b4343e81b4f038180c92b374f17e886b.ppt

- Количество слайдов: 24

Should Central Banks React to Exchange Rate Movements? Institute for Economic Research at the University of Munich Timo Wollmershäuser Doktorandenseminar Rothenfels 27/28. 2. 2002

Empirical observation Central banks respond with their interest rate instrument to exchange rate movements: • Evidence from VARs: - Clarida and Gertler (1997): Bundesbank Brischetto and Voss (1999), Dungey and Pagan (2000): Australia • Evidence from direct estimation of monetary policy rules: - Clarida, Gali and Gerler (1998): Bundesbank, Bank of Japan, Bank of England Gerlach and Smets (2000): Reserve Bank of New Zealand, Bank of Canada Ades, Buscaglia and Masih (2002): Chile, Israel, South Africa, the Czech Republic and Mexico 2

Results from normative policy-evaluation studies Taylor (2001): “Research to date indicates that monetary policy rules that react directly to the exchange rate, as well as to inflation and output, do not work much better in stabilizing inflation and real output and sometimes work worse than policy rules that do not react directly to the exchange rate”: • Small improvement of the macroeconomic performance of a central bank’s interest rate policy: Ball (1999), Svensson (2000), Batini et al. (2001), Leitemo and Söderström (2001); • Deterioration: Côté et al. (2002); • Mixed results: Taylor (1999). 3

Outline of the presentation I. III. Reproducing the results from simulation studies Explaining the results from simulation studies Modifying the simulation studies in order to provide a rationale for the empirical results 4

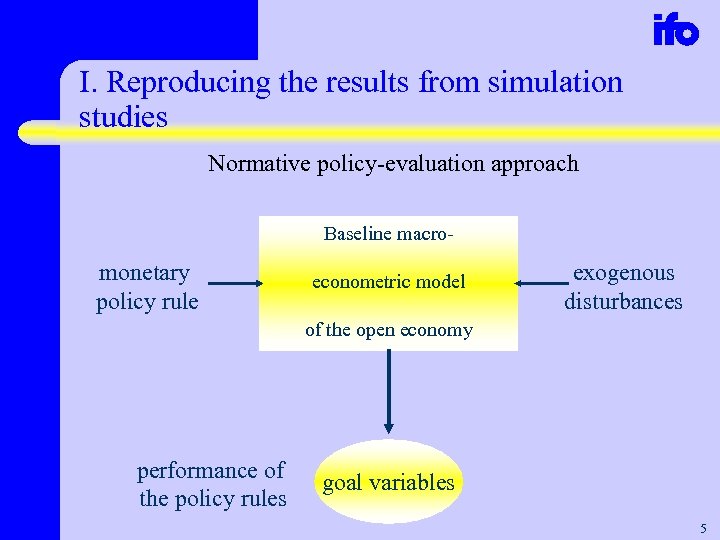

I. Reproducing the results from simulation studies Normative policy-evaluation approach Baseline macro- monetary policy rule econometric model exogenous disturbances of the open economy performance of the policy rules goal variables 5

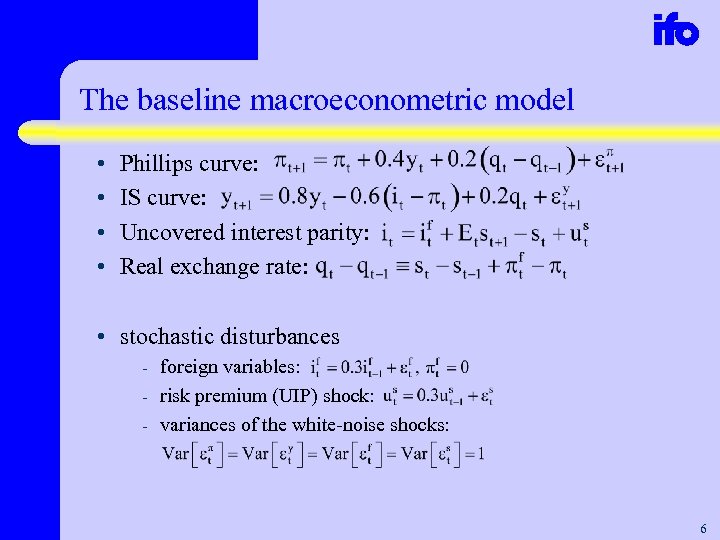

The baseline macroeconometric model • • Phillips curve: IS curve: Uncovered interest parity: Real exchange rate: • stochastic disturbances - foreign variables: risk premium (UIP) shock: variances of the white-noise shocks: 6

