies creditors Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 7 Dr Lee’s medical practice (Continued) transaction One month’s rent Office furniture bought on credit Purchase medical supplies on credit A – L cash = OI expenses fixed assets Inventory (stock) of med. supplies creditors Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

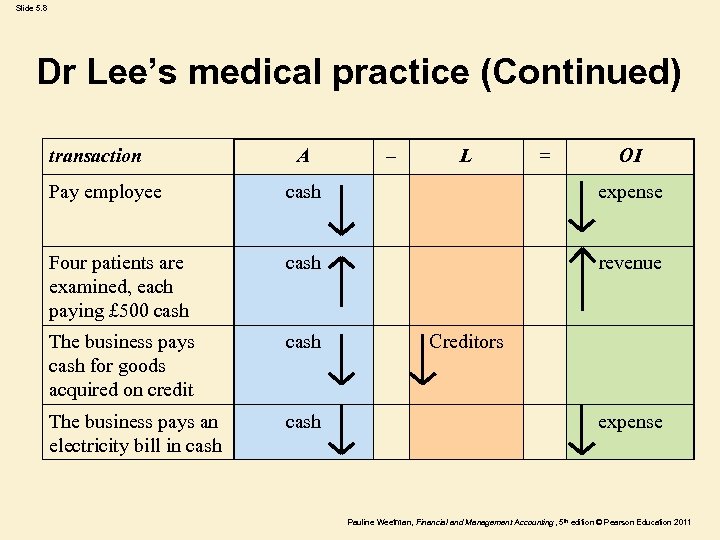

Slide 5. 8 Dr Lee’s medical practice (Continued) transaction A – L = OI Pay employee cash expense Four patients are examined, each paying £ 500 cash revenue The business pays cash for goods acquired on credit cash The business pays an electricity bill in cash Creditors expense Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 8 Dr Lee’s medical practice (Continued) transaction A – L = OI Pay employee cash expense Four patients are examined, each paying £ 500 cash revenue The business pays cash for goods acquired on credit cash The business pays an electricity bill in cash Creditors expense Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

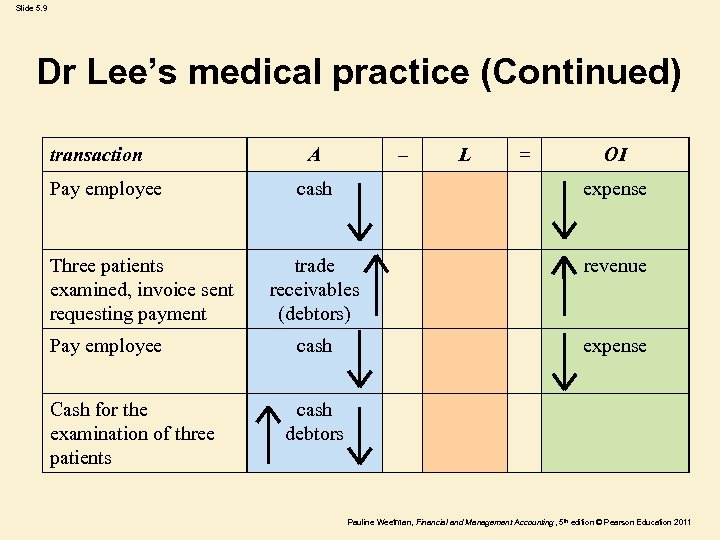

Slide 5. 9 Dr Lee’s medical practice (Continued) transaction Pay employee Three patients examined, invoice sent requesting payment Pay employee Cash for the examination of three patients A – L = OI cash expense trade receivables (debtors) revenue cash expense cash debtors Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 9 Dr Lee’s medical practice (Continued) transaction Pay employee Three patients examined, invoice sent requesting payment Pay employee Cash for the examination of three patients A – L = OI cash expense trade receivables (debtors) revenue cash expense cash debtors Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

