d7d61c4c143fca55da047ce6b8e363ef.ppt

- Количество слайдов: 30

Sharing TBC Bank experience on Credit Risk under ICAAP

Agenda 1 Overview Credit Risk Governance Credit Risk Management Credit Risk Stress test Way Forward 2

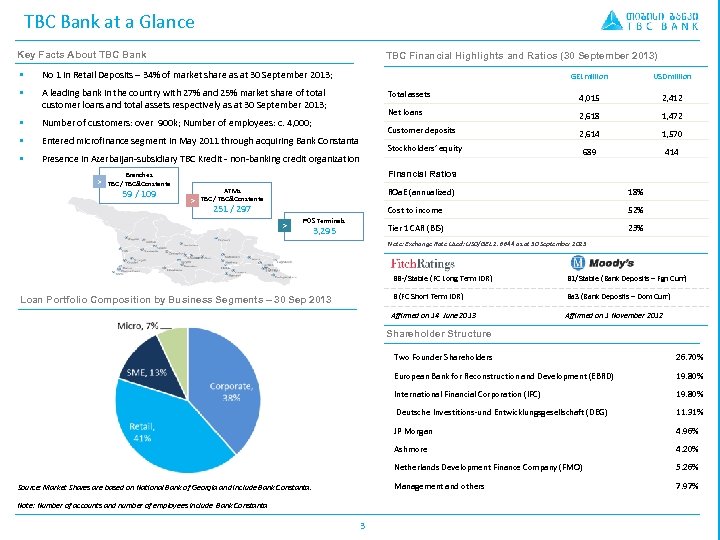

TBC Bank at a Glance Key Facts About TBC Bank TBC Financial Highlights and Ratios (30 September 2013) § No 1 in Retail Deposits – 34% of market share as at 30 September 2013; § A leading bank in the country with 27% and 25% market share of total customer loans and total assets respectively as at 30 September 2013; § § Branches > TBC / TBC&Constanta 59 / 109 2, 412 2, 618 1, 472 Customer deposits 2, 614 1, 570 Stockholders’ equity Presence in Azerbaijan-subsidiary TBC Kredit - non-banking credit organization 4, 015 Net loans Entered microfinance segment in May 2011 through acquiring Bank Constanta USD million Total assets Number of customers: over 900 k; Number of employees: c. 4, 000; § GEL million 689 414 Financial Ratios ROa. E (annualized) > POS Terminals 3, 295 52% Tier 1 CAR (BIS) 251 / 297 18% Cost to income ATMs > TBC / TBC&Constanta 23% Note: Exchange Rate Used: USD/GEL 1. 6644 as at 30 September 2013 BB-/Stable (FC Long Term IDR) B (FC Short Term IDR) Ba 3 (Bank Deposits – Dom Curr) Affirmed on 14 June 2013 Loan Portfolio Composition by Business Segments – 30 Sep 2013 B 1/Stable (Bank Deposits – Fgn Curr) Affirmed on 1 November 2012 Shareholder Structure Two Founder Shareholders European Bank for Reconstruction and Development (EBRD) 11. 31% JP Morgan 4. 96% Ashmore 4. 20% Netherlands Development Finance Company (FMO) 5. 26% Management and others 3 19. 80% Deutsche Investitions-und Entwicklungsgesellschaft (DEG) Note: Number of accounts and number of employees include Bank Constanta 19. 80% International Financial Corporation (IFC) Source: Market Shares are based on National Bank of Georgia and include Bank Constanta. 26. 70% 7. 97%

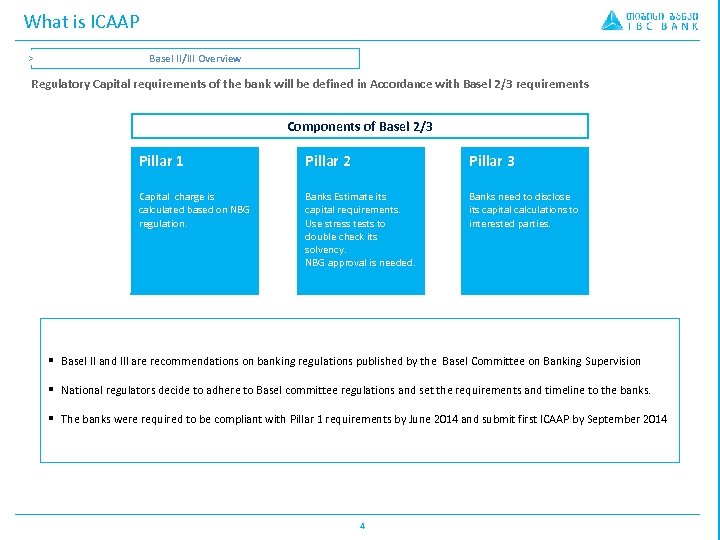

What is ICAAP > Basel II/III Overview Regulatory Capital requirements of the bank will be defined in Accordance with Basel 2/3 requirements Components of Basel 2/3 Pillar 1 Pillar 2 Pillar 3 Capital charge is calculated based on NBG regulation. Banks Estimate its capital requirements. Use stress tests to double check its solvency. NBG approval is needed. Banks need to disclose its capital calculations to interested parties. § Basel II and III are recommendations on banking regulations published by the Basel Committee on Banking Supervision § National regulators decide to adhere to Basel committee regulations and set the requirements and timeline to the banks. § The banks were required to be compliant with Pillar 1 requirements by June 2014 and submit first ICAAP by September 2014 4

