429272a29b644924f47f2cdc9b8427b7.ppt

- Количество слайдов: 45

Simon Fraser University April 24, 2012 Wayne Chappell Vice President and Director Odlum Brown Financial Services Limited* Agnes Douglas Portfolio Manager, Odlum Brown Limited *A wholly-owned subsidiary of Odlum Brown Limited is a Member-Canadian Investor Protection Fund

Simon Fraser University April 24, 2012 Wayne Chappell Vice President and Director Odlum Brown Financial Services Limited* Agnes Douglas Portfolio Manager, Odlum Brown Limited *A wholly-owned subsidiary of Odlum Brown Limited is a Member-Canadian Investor Protection Fund

Retirement Planning

Retirement Planning

The Bare Facts Between 1992 and 2006, the percentage of Canada’s labour force with Defined Benefit Pension Plans dropped from 33 per cent to 26 per cent*. *Based on information provided by Statistics Canada ( Insights Report, Fall 2008).

The Bare Facts Between 1992 and 2006, the percentage of Canada’s labour force with Defined Benefit Pension Plans dropped from 33 per cent to 26 per cent*. *Based on information provided by Statistics Canada ( Insights Report, Fall 2008).

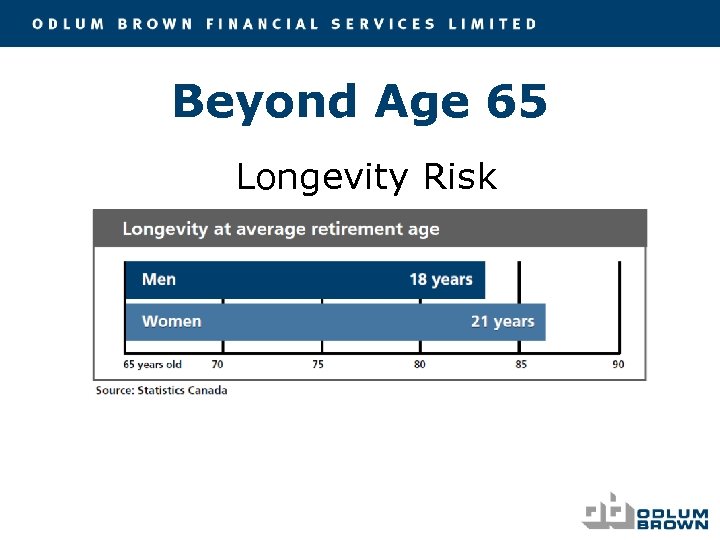

Beyond Age 65 Longevity Risk

Beyond Age 65 Longevity Risk

Beyond Age 65 – Cont’d. Underestimated spending habits Unknown future tax and inflation rates

Beyond Age 65 – Cont’d. Underestimated spending habits Unknown future tax and inflation rates

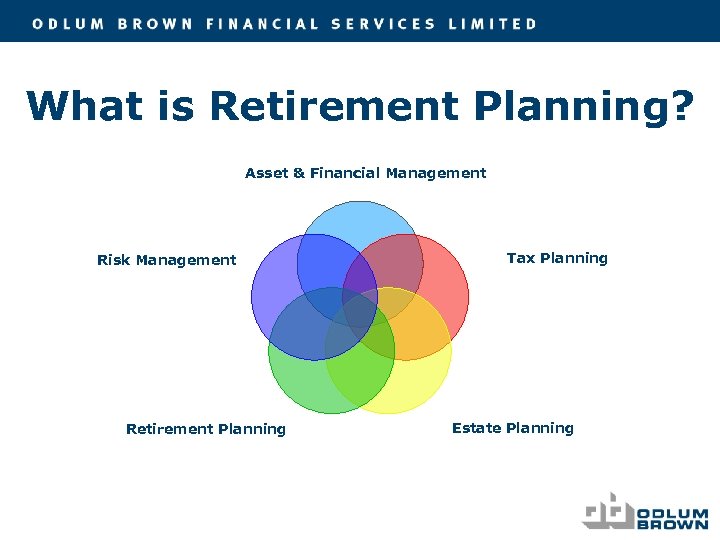

What is Retirement Planning? Asset & Financial Management Risk Management Retirement Planning Tax Planning Estate Planning

What is Retirement Planning? Asset & Financial Management Risk Management Retirement Planning Tax Planning Estate Planning

Terminology • • • Financial planning Retirement planning Estate planning Gift planning Tax planning

Terminology • • • Financial planning Retirement planning Estate planning Gift planning Tax planning

Are You Ready? Three Question Approach • Where are we now? • Where do we want to be? • What do I have to reconcile?

