9c09e60854824b45f7f7e8621063a2c5.ppt

- Количество слайдов: 55

SIM/NYU The Job of the CFO Valuation for Mergers & Acquisitions Prof. Ian Giddy New York University

What’s a Company Worth to Another Company? Required Returns l Types of Models l Yeo Hiap Seng u. Balance sheet models u. Dividend discount & corporate cash flow models u. Price/Earnings ratios u. Option models Estimating Growth Rates l Application: How These Change with M&A l Copyright © 2000 Ian H. Giddy Valuation for M&A 2

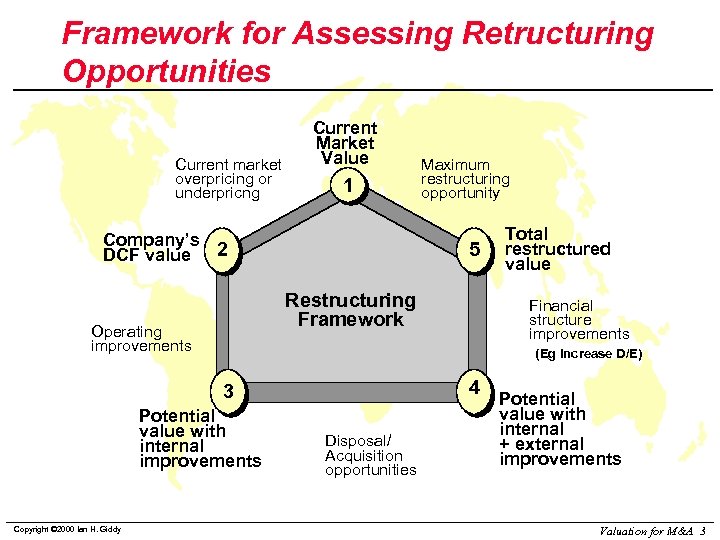

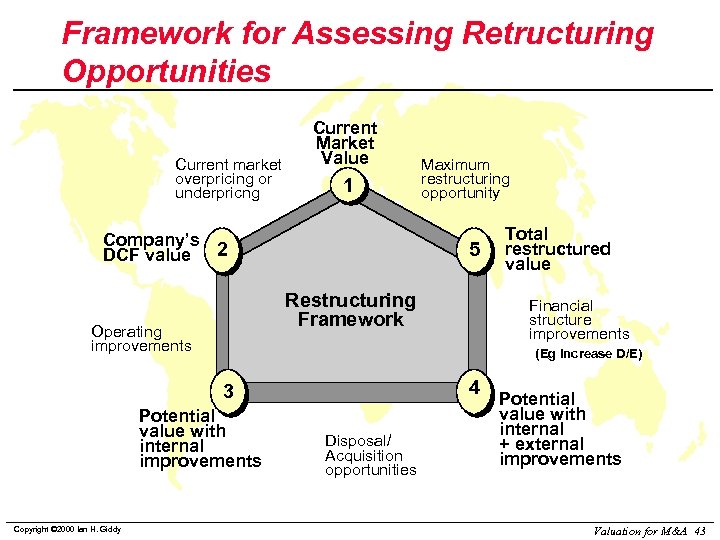

Framework for Assessing Retructuring Opportunities Current market overpricing or underpricng Current Market Value 1 Company’s DCF value 2 5 Restructuring Framework Operating improvements Total restructured value Financial structure improvements (Eg Increase D/E) 4 3 Potential value with internal improvements Copyright © 2000 Ian H. Giddy Maximum restructuring opportunity Disposal/ Acquisition opportunities Potential value with internal + external improvements Valuation for M&A 3

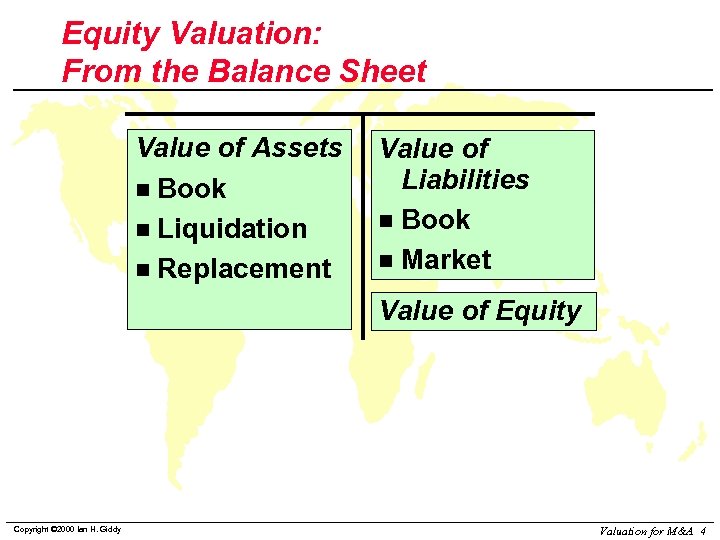

Equity Valuation: From the Balance Sheet Value of Assets n Book n Liquidation n Replacement Value of Liabilities n Book n Market Value of Equity Copyright © 2000 Ian H. Giddy Valuation for M&A 4

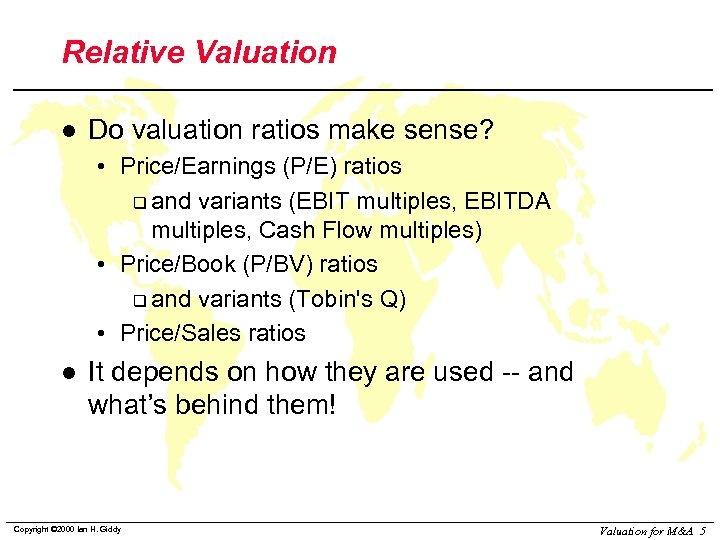

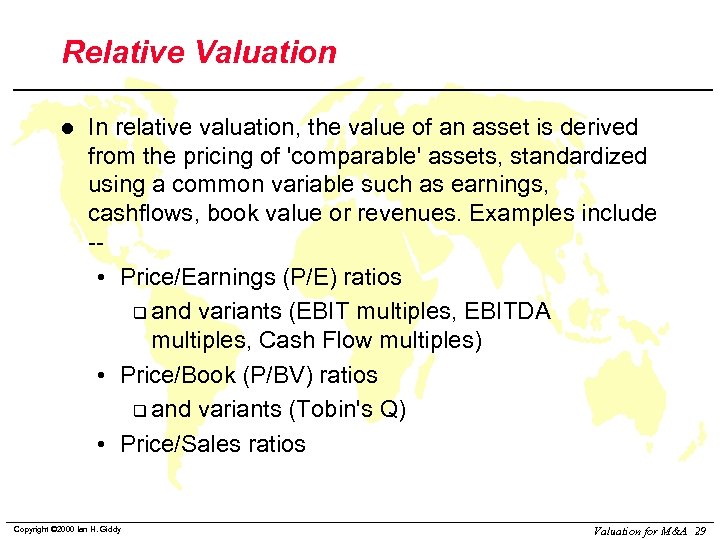

Relative Valuation l Do valuation ratios make sense? • Price/Earnings (P/E) ratios q and variants (EBIT multiples, EBITDA multiples, Cash Flow multiples) • Price/Book (P/BV) ratios q and variants (Tobin's Q) • Price/Sales ratios l It depends on how they are used -- and what’s behind them! Copyright © 2000 Ian H. Giddy Valuation for M&A 5