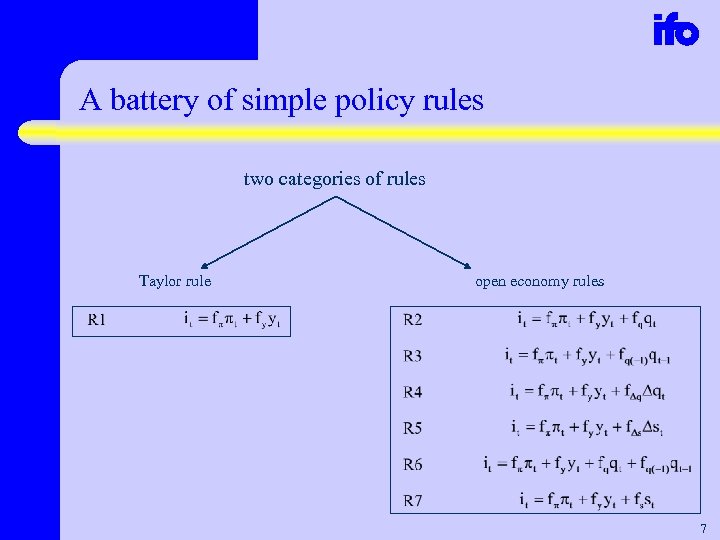

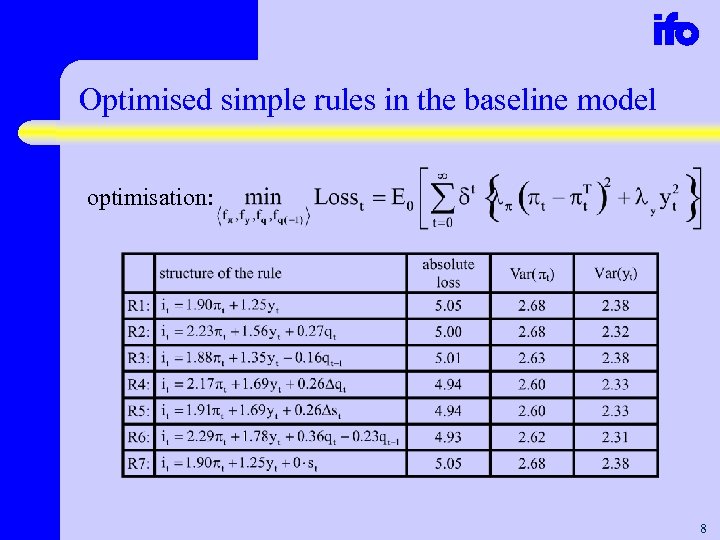

A battery of simple policy rules two categories of rules Taylor rule open economy rules 7

Optimised simple rules in the baseline model optimisation: 8

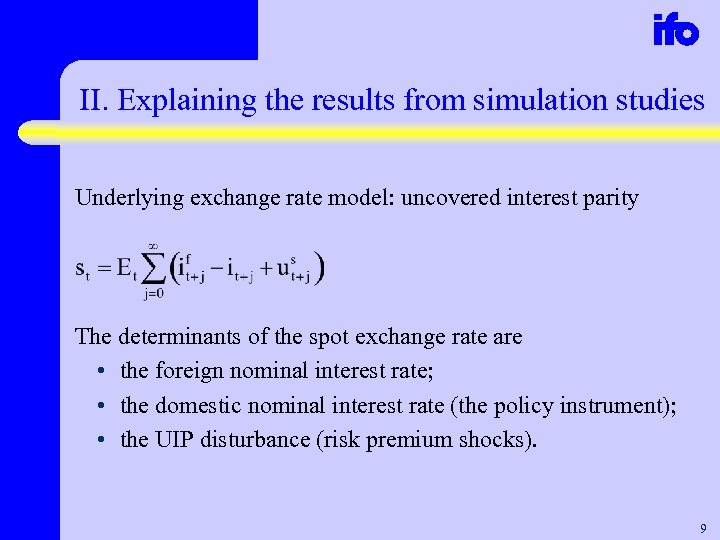

II. Explaining the results from simulation studies Underlying exchange rate model: uncovered interest parity The determinants of the spot exchange rate are • the foreign nominal interest rate; • the domestic nominal interest rate (the policy instrument); • the UIP disturbance (risk premium shocks). 9

