2b1f11c8ed0edc434a98d9e4a3180f60.ppt

- Количество слайдов: 47

Shopper. Trends 2004 Romania March 2004 1 Copyright 2004 ACNielsen Shopper. Trends

Shopper. Trends 2004 Romania March 2004 1 Copyright 2004 ACNielsen Shopper. Trends

Research Objectives 2 Copyright 2004 ACNielsen Shopper. Trends

Research Objectives 2 Copyright 2004 ACNielsen Shopper. Trends

Research Objectives • To provide retailers and manufacturers with a comprehensive overview of the Romanian retail environment Understand the Romanian consumer: what they buy, when they shop, where they shop – and why Identify the key factors driving shopper satisfaction and loyalty What differentiates one retailer from another? Store Equity: how strong is it, and what factors are driving it? How do shoppers rate retailers on key drivers of satisfaction and loyalty? 3 Copyright 2004 ACNielsen Shopper. Trends

Research Objectives • To provide retailers and manufacturers with a comprehensive overview of the Romanian retail environment Understand the Romanian consumer: what they buy, when they shop, where they shop – and why Identify the key factors driving shopper satisfaction and loyalty What differentiates one retailer from another? Store Equity: how strong is it, and what factors are driving it? How do shoppers rate retailers on key drivers of satisfaction and loyalty? 3 Copyright 2004 ACNielsen Shopper. Trends

Research Design 4 Copyright 2004 ACNielsen Shopper. Trends

Research Design 4 Copyright 2004 ACNielsen Shopper. Trends

Research Methodology • Coverage of the capital Bucharest, Romania Face to face, in home interviews using random household selection Sample size n=500, with the following split: ü n= 342 Main household buyers ü n= 158 Key Influencers Booster sample of n=60 to ensure minimum bases of n=100 for specific retailers Fieldwork: Nov Dec 2003 Utilised ACNielsen Winning Brands brand equity model 5 Copyright 2004 ACNielsen Shopper. Trends

Research Methodology • Coverage of the capital Bucharest, Romania Face to face, in home interviews using random household selection Sample size n=500, with the following split: ü n= 342 Main household buyers ü n= 158 Key Influencers Booster sample of n=60 to ensure minimum bases of n=100 for specific retailers Fieldwork: Nov Dec 2003 Utilised ACNielsen Winning Brands brand equity model 5 Copyright 2004 ACNielsen Shopper. Trends

Economic Status & Outlook 6 Copyright 2004 ACNielsen Shopper. Trends

Economic Status & Outlook 6 Copyright 2004 ACNielsen Shopper. Trends

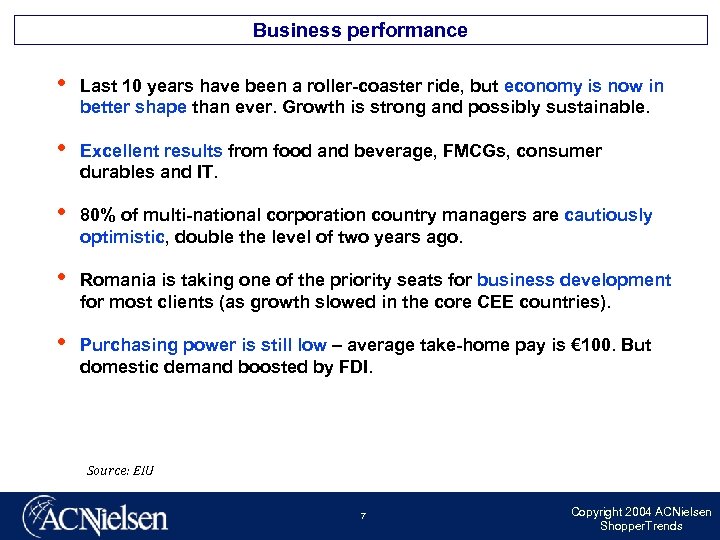

Business performance • Last 10 years have been a roller-coaster ride, but economy is now in better shape than ever. Growth is strong and possibly sustainable. • Excellent results from food and beverage, FMCGs, consumer durables and IT. • 80% of multi-national corporation country managers are cautiously optimistic, double the level of two years ago. • Romania is taking one of the priority seats for business development for most clients (as growth slowed in the core CEE countries). • Purchasing power is still low – average take-home pay is € 100. But domestic demand boosted by FDI. Source: EIU 7 Copyright 2004 ACNielsen Shopper. Trends

Business performance • Last 10 years have been a roller-coaster ride, but economy is now in better shape than ever. Growth is strong and possibly sustainable. • Excellent results from food and beverage, FMCGs, consumer durables and IT. • 80% of multi-national corporation country managers are cautiously optimistic, double the level of two years ago. • Romania is taking one of the priority seats for business development for most clients (as growth slowed in the core CEE countries). • Purchasing power is still low – average take-home pay is € 100. But domestic demand boosted by FDI. Source: EIU 7 Copyright 2004 ACNielsen Shopper. Trends

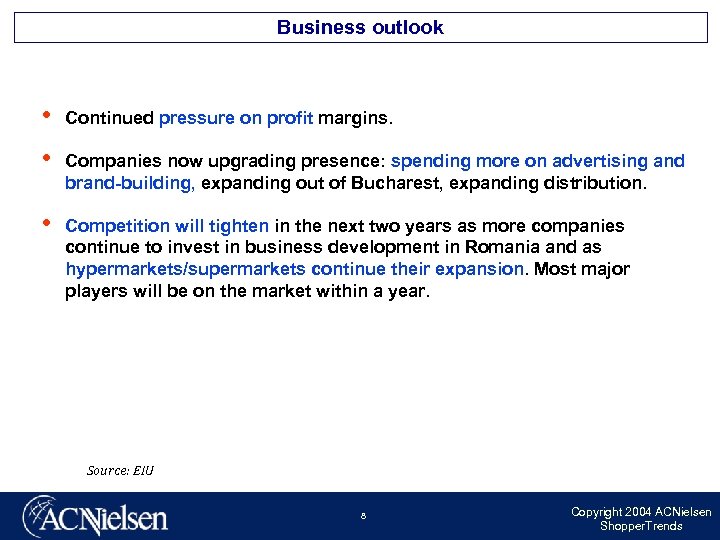

Business outlook • Continued pressure on profit margins. • Companies now upgrading presence: spending more on advertising and brand-building, expanding out of Bucharest, expanding distribution. • Competition will tighten in the next two years as more companies continue to invest in business development in Romania and as hypermarkets/supermarkets continue their expansion. Most major players will be on the market within a year. Source: EIU 8 Copyright 2004 ACNielsen Shopper. Trends

Business outlook • Continued pressure on profit margins. • Companies now upgrading presence: spending more on advertising and brand-building, expanding out of Bucharest, expanding distribution. • Competition will tighten in the next two years as more companies continue to invest in business development in Romania and as hypermarkets/supermarkets continue their expansion. Most major players will be on the market within a year. Source: EIU 8 Copyright 2004 ACNielsen Shopper. Trends

Grocery Market Performance 9 Copyright 2004 ACNielsen Shopper. Trends

Grocery Market Performance 9 Copyright 2004 ACNielsen Shopper. Trends

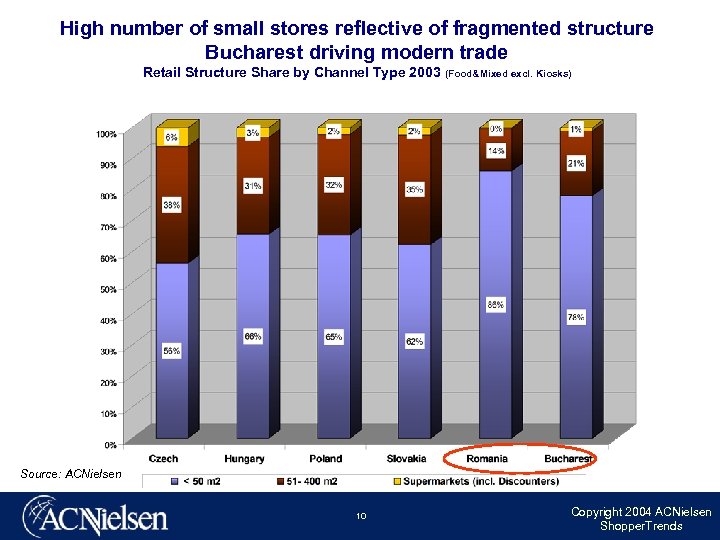

High number of small stores reflective of fragmented structure Bucharest driving modern trade Retail Structure Share by Channel Type 2003 (Food&Mixed excl. Kiosks) Source: ACNielsen 10 Copyright 2004 ACNielsen Shopper. Trends

