ea47b5495a777df0a33c47cfe9915ff5.ppt

- Количество слайдов: 28

SIM Fund 2014 MBA Presentation - December 5, 2014

James Lyle Aishwarya Srinivasan Nic Kostman Noel Hill Eugene Lee Jeremy Mortensen Rob Bayless Tyler Blue 2

Agenda Team Intro n Objectives n Quantitative Strategy n n n REITs n n 3 Intro Approach Today’s Portfolio Intro Today’s Portfolio

SIM Fund Objectives n n n 4 Apply range of course principles to fund management Utilize resources to maximize learning n Manage scope Portfolio Model n 85% - Quantitative Strategy (core) n 15% - REITs (diversification)

Dividend Premium Strategy 5

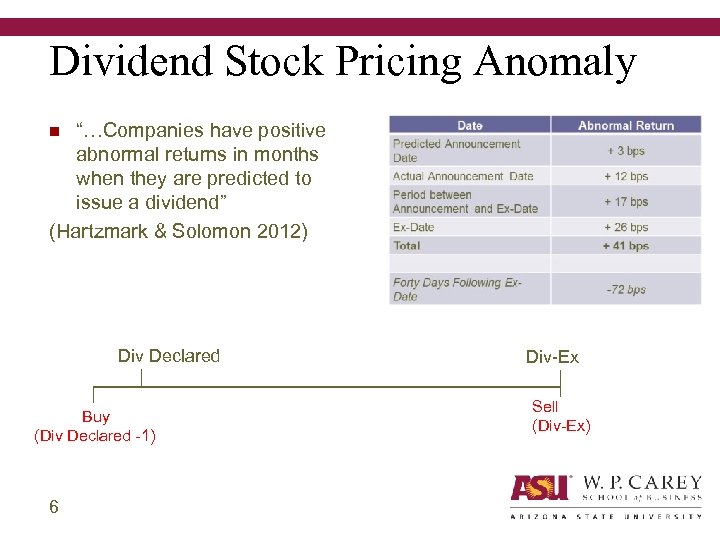

Dividend Stock Pricing Anomaly “…Companies have positive abnormal returns in months when they are predicted to issue a dividend” (Hartzmark & Solomon 2012) n Div Declared Buy (Div Declared -1) 6 Div-Ex Sell (Div-Ex)

Dividend Stock Pricing Anomaly n Why does it exist? n n 7 Mutual fund demand to pass through dividends (Harris, Hartzmark, and Solomon 2014) Cash guarantee

Constraints n Limited Human Capital n n Trading Rules n n Solution: Weekly trades on schedule Uneven distribution of declared dividends n 8 Solution: Cap holdings Solution: Adjust weights

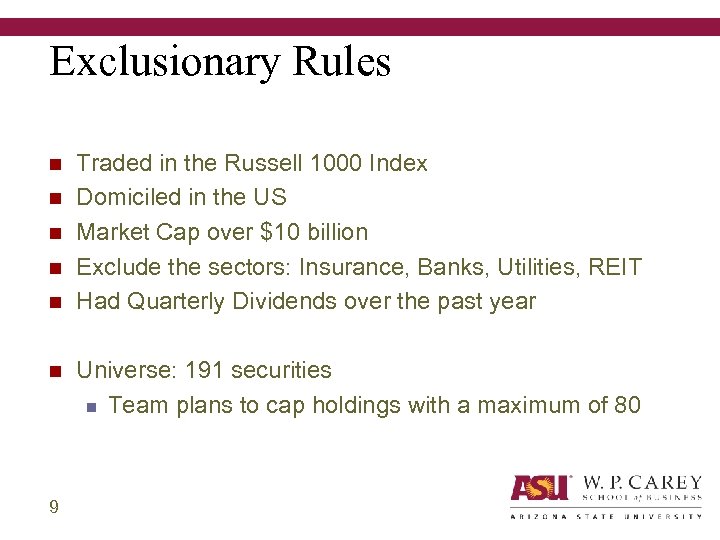

Exclusionary Rules n n n 9 Traded in the Russell 1000 Index Domiciled in the US Market Cap over $10 billion Exclude the sectors: Insurance, Banks, Utilities, REIT Had Quarterly Dividends over the past year Universe: 191 securities n Team plans to cap holdings with a maximum of 80

