a14a10ecc31fa5566bbf63c89e88952c.ppt

- Количество слайдов: 41

Sinners & Saints Bill Mc. Connell (The Lloyd’s Actuary) & James Mc. Pherson (A Lloyd’s Actuary)

Objective • Improve Lloyd’s by our actions next year

How? • Look at and discuss what we did well and badly • Individual action plan to do it better

Sinners? • Equitas + Actuaries = Lloyd’s is saved? • High Salaries + New Lloyd’s Problems =? • We must deliver !

Where are the Saints?

Ideal time spent? • • Reserving Input to price Management decisions Opportunity spotting Profitability measurements Strategic projects Other projects

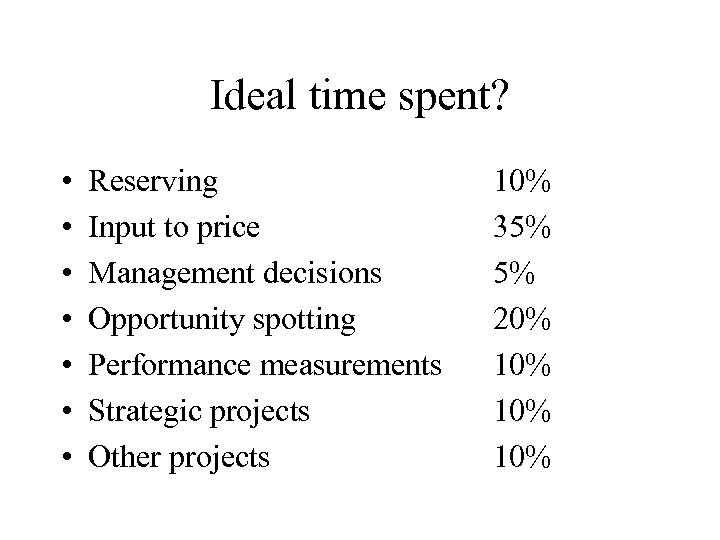

Ideal time spent? • • Reserving Input to price Management decisions Opportunity spotting Performance measurements Strategic projects Other projects 10% 35% 5% 20% 10% 10%

What Value Do You Bring to Lloyd’s?

How have Actuaries performed ?