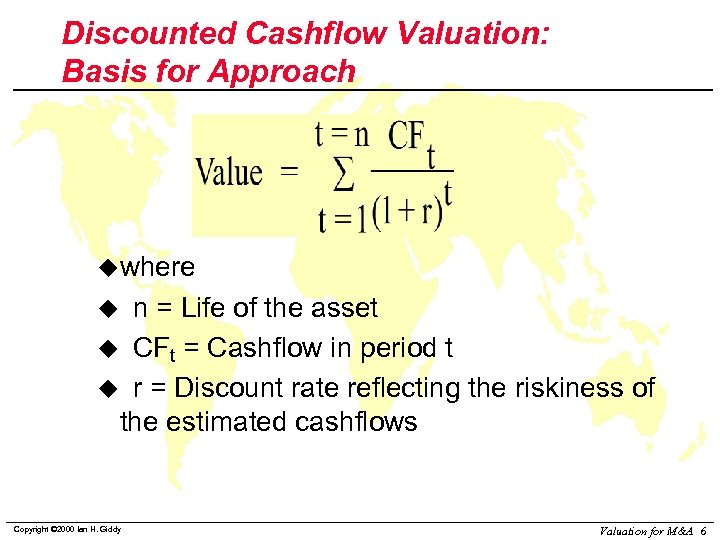

Discounted Cashflow Valuation: Basis for Approach uwhere n = Life of the asset u CFt = Cashflow in period t u r = Discount rate reflecting the riskiness of the estimated cashflows u Copyright © 2000 Ian H. Giddy Valuation for M&A 6

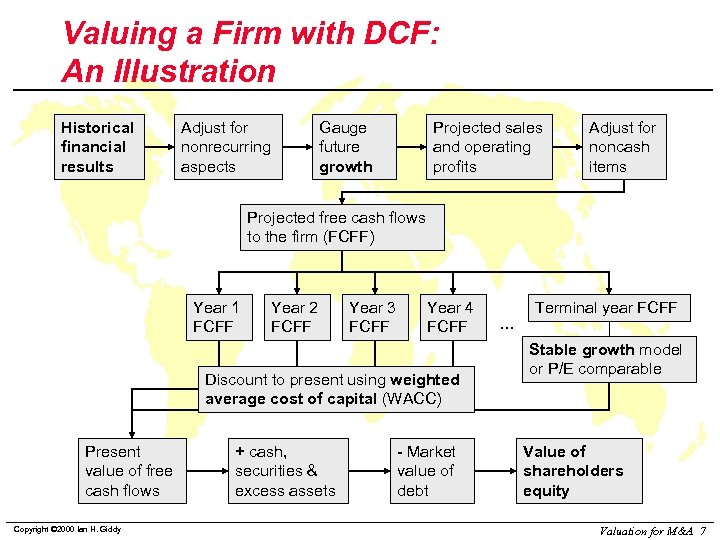

Valuing a Firm with DCF: An Illustration Historical financial results Adjust for nonrecurring aspects Gauge future growth Projected sales and operating profits Adjust for noncash items Projected free cash flows to the firm (FCFF) Year 1 FCFF Year 2 FCFF Year 3 FCFF Year 4 FCFF Discount to present using weighted average cost of capital (WACC) Present value of free cash flows Copyright © 2000 Ian H. Giddy + cash, securities & excess assets - Market value of debt … Terminal year FCFF Stable growth model or P/E comparable Value of shareholders equity Valuation for M&A 7

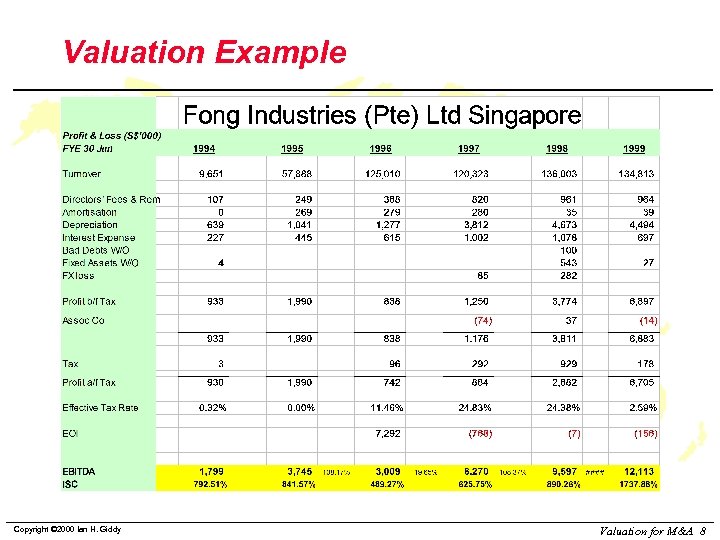

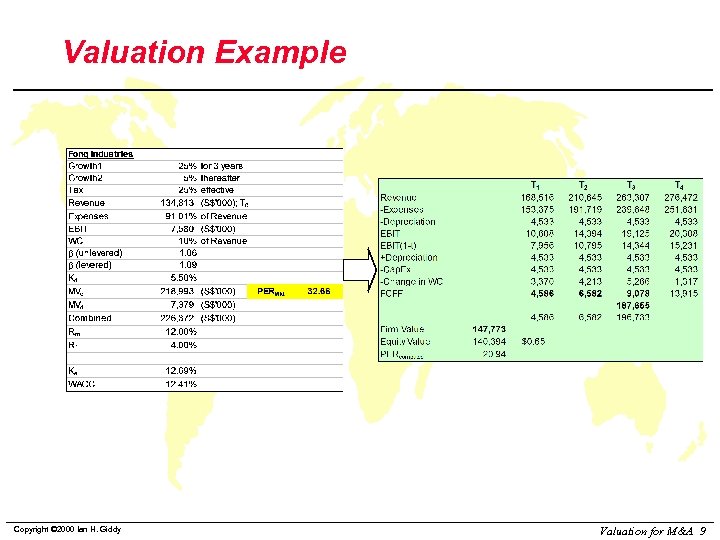

Valuation Example Copyright © 2000 Ian H. Giddy Valuation for M&A 8

Valuation Example Copyright © 2000 Ian H. Giddy Valuation for M&A 9

Estimating Future Cash Flows n n n Copyright © 2000 Ian H. Giddy Dividends? Free cash flows to equity? Free cash flows to firm? Valuation for M&A 10

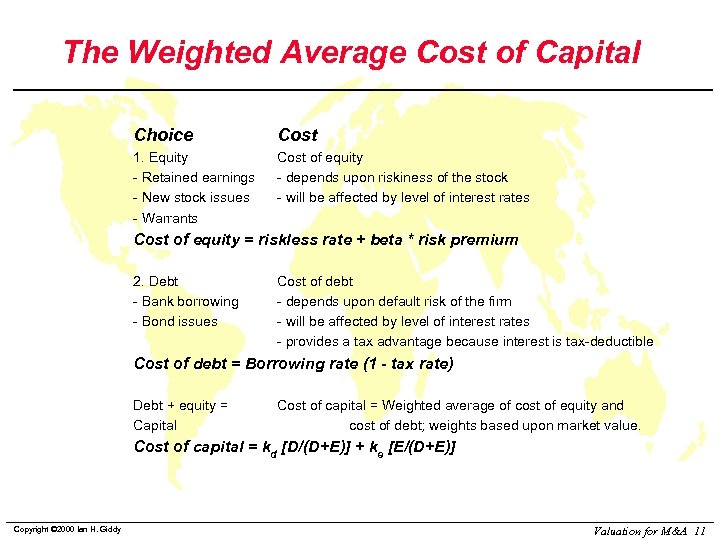

The Weighted Average Cost of Capital Choice Cost 1. Equity - Retained earnings - New stock issues - Warrants Cost of equity - depends upon riskiness of the stock - will be affected by level of interest rates Cost of equity = riskless rate + beta * risk premium 2. Debt - Bank borrowing - Bond issues Cost of debt - depends upon default risk of the firm - will be affected by level of interest rates - provides a tax advantage because interest is tax-deductible Cost of debt = Borrowing rate (1 - tax rate) Debt + equity = Capital Cost of capital = Weighted average of cost of equity and cost of debt; weights based upon market value. Cost of capital = kd [D/(D+E)] + ke [E/(D+E)] Copyright © 2000 Ian H. Giddy Valuation for M&A 11

