327396d98a0dea6bd06dadb171a97381.ppt

- Количество слайдов: 63

Short Run Costs 1

Production Processes X-Box Production http: //www. youtube. com/watch? v=dz. JUSFr 5 Ev. Q&feature=related KTM Factory http: //www. youtube. com/watch? v=jihqmd. X 0 jk. M 1939 River Rouge Plant http: //www. youtube. com/watch? v=Tc. Xfk 0 op 6 JA Scorpion Factory http: //www. youtube. com/watch? v=h. MCyqyyh 5 MA 2

Short Run versus Long Run? short run - a period of time where some inputs are fixed (capital = building, equipment, etc. ) n long run - a period of time in which all inputs can be varied (no inputs are fixed) n 3

Short Run Cost Function Definition: n A function that defines the minimum possible cost of producing each output level when variable factors are employed in the cost-minimizing fashion. (Based on the inability to change the fixed factors) 4

In this case, what is your total product/output (Q)? Number of Paninis (for simplicity assume that Panera only produces a single product). n In general a firm uses capital, labor and materials to produce the product/output where capital is often fixed in the short run. n 5

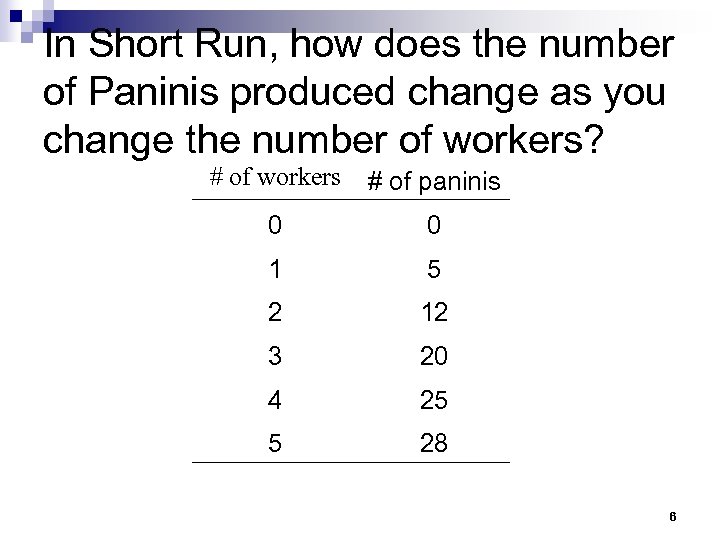

In Short Run, how does the number of Paninis produced change as you change the number of workers? # of workers # of paninis 0 0 1 5 2 12 3 20 4 25 5 28 6

How does output change if you hire one more person? n Depends on how many workers you currently have. Output increases by 5 paninis when you hire the 1 st worker, increases by 7 paninis when you hire the 2 nd worker, …. , and increases 3 paninis when you hire the 5 th worker. 7

What happens to “productivity” as the first few employees are hired? n Specialize and marginal product increases. Marginal Product is the change in total output attributable to the last unit of an input. 8

What would happen to “productivity” if you continued to hire more and more workers? Marginal product would start to fall because some inputs are fixed in the short run. n Law of diminishing marginal returns OR Law of diminishing marginal product. n 9

What costs would you have to pay even if you didn’t produce a single panini? n Fixed Costs, FC (or Total Fixed Costs, TFC) (often involves building and equipment) Fixed Costs = Costs that do not change with changes in output 10

What costs would you have to pay only if you produced paninis? n. Variable Costs, VC (or Total Variable Costs, TVC) (often assumed to be labor and material) Variable Costs = Costs that change with changes in output 11

What costs would increase if we wanted to produce one more panini? n Variable Costs (such as labor and materials) 12

If you hired more and more employees n and the store became more and more crowded until the marginal product of a worker started to fall, what would happen to the cost of producing one more panini (marginal cost)? Marginal cost = cost of producing an additional unit of output 13

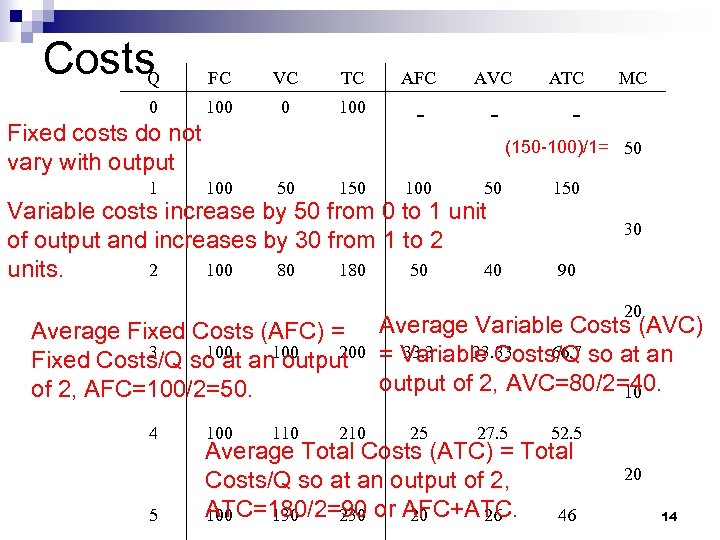

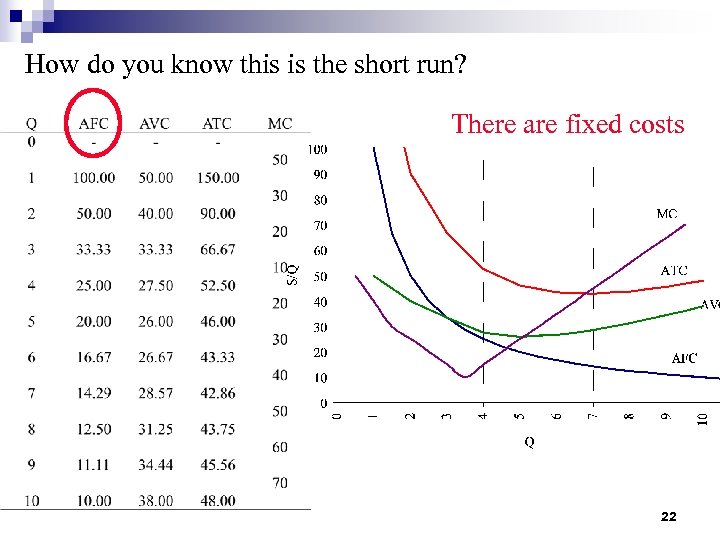

Costs Q FC VC TC AFC AVC 0 100 - - Fixed costs do not vary with output 1 50 150 - 100 50 Variable costs increase by 50 from 0 to 1 unit of output and increases by 30 from 1 to 2 2 100 80 180 50 40 units. MC (150 -100)/1= 50 100 ATC 150 30 90 20 Average Fixed Costs (AFC) = Average Variable Costs (AVC) 3 100 200 33. 33 66. 7 Fixed Costs/Q so at an 100 output = Variable Costs/Q so at an of 2, AFC=100/2=50. output of 2, AVC=80/2=40. 10 4 5 100 110 25 27. 5 52. 5 Average Total Costs (ATC) = Total Costs/Q so at an output of 2, ATC=180/2=90 or AFC+ATC. 100 130 20 26 46 20 14

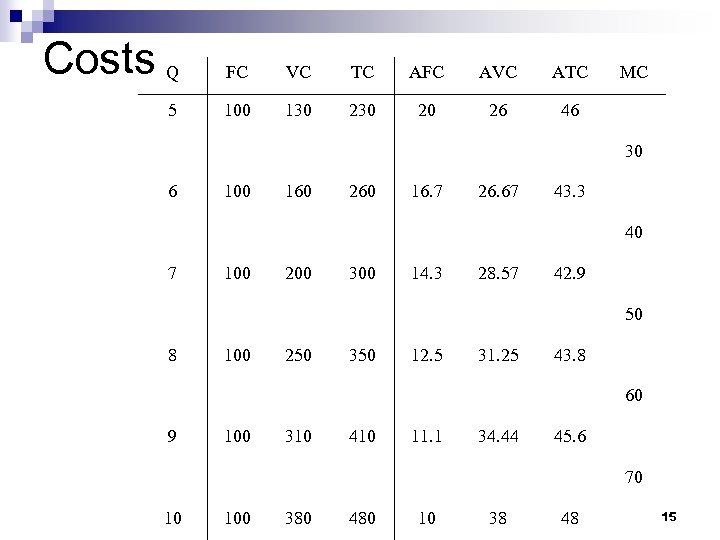

Costs Q FC VC TC AFC AVC ATC 5 100 130 20 26 46 6 100 160 7 100 200 100 250 26. 67 43. 3 300 40 14. 3 28. 57 42. 9 350 50 12. 5 31. 25 43. 8 100 310 10 16. 7 9 30 8 260 410 60 11. 1 34. 44 45. 6 100 380 480 MC 70 10 38 48 15

