7380914de3c09cad4c0ce431654a62cd.ppt

- Количество слайдов: 2

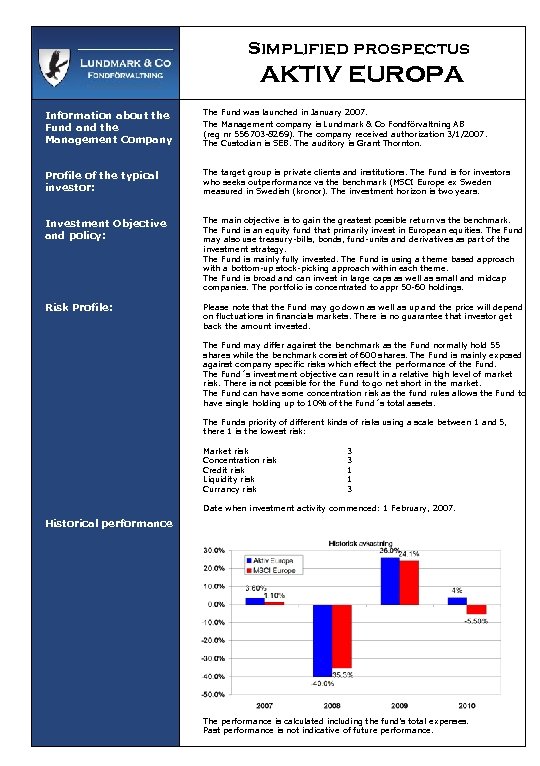

Simplified prospectus AKTIV EUROPA Information about the Fund and the Management Company The Fund was launched in January 2007. Profile of the typical investor: The target group is private clients and institutions. The Fund is for investors who seeks outperformance vs the benchmark (MSCI Europe ex Sweden measured in Swedish (kronor). The investment horizon is two years. Investment Objective and policy: The main objective is to gain the greatest possible return vs the benchmark. The Fund is an equity fund that primarily invest in European equities. The Fund may also use treasury-bills, bonds, fund-units and derivatives as part of the investment strategy. The Fund is mainly fully invested. The Fund is using a theme based approach with a bottom-up stock-picking approach within each theme. The Fund is broad and can invest in large caps as well as small and midcap companies. The portfolio is concentrated to appr 50 -60 holdings. Risk Profile: Please note that the Fund may go down as well as up and the price will depend on fluctuations in financials markets. There is no guarantee that investor get back the amount invested. The Management company is Lundmark & Co Fondförvaltning AB (reg nr 556703 -8269). The company received authorization 3/1/2007. The Custodian is SEB. The auditory is Grant Thornton. The Fund may differ against the benchmark as the Fund normally hold 55 shares while the benchmark consist of 600 shares. The Fund is mainly exposed against company specific risks which effect the performance of the Fund. The Fund´s investment objective can result in a relative high level of market risk. There is not possible for the Fund to go net short in the market. The Fund can have some concentration risk as the fund rules allows the Fund to have single holding up to 10% of the Fund´s total assets. The Funds priority of different kinds of risks using a scale between 1 and 5, there 1 is the lowest risk: Market risk Concentration risk Credit risk Liquidity risk Currancy risk 3 3 1 1 3 Date when investment activity commenced: 1 February, 2007. Historical performance The performance is calculated including the fund’s total expenses. Past performance is not indicative of future performance.

Simplified prospectus Aktiv Europa Tax rules Fees & costs The Fund is subject to Swedish legislation. Investors should inform themselves about the legislation and rules applicable to mergers, the purchase, holding and possible sale of units with regard to their residence and nationality. Subscription fee: Management fee (fixed): Performance fee. 0% 1, 40 % 20 % Redemption fee: TER(2010) Turnover(2010) 0% 1, 9% 1. 0 x Management fee can be between 0 -2 %. The performance fee (collective) is 20 % of the Fund´s performance above the benchmark (MSCI Europe excl Sweden in SEK). The Fund uses an eternal High Water Mark. The performance fee can vary between 0 - 50 %. Redemption fee is 1, 0 % if units held less then 365 days. Dividend Unit-value (NAV) The fund pays a dividend in order to transfer its tax liability to unit-holders and thereby avoid double taxation. The dividend, which is paid in November after the financial year, accrues to registered unit-holders on the dividend date determined by the fund manager. The latest dividend was 1, 45 SEK per unit. The net asset value (NAV) of a Fund unit is calculated on each Swedish banking day and can be provided by the Management Company. The NAV is also published daily in common Swedish newspapers and on fund/equity related websites e. g. Morningstar. Buy/sell The Fund is open for subscription and redemption of units on each Swedish banking day. Subscription and redemption transactions are executed at the net asset value of the unit calculated for the transaction date, provided that the transaction order has been given to the Management Company before 3: 30 PM (CET). Bank account SEB 5851 -1037950. Other information Copies of the Fund´s prospectus and financial statements may be obtained from the Management Company before any investment in the Fund is made. The funds reg nr: 515602 -1551 ISIN: SE 0001919143 This fund is authorized and regulated by the Swedish Financial Authority (Finansinspektionen). Further information is availible on the web-site: www. lundmarkfonder. se. Responsible fund manager is Håkan Lundmark. (tel. +46 -8 -21 44 36) Responsible for complaints is Eric Lundström (tel. +46 -8 -21 44 35). Lundmark & Co Fondförvaltning AB Birger Jarlsgatan 41 A 111 45 STOCKHOLM Telephone +46 -8 – 21 44 35 Fax: +46 -8 – 21 44 38 E-mail: info@lundmarkfonder. se.

7380914de3c09cad4c0ce431654a62cd.ppt