4cdfb8e9fe1a93d0993e0049fde513b7.ppt

- Количество слайдов: 48

Slide 12. 1 Chapter 12 Ownership interest Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 1 Chapter 12 Ownership interest Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

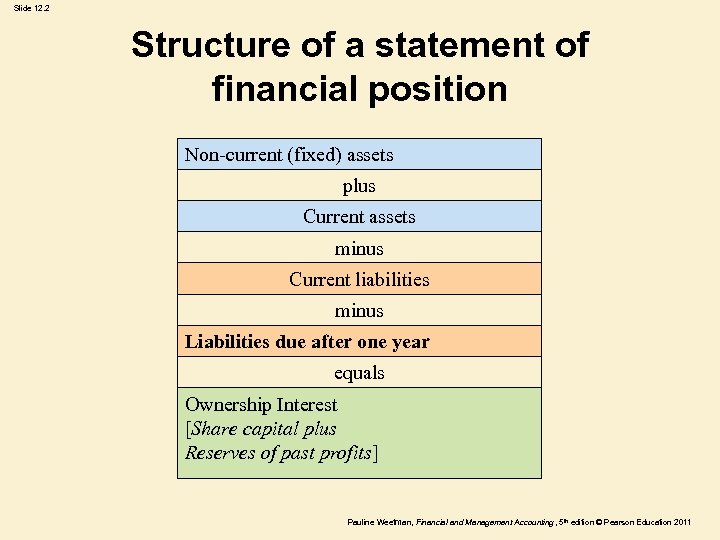

Slide 12. 2 Structure of a statement of financial position Non-current (fixed) assets plus Current assets minus Current liabilities minus Liabilities due after one year equals Ownership Interest [Share capital plus Reserves of past profits] Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 2 Structure of a statement of financial position Non-current (fixed) assets plus Current assets minus Current liabilities minus Liabilities due after one year equals Ownership Interest [Share capital plus Reserves of past profits] Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

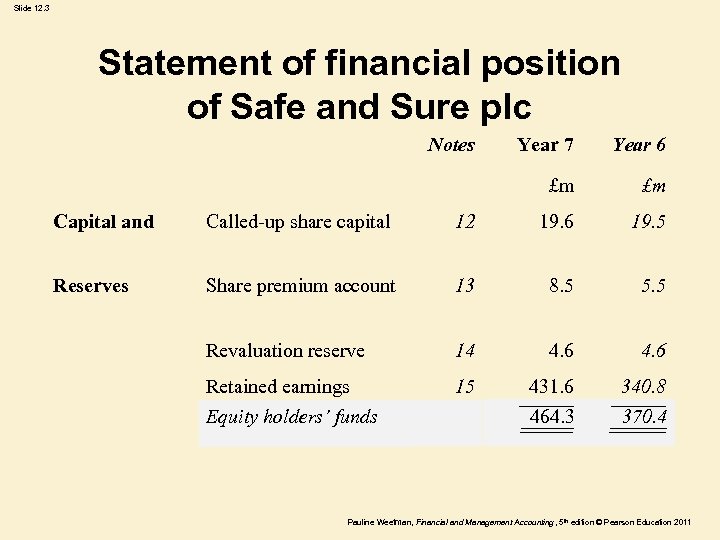

Slide 12. 3 Statement of financial position of Safe and Sure plc Notes Year 7 Year 6 £m £m Capital and Called-up share capital 12 19. 6 19. 5 Reserves Share premium account 13 8. 5 5. 5 Revaluation reserve 14 4. 6 Retained earnings 15 431. 6 464. 3 340. 8 370. 4 Equity holders’ funds Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 3 Statement of financial position of Safe and Sure plc Notes Year 7 Year 6 £m £m Capital and Called-up share capital 12 19. 6 19. 5 Reserves Share premium account 13 8. 5 5. 5 Revaluation reserve 14 4. 6 Retained earnings 15 431. 6 464. 3 340. 8 370. 4 Equity holders’ funds Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 4 Issue of shares at the date of incorporation When company first comes into existence: • it issues shares to the owners, • who become shareholders. • Each share has a named value • which is called its nominal value (par value) Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 4 Issue of shares at the date of incorporation When company first comes into existence: • it issues shares to the owners, • who become shareholders. • Each share has a named value • which is called its nominal value (par value) Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 5 Share certificate Certificate number 24516 Public Company plc SHARE CERTIFICATE This is to certify that J A Smith is the registered owner of 100, 000 ordinary shares of 25 pence each, Given under Seal of the Company the 15 th day of August 1985 Signed P Mc. Dowall Company Secretary J Jones W Brown Directors Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 5 Share certificate Certificate number 24516 Public Company plc SHARE CERTIFICATE This is to certify that J A Smith is the registered owner of 100, 000 ordinary shares of 25 pence each, Given under Seal of the Company the 15 th day of August 1985 Signed P Mc. Dowall Company Secretary J Jones W Brown Directors Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

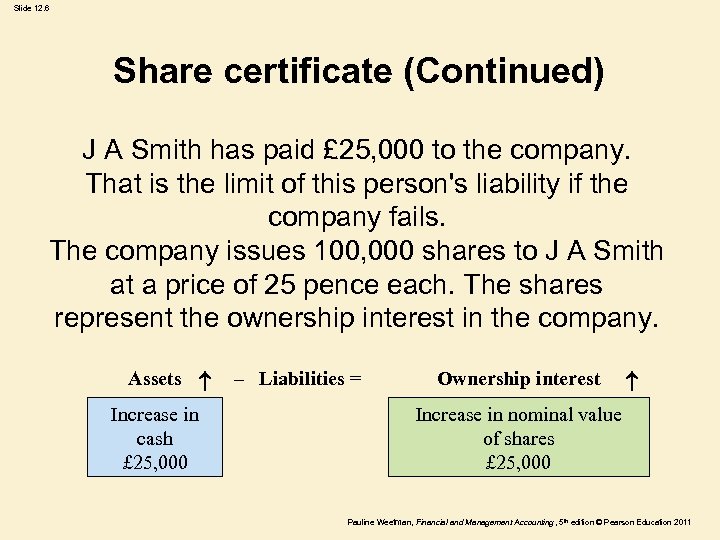

Slide 12. 6 Share certificate (Continued) J A Smith has paid £ 25, 000 to the company. That is the limit of this person's liability if the company fails. The company issues 100, 000 shares to J A Smith at a price of 25 pence each. The shares represent the ownership interest in the company. Assets Increase in cash £ 25, 000 – Liabilities = Ownership interest Increase in nominal value of shares £ 25, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 6 Share certificate (Continued) J A Smith has paid £ 25, 000 to the company. That is the limit of this person's liability if the company fails. The company issues 100, 000 shares to J A Smith at a price of 25 pence each. The shares represent the ownership interest in the company. Assets Increase in cash £ 25, 000 – Liabilities = Ownership interest Increase in nominal value of shares £ 25, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

