M02_RUGM_6563_05_PPW_CH02.ppt

- Количество слайдов: 28

Slide 2. 1 Chapter 2 The Multinational enterprise (MNE) Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 1 Chapter 2 The Multinational enterprise (MNE) Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 2 The Multinational enterprise (MNE) • Objectives • The nature of multinational enterprises • Strategic management and multinational enterprises • A framework for global strategies: the FSA/CSA matrix. • It’s regional, not flat. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 2 The Multinational enterprise (MNE) • Objectives • The nature of multinational enterprises • Strategic management and multinational enterprises • A framework for global strategies: the FSA/CSA matrix. • It’s regional, not flat. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 3 Objectives • • • Describe the characteristics of MNEs. Explain the internationalization process. Explain why firms become MNEs. Discuss the strategic philosophy of these firms. Introduce a country/firm framework for examining a firm’s competitiveness. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 3 Objectives • • • Describe the characteristics of MNEs. Explain the internationalization process. Explain why firms become MNEs. Discuss the strategic philosophy of these firms. Introduce a country/firm framework for examining a firm’s competitiveness. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 4 The Multinational enterprise (MNE) • A company headquartered in one country but with operations in one or more other countries. • MNEs often downplay the fact that they are foreign-held. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 4 The Multinational enterprise (MNE) • A company headquartered in one country but with operations in one or more other countries. • MNEs often downplay the fact that they are foreign-held. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 5 The nature of MNEs Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 5 The nature of MNEs Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

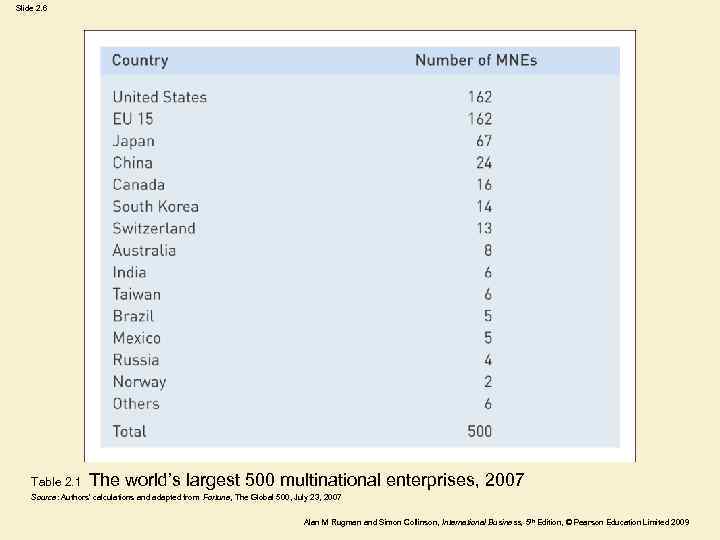

Slide 2. 6 Table 2. 1 The world’s largest 500 multinational enterprises, 2007 Source: Authors’ calculations and adapted from Fortune, The Global 500, July 23, 2007 Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 6 Table 2. 1 The world’s largest 500 multinational enterprises, 2007 Source: Authors’ calculations and adapted from Fortune, The Global 500, July 23, 2007 Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 7 Characteristics of MNES • Affiliates must be responsive to a number of important environmental forces, including competitors, customers, suppliers, financial institutions, and government. • Draw on a common pool of resources, including assets, patents, trademarks, information, and human resources. • Affiliates and business partners are linked together by a common strategic vision. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 7 Characteristics of MNES • Affiliates must be responsive to a number of important environmental forces, including competitors, customers, suppliers, financial institutions, and government. • Draw on a common pool of resources, including assets, patents, trademarks, information, and human resources. • Affiliates and business partners are linked together by a common strategic vision. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

