57c45487904e53edf5cad941c13a997c.ppt

- Количество слайдов: 40

Short-Term Business Decisions Chapter 8 1 Copyright © 2008 Prentice Hall All rights reserved

Objective 1 Describe and identify information relevant to short term business decisions 2 Copyright © 2008 Prentice Hall All rights reserved

How Managers Make Decisions • • Define business goals Identify alternative courses of action Gather and analyze relevant information Compare alternatives Choose best alternative Implement decision Follow-up: Compare actual results with results anticipated 3 Copyright © 2008 Prentice Hall All rights reserved

Relevant Information • Expected future (cost and revenue) data • Differs among alternative courses of action • Is both quantitative and qualitative 4 Copyright © 2008 Prentice Hall All rights reserved

Irrelevant Costs • Costs that do not differ between alternatives • Sunk costs – incurred in past and cannot be changed 5 Copyright © 2008 Prentice Hall All rights reserved

Relevant Information Approach • Two keys in analyzing short-term special business decisions § Focus on relevant revenues, costs, and profits § Use contribution margin approach that separates variable costs from fixed costs 6 Copyright © 2008 Prentice Hall All rights reserved

Objective 2 Make special order decisions 7 Copyright © 2008 Prentice Hall All rights reserved

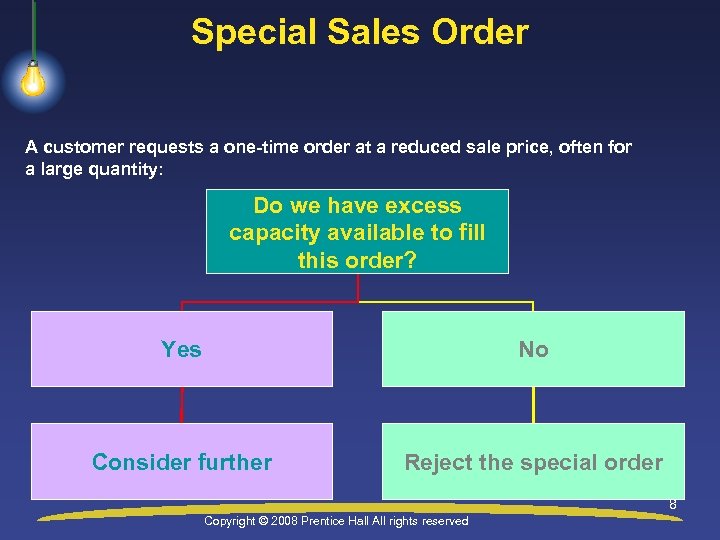

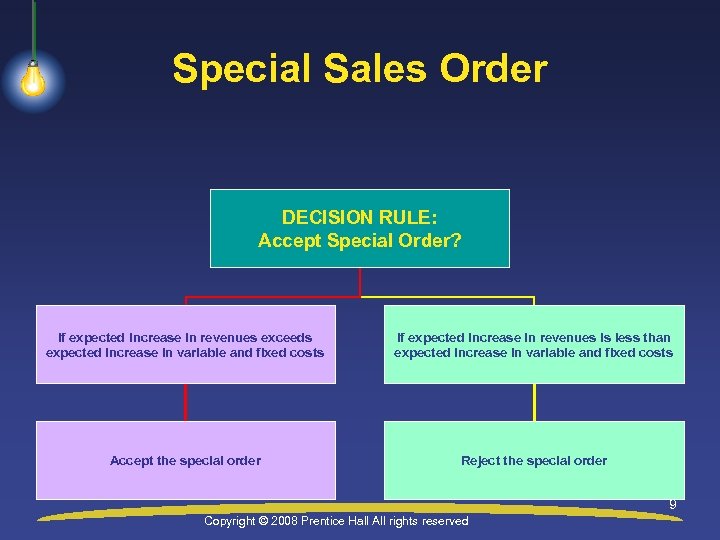

Special Sales Order A customer requests a one-time order at a reduced sale price, often for a large quantity: Do we have excess capacity available to fill this order? Yes No Consider further Reject the special order 8 Copyright © 2008 Prentice Hall All rights reserved

Special Sales Order DECISION RULE: Accept Special Order? If expected increase in revenues exceeds expected increase in variable and fixed costs If expected increase in revenues is less than expected increase in variable and fixed costs Accept the special order Reject the special order 9 Copyright © 2008 Prentice Hall All rights reserved