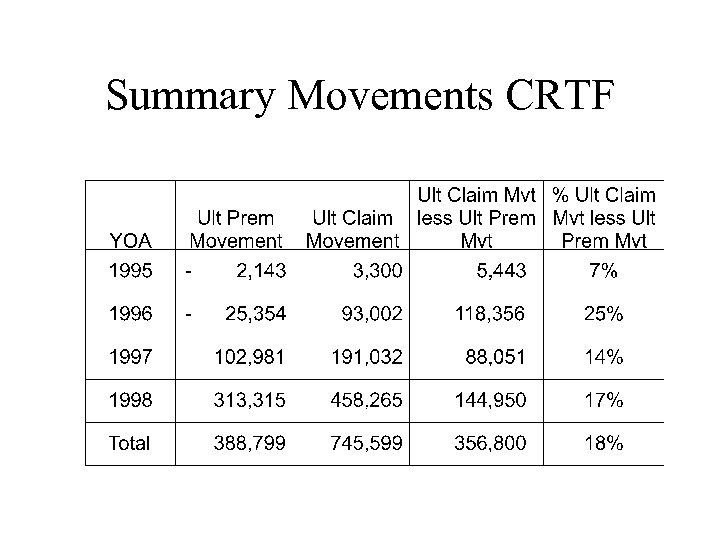

Summary Movements CRTF

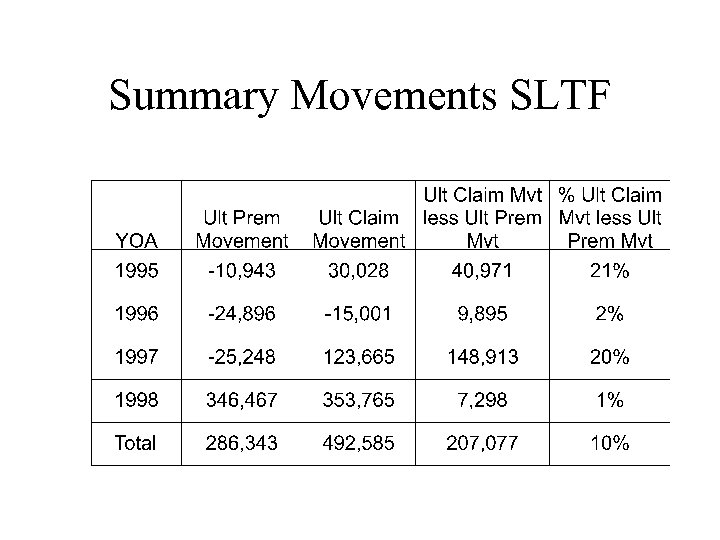

Summary Movements SLTF

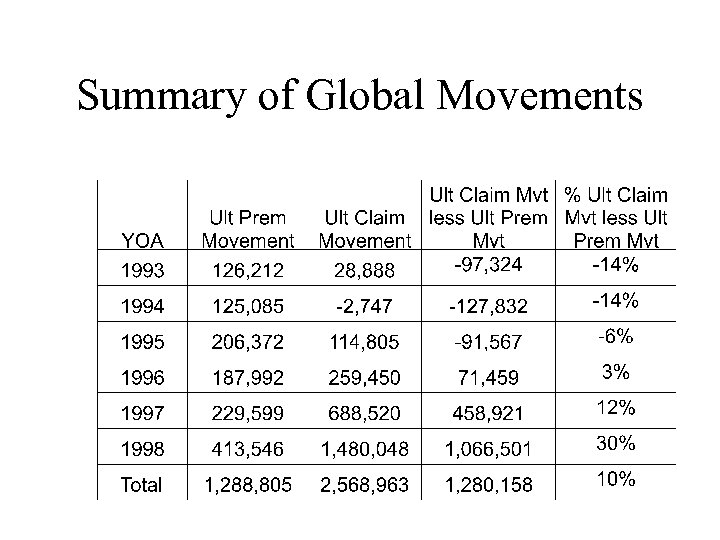

Summary of Global Movements

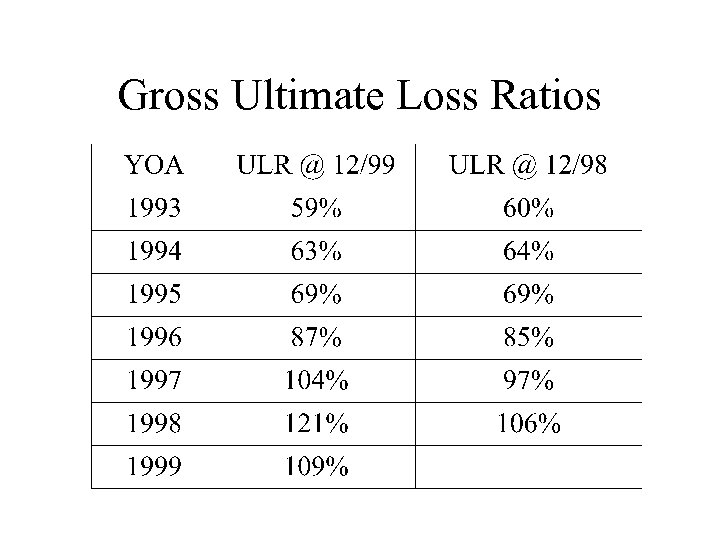

Gross Ultimate Loss Ratios

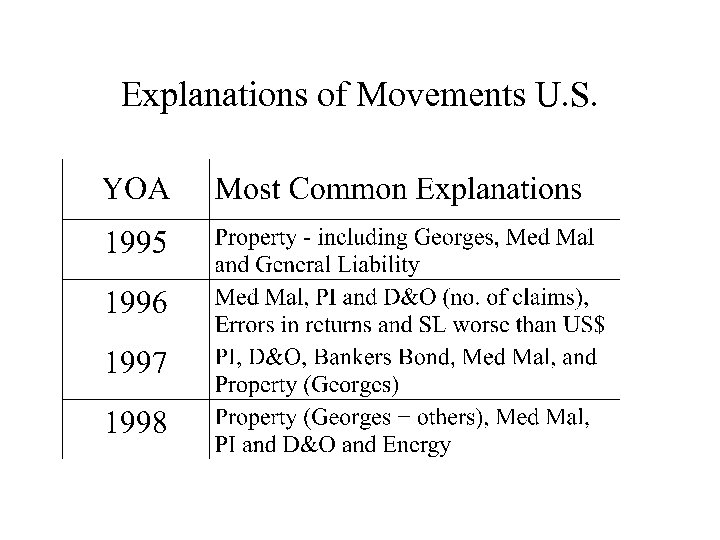

Explanations of Movements U. S.