TBC Experience in Implementation Timeline > Feb 2012 ICAAP Mar Apr External High Level consultant Gap analysis. selection Credit review May Jun Jul Aug Detailed Gap Analysis > ICAAP implementation included: § Significant changes in corporate governance both on the Supervisory and Management board level § Enhanced transparency in capital calculation and risk management resulting in enhanced trust from regulators and investors Availability of high quality data Development of adequate framework § Main Benefits § Enhanced corporate governance Main Challenges § Jan 2013 § Better understanding and management of the risk that banks face § 25+ people from the banks side and two outsourcing companies including Ernst & Young were involved in the project § Dec § Better capital management through better capital allocation practice In total: > Nov § Capital assessment and planning in accordance with the risk profile Major improvements in risk management including credit, operational, market and other risk management § Oct Implementation and Capital Calculation Summary > Sep Integration of the processes into day management 5 Feb

Credit Risk Breakdown In million GEL Data as of Dec 2013 Risk Weighted Exposures 1 Pillar 2 Credit Risk 1. 1 Credit Risk 3, 380 1. 2 FX Induced Credit Risk 1, 272 437 1. 3 Concentration Risk - 455 2 Market Risk 4 4 3 Operational Risk 344 81 4 Strategic risk - 67 5 Reputational risk - 67 6 Interest rate risk - 127 7 Total Risk Weighted Exposures 5, 000 4, 619 § § Compared to Pillar 1 Pillar 2 contains number of additional risks Credit risk remains significant part of both Pillar 1 and Pillar 2 Risk Weighted Assets 6 92%

Agenda Credit Risk Under ICAAP 2 Credit Risk Governance Credit Risk Management Credit Risk Stress test Way Forward 7

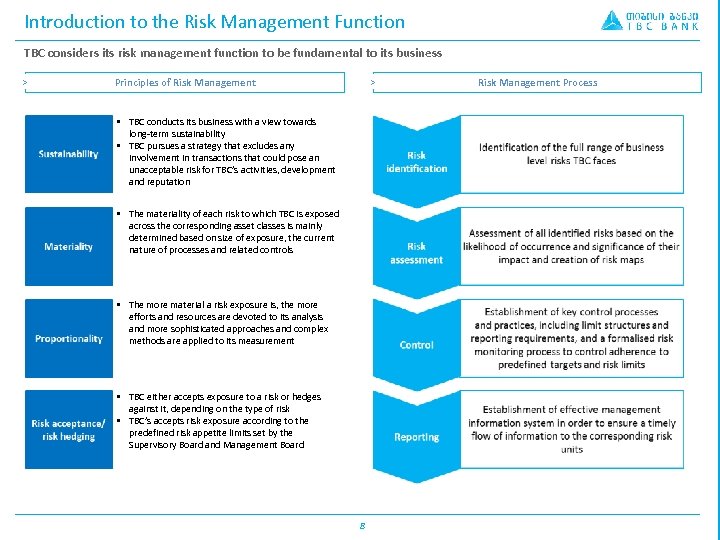

Introduction to the Risk Management Function TBC considers its risk management function to be fundamental to its business > Principles of Risk Management > § TBC conducts its business with a view towards long-term sustainability § TBC pursues a strategy that excludes any involvement in transactions that could pose an unacceptable risk for TBC’s activities, development and reputation § The materiality of each risk to which TBC is exposed across the corresponding asset classes is mainly determined based on size of exposure, the current nature of processes and related controls § The more material a risk exposure is, the more efforts and resources are devoted to its analysis and more sophisticated approaches and complex methods are applied to its measurement § TBC either accepts exposure to a risk or hedges against it, depending on the type of risk § TBC’s accepts risk exposure according to the predefined risk appetite limits set by the Supervisory Board and Management Board 8 Risk Management Process

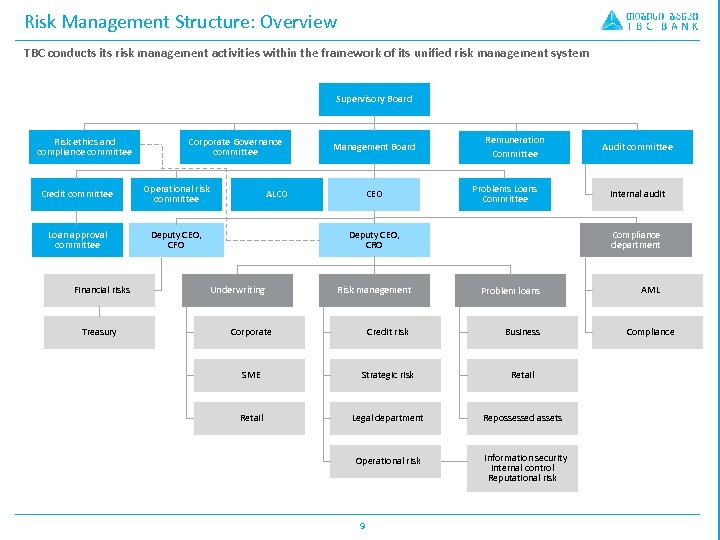

Risk Management Structure: Overview TBC conducts its risk management activities within the framework of its unified risk management system Supervisory Board Risk ethics and compliance committee Corporate Governance committee Credit committee Operational risk committee Loan approval committee Deputy CEO, CFO Financial risks Treasury Management Board ALCO CEO Remuneration Committee Problems Loans Committee Risk management Problem loans Corporate Credit risk Business SME Strategic risk Retail Legal department Repossessed assets Operational risk Information security Internal control Reputational risk 9 Internal audit Compliance department Deputy CEO, CRO Underwriting Audit committee AML Compliance