Are You Ready? Three Question Approach • Where are we now? • Where do we want to be? • What do I have to reconcile?

Are You Ready? Things You Can Do Now! Four Broad Categories • • Income Lifestyle - Housing Risk Management - Obstacles to achieving my goals Estate Issues What happens to what’s left? -

Are You Ready? Things You Can Do Now! Four Broad Categories • • Income Lifestyle - Housing Risk Management - Obstacles to achieving my goals Estate Issues What happens to what’s left? -

Retirement Planning Income • • • Where are we now? What will I need? How do I reconcile the difference?

Retirement Planning Income • • • Where are we now? What will I need? How do I reconcile the difference?

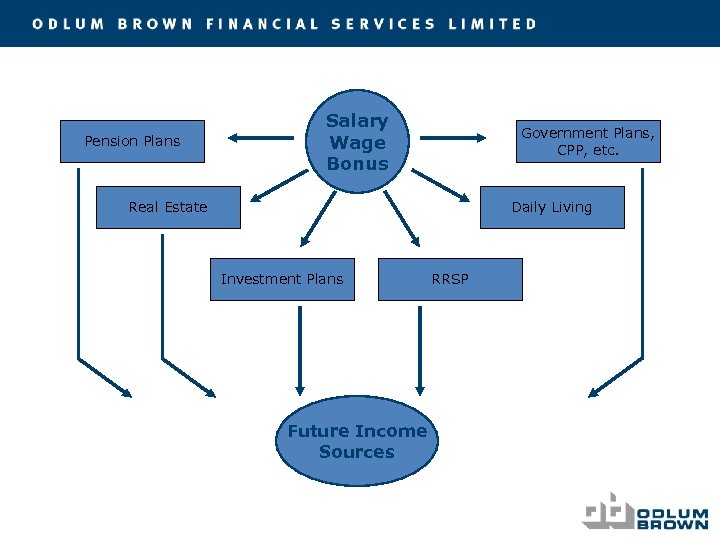

Where Are We Now?

Where Are We Now?

Where will we be if we keep doing what we are doing right now?

Where will we be if we keep doing what we are doing right now?

Pension Plans Salary Wage Bonus Government Plans, CPP, etc. Real Estate Daily Living Investment Plans Future Income Sources RRSP

Pension Plans Salary Wage Bonus Government Plans, CPP, etc. Real Estate Daily Living Investment Plans Future Income Sources RRSP

Could we live on that amount today? Why not?

Could we live on that amount today? Why not?

Where Do We Want To Be?

Where Do We Want To Be?

BUDGETING? !? !? !

BUDGETING? !? !? !

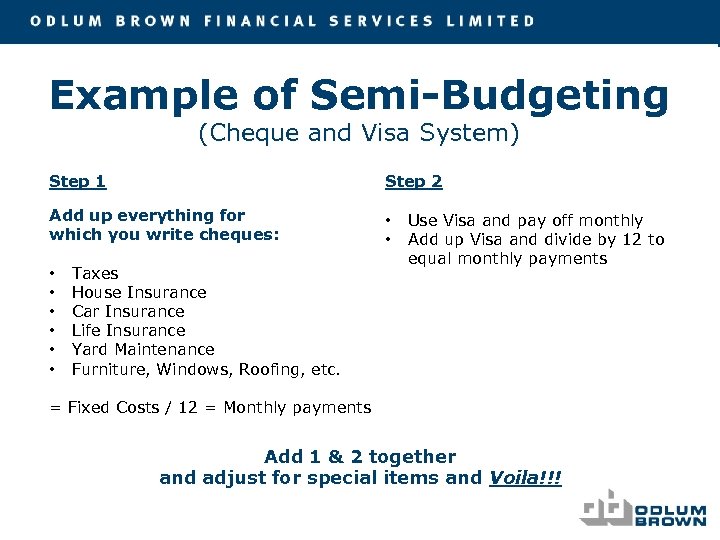

Example of Semi-Budgeting (Cheque and Visa System) Step 1 Step 2 Add up everything for which you write cheques: • • Taxes House Insurance Car Insurance Life Insurance Yard Maintenance Furniture, Windows, Roofing, etc. Use Visa and pay off monthly Add up Visa and divide by 12 to equal monthly payments = Fixed Costs / 12 = Monthly payments Add 1 & 2 together and adjust for special items and Voila!!!