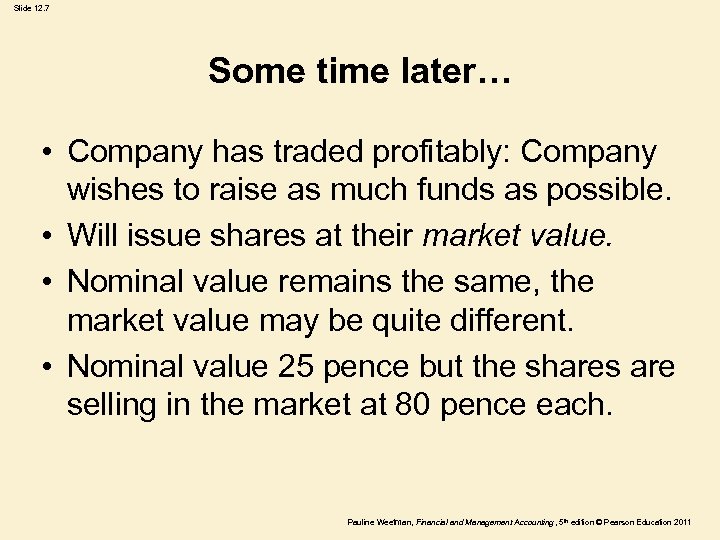

Slide 12. 7 Some time later… • Company has traded profitably: Company wishes to raise as much funds as possible. • Will issue shares at their market value. • Nominal value remains the same, the market value may be quite different. • Nominal value 25 pence but the shares are selling in the market at 80 pence each. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 7 Some time later… • Company has traded profitably: Company wishes to raise as much funds as possible. • Will issue shares at their market value. • Nominal value remains the same, the market value may be quite different. • Nominal value 25 pence but the shares are selling in the market at 80 pence each. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

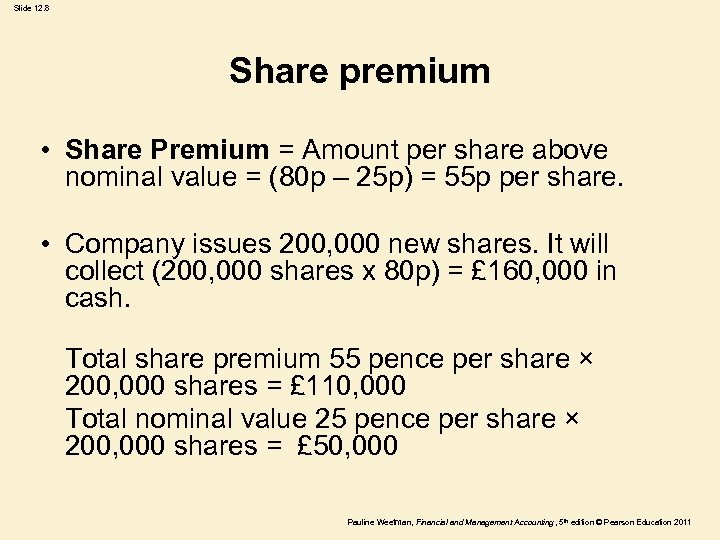

Slide 12. 8 Share premium • Share Premium = Amount per share above nominal value = (80 p – 25 p) = 55 p per share. • Company issues 200, 000 new shares. It will collect (200, 000 shares x 80 p) = £ 160, 000 in cash. Total share premium 55 pence per share × 200, 000 shares = £ 110, 000 Total nominal value 25 pence per share × 200, 000 shares = £ 50, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 8 Share premium • Share Premium = Amount per share above nominal value = (80 p – 25 p) = 55 p per share. • Company issues 200, 000 new shares. It will collect (200, 000 shares x 80 p) = £ 160, 000 in cash. Total share premium 55 pence per share × 200, 000 shares = £ 110, 000 Total nominal value 25 pence per share × 200, 000 shares = £ 50, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

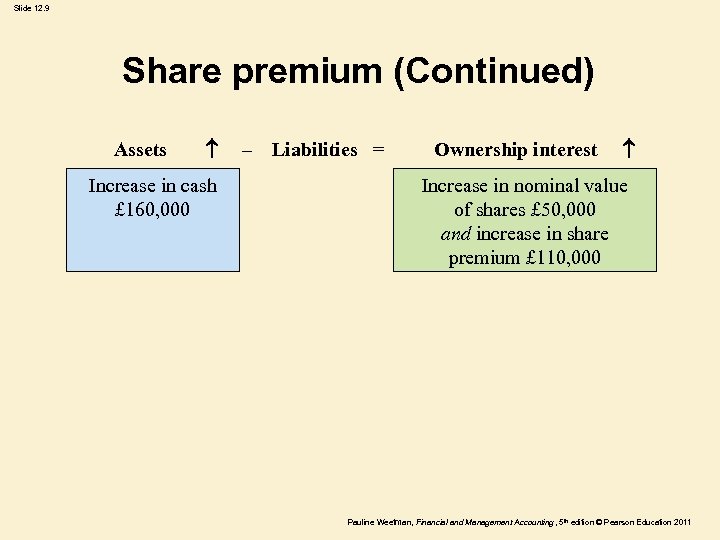

Slide 12. 9 Share premium (Continued) Assets Increase in cash £ 160, 000 – Liabilities = Ownership interest Increase in nominal value of shares £ 50, 000 and increase in share premium £ 110, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 9 Share premium (Continued) Assets Increase in cash £ 160, 000 – Liabilities = Ownership interest Increase in nominal value of shares £ 50, 000 and increase in share premium £ 110, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 10 Revaluation Hotel cost is £ 560, 000. The hotel is run successfully for a period of three years and at the end of that period a professional valuer confirms that the hotel, if sold, would probably result in sale proceeds of £ 620, 000. The directors of the company may wish to tell shareholders about this increased market value of the company's (fixed) asset. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 10 Revaluation Hotel cost is £ 560, 000. The hotel is run successfully for a period of three years and at the end of that period a professional valuer confirms that the hotel, if sold, would probably result in sale proceeds of £ 620, 000. The directors of the company may wish to tell shareholders about this increased market value of the company's (fixed) asset. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 11 Revaluation – choices • Keep the reported value at £ 560, 000 (the historical cost) but include a note to the statement of financial position explaining that the market value is £ 620, 000. 2. Alternative treatment is to RECOGNISE in financial statements the increase in value. But not a realised profit. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 11 Revaluation – choices • Keep the reported value at £ 560, 000 (the historical cost) but include a note to the statement of financial position explaining that the market value is £ 620, 000. 2. Alternative treatment is to RECOGNISE in financial statements the increase in value. But not a realised profit. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