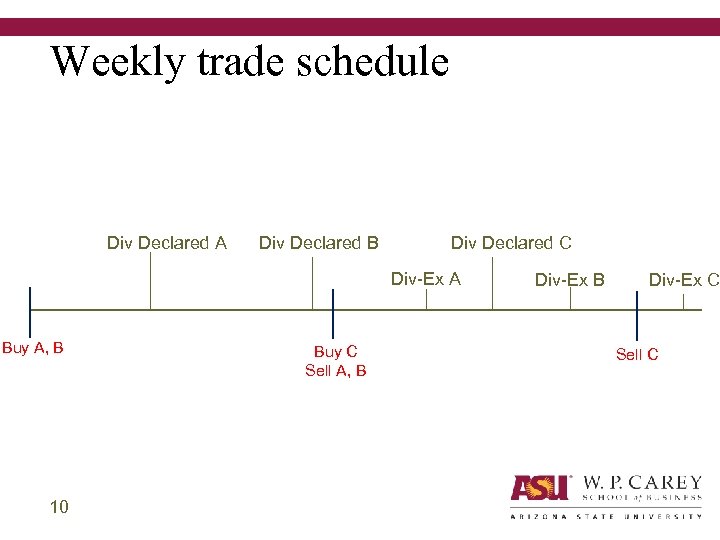

Weekly trade schedule Div Declared A Div Declared B Div Declared C Div-Ex A Buy A, B 10 Buy C Sell A, B Div-Ex C Sell C

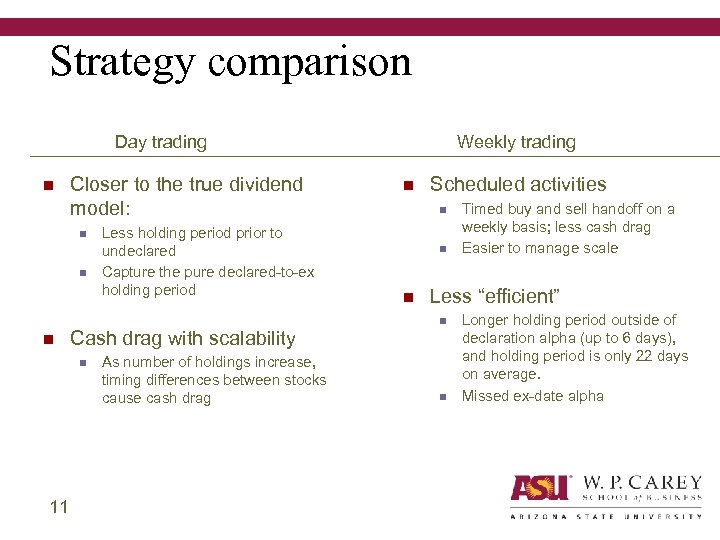

Strategy comparison Weekly trading Day trading n Closer to the true dividend model: n n n Cash drag with scalability n 11 Less holding period prior to undeclared Capture the pure declared-to-ex holding period As number of holdings increase, timing differences between stocks cause cash drag n Scheduled activities n n n Timed buy and sell handoff on a weekly basis; less cash drag Easier to manage scale Less “efficient” n n Longer holding period outside of declaration alpha (up to 6 days), and holding period is only 22 days on average. Missed ex-date alpha