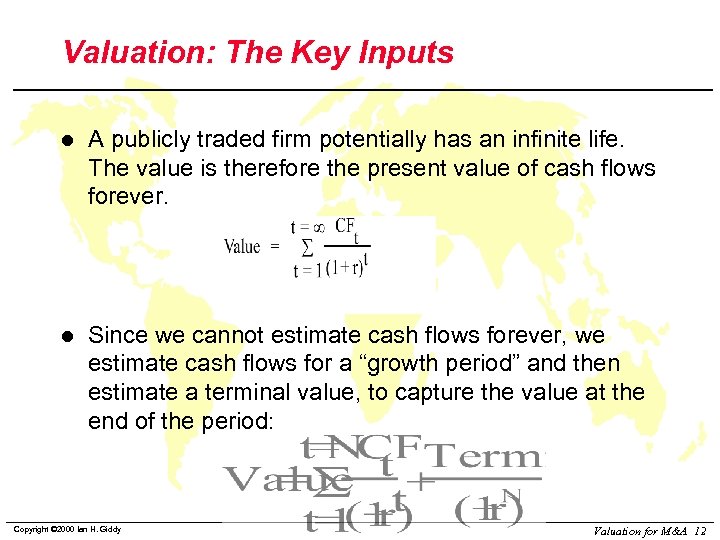

Valuation: The Key Inputs l A publicly traded firm potentially has an infinite life. The value is therefore the present value of cash flows forever. l Since we cannot estimate cash flows forever, we estimate cash flows for a “growth period” and then estimate a terminal value, to capture the value at the end of the period: Copyright © 2000 Ian H. Giddy Valuation for M&A 12

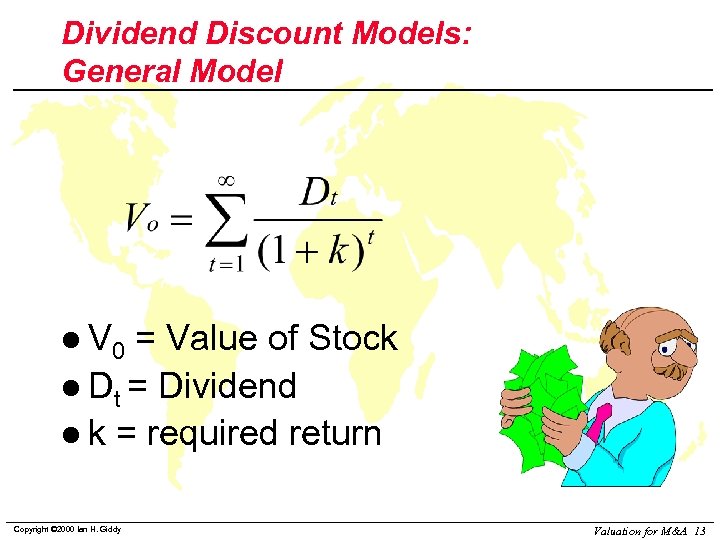

Dividend Discount Models: General Model l V 0 = Value of Stock l Dt = Dividend l k = required return Copyright © 2000 Ian H. Giddy Valuation for M&A 13

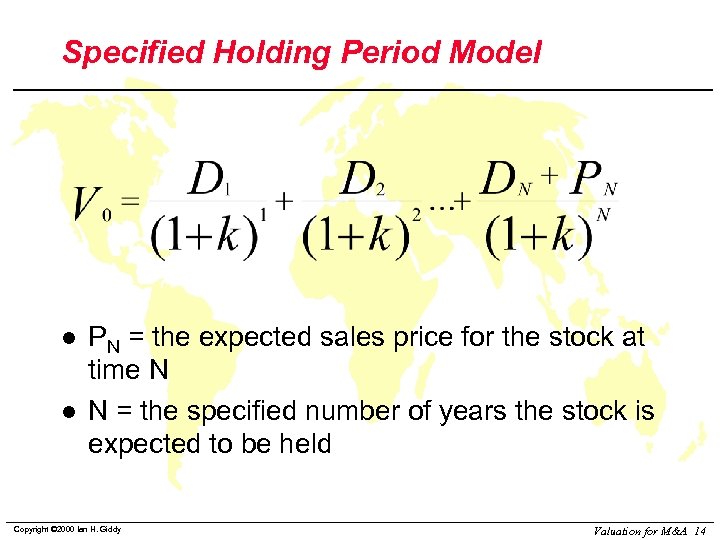

Specified Holding Period Model l l PN = the expected sales price for the stock at time N N = the specified number of years the stock is expected to be held Copyright © 2000 Ian H. Giddy Valuation for M&A 14

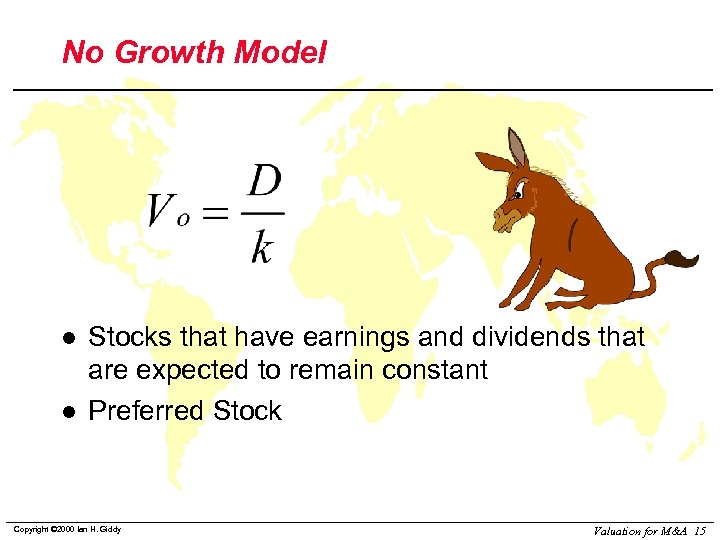

No Growth Model l l Stocks that have earnings and dividends that are expected to remain constant Preferred Stock Copyright © 2000 Ian H. Giddy Valuation for M&A 15

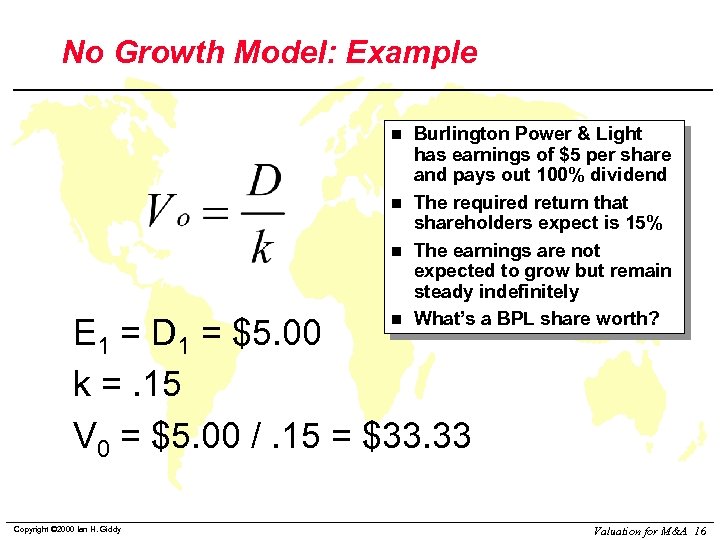

No Growth Model: Example n n Burlington Power & Light has earnings of $5 per share and pays out 100% dividend The required return that shareholders expect is 15% The earnings are not expected to grow but remain steady indefinitely What’s a BPL share worth? E 1 = D 1 = $5. 00 k =. 15 V 0 = $5. 00 /. 15 = $33. 33 Copyright © 2000 Ian H. Giddy Valuation for M&A 16

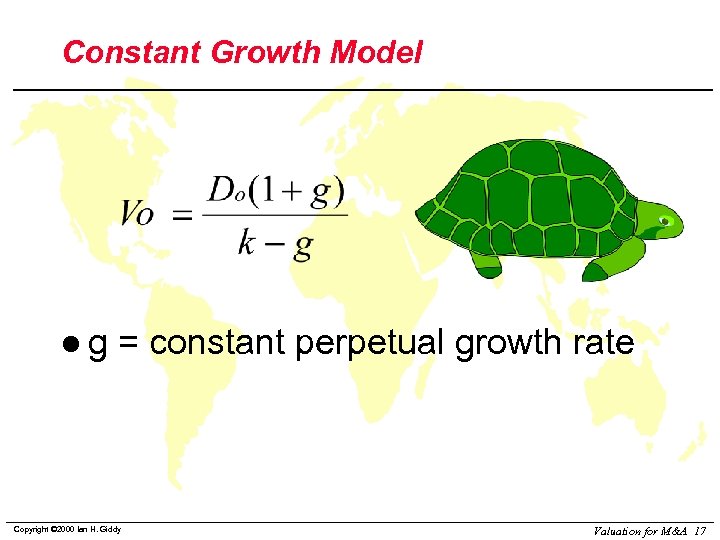

Constant Growth Model lg = constant perpetual growth rate Copyright © 2000 Ian H. Giddy Valuation for M&A 17

