da34b732aa3d8c85f193991ac998edc4.ppt

- Количество слайдов: 26

Shareclub Orientation Course The Basics – A Plan, A Starting Point, A Path Presented by: David Cox, CFA, CMT, FCSI, FMA, BMath Portfolio Manager April 17 th, 2014 University of Guelph, ON

What Do I Do? § Provide clients with a comprehensive wealth planning approach § Offer clients a way to comfortably grow and protect wealth irrespective of the underlying state of global investment markets 2

Who Am I? § Bachelor of Mathematics – University of Waterloo § My family recently relocated to Guelph after 13 years in B. C. § One of 206 dual holders, globally, of both the Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT) designations § Passionate about the investment markets, skiing, golfing, wine, poker and music 3

Our Agenda § Where do I stand? § Where do I want to be? § What is most important to me? § Do I like my job or vocation? § How do I picture my retirement? 4

Where Do I Stand? § Net Worth Statement § Income (Cash Flow) Statement § Need to really understand your current situation (income/expenses/lifestyle) 5

Starting Point § List ALL of your assets § List ALL of your liabilities § Assets – Liabilities = Net Worth 6

Assets § Your house § Your business § Your 2 nd property § Your cars § Your “toys” § Other (i. e, expected inheritance) 7

Liabilities § Your mortgage § Your lines of credit § Your loans § Money owing to your family § Credit card debt 8

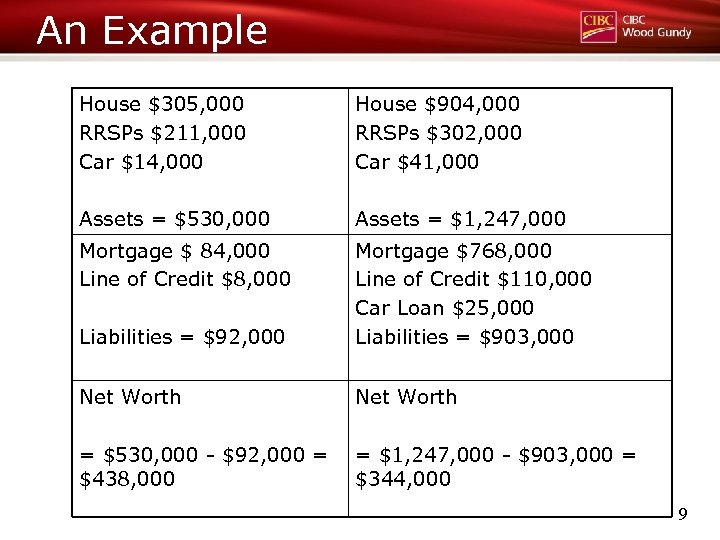

An Example House $305, 000 RRSPs $211, 000 Car $14, 000 House $904, 000 RRSPs $302, 000 Car $41, 000 Assets = $530, 000 Assets = $1, 247, 000 Mortgage $ 84, 000 Line of Credit $8, 000 Liabilities = $92, 000 Mortgage $768, 000 Line of Credit $110, 000 Car Loan $25, 000 Liabilities = $903, 000 Net Worth = $530, 000 - $92, 000 = $438, 000 = $1, 247, 000 - $903, 000 = $344, 000 9

Interest Rates § Mortgage interest is not deductible § Interest paid on monies borrowed for investment are deductible § Equity secured line of credit § Non-Equity/unsecured line of credit vs. § Loans vs. § Credit cards 10