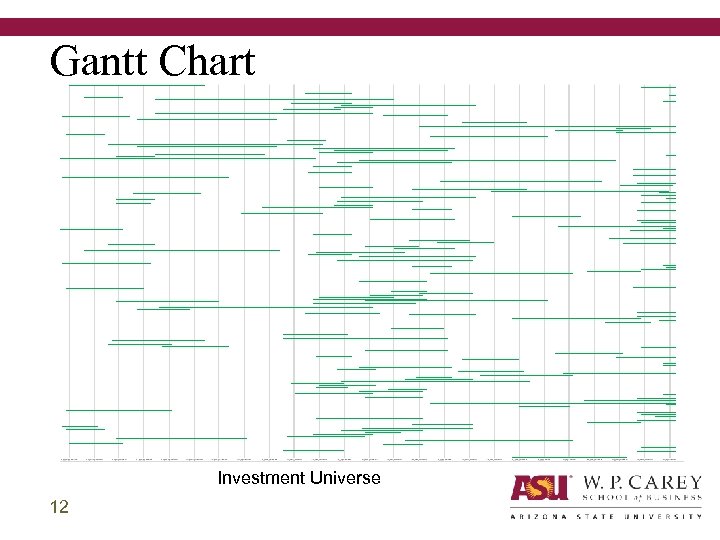

Gantt Chart Investment Universe 12

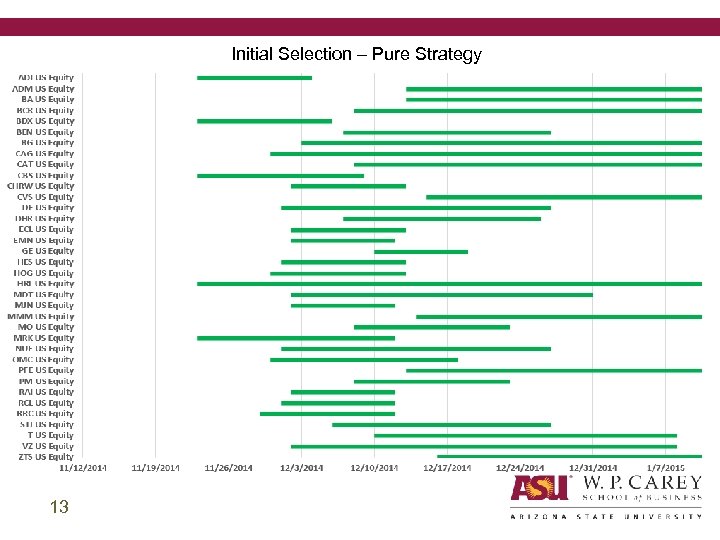

Initial Selection – Pure Strategy 13

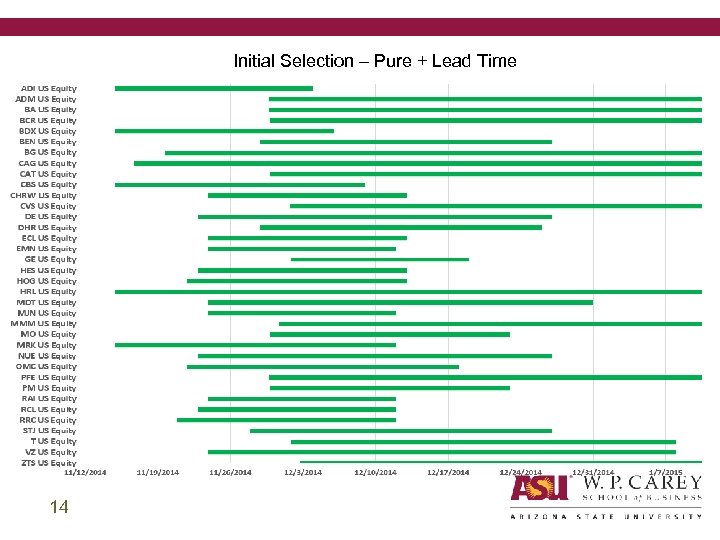

Initial Selection – Pure + Lead Time 14

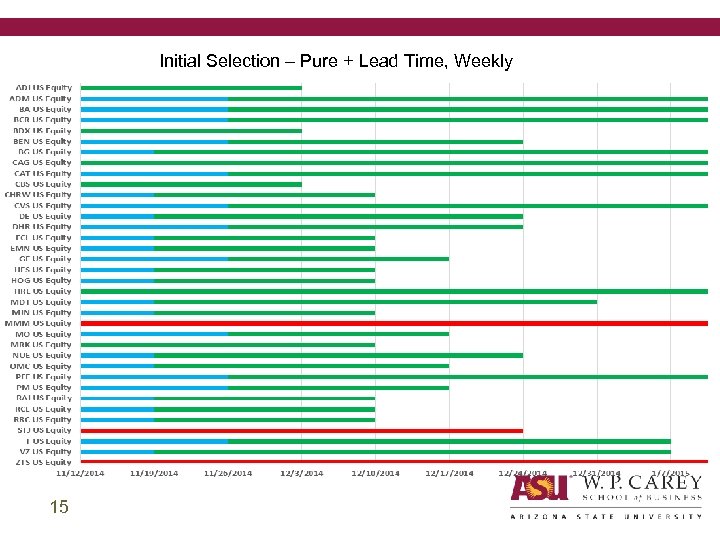

Initial Selection – Pure + Lead Time, Weekly 15

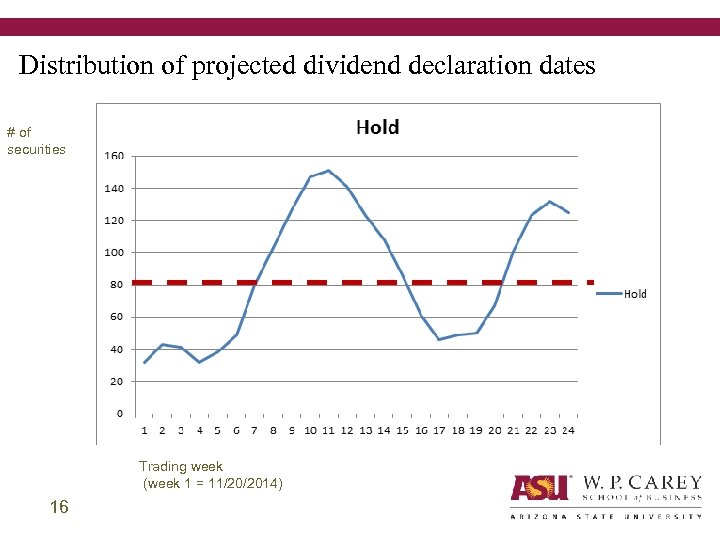

Distribution of projected dividend declaration dates # of securities Trading week (week 1 = 11/20/2014) 16