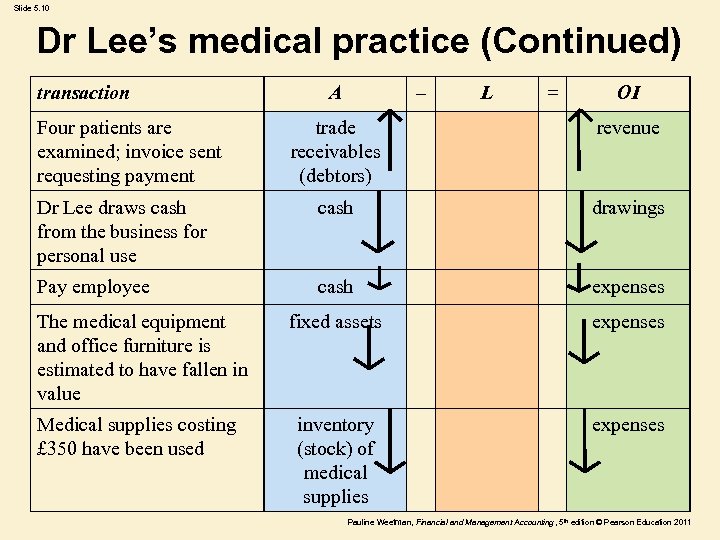

Slide 5. 10 Dr Lee’s medical practice (Continued) transaction Four patients are examined; invoice sent requesting payment A – L = OI trade receivables (debtors) revenue Dr Lee draws cash from the business for personal use cash drawings Pay employee cash expenses fixed assets expenses inventory (stock) of medical supplies expenses The medical equipment and office furniture is estimated to have fallen in value Medical supplies costing £ 350 have been used Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 10 Dr Lee’s medical practice (Continued) transaction Four patients are examined; invoice sent requesting payment A – L = OI trade receivables (debtors) revenue Dr Lee draws cash from the business for personal use cash drawings Pay employee cash expenses fixed assets expenses inventory (stock) of medical supplies expenses The medical equipment and office furniture is estimated to have fallen in value Medical supplies costing £ 350 have been used Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 11 Dr Lee’s medical practice (Continued) See Chapter 5 for: • Spreadsheet entries • Financial statements Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 11 Dr Lee’s medical practice (Continued) See Chapter 5 for: • Spreadsheet entries • Financial statements Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 12 Chapter 5 Bookkeeping Supplement Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 12 Chapter 5 Bookkeeping Supplement Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

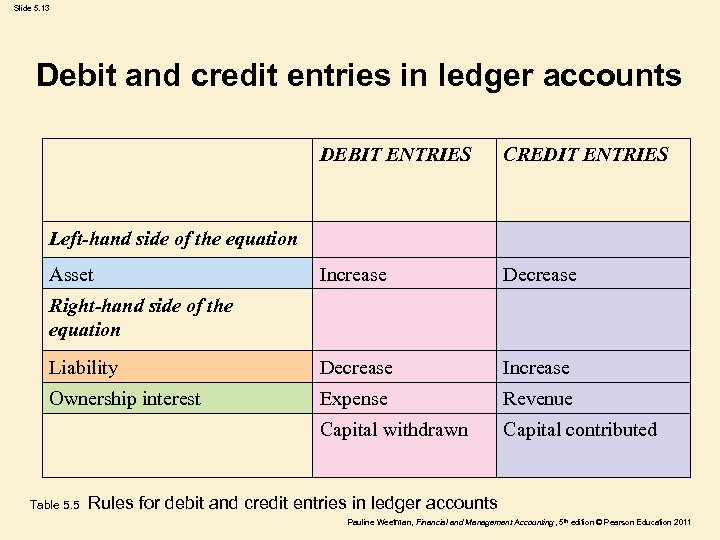

Slide 5. 13 Debit and credit entries in ledger accounts DEBIT ENTRIES CREDIT ENTRIES Increase Decrease Liability Decrease Increase Ownership interest Expense Revenue Capital withdrawn Capital contributed Left-hand side of the equation Asset Right-hand side of the equation Table 5. 5 Rules for debit and credit entries in ledger accounts Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 13 Debit and credit entries in ledger accounts DEBIT ENTRIES CREDIT ENTRIES Increase Decrease Liability Decrease Increase Ownership interest Expense Revenue Capital withdrawn Capital contributed Left-hand side of the equation Asset Right-hand side of the equation Table 5. 5 Rules for debit and credit entries in ledger accounts Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