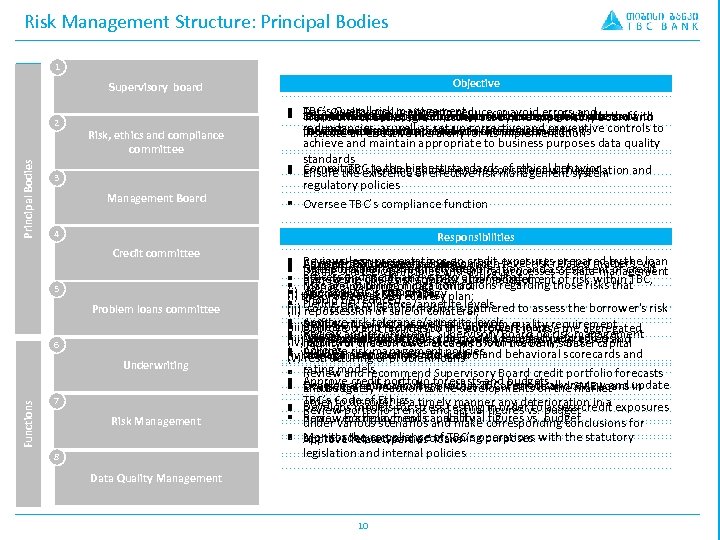

Risk Management Structure: Principal Bodies 1 Objective Supervisory board Principal Bodies 2 Risk, ethics and compliance committee 3 Management Board 4 Responsibilities Credit committee 5 Problem loans committee 6 Underwriting Functions § TBC’s Overall risk management § Data Quality goal is either to reduce or avoid errors and Is involved in the applications approval process as members of Ensure the quality of the credit portfolio is in correspondence with Ensures the maintenance of a balanced loan portfolio and the Monitor TBC's portfolio of problem assets through all phases of Support the Supervisory Board in Transform the strategic direction set by the supervisory board and redundancies, as well as set up corrective and preventive controls to corresponding loan approval committees. the TBC’s risk appetite correspondence of actual risks to the predefined limits collection its work with and supervision of risk management institute an effective hierarchy for its implementation achieve and maintain appropriate to business purposes data quality standards § Commit TBC to the highest standards of ethical behavior § Ensure TBC’s lending guidelines are consistent with legislation and Ensure the existence of effective risk management system regulatory policies § Oversee TBC’s compliance function 7 Risk Management 8 Reviews loan presentations on credit exposures prepared by the loan § Advise the Supervisory Board on high-level risk related matters, via Considers and makes decisions on: § Approve TBC’s overall strategy Define risk management strategy Is responsible for the timely identification and assessment of credit Define strategic principles and critical processes of data management officers and credit analysts to ensure that § overseeing TBC’s risk strategy and management of risk within TBC, Review the quality of the TBC’s loan portfolio § risks and outlining mitigation actions regarding those risks that Manage planning of data control (i) the analysis is complete; § Approve TBC’s risk strategy also reviewing Risk Maps (i) the problem asset recovery plan; § should be reduced Define risk tolerance/appetite levels (ii) comprehensive information is gathered to assess the borrower's risk (ii) repossession or sale of collateral; § Approve risk tolerance/appetite levels profile; (iii) collection and recovery of all written-off loans; § Define critical data as well as minimum quality requirement Approve credit facilities to the borrowers in case the aggregated § Discuss industry trends Develops adequate tools and models for effective credit risk (iii) all relevant risks are identified and adequately addressed and § Review and recommend Supervisory Board on risk management Monitor data quality (iv) approval of costs associated with loan recovery; and liability of the borrower exceeds 5% of the Bank's Basel capital § Approve risk management policies management, such as application and behavioral scorecards and (iv) the loan is properly structured. § policies Manage execution of data control (v) restructuring of problem loans § rating models Review and recommend Supervisory Board credit portfolio forecasts § Approve credit portfolio forecasts and budgets § Develop an ethical culture within TBC. Periodically review and update Oversees the monitoring process of Corporate and SME Loans in § Ensure timely reaction to the developments on the market and budgets order to discover in a timely manner any deterioration in a § TBC’s Code of Ethics Develops models for stress testing in order to assess credit exposures Review portfolio trends and actual figures vs. budget borrower's repayment capability § Review portfolio trends and actual figures vs. budget under various scenarios and make corresponding conclusions for Monitor the compliance of TBC’s operations with the statutory capital adequacy and provisioning purposes. § Approve related parties’ loans legislation and internal policies Data Quality Management 10

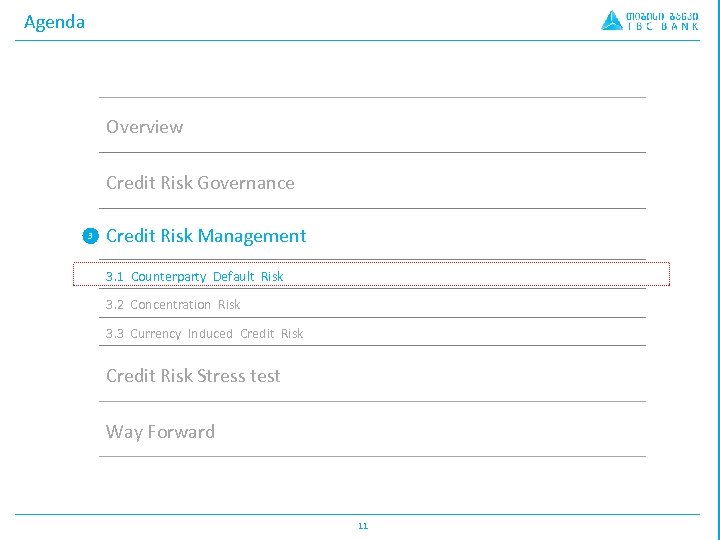

Agenda Overview Credit Risk Governance 3 Credit Risk Management 3. 1 Counterparty Default Risk 3. 2 Concentration Risk 3. 3 Currency Induced Credit Risk Stress test Way Forward 11