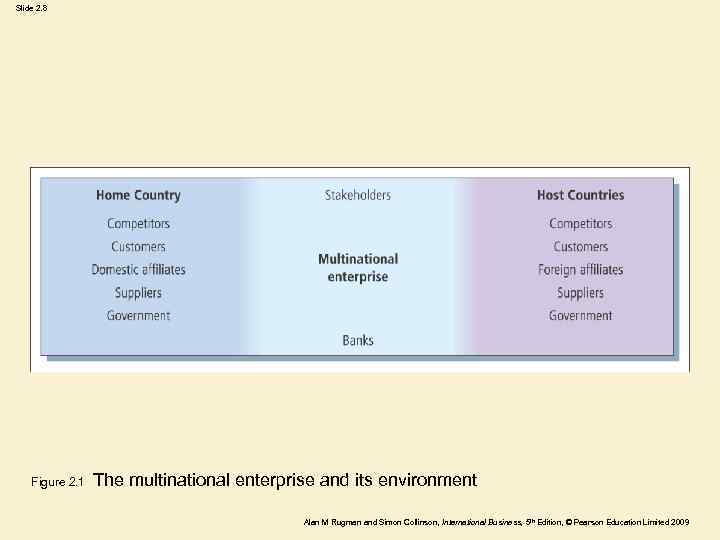

Slide 2. 8 Figure 2. 1 The multinational enterprise and its environment Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 8 Figure 2. 1 The multinational enterprise and its environment Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 9 The internationalization process • Internationalization: The process by which a company enters a foreign market. • Not all international business is done by MNEs. Indeed, setting up a wholly-owned subsidiary is usually the last stage of doing business abroad. • Why do businesses wait to set up wholly-owned subsidiaries? – Foreign markets are risky. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 9 The internationalization process • Internationalization: The process by which a company enters a foreign market. • Not all international business is done by MNEs. Indeed, setting up a wholly-owned subsidiary is usually the last stage of doing business abroad. • Why do businesses wait to set up wholly-owned subsidiaries? – Foreign markets are risky. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 10 A typical internationalization process • Initially, the firm might license patents, trademarks or technology to a foreign company in exchange for a fee or royalty. • The firm sees a potential for extra sales by exporting and uses a local agent or distributor to enter a foreign market. • The firm may use exporting as a “vent” for its surplus production and might have no long-term commitment to the international market. • As exports become more important, the MNE will set up an office for its sales representative or a sales subsidiary. • The firm might set up local packaging and/or assembly operations. • Finally, the firm will set up a wholly-owned subsidiary (FDI). Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 10 A typical internationalization process • Initially, the firm might license patents, trademarks or technology to a foreign company in exchange for a fee or royalty. • The firm sees a potential for extra sales by exporting and uses a local agent or distributor to enter a foreign market. • The firm may use exporting as a “vent” for its surplus production and might have no long-term commitment to the international market. • As exports become more important, the MNE will set up an office for its sales representative or a sales subsidiary. • The firm might set up local packaging and/or assembly operations. • Finally, the firm will set up a wholly-owned subsidiary (FDI). Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

