c582227fb97045fffd8be1b7fa9950b2.ppt

- Количество слайдов: 24

Seven Questions About Your Savings 1. Do I have 3 -6 months living expenses in an emergency fund? 2. Do I save regularly? 3. Am I saving enough for future high cost goals (education, house)? 4. Do I save to purchase big ticket items instead of buying on credit?

Seven Questions About Your Savings continued 5. When I use credit, do I save to make as large a down payment as possible? 6. Do I set aside enough into another account to cover my periodic expenses? 7. Am I saving enough for my retirement?

The more times you answer “yes” to these questions, the more likely you are a prudent saver. Any “no’s” can help you identify areas where you could do better

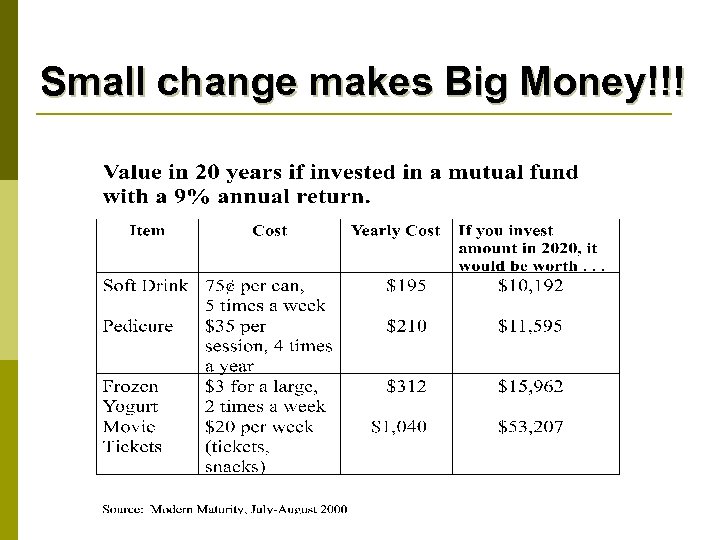

Small change makes Big Money!!!

pputting money aside from present earnings to provide for the future.

WHY WE NEED TO SAVE è Everyday è Loss Emergencies of Income è Retirement è Special Family Goals è Irregular Expenses

Emergency !!!! What would YOU do if this happens? p Karen has a serious dental problem. The dental bill is already $800 with more dental care needed. No dental insurance. No savings. No credit card limit remains.

$ Set up a regular plan $ Pay yourself first $ Payroll deduction $ Save bonus money $ Save coupon money $ Pay installments to yourself

$ Save loose change $ Break a habit $ Save lunch money $ Buy items on sale $ “Nothing Week” $ Use a “Crash Budget” $ Evaluate all spending decisions

P. Y. F. Rule Pay Yourself First

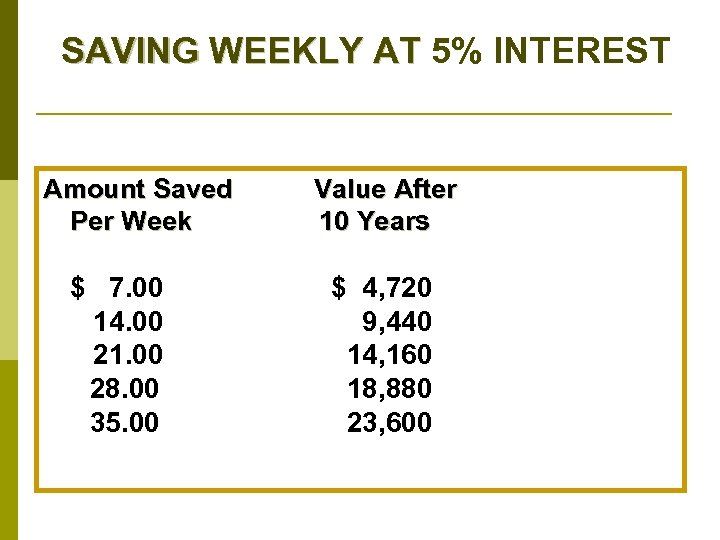

SAVING WEEKLY AT 5% INTEREST Amount Saved Per Week $ 7. 00 14. 00 21. 00 28. 00 35. 00 Value After 10 Years $ 4, 720 9, 440 14, 160 18, 880 23, 600