High number of small stores reflective of fragmented structure Bucharest driving modern trade Retail Structure Share by Channel Type 2003 (Food&Mixed excl. Kiosks) Source: ACNielsen 10 Copyright 2004 ACNielsen Shopper. Trends

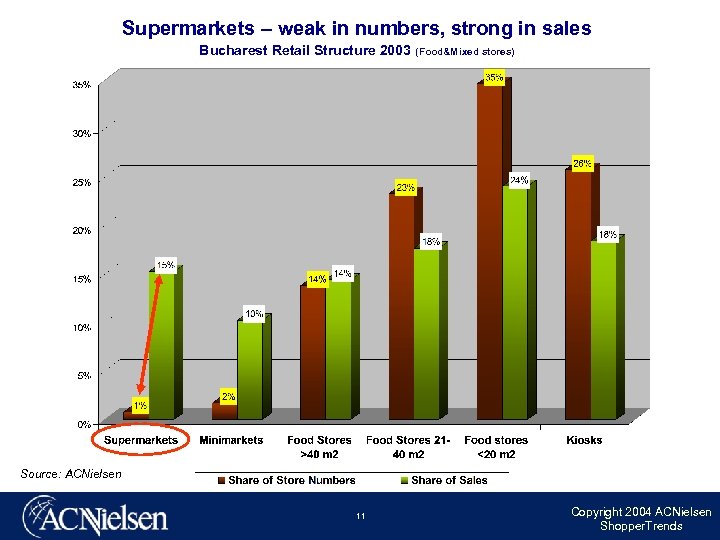

Supermarkets – weak in numbers, strong in sales Bucharest Retail Structure 2003 (Food&Mixed stores) Source: ACNielsen 11 Copyright 2004 ACNielsen Shopper. Trends

Supermarkets – weak in numbers, strong in sales Bucharest Retail Structure 2003 (Food&Mixed stores) Source: ACNielsen 11 Copyright 2004 ACNielsen Shopper. Trends

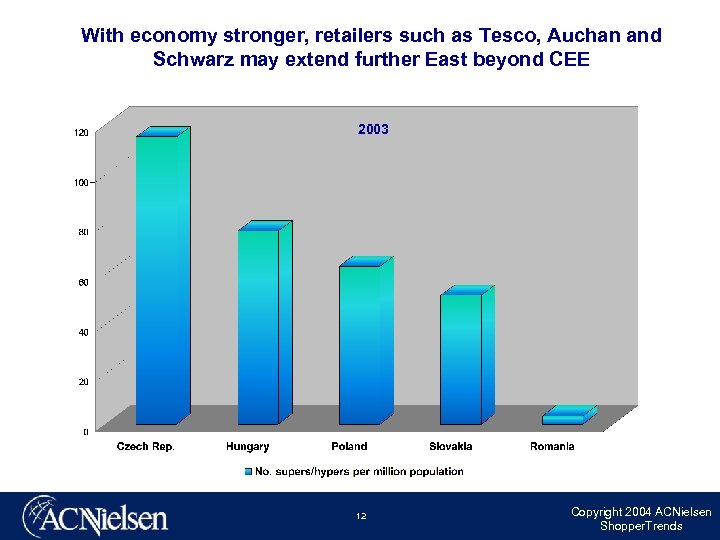

With economy stronger, retailers such as Tesco, Auchan and Schwarz may extend further East beyond CEE 2003 12 Copyright 2004 ACNielsen Shopper. Trends

With economy stronger, retailers such as Tesco, Auchan and Schwarz may extend further East beyond CEE 2003 12 Copyright 2004 ACNielsen Shopper. Trends

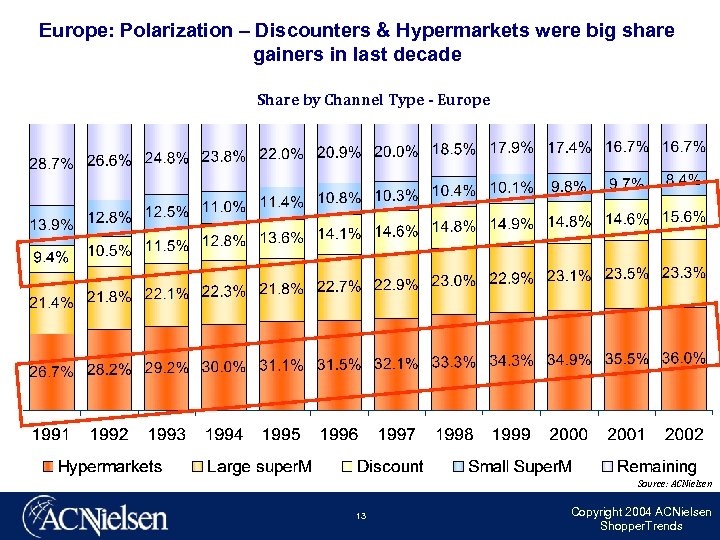

Europe: Polarization – Discounters & Hypermarkets were big share gainers in last decade Share by Channel Type - Europe Source: ACNielsen 13 Copyright 2004 ACNielsen Shopper. Trends

Europe: Polarization – Discounters & Hypermarkets were big share gainers in last decade Share by Channel Type - Europe Source: ACNielsen 13 Copyright 2004 ACNielsen Shopper. Trends

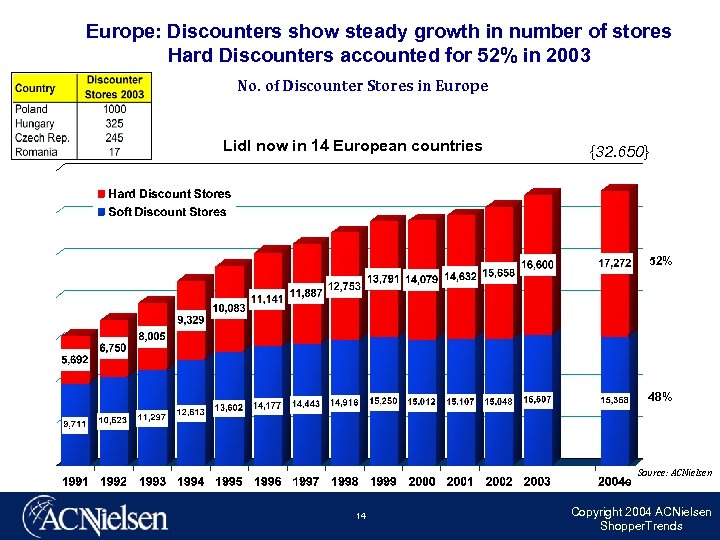

Europe: Discounters show steady growth in number of stores Hard Discounters accounted for 52% in 2003 No. of Discounter Stores in Europe Lidl now in 14 European countries {32. 650} 52% 48% Source: ACNielsen 14 Copyright 2004 ACNielsen Shopper. Trends

Europe: Discounters show steady growth in number of stores Hard Discounters accounted for 52% in 2003 No. of Discounter Stores in Europe Lidl now in 14 European countries {32. 650} 52% 48% Source: ACNielsen 14 Copyright 2004 ACNielsen Shopper. Trends

