d30d9f1e39ae85333015c47b4326ab17.ppt

- Количество слайдов: 43

SKY NETWORK TELEVISION ANNUAL RESULTS 2008

SKY NETWORK TELEVISION ANNUAL RESULTS 2008

JOHN FELLET CEO

JOHN FELLET CEO

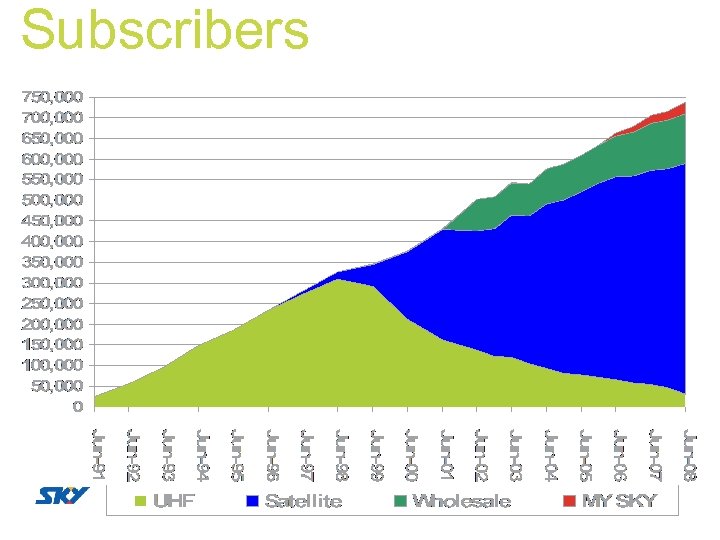

Subscribers

Subscribers

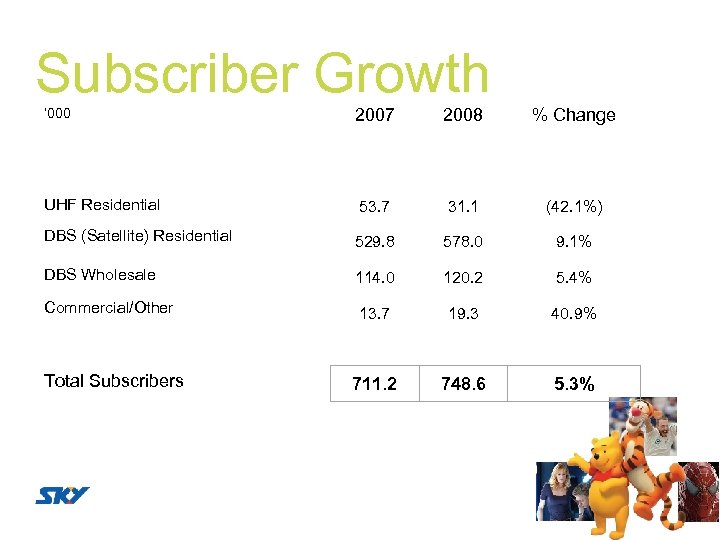

Subscriber Growth ‘ 000 2007 2008 % Change UHF Residential 53. 7 31. 1 (42. 1%) DBS (Satellite) Residential 529. 8 578. 0 9. 1% DBS Wholesale 114. 0 120. 2 5. 4% Commercial/Other 13. 7 19. 3 40. 9% 711. 2 748. 6 5. 3% Total Subscribers

Subscriber Growth ‘ 000 2007 2008 % Change UHF Residential 53. 7 31. 1 (42. 1%) DBS (Satellite) Residential 529. 8 578. 0 9. 1% DBS Wholesale 114. 0 120. 2 5. 4% Commercial/Other 13. 7 19. 3 40. 9% 711. 2 748. 6 5. 3% Total Subscribers

