ed6b29e21378124c7bdda4a958db8284.ppt

- Количество слайдов: 29

Short-term financing & working capital management RWJ Ch. 27. 28 BMW Ch. 30

Short-term financing & working capital management RWJ Ch. 27. 28 BMW Ch. 30

Cash Budgeting A cash budget is a primary tool of short-run financial planning. The cash balance tells the manager what borrowing is required or what lending will be possible in the short run. The idea is simple: Record the estimates of cash receipts and disbursements: Steps to prepare a cash budget Forecast the cash receipts Forecast the cash disbursements Calculate whether the firm is facing a cash shortage or surplus

Cash Budgeting A cash budget is a primary tool of short-run financial planning. The cash balance tells the manager what borrowing is required or what lending will be possible in the short run. The idea is simple: Record the estimates of cash receipts and disbursements: Steps to prepare a cash budget Forecast the cash receipts Forecast the cash disbursements Calculate whether the firm is facing a cash shortage or surplus

Cash Budgeting Cash Receipts: cash inflow (sources of cash) Arise from sales, but cash comes later from collections on accounts receivables. We need to estimate when we actually collect. Cash disbursement : cash outflow (uses of cash) Payments of Accounts Payable Wages, Taxes, and other Expenses Capital Expenditures Long-Term Financial Planning

Cash Budgeting Cash Receipts: cash inflow (sources of cash) Arise from sales, but cash comes later from collections on accounts receivables. We need to estimate when we actually collect. Cash disbursement : cash outflow (uses of cash) Payments of Accounts Payable Wages, Taxes, and other Expenses Capital Expenditures Long-Term Financial Planning

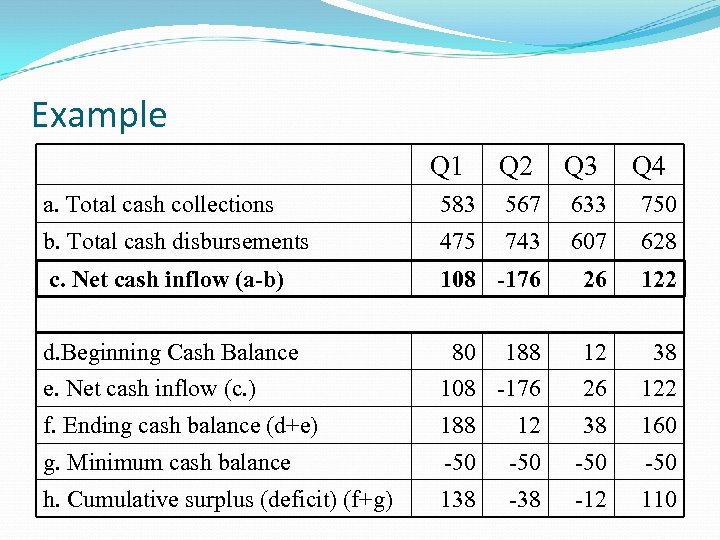

Example Pet Treats Inc. specializes in gourmet pet treats and receives all income from sales Sales estimates (in millions) Q 1 = 500; Q 2 = 600; Q 3 = 650; Q 4 = 800; Q 1 next year = 550 Accounts receivable Beginning receivables = $250 Average collection period = 30 days Accounts payable Purchases = 50% of next quarter’s sales Beginning payables = $125 Accounts payable period is 45 days Other expenses Wages, taxes and other expense are 30% of sales Interest and dividend payments are $50 A major capital expenditure of $200 is expected in the second quarter The initial cash balance is $80 and the company maintains a minimum balance of $50

Example Pet Treats Inc. specializes in gourmet pet treats and receives all income from sales Sales estimates (in millions) Q 1 = 500; Q 2 = 600; Q 3 = 650; Q 4 = 800; Q 1 next year = 550 Accounts receivable Beginning receivables = $250 Average collection period = 30 days Accounts payable Purchases = 50% of next quarter’s sales Beginning payables = $125 Accounts payable period is 45 days Other expenses Wages, taxes and other expense are 30% of sales Interest and dividend payments are $50 A major capital expenditure of $200 is expected in the second quarter The initial cash balance is $80 and the company maintains a minimum balance of $50