Optimised policy rules under a perfectly holding UIP condition and constant foreign interest rates 1. No informational gain from responding to contemporaneous exchange rate movements: the interest rate is the only determinant of the exchange rate. 2. However, small gain from commitment to an inertial policy rule: the reaction to lagged exchange rate movements can be regarded as substitute for interest rate smoothing. 10

III. to Modifying the simulation studies in order provide a rationale for empirical results 1. Introducing the idea of exchange rate uncertainty 2. Discussing the consequences of exchange rate uncertainty 11

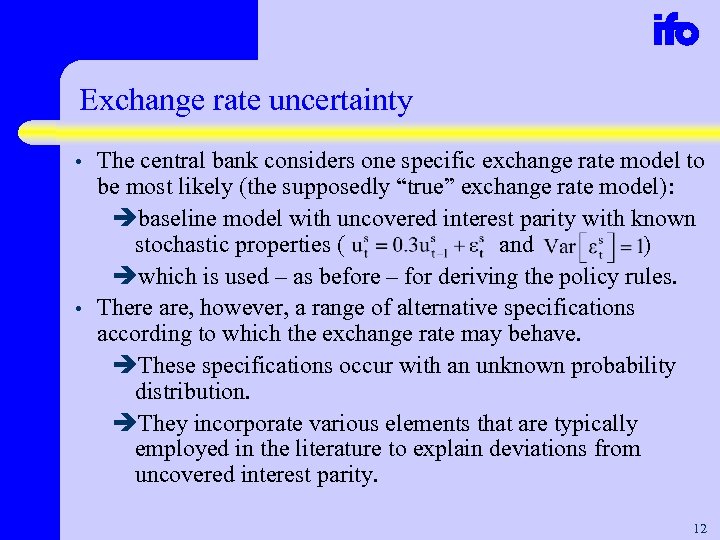

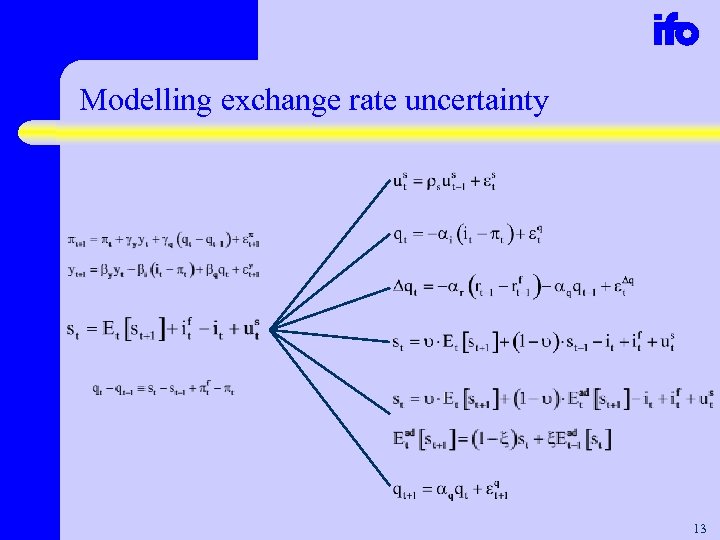

Exchange rate uncertainty • • The central bank considers one specific exchange rate model to be most likely (the supposedly “true” exchange rate model): èbaseline model with uncovered interest parity with known stochastic properties ( and ) èwhich is used – as before – for deriving the policy rules. There are, however, a range of alternative specifications according to which the exchange rate may behave. èThese specifications occur with an unknown probability distribution. èThey incorporate various elements that are typically employed in the literature to explain deviations from uncovered interest parity. 12