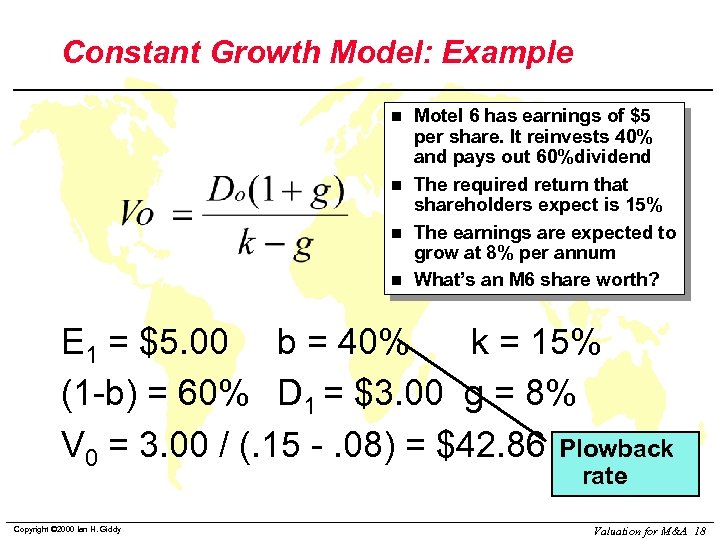

Constant Growth Model: Example n n Motel 6 has earnings of $5 per share. It reinvests 40% and pays out 60%dividend The required return that shareholders expect is 15% The earnings are expected to grow at 8% per annum What’s an M 6 share worth? E 1 = $5. 00 b = 40% k = 15% (1 -b) = 60% D 1 = $3. 00 g = 8% V 0 = 3. 00 / (. 15 -. 08) = $42. 86 Plowback rate Copyright © 2000 Ian H. Giddy Valuation for M&A 18

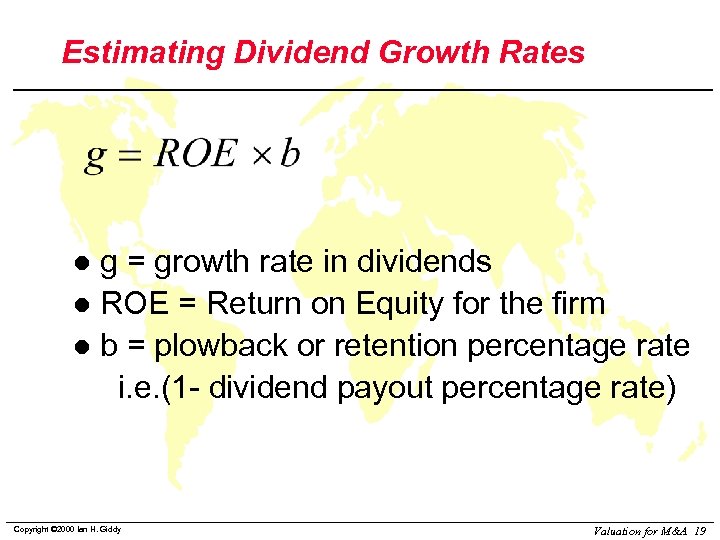

Estimating Dividend Growth Rates g = growth rate in dividends l ROE = Return on Equity for the firm l b = plowback or retention percentage rate i. e. (1 - dividend payout percentage rate) l Copyright © 2000 Ian H. Giddy Valuation for M&A 19

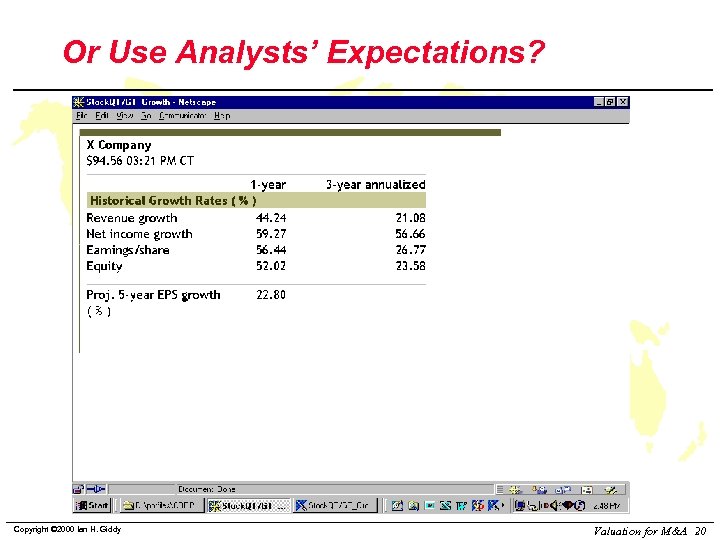

Or Use Analysts’ Expectations? Copyright © 2000 Ian H. Giddy Valuation for M&A 20

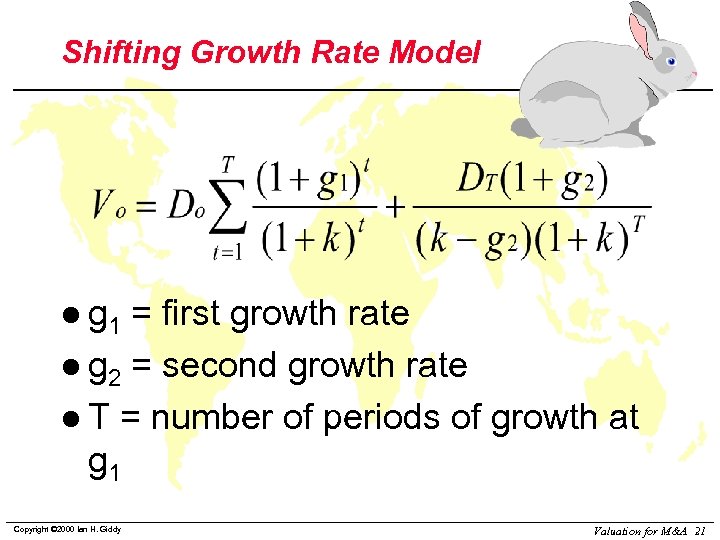

Shifting Growth Rate Model l g 1 = first growth rate l g 2 = second growth rate l T = number of periods of growth at g 1 Copyright © 2000 Ian H. Giddy Valuation for M&A 21

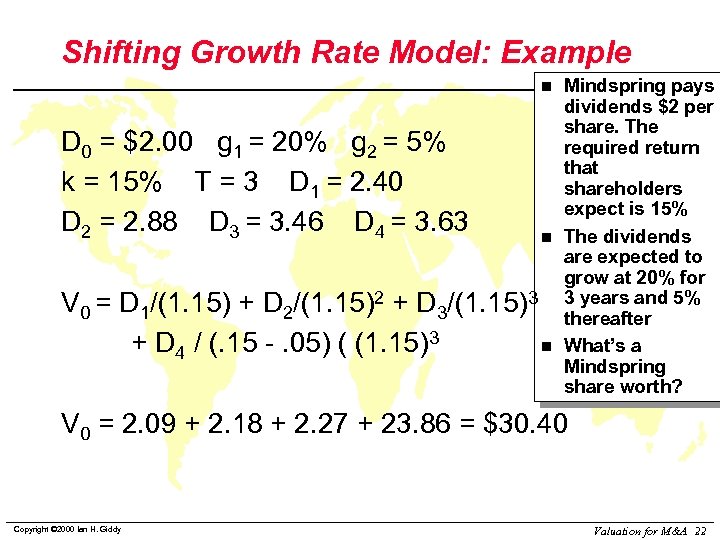

Shifting Growth Rate Model: Example n D 0 = $2. 00 g 1 = 20% g 2 = 5% k = 15% T = 3 D 1 = 2. 40 D 2 = 2. 88 D 3 = 3. 46 D 4 = 3. 63 n V 0 = D 1/(1. 15) + D 2/(1. 15)2 + D 3/(1. 15)3 n + D 4 / (. 15 -. 05) ( (1. 15)3 Mindspring pays dividends $2 per share. The required return that shareholders expect is 15% The dividends are expected to grow at 20% for 3 years and 5% thereafter What’s a Mindspring share worth? V 0 = 2. 09 + 2. 18 + 2. 27 + 23. 86 = $30. 40 Copyright © 2000 Ian H. Giddy Valuation for M&A 22