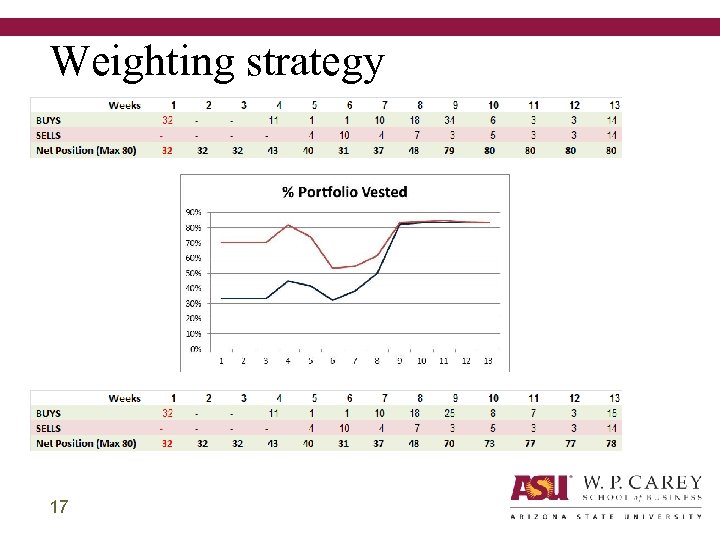

Weighting strategy 17

Issues going forward n n n 18 Need to maintain diverse holdings (>30) Limited human resources n Cap total holdings to ensure oversight and adequate trade volume n Securities assigned to individual team members for monitoring Avoid Closet Indexing

Portfolio Today – Seeding n n 19 Initial seeding on November 20 32 Securities n 3 securities eliminated due to deviation from forecast n Approximately $18, 000 per position

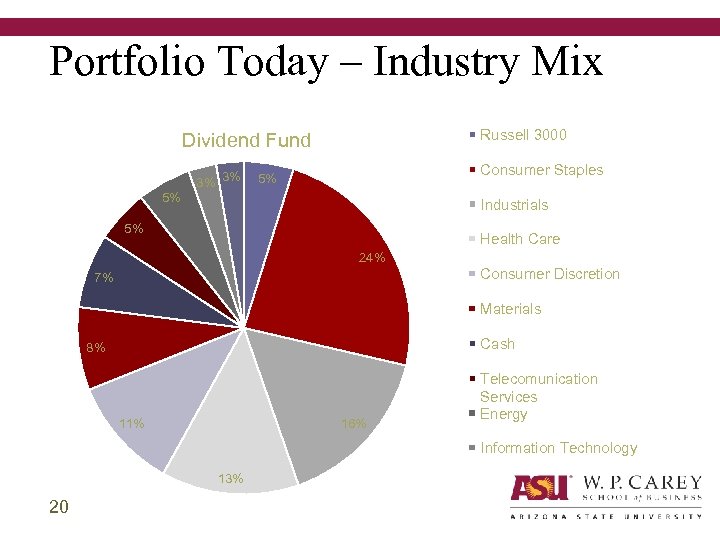

Portfolio Today – Industry Mix Russell 3000 Dividend Fund 3% 3% Consumer Staples 5% 5% Industrials 5% Health Care 24% Consumer Discretion 7% Materials Cash 8% 16% 11% Telecomunication Services Energy Information Technology 13% 20

REITs Strategy 22

REITs – Overall strategy Approximately 15% of total portfolio n Primary purpose (for us) is diversification n Focused on ETFs with low expense ratios, high trading volumes, and high assets under management n n 22 Also filtered out REIT ETFs from non-reputable companies

