8dfd30ad596b54e510ffb1ef5c39152d.ppt

- Количество слайдов: 40

Short Sea Shipping in Latin America TRB Annual Meeting Robert West Omni Shoreham Hotel Managing Director Washington, DC Global Trade & Transportation 781 -301 -9078 robert. west@globalinsight. com January 11, 2004 Copyright © 2004 Global Insight, Inc.

Agenda • Cabotage in Central America • Cabotage in South America Copyright © 2004 Global Insight, Inc 2

Definitions • Cabotage – Cargo and passenger traffic by sea, between ports within a country. • Regional Cabotage – Cargo and passenger traffic by sea, between ports within an agreed region. • Feeder – Maritime movement from one port to another where a transoceanic vessel then exports the cargo (reverse for imports). Copyright © 2004 Global Insight, Inc 3

Central America Cabotage Feasibility Study Develop Regional Cabotage as a complementary and competitive alternative to land transport, with substantial participation in both intra-regional and extra-regional trade – through feeder services between the region’s ports, to reduce total transportation costs and increase the cargo volumes through the ports. Copyright © 2004 Global Insight, Inc 4

Ship Definitions • Roll-On/Roll-Off (Ro/Ro) – Ship that transports wheeled cargo over a ramp for loading/unloading. It can carry cars, busses, trucks depending on its design. • Lift-On/Lift-Off (Lo/Lo) – Container ship, using onboard crane or land-based carne. • Roll-On/Lift-Off (Ro/Lo) – Ship that combines the above two features. • TEU - Twenty-foot Equivalent Unit, Standard measurement of containerized cargo. A 40’ container equals 2 TEU’s. Copyright © 2004 Global Insight, Inc 5

Cabotage can be an integral part of the supply chain. • Complements road transportation • Environmentally favorable – Less contamination – Lower road maintenance and repair costs • Ship versus rail and truck capacities (Europe): – 7, 451 tons of general cargo are equivalent to: • 291 trucks, or • 10 trains, or • 1 average size Ro. Ro Copyright © 2004 Global Insight, Inc 6

Cabotage in Central America Not much now, but - - - Copyright © 2004 Global Insight, Inc 7

Projections – Central America • Cabotage Atlántic/Pacífic • Feeder Atlántic/Pacífic Copyright © 2004 Global Insight, Inc 8

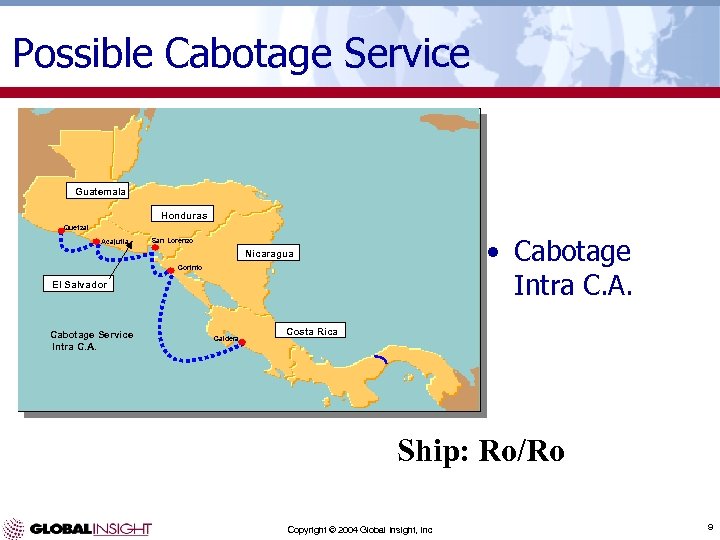

Possible Cabotage Service Guatemala Honduras Quetzal Acajutla • Cabotage Intra C. A. San Lorenzo Nicaragua Corinto El Salvador Cabotage Service Intra C. A. Caldera Costa Rica Ship: Ro/Ro Copyright © 2004 Global Insight, Inc 9

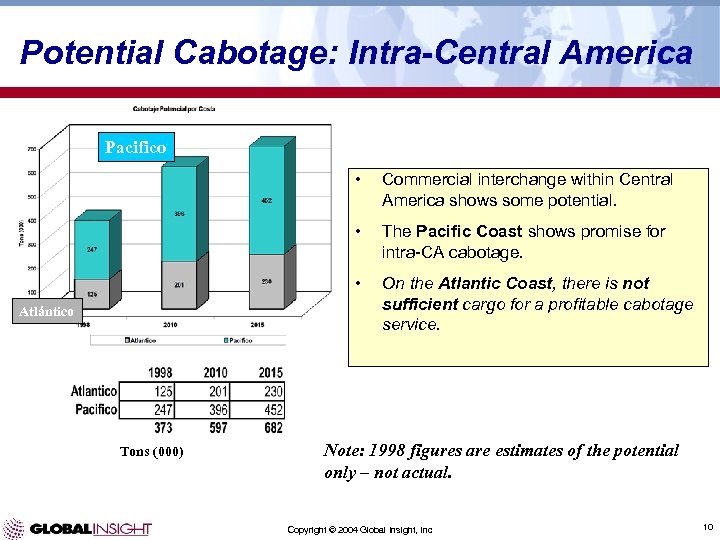

Potential Cabotage: Intra-Central America Pacifico • • Tons (000) The Pacific Coast shows promise for intra-CA cabotage. • Atlántico Commercial interchange within Central America shows some potential. On the Atlantic Coast, there is not sufficient cargo for a profitable cabotage service. Note: 1998 figures are estimates of the potential only – not actual. Copyright © 2004 Global Insight, Inc 10