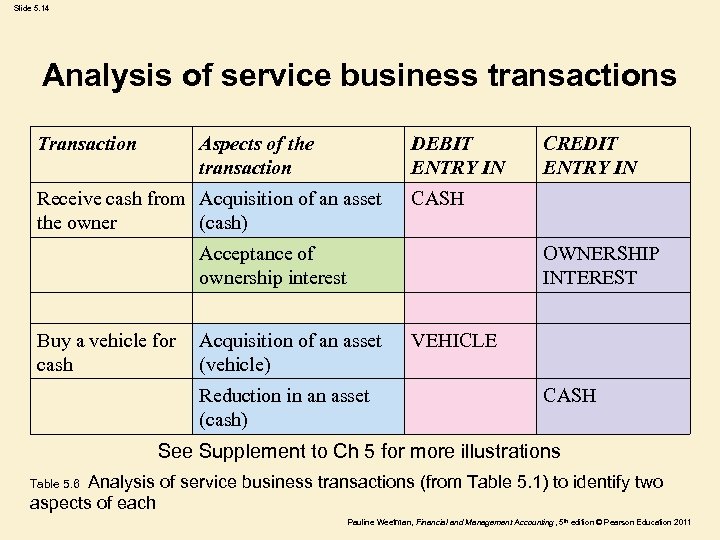

Slide 5. 14 Analysis of service business transactions Transaction Aspects of the transaction DEBIT ENTRY IN Receive cash from Acquisition of an asset the owner (cash) CASH Acceptance of ownership interest Buy a vehicle for cash CREDIT ENTRY IN OWNERSHIP INTEREST Acquisition of an asset (vehicle) Reduction in an asset (cash) VEHICLE CASH See Supplement to Ch 5 for more illustrations Analysis of service business transactions (from Table 5. 1) to identify two aspects of each Table 5. 6 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 14 Analysis of service business transactions Transaction Aspects of the transaction DEBIT ENTRY IN Receive cash from Acquisition of an asset the owner (cash) CASH Acceptance of ownership interest Buy a vehicle for cash CREDIT ENTRY IN OWNERSHIP INTEREST Acquisition of an asset (vehicle) Reduction in an asset (cash) VEHICLE CASH See Supplement to Ch 5 for more illustrations Analysis of service business transactions (from Table 5. 1) to identify two aspects of each Table 5. 6 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