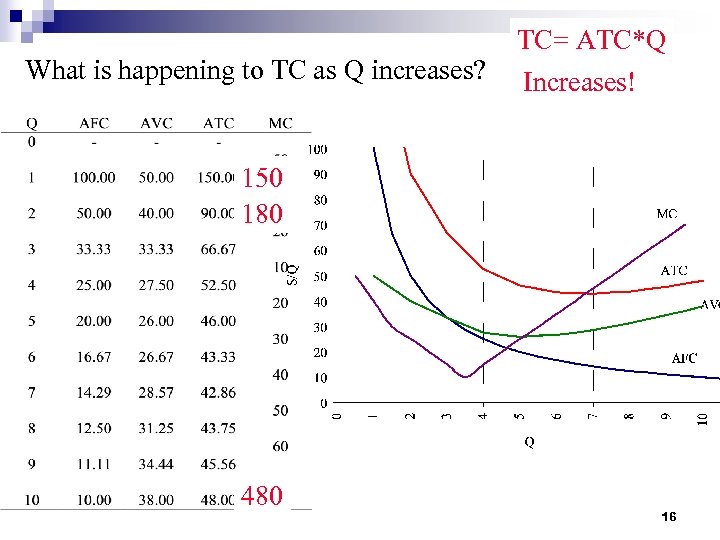

What is happening to TC as Q increases? TC= ATC*Q Increases! 150 180 480 16

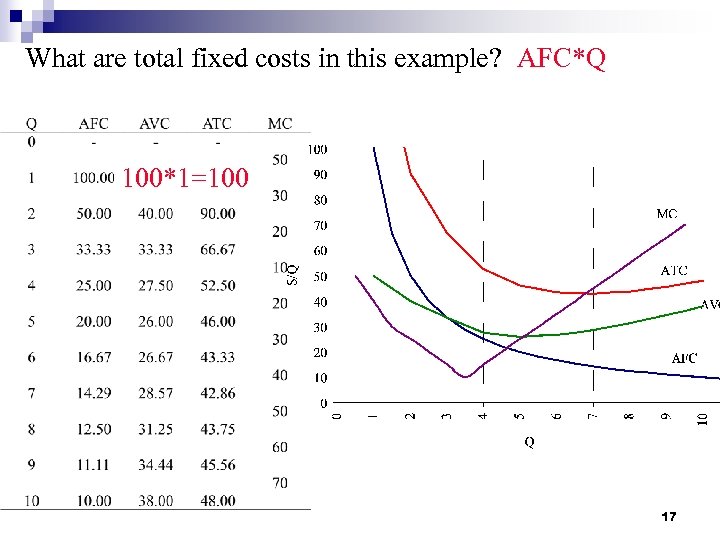

What are total fixed costs in this example? AFC*Q 100*1=100 17

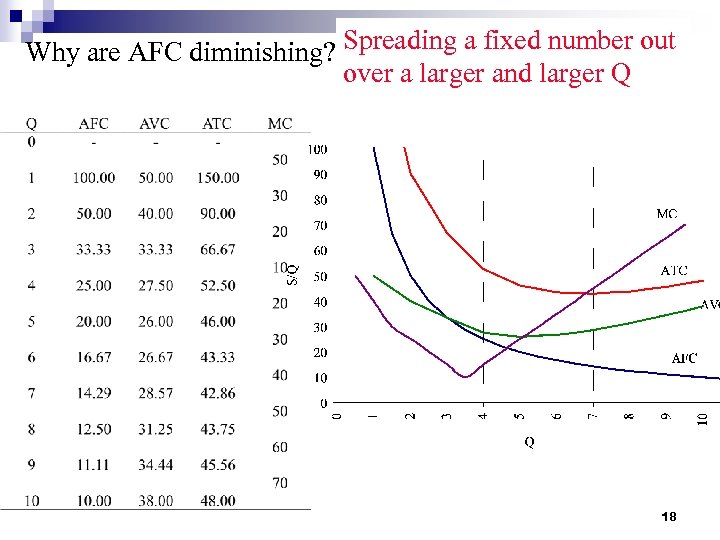

Why are AFC diminishing? Spreading a fixed number out over a larger and larger Q 18

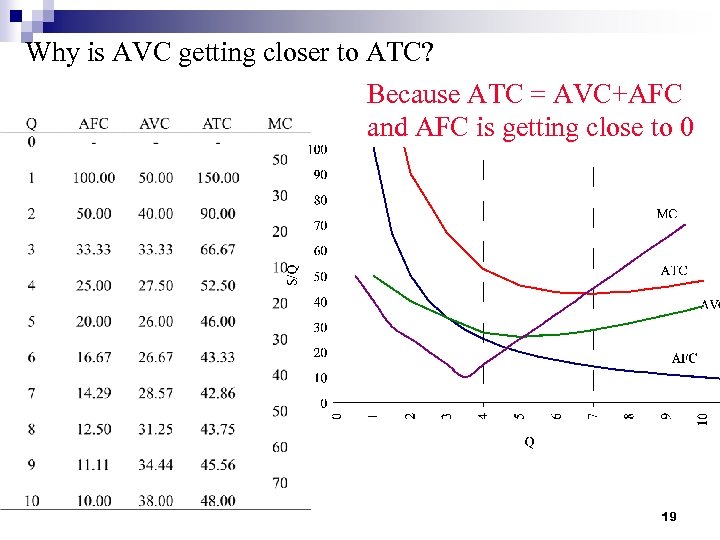

Why is AVC getting closer to ATC? Because ATC = AVC+AFC and AFC is getting close to 0 19

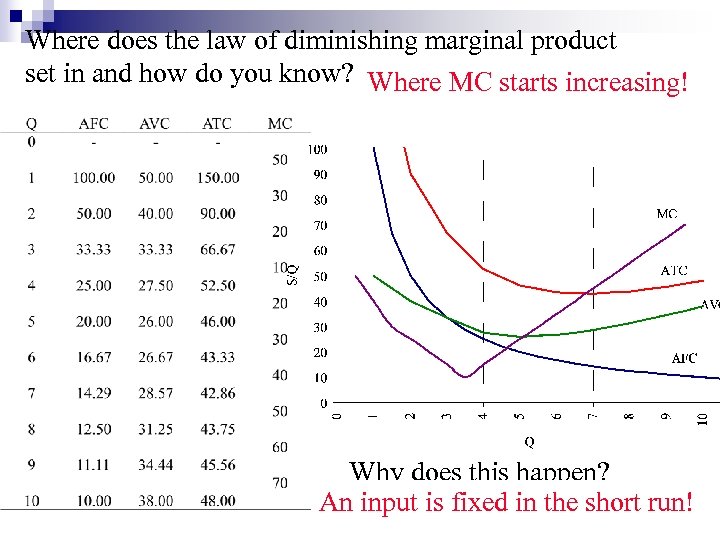

Where does the law of diminishing marginal product set in and how do you know? Where MC starts increasing! Why does this happen? An input is fixed in the short run! 20

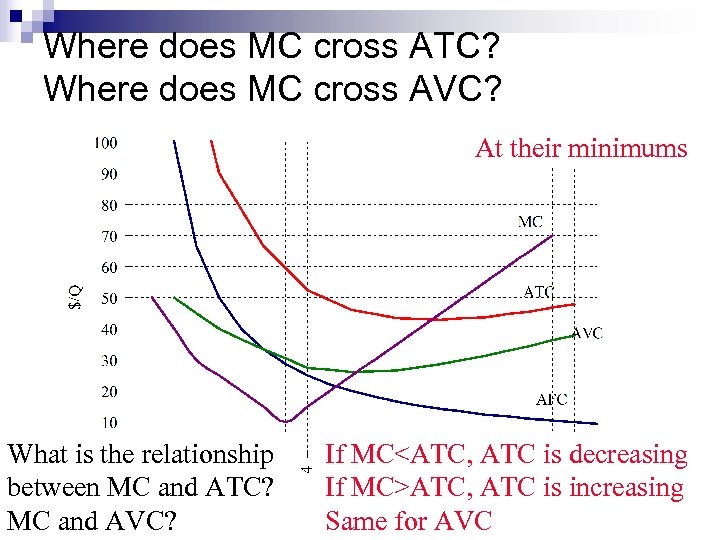

Where does MC cross ATC? Where does MC cross AVC? At their minimums What is the relationship between MC and ATC? MC and AVC? If MC<ATC, ATC is decreasing If MC>ATC, ATC is increasing 21 Same for AVC