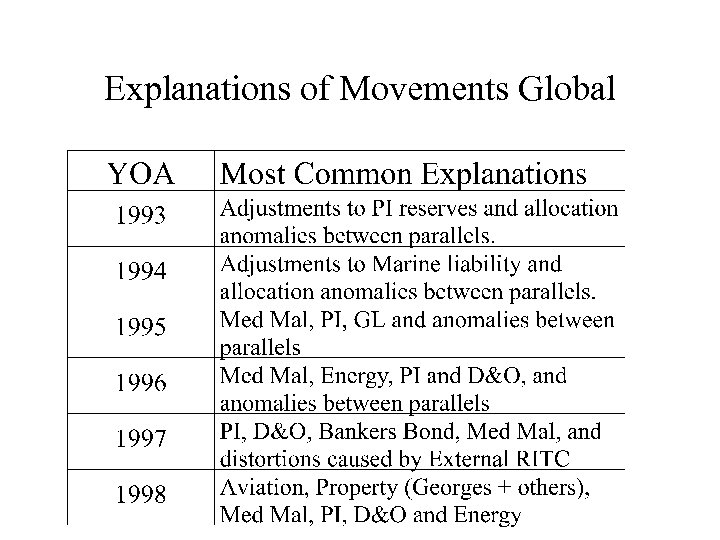

Explanations of Movements Global

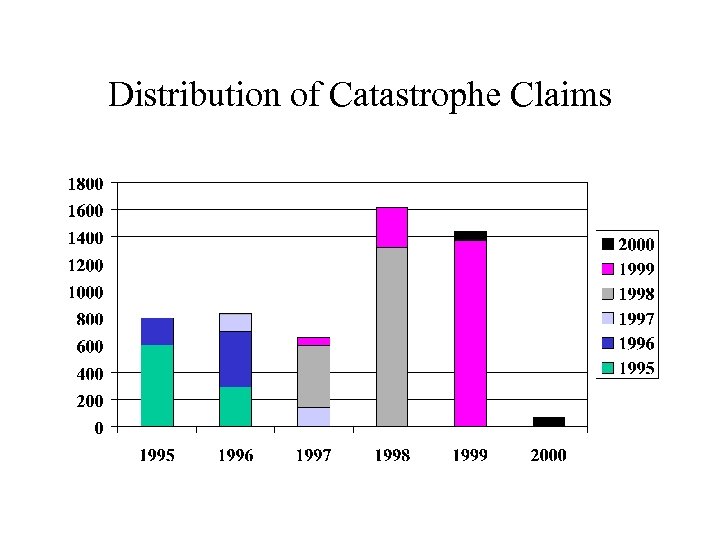

Distribution of Catastrophe Claims

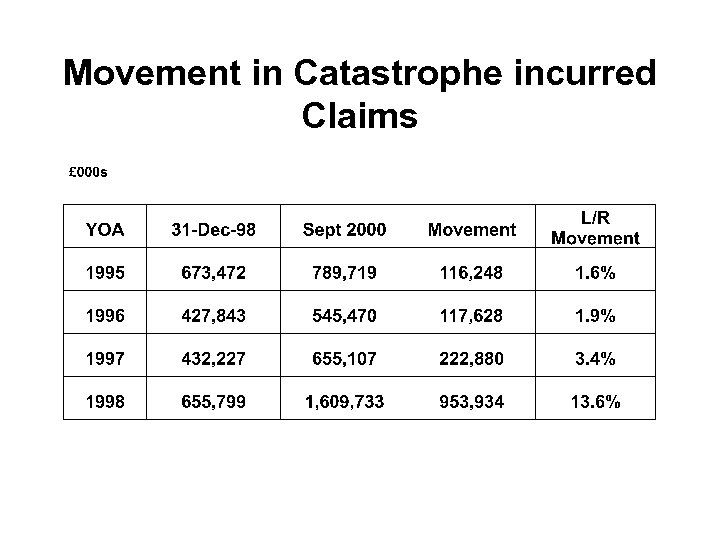

Movement in Catastrophe incurred Claims

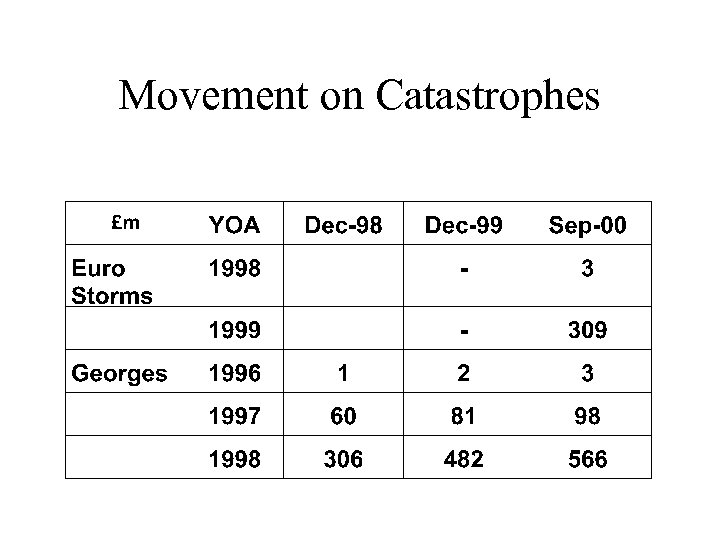

Movement on Catastrophes

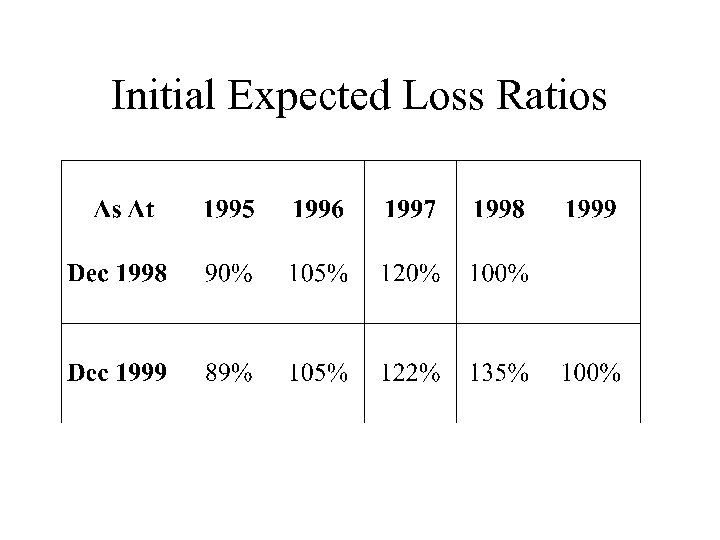

Initial Expected Loss Ratios

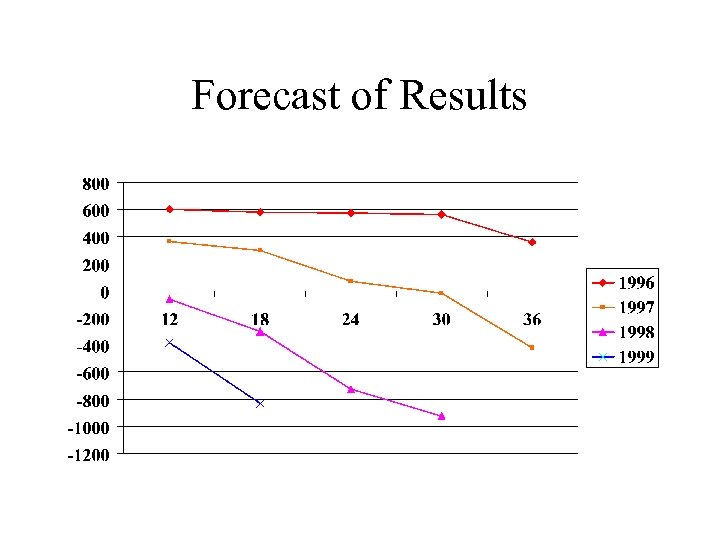