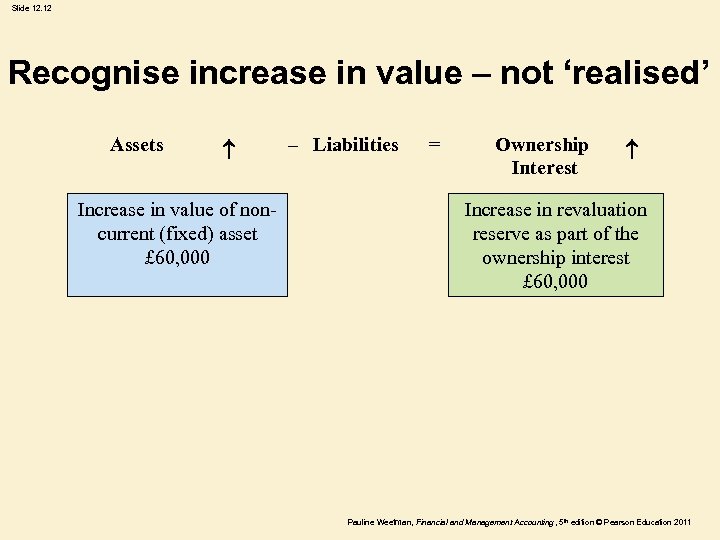

Slide 12. 12 Recognise increase in value – not ‘realised’ Assets Increase in value of noncurrent (fixed) asset £ 60, 000 – Liabilities = Ownership Interest Increase in revaluation reserve as part of the ownership interest £ 60, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 12 Recognise increase in value – not ‘realised’ Assets Increase in value of noncurrent (fixed) asset £ 60, 000 – Liabilities = Ownership Interest Increase in revaluation reserve as part of the ownership interest £ 60, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 13 Foreign currency gains & losses Gains or losses resulting from changes in the rates of exchange with regard to assets held and liabilities owed and denominated in a different currency. • Loans $6 m when rate of exchange is £ 1 = $2 Liability expressed in £ = (6 × 1/2) = £ 3 m • Rate of exchanges to £ 1 = $3 Liability expressed in £ = (6 × 1/3) = £ 2 m Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 13 Foreign currency gains & losses Gains or losses resulting from changes in the rates of exchange with regard to assets held and liabilities owed and denominated in a different currency. • Loans $6 m when rate of exchange is £ 1 = $2 Liability expressed in £ = (6 × 1/2) = £ 3 m • Rate of exchanges to £ 1 = $3 Liability expressed in £ = (6 × 1/3) = £ 2 m Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 14 Foreign currency (Continued) • Assets – Liabilities↓ = Ownership interest↑ Gain of £ 1 m but not a realised gain Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 14 Foreign currency (Continued) • Assets – Liabilities↓ = Ownership interest↑ Gain of £ 1 m but not a realised gain Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

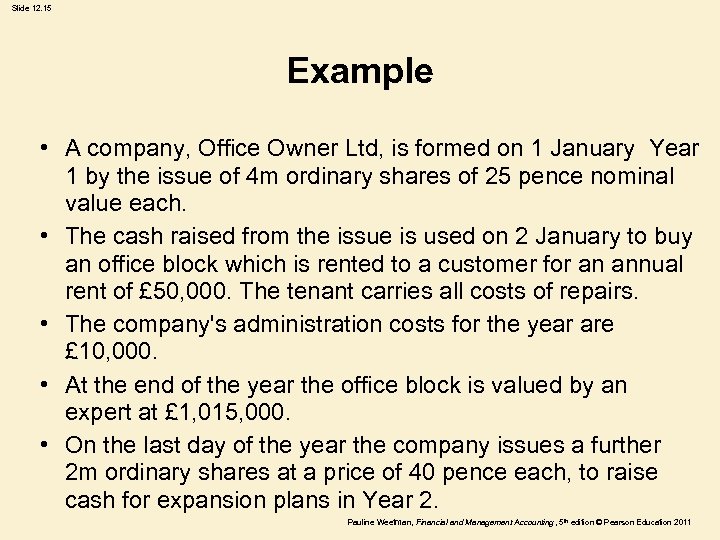

Slide 12. 15 Example • A company, Office Owner Ltd, is formed on 1 January Year 1 by the issue of 4 m ordinary shares of 25 pence nominal value each. • The cash raised from the issue is used on 2 January to buy an office block which is rented to a customer for an annual rent of £ 50, 000. The tenant carries all costs of repairs. • The company's administration costs for the year are £ 10, 000. • At the end of the year the office block is valued by an expert at £ 1, 015, 000. • On the last day of the year the company issues a further 2 m ordinary shares at a price of 40 pence each, to raise cash for expansion plans in Year 2. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 15 Example • A company, Office Owner Ltd, is formed on 1 January Year 1 by the issue of 4 m ordinary shares of 25 pence nominal value each. • The cash raised from the issue is used on 2 January to buy an office block which is rented to a customer for an annual rent of £ 50, 000. The tenant carries all costs of repairs. • The company's administration costs for the year are £ 10, 000. • At the end of the year the office block is valued by an expert at £ 1, 015, 000. • On the last day of the year the company issues a further 2 m ordinary shares at a price of 40 pence each, to raise cash for expansion plans in Year 2. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

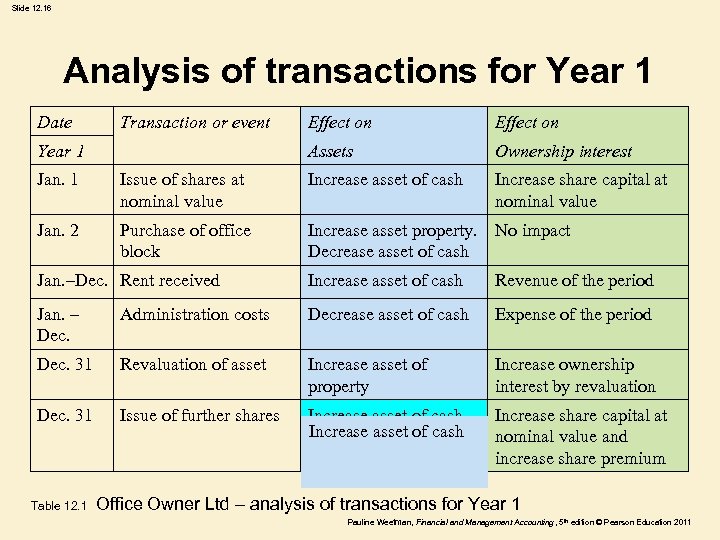

Slide 12. 16 Analysis of transactions for Year 1 Date Transaction or event Effect on Assets Year 1 Effect on Ownership interest Increase share capital at nominal value Jan. 1 Issue of shares at nominal value Increase asset of cash Jan. 2 Purchase of office block Increase asset property. No impact Decrease asset of cash Jan. –Dec. Rent received Increase asset of cash Revenue of the period Jan. – Dec. Administration costs Decrease asset of cash Expense of the period Dec. 31 Revaluation of asset Increase asset of property Increase ownership interest by revaluation Dec. 31 Issue of further shares Increase asset of cash Increase share capital at nominal value and increase share premium Table 12. 1 Office Owner Ltd – analysis of transactions for Year 1 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 16 Analysis of transactions for Year 1 Date Transaction or event Effect on Assets Year 1 Effect on Ownership interest Increase share capital at nominal value Jan. 1 Issue of shares at nominal value Increase asset of cash Jan. 2 Purchase of office block Increase asset property. No impact Decrease asset of cash Jan. –Dec. Rent received Increase asset of cash Revenue of the period Jan. – Dec. Administration costs Decrease asset of cash Expense of the period Dec. 31 Revaluation of asset Increase asset of property Increase ownership interest by revaluation Dec. 31 Issue of further shares Increase asset of cash Increase share capital at nominal value and increase share premium Table 12. 1 Office Owner Ltd – analysis of transactions for Year 1 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