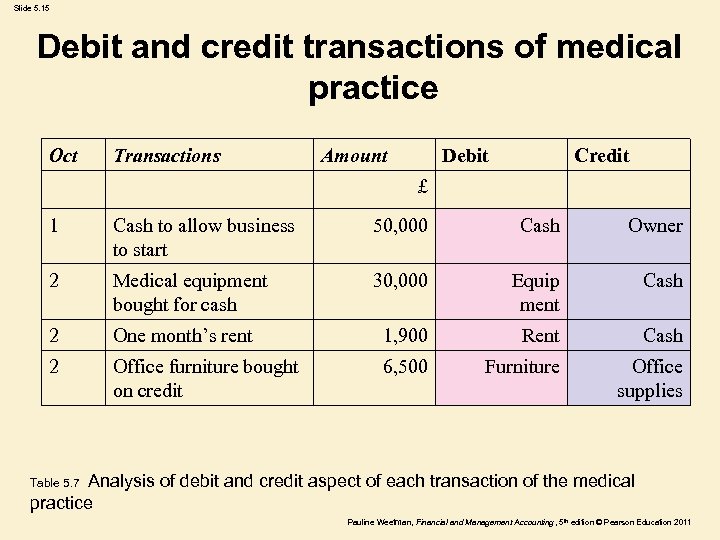

Slide 5. 15 Debit and credit transactions of medical practice Oct Transactions Amount Debit Credit £ 1 Cash to allow business to start 50, 000 Cash Owner 2 Medical equipment bought for cash 30, 000 Equip ment Cash 2 One month’s rent 1, 900 Rent Cash 2 Office furniture bought on credit 6, 500 Furniture Office supplies Analysis of debit and credit aspect of each transaction of the medical practice Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 15 Debit and credit transactions of medical practice Oct Transactions Amount Debit Credit £ 1 Cash to allow business to start 50, 000 Cash Owner 2 Medical equipment bought for cash 30, 000 Equip ment Cash 2 One month’s rent 1, 900 Rent Cash 2 Office furniture bought on credit 6, 500 Furniture Office supplies Analysis of debit and credit aspect of each transaction of the medical practice Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

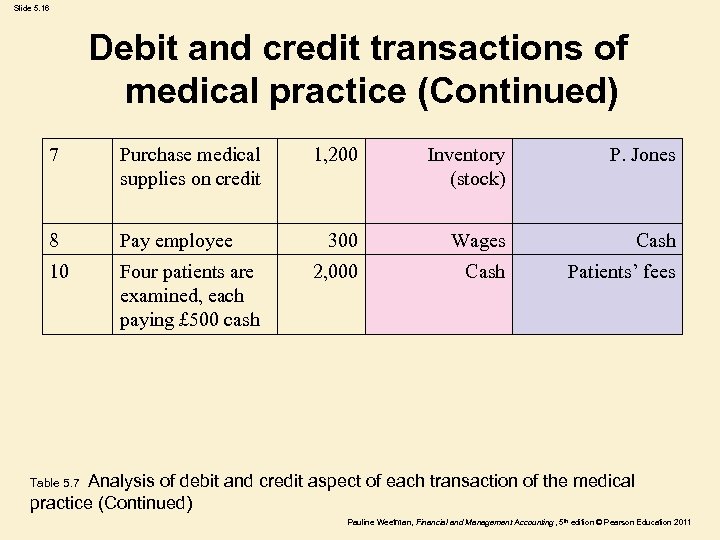

Slide 5. 16 Debit and credit transactions of medical practice (Continued) 7 Purchase medical supplies on credit 8 Pay employee 10 Four patients are examined, each paying £ 500 cash 1, 200 Inventory (stock) P. Jones 300 Wages Cash 2, 000 Cash Patients’ fees Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 16 Debit and credit transactions of medical practice (Continued) 7 Purchase medical supplies on credit 8 Pay employee 10 Four patients are examined, each paying £ 500 cash 1, 200 Inventory (stock) P. Jones 300 Wages Cash 2, 000 Cash Patients’ fees Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