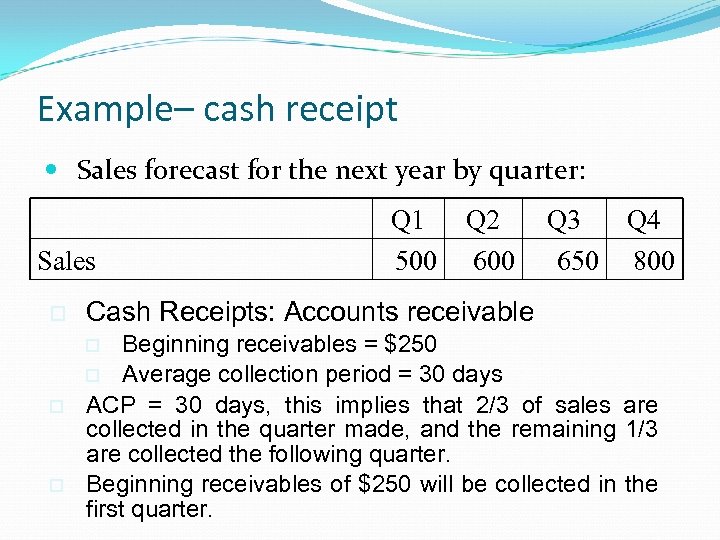

Example– cash receipt Sales forecast for the next year by quarter: Sales o o Q 2 600 Q 3 650 Q 4 800 Cash Receipts: Accounts receivable Beginning receivables = $250 o Average collection period = 30 days ACP = 30 days, this implies that 2/3 of sales are collected in the quarter made, and the remaining 1/3 are collected the following quarter. Beginning receivables of $250 will be collected in the first quarter. o o Q 1 500

Example– cash receipt Sales forecast for the next year by quarter: Sales o o Q 2 600 Q 3 650 Q 4 800 Cash Receipts: Accounts receivable Beginning receivables = $250 o Average collection period = 30 days ACP = 30 days, this implies that 2/3 of sales are collected in the quarter made, and the remaining 1/3 are collected the following quarter. Beginning receivables of $250 will be collected in the first quarter. o o Q 1 500

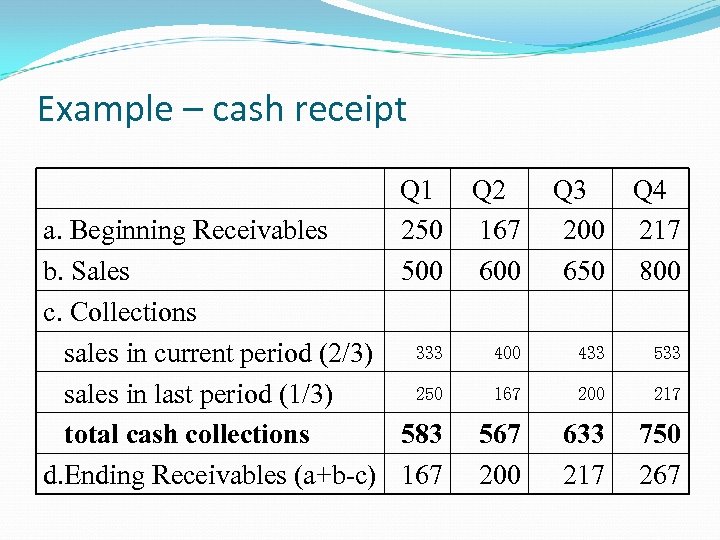

Example – cash receipt Q 1 250 500 a. Beginning Receivables b. Sales c. Collections 333 sales in current period (2/3) 250 sales in last period (1/3) total cash collections 583 d. Ending Receivables (a+b-c) 167 Q 2 167 600 Q 3 200 650 Q 4 217 800 433 533 167 200 217 567 200 633 217 750 267

Example – cash receipt Q 1 250 500 a. Beginning Receivables b. Sales c. Collections 333 sales in current period (2/3) 250 sales in last period (1/3) total cash collections 583 d. Ending Receivables (a+b-c) 167 Q 2 167 600 Q 3 200 650 Q 4 217 800 433 533 167 200 217 567 200 633 217 750 267