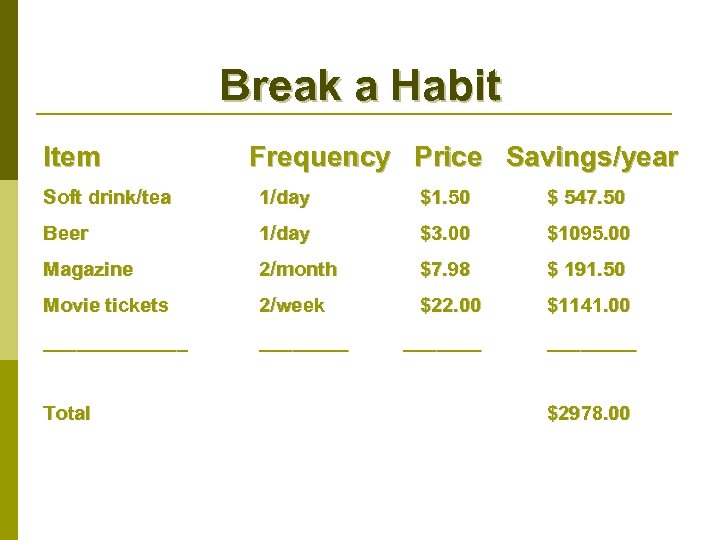

Break a Habit Item Frequency Price Savings/year Soft drink/tea 1/day $1. 50 $ 547. 50 Beer 1/day $3. 00 $1095. 00 Magazine 2/month $7. 98 $ 191. 50 Movie tickets 2/week $22. 00 $1141. 00 _______ ____ Total $2978. 00

p Regular p Money Market p Certificates p Saver’s of Deposit Club p Government Savings Bonds

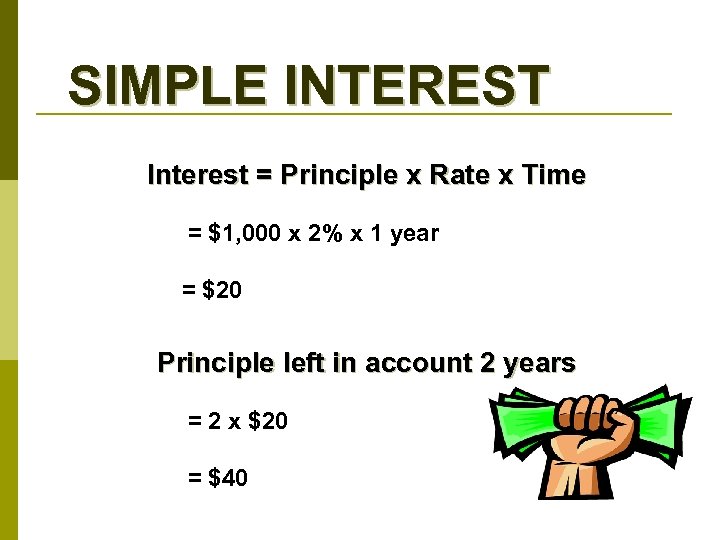

SIMPLE INTEREST Interest = Principle x Rate x Time = $1, 000 x 2% x 1 year = $20 Principle left in account 2 years = 2 x $20 = $40

COMPOUND INTEREST First Year Interest = Principle x Rate x Time = $1, 000 x 2% x 1 year = $20 Second Year Interest = (Principle + Interest) x Rate x Time = ($1, 000 + $20) = $1, 020 x 2% x 1 year = $20. 40 2 Year Interest Total $20 + $20. 40 = $40. 40