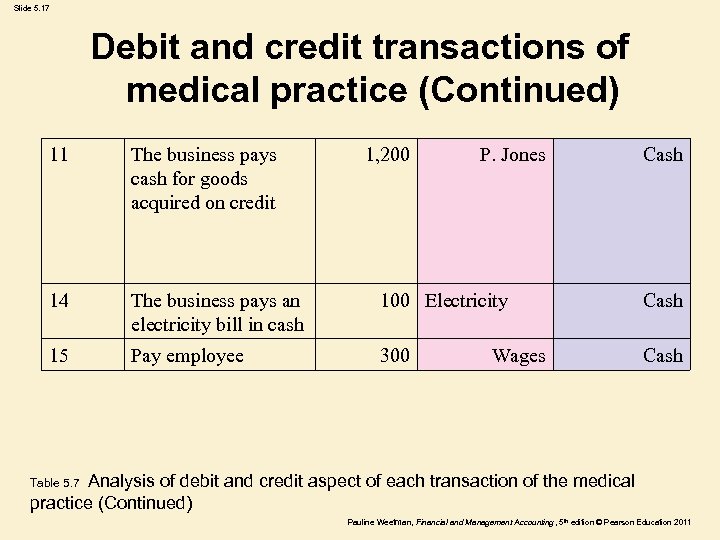

Slide 5. 17 Debit and credit transactions of medical practice (Continued) 11 The business pays cash for goods acquired on credit 1, 200 P. Jones 14 The business pays an electricity bill in cash 100 Electricity Cash 15 Pay employee 300 Cash Wages Cash Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 17 Debit and credit transactions of medical practice (Continued) 11 The business pays cash for goods acquired on credit 1, 200 P. Jones 14 The business pays an electricity bill in cash 100 Electricity Cash 15 Pay employee 300 Cash Wages Cash Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

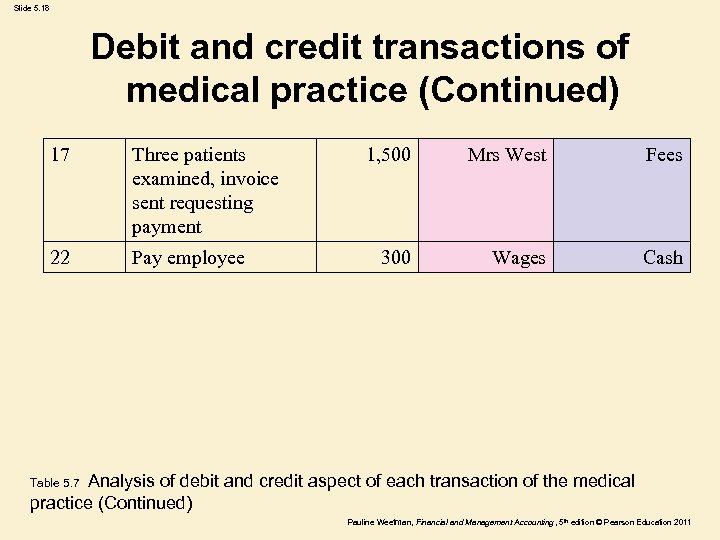

Slide 5. 18 Debit and credit transactions of medical practice (Continued) 17 Three patients examined, invoice sent requesting payment 22 Pay employee 1, 500 Mrs West Fees 300 Wages Cash Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 18 Debit and credit transactions of medical practice (Continued) 17 Three patients examined, invoice sent requesting payment 22 Pay employee 1, 500 Mrs West Fees 300 Wages Cash Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

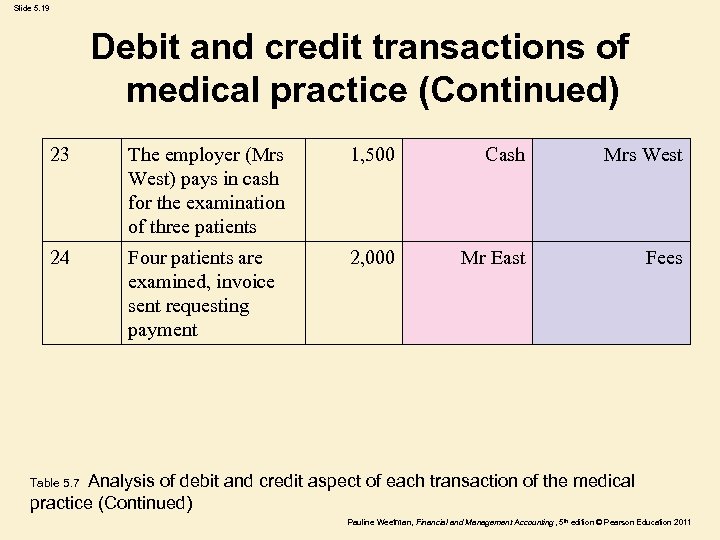

Slide 5. 19 Debit and credit transactions of medical practice (Continued) 23 The employer (Mrs West) pays in cash for the examination of three patients 1, 500 Cash Mrs West 24 Four patients are examined, invoice sent requesting payment 2, 000 Mr East Fees Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 19 Debit and credit transactions of medical practice (Continued) 23 The employer (Mrs West) pays in cash for the examination of three patients 1, 500 Cash Mrs West 24 Four patients are examined, invoice sent requesting payment 2, 000 Mr East Fees Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