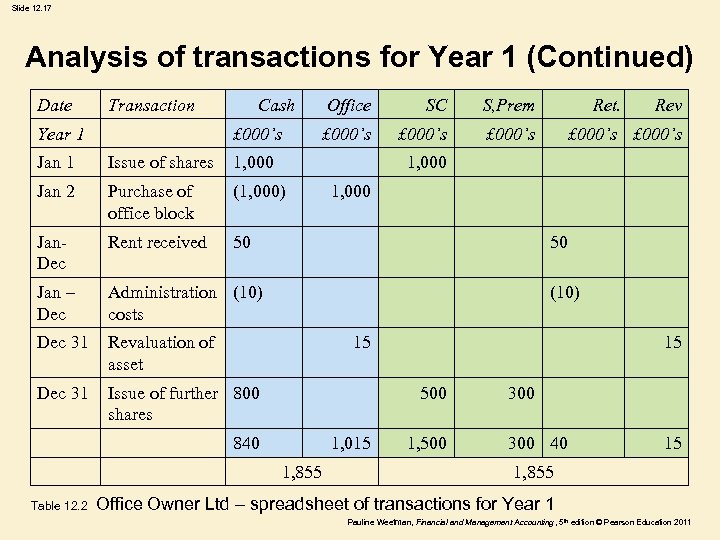

Slide 12. 17 Analysis of transactions for Year 1 (Continued) Date Transaction Year 1 Cash £ 000’s Jan 1 Issue of shares Purchase of office block Rent received £ 000’s Revaluation of asset Dec 31 £ 000’s Administration (10) costs Dec 31 £ 000’s 50 Jan – Dec S, Prem (1, 000) Jan. Dec SC 1, 000 Jan 2 Office Issue of further 800 shares Ret. Rev £ 000’s 1, 000 50 (10) 15 15 500 840 1, 015 1, 855 1, 500 300 40 15 1, 855 Table 12. 2 Office Owner Ltd – spreadsheet of transactions for Year 1 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 17 Analysis of transactions for Year 1 (Continued) Date Transaction Year 1 Cash £ 000’s Jan 1 Issue of shares Purchase of office block Rent received £ 000’s Revaluation of asset Dec 31 £ 000’s Administration (10) costs Dec 31 £ 000’s 50 Jan – Dec S, Prem (1, 000) Jan. Dec SC 1, 000 Jan 2 Office Issue of further 800 shares Ret. Rev £ 000’s 1, 000 50 (10) 15 15 500 840 1, 015 1, 855 1, 500 300 40 15 1, 855 Table 12. 2 Office Owner Ltd – spreadsheet of transactions for Year 1 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

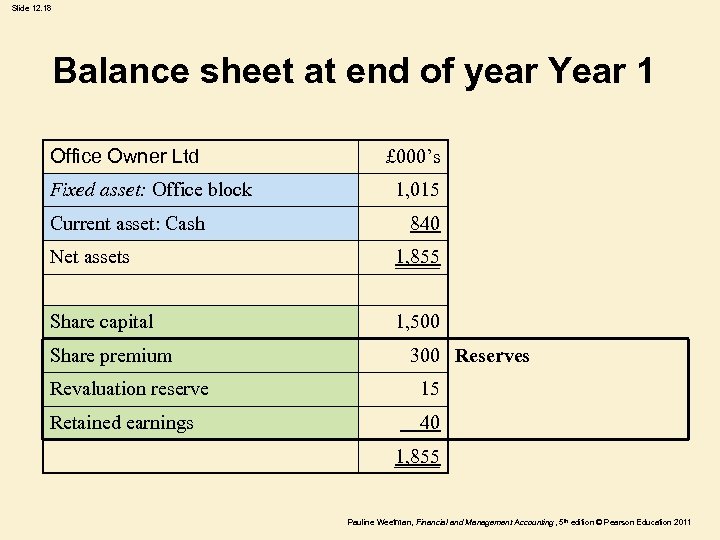

Slide 12. 18 Balance sheet at end of year Year 1 Office Owner Ltd Fixed asset: Office block Current asset: Cash £ 000’s 1, 015 840 Net assets 1, 855 Share capital 1, 500 Share premium 300 Reserves Revaluation reserve 15 Retained earnings 40 1, 855 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 18 Balance sheet at end of year Year 1 Office Owner Ltd Fixed asset: Office block Current asset: Cash £ 000’s 1, 015 840 Net assets 1, 855 Share capital 1, 500 Share premium 300 Reserves Revaluation reserve 15 Retained earnings 40 1, 855 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 19 Additional primary financial statements • IASB standards: Statement of changes in equity. (B) UK ASB standards: Statement of total recognised gains and losses (STRGL). Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 19 Additional primary financial statements • IASB standards: Statement of changes in equity. (B) UK ASB standards: Statement of total recognised gains and losses (STRGL). Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 20 Statement of changes in equity Must report (a) Profit or loss for the period (b) Items of income and expense for the period required to be reported directly through equity • Effects of changes in accounting policies and correction of errors. A statement reporting (a) + (b) + (c) also called a statement of comprehensive income. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 20 Statement of changes in equity Must report (a) Profit or loss for the period (b) Items of income and expense for the period required to be reported directly through equity • Effects of changes in accounting policies and correction of errors. A statement reporting (a) + (b) + (c) also called a statement of comprehensive income. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 21 Statement of changes in equity (Continued) Must also report (d) Transactions with equity holders (e. g. dividend). (e) Retained earnings at start and end of period. • Explanation of changes in each class of equity. A statement showing (a) to (f) is called a statement of changes in equity. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 21 Statement of changes in equity (Continued) Must also report (d) Transactions with equity holders (e. g. dividend). (e) Retained earnings at start and end of period. • Explanation of changes in each class of equity. A statement showing (a) to (f) is called a statement of changes in equity. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 22 UK Statement of total recognised gains and losses (STRGL) • Statement that helps to bridge the gap between income statement (profit and loss account) and balance sheet. • STRGL shows the extent to which shareholders’ funds have increased or decreased from the various gains and losses of the period. • Income statement (profit and loss account) only reports realised profits (the results of transactions with third parties. ) Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 22 UK Statement of total recognised gains and losses (STRGL) • Statement that helps to bridge the gap between income statement (profit and loss account) and balance sheet. • STRGL shows the extent to which shareholders’ funds have increased or decreased from the various gains and losses of the period. • Income statement (profit and loss account) only reports realised profits (the results of transactions with third parties. ) Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 23 STRGL (Continued) Income statement (profit and loss account) only reports realised profits (the results of transactions with third parties. ) Add to this unrealised gains and losses, e. g. • Revaluations of fixed assets. • Effect of exchange rates on foreign currency translation. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 23 STRGL (Continued) Income statement (profit and loss account) only reports realised profits (the results of transactions with third parties. ) Add to this unrealised gains and losses, e. g. • Revaluations of fixed assets. • Effect of exchange rates on foreign currency translation. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 24 UK movements in shareholders’ funds Shows all changes in shareholders’ funds. Could include: • Issue of new shares. • Repurchase and cancellation of shares. • Profit of the period. • Dividends of the period. • Effect of exchange rates on foreign currency translation. • Revaluations of fixed assets. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 24 UK movements in shareholders’ funds Shows all changes in shareholders’ funds. Could include: • Issue of new shares. • Repurchase and cancellation of shares. • Profit of the period. • Dividends of the period. • Effect of exchange rates on foreign currency translation. • Revaluations of fixed assets. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 25 Dividends Reward to the owner (usually cash) Questions: 1. Does the company have sufficient cash to pay a dividend? 2. Has the company made sufficient profits (increase in ownership interest) to justify a dividend? The decision is taken by the Directors. It is approved by shareholders at Annual General Meeting. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 25 Dividends Reward to the owner (usually cash) Questions: 1. Does the company have sufficient cash to pay a dividend? 2. Has the company made sufficient profits (increase in ownership interest) to justify a dividend? The decision is taken by the Directors. It is approved by shareholders at Annual General Meeting. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 26 Dividends paid Might be: • Dividend proposed for previous year, now paid. • Interim dividend as part of dividend for current year, A ↓ – L = OI ↓ Decrease in asset of cash, Decrease in ownership interest reported in income statement (profit and loss account). Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 26 Dividends paid Might be: • Dividend proposed for previous year, now paid. • Interim dividend as part of dividend for current year, A ↓ – L = OI ↓ Decrease in asset of cash, Decrease in ownership interest reported in income statement (profit and loss account). Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 27 Final dividend • At end of accounting year, after profits have been calculated, directors decide whether to pay a final dividend and, if so, how much. • This is not a liability because it has not been approved by shareholders. It is a proposal from directors. • The proposal to pay the dividend is reported as an item in the directors’ report. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 27 Final dividend • At end of accounting year, after profits have been calculated, directors decide whether to pay a final dividend and, if so, how much. • This is not a liability because it has not been approved by shareholders. It is a proposal from directors. • The proposal to pay the dividend is reported as an item in the directors’ report. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 28 Issue of further shares (1) Capitalisation issue (Bonus issue or Scrip issue) A company decides to increase the number of shares with no change to assets or liabilities. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 28 Issue of further shares (1) Capitalisation issue (Bonus issue or Scrip issue) A company decides to increase the number of shares with no change to assets or liabilities. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 29 Capitalisation issue • Share price tends to outperform the market after the announcement of a capitalisation issue. • There tends to be an acceptable range of prices for listed shares. £ 20 per share maximum. Increase number of shares, to scale down the price per share. • Capitalisation issue is often made out of reserves (of retained profits). Message given to shareholders that these are now part of the longterm funds of the company. No longer available to cover the payment of dividends. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 29 Capitalisation issue • Share price tends to outperform the market after the announcement of a capitalisation issue. • There tends to be an acceptable range of prices for listed shares. £ 20 per share maximum. Increase number of shares, to scale down the price per share. • Capitalisation issue is often made out of reserves (of retained profits). Message given to shareholders that these are now part of the longterm funds of the company. No longer available to cover the payment of dividends. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 30 Issue of further shares (2) Rights issue When a public (quoted) company raises finance by the issue of shares, this is normally done by way of a ‘rights issue’. This gives existing shareholders the choice of subscribing for new shares in the company and so maintain their proportional shareholding in the company. The issue price is set at below the current market price of the shares. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 30 Issue of further shares (2) Rights issue When a public (quoted) company raises finance by the issue of shares, this is normally done by way of a ‘rights issue’. This gives existing shareholders the choice of subscribing for new shares in the company and so maintain their proportional shareholding in the company. The issue price is set at below the current market price of the shares. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