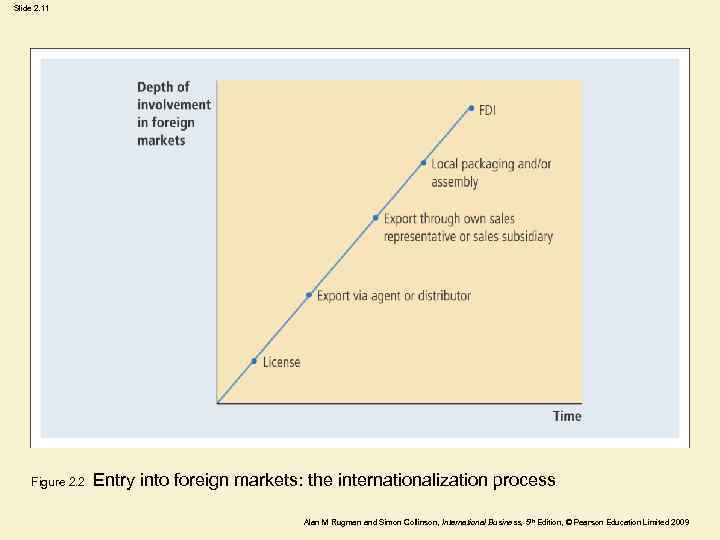

Slide 2. 11 Figure 2. 2 Entry into foreign markets: the internationalization process Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 11 Figure 2. 2 Entry into foreign markets: the internationalization process Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 12 Why do firms become MNEs? • to diversify themselves against the risks and uncertainties of the domestic business cycle; • to tap the growing world market for goods and services; • in response to foreign competition; • to reduce costs; • to overcome barriers to entry into foreign markets; • to take advantage of technological expertise by manufacturing goods directly. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 12 Why do firms become MNEs? • to diversify themselves against the risks and uncertainties of the domestic business cycle; • to tap the growing world market for goods and services; • in response to foreign competition; • to reduce costs; • to overcome barriers to entry into foreign markets; • to take advantage of technological expertise by manufacturing goods directly. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 13 The strategic philosophy of MNEs • MNEs make decisions based on what is best for the overall company, even if this means transferring jobs to other countries and cutting back the local workforce. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 13 The strategic philosophy of MNEs • MNEs make decisions based on what is best for the overall company, even if this means transferring jobs to other countries and cutting back the local workforce. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

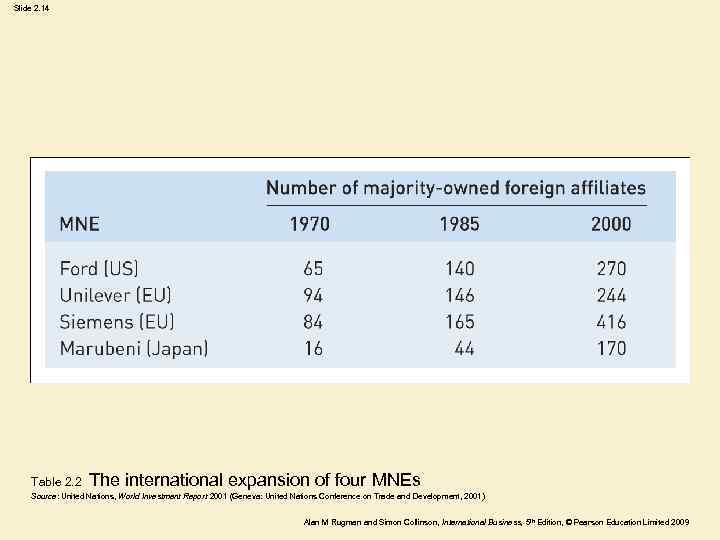

Slide 2. 14 Table 2. 2 The international expansion of four MNEs Source: United Nations, World Investment Report 2001 (Geneva: United Nations Conference on Trade and Development, 2001) Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 14 Table 2. 2 The international expansion of four MNEs Source: United Nations, World Investment Report 2001 (Geneva: United Nations Conference on Trade and Development, 2001) Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 15 Strategic management and MNEs • The strategic management process involves four major functions: strategy formulation, strategy implementation, evaluation, and the control of operations. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 15 Strategic management and MNEs • The strategic management process involves four major functions: strategy formulation, strategy implementation, evaluation, and the control of operations. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