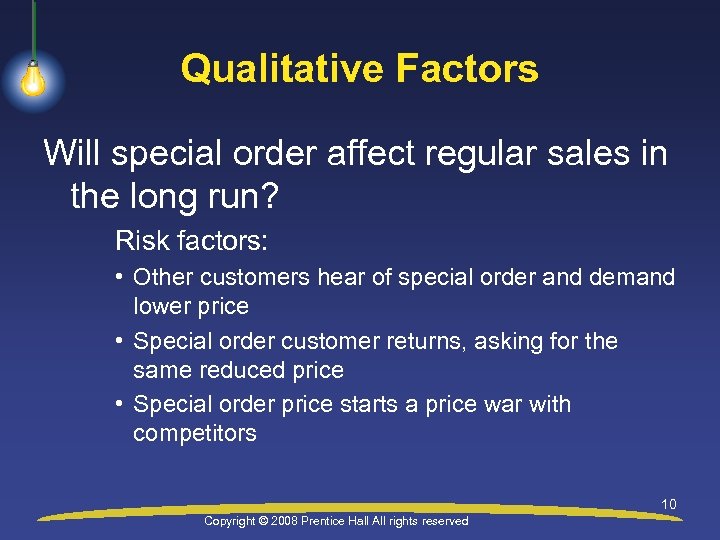

Qualitative Factors Will special order affect regular sales in the long run? Risk factors: • Other customers hear of special order and demand lower price • Special order customer returns, asking for the same reduced price • Special order price starts a price war with competitors 10 Copyright © 2008 Prentice Hall All rights reserved

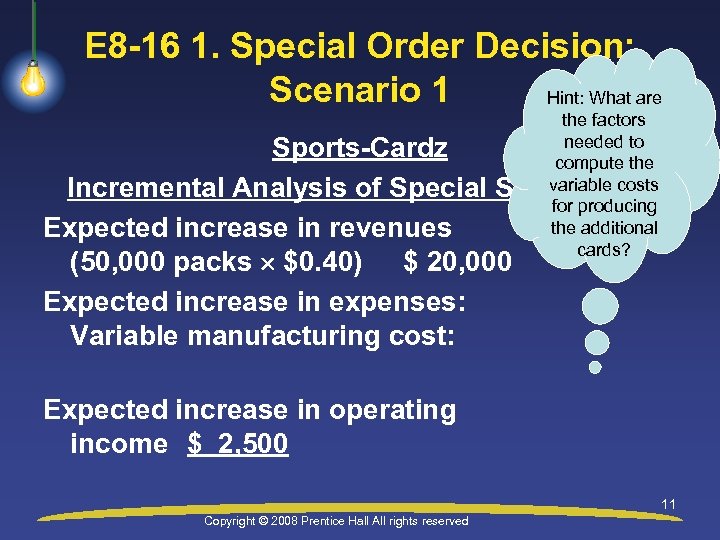

E 8 -16 1. Special Order Decision: Scenario 1 Hint: What are the factors needed to compute the variable costs Sales Order for producing the additional cards? Sports-Cardz Incremental Analysis of Special Expected increase in revenues (50, 000 packs $0. 40) $ 20, 000 Expected increase in expenses: Variable manufacturing cost: Expected increase in operating income $ 2, 500 11 Copyright © 2008 Prentice Hall All rights reserved

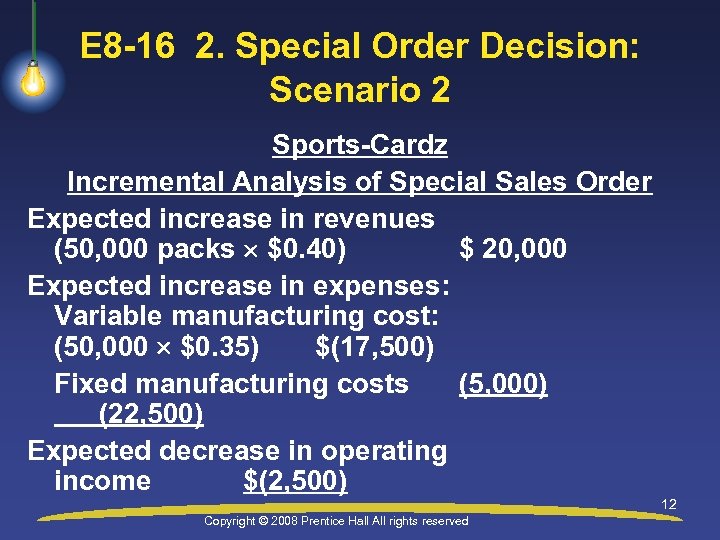

E 8 -16 2. Special Order Decision: Scenario 2 Sports-Cardz Incremental Analysis of Special Sales Order Expected increase in revenues (50, 000 packs $0. 40) $ 20, 000 Expected increase in expenses: Variable manufacturing cost: (50, 000 $0. 35) $(17, 500) Fixed manufacturing costs (5, 000) (22, 500) Expected decrease in operating income $(2, 500) 12 Copyright © 2008 Prentice Hall All rights reserved