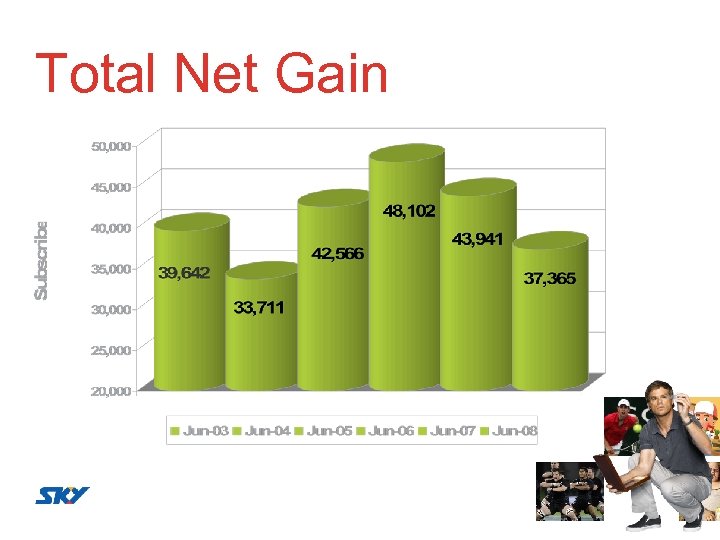

Total Net Gain

Total Net Gain

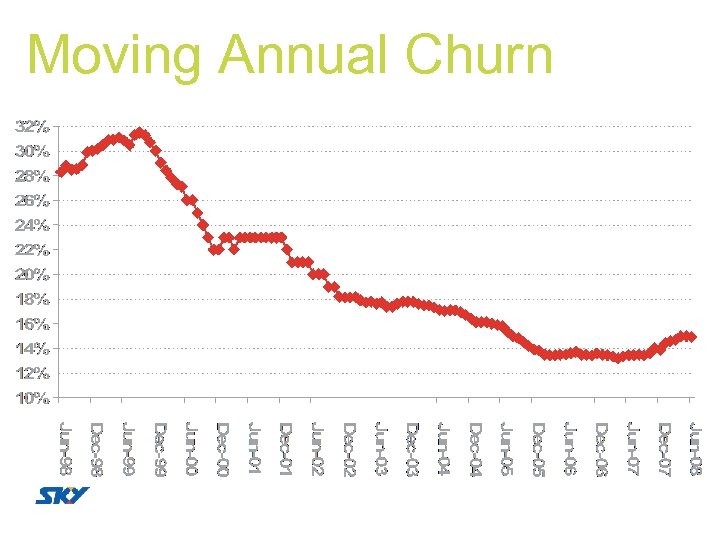

Moving Annual Churn

Moving Annual Churn

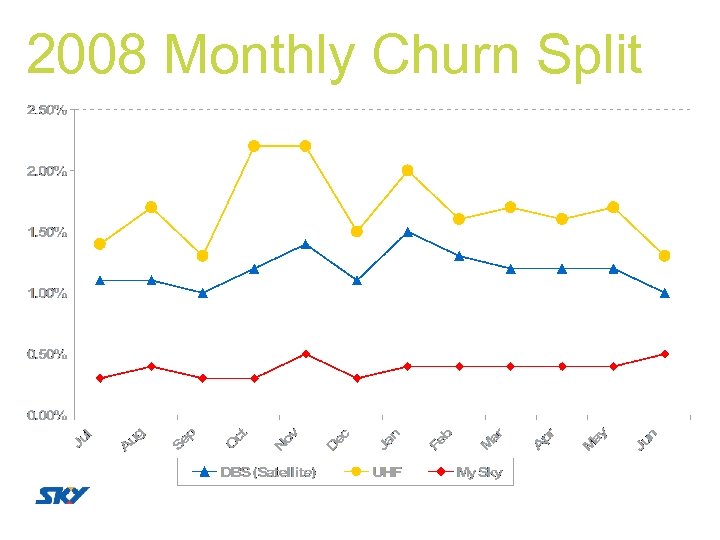

2008 Monthly Churn Split

2008 Monthly Churn Split

Total Revenue

Total Revenue

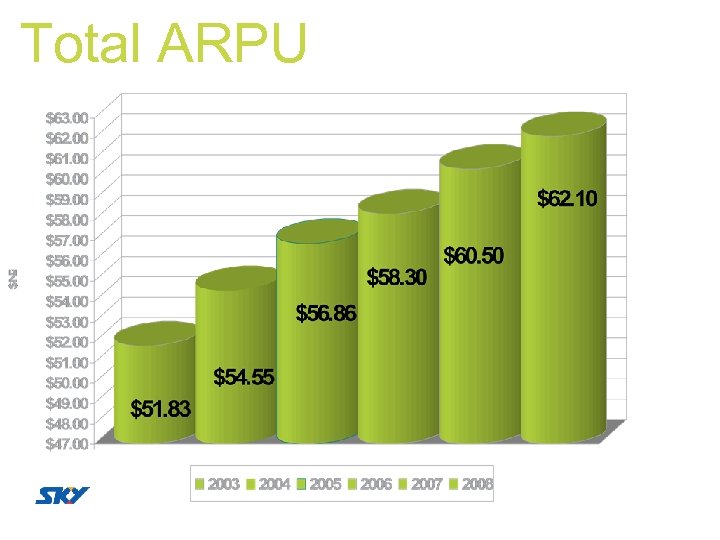

Total ARPU

Total ARPU

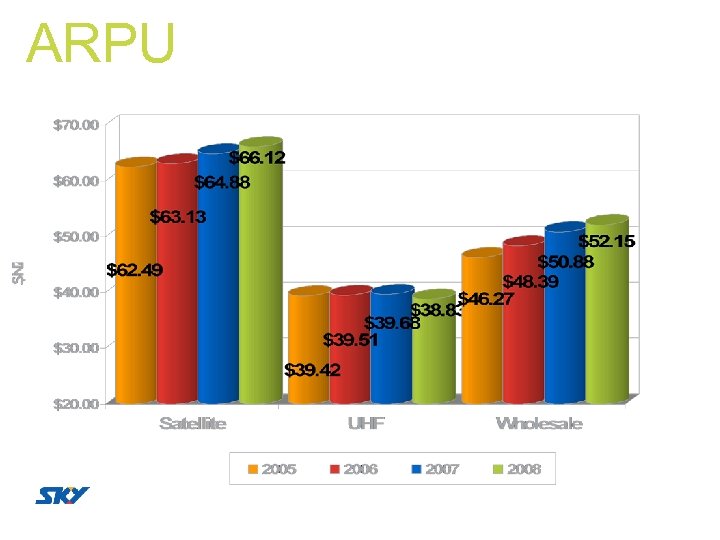

ARPU

ARPU

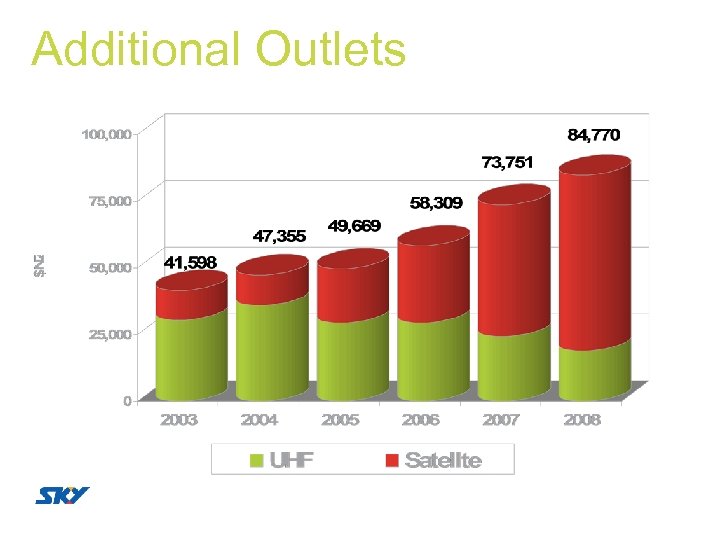

Additional Outlets

Additional Outlets

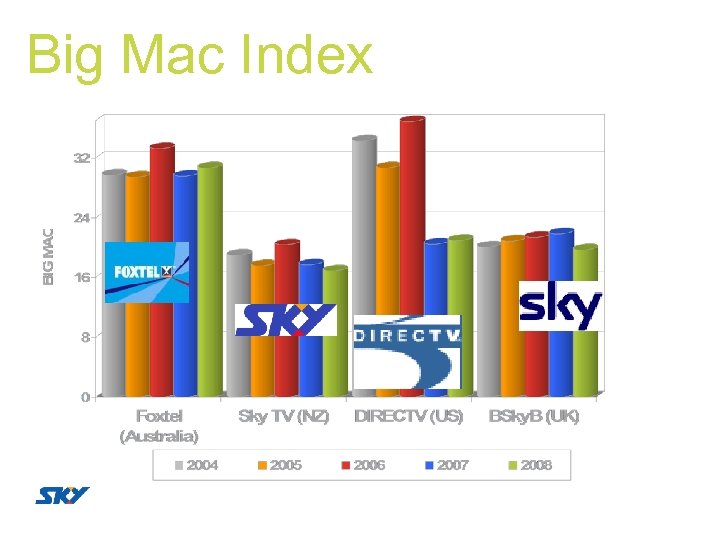

Big Mac Index

Big Mac Index

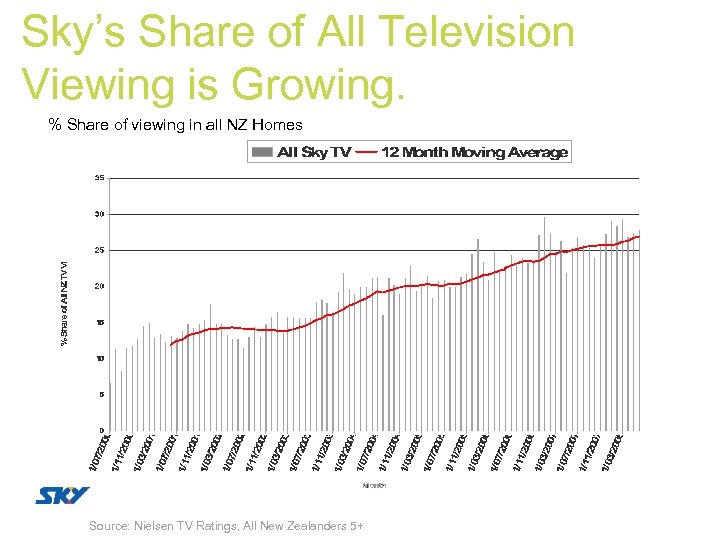

Sky’s Share of All Television Viewing is Growing. % Share of viewing in all NZ Homes Source: Nielsen TV Ratings, All New Zealanders 5+