ACNielsen I Shopper. Trends DETAILED FINDINGS 15 Copyright 2004 ACNielsen Shopper. Trends

ACNielsen I Shopper. Trends DETAILED FINDINGS 15 Copyright 2004 ACNielsen Shopper. Trends

Shopper Profile 16 Copyright 2004 ACNielsen Shopper. Trends

Shopper Profile 16 Copyright 2004 ACNielsen Shopper. Trends

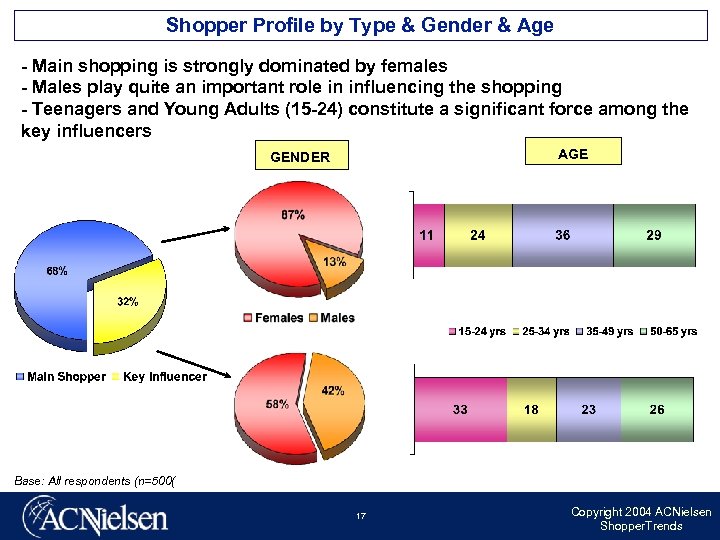

Shopper Profile by Type & Gender & Age - Main shopping is strongly dominated by females - Males play quite an important role in influencing the shopping - Teenagers and Young Adults (15 -24) constitute a significant force among the key influencers AGE GENDER Base: All respondents (n=500( 17 Copyright 2004 ACNielsen Shopper. Trends

Shopper Profile by Type & Gender & Age - Main shopping is strongly dominated by females - Males play quite an important role in influencing the shopping - Teenagers and Young Adults (15 -24) constitute a significant force among the key influencers AGE GENDER Base: All respondents (n=500( 17 Copyright 2004 ACNielsen Shopper. Trends

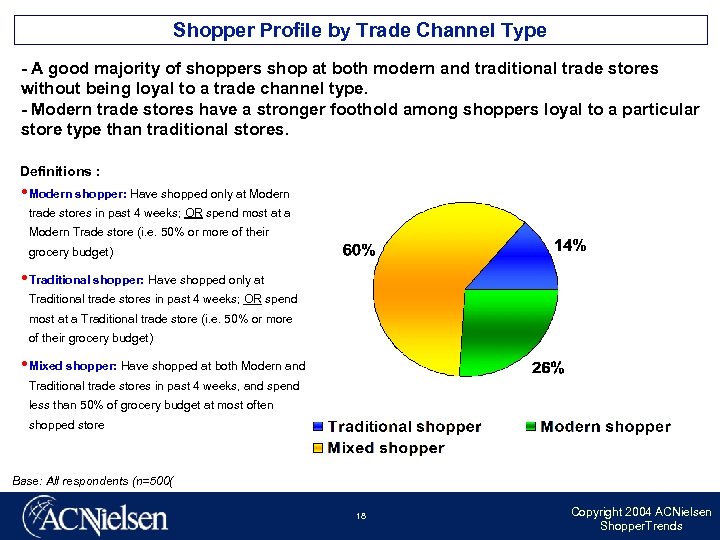

Shopper Profile by Trade Channel Type - A good majority of shoppers shop at both modern and traditional trade stores without being loyal to a trade channel type. - Modern trade stores have a stronger foothold among shoppers loyal to a particular store type than traditional stores. Definitions : Modern shopper: Have shopped only at Modern trade stores in past 4 weeks; OR spend most at a Modern Trade store (i. e. 50% or more of their grocery budget) Traditional shopper: Have shopped only at Traditional trade stores in past 4 weeks; OR spend most at a Traditional trade store (i. e. 50% or more of their grocery budget) Mixed shopper: Have shopped at both Modern and Traditional trade stores in past 4 weeks, and spend less than 50% of grocery budget at most often shopped store Base: All respondents (n=500( 18 Copyright 2004 ACNielsen Shopper. Trends

Shopper Profile by Trade Channel Type - A good majority of shoppers shop at both modern and traditional trade stores without being loyal to a trade channel type. - Modern trade stores have a stronger foothold among shoppers loyal to a particular store type than traditional stores. Definitions : Modern shopper: Have shopped only at Modern trade stores in past 4 weeks; OR spend most at a Modern Trade store (i. e. 50% or more of their grocery budget) Traditional shopper: Have shopped only at Traditional trade stores in past 4 weeks; OR spend most at a Traditional trade store (i. e. 50% or more of their grocery budget) Mixed shopper: Have shopped at both Modern and Traditional trade stores in past 4 weeks, and spend less than 50% of grocery budget at most often shopped store Base: All respondents (n=500( 18 Copyright 2004 ACNielsen Shopper. Trends

Trade Sector Overview 19 Copyright 2004 ACNielsen Shopper. Trends

Trade Sector Overview 19 Copyright 2004 ACNielsen Shopper. Trends

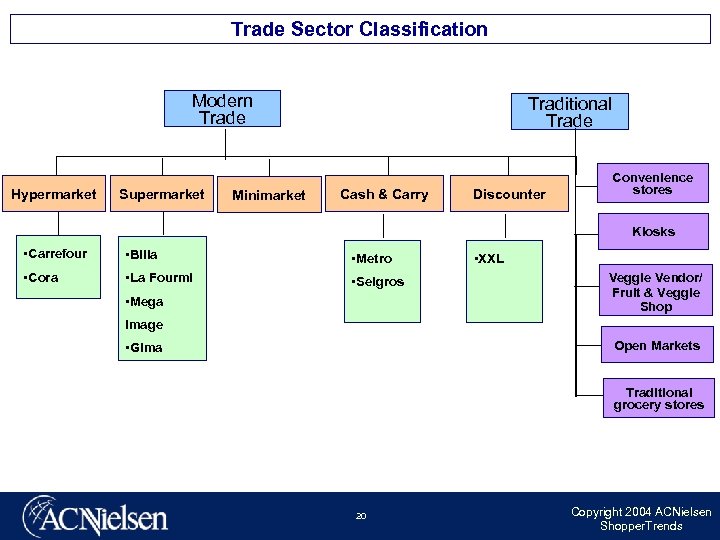

Trade Sector Classification Modern Trade Hypermarket Supermarket Minimarket Traditional Trade Cash & Carry Discounter Convenience stores Kiosks • Carrefour • Billa • Metro • Cora • La Fourmi • Selgros • Mega • XXL Veggie Vendor/ Fruit & Veggie Shop Image Open Markets • Gima Traditional grocery stores 20 Copyright 2004 ACNielsen Shopper. Trends

Trade Sector Classification Modern Trade Hypermarket Supermarket Minimarket Traditional Trade Cash & Carry Discounter Convenience stores Kiosks • Carrefour • Billa • Metro • Cora • La Fourmi • Selgros • Mega • XXL Veggie Vendor/ Fruit & Veggie Shop Image Open Markets • Gima Traditional grocery stores 20 Copyright 2004 ACNielsen Shopper. Trends

Trade Sector Relationships Modern Trade & Traditional Trade 21 Copyright 2004 ACNielsen Shopper. Trends

Trade Sector Relationships Modern Trade & Traditional Trade 21 Copyright 2004 ACNielsen Shopper. Trends