Objective 3 Make pricing decisions 13 Copyright © 2008 Prentice Hall All rights reserved

Regular Pricing Considerations • What is our target profit? • How much will customers pay? • Are we a price-taker or a price-setter for this product? 14 Copyright © 2008 Prentice Hall All rights reserved

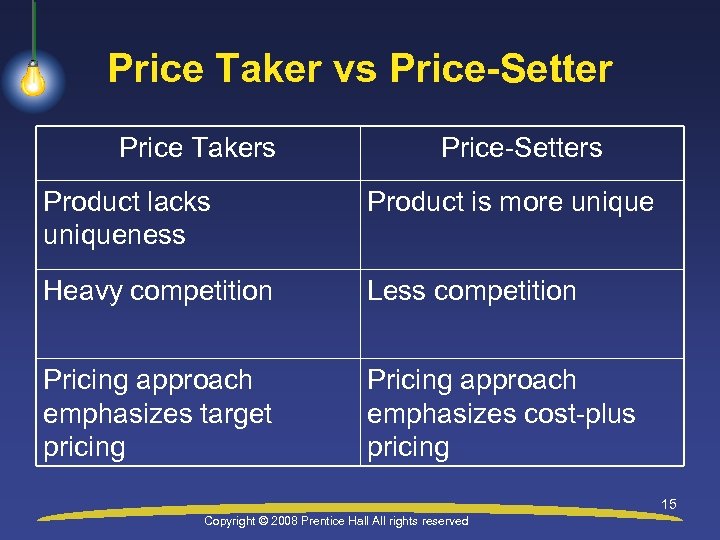

Price Taker vs Price-Setter Price Takers Price-Setters Product lacks uniqueness Product is more unique Heavy competition Less competition Pricing approach emphasizes target pricing Pricing approach emphasizes cost-plus pricing 15 Copyright © 2008 Prentice Hall All rights reserved

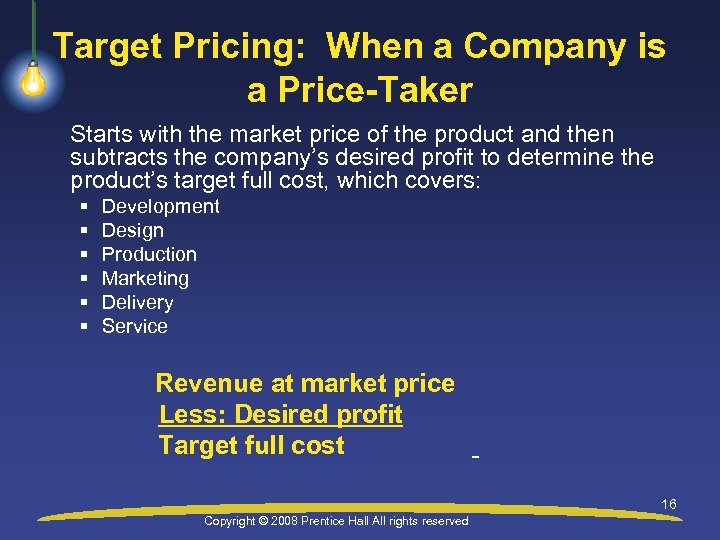

Target Pricing: When a Company is a Price-Taker Starts with the market price of the product and then subtracts the company’s desired profit to determine the product’s target full cost, which covers: § § § Development Design Production Marketing Delivery Service Revenue at market price Less: Desired profit Target full cost 16 Copyright © 2008 Prentice Hall All rights reserved

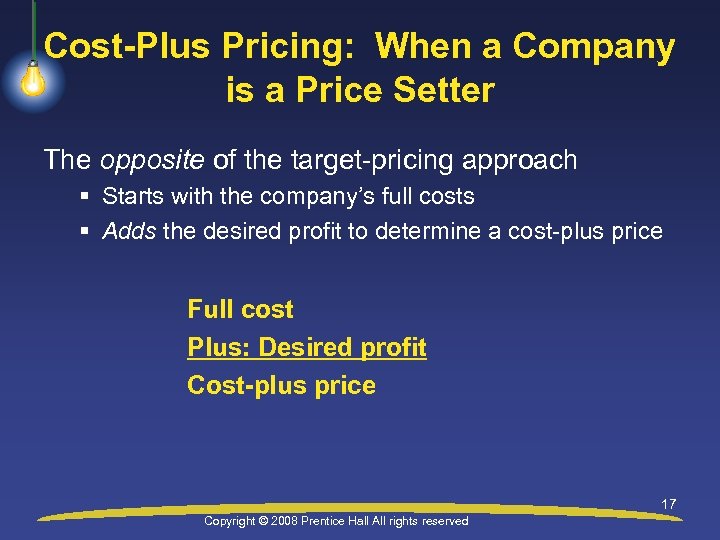

Cost-Plus Pricing: When a Company is a Price Setter The opposite of the target-pricing approach § Starts with the company’s full costs § Adds the desired profit to determine a cost-plus price Full cost Plus: Desired profit Cost-plus price 17 Copyright © 2008 Prentice Hall All rights reserved