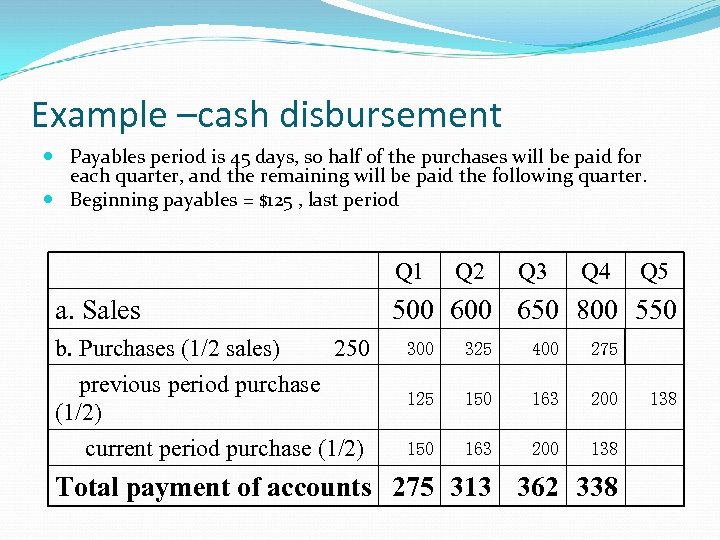

Example –cash disbursement Payables period is 45 days, so half of the purchases will be paid for each quarter, and the remaining will be paid the following quarter. Beginning payables = $125 , last period Q 1 a. Sales b. Purchases (1/2 sales) Q 2 Q 3 Q 4 Q 5 500 650 800 550 250 previous period purchase (1/2) current period purchase (1/2) 300 325 400 275 125 150 163 200 138 Total payment of accounts 275 313 362 338 138

Example –cash disbursement Payables period is 45 days, so half of the purchases will be paid for each quarter, and the remaining will be paid the following quarter. Beginning payables = $125 , last period Q 1 a. Sales b. Purchases (1/2 sales) Q 2 Q 3 Q 4 Q 5 500 650 800 550 250 previous period purchase (1/2) current period purchase (1/2) 300 325 400 275 125 150 163 200 138 Total payment of accounts 275 313 362 338 138

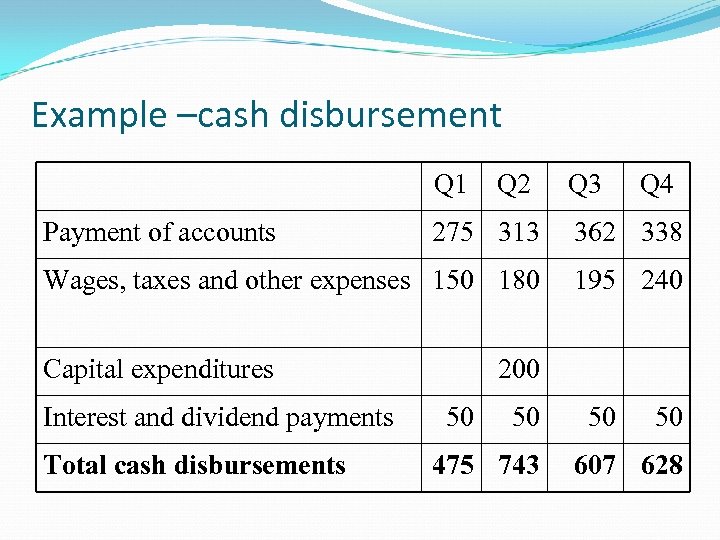

Example –cash disbursement Q 1 Payment of accounts Q 2 Q 3 Q 4 275 313 362 338 Wages, taxes and other expenses 150 180 195 240 Capital expenditures Interest and dividend payments Total cash disbursements 200 50 50 475 743 50 50 607 628

Example –cash disbursement Q 1 Payment of accounts Q 2 Q 3 Q 4 275 313 362 338 Wages, taxes and other expenses 150 180 195 240 Capital expenditures Interest and dividend payments Total cash disbursements 200 50 50 475 743 50 50 607 628

Example Q 1 Q 2 Q 3 Q 4 a. Total cash collections 583 567 633 750 b. Total cash disbursements 475 743 607 628 c. Net cash inflow (a-b) 108 -176 26 122 188 12 38 e. Net cash inflow (c. ) 108 -176 26 122 f. Ending cash balance (d+e) 188 12 38 160 g. Minimum cash balance -50 -50 h. Cumulative surplus (deficit) (f+g) 138 -12 110 d. Beginning Cash Balance 80