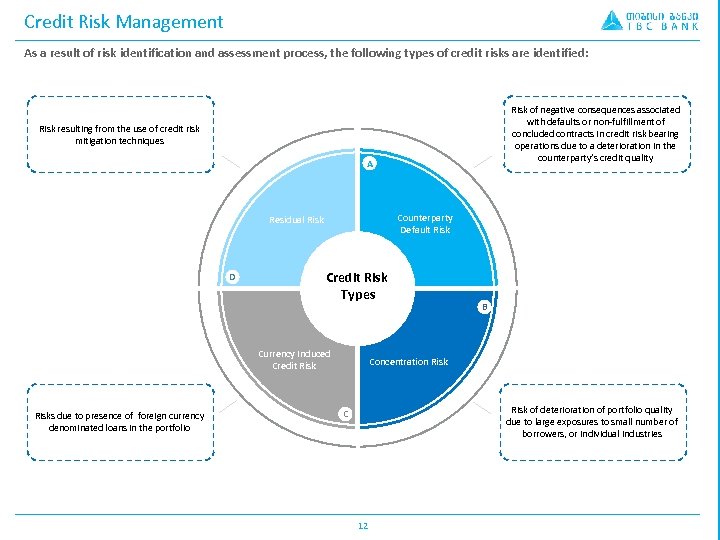

Credit Risk Management As a result of risk identification and assessment process, the following types of credit risks are identified: Risk of negative consequences associated with defaults or non-fulfillment of concluded contracts in credit risk bearing operations due to a deterioration in the counterparty’s credit quality Risk resulting from the use of credit risk mitigation techniques A Counterparty Default Risk Residual Risk D Credit Risk Types Currency Induced Credit Risks due to presence of foreign currency denominated loans in the portfolio B Concentration Risk of deterioration of portfolio quality due to large exposures to small number of borrowers, or individual industries C 12

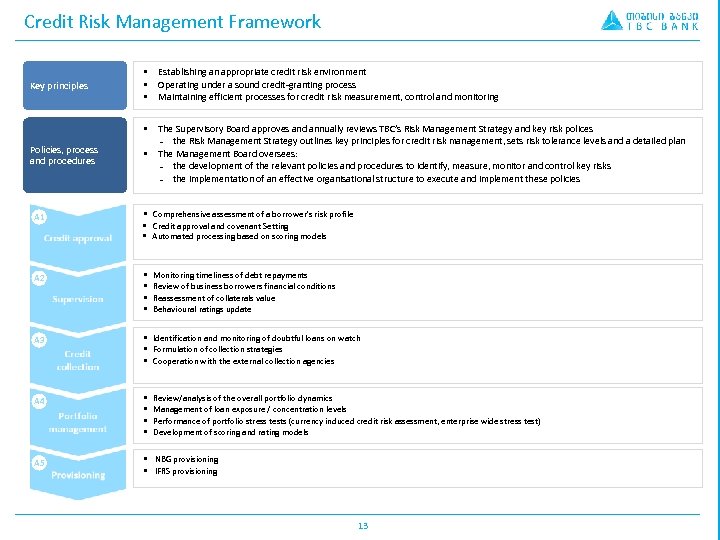

Credit Risk Management Framework Policies, process and procedures Establishing an appropriate credit risk environment Operating under a sound credit-granting process Maintaining efficient processes for credit risk measurement, control and monitoring § Key principles § § § The Supervisory Board approves and annually reviews TBC’s Risk Management Strategy and key risk polices ₋ the Risk Management Strategy outlines key principles for credit risk management, sets risk tolerance levels and a detailed plan The Management Board oversees: ₋ the development of the relevant policies and procedures to identify, measure, monitor and control key risks ₋ the implementation of an effective organisational structure to execute and implement these policies § A 1 § Comprehensive assessment of a borrower's risk profile § Credit approval and covenant Setting § Automated processing based on scoring models A 2 § § A 3 § Identification and monitoring of doubtful loans on watch § Formulation of collection strategies § Cooperation with the external collection agencies A 4 § § A 5 § NBG provisioning § IFRS provisioning Monitoring timeliness of debt repayments Review of business borrowers financial conditions Reassessment of collaterals value Behavioural ratings update Review/analysis of the overall portfolio dynamics Management of loan exposure / concentration levels Performance of portfolio stress tests (currency induced credit risk assessment, enterprise wide stress test) Development of scoring and rating models 13

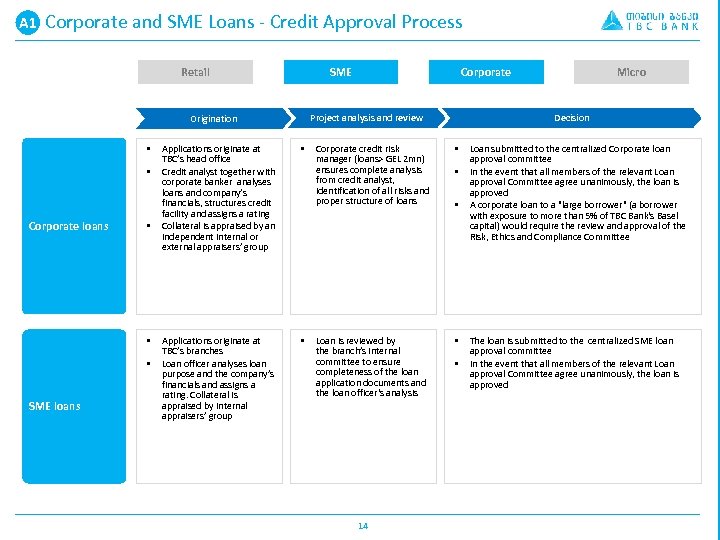

A 1 A. Corporate and SME Loans - Credit Approval Process Retail SME Project analysis and review Origination § § Corporate loans § § § SME loans Corporate Applications originate at TBC’s head office Credit analyst together with corporate banker analyses loans and company’s financials, structures credit facility and assigns a rating Collateral is appraised by an independent internal or external appraisers’ group § Applications originate at TBC’s branches Loan officer analyses loan purpose and the company’s financials and assigns a rating. Collateral is appraised by internal appraisers’ group § Decision Corporate credit risk manager (loans> GEL 2 mn) ensures complete analysis from credit analyst, identification of all risks and proper structure of loans § Loan is reviewed by the branch’s internal committee to ensure completeness of the loan application documents and the loan officer's analysis § 14 Micro § § § Loan submitted to the centralized Corporate loan approval committee In the event that all members of the relevant Loan approval Committee agree unanimously, the loan is approved A corporate loan to a "large borrower" (a borrower with exposure to more than 5% of TBC Bank's Basel capital) would require the review and approval of the Risk, Ethics and Compliance Committee The loan is submitted to the centralized SME loan approval committee In the event that all members of the relevant Loan approval Committee agree unanimously, the loan is approved