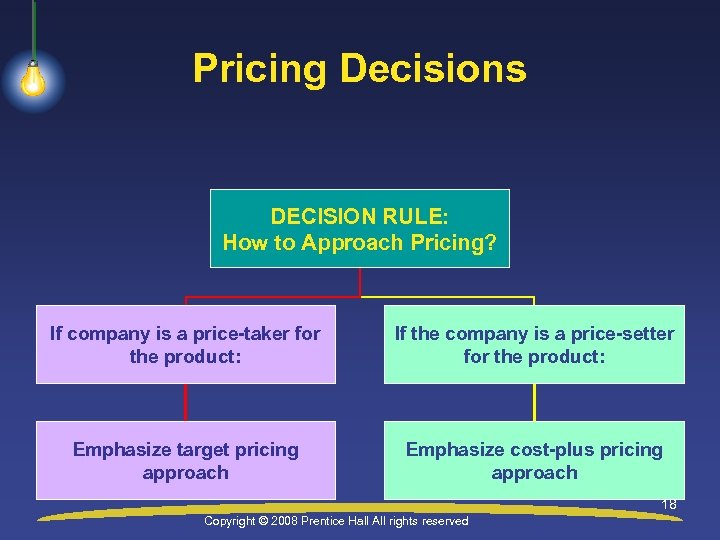

Pricing Decisions DECISION RULE: How to Approach Pricing? If company is a price-taker for the product: If the company is a price-setter for the product: Emphasize target pricing approach Emphasize cost-plus pricing approach 18 Copyright © 2008 Prentice Hall All rights reserved

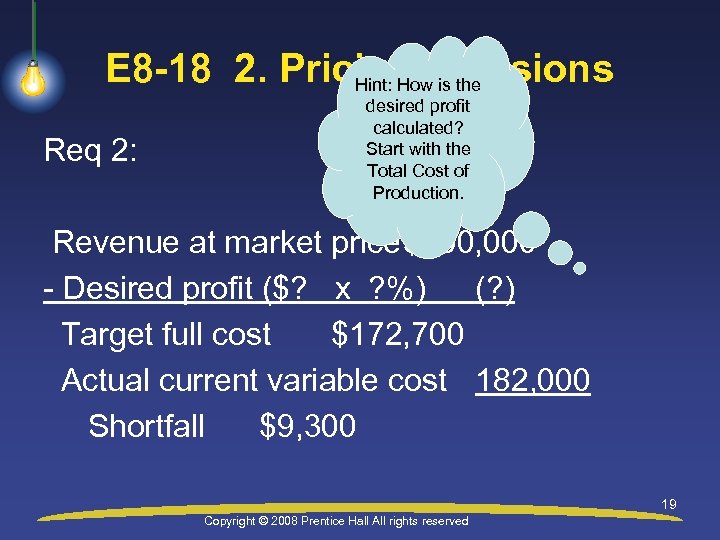

E 8 -18 2. Pricing Decisions Hint: How is the Req 2: desired profit calculated? Start with the Total Cost of Production. Revenue at market price$200, 000 - Desired profit ($? x ? %) (? ) Target full cost $172, 700 Actual current variable cost 182, 000 Shortfall $9, 300 19 Copyright © 2008 Prentice Hall All rights reserved

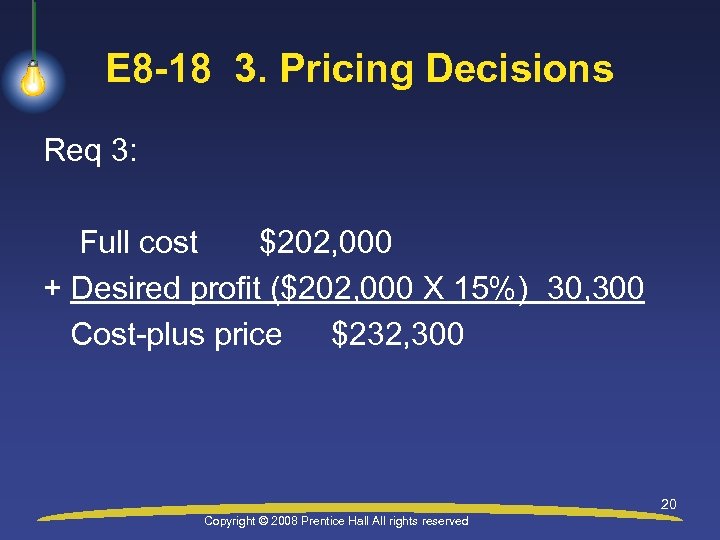

E 8 -18 3. Pricing Decisions Req 3: Full cost $202, 000 + Desired profit ($202, 000 X 15%) 30, 300 Cost-plus price $232, 300 20 Copyright © 2008 Prentice Hall All rights reserved