How do you know this is the short run? There are fixed costs 22

Fixed Cost versus Sunk Cost Fixed Cost = costs that do not change with changes in output Sunk Cost= a cost that is forever lost after it has been paid n Does profit maximizing output depend on whether cost if fixed or sunk given that you produce paninis? No n Does the decision whether to produce any paninis depend on whether cost is fixed or sunk? Yes 23

Short Run versus Long Run? short run - a period of time where some inputs are fixed (capital = building, equipment, etc. ) n long run - a period of time in which all inputs can be varied (no inputs are fixed) n UQM Technologies http: //www. youtube. com/watch? v=Uvn. HQz 6 l. DQ 8&feature=related 24

Profit Maximization 25

Profit Maximization assuming: 1. 2. Firm must charge every consumer the same price (i. e. , no price discrimination) No Strategic Interaction among Firms We will consider three industry structures: n Price taking Firms n Monopoly n Monopolistic Competition 26

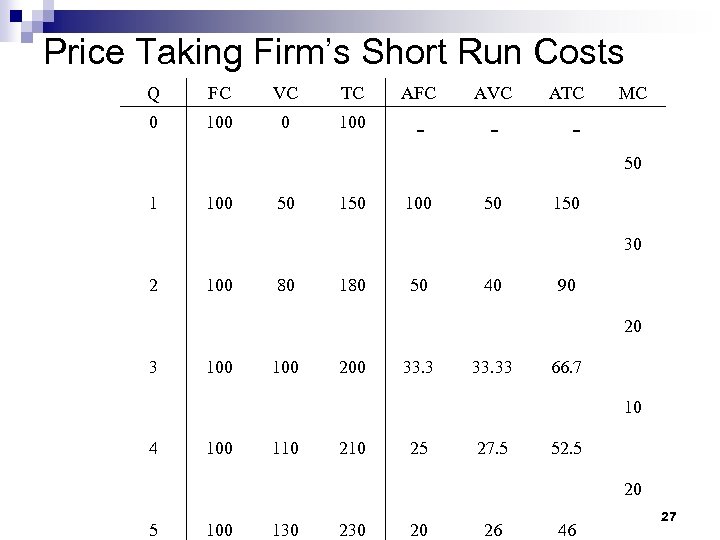

Price Taking Firm’s Short Run Costs Q FC VC TC AFC AVC 0 100 - - 1 100 50 100 80 100 50 180 30 50 40 90 20 33. 33 66. 7 100 110 5 100 4 50 3 150 210 10 25 27. 5 52. 5 100 130 230 MC - 2 ATC 20 20 26 46 27

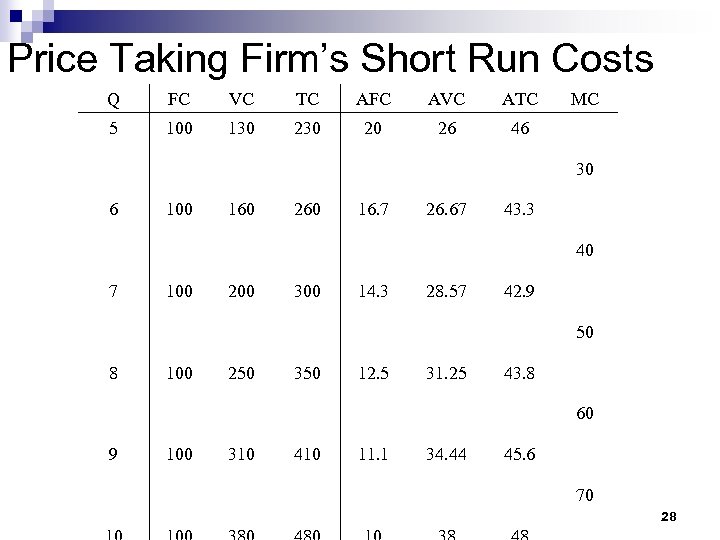

Price Taking Firm’s Short Run Costs Q FC VC TC AFC AVC ATC 5 100 130 20 26 46 6 100 160 7 100 200 16. 7 26. 67 43. 3 300 40 14. 3 28. 57 42. 9 100 250 9 30 8 260 350 50 12. 5 31. 25 43. 8 100 310 410 MC 60 11. 1 34. 44 45. 6 70 28

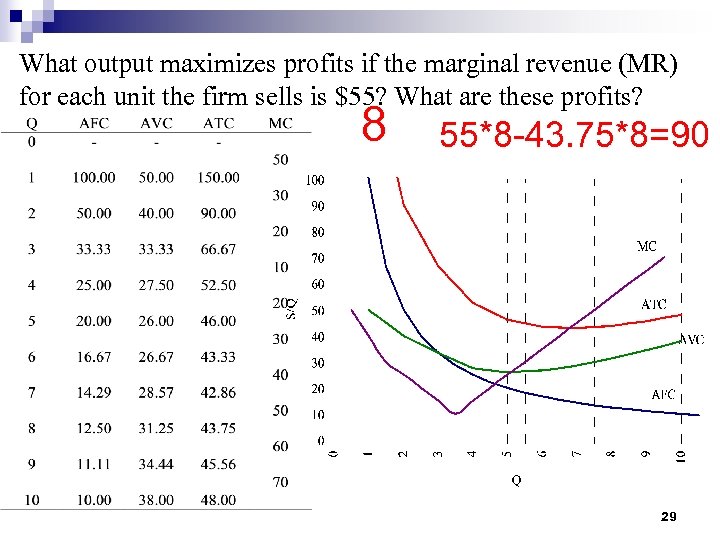

What output maximizes profits if the marginal revenue (MR) for each unit the firm sells is $55? What are these profits? 8 55*8 -43. 75*8=90 29

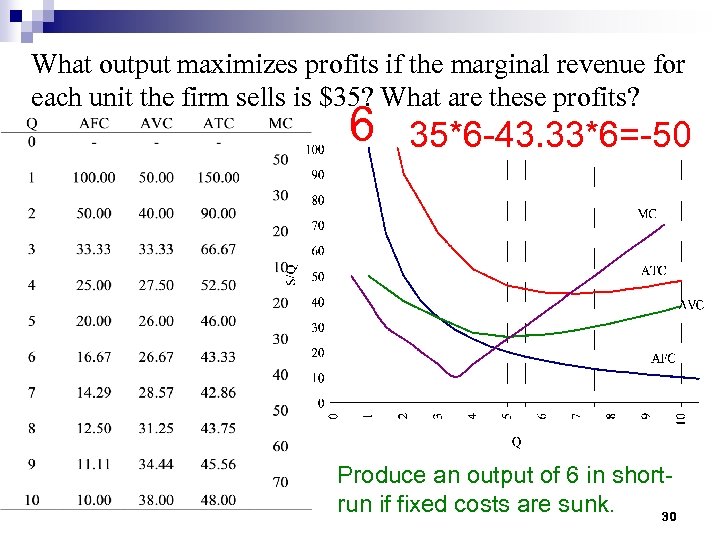

What output maximizes profits if the marginal revenue for each unit the firm sells is $35? What are these profits? 6 35*6 -43. 33*6=-50 Produce an output of 6 in shortrun if fixed costs are sunk. 30

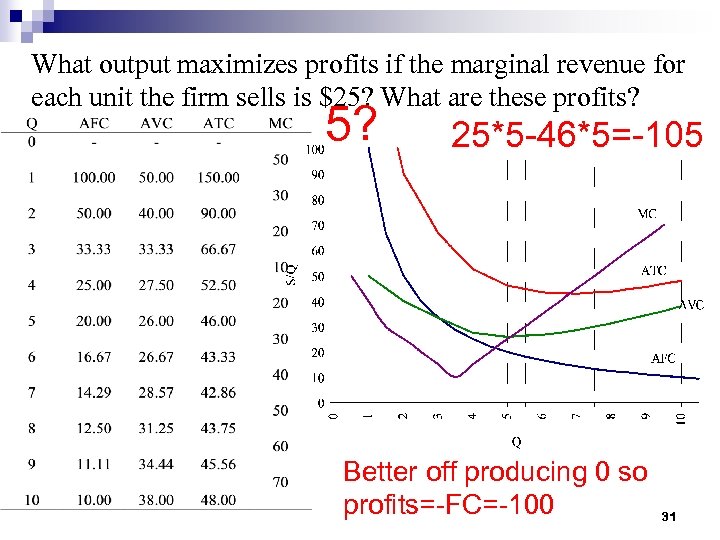

What output maximizes profits if the marginal revenue for each unit the firm sells is $25? What are these profits? 5? 25*5 -46*5=-105 Better off producing 0 so profits=-FC=-100 31

