9547765f15a790a2facb3c52ac28ebfe.ppt

- Количество слайдов: 13

SINMAG EQUIPMENT CORPORATION 1580 TT

SINMAG EQUIPMENT CORPORATION 1580 TT

Summary of Presentation n n n n Company Profile Consolidated Income Statement Company’s currently financial and operational highlights Top and Bottom share price of each year and company value Market Overview of China Market Overview of other subsidiaries Bakery factory in Congo (Kinshasha) Development Strategy

Summary of Presentation n n n n Company Profile Consolidated Income Statement Company’s currently financial and operational highlights Top and Bottom share price of each year and company value Market Overview of China Market Overview of other subsidiaries Bakery factory in Congo (Kinshasha) Development Strategy

Company Profile Established in 1983, 31 years anniversary in this year. Ø Sinmag subsidiaries are strategically located in Wuxi, U. S. A. , Malaysia, Thailand India. Ø Sinmag is the largest bakery equipment manufacturer in Asia, also among Top 6 in the world. Ø Sinmag has developed most of the needed bakery equipments for retail bakery and is now developing automatic production line for industrial bakery. Ø Sinmag has started manufacturing of food service equipment for 5 years, and has sold many chicken rotisserie, meat processing equipment to supermarkets. Sinmag pizza equipments are in good sales progress. We started selling dish washers, tray washing machine and transfer-box washing machines recently. The washing machine had been sold to Uni. President’s bakery factory in Kunshan (China). This new machine operates well according to our client. Ø 1

Company Profile Established in 1983, 31 years anniversary in this year. Ø Sinmag subsidiaries are strategically located in Wuxi, U. S. A. , Malaysia, Thailand India. Ø Sinmag is the largest bakery equipment manufacturer in Asia, also among Top 6 in the world. Ø Sinmag has developed most of the needed bakery equipments for retail bakery and is now developing automatic production line for industrial bakery. Ø Sinmag has started manufacturing of food service equipment for 5 years, and has sold many chicken rotisserie, meat processing equipment to supermarkets. Sinmag pizza equipments are in good sales progress. We started selling dish washers, tray washing machine and transfer-box washing machines recently. The washing machine had been sold to Uni. President’s bakery factory in Kunshan (China). This new machine operates well according to our client. Ø 1

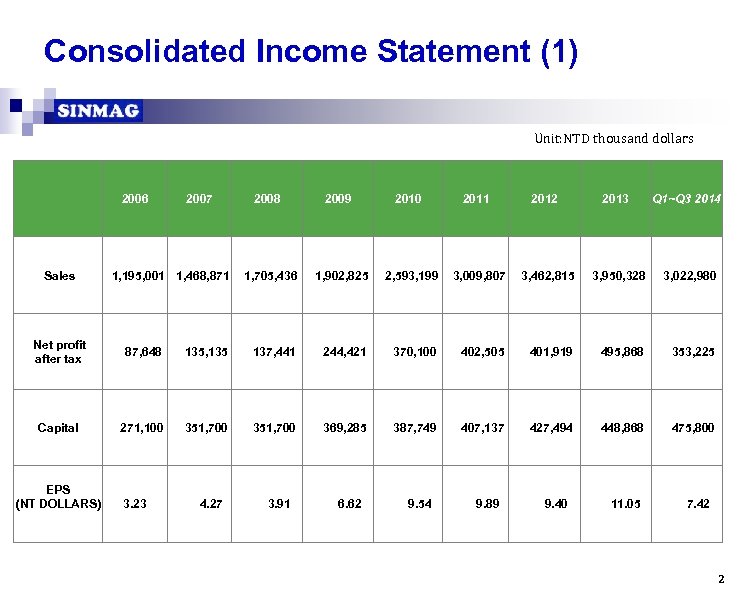

Consolidated Income Statement (1) Unit: NTD thousand dollars Sales 2006 2007 1, 195, 001 1, 468, 871 2008 2009 2010 2011 2012 2013 Q 1~Q 3 2014 1, 705, 436 1, 902, 825 2, 593, 199 3, 009, 807 3, 462, 815 3, 950, 328 3, 022, 980 Net profit after tax 87, 648 135, 135 137, 441 244, 421 370, 100 402, 505 401, 919 495, 868 353, 225 Capital 271, 100 351, 700 369, 285 387, 749 407, 137 427, 494 448, 868 475, 800 EPS (NT DOLLARS) 3. 23 4. 27 3. 91 6. 62 9. 54 9. 89 9. 40 11. 05 7. 42 2