Example of Semi-Budgeting (Cheque and Visa System) Step 1 Step 2 Add up everything for which you write cheques: • • Taxes House Insurance Car Insurance Life Insurance Yard Maintenance Furniture, Windows, Roofing, etc. Use Visa and pay off monthly Add up Visa and divide by 12 to equal monthly payments = Fixed Costs / 12 = Monthly payments Add 1 & 2 together and adjust for special items and Voila!!!

Set Goals • • Realistic Wish lists vs. to-do lists Income and lifestyle needs Flexibility

Set Goals • • Realistic Wish lists vs. to-do lists Income and lifestyle needs Flexibility

What Do We Have To Reconcile?

What Do We Have To Reconcile?

Planning A daunting exercise made too complicated by the desire to “Get It Right. ”

Planning A daunting exercise made too complicated by the desire to “Get It Right. ”

Investing for Retirement: The Transition Begins Agnes Douglas, CFP, CIM, FCSI Portfolio Manager, Odlum Brown Limited Member-Canadian Investor Protection Fund

Investing for Retirement: The Transition Begins Agnes Douglas, CFP, CIM, FCSI Portfolio Manager, Odlum Brown Limited Member-Canadian Investor Protection Fund

Your Investments 1. Transition Into Retirement 2. Getting Advice

Your Investments 1. Transition Into Retirement 2. Getting Advice

The Transition “Creating your new paycheque. ” • Income withdrawal plan • Security of income pay-outs • Continued investment growth • Tax efficiency

The Transition “Creating your new paycheque. ” • Income withdrawal plan • Security of income pay-outs • Continued investment growth • Tax efficiency

Process for Investing • Goals & Needs • Risk Tolerance • Time Frame • Diversification

Process for Investing • Goals & Needs • Risk Tolerance • Time Frame • Diversification

Investment Goals Be specific and realistic 1. Growth 2. Income 3. Liquidity

Investment Goals Be specific and realistic 1. Growth 2. Income 3. Liquidity

Risk vs. Return • Risk is defined as the potential for loss • Understand the relationship between risk and return

Risk vs. Return • Risk is defined as the potential for loss • Understand the relationship between risk and return

Asset Allocation Diversifies assets into three classes: • Cash • Fixed Income • Equities

Asset Allocation Diversifies assets into three classes: • Cash • Fixed Income • Equities

Cash (i. e. Liquid Investments) • • • Canadian savings bonds Treasury bills Money market instruments

Cash (i. e. Liquid Investments) • • • Canadian savings bonds Treasury bills Money market instruments

Fixed Income • • • GICs Bonds Debentures

Fixed Income • • • GICs Bonds Debentures

Equities When you buy an equity (stock), you own a share of the company. Two types: • Common Shares • Preferred Shares

Equities When you buy an equity (stock), you own a share of the company. Two types: • Common Shares • Preferred Shares

Equity Products • Common or preferred shares – Large, medium and small cap – Domestic, foreign and emerging markets • Mutual funds • Real estate income trusts (REIT’s) • Exchange traded funds (ETF’s) • Income trust units • Options/hedge funds

Equity Products • Common or preferred shares – Large, medium and small cap – Domestic, foreign and emerging markets • Mutual funds • Real estate income trusts (REIT’s) • Exchange traded funds (ETF’s) • Income trust units • Options/hedge funds

When Transition Begins • • • Critical point Develop comprehensive income withdrawal plan Time to delegate

When Transition Begins • • • Critical point Develop comprehensive income withdrawal plan Time to delegate

Getting Advice 1. Working with an advisor 2. Finding the right resources 3. Finding an advisor 4. Assessing your advisor

