ba8559dd3536cf965659610543e686d7.ppt

- Количество слайдов: 17

Singapore Update Presented by Dave Carlson Chief Executive Officer 30 October

Agenda • Background • Key features of the NEMS • Price determination • The move to gas • Benefits • Issues and challenges • Market power • Vertical integration • Retail competition • Fuel supply

Background 3

Singapore’s Market • Wholesale market: • Mandatory gross pool • Locational marginal pricing • Half-hourly pricing and dispatch • Co-optimisation of energy and ancillary products • Daily settlement • Five active generators • Retail market: • Industrial and commercial customers are contestable • Five active retailers • Householders supplied by utility that also owns t&d assets

Wholesale Prices • Comfortable supply cushion • Peak demand = 5, 475 MW with 3. 58% growth p. a. • Installed capacity = 10, 104 MW • Transmission system unconstrained during normal operations • Prices generally influenced by: • Load profile • Fuel costs (HSFO) • Unplanned equipment outages • Gas supply issues

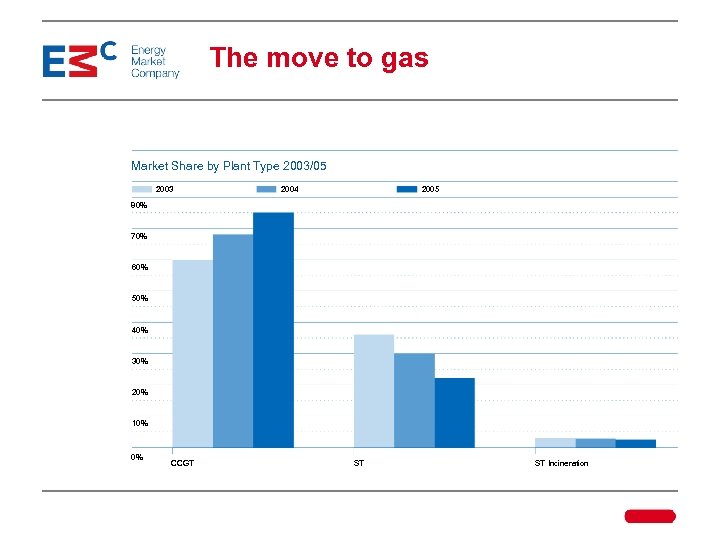

The move to gas Market Share by Plant Type 2003/05 2003 2005 2004 80% 70% 60% 50% 40% 30% 20% 10% 0% CCGT ST ST Incineration

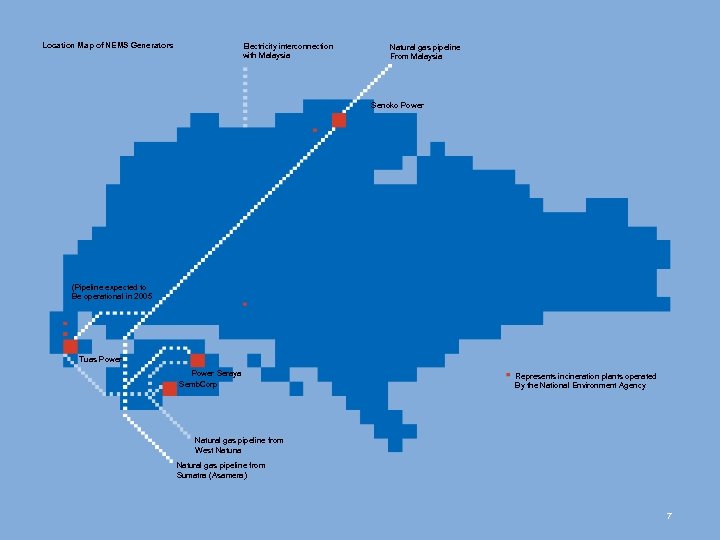

Location Map of NEMS Generators Electricity interconnection with Malaysia Natural gas pipeline From Malaysia Senoko Power (Pipeline expected to Be operational in 2005 Tuas Power Seraya Semb. Corp Represents incineration plants operated By the National Environment Agency Natural gas pipeline from West Natuna Natural gas pipeline from Sumatra (Asamera) 7