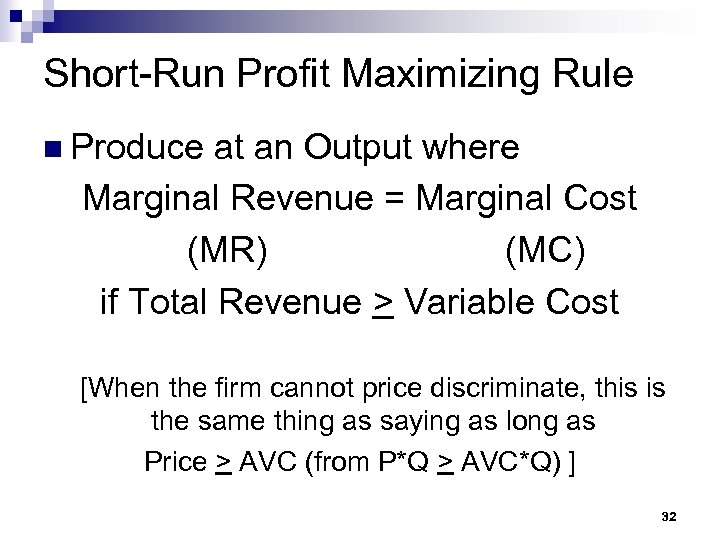

Short-Run Profit Maximizing Rule n Produce at an Output where Marginal Revenue = Marginal Cost (MR) (MC) if Total Revenue > Variable Cost [When the firm cannot price discriminate, this is the same thing as saying as long as Price > AVC (from P*Q > AVC*Q) ] 32

Monopoly Characteristics 1. 2. 3. There is a single seller There are no close substitutes for the good There are extremely high barriers to entry 33

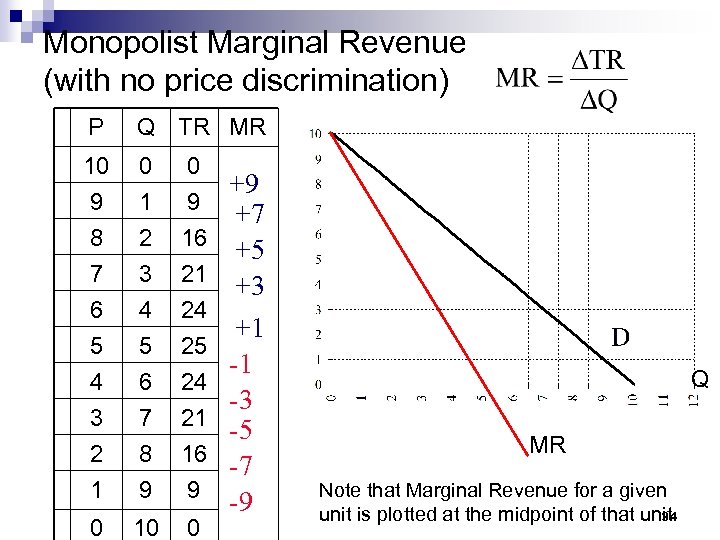

Monopolist Marginal Revenue (with no price discrimination) P Q TR MR 10 9 8 0 1 2 0 +9 9 +7 16 7 6 5 4 3 2 1 3 4 5 6 7 8 9 21 24 25 24 21 16 9 0 10 0 +5 +3 +1 -1 -3 -5 -7 -9 Q MR Note that Marginal Revenue for a given unit is plotted at the midpoint of that unit. 34

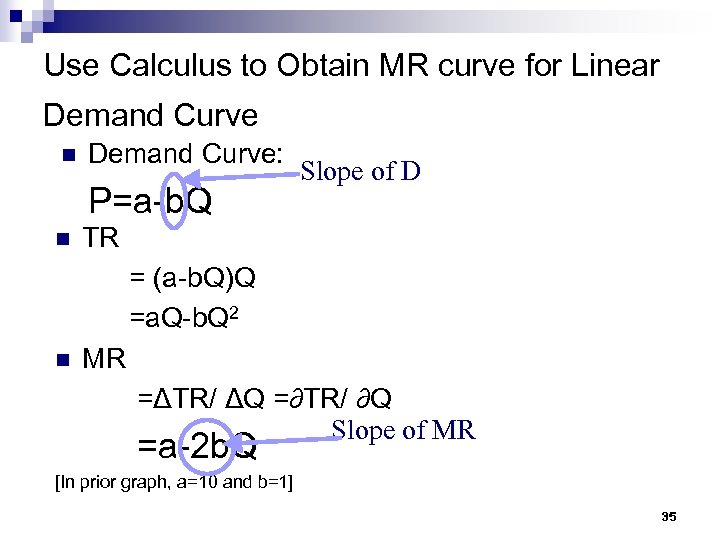

Use Calculus to Obtain MR curve for Linear Demand Curve n Demand Curve: Slope of D n P=a-b. Q n TR n = (a-b. Q)Q n =a. Q-b. Q 2 n MR n =ΔTR/ ΔQ =∂TR/ ∂Q Slope of MR n =a-2 b. Q [In prior graph, a=10 and b=1] 35

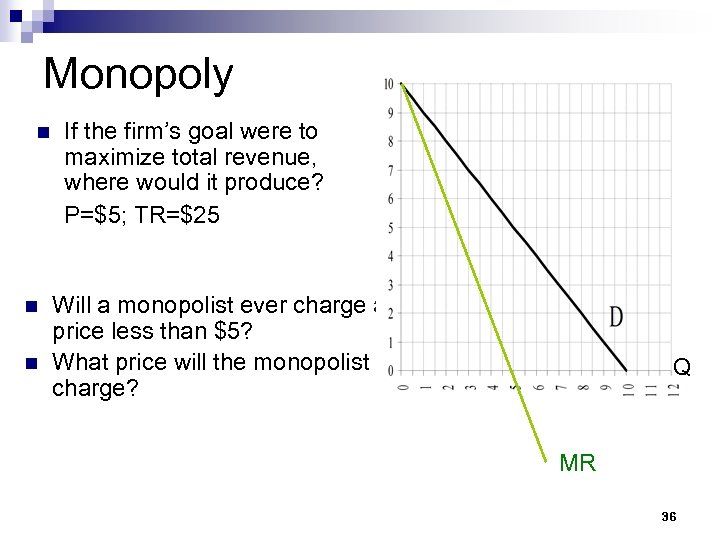

Monopoly n n If the firm’s goal were to maximize total revenue, where would it produce? P=$5; TR=$25 Will a monopolist ever charge a price less than $5? What price will the monopolist charge? Q MR 36

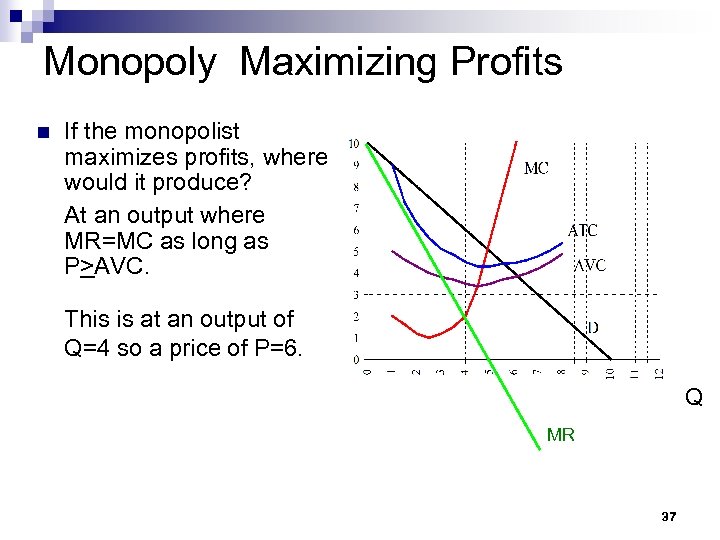

Monopoly Maximizing Profits n n n If the monopolist maximizes profits, where would it produce? At an output where MR=MC as long as P>AVC. This is at an output of Q=4 so a price of P=6. Q MR 37