Getting Advice 1. Working with an advisor 2. Finding the right resources 3. Finding an advisor 4. Assessing your advisor

Working With An Advisor WHY? What should you expect from an advisor? a. Clear and specific recommendations b. Explanation of risk c. Need permission for each transaction unless discretionary d. Send regular statements How is your advisor compensated? a. Salary d. Fee-only b. Sales fee/commission e. Fee-based

Working With An Advisor WHY? What should you expect from an advisor? a. Clear and specific recommendations b. Explanation of risk c. Need permission for each transaction unless discretionary d. Send regular statements How is your advisor compensated? a. Salary d. Fee-only b. Sales fee/commission e. Fee-based

Finding The Right Resources Sources of advice on financial matters: 1. Customer Service Representative 2. Personal Banker 3. Mutual Fund Representative 4. Investment Advisor 5. Portfolio Manager 6. Financial Planner 7. Insurance Representative i. e. Bank i. e. Investment Firm

Finding The Right Resources Sources of advice on financial matters: 1. Customer Service Representative 2. Personal Banker 3. Mutual Fund Representative 4. Investment Advisor 5. Portfolio Manager 6. Financial Planner 7. Insurance Representative i. e. Bank i. e. Investment Firm

Choosing The Right Advisor Questions to Ask Yourself 1. What are your financial goals? 2. How much do you know about investing? 3. How much money do you plan to invest? 4. What type of products and services do you need?

Choosing The Right Advisor Questions to Ask Yourself 1. What are your financial goals? 2. How much do you know about investing? 3. How much money do you plan to invest? 4. What type of products and services do you need?

Choosing The Right Advisor Questions to Ask An Advisor 1. What are your qualifications? 2. Are you and your firm registered? 3. How much experience do you have? 4. What products and services do you offer?

Choosing The Right Advisor Questions to Ask An Advisor 1. What are your qualifications? 2. Are you and your firm registered? 3. How much experience do you have? 4. What products and services do you offer?

Choosing The Right Advisor Questions to Ask An Advisor 5. To which type of clients do you cater? 6. What is your investment philosophy? 7. How are you compensated? 8. How will you work with me?

Choosing The Right Advisor Questions to Ask An Advisor 5. To which type of clients do you cater? 6. What is your investment philosophy? 7. How are you compensated? 8. How will you work with me?

Finding An Advisor • Through referrals • Online or contact local security regulator Search for an advisor through industry sources: (See slide 44 for useful links) • IIROC: Investment Industry Regulatory Organization of Canada • MFDA: Mutual Fund Dealers Association of Canada • Advocis: The Financial Advisors Association of Canada • FPSC: Financial Planners Standards Council of Canada • BCSC: BC Securities Commission • OSC: Ontario Securities Commission

Finding An Advisor • Through referrals • Online or contact local security regulator Search for an advisor through industry sources: (See slide 44 for useful links) • IIROC: Investment Industry Regulatory Organization of Canada • MFDA: Mutual Fund Dealers Association of Canada • Advocis: The Financial Advisors Association of Canada • FPSC: Financial Planners Standards Council of Canada • BCSC: BC Securities Commission • OSC: Ontario Securities Commission

Assessing Your Advisor 5 Steps: 1. Understand your total return over time 2. Calculate your total costs for each year 3. Compare your results with benchmarks 4. Assess the total value your advisor provides 5. Assess whether you are happy with your results

Assessing Your Advisor 5 Steps: 1. Understand your total return over time 2. Calculate your total costs for each year 3. Compare your results with benchmarks 4. Assess the total value your advisor provides 5. Assess whether you are happy with your results

Assessing Your Advisor Have a Complaint? 1. Talk to your advisor 2. Write a letter to senior management 3. Complain to the appropriate regulator 1. BCSC – File a complaint (http: //www. investright. org/file_complaint. aspx) 2. IIROC - An Investor’s Guide to Making a Complaint (http: //www. iiroc. ca/English/Member. Resources/Brochures/Documents/ Investor. Protection. Brochure_en. pdf)