Sky’s Share of All Television Viewing is Growing. % Share of viewing in all NZ Homes Source: Nielsen TV Ratings, All New Zealanders 5+

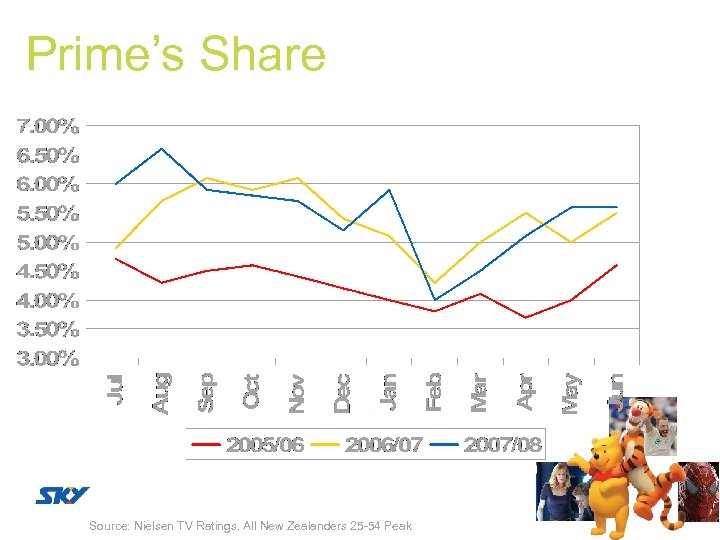

Prime’s Share Source: Nielsen TV Ratings, All New Zealanders 25 54 Peak

Prime’s Share Source: Nielsen TV Ratings, All New Zealanders 25 54 Peak

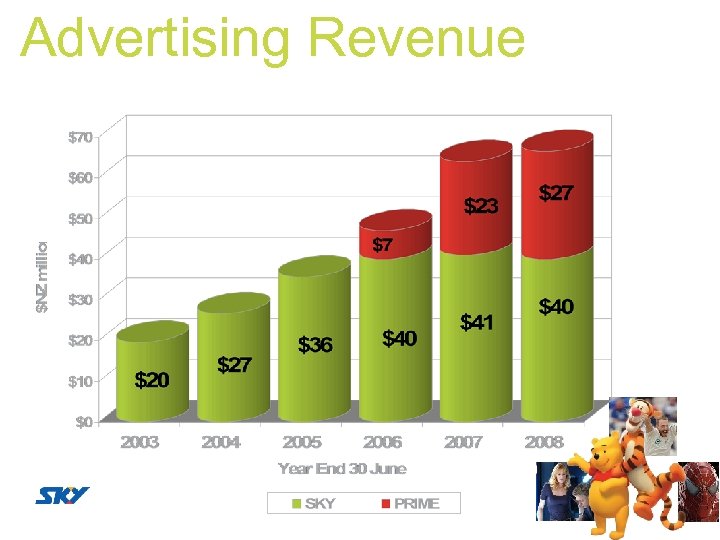

Advertising Revenue

Advertising Revenue

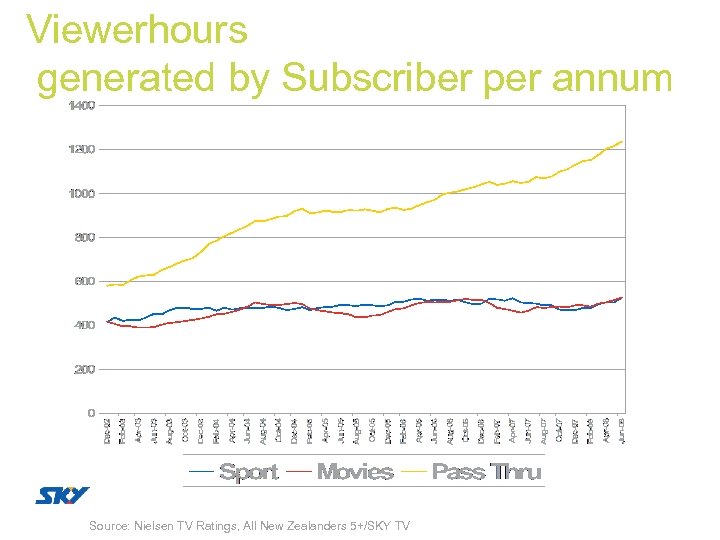

Viewerhours generated by Subscriber per annum Source: Nielsen TV Ratings, All New Zealanders 5+/SKY TV

Viewerhours generated by Subscriber per annum Source: Nielsen TV Ratings, All New Zealanders 5+/SKY TV