Objective 4 Make dropping a product, department or territory decisions 21 Copyright © 2008 Prentice Hall All rights reserved

Considerations for Dropping Products, Departments or Territories • Does product provide positive contribution margin? • Will fixed costs continue to exist, even if we drop the product? • Are there any direct fixed costs that can be avoided if we drop the product? • Will dropping the product affect sales of the company’s other products? • What can be done with the freed capacity? 22 Copyright © 2008 Prentice Hall All rights reserved

Dropping Products, Departments or Territories • Are there unavoidable fixed costs? § Unavoidable fixed costs continue even if the product line is dropped ; they are irrelevant because they will not differ between alternatives • Are there avoidable fixed costs? § If a cost will not be incurred if a product line is dropped, the cost is relevant to the decision because it causes a difference between alternatives 23 Copyright © 2008 Prentice Hall All rights reserved

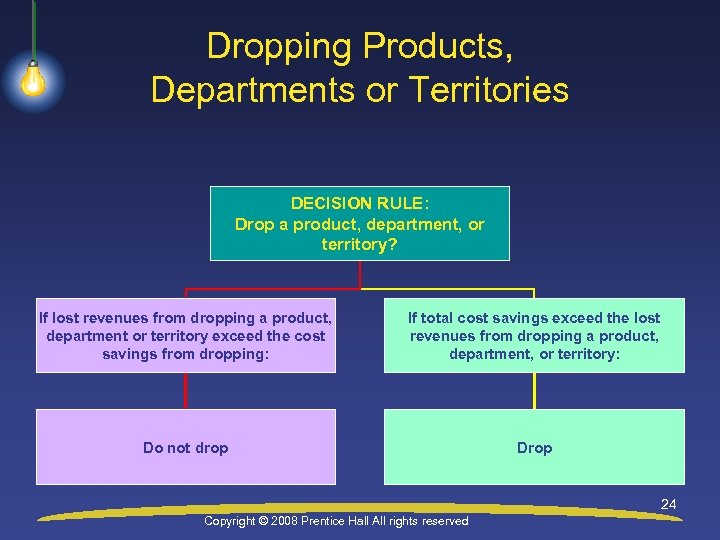

Dropping Products, Departments or Territories DECISION RULE: Drop a product, department, or territory? If lost revenues from dropping a product, department or territory exceed the cost savings from dropping: If total cost savings exceed the lost revenues from dropping a product, department, or territory: Do not drop Drop 24 Copyright © 2008 Prentice Hall All rights reserved

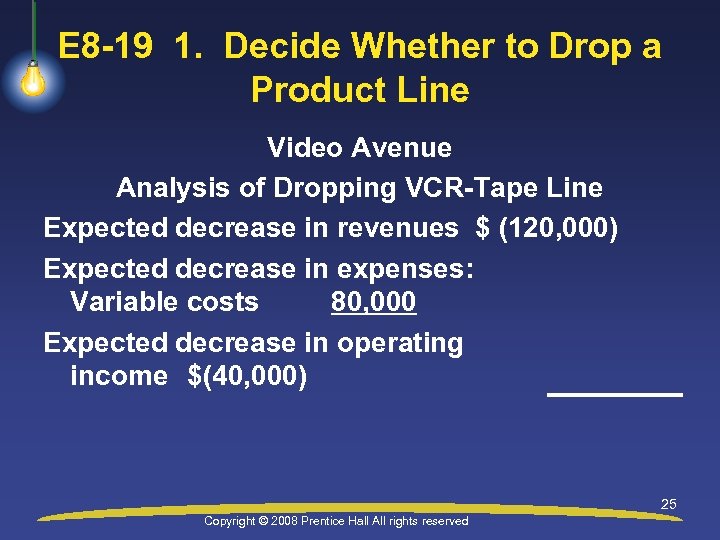

E 8 -19 1. Decide Whether to Drop a Product Line Video Avenue Analysis of Dropping VCR-Tape Line Expected decrease in revenues $ (120, 000) Expected decrease in expenses: Variable costs 80, 000 Expected decrease in operating income $(40, 000) 25 Copyright © 2008 Prentice Hall All rights reserved

Objective 5 Make product-mix decisions 26 Copyright © 2008 Prentice Hall All rights reserved