Example Q 1 Q 2 Q 3 Q 4 a. Total cash collections 583 567 633 750 b. Total cash disbursements 475 743 607 628 c. Net cash inflow (a-b) 108 -176 26 122 188 12 38 e. Net cash inflow (c. ) 108 -176 26 122 f. Ending cash balance (d+e) 188 12 38 160 g. Minimum cash balance -50 -50 h. Cumulative surplus (deficit) (f+g) 138 -12 110 d. Beginning Cash Balance 80

The Short-Term Financial Plan There are dozens of ways to finance a temporary cash deficit : The most common way is to arrange a short-term loan. Unsecured Loans: Line of credit (at the bank) Secured Loans: Accounts receivable financing/ inventor loan. Commercial paper => pays interest Stretching payables

The Short-Term Financial Plan There are dozens of ways to finance a temporary cash deficit : The most common way is to arrange a short-term loan. Unsecured Loans: Line of credit (at the bank) Secured Loans: Accounts receivable financing/ inventor loan. Commercial paper => pays interest Stretching payables

Working capital mamangement How do firms manage the short-term asset? Inventory management Credit management Cash management Investing in short-term securities How can firm finance the short-term asset? Sources of short-term borrowing 10

Working capital mamangement How do firms manage the short-term asset? Inventory management Credit management Cash management Investing in short-term securities How can firm finance the short-term asset? Sources of short-term borrowing 10

Inventory Management Components of Inventory Raw materials Work in process Finished goods Goal = Minimize amount of cash (cost) tied up in inventory Tools used to minimize inventory Just-in-time/Lean manufacturing by Toyota Customize production through internet by Dell Computer.

Inventory Management Components of Inventory Raw materials Work in process Finished goods Goal = Minimize amount of cash (cost) tied up in inventory Tools used to minimize inventory Just-in-time/Lean manufacturing by Toyota Customize production through internet by Dell Computer.

Inventories Trade-off between : Carry cost and order cost. As the firm increases its order size, the number of orders falls and therefore the order costs decline. However, an increase in order size also increases the average amount in inventory, so that the carrying cost of inventory rises. The trick is to strike a balance between these two costs.

Inventories Trade-off between : Carry cost and order cost. As the firm increases its order size, the number of orders falls and therefore the order costs decline. However, an increase in order size also increases the average amount in inventory, so that the carrying cost of inventory rises. The trick is to strike a balance between these two costs.

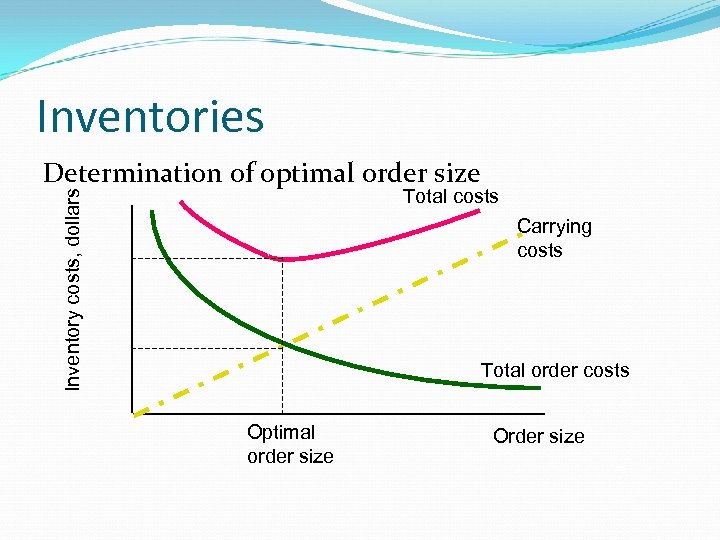

Inventories Determination of optimal order size Inventory costs, dollars Total costs Carrying costs Total order costs Optimal order size Order size

Inventories Determination of optimal order size Inventory costs, dollars Total costs Carrying costs Total order costs Optimal order size Order size

Credit management Specify a terms of sales Design the contract of trade Estimate the probability of default to pay Collect your receivables 14

Credit management Specify a terms of sales Design the contract of trade Estimate the probability of default to pay Collect your receivables 14

Terms of Sale - Credit, discount, and payment terms offered on a sale. Example - 5/10 net 30 5 - percent discount for early payment 10 - number of days that the discount is available net 30 - number of days before payment is due

Terms of Sale - Credit, discount, and payment terms offered on a sale. Example - 5/10 net 30 5 - percent discount for early payment 10 - number of days that the discount is available net 30 - number of days before payment is due