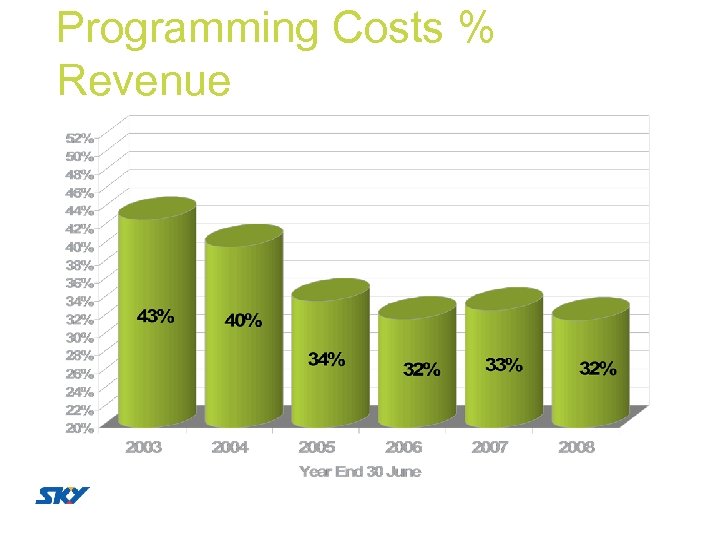

Programming Costs % Revenue

Programming Costs % Revenue

EBITDA

EBITDA

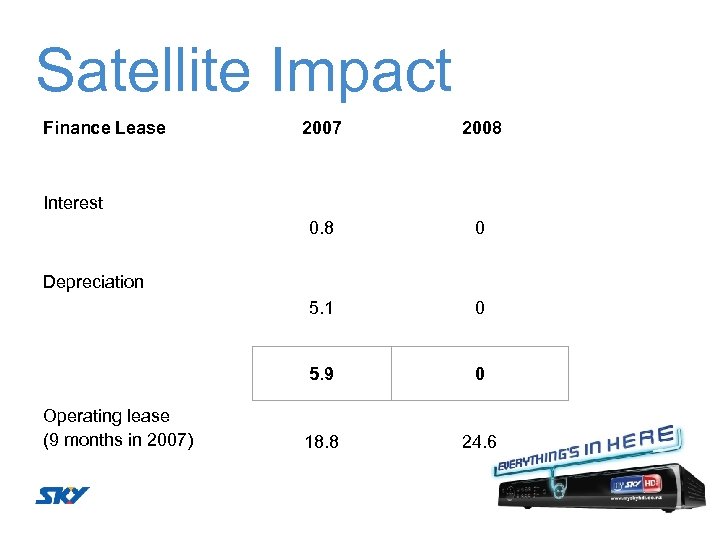

Satellite Impact Finance Lease 2007 2008 0. 8 0 5. 1 0 5. 9 0 18. 8 24. 6 Interest Depreciation Operating lease (9 months in 2007)

Satellite Impact Finance Lease 2007 2008 0. 8 0 5. 1 0 5. 9 0 18. 8 24. 6 Interest Depreciation Operating lease (9 months in 2007)

Net Profit/(Loss)

Net Profit/(Loss)

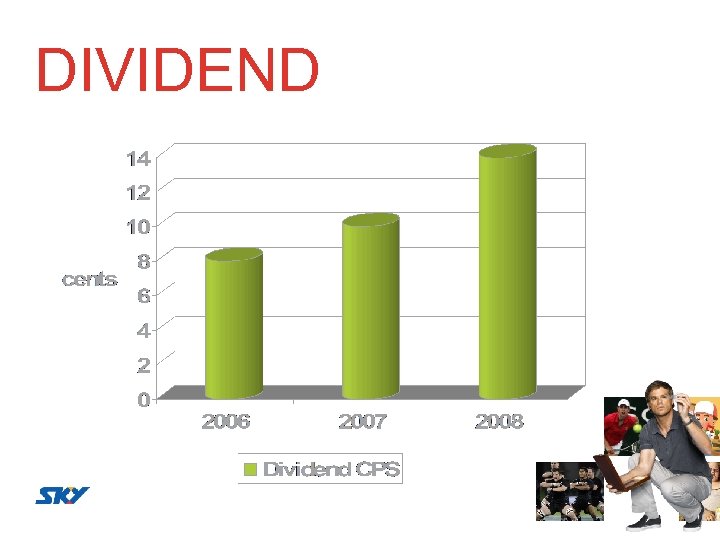

DIVIDEND

DIVIDEND

DIVIDEND The SKY Board has declared a fully imputed final dividend of 7. 0 cps. Record date is 5 September 2008. Payment date is 12 September 2008. Total dividend for the year is 14. 0 cps

DIVIDEND The SKY Board has declared a fully imputed final dividend of 7. 0 cps. Record date is 5 September 2008. Payment date is 12 September 2008. Total dividend for the year is 14. 0 cps

JASON HOLLINGWORTH CFO

JASON HOLLINGWORTH CFO

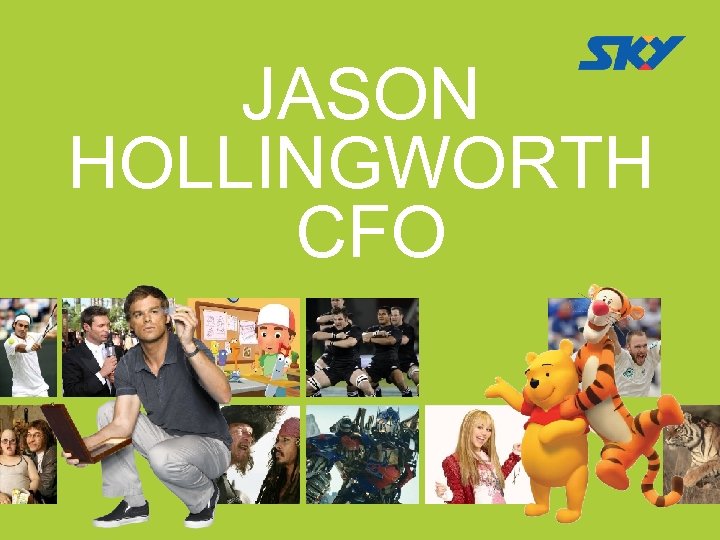

Capital Expenditure (excluding transponders and Prime assets)

Capital Expenditure (excluding transponders and Prime assets)