Stable Growth and Terminal Value l l When a firm’s cash flows grow at a “constant” rate forever, the present value of those cash flows can be written as: Value = Expected Cash Flow Next Period / (r - g) where, r = Discount rate (Cost of Equity or Cost of Capital) g = Expected growth rate This “constant” growth rate is called a stable growth rate and cannot be higher than the growth rate of the economy in which the firm operates. While companies can maintain high growth rates for extended periods, they will approach “stable growth” at some point in time. When they do approach stable growth, the valuation formula above can be used to estimate the “terminal value” of all cash flows beyond. Copyright © 2000 Ian H. Giddy Valuation for M&A 23

Growth Patterns l l A key assumption in all discounted cash flow models is the period of high growth, and the pattern of growth during that period. In general, we can make one of three assumptions: u there is no high growth, in which case the firm is already in stable growth u there will be high growth for a period, at the end of which the growth rate will drop to the stable growth rate (2 -stage) u there will be high growth for a period, at the end of which the growth rate will decline gradually to a stable growth rate(3 stage) The assumption of how long high growth will continue will depend upon several factors including: u the size of the firm (larger firm -> shorter high growth periods) u current growth rate (if high -> longer high growth period) u barriers to entry and differential advantages (if high -> longer growth period) Copyright © 2000 Ian H. Giddy Valuation for M&A 24

Length of High Growth Period l Assume that you are analyzing two firms, both of which are enjoying high growth. The first firm is Earthlink Network, an internet service provider, which operates in an environment with few barriers to entry and extraordinary competition. The second firm is Biogen, a bio-technology firm which is enjoying growth from two drugs to which it owns patents for the next decade. Assuming that both firms are well managed, which of the two firms would you expect to have a longer high growth period? Earthlink Network Biogen Both are well managed and should have the same high growth period Copyright © 2000 Ian H. Giddy Valuation for M&A 25

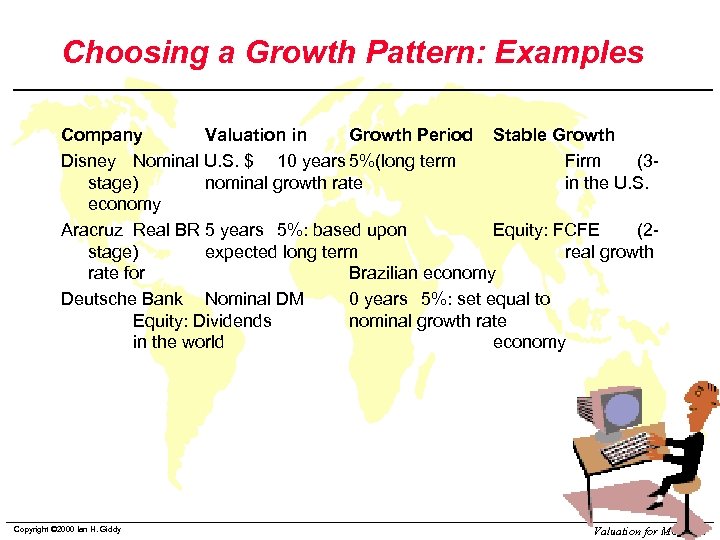

Choosing a Growth Pattern: Examples Company Valuation in Growth Period Stable Growth Disney Nominal U. S. $ 10 years 5%(long term Firm (3 stage) nominal growth rate in the U. S. economy Aracruz Real BR 5 years 5%: based upon Equity: FCFE (2 stage) expected long term real growth rate for Brazilian economy Deutsche Bank Nominal DM 0 years 5%: set equal to Equity: Dividends nominal growth rate in the world economy Copyright © 2000 Ian H. Giddy Valuation for M&A 26

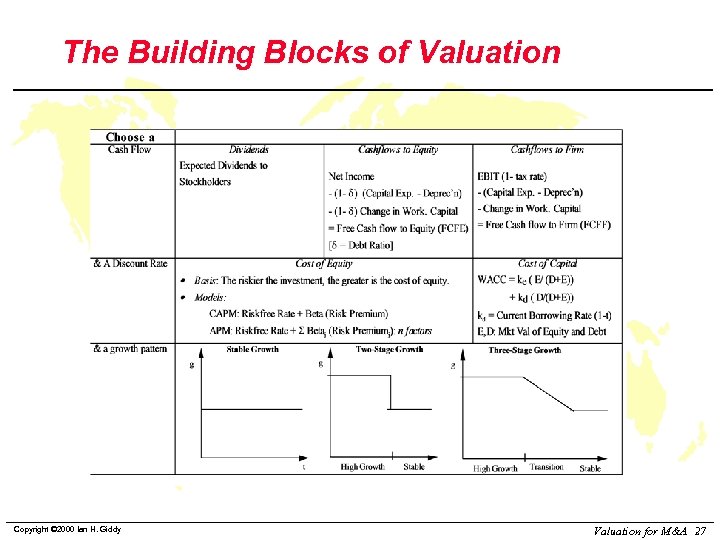

The Building Blocks of Valuation Copyright © 2000 Ian H. Giddy Valuation for M&A 27

The Building Blocks of Valuation Spreadsheet example Copyright © 2000 Ian H. Giddy Valuation for M&A 28

Relative Valuation l In relative valuation, the value of an asset is derived from the pricing of 'comparable' assets, standardized using a common variable such as earnings, cashflows, book value or revenues. Examples include - • Price/Earnings (P/E) ratios q and variants (EBIT multiples, EBITDA multiples, Cash Flow multiples) • Price/Book (P/BV) ratios q and variants (Tobin's Q) • Price/Sales ratios Copyright © 2000 Ian H. Giddy Valuation for M&A 29

Price Earnings Ratios l P/E Ratios are a function of two factors u. Required rates of return (k) u. Expected growth in dividends l Uses u. Relative valuation u. Extensive use in industry Copyright © 2000 Ian H. Giddy Valuation for M&A 30

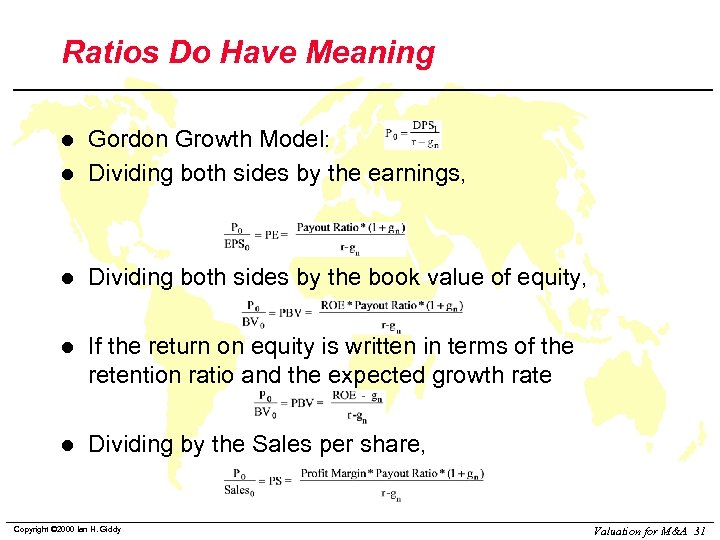

Ratios Do Have Meaning l Gordon Growth Model: Dividing both sides by the earnings, l Dividing both sides by the book value of equity, l If the return on equity is written in terms of the retention ratio and the expected growth rate l Dividing by the Sales per share, l Copyright © 2000 Ian H. Giddy Valuation for M&A 31