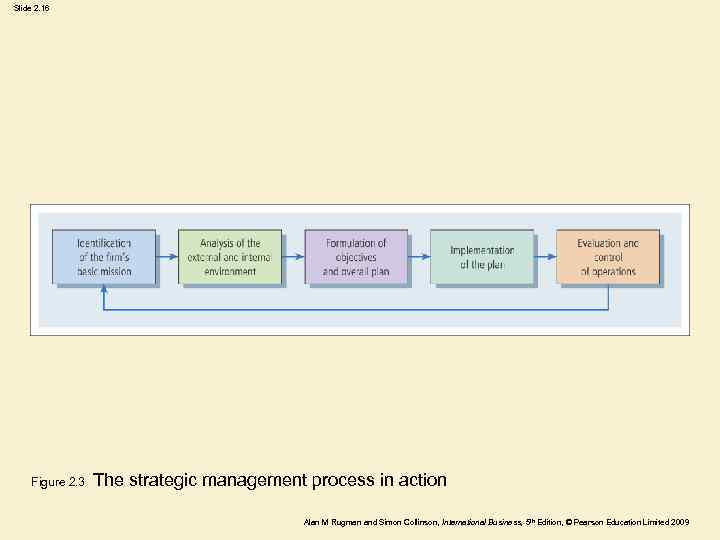

Slide 2. 16 Figure 2. 3 The strategic management process in action Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 16 Figure 2. 3 The strategic management process in action Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 17 Basic mission • The following questions must be answered to determine the firm’s basic mission: – What is the firm’s business? – What is the reason for its existence? For example, • Royal Dutch/Shell; BP Amoco and Texaco are in the energy business, not the oil business. • AT&T, Sprint and MCI are in the communications business, not the telephone business. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 17 Basic mission • The following questions must be answered to determine the firm’s basic mission: – What is the firm’s business? – What is the reason for its existence? For example, • Royal Dutch/Shell; BP Amoco and Texaco are in the energy business, not the oil business. • AT&T, Sprint and MCI are in the communications business, not the telephone business. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 18 Analysis of the external and internal environment • The goal of external environmental analysis is to identify opportunities and threats that will need to be addressed. • The purpose of an internal environmental analysis is to evaluate the company’s financial and personnel strengths and weaknesses. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 18 Analysis of the external and internal environment • The goal of external environmental analysis is to identify opportunities and threats that will need to be addressed. • The purpose of an internal environmental analysis is to evaluate the company’s financial and personnel strengths and weaknesses. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 19 Formulation of objectives and overall plan • Internal and external analyses will help identify long-term (2– 5 years) and short-term (< 2 years) goals. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 19 Formulation of objectives and overall plan • Internal and external analyses will help identify long-term (2– 5 years) and short-term (< 2 years) goals. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 20 The implementation process • Once goals have been established, the plan is then broken into major parts and each affiliate and department is assigned goals and responsibilities. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 20 The implementation process • Once goals have been established, the plan is then broken into major parts and each affiliate and department is assigned goals and responsibilities. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 21 Evaluation and control of operations • Progress is periodically evaluated and changes are made in the plan to accommodate changing circumstances and new information. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 21 Evaluation and control of operations • Progress is periodically evaluated and changes are made in the plan to accommodate changing circumstances and new information. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 22 Framework for global strategies: the FSA/CSA matrix Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 22 Framework for global strategies: the FSA/CSA matrix Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 23 Building blocks in our international business • There are two basic building blocks in an international business course. – Firm-specific advantages (FSAs): a unique capability proprietary to the organization § It may be built upon product or process technology, marketing or distributional skills. – Country-specific advantages (CSAs): country factors § Natural resource endowments (minerals, energy and forests), the labour force and associated cultural factors, etc. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 23 Building blocks in our international business • There are two basic building blocks in an international business course. – Firm-specific advantages (FSAs): a unique capability proprietary to the organization § It may be built upon product or process technology, marketing or distributional skills. – Country-specific advantages (CSAs): country factors § Natural resource endowments (minerals, energy and forests), the labour force and associated cultural factors, etc. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

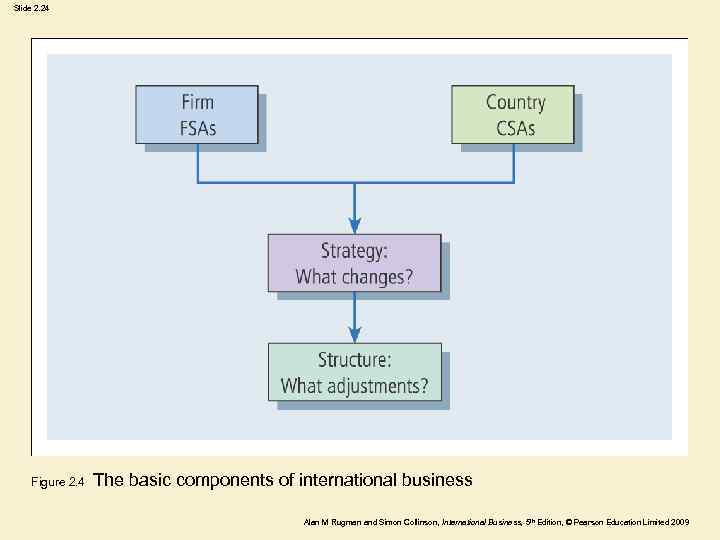

Slide 2. 24 Figure 2. 4 The basic components of international business Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 24 Figure 2. 4 The basic components of international business Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