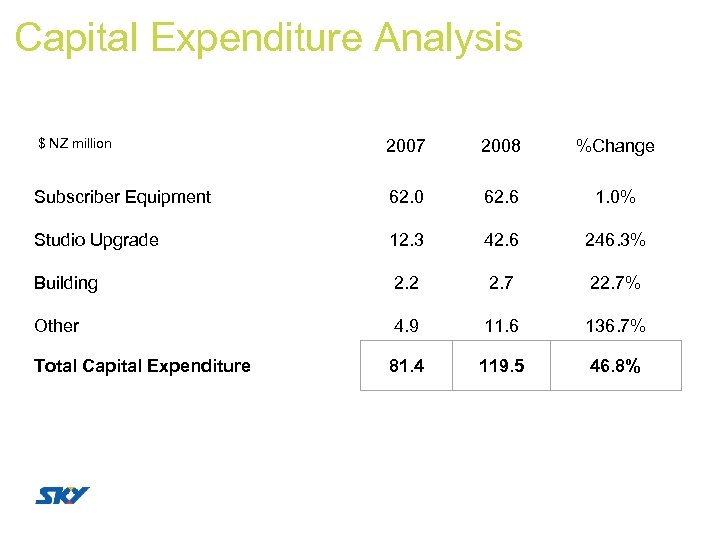

Capital Expenditure Analysis $ NZ million 2007 2008 %Change Subscriber Equipment 62. 0 62. 6 1. 0% Studio Upgrade 12. 3 42. 6 246. 3% Building 2. 2 2. 7 22. 7% Other 4. 9 11. 6 136. 7% Total Capital Expenditure 81. 4 119. 5 46. 8%

Capital Expenditure Analysis $ NZ million 2007 2008 %Change Subscriber Equipment 62. 0 62. 6 1. 0% Studio Upgrade 12. 3 42. 6 246. 3% Building 2. 2 2. 7 22. 7% Other 4. 9 11. 6 136. 7% Total Capital Expenditure 81. 4 119. 5 46. 8%

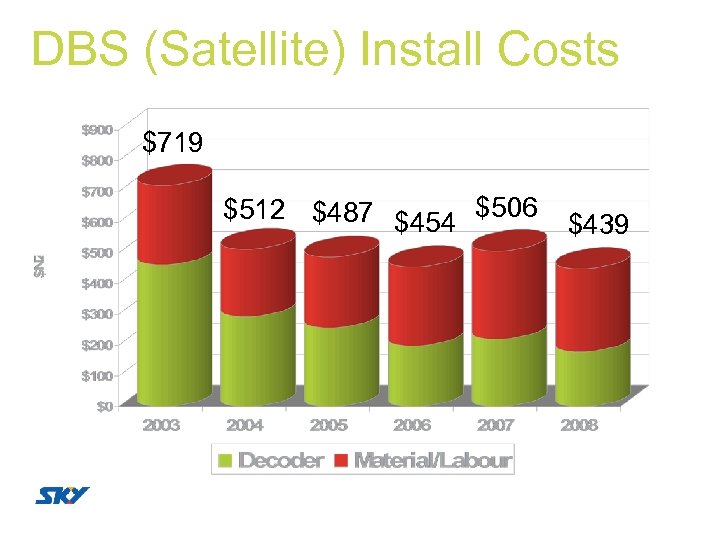

DBS (Satellite) Install Costs $719 $512 $487 $454 $506 $439

DBS (Satellite) Install Costs $719 $512 $487 $454 $506 $439

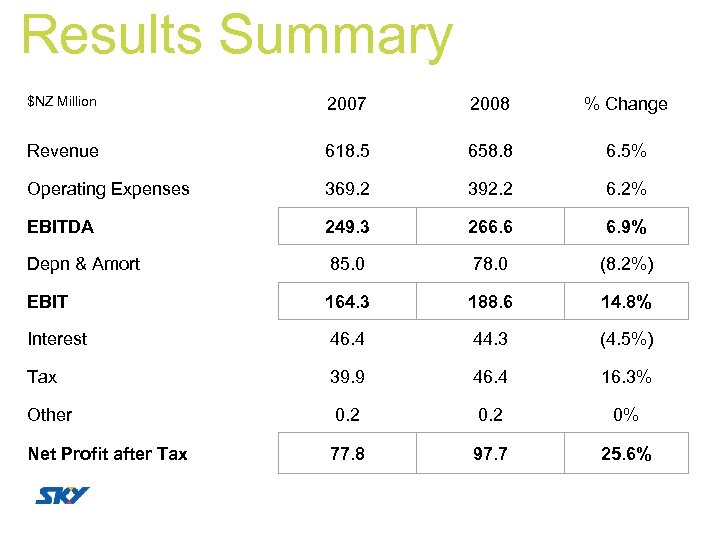

Results Summary $NZ Million 2007 2008 % Change Revenue 618. 5 658. 8 6. 5% Operating Expenses 369. 2 392. 2 6. 2% EBITDA 249. 3 266. 6 6. 9% Depn & Amort 85. 0 78. 0 (8. 2%) EBIT 164. 3 188. 6 14. 8% Interest 46. 4 44. 3 (4. 5%) Tax 39. 9 46. 4 16. 3% Other 0. 2 0% Net Profit after Tax 77. 8 97. 7 25. 6%

Results Summary $NZ Million 2007 2008 % Change Revenue 618. 5 658. 8 6. 5% Operating Expenses 369. 2 392. 2 6. 2% EBITDA 249. 3 266. 6 6. 9% Depn & Amort 85. 0 78. 0 (8. 2%) EBIT 164. 3 188. 6 14. 8% Interest 46. 4 44. 3 (4. 5%) Tax 39. 9 46. 4 16. 3% Other 0. 2 0% Net Profit after Tax 77. 8 97. 7 25. 6%

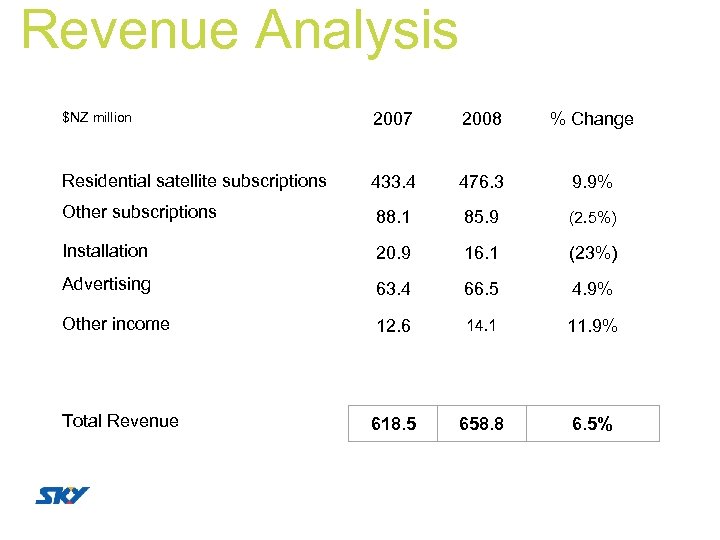

Revenue Analysis $NZ million 2007 2008 % Change Residential satellite subscriptions 433. 4 476. 3 9. 9% Other subscriptions 88. 1 85. 9 (2. 5%) Installation 20. 9 16. 1 (23%) Advertising 63. 4 66. 5 4. 9% Other income 12. 6 14. 1 11. 9% Total Revenue 618. 5 658. 8 6. 5%