Consolidated Income Statement (1) Unit: NTD thousand dollars Sales 2006 2007 1, 195, 001 1, 468, 871 2008 2009 2010 2011 2012 2013 Q 1~Q 3 2014 1, 705, 436 1, 902, 825 2, 593, 199 3, 009, 807 3, 462, 815 3, 950, 328 3, 022, 980 Net profit after tax 87, 648 135, 135 137, 441 244, 421 370, 100 402, 505 401, 919 495, 868 353, 225 Capital 271, 100 351, 700 369, 285 387, 749 407, 137 427, 494 448, 868 475, 800 EPS (NT DOLLARS) 3. 23 4. 27 3. 91 6. 62 9. 54 9. 89 9. 40 11. 05 7. 42 2

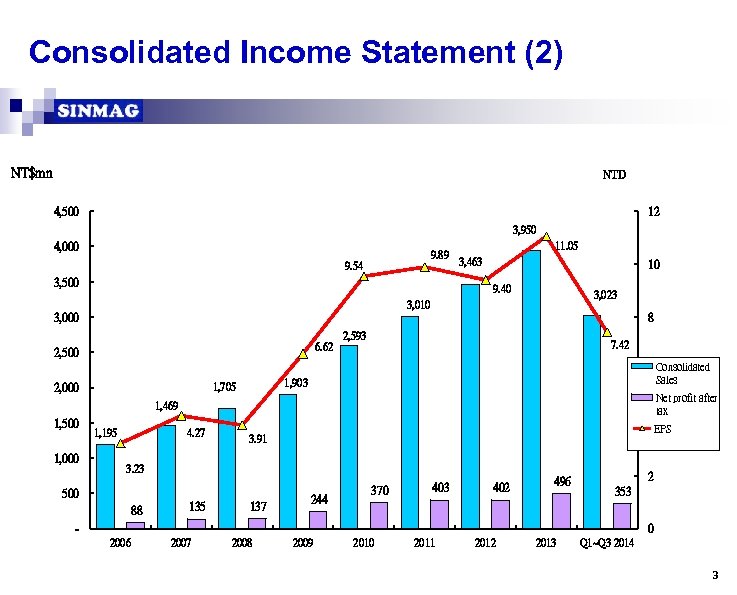

Consolidated Income Statement (2) NT$mn NTD 4, 500 12 3, 950 4, 000 9. 89 9. 54 3, 500 11. 05 3, 463 10 9. 40 3, 023 3, 010 3, 000 8 2, 593 7. 42 6. 62 2, 500 6 Consolidated Sales 1, 903 1, 705 2, 000 Net profit after tax 1, 469 1, 500 1, 000 1, 195 4. 27 4 EPS 3. 91 3. 23 500 88 135 137 244 370 403 402 496 2 353 - 0 2006 2007 2008 2009 2010 2011 2012 2013 Q 1~Q 3 2014 3

Consolidated Income Statement (2) NT$mn NTD 4, 500 12 3, 950 4, 000 9. 89 9. 54 3, 500 11. 05 3, 463 10 9. 40 3, 023 3, 010 3, 000 8 2, 593 7. 42 6. 62 2, 500 6 Consolidated Sales 1, 903 1, 705 2, 000 Net profit after tax 1, 469 1, 500 1, 000 1, 195 4. 27 4 EPS 3. 91 3. 23 500 88 135 137 244 370 403 402 496 2 353 - 0 2006 2007 2008 2009 2010 2011 2012 2013 Q 1~Q 3 2014 3