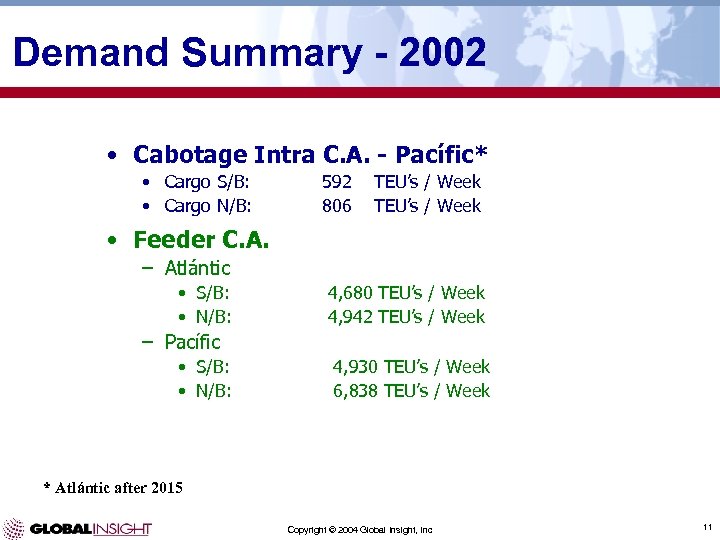

Demand Summary - 2002 • Cabotage Intra C. A. - Pacífic* • Cargo S/B: • Cargo N/B: 592 806 TEU’s / Week • Feeder C. A. – Atlántic • S/B: • N/B: 4, 680 TEU’s / Week 4, 942 TEU’s / Week – Pacífic • S/B: • N/B: 4, 930 TEU’s / Week 6, 838 TEU’s / Week * Atlántic after 2015 Copyright © 2004 Global Insight, Inc 11

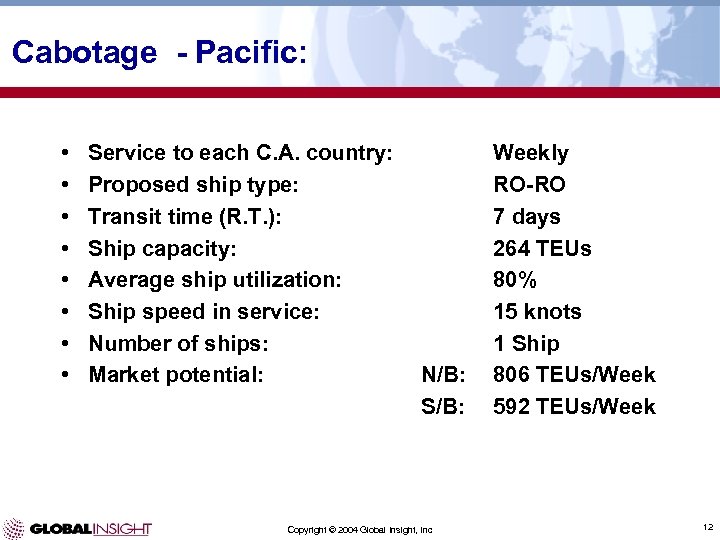

Cabotage - Pacific: • • Service to each C. A. country: Proposed ship type: Transit time (R. T. ): Ship capacity: Average ship utilization: Ship speed in service: Number of ships: Market potential: N/B: S/B: Copyright © 2004 Global Insight, Inc Weekly RO-RO 7 days 264 TEUs 80% 15 knots 1 Ship 806 TEUs/Week 592 TEUs/Week 12

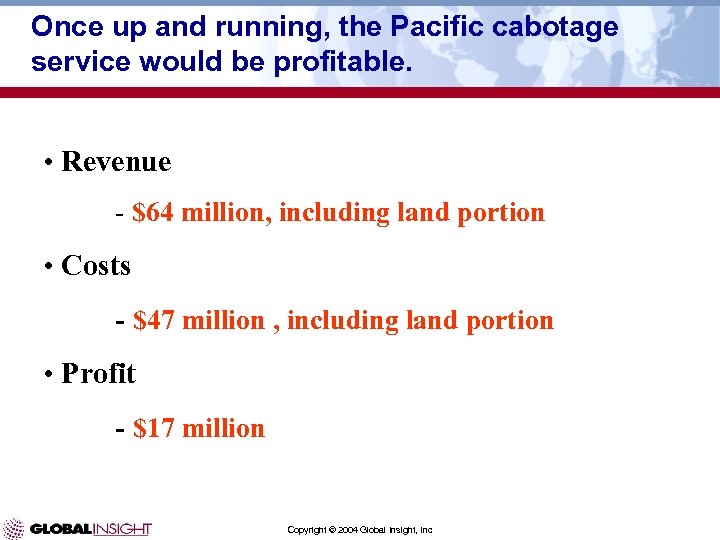

Once up and running, the Pacific cabotage service would be profitable. • Revenue - $64 million, including land portion • Costs - $47 million , including land portion • Profit - $17 million Copyright © 2004 Global Insight, Inc