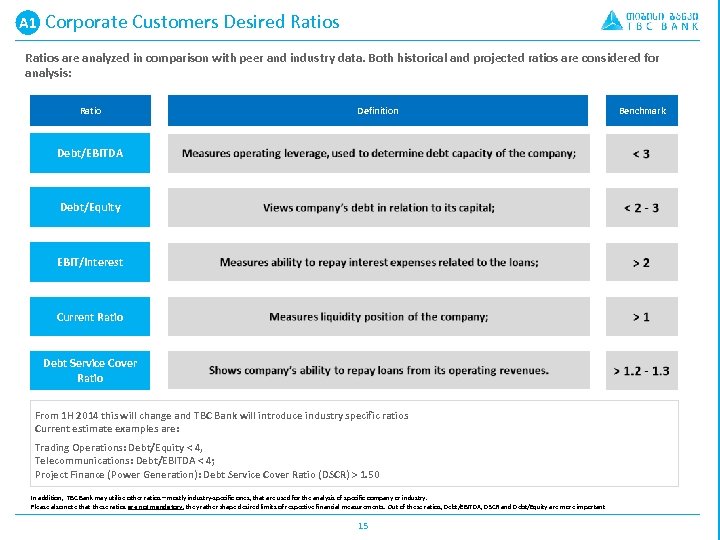

A 1 A. Corporate Customers Desired Ratios are analyzed in comparison with peer and industry data. Both historical and projected ratios are considered for analysis: Ratio Definition Debt/EBITDA Debt/Equity EBIT/Interest Current Ratio Debt Service Cover Ratio From 1 H 2014 this will change and TBC Bank will introduce industry specific ratios Current estimate examples are: Trading Operations: Debt/Equity < 4, Telecommunications: Debt/EBITDA < 4; Project Finance (Power Generation): Debt Service Cover Ratio (DSCR) > 1. 50 In addition, TBC Bank may utilize other ratios – mostly industry-specific ones, that are used for the analysis of specific company or industry. Please also note that these ratios are not mandatory, they rather shape desired limits of respective financial measurements. Out of these ratios, Debt/EBITDA, DSCR and Debt/Equity are more important 15 Benchmark

A 1 A. Corporate and SME Loans – Rating models > § § Expert model was developed together with Ernst &Young during Basel II/III implementation project At present the model is applied for portfolio quality monitoring. Given the expert origin, the model is carefully monitored for validity Once the model is validated, it will be used as a supporting tool in credit approval process, for limit setting and pricing purposes, for provisioning purposes Final grade consists of : Industry score (20%) Qualitative Borrower score (15%) Quantitative Borrower score (65%) Industry assessment § Financial Stability § Economic Volatility § Demand Trend § Barriers to Entry § Sector Competition § Access to Inputs § Operational Gearing and Capital Intensive Qualitative criteria § Company's position in the industry § Organizational and managerial activity § Company’s governance § Finance, accounting and control § Business reputation § Relationship with the Bank 16 Quantitative criteria § Evaluation of solvency § Cover debt service through gross profit § Effectiveness of operations § Assessment of profitability § Earnings volatility § Dividends / Net income § Coefficient of autonomy § Valuating of client’s liquidity § Rates of turnover

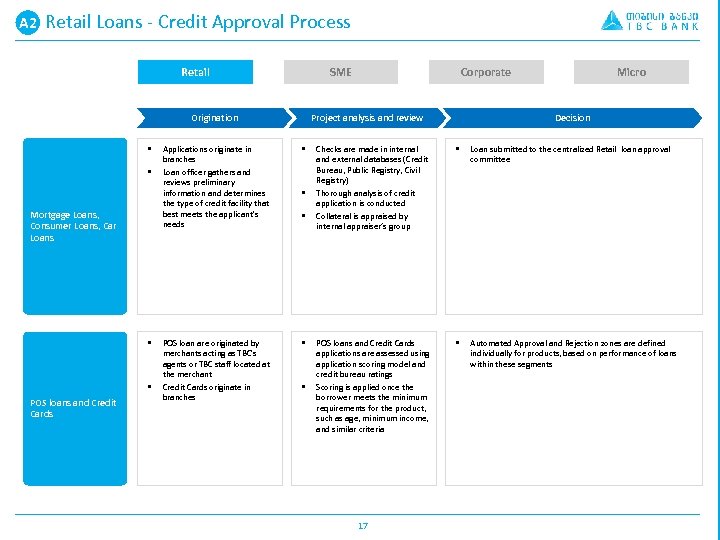

A 2 A. Retail Loans - Credit Approval Process Retail SME Origination § § Mortgage Loans, Consumer Loans, Car Loans § § POS loans and Credit Cards Corporate Project analysis and review Applications originate in branches Loan officer gathers and reviews preliminary information and determines the type of credit facility that best meets the applicant's needs § POS loan are originated by merchants acting as TBC's agents or TBC staff located at the merchant Credit Cards originate in branches § § Micro Decision Checks are made in internal and external databases (Credit Bureau, Public Registry, Civil Registry) Thorough analysis of credit application is conducted Collateral is appraised by internal appraiser’s group § Loan submitted to the centralized Retail loan approval committee POS loans and Credit Cards applications are assessed using application scoring model and credit bureau ratings Scoring is applied once the borrower meets the minimum requirements for the product, such as age, minimum income, and similar criteria § Automated Approval and Rejection zones are defined individually for products, based on performance of loans within these segments 17