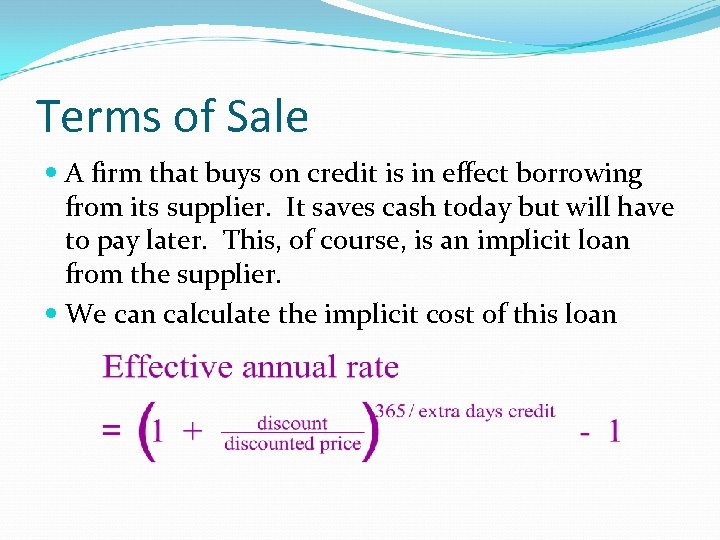

Terms of Sale A firm that buys on credit is in effect borrowing from its supplier. It saves cash today but will have to pay later. This, of course, is an implicit loan from the supplier. We can calculate the implicit cost of this loan

Terms of Sale A firm that buys on credit is in effect borrowing from its supplier. It saves cash today but will have to pay later. This, of course, is an implicit loan from the supplier. We can calculate the implicit cost of this loan

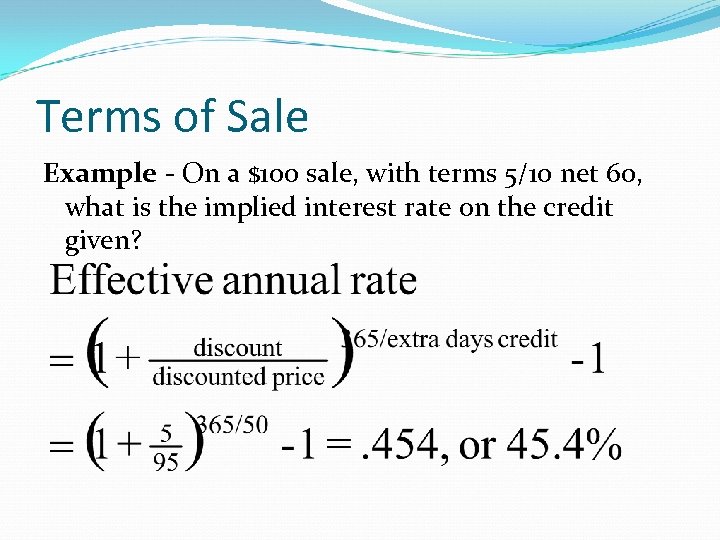

Terms of Sale Example - On a $100 sale, with terms 5/10 net 60, what is the implied interest rate on the credit given?

Terms of Sale Example - On a $100 sale, with terms 5/10 net 60, what is the implied interest rate on the credit given?

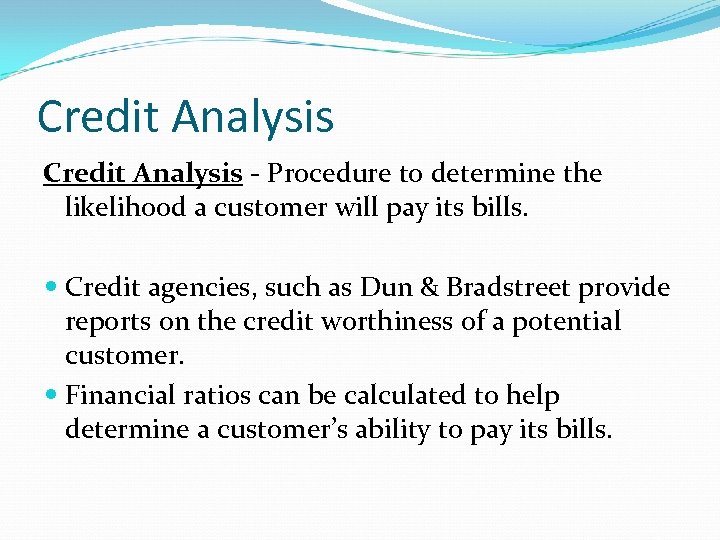

Credit Analysis - Procedure to determine the likelihood a customer will pay its bills. Credit agencies, such as Dun & Bradstreet provide reports on the credit worthiness of a potential customer. Financial ratios can be calculated to help determine a customer’s ability to pay its bills.