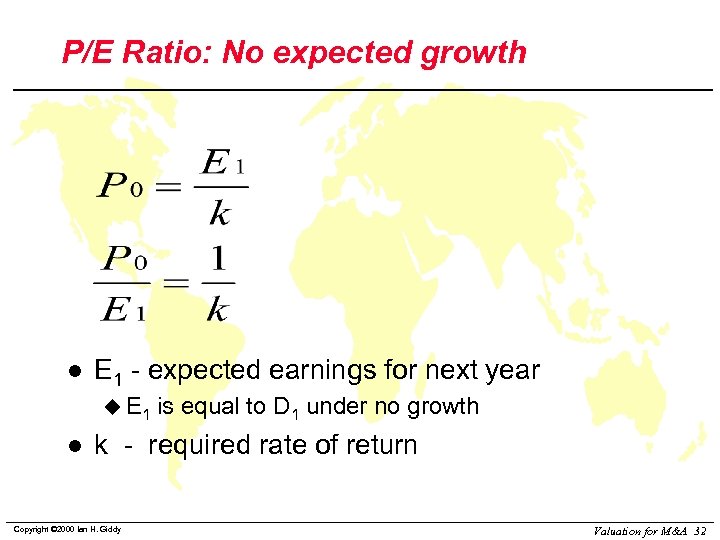

P/E Ratio: No expected growth l E 1 - expected earnings for next year u E 1 l is equal to D 1 under no growth k - required rate of return Copyright © 2000 Ian H. Giddy Valuation for M&A 32

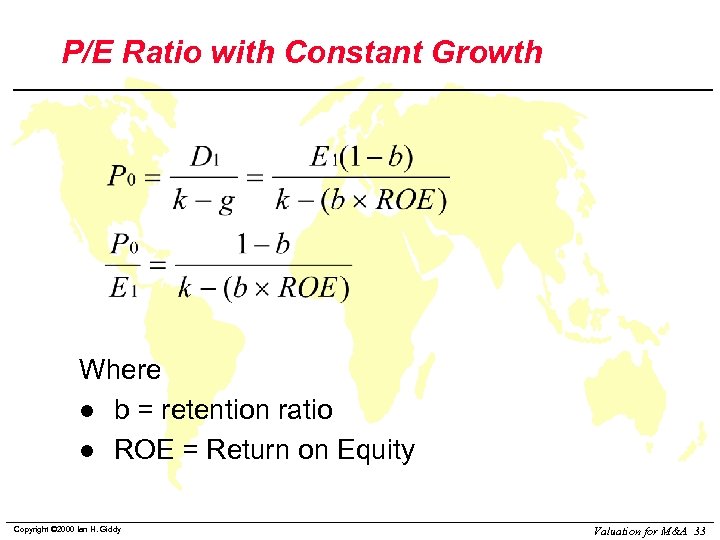

P/E Ratio with Constant Growth Where l b = retention ratio l ROE = Return on Equity Copyright © 2000 Ian H. Giddy Valuation for M&A 33

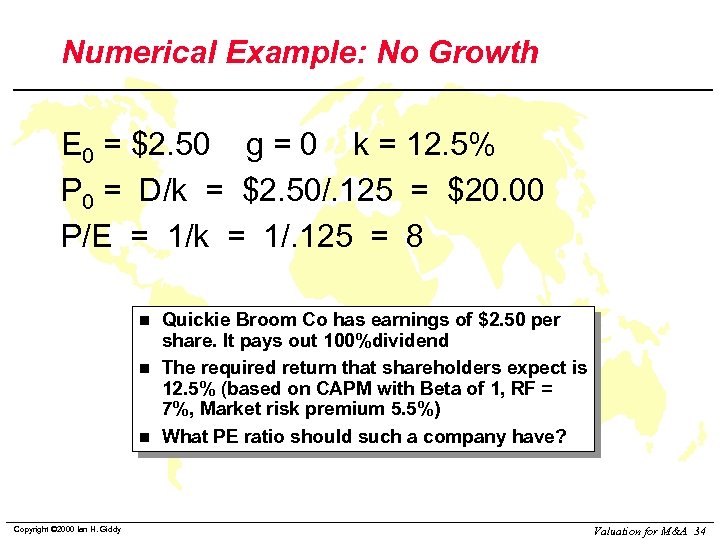

Numerical Example: No Growth E 0 = $2. 50 g = 0 k = 12. 5% P 0 = D/k = $2. 50/. 125 = $20. 00 P/E = 1/k = 1/. 125 = 8 n n n Copyright © 2000 Ian H. Giddy Quickie Broom Co has earnings of $2. 50 per share. It pays out 100%dividend The required return that shareholders expect is 12. 5% (based on CAPM with Beta of 1, RF = 7%, Market risk premium 5. 5%) What PE ratio should such a company have? Valuation for M&A 34

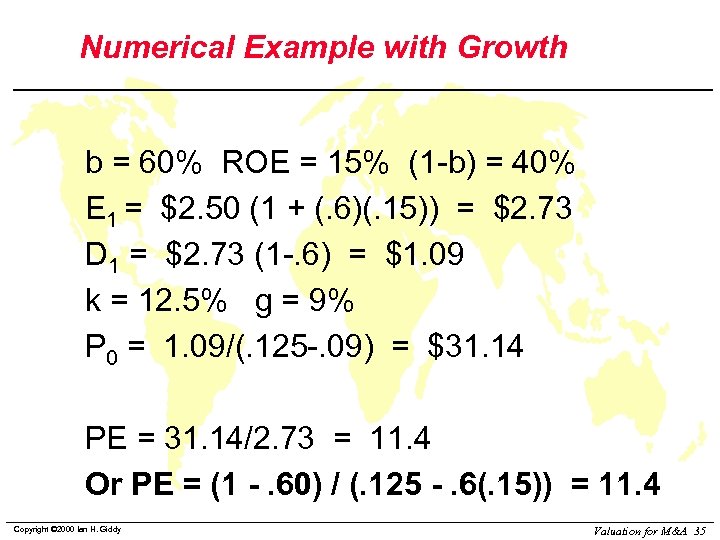

Numerical Example with Growth b = 60% ROE = 15% (1 -b) = 40% E 1 = $2. 50 (1 + (. 6)(. 15)) = $2. 73 D 1 = $2. 73 (1 -. 6) = $1. 09 k = 12. 5% g = 9% P 0 = 1. 09/(. 125 -. 09) = $31. 14 PE = 31. 14/2. 73 = 11. 4 Or PE = (1 -. 60) / (. 125 -. 6(. 15)) = 11. 4 Copyright © 2000 Ian H. Giddy Valuation for M&A 35

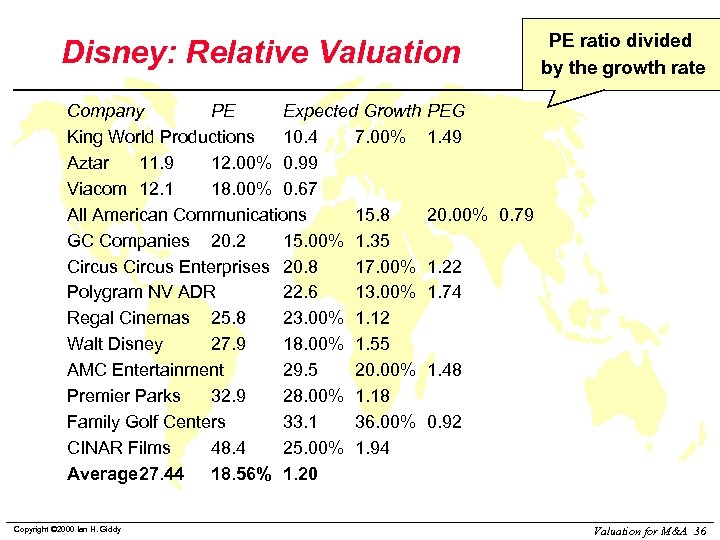

Disney: Relative Valuation Company PE Expected Growth King World Productions 10. 4 7. 00% Aztar 11. 9 12. 00% 0. 99 Viacom 12. 1 18. 00% 0. 67 All American Communications 15. 8 GC Companies 20. 2 15. 00% 1. 35 Circus Enterprises 20. 8 17. 00% Polygram NV ADR 22. 6 13. 00% Regal Cinemas 25. 8 23. 00% 1. 12 Walt Disney 27. 9 18. 00% 1. 55 AMC Entertainment 29. 5 20. 00% Premier Parks 32. 9 28. 00% 1. 18 Family Golf Centers 33. 1 36. 00% CINAR Films 48. 4 25. 00% 1. 94 Average 27. 44 18. 56% 1. 20 Copyright © 2000 Ian H. Giddy PE ratio divided by the growth rate PEG 1. 49 20. 00% 0. 79 1. 22 1. 74 1. 48 0. 92 Valuation for M&A 36