Product Mix Considerations • What constraint(s) stops us from making (or displaying) all the units we can sell? • Which products offer the highest contribution margin per unit of the constraint? • Would emphasizing one product over another affect fixed costs? 27 Copyright © 2008 Prentice Hall All rights reserved

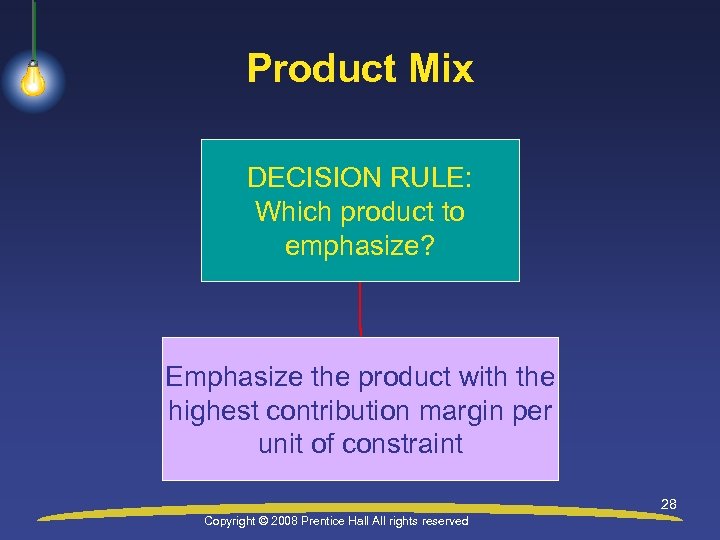

Product Mix DECISION RULE: Which product to emphasize? Emphasize the product with the highest contribution margin per unit of constraint 28 Copyright © 2008 Prentice Hall All rights reserved

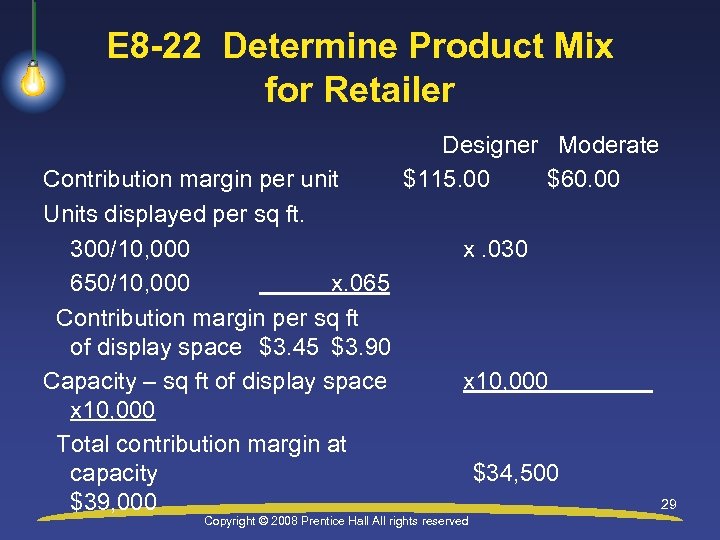

E 8 -22 Determine Product Mix for Retailer Contribution margin per unit Units displayed per sq ft. 300/10, 000 650/10, 000 x. 065 Contribution margin per sq ft of display space $3. 45 $3. 90 Capacity – sq ft of display space x 10, 000 Total contribution margin at capacity $39, 000 Designer Moderate $115. 00 $60. 00 x. 030 x 10, 000 Copyright © 2008 Prentice Hall All rights reserved $34, 500 29

Objective 6 Make outsourcing (make or buy) decisions 30 Copyright © 2008 Prentice Hall All rights reserved

Outsourcing (Make or Buy) Considerations • How do our variable costs compare to the outsourcing cost? • Are any fixed costs avoidable if we outsource? • What could we do with the freed capacity? 31 Copyright © 2008 Prentice Hall All rights reserved

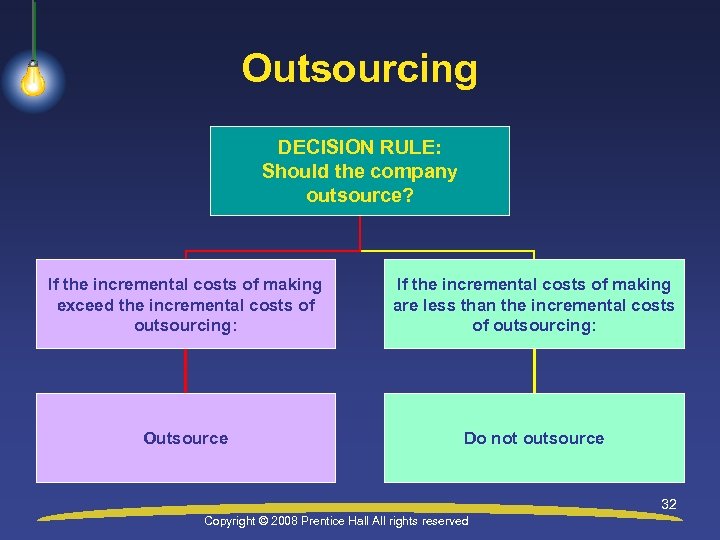

Outsourcing DECISION RULE: Should the company outsource? If the incremental costs of making exceed the incremental costs of outsourcing: If the incremental costs of making are less than the incremental costs of outsourcing: Outsource Do not outsource 32 Copyright © 2008 Prentice Hall All rights reserved