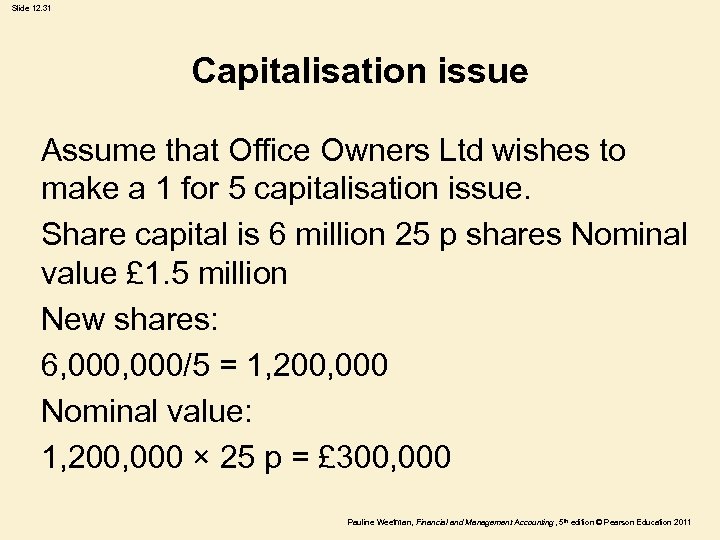

Slide 12. 31 Capitalisation issue Assume that Office Owners Ltd wishes to make a 1 for 5 capitalisation issue. Share capital is 6 million 25 p shares Nominal value £ 1. 5 million New shares: 6, 000/5 = 1, 200, 000 Nominal value: 1, 200, 000 × 25 p = £ 300, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 31 Capitalisation issue Assume that Office Owners Ltd wishes to make a 1 for 5 capitalisation issue. Share capital is 6 million 25 p shares Nominal value £ 1. 5 million New shares: 6, 000/5 = 1, 200, 000 Nominal value: 1, 200, 000 × 25 p = £ 300, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

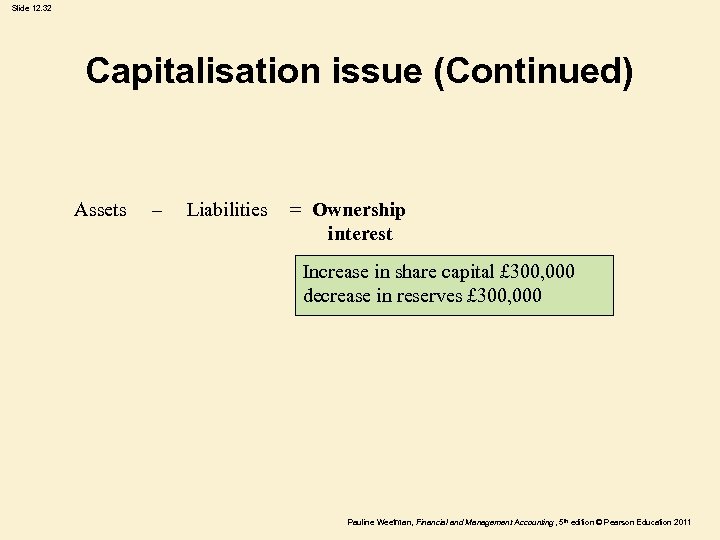

Slide 12. 32 Capitalisation issue (Continued) Assets – Liabilities = Ownership interest Increase in share capital £ 300, 000 decrease in reserves £ 300, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 32 Capitalisation issue (Continued) Assets – Liabilities = Ownership interest Increase in share capital £ 300, 000 decrease in reserves £ 300, 000 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