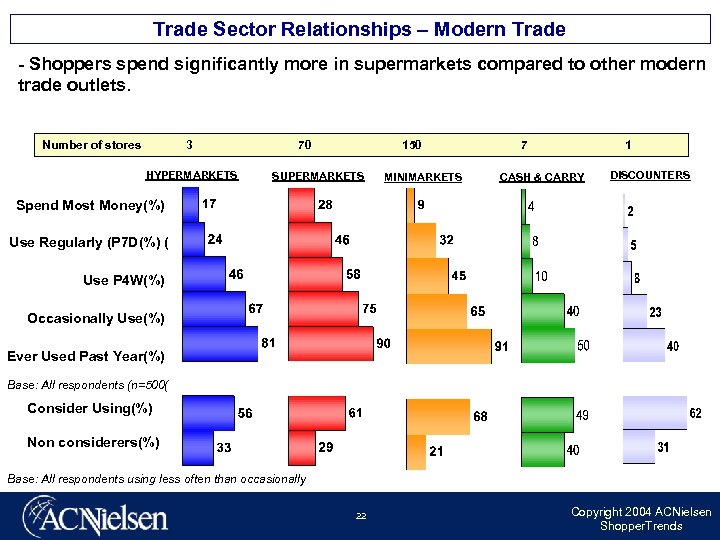

Trade Sector Relationships – Modern Trade - Shoppers spend significantly more in supermarkets compared to other modern trade outlets. Number of stores 3 HYPERMARKETS 70 150 SUPERMARKETS MINIMARKETS 7 1 CASH & CARRY DISCOUNTERS Spend Most Money(%) Use Regularly (P 7 D(%) ( Use P 4 W(%) Occasionally Use(%) Ever Used Past Year(%) Base: All respondents (n=500( Consider Using(%) Non considerers(%) Base: All respondents using less often than occasionally 22 Copyright 2004 ACNielsen Shopper. Trends

Trade Sector Relationships – Modern Trade - Shoppers spend significantly more in supermarkets compared to other modern trade outlets. Number of stores 3 HYPERMARKETS 70 150 SUPERMARKETS MINIMARKETS 7 1 CASH & CARRY DISCOUNTERS Spend Most Money(%) Use Regularly (P 7 D(%) ( Use P 4 W(%) Occasionally Use(%) Ever Used Past Year(%) Base: All respondents (n=500( Consider Using(%) Non considerers(%) Base: All respondents using less often than occasionally 22 Copyright 2004 ACNielsen Shopper. Trends

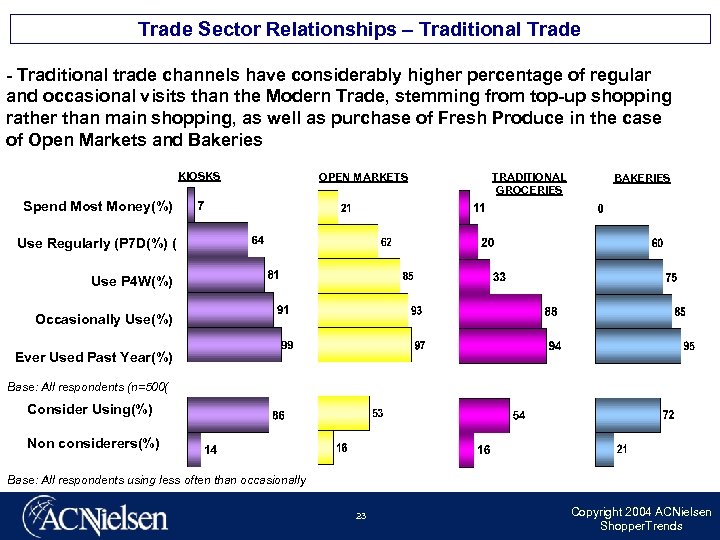

Trade Sector Relationships – Traditional Trade - Traditional trade channels have considerably higher percentage of regular and occasional visits than the Modern Trade, stemming from top-up shopping rather than main shopping, as well as purchase of Fresh Produce in the case of Open Markets and Bakeries KIOSKS OPEN MARKETS TRADITIONAL GROCERIES BAKERIES Spend Most Money(%) Use Regularly (P 7 D(%) ( Use P 4 W(%) Occasionally Use(%) Ever Used Past Year(%) Base: All respondents (n=500( Consider Using(%) Non considerers(%) Base: All respondents using less often than occasionally 23 Copyright 2004 ACNielsen Shopper. Trends

Trade Sector Relationships – Traditional Trade - Traditional trade channels have considerably higher percentage of regular and occasional visits than the Modern Trade, stemming from top-up shopping rather than main shopping, as well as purchase of Fresh Produce in the case of Open Markets and Bakeries KIOSKS OPEN MARKETS TRADITIONAL GROCERIES BAKERIES Spend Most Money(%) Use Regularly (P 7 D(%) ( Use P 4 W(%) Occasionally Use(%) Ever Used Past Year(%) Base: All respondents (n=500( Consider Using(%) Non considerers(%) Base: All respondents using less often than occasionally 23 Copyright 2004 ACNielsen Shopper. Trends

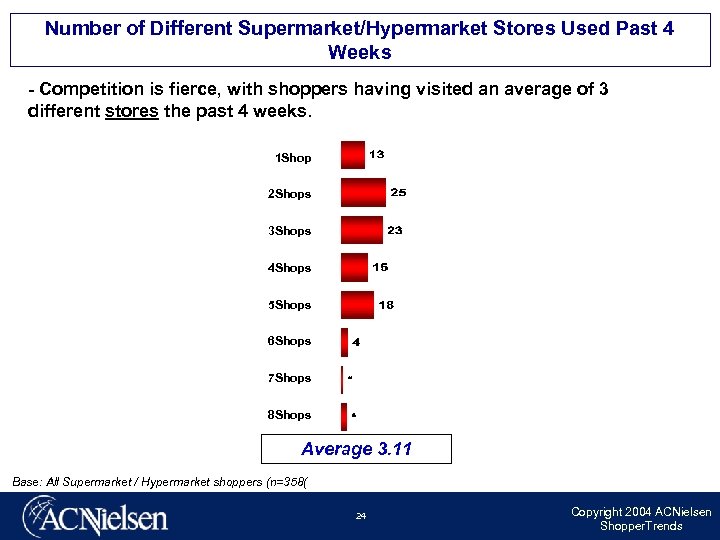

Number of Different Supermarket/Hypermarket Stores Used Past 4 Weeks - Competition is fierce, with shoppers having visited an average of 3 different stores the past 4 weeks. 1 Shop 2 Shops 3 Shops 4 Shops 5 Shops 6 Shops 7 Shops 8 Shops Average 3. 11 Base: All Supermarket / Hypermarket shoppers (n=358( 24 Copyright 2004 ACNielsen Shopper. Trends

Number of Different Supermarket/Hypermarket Stores Used Past 4 Weeks - Competition is fierce, with shoppers having visited an average of 3 different stores the past 4 weeks. 1 Shop 2 Shops 3 Shops 4 Shops 5 Shops 6 Shops 7 Shops 8 Shops Average 3. 11 Base: All Supermarket / Hypermarket shoppers (n=358( 24 Copyright 2004 ACNielsen Shopper. Trends