Assessing Your Advisor Have a Complaint? 1. Talk to your advisor 2. Write a letter to senior management 3. Complain to the appropriate regulator 1. BCSC – File a complaint (http: //www. investright. org/file_complaint. aspx) 2. IIROC - An Investor’s Guide to Making a Complaint (http: //www. iiroc. ca/English/Member. Resources/Brochures/Documents/ Investor. Protection. Brochure_en. pdf)

WE’RE ALMOST THERE! Now to. . . Brush up on your abilities to live life to the fullest in retirement. Food for Thought: “Keeping up with the Joneses in retirement – don’t even think of it. . . Keeping up with inflation – plan on it!” Quote from a Mackenzie Financial presentation: http: //www. mackenziefinancial. com/eprise/main/MF/Doc. Lib/Public/Retirement_U_201. pdf

WE’RE ALMOST THERE! Now to. . . Brush up on your abilities to live life to the fullest in retirement. Food for Thought: “Keeping up with the Joneses in retirement – don’t even think of it. . . Keeping up with inflation – plan on it!” Quote from a Mackenzie Financial presentation: http: //www. mackenziefinancial. com/eprise/main/MF/Doc. Lib/Public/Retirement_U_201. pdf

Agnes Douglas, CFP, CIM, FCSI Portfolio Manager | Odlum Brown Limited • Over 22 years of investment industry experience • With Odlum Brown Limited since 1999 Wayne Chappell, CFP, CLU, Ch. FC, CPCA. Vice President and Director, Odlum Brown Financial Services Limited • Over 40 years of financial industry experience • With Odlum Brown Financial Services Limited since 1990

Agnes Douglas, CFP, CIM, FCSI Portfolio Manager | Odlum Brown Limited • Over 22 years of investment industry experience • With Odlum Brown Limited since 1999 Wayne Chappell, CFP, CLU, Ch. FC, CPCA. Vice President and Director, Odlum Brown Financial Services Limited • Over 40 years of financial industry experience • With Odlum Brown Financial Services Limited since 1990

Bibliography and Other Useful Links • • Answers to Your Money Questions: Getting Advice. http: //www. getsmarteraboutmoney. ca/ BCSC: Invest. Right. Tools for investors. http: //www. investright. org/content. aspx? id=94 IIROC: Investment Industry Regulatory Organization of Canada. http: //iiroc. ca/ MFDA: Mutual Fund Dealers Association of Canada. http: //www. mfda. ca/ Advocis: The Financial Advisors Association of Canada. http: //www. advocis. ca/ FPSC: Financial Planners Standards Council of Canada. https: //www. fpsc. ca/ OSC: Ontario Securities Commission. http: //www. osc. gov. on. ca/en/home. htm Disclaimer The information contained herein is for general information purposes only and is not intended to provide financial, legal, accounting or tax advice and should not be relied upon in that regard. Many factors unknown to Odlum Brown Limited may affect the applicability of any matter discussed herein to your particular circumstances. You should consult directly with your financial advisor before acting on any matter discussed herein. No part of this publication may be reproduced without the express written consent of Odlum Brown Limited is a Member of the Canadian Investor Protection Fund.

Bibliography and Other Useful Links • • Answers to Your Money Questions: Getting Advice. http: //www. getsmarteraboutmoney. ca/ BCSC: Invest. Right. Tools for investors. http: //www. investright. org/content. aspx? id=94 IIROC: Investment Industry Regulatory Organization of Canada. http: //iiroc. ca/ MFDA: Mutual Fund Dealers Association of Canada. http: //www. mfda. ca/ Advocis: The Financial Advisors Association of Canada. http: //www. advocis. ca/ FPSC: Financial Planners Standards Council of Canada. https: //www. fpsc. ca/ OSC: Ontario Securities Commission. http: //www. osc. gov. on. ca/en/home. htm Disclaimer The information contained herein is for general information purposes only and is not intended to provide financial, legal, accounting or tax advice and should not be relied upon in that regard. Many factors unknown to Odlum Brown Limited may affect the applicability of any matter discussed herein to your particular circumstances. You should consult directly with your financial advisor before acting on any matter discussed herein. No part of this publication may be reproduced without the express written consent of Odlum Brown Limited is a Member of the Canadian Investor Protection Fund.

Thank You!

Thank You!