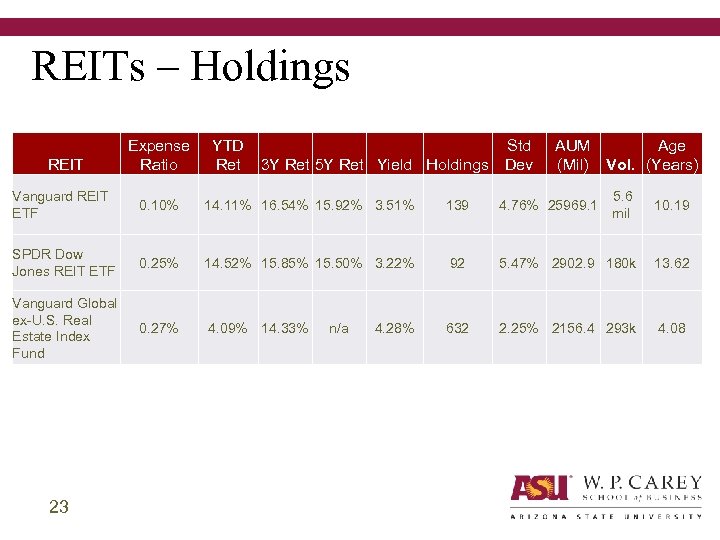

REITs – Holdings REIT Expense Ratio YTD Ret 3 Y Ret 5 Y Ret Yield Holdings Std Dev AUM Age (Mil) Vol. (Years) Vanguard REIT ETF 0. 10% 14. 11% 16. 54% 15. 92% 3. 51% 139 4. 76% 25969. 1 5. 6 mil 10. 19 SPDR Dow Jones REIT ETF 0. 25% 14. 52% 15. 85% 15. 50% 3. 22% 92 5. 47% 2902. 9 180 k 13. 62 Vanguard Global ex-U. S. Real Estate Index Fund 0. 27% 4. 09% 14. 33% 632 2. 25% 2156. 4 293 k 4. 08 23 n/a 4. 28%

REITs – ETFs: Why we chose them n Pros: n n n 24 Strong performance across most REIT sectors Highly liquid Diversification Not correlated with rest of strategy Can hedge against inflation n Cons: n n n Sensitive to increases in interest rates Falling occupancy rates hurt profitability Differentiation

Thank you Questions? 27

Appendix 26

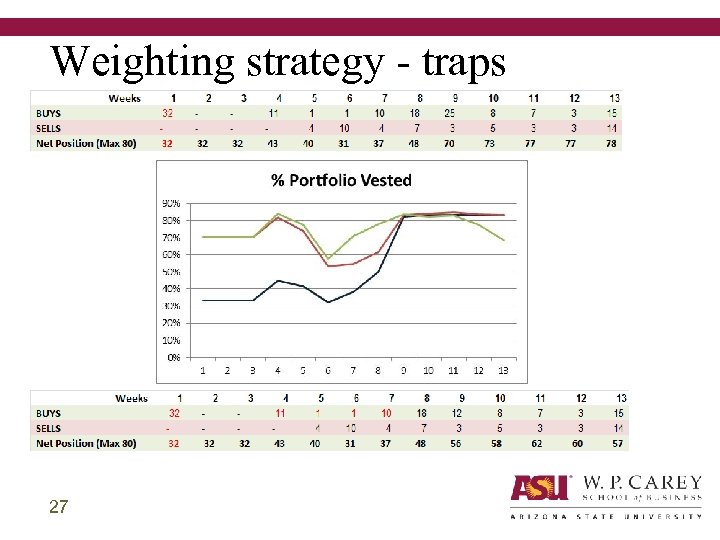

Weighting strategy - traps 27

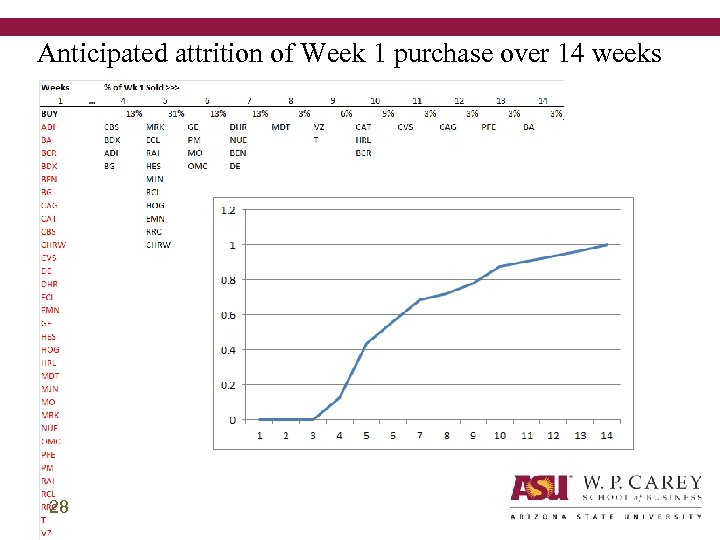

Anticipated attrition of Week 1 purchase over 14 weeks 28

ea47b5495a777df0a33c47cfe9915ff5.ppt