Revenue Analysis $NZ million 2007 2008 % Change Residential satellite subscriptions 433. 4 476. 3 9. 9% Other subscriptions 88. 1 85. 9 (2. 5%) Installation 20. 9 16. 1 (23%) Advertising 63. 4 66. 5 4. 9% Other income 12. 6 14. 1 11. 9% Total Revenue 618. 5 658. 8 6. 5%

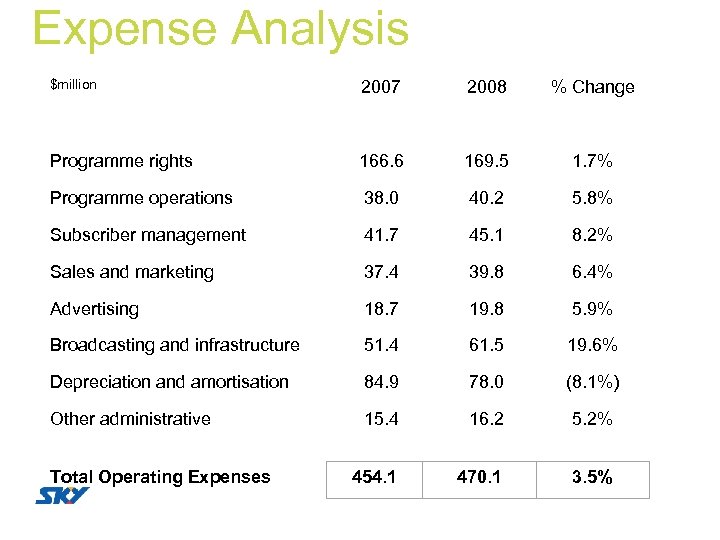

Expense Analysis $million 2007 2008 % Change Programme rights 166. 6 169. 5 1. 7% Programme operations 38. 0 40. 2 5. 8% Subscriber management 41. 7 45. 1 8. 2% Sales and marketing 37. 4 39. 8 6. 4% Advertising 18. 7 19. 8 5. 9% Broadcasting and infrastructure 51. 4 61. 5 19. 6% Depreciation and amortisation 84. 9 78. 0 (8. 1%) Other administrative 15. 4 16. 2 5. 2% 454. 1 470. 1 3. 5% Total Operating Expenses

Expense Analysis $million 2007 2008 % Change Programme rights 166. 6 169. 5 1. 7% Programme operations 38. 0 40. 2 5. 8% Subscriber management 41. 7 45. 1 8. 2% Sales and marketing 37. 4 39. 8 6. 4% Advertising 18. 7 19. 8 5. 9% Broadcasting and infrastructure 51. 4 61. 5 19. 6% Depreciation and amortisation 84. 9 78. 0 (8. 1%) Other administrative 15. 4 16. 2 5. 2% 454. 1 470. 1 3. 5% Total Operating Expenses

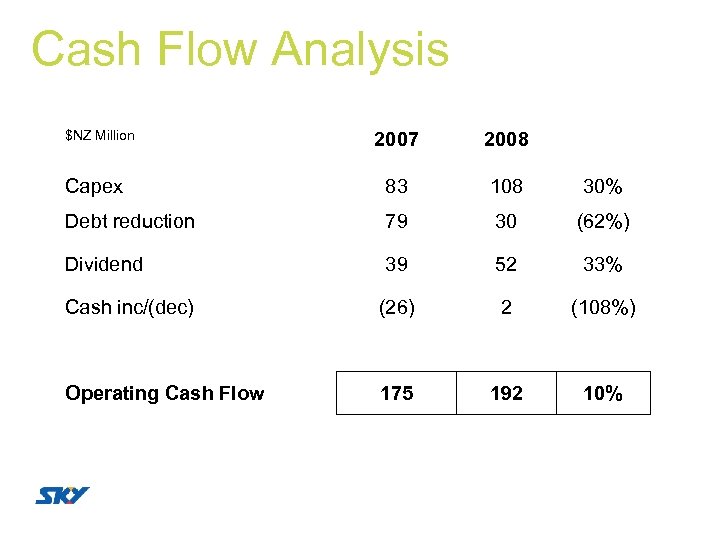

Cash Flow Analysis $NZ Million 2007 2008 Capex 83 108 30% Debt reduction 79 30 (62%) Dividend 39 52 33% Cash inc/(dec) (26) 2 (108%) Operating Cash Flow 175 192 10%

Cash Flow Analysis $NZ Million 2007 2008 Capex 83 108 30% Debt reduction 79 30 (62%) Dividend 39 52 33% Cash inc/(dec) (26) 2 (108%) Operating Cash Flow 175 192 10%

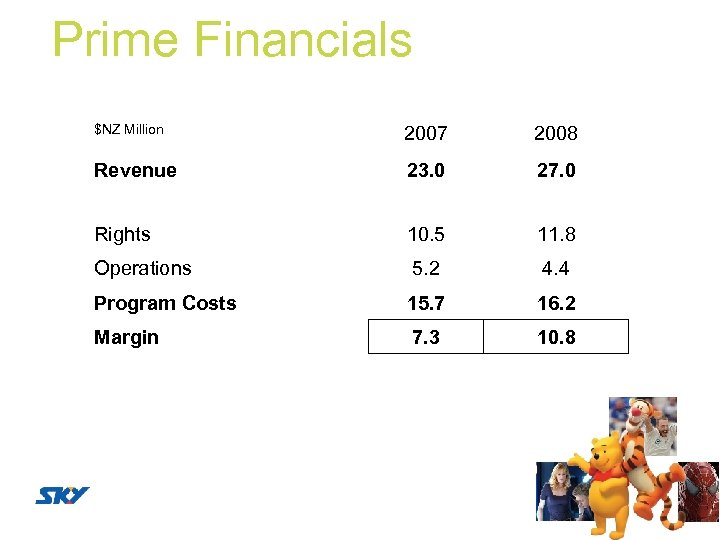

Prime Financials $NZ Million 2007 2008 Revenue 23. 0 27. 0 Rights 10. 5 11. 8 Operations 5. 2 4. 4 Program Costs 15. 7 16. 2 Margin 7. 3 10. 8