Credit Analysis - Procedure to determine the likelihood a customer will pay its bills. Credit agencies, such as Dun & Bradstreet provide reports on the credit worthiness of a potential customer. Financial ratios can be calculated to help determine a customer’s ability to pay its bills.

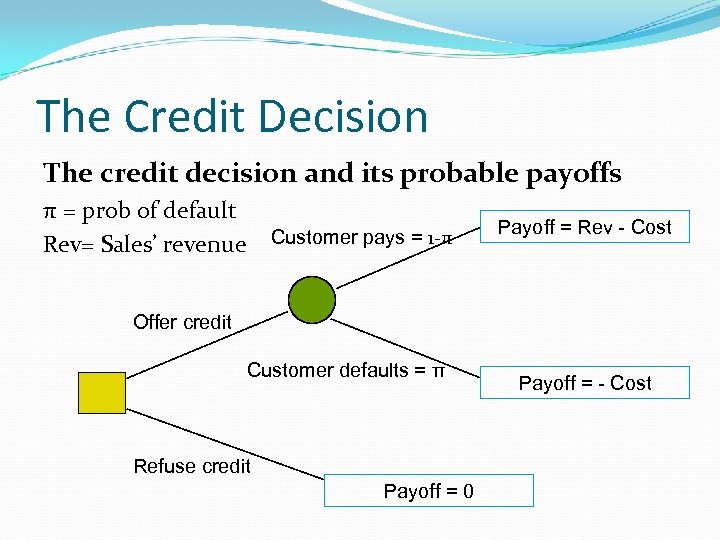

The Credit Decision Extending credit gives you the probability of making a profit, not the guarantee. There is still a chance of default. Denying credit guarantees neither profit or loss.

The Credit Decision Extending credit gives you the probability of making a profit, not the guarantee. There is still a chance of default. Denying credit guarantees neither profit or loss.

The Credit Decision The credit decision and its probable payoffs π = prob of default Rev= Sales’ revenue Customer pays = 1 -π Payoff = Rev - Cost Offer credit Customer defaults = π Refuse credit Payoff = 0 Payoff = - Cost

The Credit Decision The credit decision and its probable payoffs π = prob of default Rev= Sales’ revenue Customer pays = 1 -π Payoff = Rev - Cost Offer credit Customer defaults = π Refuse credit Payoff = 0 Payoff = - Cost

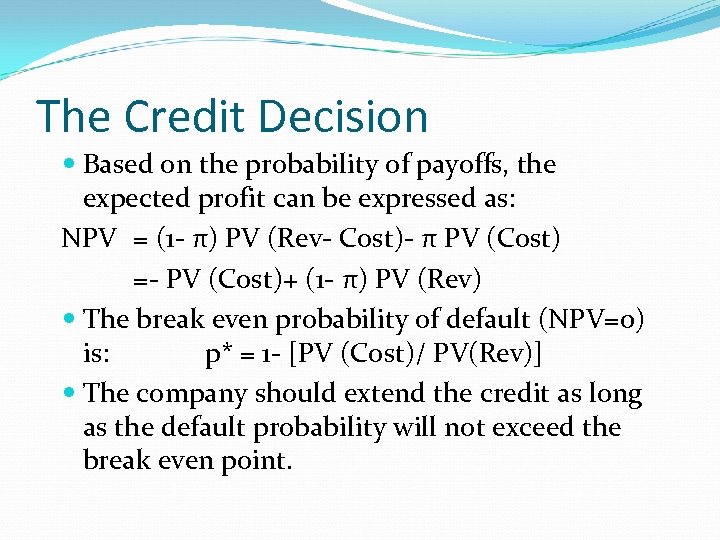

The Credit Decision Based on the probability of payoffs, the expected profit can be expressed as: NPV = (1 - π) PV (Rev- Cost)- π PV (Cost) =- PV (Cost)+ (1 - π) PV (Rev) The break even probability of default (NPV=0) is: p* = 1 - [PV (Cost)/ PV(Rev)] The company should extend the credit as long as the default probability will not exceed the break even point.