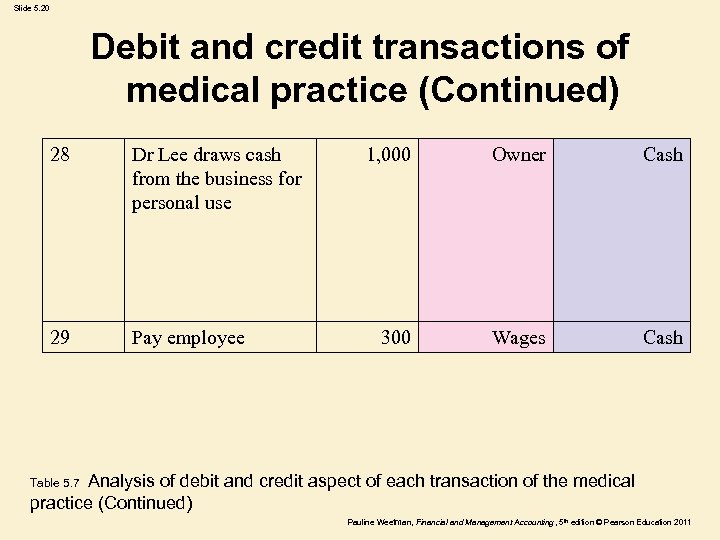

Slide 5. 20 Debit and credit transactions of medical practice (Continued) 28 Dr Lee draws cash from the business for personal use 29 Pay employee 1, 000 Owner Cash 300 Wages Cash Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 20 Debit and credit transactions of medical practice (Continued) 28 Dr Lee draws cash from the business for personal use 29 Pay employee 1, 000 Owner Cash 300 Wages Cash Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

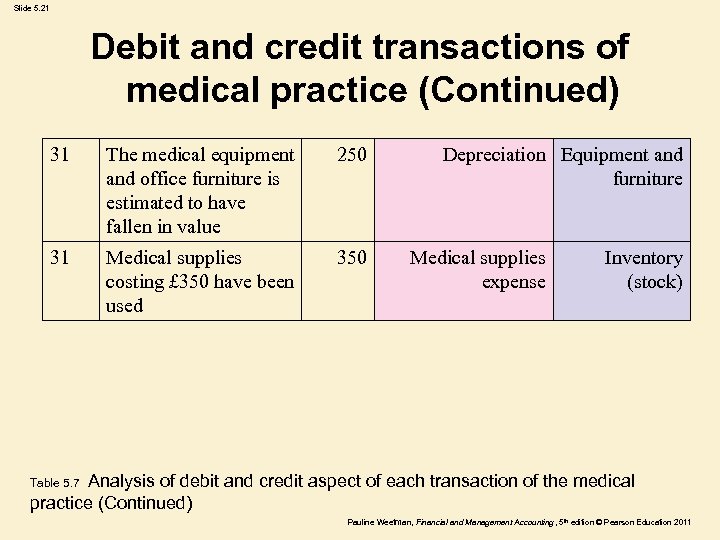

Slide 5. 21 Debit and credit transactions of medical practice (Continued) 31 The medical equipment and office furniture is estimated to have fallen in value 250 31 Medical supplies costing £ 350 have been used 350 Depreciation Equipment and furniture Medical supplies expense Inventory (stock) Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 21 Debit and credit transactions of medical practice (Continued) 31 The medical equipment and office furniture is estimated to have fallen in value 250 31 Medical supplies costing £ 350 have been used 350 Depreciation Equipment and furniture Medical supplies expense Inventory (stock) Analysis of debit and credit aspect of each transaction of the medical practice (Continued) Table 5. 7 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