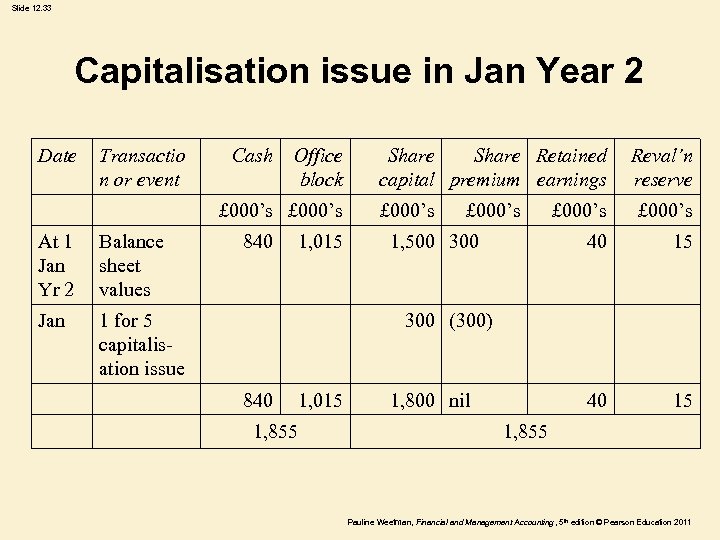

Slide 12. 33 Capitalisation issue in Jan Year 2 Date Transactio n or event Cash Office block £ 000’s At 1 Jan Yr 2 Balance sheet values Jan 840 1, 015 1 for 5 capitalisation issue Share Retained capital premium earnings £ 000’s Reval’n reserve £ 000’s 40 15 40 1, 500 300 £ 000’s 15 300 (300) 840 1, 015 1, 855 1, 800 nil 1, 855 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 33 Capitalisation issue in Jan Year 2 Date Transactio n or event Cash Office block £ 000’s At 1 Jan Yr 2 Balance sheet values Jan 840 1, 015 1 for 5 capitalisation issue Share Retained capital premium earnings £ 000’s Reval’n reserve £ 000’s 40 15 40 1, 500 300 £ 000’s 15 300 (300) 840 1, 015 1, 855 1, 800 nil 1, 855 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

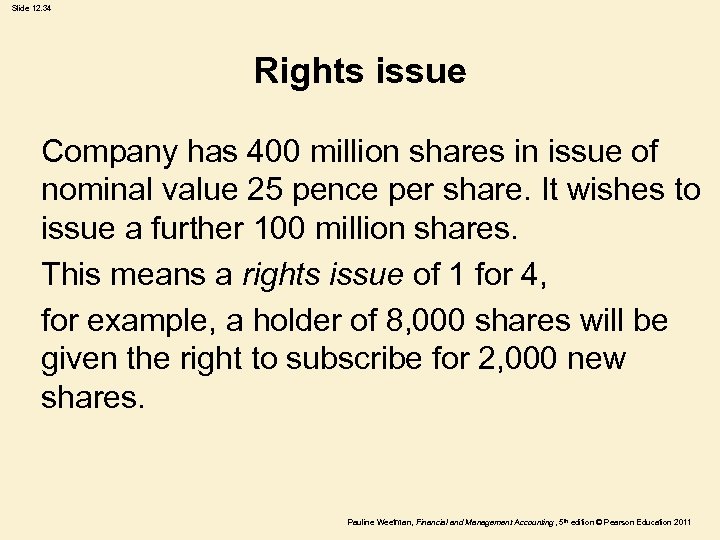

Slide 12. 34 Rights issue Company has 400 million shares in issue of nominal value 25 pence per share. It wishes to issue a further 100 million shares. This means a rights issue of 1 for 4, for example, a holder of 8, 000 shares will be given the right to subscribe for 2, 000 new shares. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 34 Rights issue Company has 400 million shares in issue of nominal value 25 pence per share. It wishes to issue a further 100 million shares. This means a rights issue of 1 for 4, for example, a holder of 8, 000 shares will be given the right to subscribe for 2, 000 new shares. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

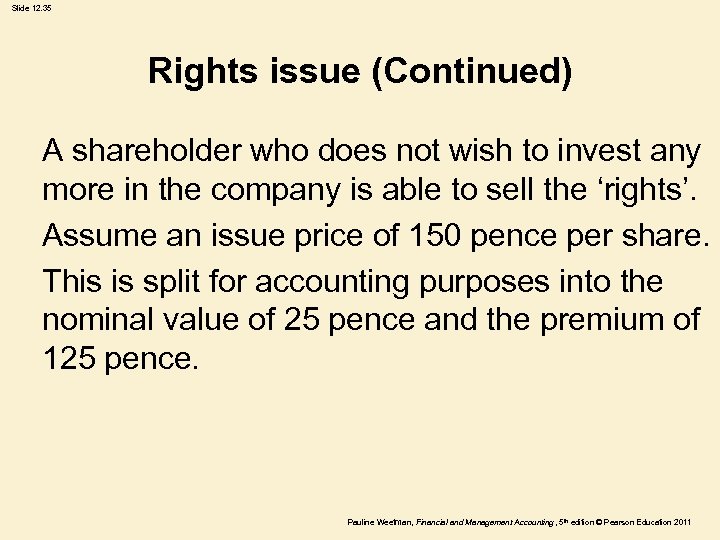

Slide 12. 35 Rights issue (Continued) A shareholder who does not wish to invest any more in the company is able to sell the ‘rights’. Assume an issue price of 150 pence per share. This is split for accounting purposes into the nominal value of 25 pence and the premium of 125 pence. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 35 Rights issue (Continued) A shareholder who does not wish to invest any more in the company is able to sell the ‘rights’. Assume an issue price of 150 pence per share. This is split for accounting purposes into the nominal value of 25 pence and the premium of 125 pence. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

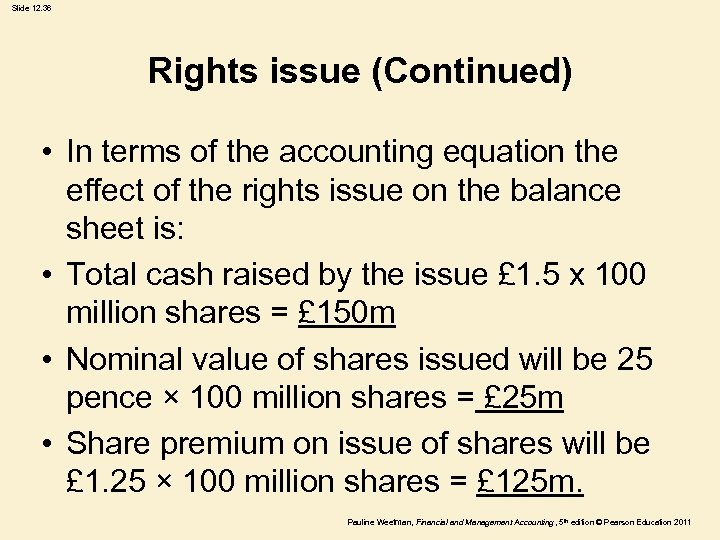

Slide 12. 36 Rights issue (Continued) • In terms of the accounting equation the effect of the rights issue on the balance sheet is: • Total cash raised by the issue £ 1. 5 x 100 million shares = £ 150 m • Nominal value of shares issued will be 25 pence × 100 million shares = £ 25 m • Share premium on issue of shares will be £ 1. 25 × 100 million shares = £ 125 m. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 36 Rights issue (Continued) • In terms of the accounting equation the effect of the rights issue on the balance sheet is: • Total cash raised by the issue £ 1. 5 x 100 million shares = £ 150 m • Nominal value of shares issued will be 25 pence × 100 million shares = £ 25 m • Share premium on issue of shares will be £ 1. 25 × 100 million shares = £ 125 m. Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