Forecast of Results

Other Points • Claims Inflation. • How many syndicates should an actuary be appointed to? • Actuarial reports.

Actuaries Roles

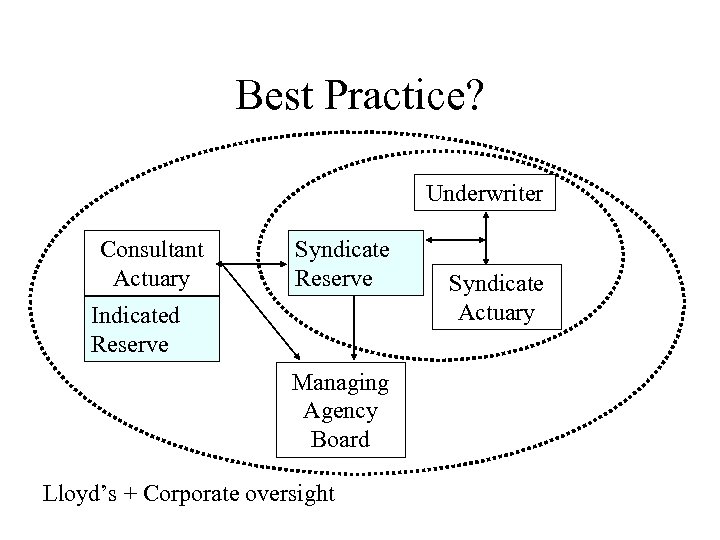

Best Practice? Underwriter Consultant Actuary Syndicate Reserve Indicated Reserve Managing Agency Board Lloyd’s + Corporate oversight Syndicate Actuary

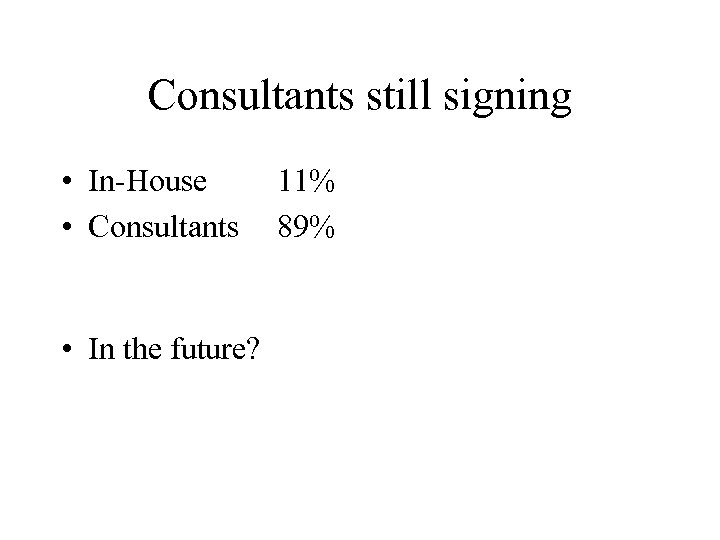

Consultants still signing • In-House • Consultants • In the future? 11% 89%

Roles • Managing Agency - Final say • Underwriter / In-house actuaries propose • Consultant gives independent benchmark + check for comfort (+ sign off? )

Do you do your bit? • • • Get enough information? Improve the reserves / reserving process? Interpret the results better? Give better feedback on exercise? CUT THE TIME TAKEN ?