Modelling exchange rate uncertainty 13

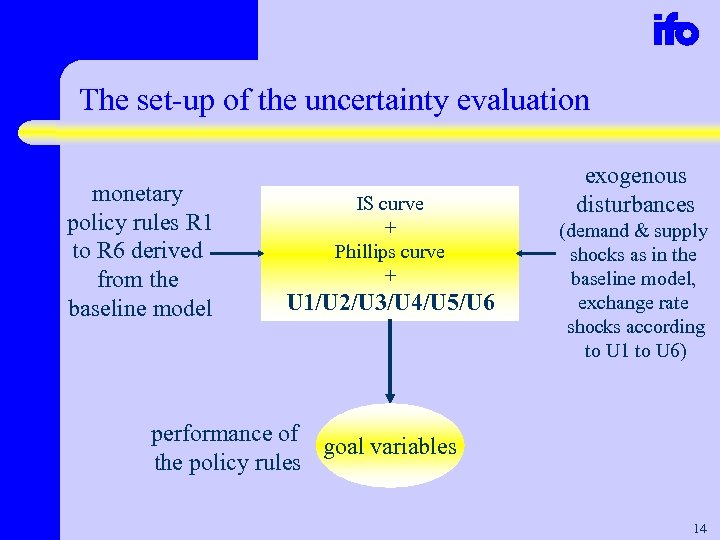

The set-up of the uncertainty evaluation monetary policy rules R 1 to R 6 derived from the baseline model IS curve + Phillips curve + U 1/U 2/U 3/U 4/U 5/U 6 exogenous disturbances (demand & supply shocks as in the baseline model, exchange rate shocks according to U 1 to U 6) performance of goal variables the policy rules 14