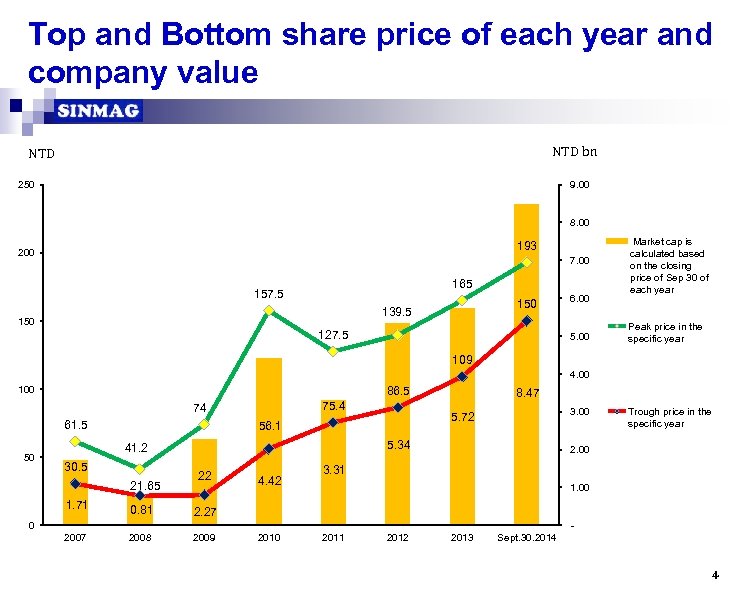

Top and Bottom share price of each year and company value NTD bn NTD 250 9. 00 8. 00 193 200 7. 00 165 157. 5 150 139. 5 150 127. 5 6. 00 5. 00 Market cap is calculated based on the closing price of Sep 30 of each year Peak price in the specific year 109 4. 00 100 86. 5 75. 4 74 61. 5 50 5. 34 41. 2 21. 65 1. 71 3. 00 5. 72 56. 1 30. 5 8. 47 22 0. 81 2009 2. 00 3. 31 1. 00 2. 27 2008 4. 42 Trough price in the specific year 0 2007 2010 2011 2012 2013 Sept. 30. 2014 4

Top and Bottom share price of each year and company value NTD bn NTD 250 9. 00 8. 00 193 200 7. 00 165 157. 5 150 139. 5 150 127. 5 6. 00 5. 00 Market cap is calculated based on the closing price of Sep 30 of each year Peak price in the specific year 109 4. 00 100 86. 5 75. 4 74 61. 5 50 5. 34 41. 2 21. 65 1. 71 3. 00 5. 72 56. 1 30. 5 8. 47 22 0. 81 2009 2. 00 3. 31 1. 00 2. 27 2008 4. 42 Trough price in the specific year 0 2007 2010 2011 2012 2013 Sept. 30. 2014 4

Company’s currently financial and operational highlights (1) 1. 2013 consolidated revenue is NT$3, 950 M, which grows by 14. 08% compared with the revenue of NT$3, 462 M in 2012. Q 1~Q 3 2014 consolidated revenue is NT$3, 023 M, which grows by 10. 99% compared with the revenue of NT$2, 724 M in Q 1~Q 3 2013. The growth comes mainly from China market. 2. China market revenue in 2013 and Q 1~Q 3 2014 grows 24. 19% and 19. 65% accounting for 58. 75% and 60. 67% of consolidated revenue respectively. 3. Sinmag has sold product to about 70 countries. Headquarter Taiwan and five subsidiaries are among top 11 sales territories. The top five in order : China, U. S. A, South Africa, Malaysia, and Taiwan. Sales of top 11 territories is 92% of total consolidated sales. 5

Company’s currently financial and operational highlights (1) 1. 2013 consolidated revenue is NT$3, 950 M, which grows by 14. 08% compared with the revenue of NT$3, 462 M in 2012. Q 1~Q 3 2014 consolidated revenue is NT$3, 023 M, which grows by 10. 99% compared with the revenue of NT$2, 724 M in Q 1~Q 3 2013. The growth comes mainly from China market. 2. China market revenue in 2013 and Q 1~Q 3 2014 grows 24. 19% and 19. 65% accounting for 58. 75% and 60. 67% of consolidated revenue respectively. 3. Sinmag has sold product to about 70 countries. Headquarter Taiwan and five subsidiaries are among top 11 sales territories. The top five in order : China, U. S. A, South Africa, Malaysia, and Taiwan. Sales of top 11 territories is 92% of total consolidated sales. 5

Company’s currently financial and operational highlights (2) 4. Growing markets (Q 1~Q 3 2014) (1)China 19. 65% (2)South Africa 14. 24% (3) U. S. A 14. 02% (4) Malaysia 11. 06% 6

Company’s currently financial and operational highlights (2) 4. Growing markets (Q 1~Q 3 2014) (1)China 19. 65% (2)South Africa 14. 24% (3) U. S. A 14. 02% (4) Malaysia 11. 06% 6

Market Overview of China (1) 1. Q 1~Q 3, 2014 sales in China increasrd by 19. 65%. 2. We saw impressive sales results of large machines/ automation products. Among many successful cases, our customer in Shanghai could one a good example. This Shanghai customer produces and sell frozen foods originally. In mid 90's, this client started selling frozen pissa to supermarket. In this year, the client purchased an automated production line to produce 4, 500 pizza/hour from Sinmag. This line consists of equipment from mixing, dividing, rounding, flattening, topping and baking to produce both prebaked pizza crust and baked pizza with topping. 3. We also saw many bakery chains buy machines from Sinmag for their new stores. For example, new chains, e. g. 貝克新語 , 慕蘭卡, are our new clients on top of seeing growths from existing clients from 85度C, 好利來, 味多美 , 一鳴. 7

