316aa30b8ef54886de12155b6cd6d408.ppt

- Количество слайдов: 16

Should Broadband Internet Services To The Home Offer Choice of ISP? YES! Group E: *Brian Bohan *John Musacchio *Randi Thomas *Wanyu Tsai

Criteria for Answering the Question • Public Must Benefit through – Lower Prices – Broader Access – Variety of Services – Higher Quality

Narrowband to Broadband • Nearly all home users using dial up access • Barrier to entry for dial up ISPs low – over 4, 000 ISPs available • Appetite for bandwidth causing migration to broadband – barrier to entry prohibitively high to ISPs – ISP choice threatened

Broadband Internet Players • Cable Industry • Telecommunications Industry

Cable Industry • A few big players getting bigger • Regional monopolies • Only one ISP per Regional Cable Co. – Usually partially owned by cable co. • @Home-TCI • Road Runner-Time Warner – Controls how end user experiences Internet • Controls quality of service

Telecommunications Industry • Pre 1996: Looked a lot like cable today – RBOCs Monopoly provided high price solutions: • ISDN, TI, T 3 – Sat on DSL technology • 1996 Telecommunications Act – unbundled infrastructure and services

Impact from the Act • Data CLECs emerge – Introduced DSL to market • RBOCs forced to respond • Multiple Broadband ISPs offering variety of services

Does Sufficient Competition Exist in Cable Today? • Negative will Argue Current Competition between Broadband is sufficient • We will show that it is not • To have true competition, the cable infrastructure must be opened to ISPs

DSL vs. Cable Not Sufficient • Pocket Argument – More profit in Virgin areas • Cost Argument – Cable = $40/mo vs. $60 for DSL – Cable technology enjoys greater economies of scale due to shared resources • Momemtum – Cable outselling DSL 10 to 1 – Merger Mania • AT&T planning to spend $5. 7 bn on TCI network upgrades • Industry planning to spend $10 bn in ‘ 99 on upgrades

Introduce Two-Layer Model • Cable Company leases/sells infrastructure to ISPs at “reasonable rate” – ISP and cable company split monthly fee • Cable companies continue to pay for infrastructure build out • ISPs pay for web servers, caching, content, etc.

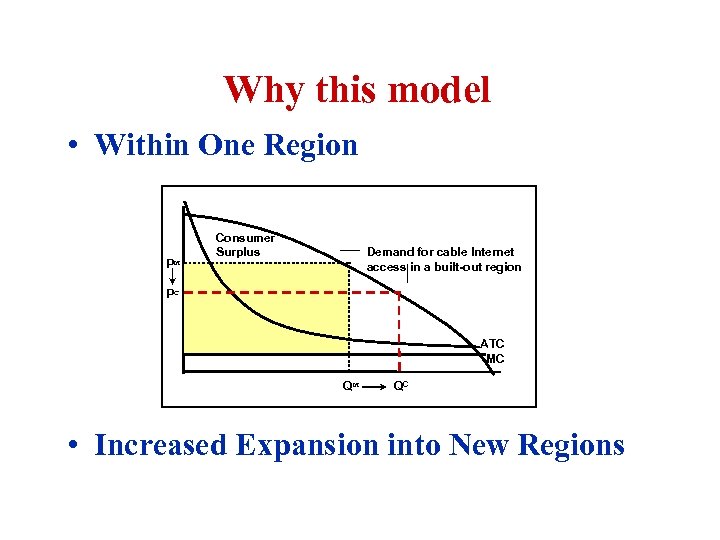

Why this model • Within One Region PM Consumer Surplus Demand for cable Internet access in a built-out region PC ATC MC QM QC • Increased Expansion into New Regions

Build-Outs in Today’s Model • Big initial infrastructure + Marketing costs – Marketing for new build-outs involves huge cost/risk • Cable/ISP company assumes costs & risks – Must achieve subscription rate to cover these costs – Non-Trivial Issue: 500 K subscribers out of 20 million with access = 2. 5%: • Cable company manages this risk by building out slower than they could

Build-Outs in Two-Layered Model • ISPs will assume the cost of marketing – They market agressively • AOL spends upwards of $300 for every new subscriber • 3. 9 million new subscribers in 1998 – Primary demand stimulated nationwide – • Cable companies can then rapidly expand service to new areas • Result: More Access for the Public

Multiple ISPs Mean Variety • AT&T wants to be your big brother – $57 bn to buy TCI & $54 bn to buy Media. One – TCI/Media. One biggest cable provider • reaching 25 million homes, potentially 60 million – “They could rule the world” - Securities Analyst • Imagine NBC as your only TV station – @Home will be just that, controlling all content – Increasingly important as Internet goes multimedia

Policy Goals Achieved The Consumer Wins! • Thanks to competition in ISP layer. . . – We have lower prices • As a result of shared risks and costs – We have broader access • Due to more choice of service providers – We have variety of services

Vote Yes on Opening Cable

316aa30b8ef54886de12155b6cd6d408.ppt