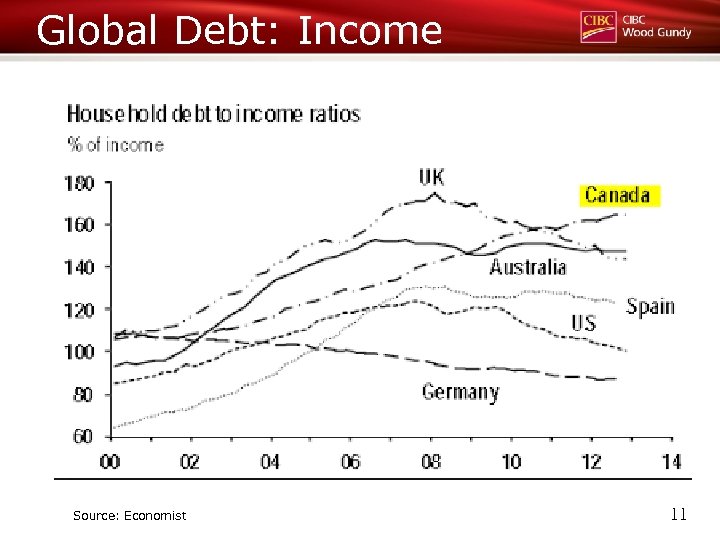

Global Debt: Income Source: Economist 11

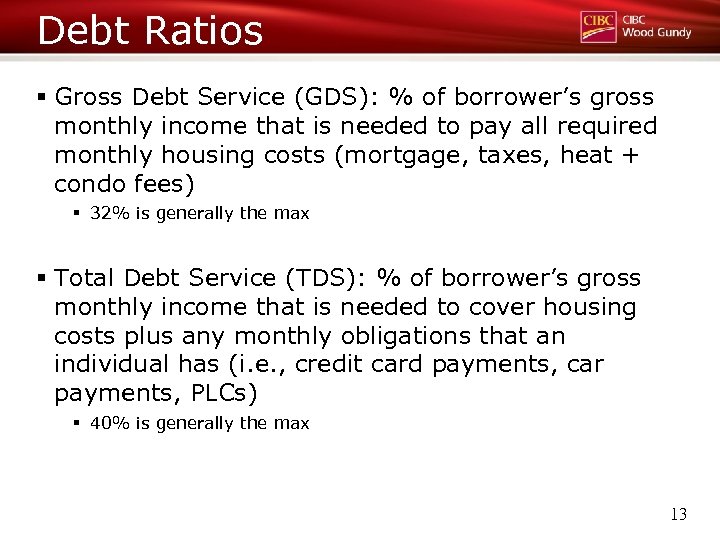

Borrowing Money § Banks will loan you more than you might be comfortable with § Do your own math 12

Debt Ratios § Gross Debt Service (GDS): % of borrower’s gross monthly income that is needed to pay all required monthly housing costs (mortgage, taxes, heat + condo fees) § 32% is generally the max § Total Debt Service (TDS): % of borrower’s gross monthly income that is needed to cover housing costs plus any monthly obligations that an individual has (i. e. , credit card payments, car payments, PLCs) § 40% is generally the max 13

Real Estate: Income 14

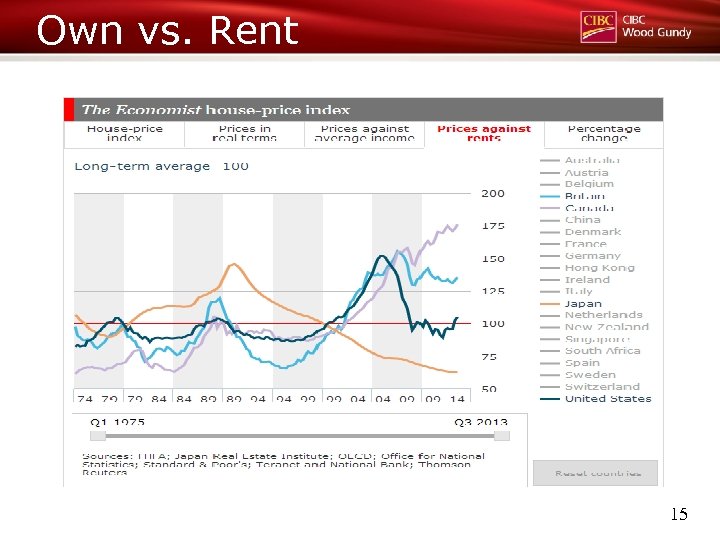

Own vs. Rent 15

Where Do I Want to Be? § Travelling the world? § Time with family? § Reading a book by the lake? § How much money would I like to live on? § Is that a reasonable amount? § Important to be realistic 16

Cash Flow § How much $$$ does your lifestyle cost? § What % is basic needs (i. e. , food, shelter, utilities, etc) § What % is discretionary? (i. e. , alcohol, dining out, travel, etc) 17

Figure Out Your Expenses § After-tax income § Less: RRSP contributions § Less: New investment deposits § Less: Mortgage principal pay-down in past year § Less: $ change in your bank account balance § = YOUR SPENDING FOR THE YEAR 18

Making a Plan § Figure out how much life costs § Map out expected future income (i. e. , OAS/CPP/company pensions) § Determine the shortfall and figure out how many assets are required § Be conservative in assumptions (i. e. , returns) § A realistic plan that is POSSIBLE is better than a plan that looks great but can NEVER happen! 19

Following Your Plan § Annual review § Did your investment assets grow as planned? § Did your expenses stay at or below expectations? § Any other big life changes that require a change in plan? 20

Key Risks § Insufficient investment returns § Unwillingness to take appropriate risk § Emotions/mental struggles with finances § Inflation risk § Interest rate risk § Real estate risk § Employment risk § Government/political risk 21

Tips § Prepare an annual asset list for your executor § Have an updated will + power of attorney § Save 10% § Focus on your plan not your neighbour’s § Looks can be deceiving § Have a financial plan before doing any investing! § Accounting vs. Mental Accounting § Extraordinary expenses occur EVERY year so make sure to consider them in planning 22

Useful Links CMHC Spending Tool § http: //www. cmhcschl. gc. ca/en/co/buho/hostst_002. cfm 23

Useful Stuff § Monthly Market Chit Chat” – monthly e-publication that discusses the risks and opportunities facing investors – email me to subscribe § Twitter: http: //www. twitter. com/David. Cox. WG § Facebook: http: //www. facebook. com/David. Cox. WG § Linked. In: http: //ca. linkedin. com/in/David. Cox. WG § www. davidcox. ca – a variety of seminars, webinars and publications are published along with David’s travel schedule 24

Questions & Answers 25

Thank You 42 Wyndham St. N, Suite 201 | Guelph | Ontario | N 1 H 4 E 6 (519) 823 -4411 | 1 855 -246 -4076 CIBC Wood Gundy is a division of CIBC World Markets Inc. , a subsidiary of CIBC and a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor. This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc. , their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2014.

da34b732aa3d8c85f193991ac998edc4.ppt