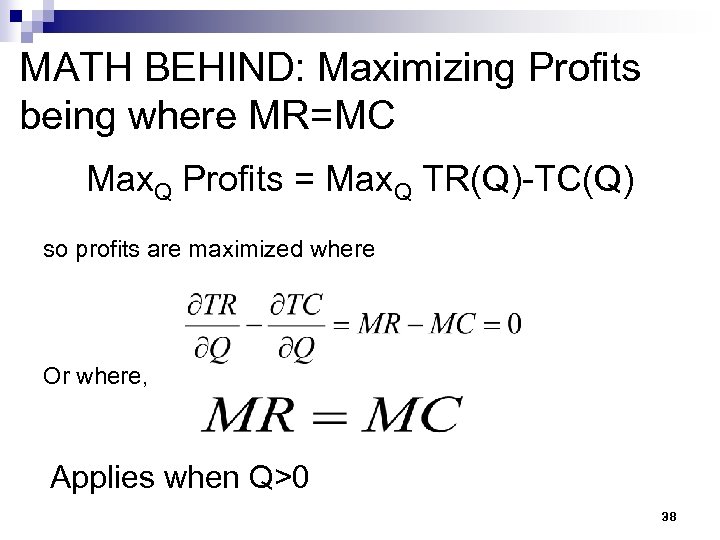

MATH BEHIND: Maximizing Profits being where MR=MC Max. Q Profits = Max. Q TR(Q)-TC(Q) so profits are maximized where Or where, Applies when Q>0 38

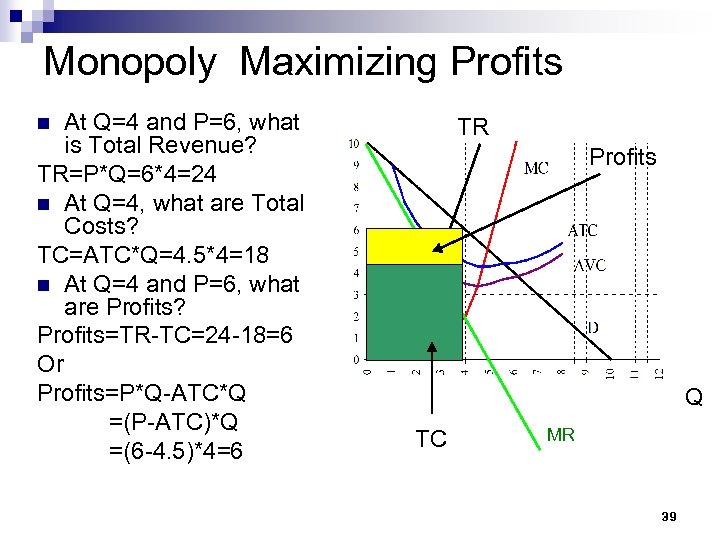

Monopoly Maximizing Profits At Q=4 and P=6, what is Total Revenue? TR=P*Q=6*4=24 n At Q=4, what are Total Costs? TC=ATC*Q=4. 5*4=18 n At Q=4 and P=6, what are Profits? Profits=TR-TC=24 -18=6 Or Profits=P*Q-ATC*Q =(P-ATC)*Q =(6 -4. 5)*4=6 TR n Profits Q TC MR 39

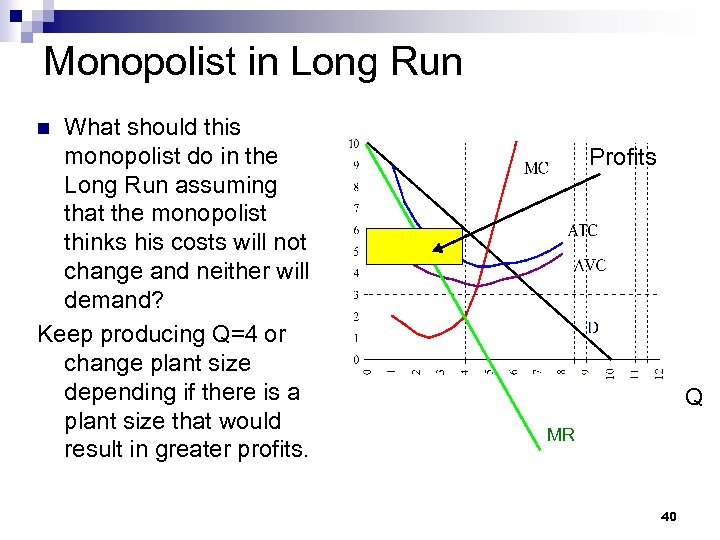

Monopolist in Long Run What should this monopolist do in the Long Run assuming that the monopolist thinks his costs will not change and neither will demand? Keep producing Q=4 or change plant size depending if there is a plant size that would result in greater profits. n Profits Q MR 40

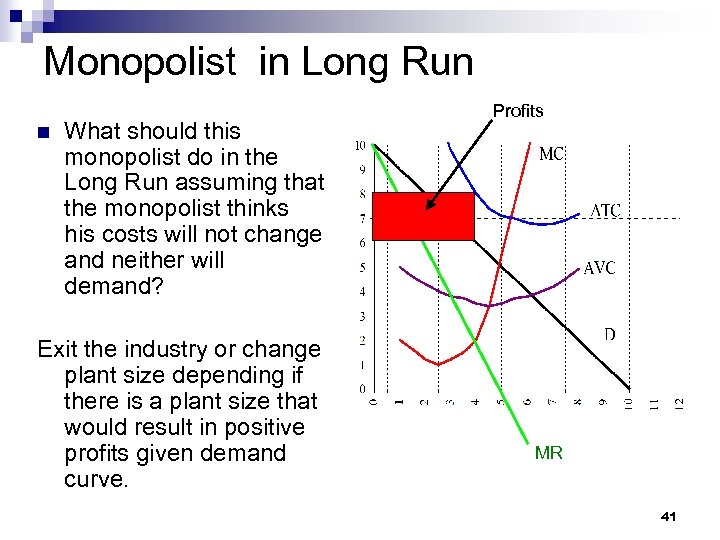

Monopolist in Long Run n What should this monopolist do in the Long Run assuming that the monopolist thinks his costs will not change and neither will demand? Exit the industry or change plant size depending if there is a plant size that would result in positive profits given demand curve. Profits MR 41

Monopolistic Competition Characteristics 1. 2. 3. There are many buyers and seller Each firm in the industry produces a differentiated product There is free entry into and exit from the industry [Think bakery or coffee shop in big city. ] 42

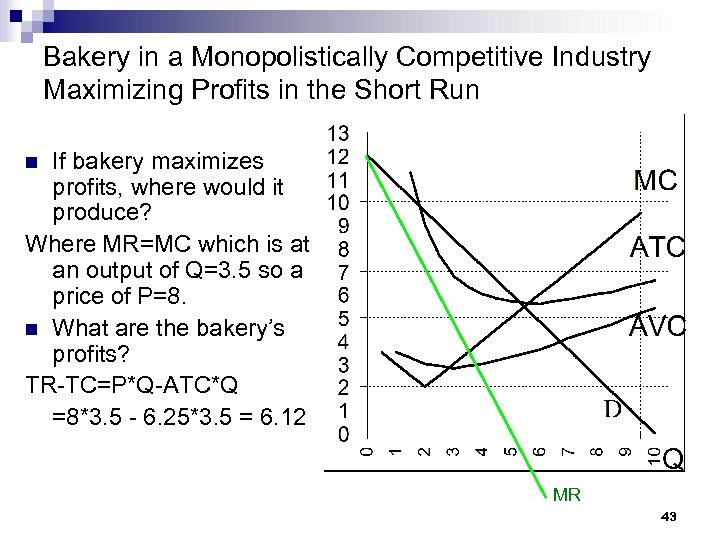

Bakery in a Monopolistically Competitive Industry Maximizing Profits in the Short Run If bakery maximizes profits, where would it produce? Where MR=MC which is at an output of Q=3. 5 so a price of P=8. n What are the bakery’s profits? TR-TC=P*Q-ATC*Q =8*3. 5 - 6. 25*3. 5 = 6. 12 n MR 43