Practical Reinsurance Guide

Must do gross of reinsurance and then net down Reinsurance + bad debt is the biggest issue for next year

It is not that hard – each year separately • Quota Share - adjusted gross ULR (PC etc) • XL - tricky bit (unless Cat protection only) reinstatements • Stop loss – Read slip carefully (additional premiums, non renewal clauses) • Financial – talk with auditors

Likely issues • Bad debt – including delays • Reinsurance exhaustion (all “working” layers? – check slips) • Much less protection for next year • More expensive for next year • Hence more finite arrangements?

Good rating index • At Policy level • Compared to unbiased / objective measure such as rating model • Easy to use (no more than 2 inputs per policy)

Suggestions – 1 – in use • Change in premium cash terms % • Change in non cash terms %

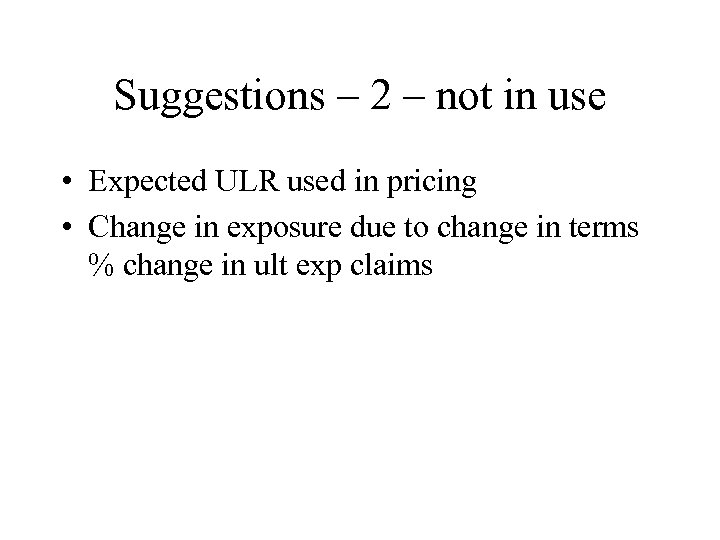

Suggestions – 2 – not in use • Expected ULR used in pricing • Change in exposure due to change in terms % change in ult exp claims

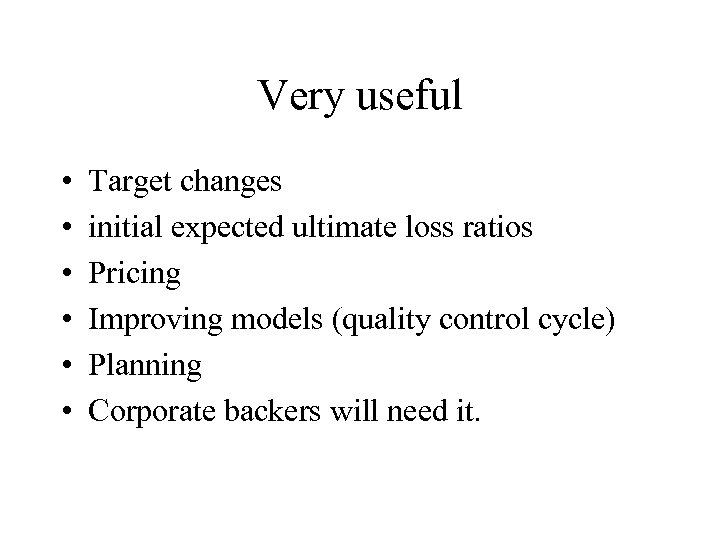

Very useful • • • Target changes initial expected ultimate loss ratios Pricing Improving models (quality control cycle) Planning Corporate backers will need it.