Simple Interest = $240 Compound Interest = $240. 40 Difference = $. 40

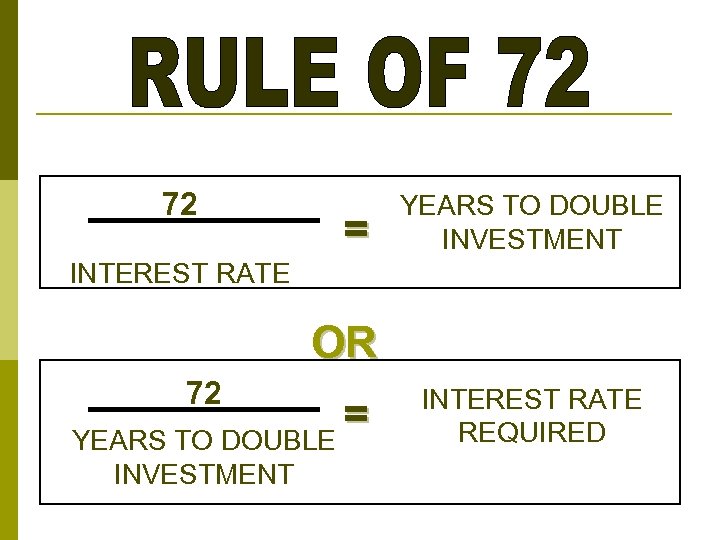

72 = YEARS TO DOUBLE INVESTMENT INTEREST RATE OR 72 = YEARS TO DOUBLE INVESTMENT INTEREST RATE REQUIRED

Savings is the process of telling your money where to go - rather than asking where it went !

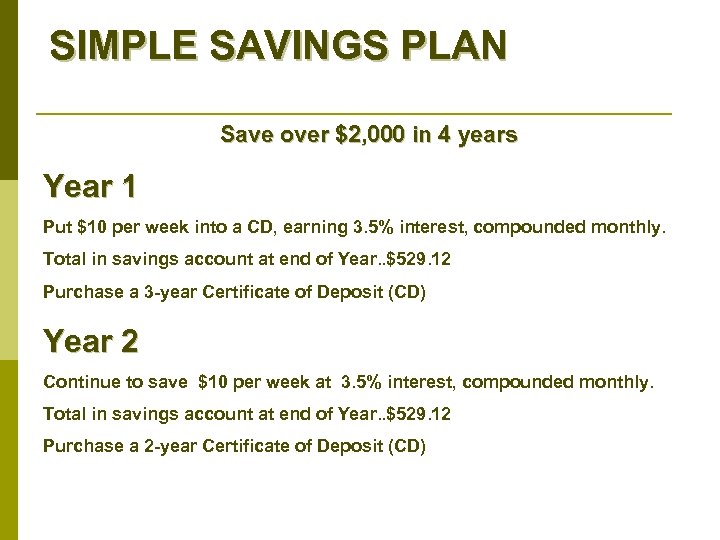

SIMPLE SAVINGS PLAN Save over $2, 000 in 4 years Year 1 Put $10 per week into a CD, earning 3. 5% interest, compounded monthly. Total in savings account at end of Year. . $529. 12 Purchase a 3 -year Certificate of Deposit (CD) Year 2 Continue to save $10 per week at 3. 5% interest, compounded monthly. Total in savings account at end of Year. . $529. 12 Purchase a 2 -year Certificate of Deposit (CD)