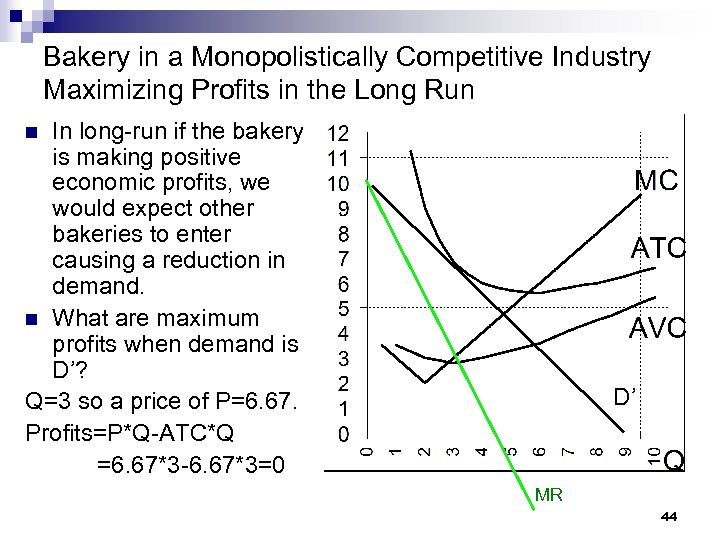

Bakery in a Monopolistically Competitive Industry Maximizing Profits in the Long Run In long-run if the bakery is making positive economic profits, we would expect other bakeries to enter causing a reduction in demand. n What are maximum profits when demand is D’? Q=3 so a price of P=6. 67. Profits=P*Q-ATC*Q =6. 67*3 -6. 67*3=0 n D’ MR 44

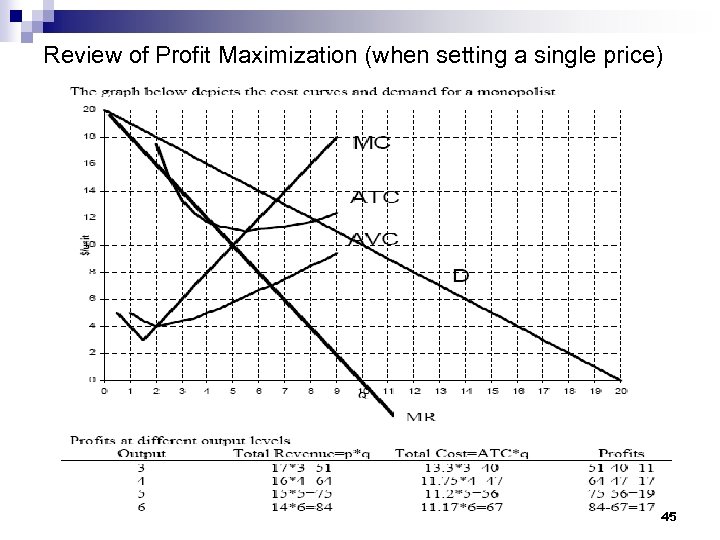

Review of Profit Maximization (when setting a single price) 45

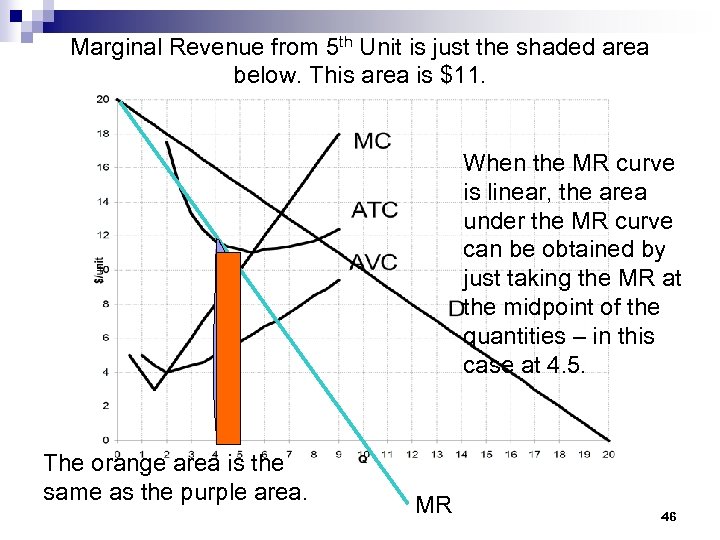

Marginal Revenue from 5 th Unit is just the shaded area below. This area is $11. When the MR curve is linear, the area under the MR curve can be obtained by just taking the MR at the midpoint of the quantities – in this case at 4. 5. The orange area is the same as the purple area. MR 46

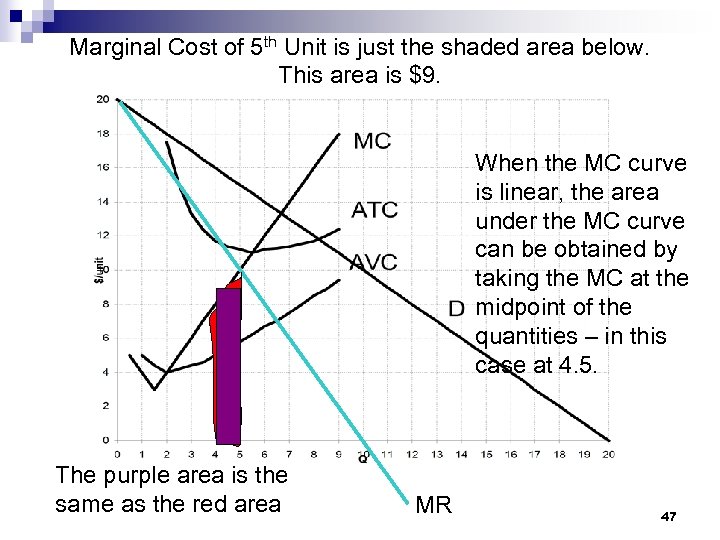

Marginal Cost of 5 th Unit is just the shaded area below. This area is $9. When the MC curve is linear, the area under the MC curve can be obtained by taking the MC at the midpoint of the quantities – in this case at 4. 5. The purple area is the same as the red area MR 47

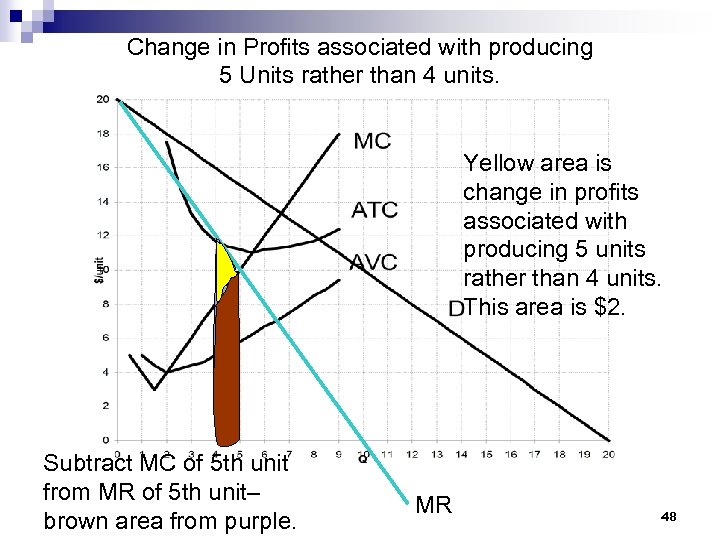

Change in Profits associated with producing 5 Units rather than 4 units. Yellow area is change in profits associated with producing 5 units rather than 4 units. This area is $2. Subtract MC of 5 th unit from MR of 5 th unit– brown area from purple. MR 48