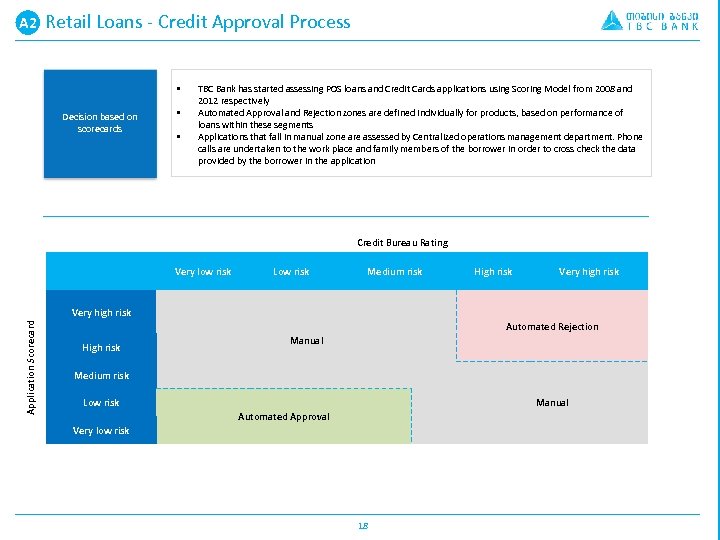

A 2 A. Retail Loans - Credit Approval Process § Decision based on scorecards § § TBC Bank has started assessing POS loans and Credit Cards applications using Scoring Model from 2008 and 2012 respectively Automated Approval and Rejection zones are defined individually for products, based on performance of loans within these segments Applications that fall in manual zone are assessed by Centralized operations management department. Phone calls are undertaken to the work place and family members of the borrower in order to cross check the data provided by the borrower in the application Credit Bureau Rating Very low risk Low risk Medium risk High risk Very high risk Application Scorecard Very high risk Automated Rejection High risk Manual Medium risk Low risk Automated Approval Very low risk 18 Manual

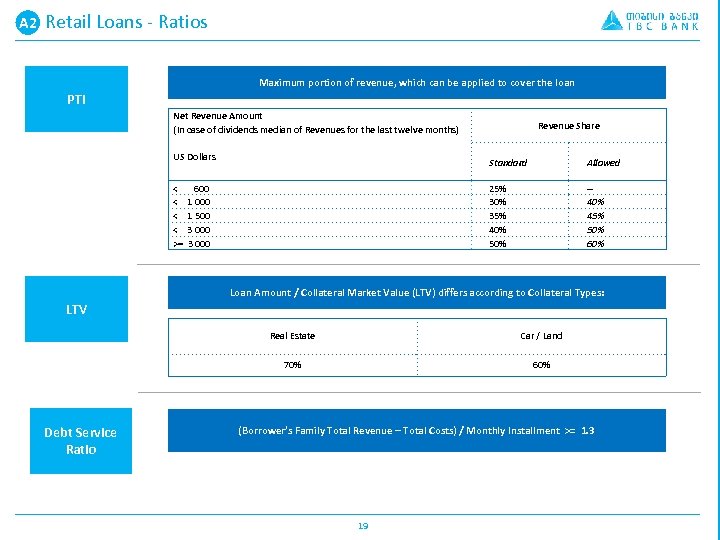

A 2 A. Retail Loans - Ratios Maximum portion of revenue, which can be applied to cover the loan PTI Net Revenue Amount (In case of dividends median of Revenues for the last twelve months) US Dollars Revenue Share Standard 25% 30% 35% 40% 50% < 600 < 1 000 < 1 500 < 3 000 >= 3 000 Allowed -40% 45% 50% 60% Loan Amount / Collateral Market Value (LTV) differs according to Collateral Types: LTV Real Estate 70% Debt Service Ratio Car / Land 60% (Borrower’s Family Total Revenue – Total Costs) / Monthly Installment >= 1. 3 19

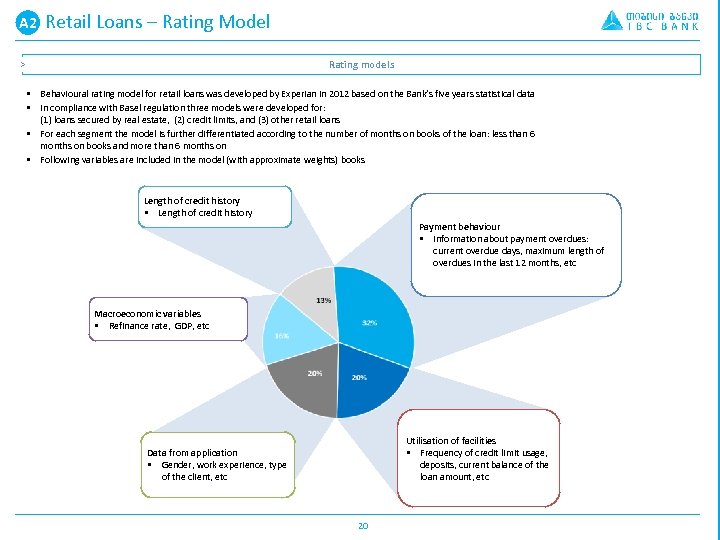

A 2 A. Retail Loans – Rating Model Rating models > § Behavioural rating model for retail loans was developed by Experian in 2012 based on the Bank’s five years statistical data § In compliance with Basel regulation three models were developed for: (1) loans secured by real estate, (2) credit limits, and (3) other retail loans § For each segment the model is further differentiated according to the number of months on books of the loan: less than 6 months on books and more than 6 months on § Following variables are included in the model (with approximate weights) books Length of credit history § Length of credit history Payment behaviour § Information about payment overdues: current overdue days, maximum length of overdues in the last 12 months, etc Macroeconomic variables § Refinance rate, GDP, etc Utilisation of facilities § Frequency of credit limit usage, deposits, current balance of the loan amount, etc Data from application § Gender, work experience, type of the client, etc 20