Market Overview of China (1) 1. Q 1~Q 3, 2014 sales in China increasrd by 19. 65%. 2. We saw impressive sales results of large machines/ automation products. Among many successful cases, our customer in Shanghai could one a good example. This Shanghai customer produces and sell frozen foods originally. In mid 90's, this client started selling frozen pissa to supermarket. In this year, the client purchased an automated production line to produce 4, 500 pizza/hour from Sinmag. This line consists of equipment from mixing, dividing, rounding, flattening, topping and baking to produce both prebaked pizza crust and baked pizza with topping. 3. We also saw many bakery chains buy machines from Sinmag for their new stores. For example, new chains, e. g. 貝克新語 , 慕蘭卡, are our new clients on top of seeing growths from existing clients from 85度C, 好利來, 味多美 , 一鳴. 7

Market Overview of China (2) 4. In our new segment of pizza machines, we also see many new stores use Sinmag’s pizza machines. For instance, 北京好倫哥 added 17 new stores in 2014; 比格 has debut 8 new stores. All these new stores have installed Sinmag’s machines. 5. We saw the growth of new stores in the supermarkets slowed down due to weaker real estate business and development. 6. The sales of moon cake decreased but it didn’t cause major impact to Sinmag. 8

Market Overview of China (2) 4. In our new segment of pizza machines, we also see many new stores use Sinmag’s pizza machines. For instance, 北京好倫哥 added 17 new stores in 2014; 比格 has debut 8 new stores. All these new stores have installed Sinmag’s machines. 5. We saw the growth of new stores in the supermarkets slowed down due to weaker real estate business and development. 6. The sales of moon cake decreased but it didn’t cause major impact to Sinmag. 8

Market Overview of other subsidiaries Yo. Y for Q 1~Q 3, 2014: 1. U. S. A:Increases 14. 02%. 2. Malaysia : Increases 11. 06%. 3. South Africa : Increases 14. 24%. 4. Thailand:Decrease 10. 87% in Thailand due to political issue. 5. India:For India, we think the GDP still too low for bakery market. It takes time. 6. In general, due to depreciation to Dollar, the export growth momentum is not strong in 2014. 9

Market Overview of other subsidiaries Yo. Y for Q 1~Q 3, 2014: 1. U. S. A:Increases 14. 02%. 2. Malaysia : Increases 11. 06%. 3. South Africa : Increases 14. 24%. 4. Thailand:Decrease 10. 87% in Thailand due to political issue. 5. India:For India, we think the GDP still too low for bakery market. It takes time. 6. In general, due to depreciation to Dollar, the export growth momentum is not strong in 2014. 9

Bakery factory in Congo (Kinshasha) 1. Building for our bakery is expected to be completed mid of Dec. 2014. 2. The 1 st part of production equipment will arrive to our factories by the end of Nov 2014. The 2 nd part of equipments will be installed by the end of Dec 2014. 3. We have sent two engineers to Congo for assisting the factory construction. They will help on constructing of utility, water, electric and gas etc in our factories. 4. The chief of plant and warehouse manager will depart to Congo in Nov; other managers will be there at the end of Dec. 2014. 5. In Jan 2015, pilot- run of the new machines is expected; products of breads will be made and sold in Feb 2015 officially. 10

Bakery factory in Congo (Kinshasha) 1. Building for our bakery is expected to be completed mid of Dec. 2014. 2. The 1 st part of production equipment will arrive to our factories by the end of Nov 2014. The 2 nd part of equipments will be installed by the end of Dec 2014. 3. We have sent two engineers to Congo for assisting the factory construction. They will help on constructing of utility, water, electric and gas etc in our factories. 4. The chief of plant and warehouse manager will depart to Congo in Nov; other managers will be there at the end of Dec. 2014. 5. In Jan 2015, pilot- run of the new machines is expected; products of breads will be made and sold in Feb 2015 officially. 10

Development Strategy Ø Keep developing automatic production equipments for bread and cake. Ø Keep developing kitchen equipments. Ø Strengthen the market leader position in China by enhancing after sales service and baker service. Ø Evaluate to expand our business by establishing overseas subsidiaries to grow sales revenue. 11

Development Strategy Ø Keep developing automatic production equipments for bread and cake. Ø Keep developing kitchen equipments. Ø Strengthen the market leader position in China by enhancing after sales service and baker service. Ø Evaluate to expand our business by establishing overseas subsidiaries to grow sales revenue. 11