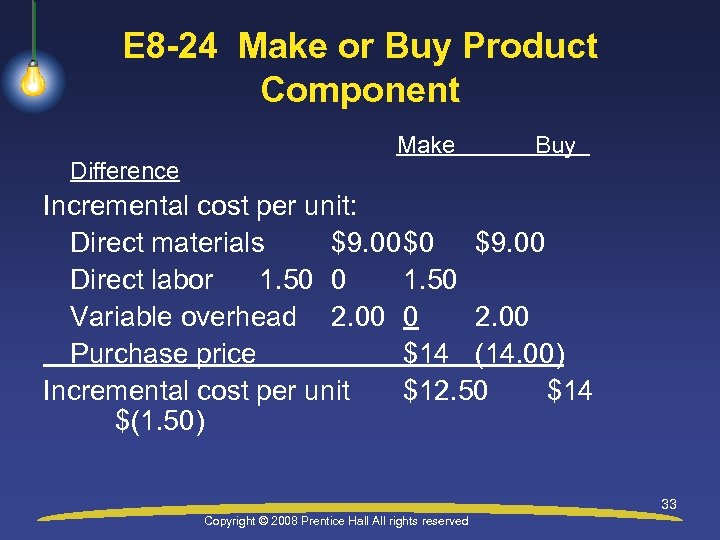

E 8 -24 Make or Buy Product Component Difference Make Buy Incremental cost per unit: Direct materials $9. 00$0 $9. 00 Direct labor 1. 50 0 1. 50 Variable overhead 2. 00 0 2. 00 Purchase price $14 (14. 00) Incremental cost per unit $12. 50 $14 $(1. 50) 33 Copyright © 2008 Prentice Hall All rights reserved

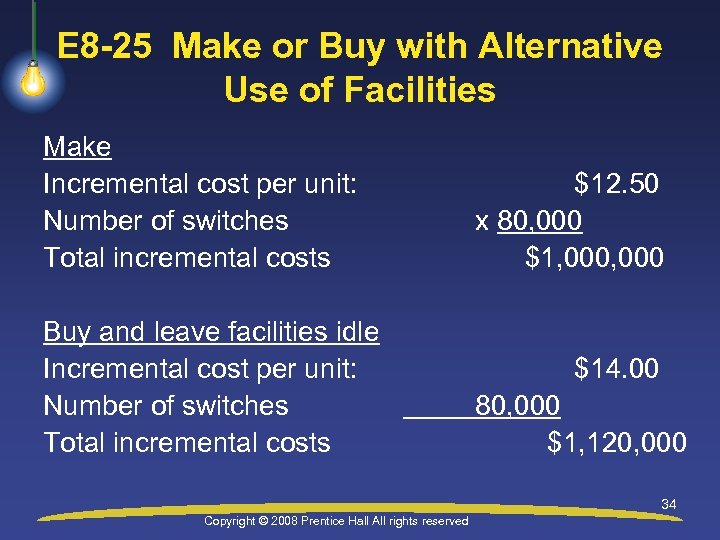

E 8 -25 Make or Buy with Alternative Use of Facilities Make Incremental cost per unit: Number of switches Total incremental costs Buy and leave facilities idle Incremental cost per unit: Number of switches Total incremental costs $12. 50 x 80, 000 $1, 000 $14. 00 80, 000 $1, 120, 000 34 Copyright © 2008 Prentice Hall All rights reserved