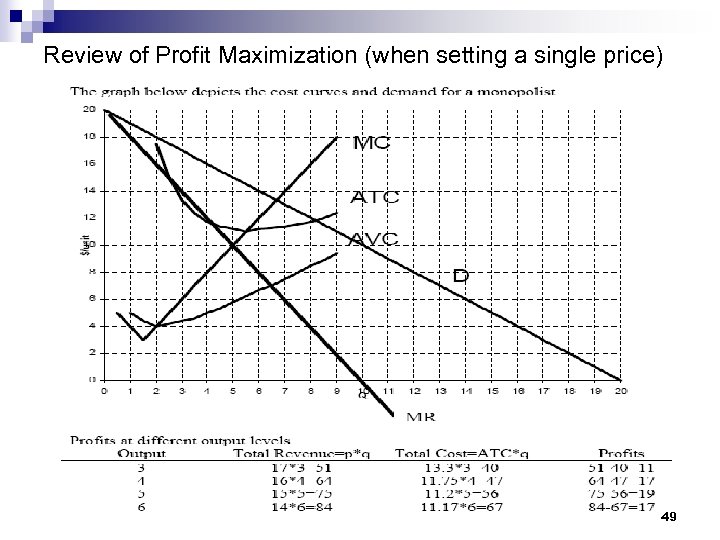

Review of Profit Maximization (when setting a single price) 49

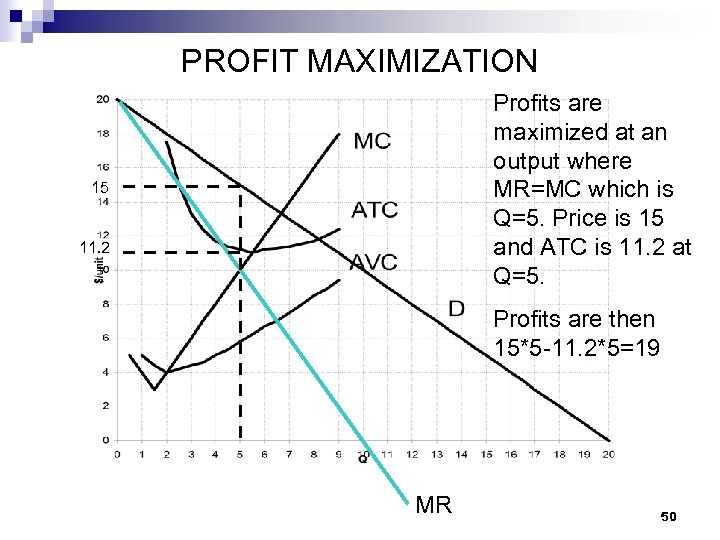

PROFIT MAXIMIZATION Profits are maximized at an output where MR=MC which is Q=5. Price is 15 and ATC is 11. 2 at Q=5. 15 11. 2 Profits are then 15*5 -11. 2*5=19 MR 50

The Nature of Industry 51

Case Study February 20, 1986: n Coca Cola announced intentions to purchase Dr Pepper n Pepsi announced intentions to buy Seven. Up n The FTC (Federal Trade Commission) announced decision to oppose n Pepsi withdrew; Coca Cola persisted n 52

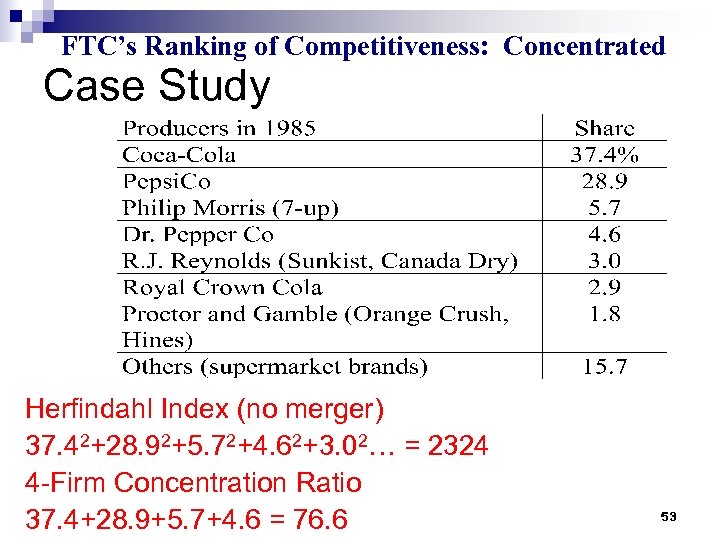

FTC’s Ranking of Competitiveness: Concentrated Case Study Herfindahl Index (no merger) 37. 42+28. 92+5. 72+4. 62+3. 02… = 2324 4 -Firm Concentration Ratio 37. 4+28. 9+5. 7+4. 6 = 76. 6 53

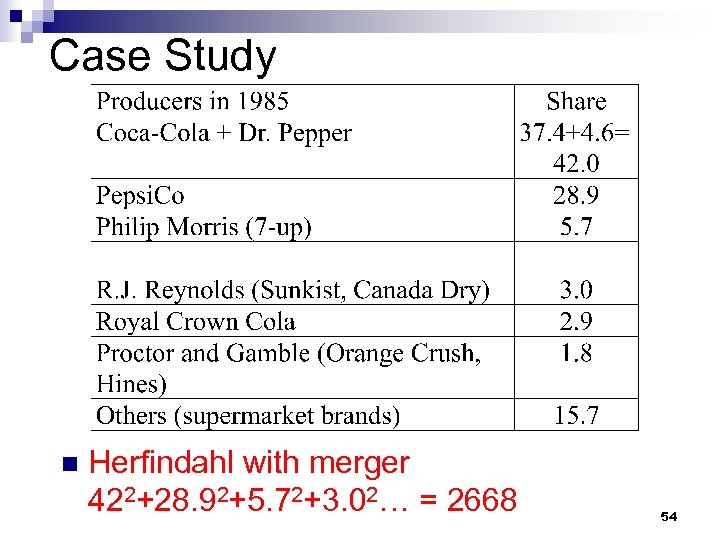

Case Study n Herfindahl with merger 422+28. 92+5. 72+3. 02… = 2668 54

Anti-trust Enforcement Department of Justice /Federal Trade Commission Enforcement n FTC Horizontal Merger Guidelines http: //www. usdoj. gov/atr/public/guidelines/horiz_book/hmg 1. html n FTC Competition Enforcement Reports http: //www. ftc. gov/search/site/competition%20 enforcement%20 report 55

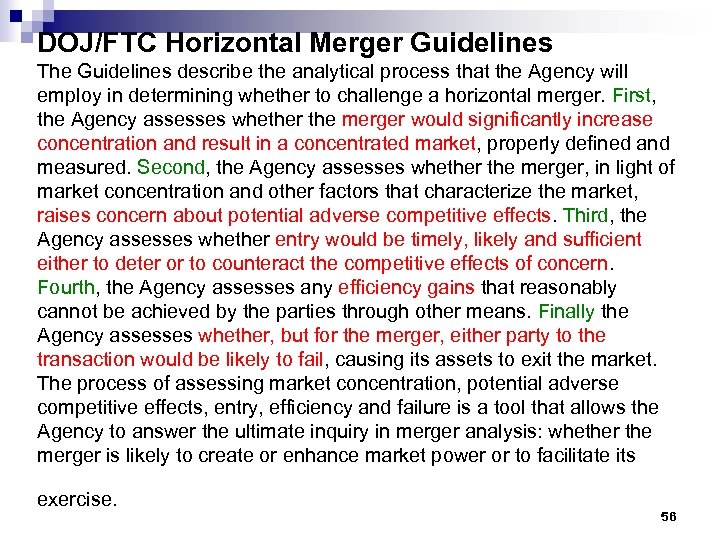

DOJ/FTC Horizontal Merger Guidelines The Guidelines describe the analytical process that the Agency will employ in determining whether to challenge a horizontal merger. First, the Agency assesses whether the merger would significantly increase concentration and result in a concentrated market, properly defined and measured. Second, the Agency assesses whether the merger, in light of market concentration and other factors that characterize the market, raises concern about potential adverse competitive effects. Third, the Agency assesses whether entry would be timely, likely and sufficient either to deter or to counteract the competitive effects of concern. Fourth, the Agency assesses any efficiency gains that reasonably cannot be achieved by the parties through other means. Finally the Agency assesses whether, but for the merger, either party to the transaction would be likely to fail, causing its assets to exit the market. The process of assessing market concentration, potential adverse competitive effects, entry, efficiency and failure is a tool that allows the Agency to answer the ultimate inquiry in merger analysis: whether the merger is likely to create or enhance market power or to facilitate its exercise. 56

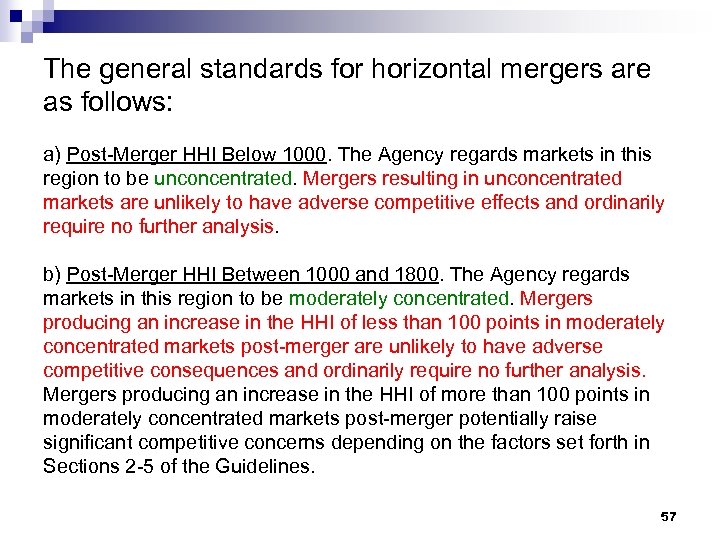

The general standards for horizontal mergers are as follows: a) Post-Merger HHI Below 1000. The Agency regards markets in this region to be unconcentrated. Mergers resulting in unconcentrated markets are unlikely to have adverse competitive effects and ordinarily require no further analysis. b) Post-Merger HHI Between 1000 and 1800. The Agency regards markets in this region to be moderately concentrated. Mergers producing an increase in the HHI of less than 100 points in moderately concentrated markets post-merger are unlikely to have adverse competitive consequences and ordinarily require no further analysis. Mergers producing an increase in the HHI of more than 100 points in moderately concentrated markets post-merger potentially raise significant competitive concerns depending on the factors set forth in Sections 2 -5 of the Guidelines. 57