The Credit Decision Based on the probability of payoffs, the expected profit can be expressed as: NPV = (1 - π) PV (Rev- Cost)- π PV (Cost) =- PV (Cost)+ (1 - π) PV (Rev) The break even probability of default (NPV=0) is: p* = 1 - [PV (Cost)/ PV(Rev)] The company should extend the credit as long as the default probability will not exceed the break even point.

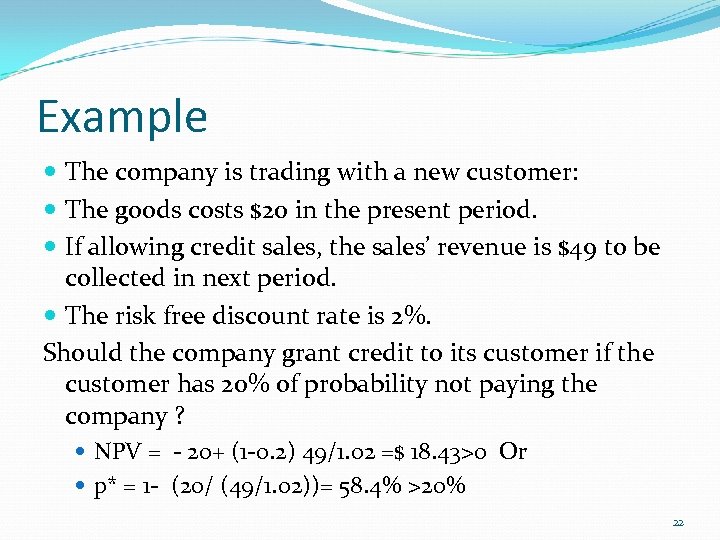

Example The company is trading with a new customer: The goods costs $20 in the present period. If allowing credit sales, the sales’ revenue is $49 to be collected in next period. The risk free discount rate is 2%. Should the company grant credit to its customer if the customer has 20% of probability not paying the company ? NPV = - 20+ (1 -0. 2) 49/1. 02 =$ 18. 43>0 Or p* = 1 - (20/ (49/1. 02))= 58. 4% >20% 22

Example The company is trading with a new customer: The goods costs $20 in the present period. If allowing credit sales, the sales’ revenue is $49 to be collected in next period. The risk free discount rate is 2%. Should the company grant credit to its customer if the customer has 20% of probability not paying the company ? NPV = - 20+ (1 -0. 2) 49/1. 02 =$ 18. 43>0 Or p* = 1 - (20/ (49/1. 02))= 58. 4% >20% 22

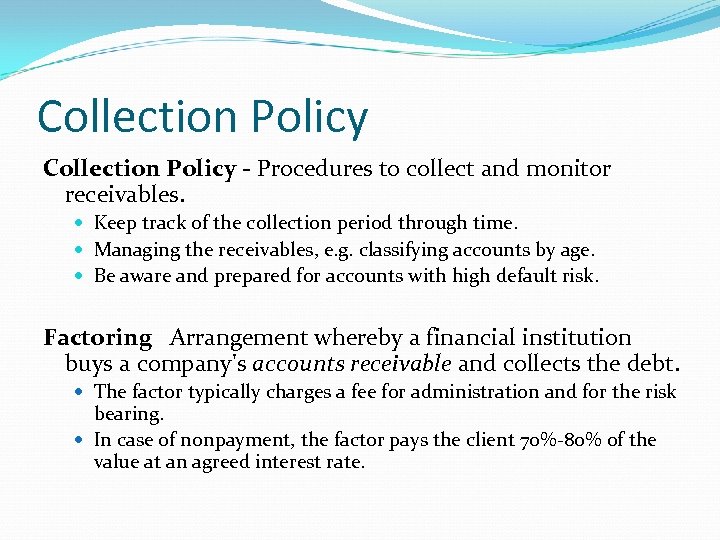

Collection Policy - Procedures to collect and monitor receivables. Keep track of the collection period through time. Managing the receivables, e. g. classifying accounts by age. Be aware and prepared for accounts with high default risk. Factoring Arrangement whereby a financial institution buys a company's accounts receivable and collects the debt. The factor typically charges a fee for administration and for the risk bearing. In case of nonpayment, the factor pays the client 70%-80% of the value at an agreed interest rate.