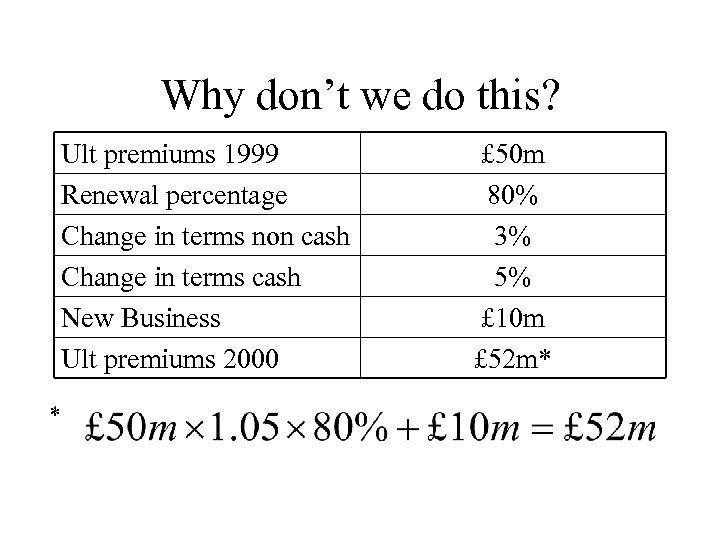

Why don’t we do this? Ult premiums 1999 Renewal percentage Change in terms non cash Change in terms cash New Business Ult premiums 2000 * £ 50 m 80% 3% 5% £ 10 m £ 52 m*

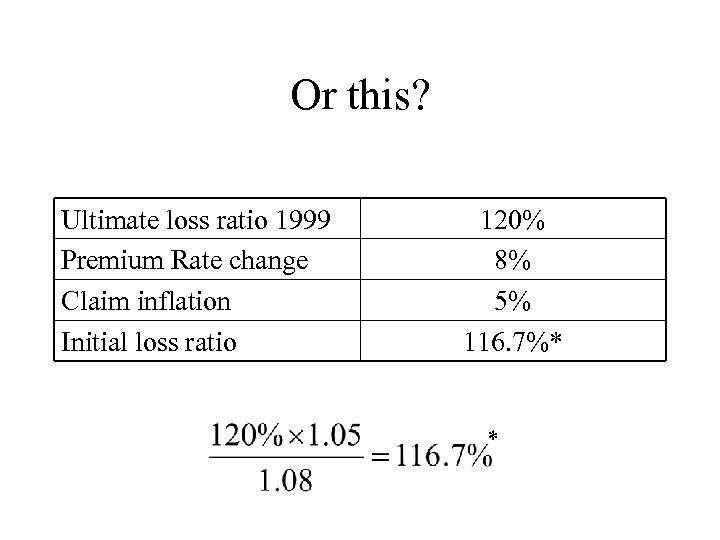

Or this? Ultimate loss ratio 1999 Premium Rate change Claim inflation Initial loss ratio 120% 8% 5% 116. 7%* *

This calculation is • Easy • Verifiable • Done in most non-Lloyd’s contexts • Rarely done in Lloyd’s !

Do all of Lloyd’s example If time (more than 10 minutes to go)

James improvement list • All Gross to Net • Write up clear Initial Ultimate Expected Loss Ratios for all main classes (Never Underwriters figure unless documented) • Allocation by Lloyd’s risk code • Benchmark against market stats • Reinsurance costs • Early warning (US Trust Funds)

Bill’s suggestion • All Gross to Net • Write up clear Initial Ultimate Expected Loss Ratios for all main classes (Never Underwriters figure unless documented) • Allocation by Lloyd’s risk code • Benchmark against market stats • Reinsurance costs • Early warning (US Trust Funds)

Your Improvement List ?

a14a10ecc31fa5566bbf63c89e88952c.ppt