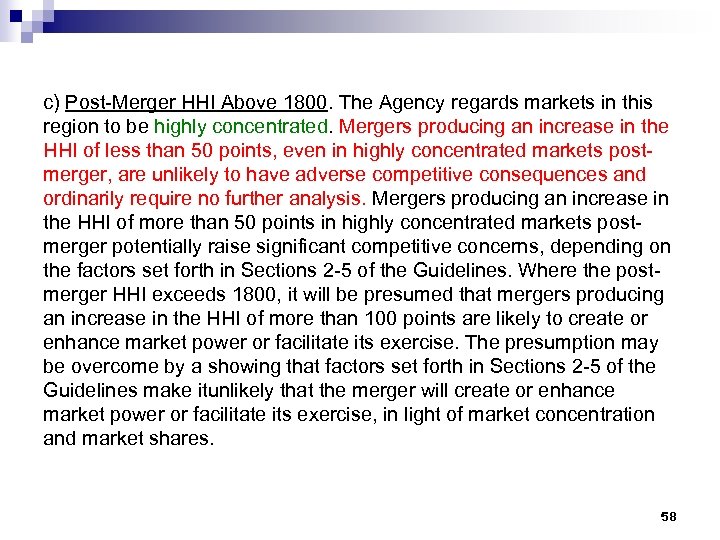

c) Post-Merger HHI Above 1800. The Agency regards markets in this region to be highly concentrated. Mergers producing an increase in the HHI of less than 50 points, even in highly concentrated markets postmerger, are unlikely to have adverse competitive consequences and ordinarily require no further analysis. Mergers producing an increase in the HHI of more than 50 points in highly concentrated markets postmerger potentially raise significant competitive concerns, depending on the factors set forth in Sections 2 -5 of the Guidelines. Where the postmerger HHI exceeds 1800, it will be presumed that mergers producing an increase in the HHI of more than 100 points are likely to create or enhance market power or facilitate its exercise. The presumption may be overcome by a showing that factors set forth in Sections 2 -5 of the Guidelines make itunlikely that the merger will create or enhance market power or facilitate its exercise, in light of market concentration and market shares. 58

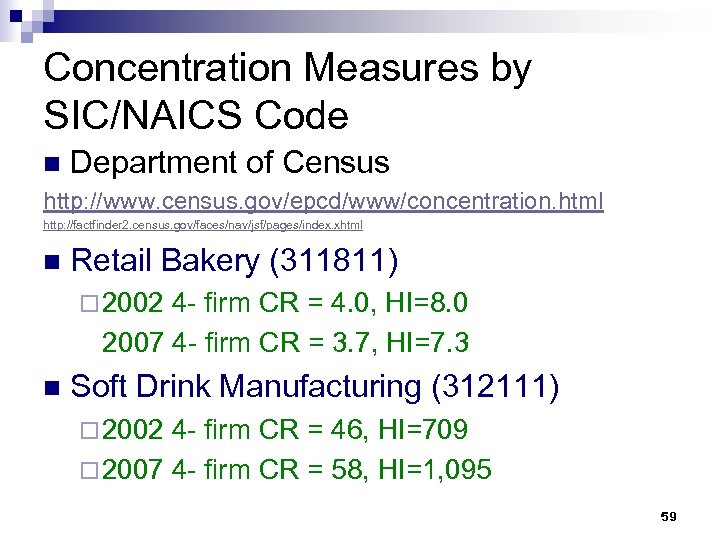

Concentration Measures by SIC/NAICS Code n Department of Census http: //www. census. gov/epcd/www/concentration. html http: //factfinder 2. census. gov/faces/nav/jsf/pages/index. xhtml n Retail Bakery (311811) ¨ 2002 4 - firm CR = 4. 0, HI=8. 0 2007 4 - firm CR = 3. 7, HI=7. 3 n Soft Drink Manufacturing (312111) ¨ 2002 4 - firm CR = 46, HI=709 ¨ 2007 4 - firm CR = 58, HI=1, 095 59

Problems with using only CR and HI to proxy for level of competition 1) 2) 3) 4) 5) Often difficult to Define Relevant Market Does not take into account Entry Barriers Cannot necessarily equate more concentration with less competition Merger may increase efficiency which may benefit consumers Must consider how industry is likely to evolve with and without merger 60

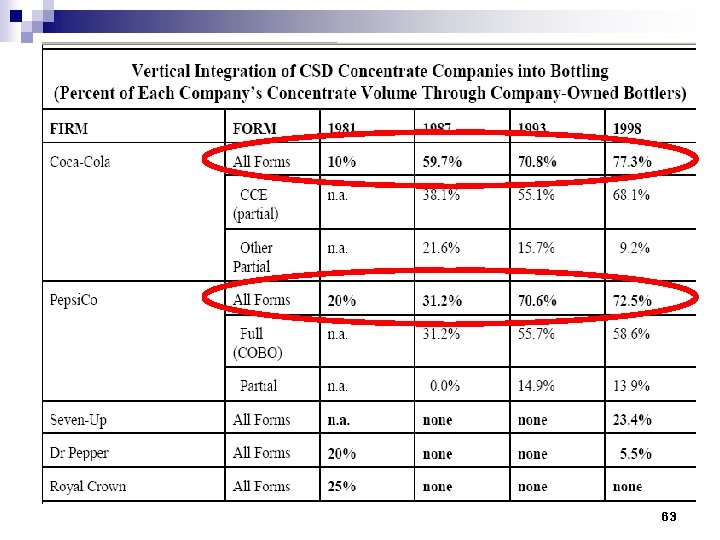

Major Changes in CSD Industry Post-1985 1. 2. 3. 4. 7 -Up and Dr. Pepper merged in late 1986 and Cadbury-Schweppes purchased them in 1995. Cadbury-Schweppes also acquired a number of other brands including Canada-Dry, Sunkist, A&W, Crush and Hires. Technological change results in greater economies of scale associated with bottling. Coca-Cola and Pepsi vertically integrate by acquiring a number of their bottling companies. Diet CSDs’ market share has increased (from 25. 9% in 1999 to 30. 2% in 2004). 61

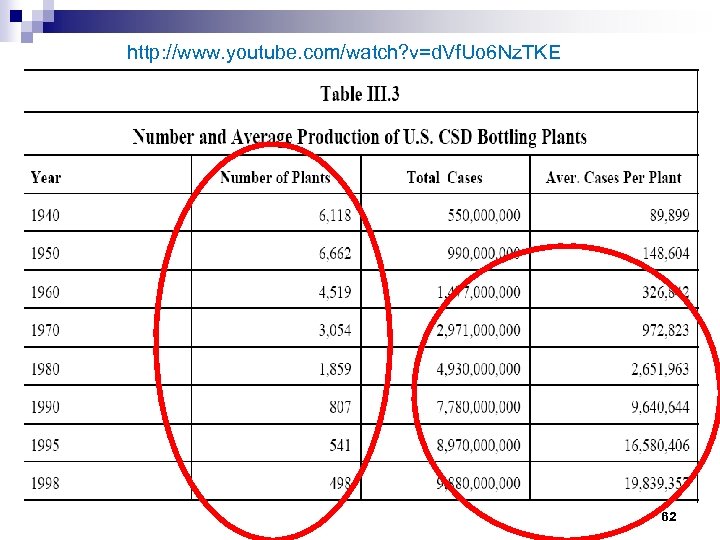

http: //www. youtube. com/watch? v=d. Vf. Uo 6 Nz. TKE 62

63

327396d98a0dea6bd06dadb171a97381.ppt