0bd9e8ccb74cf00df7a02b816afde327.ppt

- Количество слайдов: 17

SJC’s On-Demand Dispatch Model Three views of where we are now

SJC’s On-Demand Dispatch Model Three views of where we are now

Today’s Points of View • Airport Landside Operations • Taxi San Jose • Dispatch Services Contractor under contract through September 2012 • Yellow Checker Cab • Taxi Company whose affiliated drivers are performing over 50% of the Airport On-Demand trips

Today’s Points of View • Airport Landside Operations • Taxi San Jose • Dispatch Services Contractor under contract through September 2012 • Yellow Checker Cab • Taxi Company whose affiliated drivers are performing over 50% of the Airport On-Demand trips

A Brief History • Airport Taxi Concessions in place from 1994 through start of this model in 2005 • Mayor’s Taxi Task Force and Taxi Advisory Team studied City’s taxi model • Consultant study provided a City-wide Taxicab Services Model that was approved by City Council in 2004 • The current Airport Model was implemented in September 2005

A Brief History • Airport Taxi Concessions in place from 1994 through start of this model in 2005 • Mayor’s Taxi Task Force and Taxi Advisory Team studied City’s taxi model • Consultant study provided a City-wide Taxicab Services Model that was approved by City Council in 2004 • The current Airport Model was implemented in September 2005

A Brief History • The Airport model implemented an On. Demand Dispatch Services company to dispatch taxis and door-to-door shuttles • 300 Airport Access Permits issued • 195 to taxi drivers • 105 to taxi companies • Alternate day access (150 per day) • Taxi and Shuttle companies contracted to provide service, drivers affiliate with them

A Brief History • The Airport model implemented an On. Demand Dispatch Services company to dispatch taxis and door-to-door shuttles • 300 Airport Access Permits issued • 195 to taxi drivers • 105 to taxi companies • Alternate day access (150 per day) • Taxi and Shuttle companies contracted to provide service, drivers affiliate with them

A Brief History • In 2005 • 14 Taxicab Companies each issued a minimum of 7 Permits • 31 Door-to-door shuttle companies • Taxi San Jose used a contractor to perform dispatch / management duties • Companies started reporting non-Airport trips, upgrading dispatch systems

A Brief History • In 2005 • 14 Taxicab Companies each issued a minimum of 7 Permits • 31 Door-to-door shuttle companies • Taxi San Jose used a contractor to perform dispatch / management duties • Companies started reporting non-Airport trips, upgrading dispatch systems

A Brief History • In 2007 • Started reallocation of Company Permits based on non-Airport trip volumes and minimum requirements: • 15 drivers and 15 vehicles • 25% clean fuel vehicle trips • Computerized dispatch system • Paid up on fees

A Brief History • In 2007 • Started reallocation of Company Permits based on non-Airport trip volumes and minimum requirements: • 15 drivers and 15 vehicles • 25% clean fuel vehicle trips • Computerized dispatch system • Paid up on fees

A Brief History • During Four Years of Airport Construction • Staging lot was relocated four times • Curbside loading areas were moved: • Two times at Terminal A • Five times between Terminal C and B • The AVI system has been completely replaced • Taxi rates of fare and trip fees have each changed once

A Brief History • During Four Years of Airport Construction • Staging lot was relocated four times • Curbside loading areas were moved: • Two times at Terminal A • Five times between Terminal C and B • The AVI system has been completely replaced • Taxi rates of fare and trip fees have each changed once

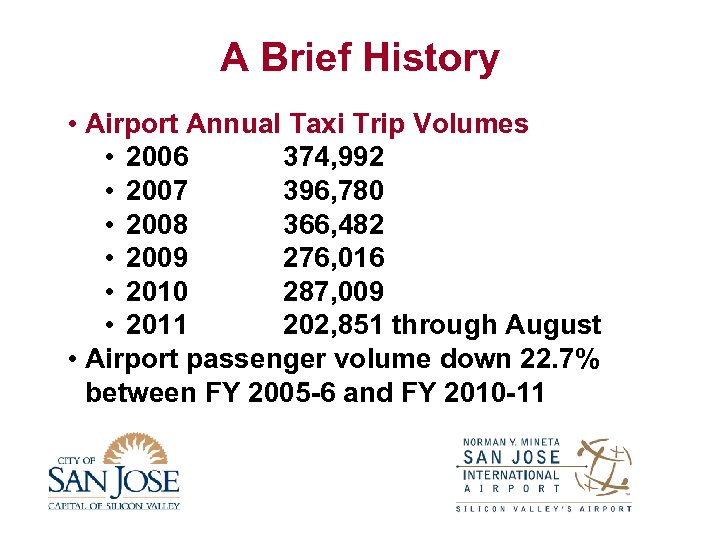

A Brief History • Airport Annual Taxi Trip Volumes • 2006 374, 992 • 2007 396, 780 • 2008 366, 482 • 2009 276, 016 • 2010 287, 009 • 2011 202, 851 through August • Airport passenger volume down 22. 7% between FY 2005 -6 and FY 2010 -11

A Brief History • Airport Annual Taxi Trip Volumes • 2006 374, 992 • 2007 396, 780 • 2008 366, 482 • 2009 276, 016 • 2010 287, 009 • 2011 202, 851 through August • Airport passenger volume down 22. 7% between FY 2005 -6 and FY 2010 -11

Current Status • Eight Taxi companies, Six with Permits • 3 of the 8 comprise over 83% of the trips • 32 Door-to-Door Shuttle Companies • 38 vehicles compared to 63 in 2008 • Taxi San Jose has hired all staff and manages the program in-house with their fourth on-site general manager • Curbside locations were relocated at Terminal B one more time