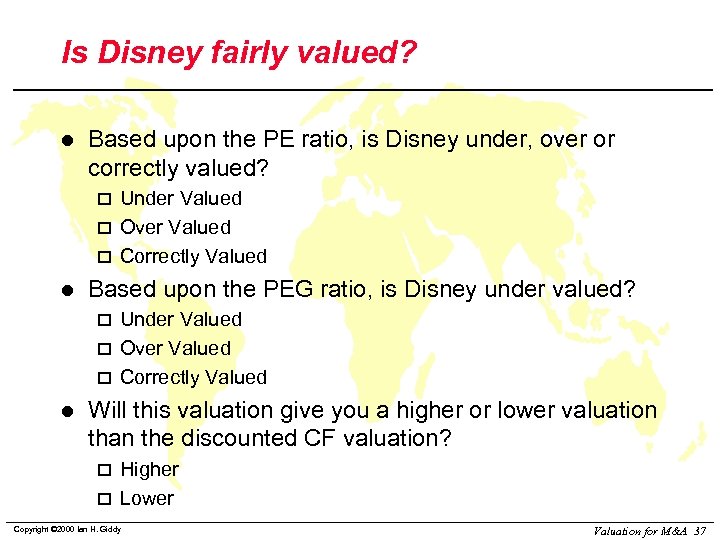

Is Disney fairly valued? l Based upon the PE ratio, is Disney under, over or correctly valued? Under Valued Over Valued Correctly Valued l Based upon the PEG ratio, is Disney under valued? Under Valued Over Valued Correctly Valued l Will this valuation give you a higher or lower valuation than the discounted CF valuation? Higher Lower Copyright © 2000 Ian H. Giddy Valuation for M&A 37

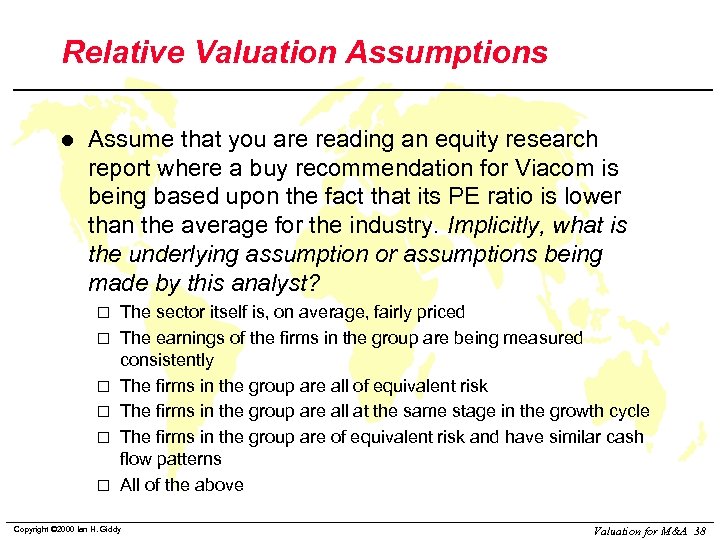

Relative Valuation Assumptions l Assume that you are reading an equity research report where a buy recommendation for Viacom is being based upon the fact that its PE ratio is lower than the average for the industry. Implicitly, what is the underlying assumption or assumptions being made by this analyst? The sector itself is, on average, fairly priced The earnings of the firms in the group are being measured consistently The firms in the group are all of equivalent risk The firms in the group are all at the same stage in the growth cycle The firms in the group are of equivalent risk and have similar cash flow patterns All of the above Copyright © 2000 Ian H. Giddy Valuation for M&A 38

Equity Valuation: Application to M&A Prof. Ian Giddy New York University

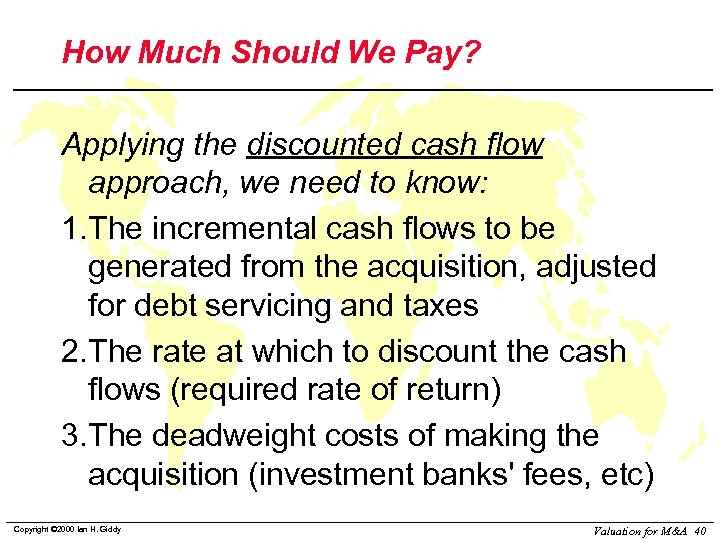

How Much Should We Pay? Applying the discounted cash flow approach, we need to know: 1. The incremental cash flows to be generated from the acquisition, adjusted for debt servicing and taxes 2. The rate at which to discount the cash flows (required rate of return) 3. The deadweight costs of making the acquisition (investment banks' fees, etc) Copyright © 2000 Ian H. Giddy Valuation for M&A 40

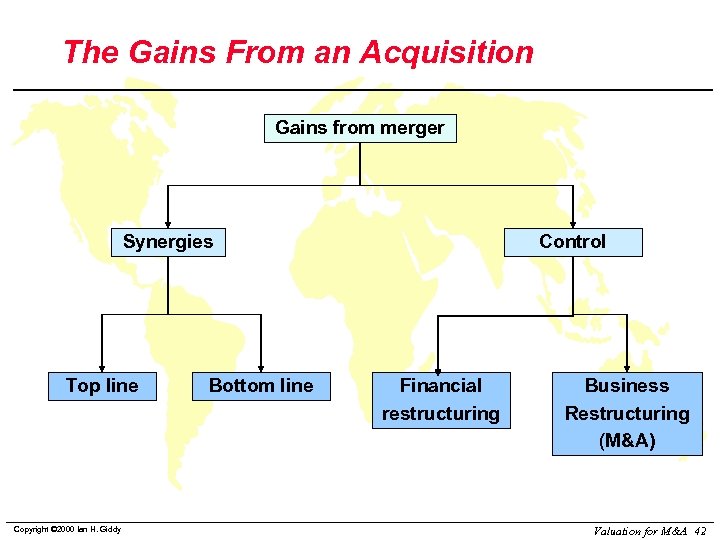

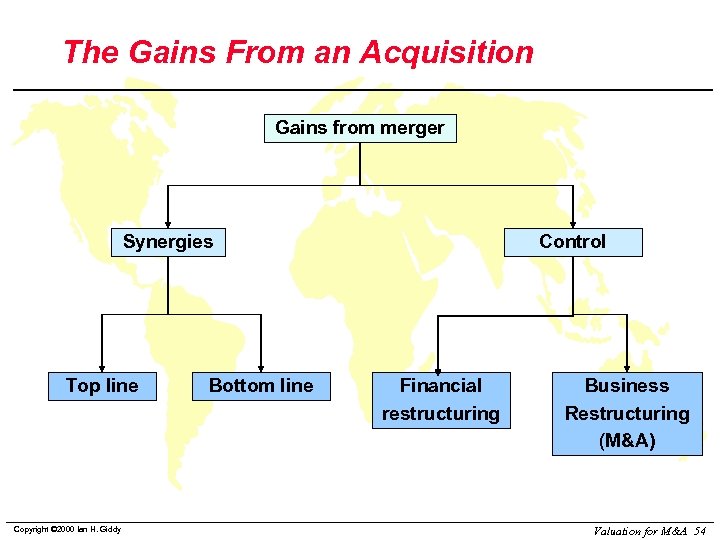

The Gains From an Acquisition Gains from merger Synergies Top line Copyright © 2000 Ian H. Giddy Bottom line Control Financial restructuring Business Restructuring (M&A) Valuation for M&A 42