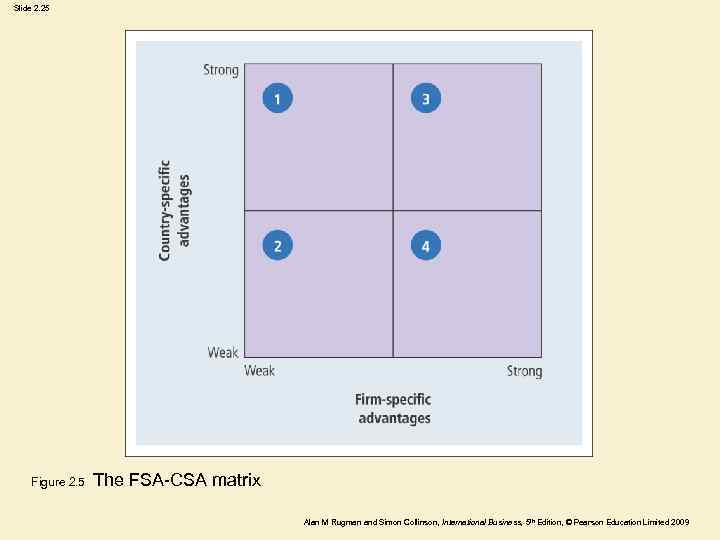

Slide 2. 25 Figure 2. 5 The FSA-CSA matrix Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 25 Figure 2. 5 The FSA-CSA matrix Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 26 The competitive advantage matrix • Quadrant 1: resource-based and/or mature, globally-oriented firms producing a commoditytype product cost leadership (Improving FSA can make them move to quadrant 3. ) • Quadrant 2: inefficient, floundering firms no alternative but to exit or to restructure • Quadrant 3: follow any of the generic strategies both cost leadership & differentiation • Quadrant 4: differentiated firms with strong FSAs in marketing and customization differentiation (the CSA is not relevant) Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 26 The competitive advantage matrix • Quadrant 1: resource-based and/or mature, globally-oriented firms producing a commoditytype product cost leadership (Improving FSA can make them move to quadrant 3. ) • Quadrant 2: inefficient, floundering firms no alternative but to exit or to restructure • Quadrant 3: follow any of the generic strategies both cost leadership & differentiation • Quadrant 4: differentiated firms with strong FSAs in marketing and customization differentiation (the CSA is not relevant) Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 27 Dunning’s “eclectic” theory of MNEs: OLI framework • Ownership factors (O): FSAs • Location factors (L): CSAs • Internalization factors (I): FSAs • O and I, in practice, are integrated features of FSA management within the MNE that cannot be decoupled in strategic decision making. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 27 Dunning’s “eclectic” theory of MNEs: OLI framework • Ownership factors (O): FSAs • Location factors (L): CSAs • Internalization factors (I): FSAs • O and I, in practice, are integrated features of FSA management within the MNE that cannot be decoupled in strategic decision making. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 28 It’s regional, not flat • The world is flat by Thomas Friedman, the New York Times journalist. – Today, a large proportion of international business takes place through offshoring leading to globalization. • The world is not flat! – There remain strong barriers as a business attempts to cross the boundaries of triad regions. – The liability of inter-regional foreignness. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009

Slide 2. 28 It’s regional, not flat • The world is flat by Thomas Friedman, the New York Times journalist. – Today, a large proportion of international business takes place through offshoring leading to globalization. • The world is not flat! – There remain strong barriers as a business attempts to cross the boundaries of triad regions. – The liability of inter-regional foreignness. Alan M Rugman and Simon Collinson, International Business, 5 th Edition, © Pearson Education Limited 2009