Prime Financials $NZ Million 2007 2008 Revenue 23. 0 27. 0 Rights 10. 5 11. 8 Operations 5. 2 4. 4 Program Costs 15. 7 16. 2 Margin 7. 3 10. 8

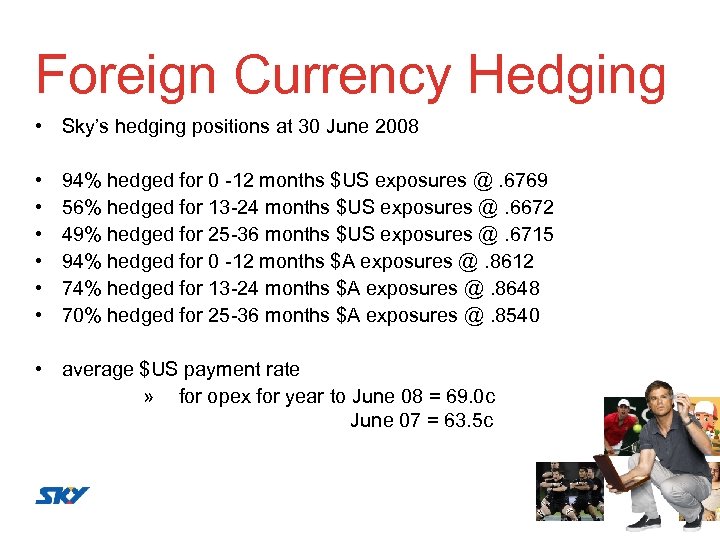

Foreign Currency Hedging • Sky’s hedging positions at 30 June 2008 • • • 94% hedged for 0 12 months $US exposures @. 6769 56% hedged for 13 24 months $US exposures @. 6672 49% hedged for 25 36 months $US exposures @. 6715 94% hedged for 0 12 months $A exposures @. 8612 74% hedged for 13 24 months $A exposures @. 8648 70% hedged for 25 36 months $A exposures @. 8540 • average $US payment rate » for opex for year to June 08 = 69. 0 c June 07 = 63. 5 c

Foreign Currency Hedging • Sky’s hedging positions at 30 June 2008 • • • 94% hedged for 0 12 months $US exposures @. 6769 56% hedged for 13 24 months $US exposures @. 6672 49% hedged for 25 36 months $US exposures @. 6715 94% hedged for 0 12 months $A exposures @. 8612 74% hedged for 13 24 months $A exposures @. 8648 70% hedged for 25 36 months $A exposures @. 8540 • average $US payment rate » for opex for year to June 08 = 69. 0 c June 07 = 63. 5 c

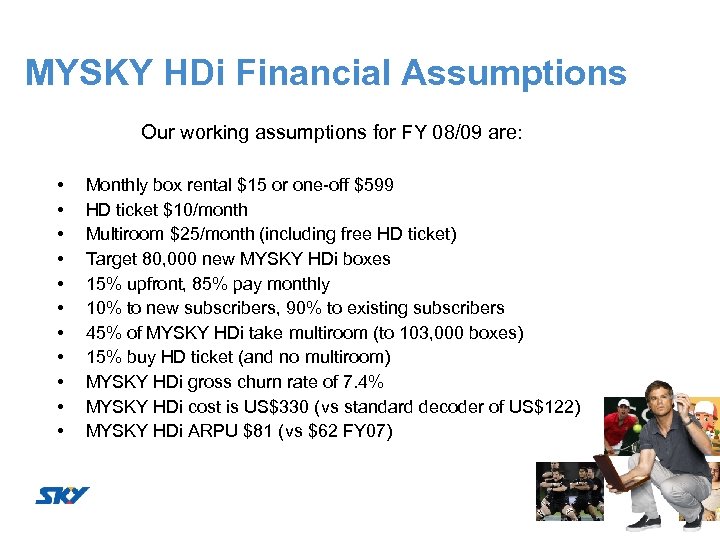

MYSKY HDi Financial Assumptions Our working assumptions for FY 08/09 are: • • • Monthly box rental $15 or one off $599 HD ticket $10/month Multiroom $25/month (including free HD ticket) Target 80, 000 new MYSKY HDi boxes 15% upfront, 85% pay monthly 10% to new subscribers, 90% to existing subscribers 45% of MYSKY HDi take multiroom (to 103, 000 boxes) 15% buy HD ticket (and no multiroom) MYSKY HDi gross churn rate of 7. 4% MYSKY HDi cost is US$330 (vs standard decoder of US$122) MYSKY HDi ARPU $81 (vs $62 FY 07)

MYSKY HDi Financial Assumptions Our working assumptions for FY 08/09 are: • • • Monthly box rental $15 or one off $599 HD ticket $10/month Multiroom $25/month (including free HD ticket) Target 80, 000 new MYSKY HDi boxes 15% upfront, 85% pay monthly 10% to new subscribers, 90% to existing subscribers 45% of MYSKY HDi take multiroom (to 103, 000 boxes) 15% buy HD ticket (and no multiroom) MYSKY HDi gross churn rate of 7. 4% MYSKY HDi cost is US$330 (vs standard decoder of US$122) MYSKY HDi ARPU $81 (vs $62 FY 07)