Benefits 8

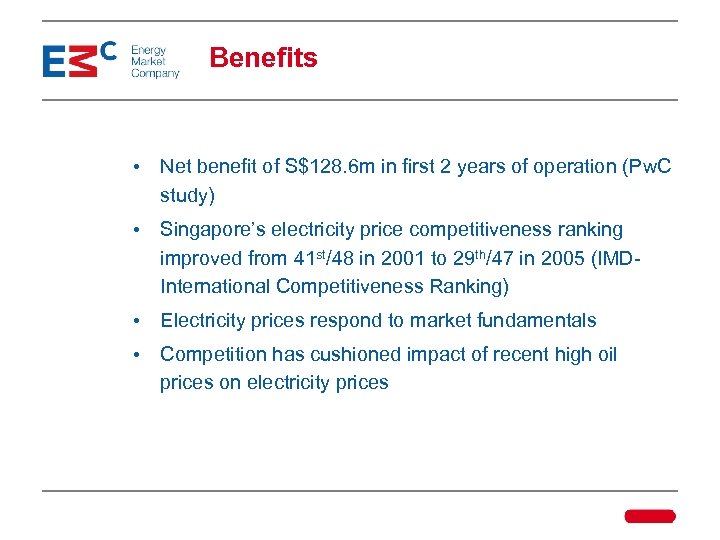

Benefits • Net benefit of S$128. 6 m in first 2 years of operation (Pw. C study) • Singapore’s electricity price competitiveness ranking improved from 41 st/48 in 2001 to 29 th/47 in 2005 (IMDInternational Competitiveness Ranking) • Electricity prices respond to market fundamentals • Competition has cushioned impact of recent high oil prices on electricity prices

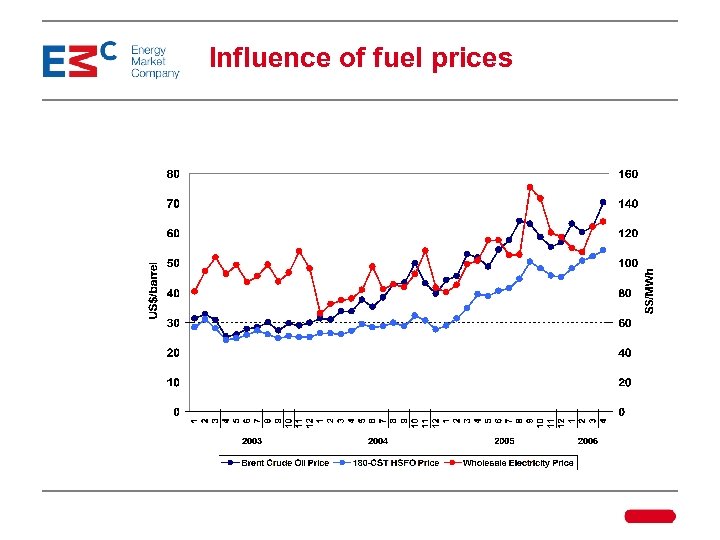

Influence of fuel prices

Issues and Challenges 11

Market Power • Concentrated market with three major generators holding 85% market share • Regulator concerned that these generators could potentially exercise market power to influence prices • Introduced vesting contracts • • Cover approx 65% of load priced set at LRMC of most efficient plant in the power system • LRMC reset quarterly – reflects fuel costs • • Mandatory hedge contract for generators Vesting quantity reduced as market becomes less concentrated Dampened wholesale settlement prices

Vertical Integration • All major generators have affiliated retail companies • Vertical integration and vesting contracts mean that all market participants are nearly perfectly hedged • This limits the need for a hedge contract market • As a result, there is very limited bilateral contracting between spot market participants

Retail Competition • Retail contestability introduced in phases based on consumption level • Nearly 75% of the market is open • Contestable consumers can chose to buy from a retailer, directly from the market or indirectly from SP Services • Non-contestable consumers are supplied by SP Services at a regulated (un-subsidised) tariff • Government has decided to defer making the remaining (domestic) customers contestable

Fuel Supply • Singapore is highly reliant on piped natural gas for electricity production • In June 2004 Singapore experienced a partial power black out due to a disruption in piped gas supply • Fuel risks are being mitigated by: • Gas generation units have dual-fuel capability and access to two sources of piped gas • Government has made a decision to import LNG from 2012 to diversify supply options and develop a storage capability

Privitisation • The three largest ‘Gentailers’ are government owned • Privitisation of these assets is under consideration, with media reports suggesting that sale may be imminent • Ownership changes are likely to change market dynamics

Conclusion • The market is: • working well – prices respond to changes in demand supply conditions and reflect changes in input costs • 3 ½ years old and generally supported by the industry • well positioned for future development and evolution

ba8559dd3536cf965659610543e686d7.ppt