Key Product Category Purchases 25 Copyright 2004 ACNielsen Shopper. Trends

Key Product Category Purchases 25 Copyright 2004 ACNielsen Shopper. Trends

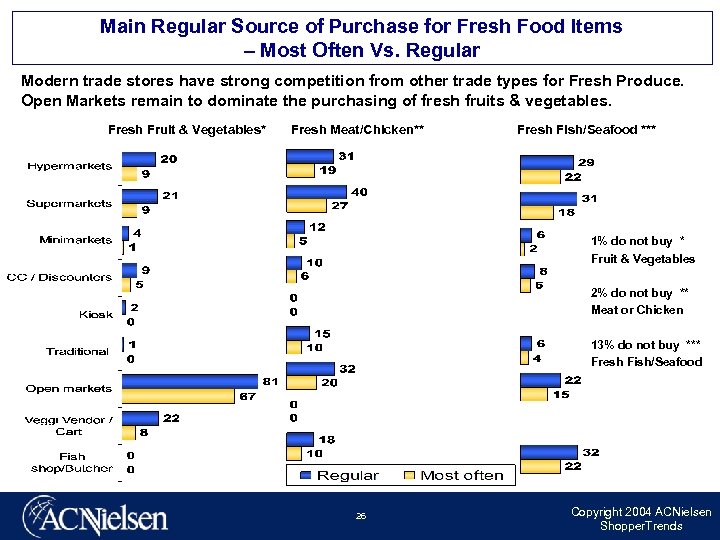

Main Regular Source of Purchase for Fresh Food Items – Most Often Vs. Regular Modern trade stores have strong competition from other trade types for Fresh Produce. Open Markets remain to dominate the purchasing of fresh fruits & vegetables. Fresh Fruit & Vegetables* Fresh Meat/Chicken** Fresh Fish/Seafood *** 1% do not buy * Fruit & Vegetables 2% do not buy ** Meat or Chicken 13% do not buy *** Fresh Fish/Seafood 26 Copyright 2004 ACNielsen Shopper. Trends

Main Regular Source of Purchase for Fresh Food Items – Most Often Vs. Regular Modern trade stores have strong competition from other trade types for Fresh Produce. Open Markets remain to dominate the purchasing of fresh fruits & vegetables. Fresh Fruit & Vegetables* Fresh Meat/Chicken** Fresh Fish/Seafood *** 1% do not buy * Fruit & Vegetables 2% do not buy ** Meat or Chicken 13% do not buy *** Fresh Fish/Seafood 26 Copyright 2004 ACNielsen Shopper. Trends

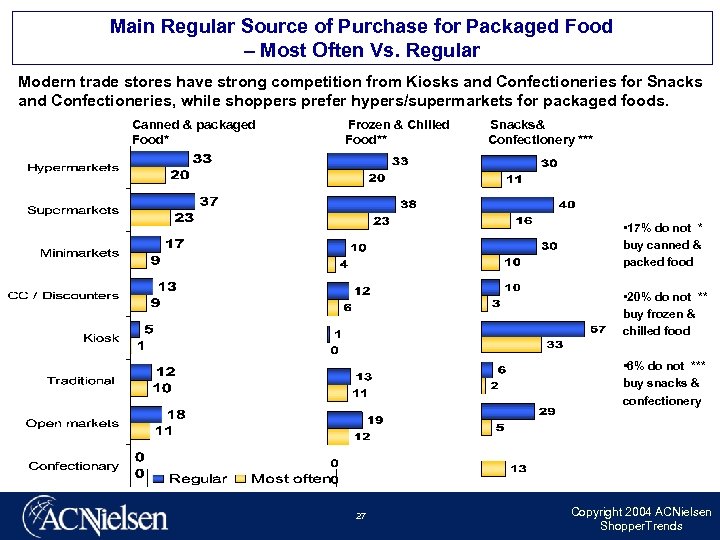

Main Regular Source of Purchase for Packaged Food – Most Often Vs. Regular Modern trade stores have strong competition from Kiosks and Confectioneries for Snacks and Confectioneries, while shoppers prefer hypers/supermarkets for packaged foods. Canned & packaged Food* Frozen & Chilled Food** Snacks& Confectionery *** • 17% do not * buy canned & packed food • 20% do not ** buy frozen & chilled food • 6% do not *** buy snacks & confectionery 27 Copyright 2004 ACNielsen Shopper. Trends

Main Regular Source of Purchase for Packaged Food – Most Often Vs. Regular Modern trade stores have strong competition from Kiosks and Confectioneries for Snacks and Confectioneries, while shoppers prefer hypers/supermarkets for packaged foods. Canned & packaged Food* Frozen & Chilled Food** Snacks& Confectionery *** • 17% do not * buy canned & packed food • 20% do not ** buy frozen & chilled food • 6% do not *** buy snacks & confectionery 27 Copyright 2004 ACNielsen Shopper. Trends

Winning B®ands™ Equity Model l What is Store Equity Index l Store Relationship with Customers l Store Equity Indices for Hypermarkets/ supermarkets 28 Copyright 2004 ACNielsen Shopper. Trends

Winning B®ands™ Equity Model l What is Store Equity Index l Store Relationship with Customers l Store Equity Indices for Hypermarkets/ supermarkets 28 Copyright 2004 ACNielsen Shopper. Trends

What is Store Equity Index 29 Copyright 2004 ACNielsen Shopper. Trends

What is Store Equity Index 29 Copyright 2004 ACNielsen Shopper. Trends

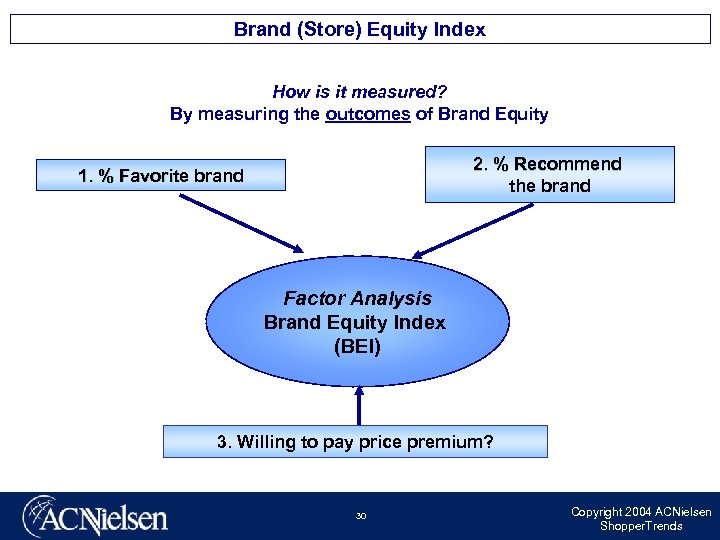

Brand (Store) Equity Index How is it measured? By measuring the outcomes of Brand Equity 2. % Recommend the brand 1. % Favorite brand Factor Analysis Brand Equity Index (BEI) 3. Willing to pay price premium? 30 Copyright 2004 ACNielsen Shopper. Trends

Brand (Store) Equity Index How is it measured? By measuring the outcomes of Brand Equity 2. % Recommend the brand 1. % Favorite brand Factor Analysis Brand Equity Index (BEI) 3. Willing to pay price premium? 30 Copyright 2004 ACNielsen Shopper. Trends

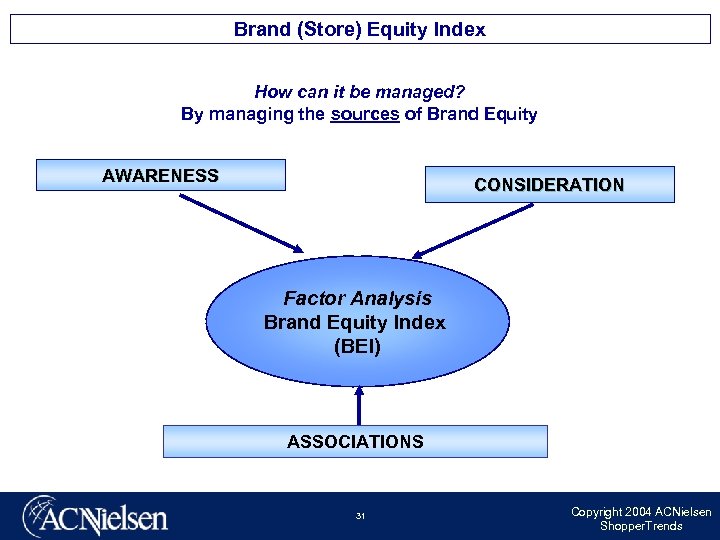

Brand (Store) Equity Index How can it be managed? By managing the sources of Brand Equity AWARENESS CONSIDERATION Factor Analysis Brand Equity Index (BEI) ASSOCIATIONS 31 Copyright 2004 ACNielsen Shopper. Trends