Cooperation with the truckers - Experience in Other Countries • Cabotage is complementary, not competitive • Compatibility of land sea equipment • Contractual flexibility between sea and truck: – European experience • Involvement of the trucker in maritime transport: – As stockholder or partner Copyright © 2004 Global Insight, Inc 14

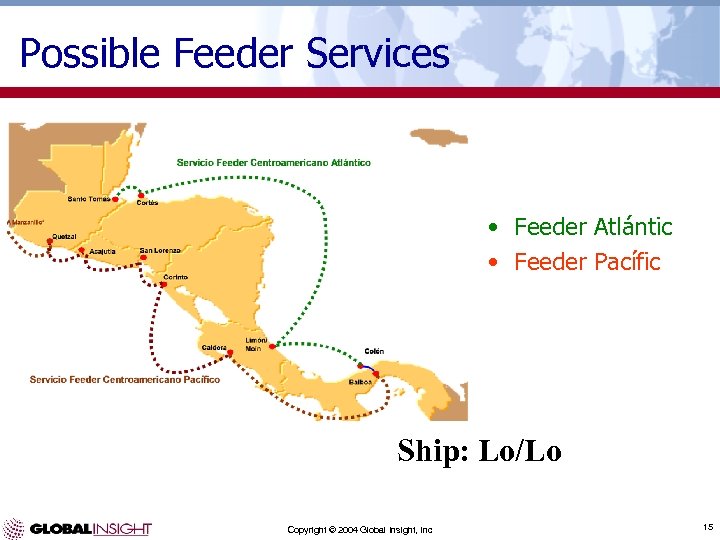

Possible Feeder Services • Feeder Atlántic • Feeder Pacífic Ship: Lo/Lo Copyright © 2004 Global Insight, Inc 15

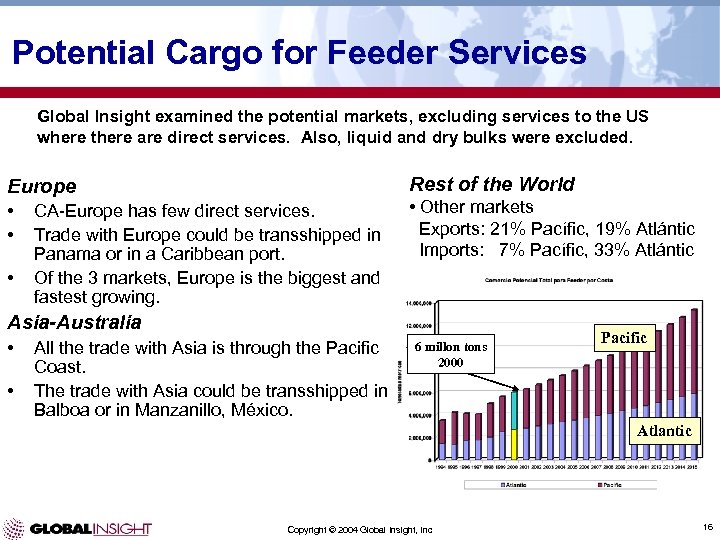

Potential Cargo for Feeder Services Global Insight examined the potential markets, excluding services to the US where there are direct services. Also, liquid and dry bulks were excluded. Rest of the World Europe • • • CA-Europe has few direct services. Trade with Europe could be transshipped in Panama or in a Caribbean port. Of the 3 markets, Europe is the biggest and fastest growing. • Other markets Exports: 21% Pacífic, 19% Atlántic Imports: 7% Pacífic, 33% Atlántic Asia-Australia • • All the trade with Asia is through the Pacific Coast. The trade with Asia could be transshipped in Balboa or in Manzanillo, México. 6 millon tons 2000 Pacific Atlantic Copyright © 2004 Global Insight, Inc 16

Feeder on the Atlantic – Central America • • Service in all CA nations, and Panama: Proposed ship type: Transit Time (RT): Ship capacity: Average ship utilization: Ship speed in service: No. Ships in initial service: Potencial del Mercado: S/B: N/B: Copyright © 2004 Global Insight, Inc Weekly LO-LO 7 días 1, 130 Teu’s 50% 16 knots (Cap. 18) 1 ship 4, 680 Teu’s/Week 4, 942 Teu’s/Week 17

In the first full year of operation, the Pacific Feeder service would be profitable. • Revenue - $78 million, including land portion • Costs - $56 million , including land portion • Profit - $22 million Copyright © 2004 Global Insight, Inc

Combination Feeder - Cabotage on the Pacífic Ship: Ro/Lo * The Pacific Feeder service could transship in Manzaillo, Mexico, or in Balboa, Panama. Copyright © 2004 Global Insight, Inc 19