Framework for Assessing Retructuring Opportunities Current market overpricing or underpricng Current Market Value 1 Company’s DCF value 2 5 Restructuring Framework Operating improvements Total restructured value Financial structure improvements (Eg Increase D/E) 4 3 Potential value with internal improvements Copyright © 2000 Ian H. Giddy Maximum restructuring opportunity Disposal/ Acquisition opportunities Potential value with internal + external improvements Valuation for M&A 43

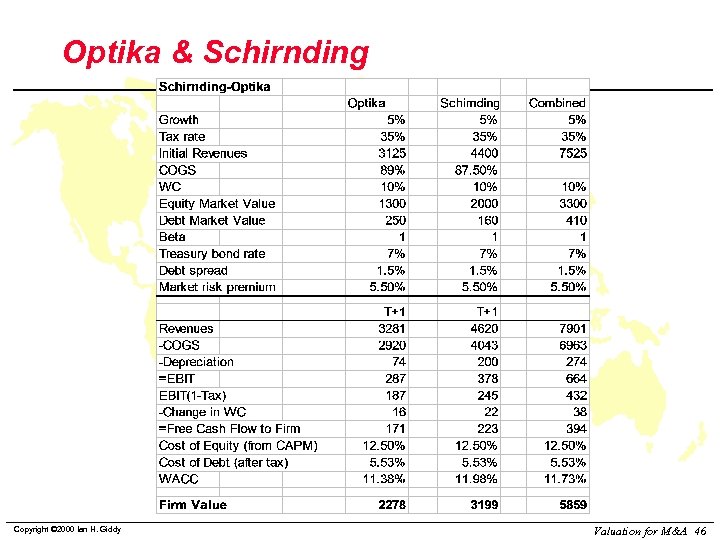

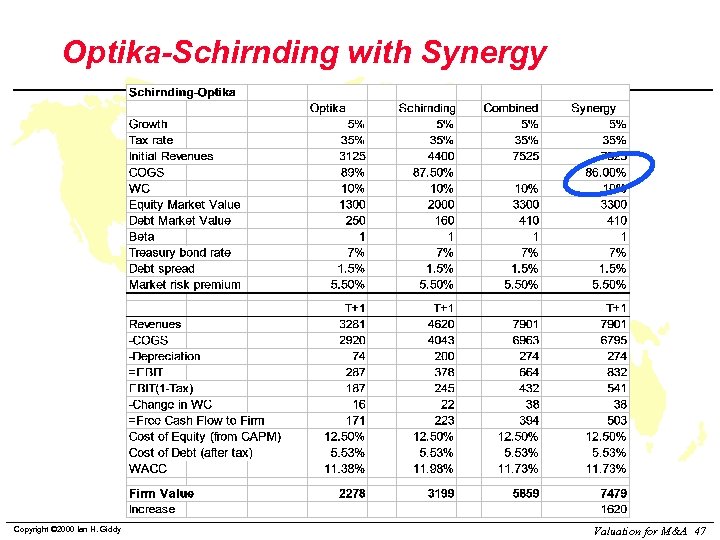

Equity Valuation in Practice Estimating discount rate l Estimating cash flows l Application to Optika l Application in M&A: Schirnding-Optika l Copyright © 2000 Ian H. Giddy Valuation for M&A 44

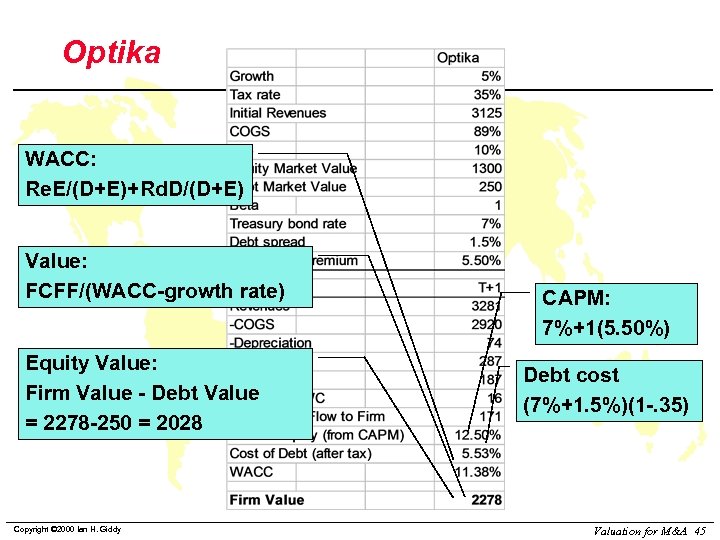

Optika WACC: Re. E/(D+E)+Rd. D/(D+E) Value: FCFF/(WACC-growth rate) Equity Value: Firm Value - Debt Value = 2278 -250 = 2028 Copyright © 2000 Ian H. Giddy CAPM: 7%+1(5. 50%) Debt cost (7%+1. 5%)(1 -. 35) Valuation for M&A 45

Optika & Schirnding Copyright © 2000 Ian H. Giddy Valuation for M&A 46

Optika-Schirnding with Synergy Copyright © 2000 Ian H. Giddy Valuation for M&A 47

Breaking Up is Hard to Do Copyright © 2000 Ian H. Giddy Valuation for M&A 50

Implementation Case Studies: n Intraco n Natsteel Copyright © 2000 Ian H. Giddy Valuation for M&A 51

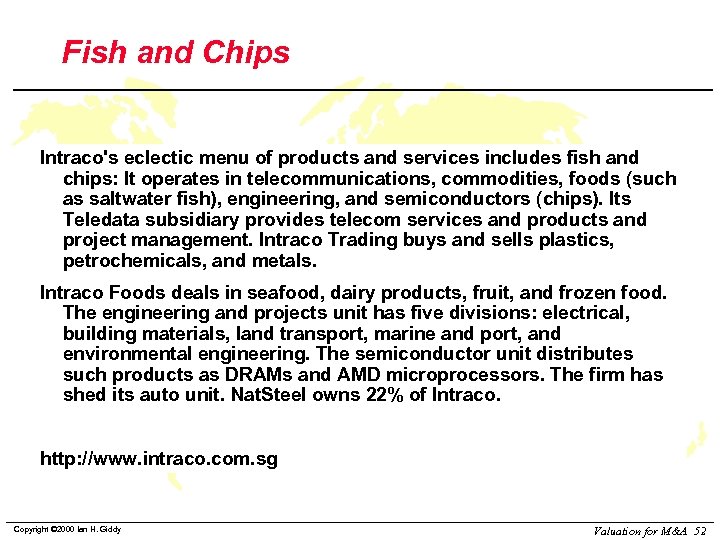

Fish and Chips Intraco's eclectic menu of products and services includes fish and chips: It operates in telecommunications, commodities, foods (such as saltwater fish), engineering, and semiconductors (chips). Its Teledata subsidiary provides telecom services and products and project management. Intraco Trading buys and sells plastics, petrochemicals, and metals. Intraco Foods deals in seafood, dairy products, fruit, and frozen food. The engineering and projects unit has five divisions: electrical, building materials, land transport, marine and port, and environmental engineering. The semiconductor unit distributes such products as DRAMs and AMD microprocessors. The firm has shed its auto unit. Nat. Steel owns 22% of Intraco. http: //www. intraco. com. sg Copyright © 2000 Ian H. Giddy Valuation for M&A 52

Natsteal Just as a metallurgist mixes metals to produce a strong alloy, Nat. Steel mixes steelmaking and a variety of other activities to make it one of Singapore's largest industrial groups. Nat. Steel's range of operations includes electronics, building products (cement and precast concrete), chemicals, engineering products and services, and property development. Its steel division has mini-mills in China, Malaysia, the Philippines, Singapore, and Vietnam. Its electronics division consists of two contract manufacturers. The company has an e-commerce initiative to transform its steel commodities into a value-added service business. Nat. Steel's operations span 15 countries in Asia, Australia, and Europe. http: //www. natsteel. com. sg Copyright © 2000 Ian H. Giddy Valuation for M&A 53

The Gains From an Acquisition Gains from merger Synergies Top line Copyright © 2000 Ian H. Giddy Bottom line Control Financial restructuring Business Restructuring (M&A) Valuation for M&A 54

n www. giddy. org

giddy. org Ian Giddy NYU Stern School of Business Tel 212 -998 -0332 Fax 917 -463 -7629 ian. giddy@nyu. edu http: //giddy. org Copyright © 2000 Ian H. Giddy Valuation for M&A 60

9c09e60854824b45f7f7e8621063a2c5.ppt