Brand (Store) Equity Index How can it be managed? By managing the sources of Brand Equity AWARENESS CONSIDERATION Factor Analysis Brand Equity Index (BEI) ASSOCIATIONS 31 Copyright 2004 ACNielsen Shopper. Trends

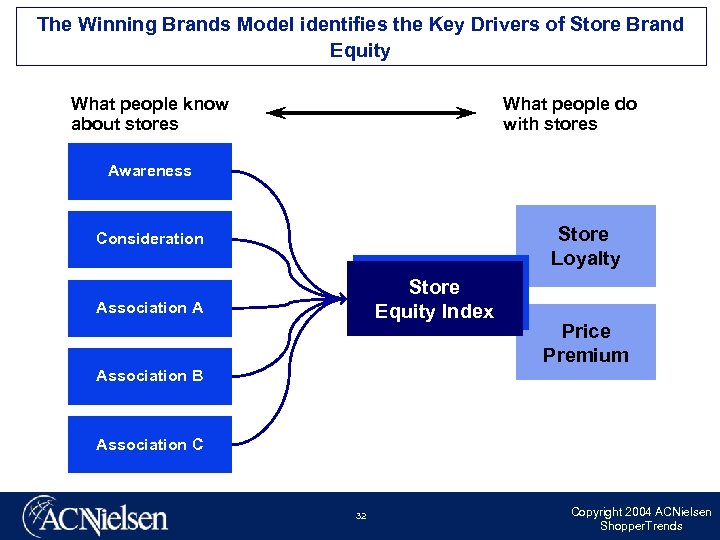

The Winning Brands Model identifies the Key Drivers of Store Brand Equity What people know about stores What people do with stores Awareness Store Loyalty Consideration Store Equity Index Association A Price Premium Association B Association C 32 Copyright 2004 ACNielsen Shopper. Trends

The Winning Brands Model identifies the Key Drivers of Store Brand Equity What people know about stores What people do with stores Awareness Store Loyalty Consideration Store Equity Index Association A Price Premium Association B Association C 32 Copyright 2004 ACNielsen Shopper. Trends

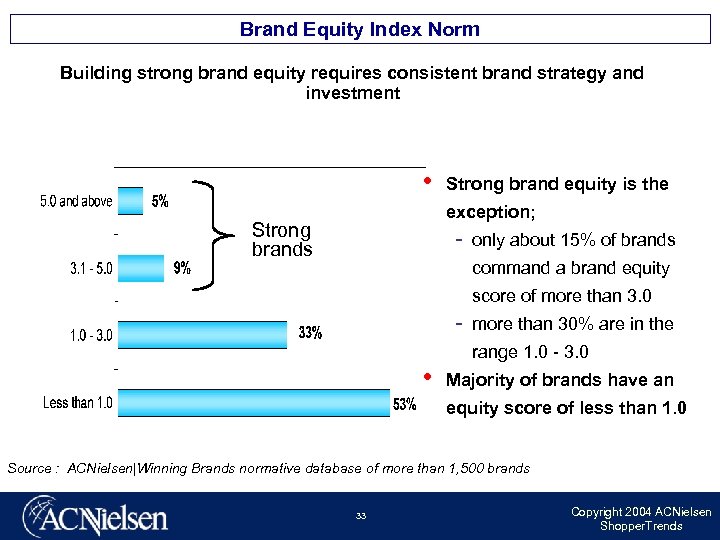

Brand Equity Index Norm Building strong brand equity requires consistent brand strategy and investment • Strong brand equity is the exception; Strong brands only about 15% of brands command a brand equity score of more than 3. 0 more than 30% are in the • range 1. 0 3. 0 Majority of brands have an equity score of less than 1. 0 Source : ACNielsen|Winning Brands normative database of more than 1, 500 brands 33 Copyright 2004 ACNielsen Shopper. Trends

Brand Equity Index Norm Building strong brand equity requires consistent brand strategy and investment • Strong brand equity is the exception; Strong brands only about 15% of brands command a brand equity score of more than 3. 0 more than 30% are in the • range 1. 0 3. 0 Majority of brands have an equity score of less than 1. 0 Source : ACNielsen|Winning Brands normative database of more than 1, 500 brands 33 Copyright 2004 ACNielsen Shopper. Trends

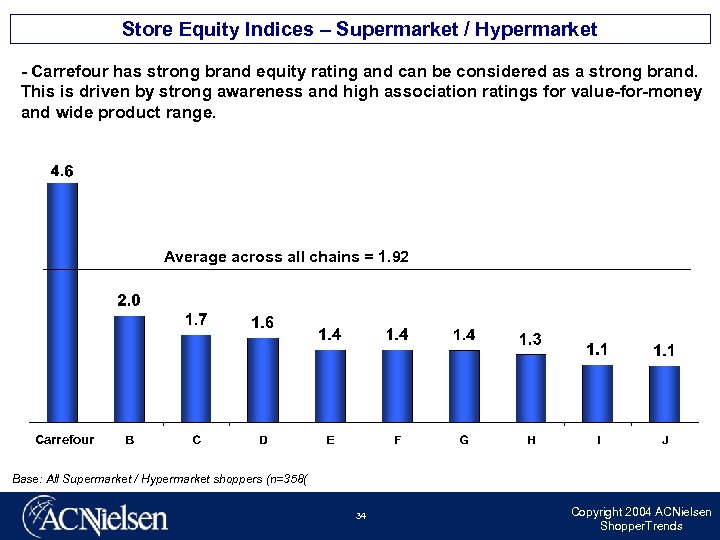

Store Equity Indices – Supermarket / Hypermarket - Carrefour has strong brand equity rating and can be considered as a strong brand. This is driven by strong awareness and high association ratings for value-for-money and wide product range. Average across all chains = 1. 92 Carrefour Base: All Supermarket / Hypermarket shoppers (n=358( 34 Copyright 2004 ACNielsen Shopper. Trends

Store Equity Indices – Supermarket / Hypermarket - Carrefour has strong brand equity rating and can be considered as a strong brand. This is driven by strong awareness and high association ratings for value-for-money and wide product range. Average across all chains = 1. 92 Carrefour Base: All Supermarket / Hypermarket shoppers (n=358( 34 Copyright 2004 ACNielsen Shopper. Trends

Store Associations : What drives Store Equity 35 Copyright 2004 ACNielsen Shopper. Trends

Store Associations : What drives Store Equity 35 Copyright 2004 ACNielsen Shopper. Trends

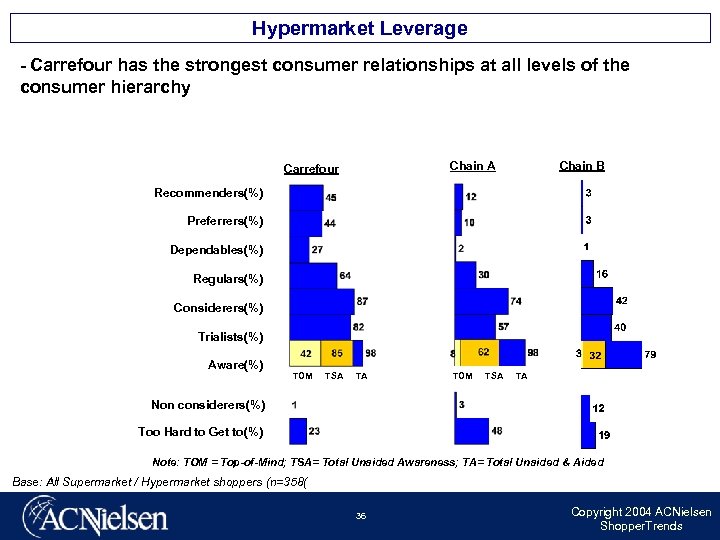

Hypermarket Leverage - Carrefour has the strongest consumer relationships at all levels of the consumer hierarchy Chain B Chain A Carrefour Recommenders(%) Preferrers(%) Dependables(%) Regulars(%) Considerers(%) Trialists(%) Aware(%) TOM TSA TA Non considerers(%) Too Hard to Get to(%) Note: TOM = Top-of-Mind; TSA= Total Unaided Awareness; TA= Total Unaided & Aided Base: All Supermarket / Hypermarket shoppers (n=358( 36 Copyright 2004 ACNielsen Shopper. Trends