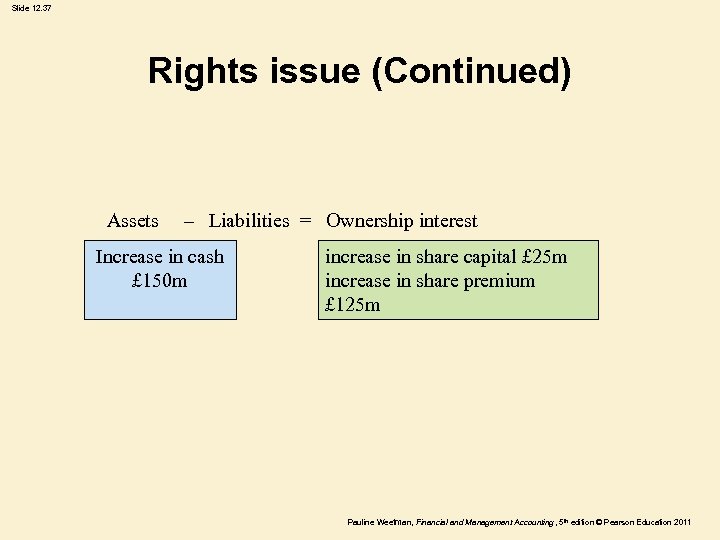

Slide 12. 37 Rights issue (Continued) Assets – Liabilities = Ownership interest Increase in cash £ 150 m increase in share capital £ 25 m increase in share premium £ 125 m Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 37 Rights issue (Continued) Assets – Liabilities = Ownership interest Increase in cash £ 150 m increase in share capital £ 25 m increase in share premium £ 125 m Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 38 Year-end adjustments (a) At the end of the month it is found that the roof has been leaking and rainwater has damaged goods worth £ 500. Assets ¯ Inventory (stock) decreases by £ 500 – Liabilities = Ownership interest ¯ Expense of £ 500 for inventory (stock) damaged Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 38 Year-end adjustments (a) At the end of the month it is found that the roof has been leaking and rainwater has damaged goods worth £ 500. Assets ¯ Inventory (stock) decreases by £ 500 – Liabilities = Ownership interest ¯ Expense of £ 500 for inventory (stock) damaged Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

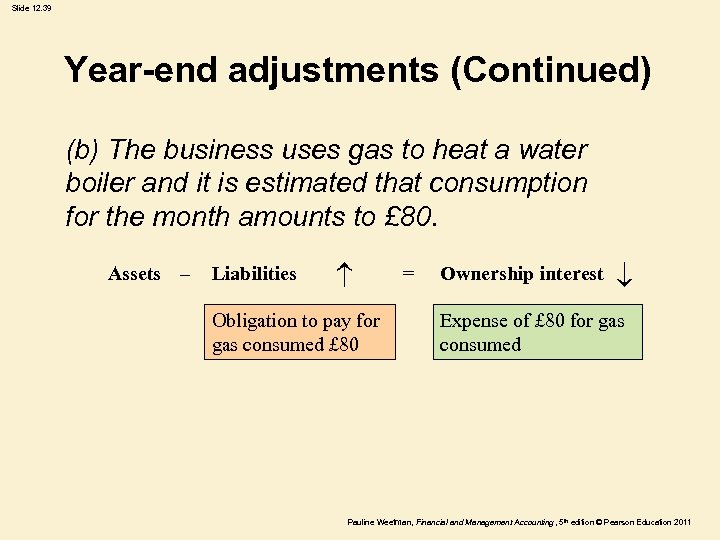

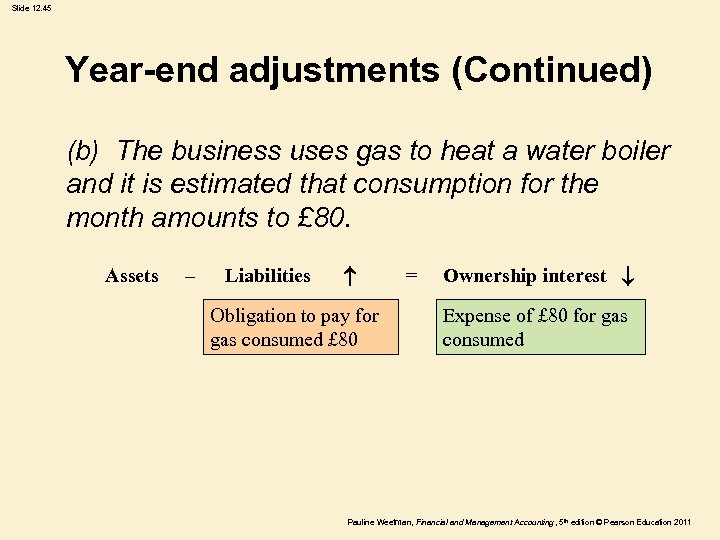

Slide 12. 39 Year-end adjustments (Continued) (b) The business uses gas to heat a water boiler and it is estimated that consumption for the month amounts to £ 80. Assets – Liabilities Obligation to pay for gas consumed £ 80 = Ownership interest ¯ Expense of £ 80 for gas consumed Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 39 Year-end adjustments (Continued) (b) The business uses gas to heat a water boiler and it is estimated that consumption for the month amounts to £ 80. Assets – Liabilities Obligation to pay for gas consumed £ 80 = Ownership interest ¯ Expense of £ 80 for gas consumed Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 40 Illustration • See Supplement to Chapter 12 in the book Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 40 Illustration • See Supplement to Chapter 12 in the book Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 41 Chapter 12 Bookkeeping supplement Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 41 Chapter 12 Bookkeeping supplement Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

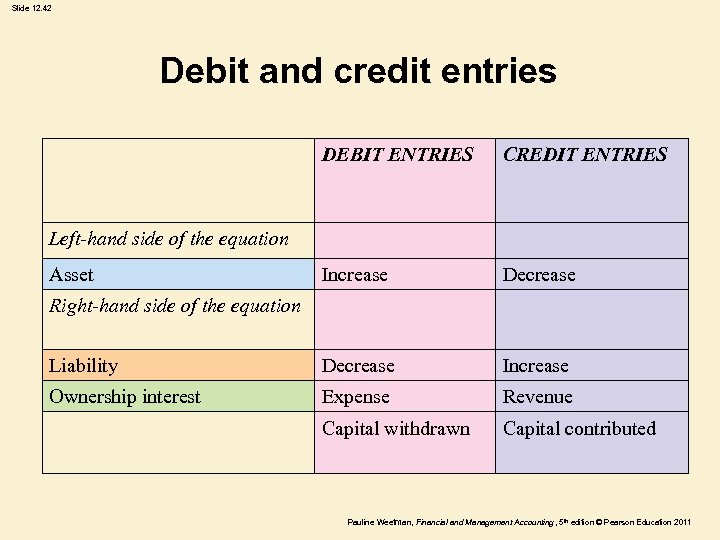

Slide 12. 42 Debit and credit entries DEBIT ENTRIES CREDIT ENTRIES Increase Decrease Liability Decrease Increase Ownership interest Expense Revenue Capital withdrawn Capital contributed Left-hand side of the equation Asset Right-hand side of the equation Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 42 Debit and credit entries DEBIT ENTRIES CREDIT ENTRIES Increase Decrease Liability Decrease Increase Ownership interest Expense Revenue Capital withdrawn Capital contributed Left-hand side of the equation Asset Right-hand side of the equation Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

