38ca992828243535e4908cf097bc3e53.ppt

- Количество слайдов: 15

Singapore. India. Libreville Shanghai. Dushanbe. Cotonou

MARVIS – Headquartered in Singapore MNC with Global Presence Core Business – Oil and Gas Exploration Other Business Interests – Cotton Trading & Timber.

Mr. Siraj Kasim Managing Director

2005 -06 allotment of 2000 FT block on Nomination basis by DGH, Gabon. Data interpretation for the block conducted by Marvis. Negotiation with Indian Oil – Oil India for farming out the block. Due Diligence done by Indian Oil – Oil India. Farm-In agreement entered into with Indian Oil – Oil India combine for 90%. Payment made to Marvis as per Farm-In agreement. Above process completed in a span of 6 months.

Protocol of Intention for cooperation in the Energy Sector signed in 2006 with Ministry of Mines and Energy, Tajikistan. Mr. Hugh North (formerly with Amerada Hess) evaluated data and advised on selection of two potential blocks. Block A, Block B and production development and enhancement for Kyzyltumshuk existing gas field signed with Ministry for Exploration, Tajikistan TRACS of UK evaluated the above data for asset verification. Risked Asset value of US$239 million as on date of assigning based on Tracs estimated resource and a value of US$ 7 per BOE.

Oil resource (Tracs estimated )~ 30 to 150 MMBBLS Gas resource (Tracs estimated) ~ 200 BCF to 1 TCF 40 Gas wells available in the existing gas field which are scheduled to be put back into production with minimum expenses. 2 Gas wells have been reworked and tested production at 0. 5 million cft per well per day. 38 Gas wells to be Re-Worked.

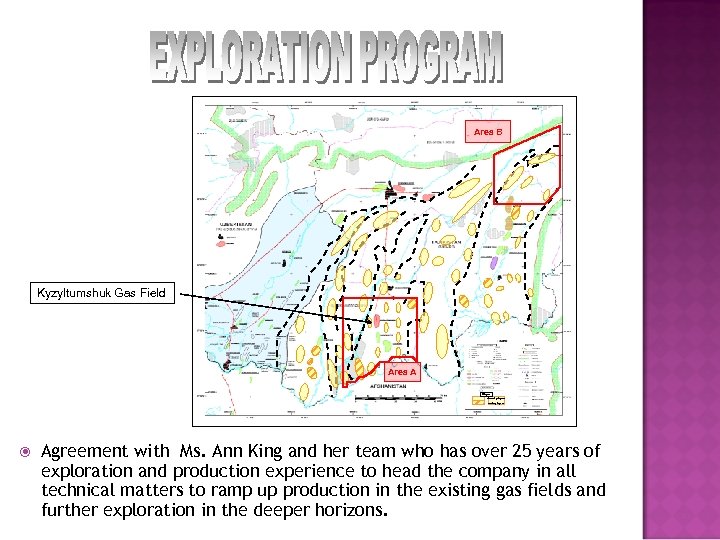

Area B Kyzyltumshuk Gas Field Area A Prospects Identified prospects Area of Interest Drillable prospects Agreement with Ms. Ann King and her team who has over 25 years of exploration and production experience to head the company in all technical matters to ramp up production in the existing gas fields and further exploration in the deeper horizons.

Current valuation- USD$239 Million @ US$ 7 per BOE. Existing Gas wells will be reworked as appropriate, projected estimates of 0. 5 Million Cft. per Gas well in Phase I. 1 well to be drilled to deeper horizon which is the producing formation in the Afghan-Tajik/Amurdarya basins in Turkmenistan, Afghanistan and Uzbekistan. Additional seismic 3 D 50 sq. kms or 2 D & 1 Exploration Well to be drilled to 4500 Meters in the first year in area A. Reworking of existing wells cost estimates US$500, 000 per well. Yield estimated 20 million Cft. Per day with potential to realise US$ 20 Million per annum. Expected M. Cap after successful Phase I work programme at above mentioned exploration level is in the order of USD$1 billion. Phase I Time Scale is 3 years.

Envisage Investment of $30 Million- 50% shares to be transferred/ issued in the name of investor. US$12 million to be paid to existing shareholders and balance to be used for E & P. On acceptance, payments to be made as per the following time schedule. Letter of Intent- 1 million to promoter 30 days Call letter ( On finalisation of the work Programme as agreed between the investor and the propmoter)- 4 million to company + 1. 5 million to promoter On starting of the work programme in Tajik – 2. 5 million to promoter + as per the requirement of company

…… INVESTMENT On completion of the seismic programme – 3 million to the promoter + as per the requirement of company On completion of interpretation of seismic programme- 4 million to the promoter + as per the requirement of company Nominees Induction to Board of Company If the investor is an Oil company with experience then we can divest up to 60% and the management can be handed over to them. Monthly/ Quarterly reports will be furnished

SALIENT The integrity of the acreage has been confirmed by the structural wells drilled during the Soviet Era. The presence of hydrocarbons and a petroleum system has been confirmed by historic production. Production in this area is at shallow depth of 600 – 900 metres. The production in similar basinal settings is at depth of 4000 to 5000 metres in Turkmenistan, Afghanistan and Uzbekistan. The upside on testing this deeper productive horizon in Tajikistan can be multi tcf potential leading to multi billion dollar valuation. The investment in a company with future ability to expand in the region

SALIENT FEATURES OF GABON PROJECT 10% Held by Marvis is a carried interest. Oil India limited is the operator with 45% working interest and Indian Oil Corporation holding the remaining 45%. Total work programme is upwrads of USD 100 Million. Seismic work is completed. This year as per work programme the first well is to be drilled. Tata Petrodyne valued this stake in 2009 at USD 7. 5 Million.

INVESTOR ADVANTAGE The company has carried interest of 10% in Block in SHAKTHI, Gabon. Exploration upside in Tajikistan. Gas field production ensuring cash flow security in Tajikistan Investment in stages giving the opportunity for the investor to come into the company in stages over a period of a year.

Liquidity for the investor will be either through An IPO after three years A trade sale of Marvis

38ca992828243535e4908cf097bc3e53.ppt