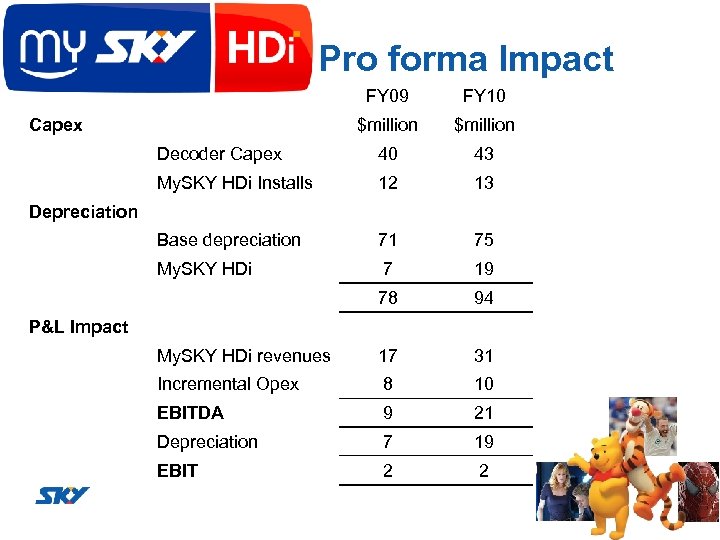

Pro forma Impact FY 09 FY 10 $million Decoder Capex 40 43 My. SKY HDi Installs 12 13 Base depreciation 71 75 My. SKY HDi 7 19 78 94 My. SKY HDi revenues 17 31 Incremental Opex 8 10 EBITDA 9 21 Depreciation 7 19 EBIT 2 2 Capex Depreciation P&L Impact

Pro forma Impact FY 09 FY 10 $million Decoder Capex 40 43 My. SKY HDi Installs 12 13 Base depreciation 71 75 My. SKY HDi 7 19 78 94 My. SKY HDi revenues 17 31 Incremental Opex 8 10 EBITDA 9 21 Depreciation 7 19 EBIT 2 2 Capex Depreciation P&L Impact

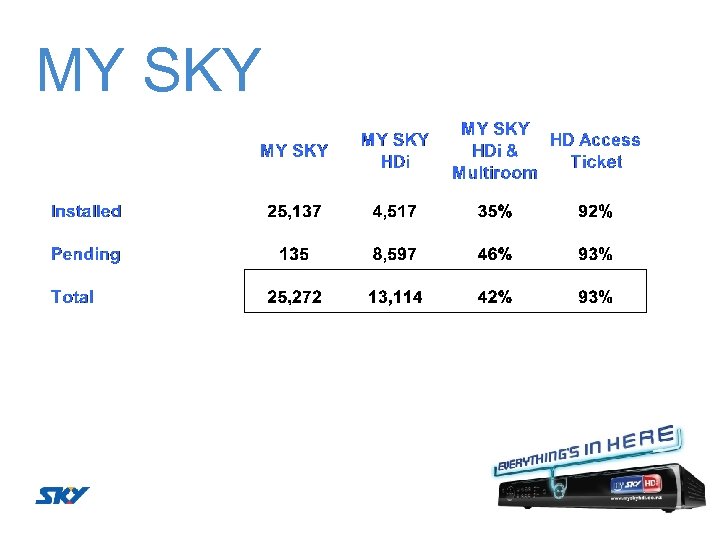

MY SKY

MY SKY

JOHN FELLET CEO

JOHN FELLET CEO

GUIDANCE

GUIDANCE

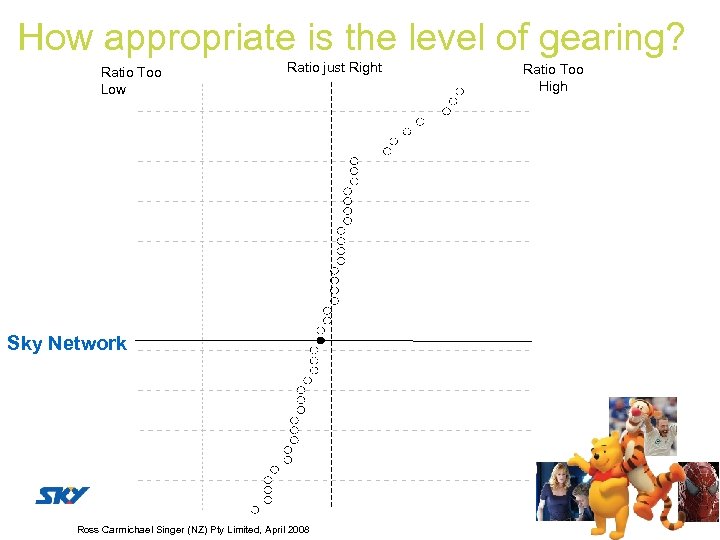

How appropriate is the level of gearing? Ratio Too Low Ratio just Right Sky Network Ross Carmichael Singer (NZ) Pty Limited, April 2008 Ratio Too High

How appropriate is the level of gearing? Ratio Too Low Ratio just Right Sky Network Ross Carmichael Singer (NZ) Pty Limited, April 2008 Ratio Too High

SKY Highlights 1. 6 new channels 2. 3. 4. 5. 6. 7. Crime & Investigation Vibe CNBC SKY Movies Greats SKY Sport Highlights Fashion TV SKY Online launched SKY Sport Magazine Netball World Champs Nov 2007 Inaugural ANZ Championship Screen Enterprises (Fatso, DVD Unlimited, Movieshack) MYSKY HDi launch

SKY Highlights 1. 6 new channels 2. 3. 4. 5. 6. 7. Crime & Investigation Vibe CNBC SKY Movies Greats SKY Sport Highlights Fashion TV SKY Online launched SKY Sport Magazine Netball World Champs Nov 2007 Inaugural ANZ Championship Screen Enterprises (Fatso, DVD Unlimited, Movieshack) MYSKY HDi launch

SKY Online Live streaming and content download via broadband internet Available now: • 35 top Movies SKY Movies, MGM, Rialto • Cartoon Network • Discovery Channel • The Box • Air New Zealand Cup • 200 sporting downloads Netball, Cricket, Rugby

SKY Online Live streaming and content download via broadband internet Available now: • 35 top Movies SKY Movies, MGM, Rialto • Cartoon Network • Discovery Channel • The Box • Air New Zealand Cup • 200 sporting downloads Netball, Cricket, Rugby

2008 Key Messages • • • Net profit of $97. 7 m, up 26% Subscriber numbers up 5. 3% to 748. 6 ARPU up 2. 6% to $62. 10, DBS ARPU up 1. 9% to $66. 12 Churn increased from 13. 4% to 14. 9% SKY share of total television viewing up from 25% to 28%

2008 Key Messages • • • Net profit of $97. 7 m, up 26% Subscriber numbers up 5. 3% to 748. 6 ARPU up 2. 6% to $62. 10, DBS ARPU up 1. 9% to $66. 12 Churn increased from 13. 4% to 14. 9% SKY share of total television viewing up from 25% to 28%

SKY NETWORK TELEVISION ANNUAL RESULTS 2008

SKY NETWORK TELEVISION ANNUAL RESULTS 2008