Agenda Overview Credit Risk Governance 3 Credit Risk Management 3. 1 Counterparty Default Risk 3. 2 Concentration Risk 3. 3 Currency Induced Credit Risk Stress test Way Forward 21

B A. Concentration Risk Concentration management is a significant function of credit risk management Already Implemented The system is already established to identify, measure, monitor, and control credit risk concentrations TBC limits the level of credit risk it undertakes by placing limits on concentrations of: (i) single borrowers and groups of related borrowers; (ii) single industry and groups of "higher-risk" industries Under Development Process New methodology is under development for concentration risk management Credit concentration risk measurement process will be improved based on the Central Bank of Spain’s guidelines Reasons for selecting Spanish regulation: § Spain was strongly effected by the global financial crisis 2007 -2012, the following global recession 2008 -2012, and by the European sovereign debt crisis § The Spanish credit market is heavily dependent on mortgages in particular and on real estate in general § The Spanish simplified option is considered good regulatory practice and implemented in a similar form by several Eastern European regulators (i. e. the Slovenian and the Serbian regulator) § The Spanish simplified option is consistent with the Basel 2 standardized approach to credit risk measurement and results into concentration risk numbers that are easily comparable across the banking industry Two Types of Concentrations are managed: Single name and Sectoral concentration Concentration indexes will be calculated using Herfindahl-Hirshman Index (HHI) 22

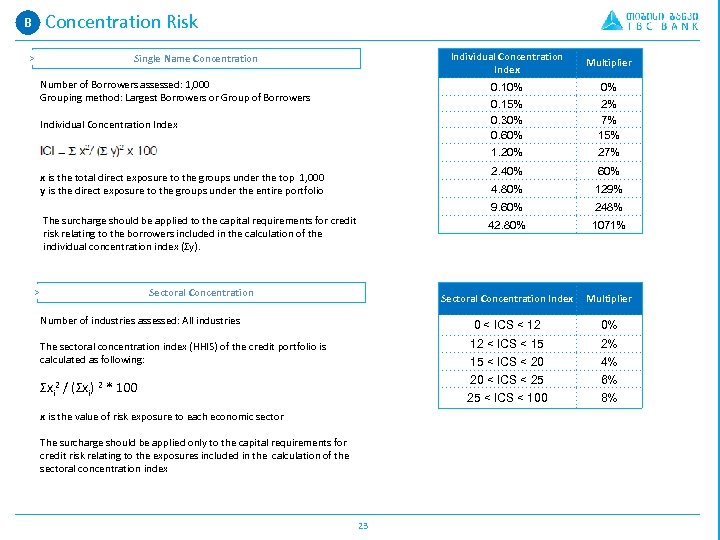

B A. Concentration Risk Individual Concentration Index x is the value of risk exposure to each economic sector The surcharge should be applied only to the capital requirements for credit risk relating to the exposures included in the calculation of the sectoral concentration index 23 Multiplier 0% 2% 4% 6% 25 < ICS < 100 Σxi 2 / (Σxi) 2 * 100 1071% 12 < ICS < 15 15 < ICS < 20 20 < ICS < 25 The sectoral concentration index (HHIS) of the credit portfolio is calculated as following: 42. 80% 0 < ICS < 12 Number of industries assessed: All industries 248% Sectoral Concentration Index Sectoral Concentration 129% 9. 60% > 60% 4. 80% The surcharge should be applied to the capital requirements for credit risk relating to the borrowers included in the calculation of the individual concentration index (Σy). 27% 2. 40% x is the total direct exposure to the groups under the top 1, 000 y is the direct exposure to the groups under the entire portfolio 2% 7% 15% 1. 20% Individual Concentration Index 0% 0. 15% 0. 30% 0. 60% Number of Borrowers assessed: 1, 000 Grouping method: Largest Borrowers or Group of Borrowers Multiplier 0. 10% Single Name Concentration > 8%

B A. Concentration Risk > Limits In addition to HHI suggested by Central Bank of Spain TBC Bank will limit single name concentration risk, using top 1, 5, 10 and 20 borrowers exposures ratios Actual limits vs maximum limits will be communicated to the Management Board on a monthly basis and to RECC on a quarterly basis > Stress Tests In addition the Bank will undertake concentration risk stress tests on a quarterly basis Under stress testing the Bank will assess what would be the loss of regulatory capital if the top 1, 3 and 5 borrowers default in the same time Results of stress test will be applied for credit risks monitoring purposes and will be communicated to the Management Board on a quarterly basis 24

Agenda Overview Credit Risk Governance 3 Credit Risk Management 3. 1 Counterparty Default Risk 3. 2 Concentration Risk 3. 3 Currency Induced Credit Risk Stress test Way Forward 25