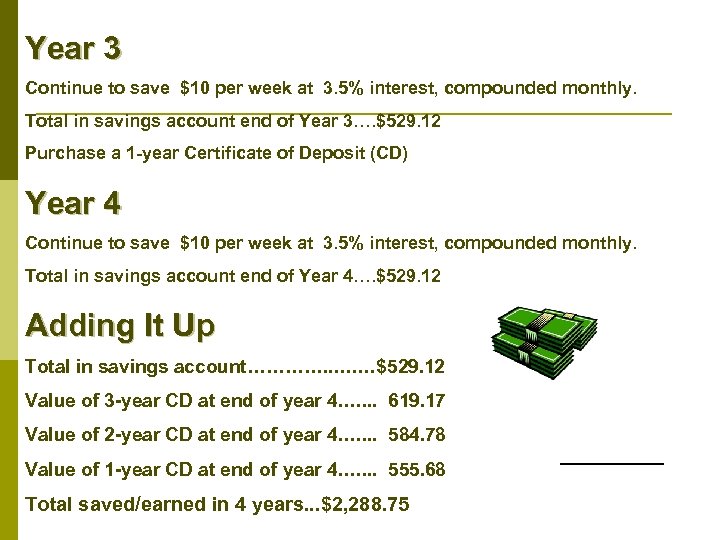

Year 3 Continue to save $10 per week at 3. 5% interest, compounded monthly. Total in savings account end of Year 3…. $529. 12 Purchase a 1 -year Certificate of Deposit (CD) Year 4 Continue to save $10 per week at 3. 5% interest, compounded monthly. Total in savings account end of Year 4…. $529. 12 Adding It Up Total in savings account…………. . …. …$529. 12 Value of 3 -year CD at end of year 4…. . 619. 17 Value of 2 -year CD at end of year 4…. . 584. 78 Value of 1 -year CD at end of year 4…. . 555. 68 Total saved/earned in 4 years. . . $2, 288. 75

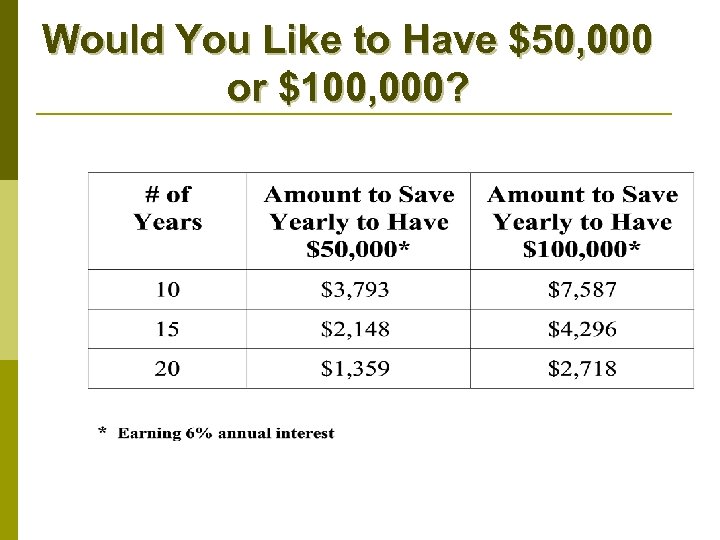

Would You Like to Have $50, 000 or $100, 000?

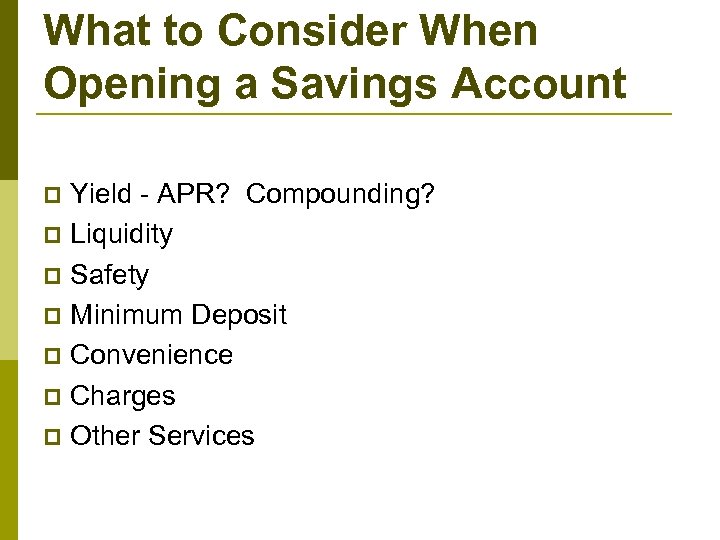

What to Consider When Opening a Savings Account Yield - APR? Compounding? p Liquidity p Safety p Minimum Deposit p Convenience p Charges p Other Services p

The Emergency Fund to cover 3 to 6 months’ living expenses in readily available accounts

c582227fb97045fffd8be1b7fa9950b2.ppt