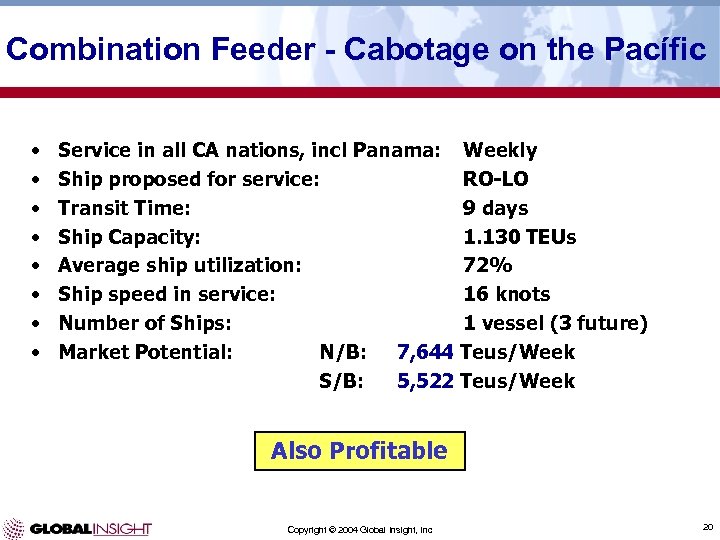

Combination Feeder - Cabotage on the Pacífic • • Service in all CA nations, incl Panama: Weekly Ship proposed for service: RO-LO Transit Time: 9 days Ship Capacity: 1. 130 TEUs Average ship utilization: 72% Ship speed in service: 16 knots Number of Ships: 1 vessel (3 future) Market Potential: N/B: 7, 644 Teus/Week S/B: 5, 522 Teus/Week Also Profitable Copyright © 2004 Global Insight, Inc 20

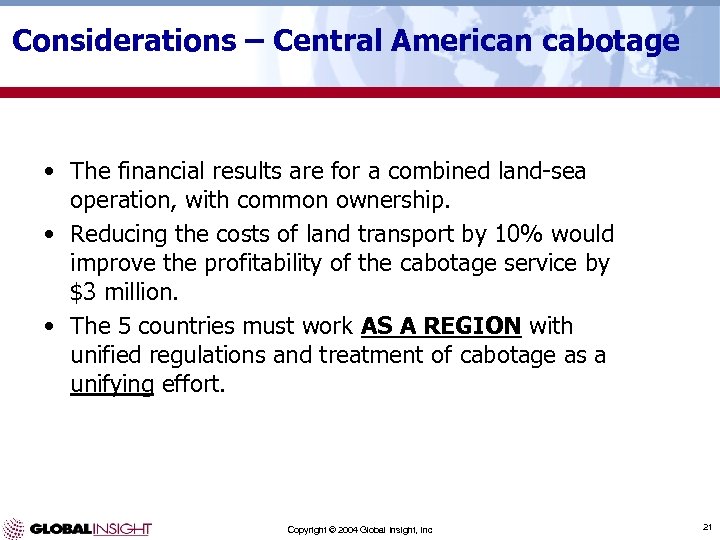

Considerations – Central American cabotage • The financial results are for a combined land-sea operation, with common ownership. • Reducing the costs of land transport by 10% would improve the profitability of the cabotage service by $3 million. • The 5 countries must work AS A REGION with unified regulations and treatment of cabotage as a unifying effort. Copyright © 2004 Global Insight, Inc 21

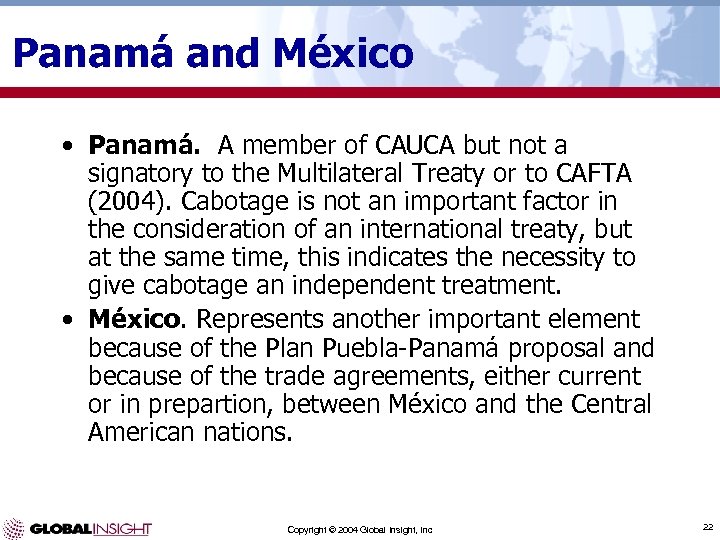

Panamá and México • Panamá. A member of CAUCA but not a signatory to the Multilateral Treaty or to CAFTA (2004). Cabotage is not an important factor in the consideration of an international treaty, but at the same time, this indicates the necessity to give cabotage an independent treatment. • México. Represents another important element because of the Plan Puebla-Panamá proposal and because of the trade agreements, either current or in prepartion, between México and the Central American nations. Copyright © 2004 Global Insight, Inc 22