Hypermarket Leverage - Carrefour has the strongest consumer relationships at all levels of the consumer hierarchy Chain B Chain A Carrefour Recommenders(%) Preferrers(%) Dependables(%) Regulars(%) Considerers(%) Trialists(%) Aware(%) TOM TSA TA Non considerers(%) Too Hard to Get to(%) Note: TOM = Top-of-Mind; TSA= Total Unaided Awareness; TA= Total Unaided & Aided Base: All Supermarket / Hypermarket shoppers (n=358( 36 Copyright 2004 ACNielsen Shopper. Trends

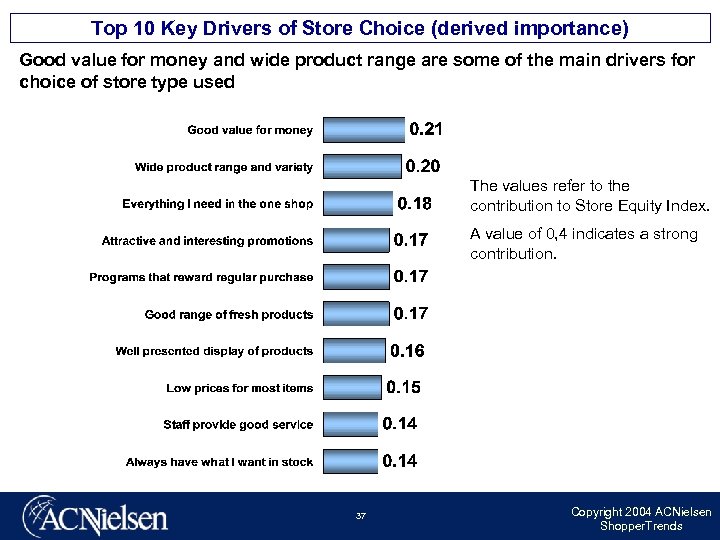

Top 10 Key Drivers of Store Choice (derived importance) Good value for money and wide product range are some of the main drivers for choice of store type used The values refer to the contribution to Store Equity Index. A value of 0, 4 indicates a strong contribution. 37 Copyright 2004 ACNielsen Shopper. Trends

Top 10 Key Drivers of Store Choice (derived importance) Good value for money and wide product range are some of the main drivers for choice of store type used The values refer to the contribution to Store Equity Index. A value of 0, 4 indicates a strong contribution. 37 Copyright 2004 ACNielsen Shopper. Trends

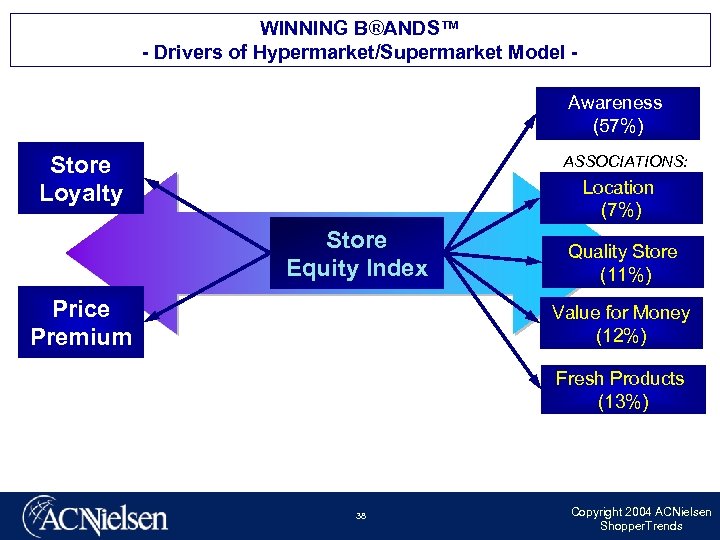

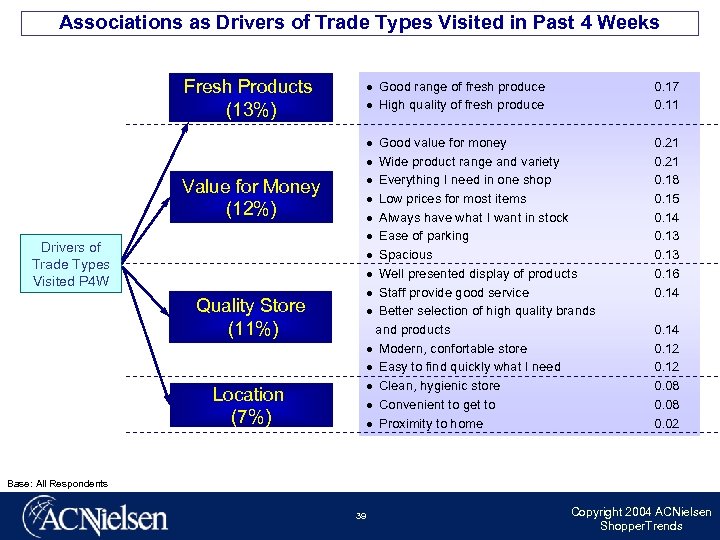

WINNING B®ANDS™ - Drivers of Hypermarket/Supermarket Model Awareness (57%) Store Loyalty ASSOCIATIONS: Location (7%) Store Equity Index Price Premium Quality Store (11%) Value for Money (12%) Fresh Products (13%) 38 Copyright 2004 ACNielsen Shopper. Trends

WINNING B®ANDS™ - Drivers of Hypermarket/Supermarket Model Awareness (57%) Store Loyalty ASSOCIATIONS: Location (7%) Store Equity Index Price Premium Quality Store (11%) Value for Money (12%) Fresh Products (13%) 38 Copyright 2004 ACNielsen Shopper. Trends

Associations as Drivers of Trade Types Visited in Past 4 Weeks Fresh Products (13%) l l Drivers of Trade Types Visited P 4 W Quality Store (11%) Location (7%) 0. 17 0. 11 Good value for money l Wide product range and variety l Everything I need in one shop l Low prices for most items l Always have what I want in stock l Ease of parking l Spacious l Well presented display of products l Staff provide good service l Better selection of high quality brands and products l Modern, confortable store l Easy to find quickly what I need l Clean, hygienic store l Convenient to get to l Proximity to home l Value for Money (12%) Good range of fresh produce High quality of fresh produce 0. 21 0. 18 0. 15 0. 14 0. 13 0. 16 0. 14 0. 12 0. 08 0. 02 Base: All Respondents 39 Copyright 2004 ACNielsen Shopper. Trends

Associations as Drivers of Trade Types Visited in Past 4 Weeks Fresh Products (13%) l l Drivers of Trade Types Visited P 4 W Quality Store (11%) Location (7%) 0. 17 0. 11 Good value for money l Wide product range and variety l Everything I need in one shop l Low prices for most items l Always have what I want in stock l Ease of parking l Spacious l Well presented display of products l Staff provide good service l Better selection of high quality brands and products l Modern, confortable store l Easy to find quickly what I need l Clean, hygienic store l Convenient to get to l Proximity to home l Value for Money (12%) Good range of fresh produce High quality of fresh produce 0. 21 0. 18 0. 15 0. 14 0. 13 0. 16 0. 14 0. 12 0. 08 0. 02 Base: All Respondents 39 Copyright 2004 ACNielsen Shopper. Trends