Collection Policy - Procedures to collect and monitor receivables. Keep track of the collection period through time. Managing the receivables, e. g. classifying accounts by age. Be aware and prepared for accounts with high default risk. Factoring Arrangement whereby a financial institution buys a company's accounts receivable and collects the debt. The factor typically charges a fee for administration and for the risk bearing. In case of nonpayment, the factor pays the client 70%-80% of the value at an agreed interest rate.

Investing Cash Temporary Cash Surpluses stem from several reasons Seasonal or cyclical activities – buy marketable securities with seasonal surpluses, convert securities back to cash when deficits occur Planned or possible expenditures – accumulate marketable securities in anticipation of upcoming expenses

Investing Cash Temporary Cash Surpluses stem from several reasons Seasonal or cyclical activities – buy marketable securities with seasonal surpluses, convert securities back to cash when deficits occur Planned or possible expenditures – accumulate marketable securities in anticipation of upcoming expenses

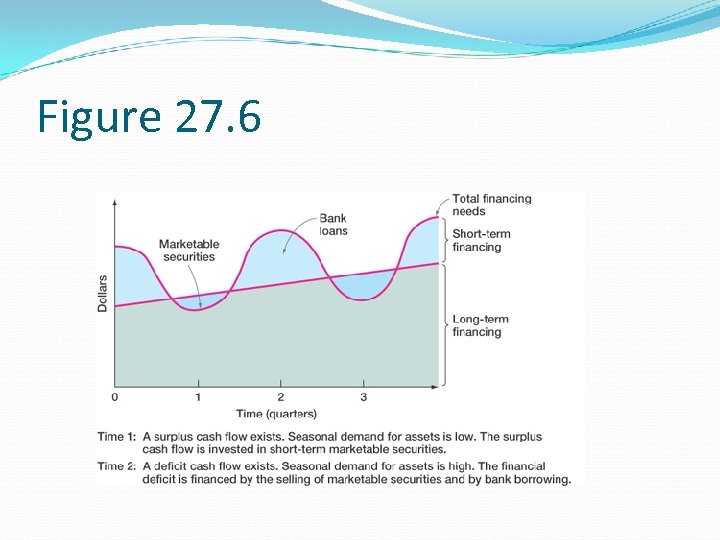

Figure 27. 6

Figure 27. 6

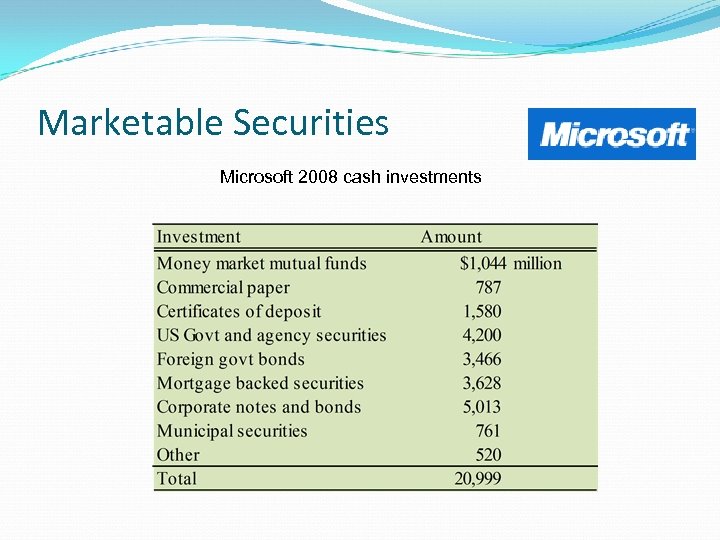

Marketable Securities Microsoft 2008 cash investments

Marketable Securities Microsoft 2008 cash investments

Minicase Keafer Manufacturing working capital management 27

Minicase Keafer Manufacturing working capital management 27

Homework 3 Due 15 Dec. Thursday 13: 55 pm In RJW 9 th ed. : Chapter 26—Questions and problems : 12, 13; Chapter 28—Questions and problems : 5, 16. 28

Homework 3 Due 15 Dec. Thursday 13: 55 pm In RJW 9 th ed. : Chapter 26—Questions and problems : 12, 13; Chapter 28—Questions and problems : 5, 16. 28