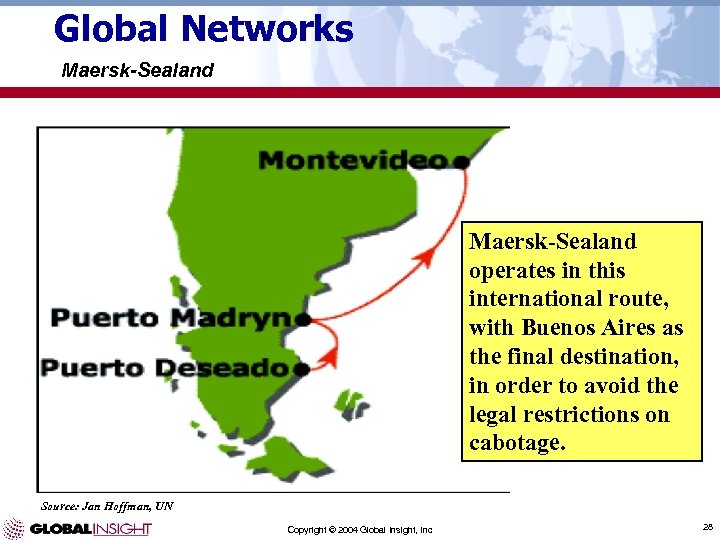

Maersk-Sealand already operates a related service. Source: Jan Hoffman, UN Copyright © 2004 Global Insight, Inc 23

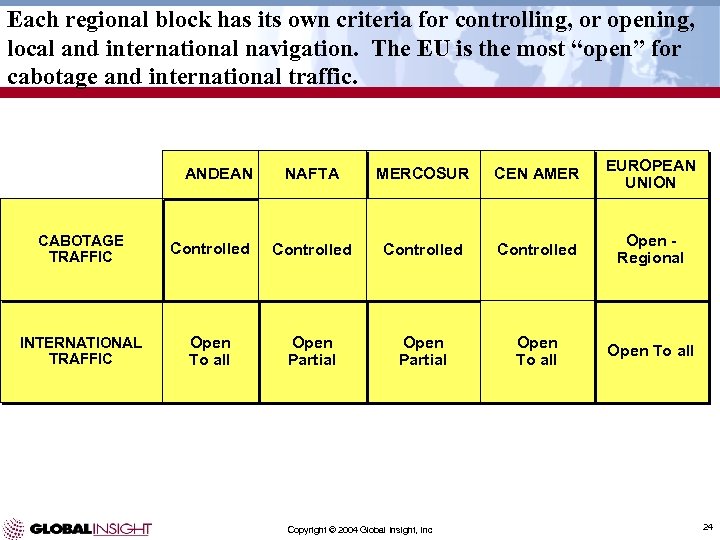

Each regional block has its own criteria for controlling, or opening, local and international navigation. The EU is the most “open” for cabotage and international traffic. ANDEAN NAFTA MERCOSUR CEN AMER EUROPEAN UNION CABOTAGE TRAFFIC Controlled Open Regional INTERNATIONAL TRAFFIC Open To all Open Partial Open To all Copyright © 2004 Global Insight, Inc 24

Cabotage in South America Great possibilities – Many problems Copyright © 2004 Global Insight, Inc 25

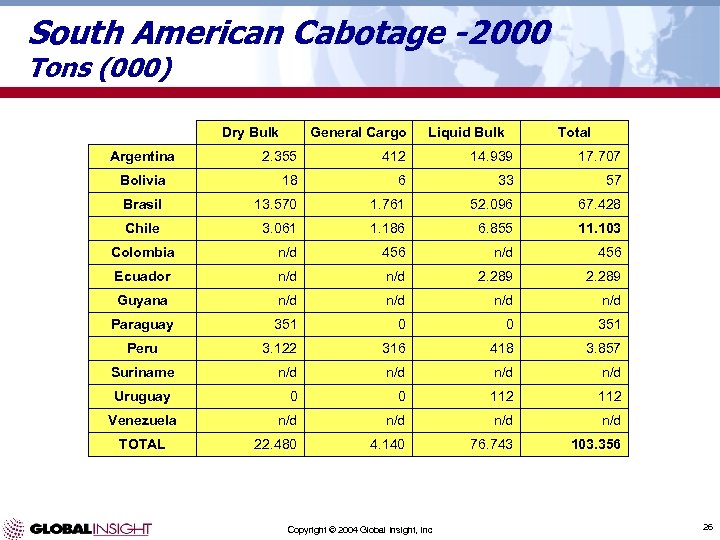

South American Cabotage -2000 Tons (000) Dry Bulk Argentina General Cargo Liquid Bulk Total 2. 355 412 14. 939 17. 707 Bolivia 18 6 33 57 Brasil 13. 570 1. 761 52. 096 67. 428 Chile 3. 061 1. 186 6. 855 11. 103 Colombia n/d 456 Ecuador n/d 2. 289 Guyana n/d n/d Paraguay 351 0 0 351 3. 122 316 418 3. 857 Suriname n/d n/d Uruguay 0 0 112 n/d n/d 22. 480 4. 140 76. 743 103. 356 Peru Venezuela TOTAL Copyright © 2004 Global Insight, Inc 26