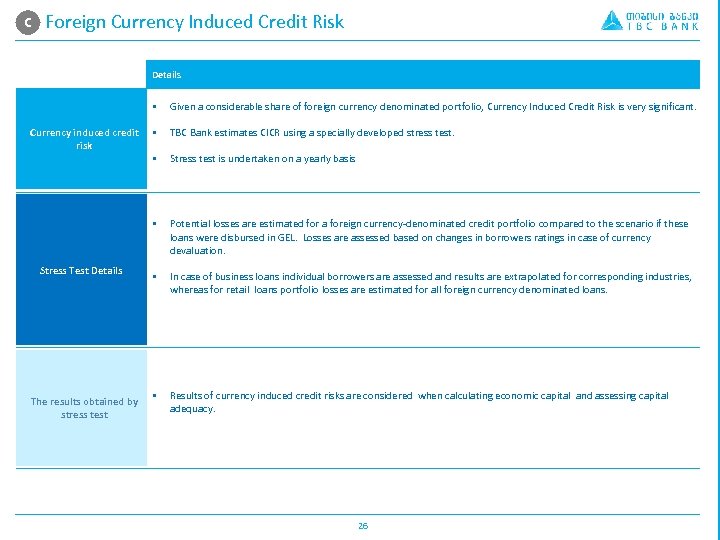

C A. Foreign Currency Induced Credit Risk Details § Currency induced credit § risk § Given a considerable share of foreign currency denominated portfolio, Currency Induced Credit Risk is very significant. TBC Bank estimates CICR using a specially developed stress test. Stress test is undertaken on a yearly basis § Stress Test Details Potential losses are estimated for a foreign currency-denominated credit portfolio compared to the scenario if these loans were disbursed in GEL. Losses are assessed based on changes in borrowers ratings in case of currency devaluation. § In case of business loans individual borrowers are assessed and results are extrapolated for corresponding industries, whereas for retail loans portfolio losses are estimated for all foreign currency denominated loans. The results obtained by stress test § Results of currency induced credit risks are considered when calculating economic capital and assessing capital adequacy. 26

Agenda Overview Credit Risk Governance Credit Risk Management 4 Credit Risk Stress test Way Forward 27

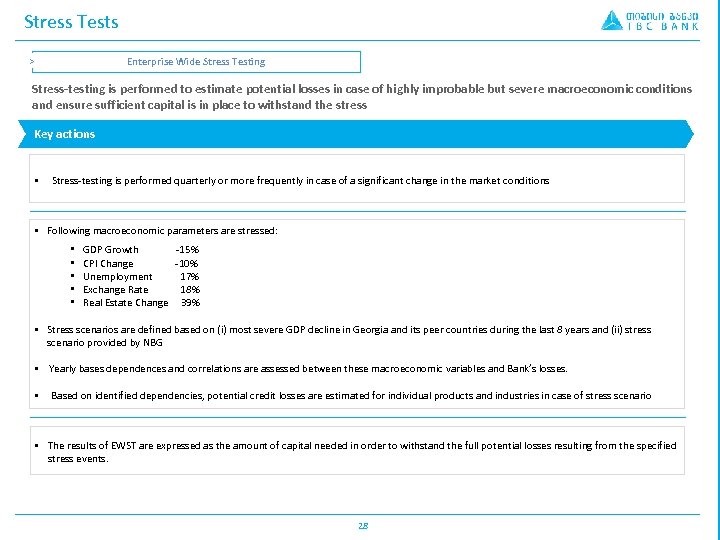

Stress Tests Enterprise Wide Stress Testing > Stress-testing is performed to estimate potential losses in case of highly improbable but severe macroeconomic conditions and ensure sufficient capital is in place to withstand the stress Key actions § Stress-testing is performed quarterly or more frequently in case of a significant change in the market conditions § Following macroeconomic parameters are stressed: • • • GDP Growth -15% CPI Change -10% Unemployment 17% Exchange Rate 18% Real Estate Change 39% § Stress scenarios are defined based on (i) most severe GDP decline in Georgia and its peer countries during the last 8 years and (ii) stress scenario provided by NBG § Yearly bases dependences and correlations are assessed between these macroeconomic variables and Bank’s losses. § Based on identified dependencies, potential credit losses are estimated for individual products and industries in case of stress scenario § The results of EWST are expressed as the amount of capital needed in order to withstand the full potential losses resulting from the specified stress events. 28

Agenda Overview Credit Risk Governance Credit Risk Management Credit Risk Stress test 5 Way Forward 29

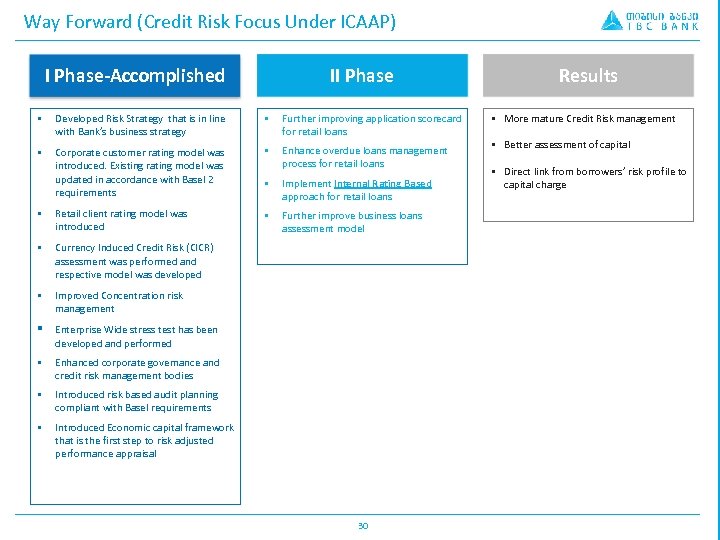

Way Forward (Credit Risk Focus Under ICAAP) I Phase-Accomplished II Phase § Developed Risk Strategy that is in line with Bank’s business strategy § Further improving application scorecard for retail loans § Corporate customer rating model was introduced. Existing rating model was updated in accordance with Basel 2 requirements § Enhance overdue loans management process for retail loans § Implement Internal Rating Based approach for retail loans § Retail client rating model was introduced § Further improve business loans assessment model § Currency Induced Credit Risk (CICR) assessment was performed and respective model was developed § Improved Concentration risk management § Enterprise Wide stress test has been developed and performed § Enhanced corporate governance and credit risk management bodies § Introduced risk based audit planning compliant with Basel requirements § Introduced Economic capital framework that is the first step to risk adjusted performance appraisal 30 Results § More mature Credit Risk management § Better assessment of capital § Direct link from borrowers’ risk profile to capital charge

d7d61c4c143fca55da047ce6b8e363ef.ppt