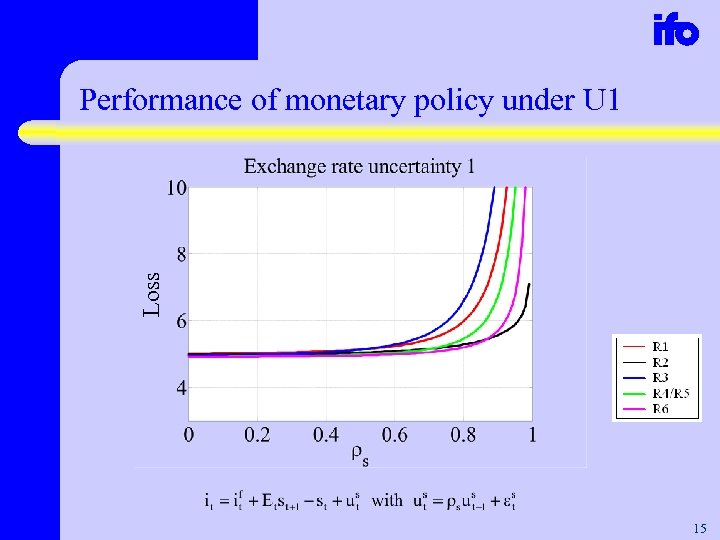

Loss Performance of monetary policy under U 1 15

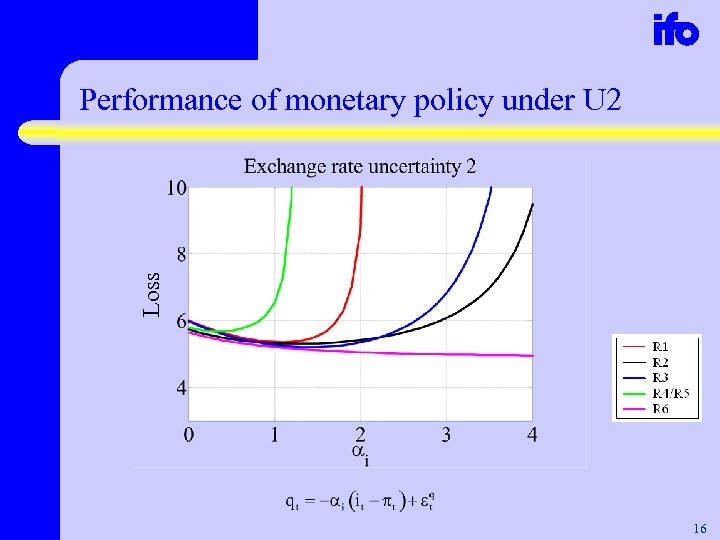

Loss Performance of monetary policy under U 2 16

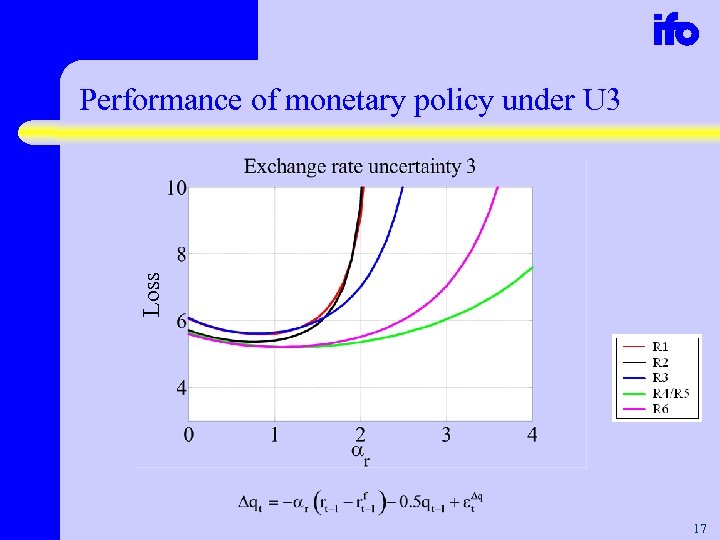

Loss Performance of monetary policy under U 3 17

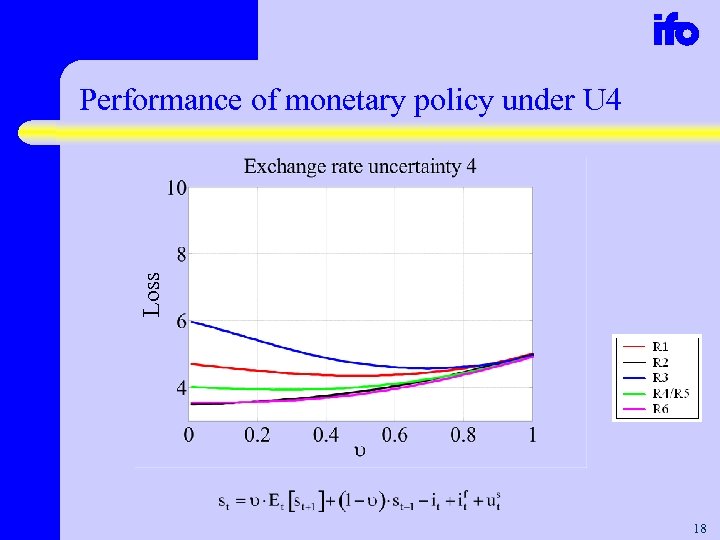

Loss Performance of monetary policy under U 4 18

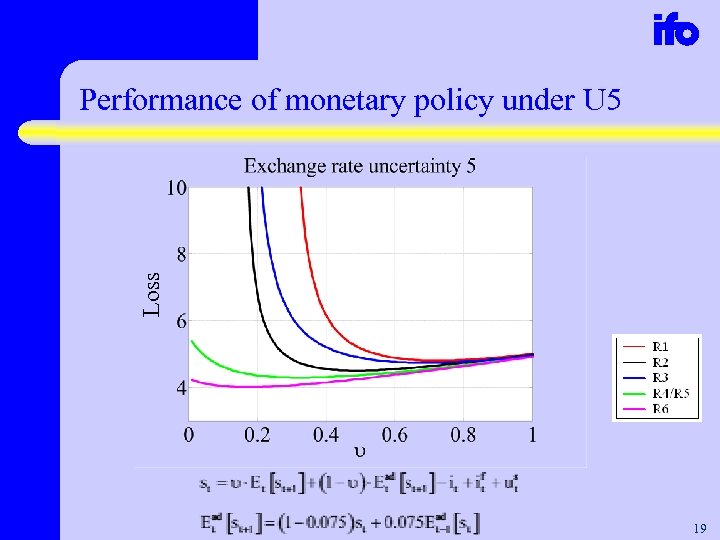

Loss Performance of monetary policy under U 5 19

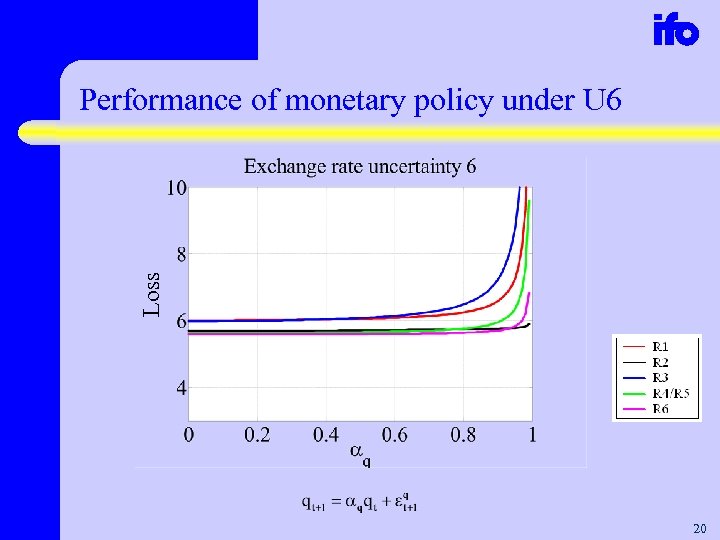

Loss Performance of monetary policy under U 6 20

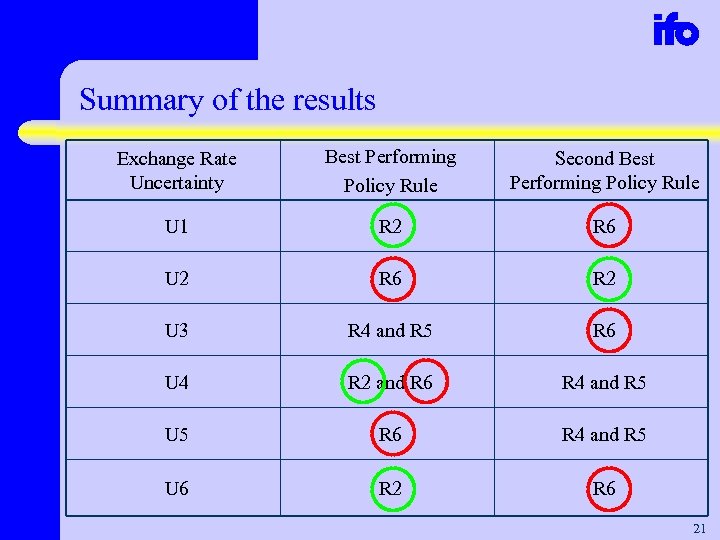

Summary of the results Exchange Rate Uncertainty Best Performing Policy Rule Second Best Performing Policy Rule U 1 R 2 R 6 U 2 R 6 R 2 U 3 R 4 and R 5 R 6 U 4 R 2 and R 6 R 4 and R 5 U 5 R 6 R 4 and R 5 U 6 R 2 R 6 21

The quest for robustness in monetary policy 1. 2. 3. A policy rule with a feedback from the lagged and the current real exchange rate is superior to a Taylor-type rule according to which the central bank only responds to movements in domestic goal variables. Such a policy rule that performs best across a range of structural models is called a robust policy rule since it best possibly insulates the economy from the negative consequences of uncertainty about the true exchange rate model. Reacting to exchange rate movements reflects the monetary policymaker‘s quest for robustness in world which is surrounded by a high degree of uncertainty about the true determination of the exchange rate. 22

Conclusion 4. 5. The reason why normative policy-evaluation studies typically come to the result that responding to exchange rate movements is redundant stems from their assumption of a well -defined and reliable relationship between the interest rate and the exchange rate. Relaxing this assumption and allowing for uncertainty about this relationship provides an economic rationale for the empirically observable interest rate response to exchange rate movements. 23

THANK YOU 24

b4343e81b4f038180c92b374f17e886b.ppt