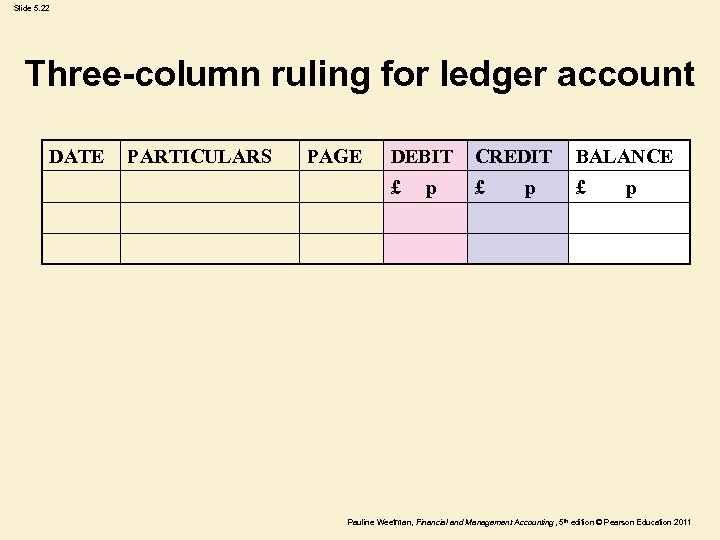

Slide 5. 22 Three-column ruling for ledger account DATE PARTICULARS PAGE DEBIT CREDIT BALANCE £ £ £ p p p Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 22 Three-column ruling for ledger account DATE PARTICULARS PAGE DEBIT CREDIT BALANCE £ £ £ p p p Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

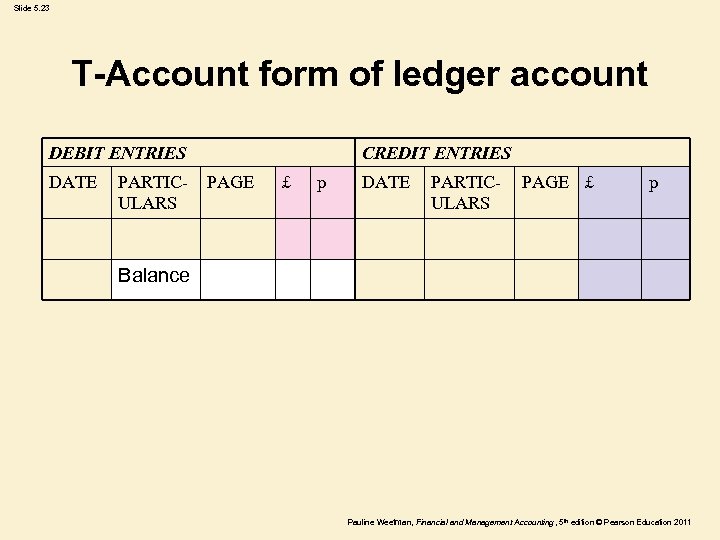

Slide 5. 23 T-Account form of ledger account DEBIT ENTRIES DATE PARTICULARS CREDIT ENTRIES PAGE £ p DATE PARTICULARS PAGE £ p Balance Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 23 T-Account form of ledger account DEBIT ENTRIES DATE PARTICULARS CREDIT ENTRIES PAGE £ p DATE PARTICULARS PAGE £ p Balance Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 24 Ledger account titles L 1 Cash L 8 Inventory (stock) of medical supplies L 2 Ownership interest L 9 P. Jones L 3 Medical equipment and office furniture L 10 Electricity L 4 Office Supplies Company L 11 Mrs West L 5 Rent L 12 Mr East L 6 Wages L 13 Depreciation L 7 Patients’ fees L 14 Expense of medical supplies Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 24 Ledger account titles L 1 Cash L 8 Inventory (stock) of medical supplies L 2 Ownership interest L 9 P. Jones L 3 Medical equipment and office furniture L 10 Electricity L 4 Office Supplies Company L 11 Mrs West L 5 Rent L 12 Mr East L 6 Wages L 13 Depreciation L 7 Patients’ fees L 14 Expense of medical supplies Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