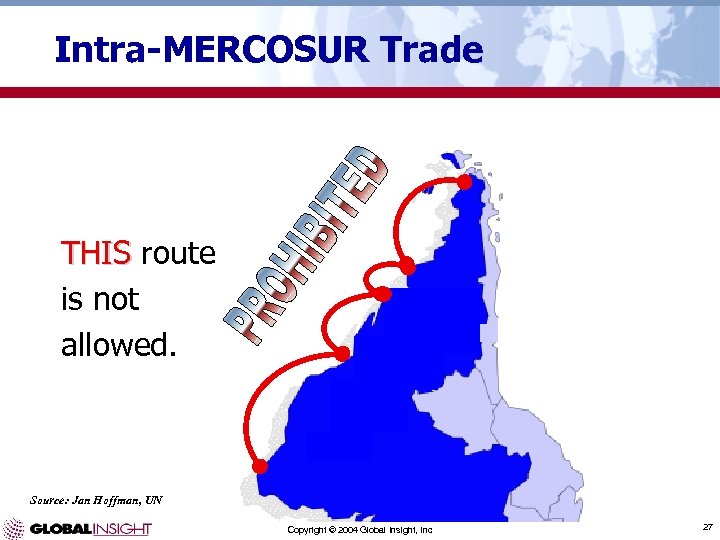

Intra-MERCOSUR Trade THIS route is not allowed. Source: Jan Hoffman, UN Copyright © 2004 Global Insight, Inc 27

Global Networks Maersk-Sealand operates in this international route, with Buenos Aires as the final destination, in order to avoid the legal restrictions on cabotage. Source: Jan Hoffman, UN Copyright © 2004 Global Insight, Inc 28

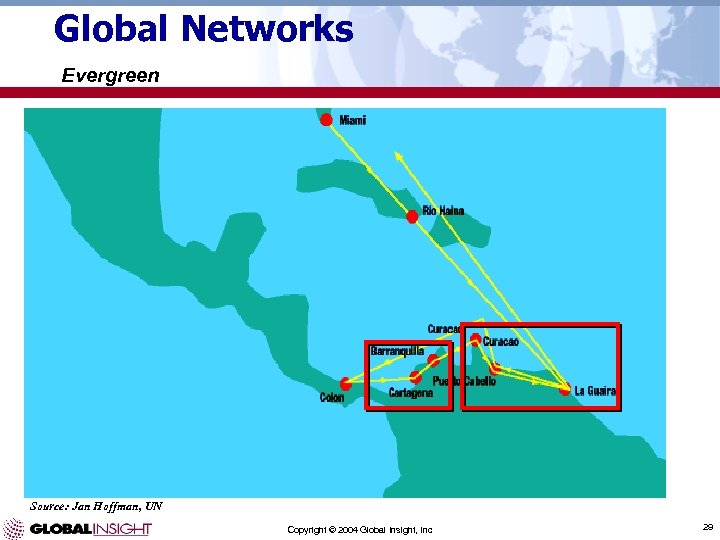

Global Networks Evergreen Source: Jan Hoffman, UN Copyright © 2004 Global Insight, Inc 29

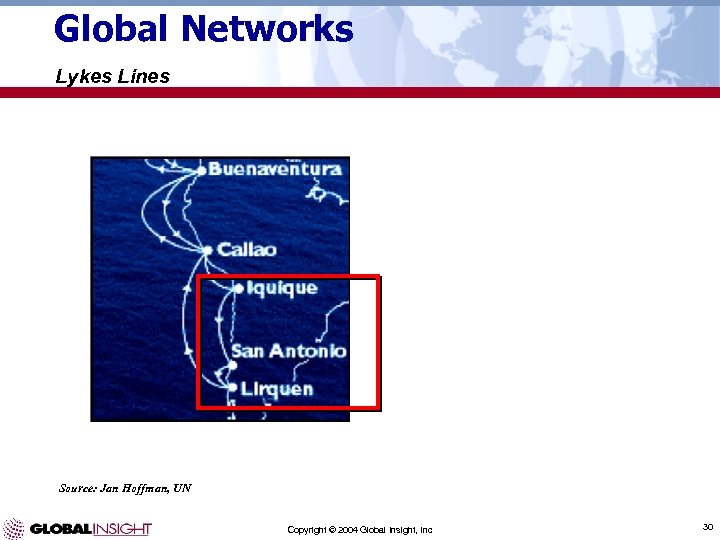

Global Networks Lykes Lines Source: Jan Hoffman, UN Copyright © 2004 Global Insight, Inc 30