Store Image Associations 40 Copyright 2004 ACNielsen Shopper. Trends

Store Image Associations 40 Copyright 2004 ACNielsen Shopper. Trends

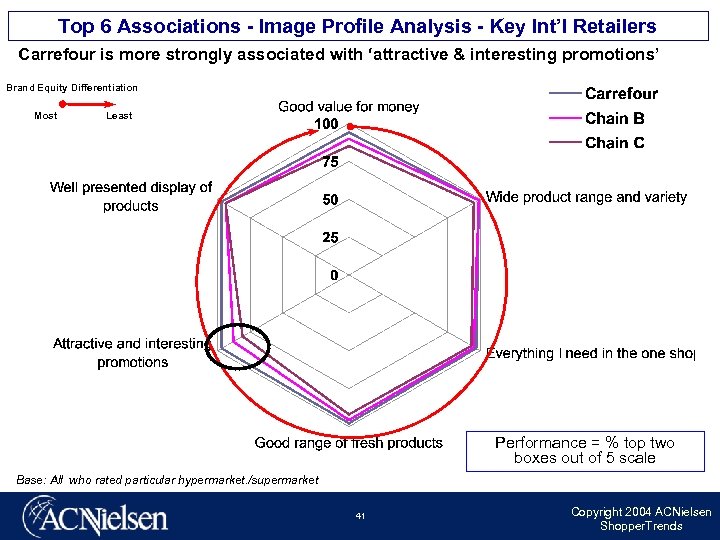

Top 6 Associations - Image Profile Analysis - Key Int’l Retailers Carrefour is more strongly associated with ‘attractive & interesting promotions’ Brand Equity Differentiation Most Least Performance = % top two boxes out of 5 scale Base: All who rated particular hypermarket. /supermarket 41 Copyright 2004 ACNielsen Shopper. Trends

Top 6 Associations - Image Profile Analysis - Key Int’l Retailers Carrefour is more strongly associated with ‘attractive & interesting promotions’ Brand Equity Differentiation Most Least Performance = % top two boxes out of 5 scale Base: All who rated particular hypermarket. /supermarket 41 Copyright 2004 ACNielsen Shopper. Trends

Shopper Behavior 42 Copyright 2004 ACNielsen Shopper. Trends

Shopper Behavior 42 Copyright 2004 ACNielsen Shopper. Trends

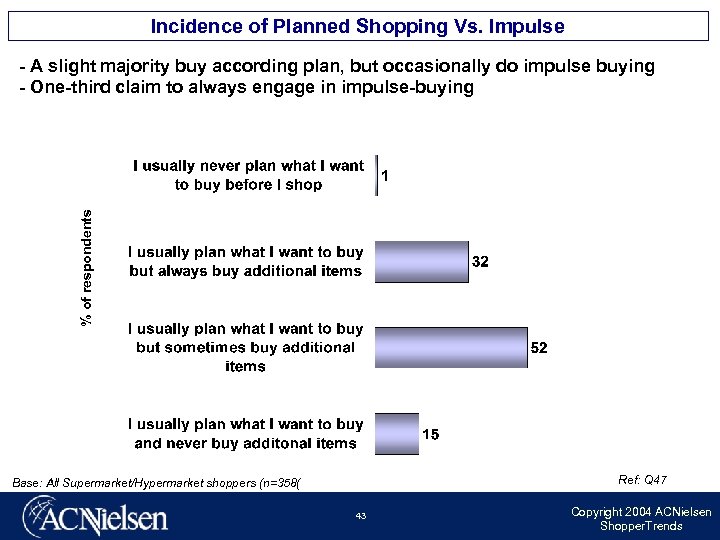

Incidence of Planned Shopping Vs. Impulse % of respondents - A slight majority buy according plan, but occasionally do impulse buying - One-third claim to always engage in impulse-buying Ref: Q 47 Base: All Supermarket/Hypermarket shoppers (n=358( 43 Copyright 2004 ACNielsen Shopper. Trends

Incidence of Planned Shopping Vs. Impulse % of respondents - A slight majority buy according plan, but occasionally do impulse buying - One-third claim to always engage in impulse-buying Ref: Q 47 Base: All Supermarket/Hypermarket shoppers (n=358( 43 Copyright 2004 ACNielsen Shopper. Trends

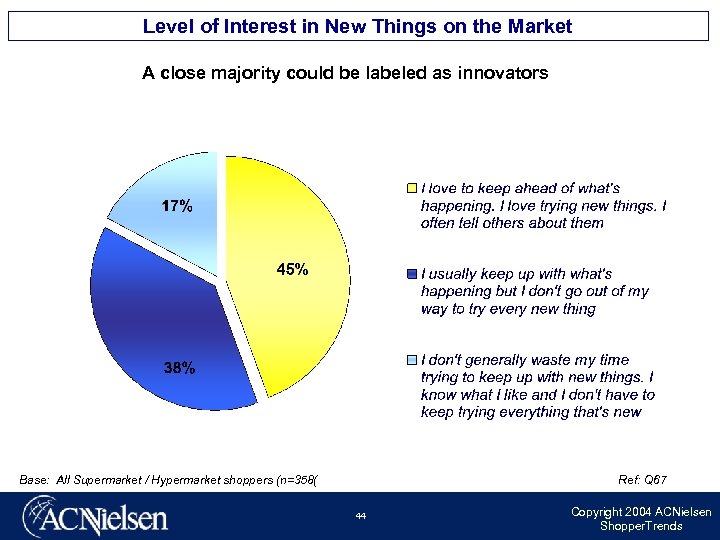

Level of Interest in New Things on the Market A close majority could be labeled as innovators Base: All Supermarket / Hypermarket shoppers (n=358( Ref: Q 67 44 Copyright 2004 ACNielsen Shopper. Trends

Level of Interest in New Things on the Market A close majority could be labeled as innovators Base: All Supermarket / Hypermarket shoppers (n=358( Ref: Q 67 44 Copyright 2004 ACNielsen Shopper. Trends

Summary • • Main shopping is strongly dominated by females Majority of shoppers shop at both modern and traditional trade stores without being loyal to a trade channel type ü The incidence of shopping around among hypers/supers is high, implying low loyalty levels Shoppers spend more in Supermarkets than in any other Modern Trade type ü Supermarkets and Hypermarkets still have a challenge and opportunity in the area of fresh fruits/vegetables vs Open Markets and Specialist outlets Store Equity ü Awareness is clearly a key driver ü Consideration is not a key driver of Store Equity, given the consistently high acceptance levels for all stores ü In terms of Associations (attributes), fresh products, value for money and store quality are similar in terms of importance for driving the Store Equity ü Each of the above associations are dependant on multiple factors as opposed to a few key factors 45 Copyright 2004 ACNielsen Shopper. Trends

Summary • • Main shopping is strongly dominated by females Majority of shoppers shop at both modern and traditional trade stores without being loyal to a trade channel type ü The incidence of shopping around among hypers/supers is high, implying low loyalty levels Shoppers spend more in Supermarkets than in any other Modern Trade type ü Supermarkets and Hypermarkets still have a challenge and opportunity in the area of fresh fruits/vegetables vs Open Markets and Specialist outlets Store Equity ü Awareness is clearly a key driver ü Consideration is not a key driver of Store Equity, given the consistently high acceptance levels for all stores ü In terms of Associations (attributes), fresh products, value for money and store quality are similar in terms of importance for driving the Store Equity ü Each of the above associations are dependant on multiple factors as opposed to a few key factors 45 Copyright 2004 ACNielsen Shopper. Trends

THANK YOU FOR YOUR ATTENTION! 46 Copyright 2004 ACNielsen Shopper. Trends

THANK YOU FOR YOUR ATTENTION! 46 Copyright 2004 ACNielsen Shopper. Trends

Building Better Brands 47 Copyright 2004 ACNielsen Shopper. Trends

Building Better Brands 47 Copyright 2004 ACNielsen Shopper. Trends