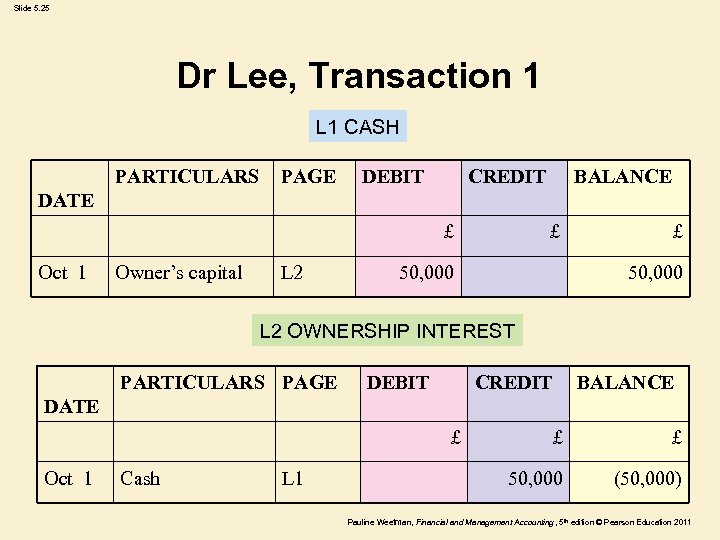

Slide 5. 25 Dr Lee, Transaction 1 L 1 CASH PARTICULARS PAGE DEBIT CREDIT BALANCE DATE £ Oct 1 Owner’s capital L 2 £ 50, 000 L 2 OWNERSHIP INTEREST PARTICULARS PAGE DEBIT CREDIT BALANCE DATE £ Oct 1 Cash L 1 £ £ 50, 000 (50, 000) Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 25 Dr Lee, Transaction 1 L 1 CASH PARTICULARS PAGE DEBIT CREDIT BALANCE DATE £ Oct 1 Owner’s capital L 2 £ 50, 000 L 2 OWNERSHIP INTEREST PARTICULARS PAGE DEBIT CREDIT BALANCE DATE £ Oct 1 Cash L 1 £ £ 50, 000 (50, 000) Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 26 Checking the accuracy of double entry records • A summary of all the balances at the end of the accounting period is called a Trial Balance (‘trial’ means ‘tests the accuracy’ of the balances). • If the total of the debit balances equals the total of the credit balances then we know that the total of the debit entries in the ledger accounts must equal the total of the credit entries in the ledger accounts. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 26 Checking the accuracy of double entry records • A summary of all the balances at the end of the accounting period is called a Trial Balance (‘trial’ means ‘tests the accuracy’ of the balances). • If the total of the debit balances equals the total of the credit balances then we know that the total of the debit entries in the ledger accounts must equal the total of the credit entries in the ledger accounts. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 27 Error detection Errors which will be detected by unequal totals in the trial balance • Entering only one aspect of a transaction (e. g. a debit entry but no credit entry). • Writing different amounts in each entry (e. g. debit £ 290 but credit £ 209). • Writing both entries in the same column (e. g. two debits, no credit). • Incorrect calculation of ledger account balance. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 27 Error detection Errors which will be detected by unequal totals in the trial balance • Entering only one aspect of a transaction (e. g. a debit entry but no credit entry). • Writing different amounts in each entry (e. g. debit £ 290 but credit £ 209). • Writing both entries in the same column (e. g. two debits, no credit). • Incorrect calculation of ledger account balance. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 28 Error detection (Continued) Errors which will not be detected because they leave the trial balance totals equal • Omitting both aspects of a transaction. • Errors in both debit and credit entry of the same magnitude. • Entering the correct amount in the wrong ledger account (e. g. debit for wages entered as debit for heat and light). Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 5. 28 Error detection (Continued) Errors which will not be detected because they leave the trial balance totals equal • Omitting both aspects of a transaction. • Errors in both debit and credit entry of the same magnitude. • Entering the correct amount in the wrong ledger account (e. g. debit for wages entered as debit for heat and light). Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011