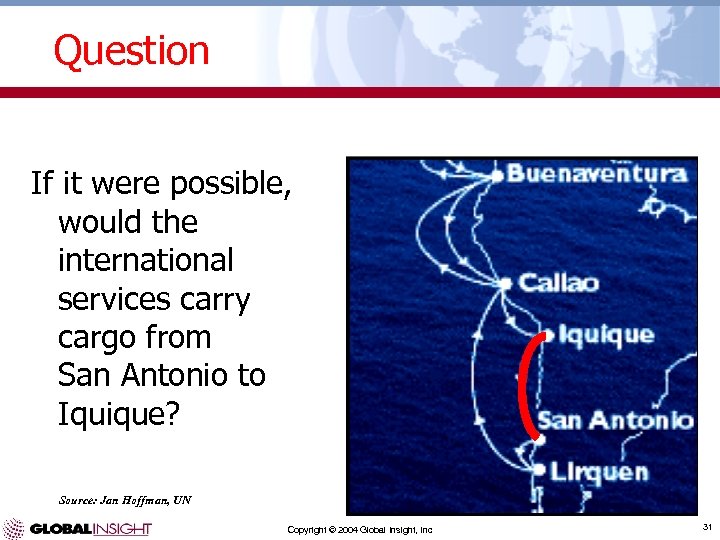

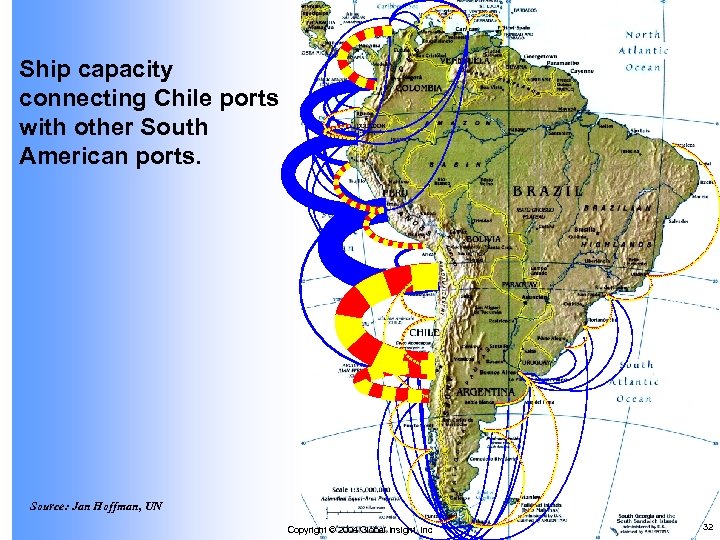

Question If it were possible, would the international services carry cargo from San Antonio to Iquique? Source: Jan Hoffman, UN Copyright © 2004 Global Insight, Inc 31

Ship capacity connecting Chile ports with other South American ports. Source: Jan Hoffman, UN Copyright © 2004 Global Insight, Inc 32

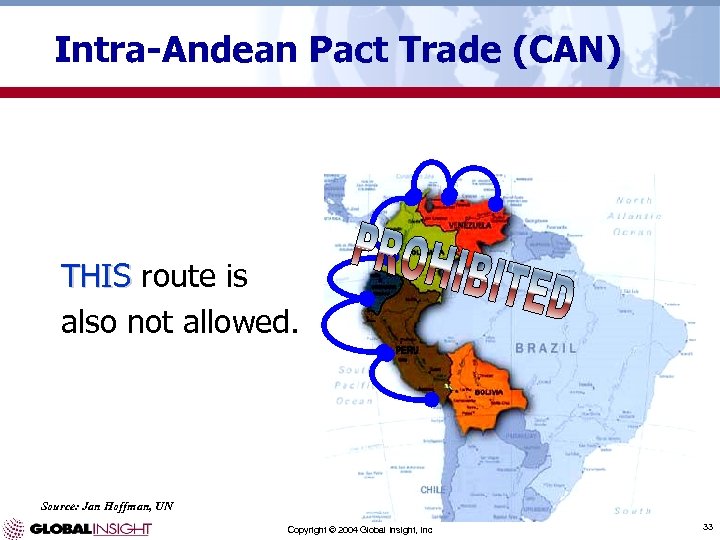

Intra-Andean Pact Trade (CAN) THIS route is also not allowed. Source: Jan Hoffman, UN Copyright © 2004 Global Insight, Inc 33

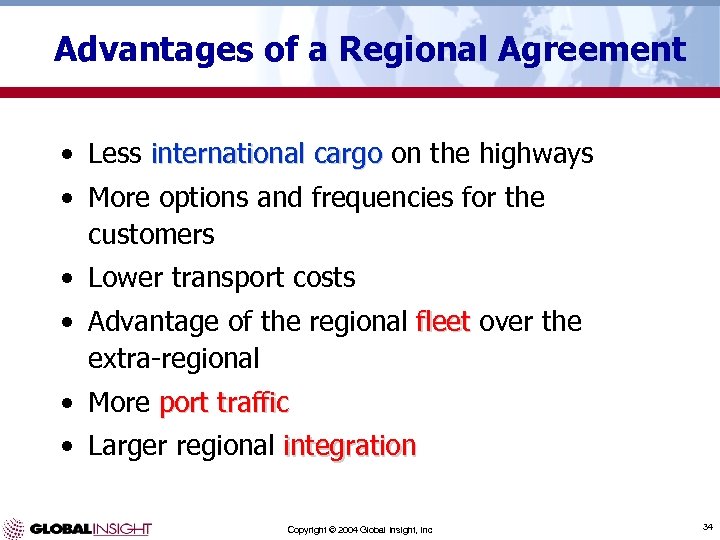

Advantages of a Regional Agreement • Less international cargo on the highways • More options and frequencies for the customers • Lower transport costs • Advantage of the regional fleet over the extra-regional • More port traffic • Larger regional integration Copyright © 2004 Global Insight, Inc 34