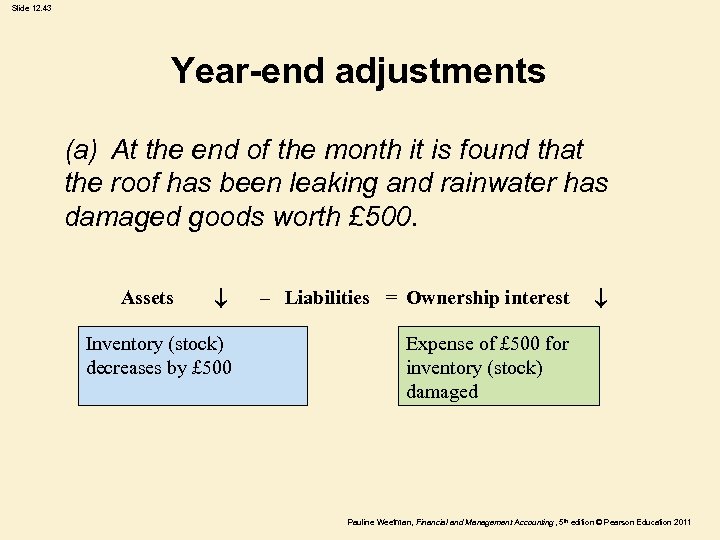

Slide 12. 43 Year-end adjustments (a) At the end of the month it is found that the roof has been leaking and rainwater has damaged goods worth £ 500. Assets ¯ – Liabilities = Ownership interest Inventory (stock) decreases by £ 500 Expense of £ 500 for inventory (stock) damaged ¯ Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 43 Year-end adjustments (a) At the end of the month it is found that the roof has been leaking and rainwater has damaged goods worth £ 500. Assets ¯ – Liabilities = Ownership interest Inventory (stock) decreases by £ 500 Expense of £ 500 for inventory (stock) damaged ¯ Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

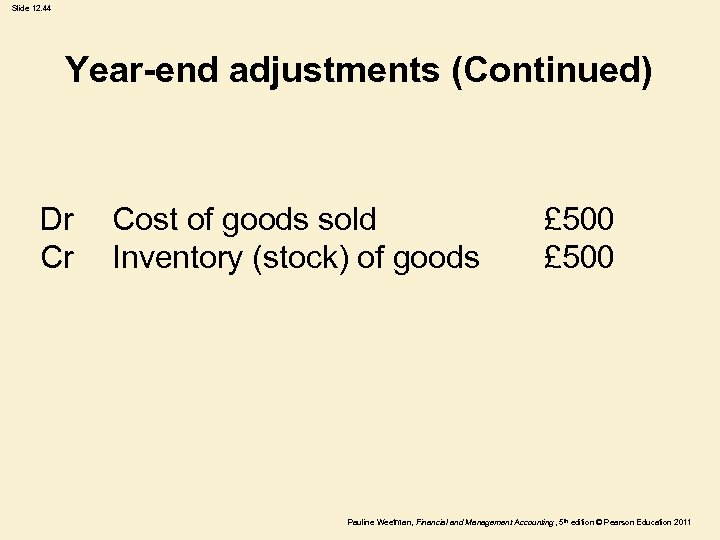

Slide 12. 44 Year-end adjustments (Continued) Dr Cr Cost of goods sold Inventory (stock) of goods £ 500 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 44 Year-end adjustments (Continued) Dr Cr Cost of goods sold Inventory (stock) of goods £ 500 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 45 Year-end adjustments (Continued) (b) The business uses gas to heat a water boiler and it is estimated that consumption for the month amounts to £ 80. Assets – Liabilities Obligation to pay for gas consumed £ 80 = Ownership interest ¯ Expense of £ 80 for gas consumed Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 45 Year-end adjustments (Continued) (b) The business uses gas to heat a water boiler and it is estimated that consumption for the month amounts to £ 80. Assets – Liabilities Obligation to pay for gas consumed £ 80 = Ownership interest ¯ Expense of £ 80 for gas consumed Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

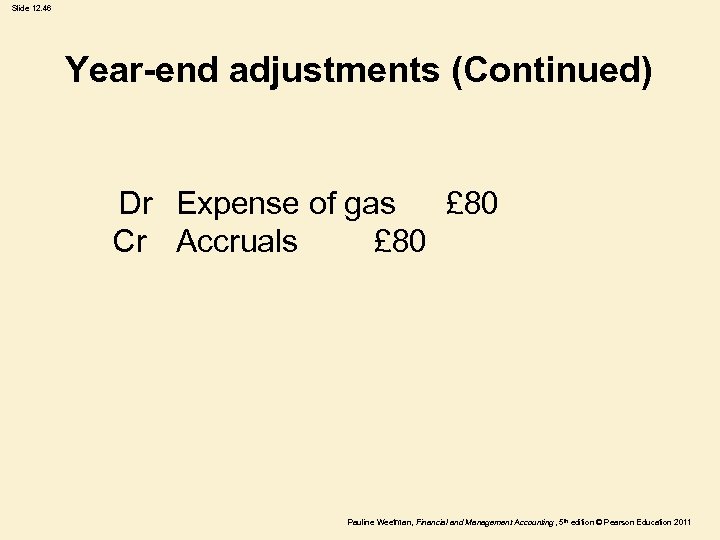

Slide 12. 46 Year-end adjustments (Continued) Dr Expense of gas £ 80 Cr Accruals £ 80 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 46 Year-end adjustments (Continued) Dr Expense of gas £ 80 Cr Accruals £ 80 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 47 Illustration • See Supplement to Chapter 12 in the book Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 47 Illustration • See Supplement to Chapter 12 in the book Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

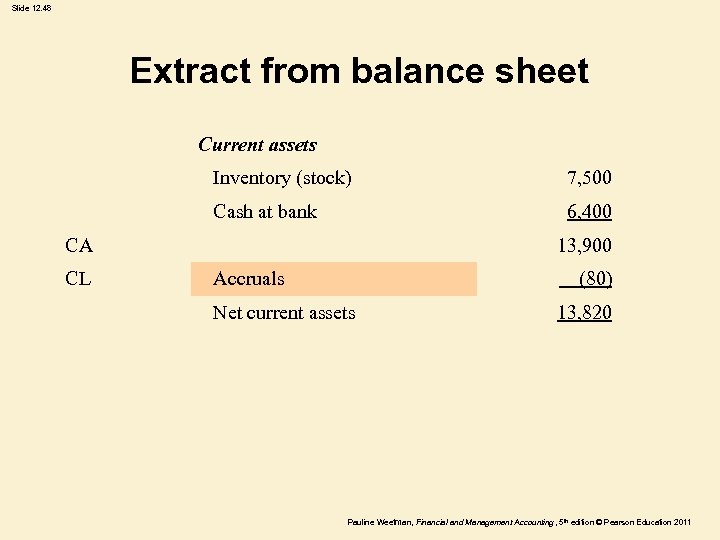

Slide 12. 48 Extract from balance sheet Current assets Inventory (stock) 7, 500 Cash at bank 6, 400 CA CL 13, 900 Accruals (80) Net current assets 13, 820 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011

Slide 12. 48 Extract from balance sheet Current assets Inventory (stock) 7, 500 Cash at bank 6, 400 CA CL 13, 900 Accruals (80) Net current assets 13, 820 Pauline Weetman, Financial and Management Accounting , 5 th edition © Pearson Education 2011