Current Status • Eight Taxi companies, Six with Permits • 3 of the 8 comprise over 83% of the trips • 32 Door-to-Door Shuttle Companies • 38 vehicles compared to 63 in 2008 • Taxi San Jose has hired all staff and manages the program in-house with their fourth on-site general manager • Curbside locations were relocated at Terminal B one more time

The Airport Perspective • Positive Impacts • Improved taxi service for the entire City • 34% increase in non-Airport trips • 71% of 2010 trips are non-Airport trips • Coordinated appearance at terminals • Minimal complaints from passengers • Reduced issues with late flight or peak period taxi service

The Airport Perspective • Positive Impacts • Improved taxi service for the entire City • 34% increase in non-Airport trips • 71% of 2010 trips are non-Airport trips • Coordinated appearance at terminals • Minimal complaints from passengers • Reduced issues with late flight or peak period taxi service

The Airport Perspective • The Challenges • Heavy administrative load • 300 Permits and 30+ contracts • Alternate day trip activity monitoring • Enforcement and appeal processes • Trip fee and monthly fee collections • Reduced Airport staffing to handle GT program • 3 people compared to 8 in 2005

The Airport Perspective • The Challenges • Heavy administrative load • 300 Permits and 30+ contracts • Alternate day trip activity monitoring • Enforcement and appeal processes • Trip fee and monthly fee collections • Reduced Airport staffing to handle GT program • 3 people compared to 8 in 2005

The Airport Perspective • The Challenges (continued) • Average waiting time for drivers in staging is 1 hour • Resistance from drivers to reduce the number of Permits issued from 300 • Continued complaints / issues from and between the industry members on model • Annual issues up to City Council level about company permit reallocations

The Airport Perspective • The Challenges (continued) • Average waiting time for drivers in staging is 1 hour • Resistance from drivers to reduce the number of Permits issued from 300 • Continued complaints / issues from and between the industry members on model • Annual issues up to City Council level about company permit reallocations

The Taxi San Jose Perspective • Permitting System a Success • Drivers income and independence supported • Ability to enforce standards increased • Airport can drive accountability • Standards have improved since concession model

The Taxi San Jose Perspective • Permitting System a Success • Drivers income and independence supported • Ability to enforce standards increased • Airport can drive accountability • Standards have improved since concession model

The Taxi San Jose Perspective • Service levels at an all time high • New convention welcoming program • Doors open, luggage loaded, visitor services performed • Five minute commitment upheld for 6 years • 300, 000 trips/year – less than. 001% have waited over five minutes • TSJ employees have longevity, consistency • Some employees since opening in 2005

The Taxi San Jose Perspective • Service levels at an all time high • New convention welcoming program • Doors open, luggage loaded, visitor services performed • Five minute commitment upheld for 6 years • 300, 000 trips/year – less than. 001% have waited over five minutes • TSJ employees have longevity, consistency • Some employees since opening in 2005

The Yellow Cab Perspective • Model has allowed Permit holders to reduce their service fees • Has increased taxis at Downtown cabstands • Drivers prefer total ‘per trip fees’ to monthly dispatch fees plus trip fees • Model leaves nearly ½ of City’s drivers without access to on-demand passengers • Concession systems reduce Airport administrative tasks

The Yellow Cab Perspective • Model has allowed Permit holders to reduce their service fees • Has increased taxis at Downtown cabstands • Drivers prefer total ‘per trip fees’ to monthly dispatch fees plus trip fees • Model leaves nearly ½ of City’s drivers without access to on-demand passengers • Concession systems reduce Airport administrative tasks

What’s Next? • The Taxi San Jose contract expires in 2012 • Review and Analysis • October 2011 - Stakeholder Meetings and submission of written input • Fall 2011 – Staff analysis of input • Spring 2012 – Recommendations and RFP process for Dispatch company • May, or may not, require prior City Council action depending on changes

What’s Next? • The Taxi San Jose contract expires in 2012 • Review and Analysis • October 2011 - Stakeholder Meetings and submission of written input • Fall 2011 – Staff analysis of input • Spring 2012 – Recommendations and RFP process for Dispatch company • May, or may not, require prior City Council action depending on changes

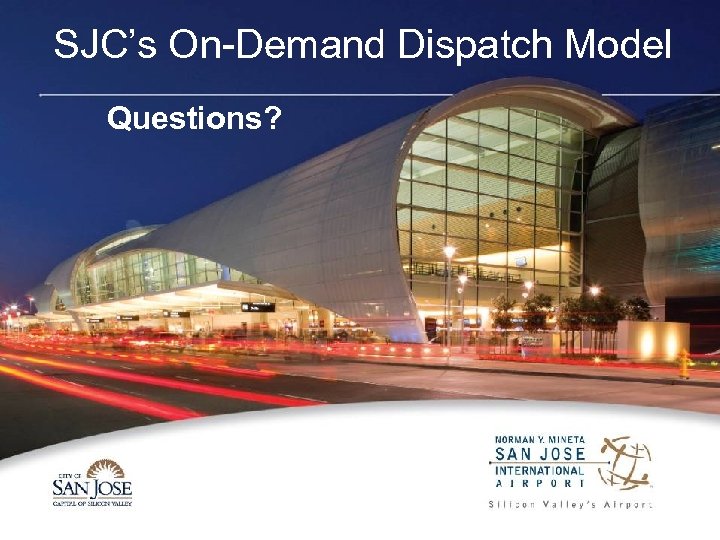

SJC’s On-Demand Dispatch Model Questions?

SJC’s On-Demand Dispatch Model Questions?