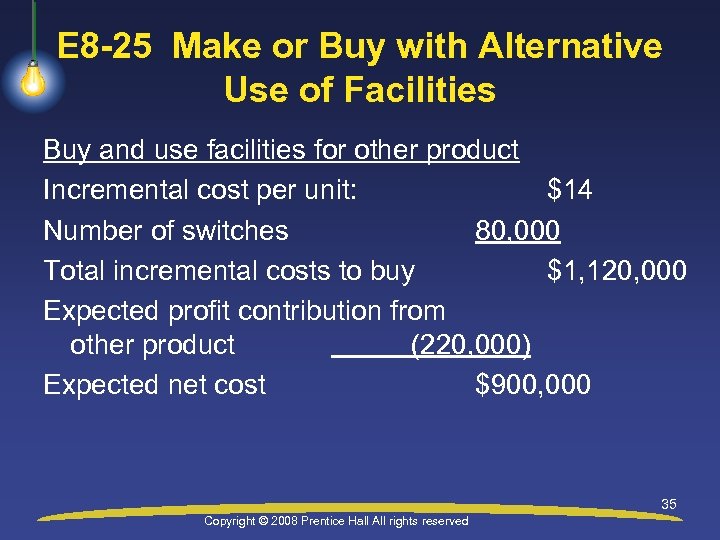

E 8 -25 Make or Buy with Alternative Use of Facilities Buy and use facilities for other product Incremental cost per unit: $14 Number of switches 80, 000 Total incremental costs to buy $1, 120, 000 Expected profit contribution from other product (220, 000) Expected net cost $900, 000 35 Copyright © 2008 Prentice Hall All rights reserved

Objective 7 Make “sell as is” or “process further” decisions 36 Copyright © 2008 Prentice Hall All rights reserved

Sell As-Is or Process Further Considerations • How much revenue is generated if we sell the product as is? • How much revenue is generated if we sell the product after processing it further? • How much will it cost to process the product further? 37 Copyright © 2008 Prentice Hall All rights reserved

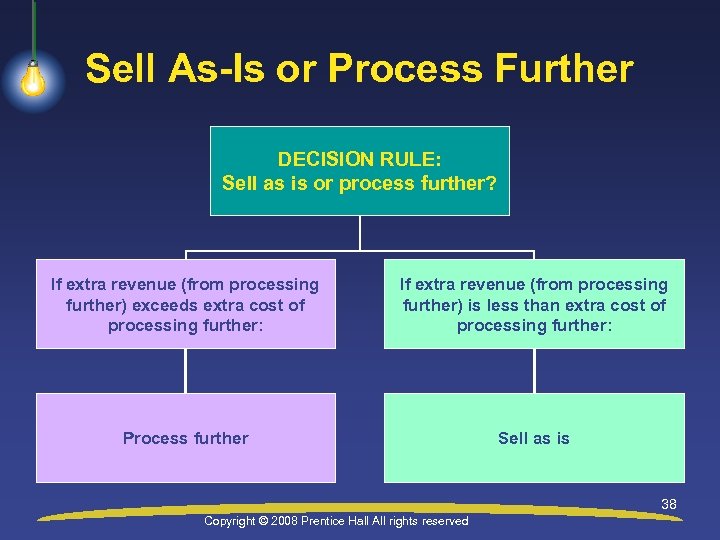

Sell As-Is or Process Further DECISION RULE: Sell as is or process further? If extra revenue (from processing further) exceeds extra cost of processing further: If extra revenue (from processing further) is less than extra cost of processing further: Process further Sell as is 38 Copyright © 2008 Prentice Hall All rights reserved

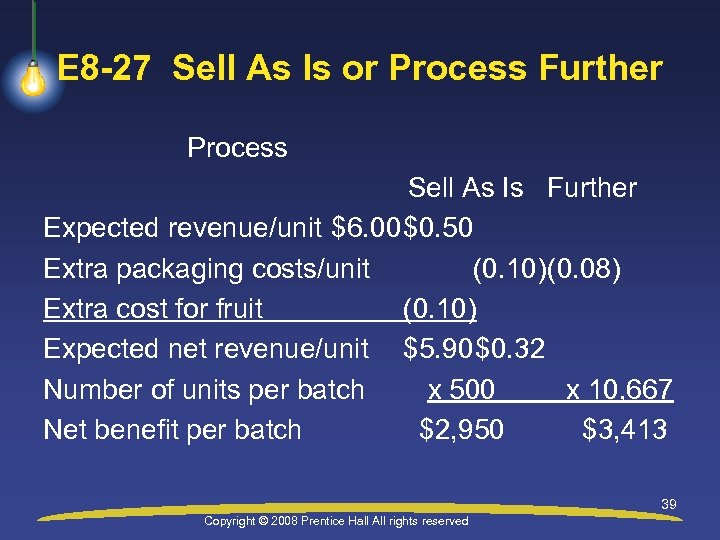

E 8 -27 Sell As Is or Process Further Process Sell As Is Further Expected revenue/unit $6. 00$0. 50 Extra packaging costs/unit (0. 10)(0. 08) Extra cost for fruit (0. 10) Expected net revenue/unit $5. 90$0. 32 Number of units per batch x 500 x 10, 667 Net benefit per batch $2, 950 $3, 413 39 Copyright © 2008 Prentice Hall All rights reserved

End of Chapter 8 40 Copyright © 2008 Prentice Hall All rights reserved

57c45487904e53edf5cad941c13a997c.ppt