Example: European Union Factsheet 4. 5. 8. : “ Regulation 4055/86 applies the principle of open delivery of services for maritime transport among Member Countries and between Member Countries and third parties. ” parties Copyright © 2004 Global Insight, Inc 35

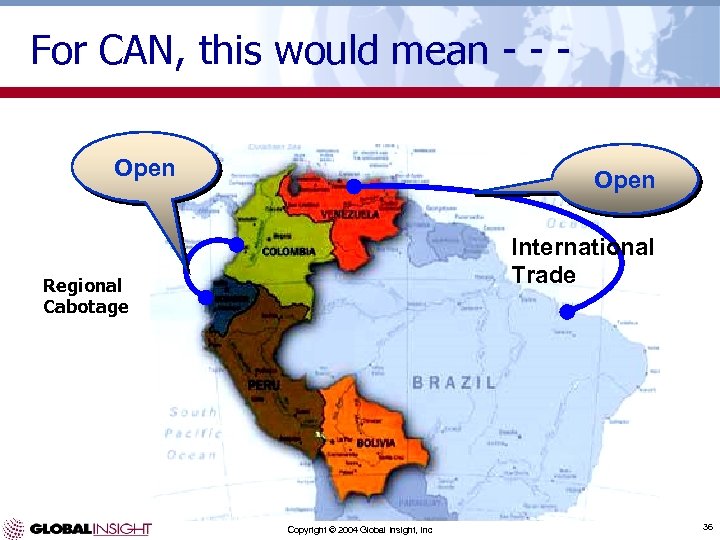

For CAN, this would mean - - Open International Trade Regional Cabotage Copyright © 2004 Global Insight, Inc 36

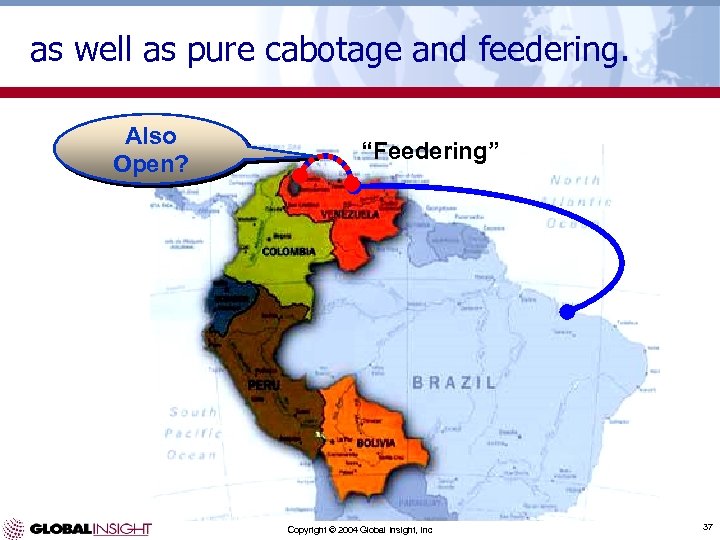

as well as pure cabotage and feedering. Also Open? “Feedering” Copyright © 2004 Global Insight, Inc 37

. . . even cabotage by international lines. International Lines would carry cargo between Buenaventura & Cartagena Copyright © 2004 Global Insight, Inc 38

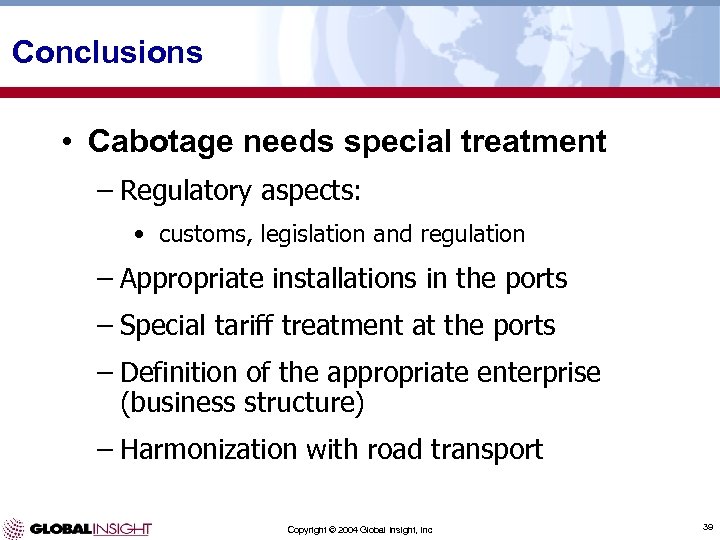

Conclusions • Cabotage needs special treatment – Regulatory aspects: • customs, legislation and regulation – Appropriate installations in the ports – Special tariff treatment at the ports – Definition of the appropriate enterprise (business structure) – Harmonization with road transport Copyright © 2004 Global Insight, Inc 39

Short Sea Shipping in Latin America TRB Annual Meeting Robert West Omni Shoreham Hotel Managing Director Washington, DC Global Trade & Transportation 781 -301 -9078 robert. west@globalinsight. com January 11, 2004 Copyright © 2004 Global Insight, Inc Copyright © 2003 Global Insight, Inc.

8dfd30ad596b54e510ffb1ef5c39152d.ppt