1097b2c16dda2aed99cad317b24d4d5d.ppt

- Количество слайдов: 68

Session 52 FINANCIAL LITERACY Small Investment - Big Return Elizabeth Coogan | Dec. 2016 U. S. Department of Education 2016 FSA Training Conference for Financial Aid Professionals

Introductions • Elizabeth Coogan, Senior Advisor, Customer Experience Office, Federal Student Aid • Gretchen Holthaus, Doctoral Student in Education Policy Studies: Higher Education, Indiana University 2

Overview • FSA Updates • Student Money Management • My. College. Money. Plan • Appendix Resources 3

FSA Updates • Financial Capability in the United States • Borrower Surveys • Borrower Resources • Financial Literacy Guidance 4

Financial Capability in the United States “Financial Capability is a multi-dimensional concept that encompasses a combination of knowledge, resources, access, and habits. ” http: //www. usfinancialcapability. org/about. php 5

Financial Capability in the United States The NFCS survey focuses on four key components of financial capability: 1. Making ends meet 2. Planning ahead 3. Managing financial products 4. Financial knowledge and decision-making 6

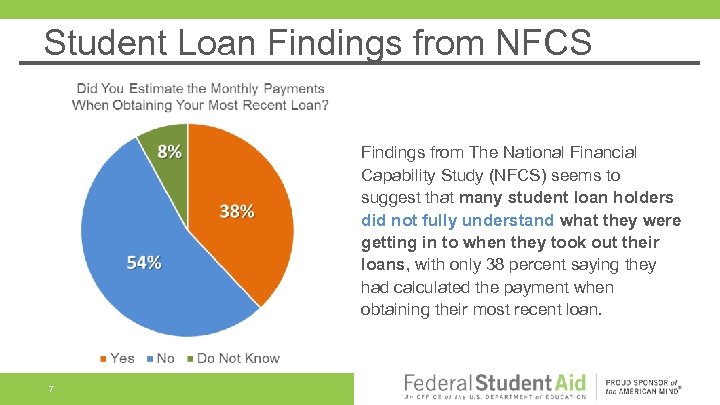

Student Loan Findings from NFCS Findings from The National Financial Capability Study (NFCS) seems to suggest that many student loan holders did not fully understand what they were getting in to when they took out their loans, with only 38 percent saying they had calculated the payment when obtaining their most recent loan. 7

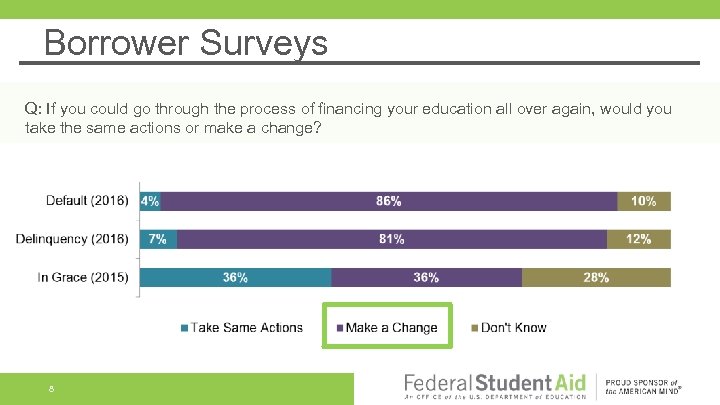

Borrower Surveys Q: If you could go through the process of financing your education all over again, would you take the same actions or make a change? 8

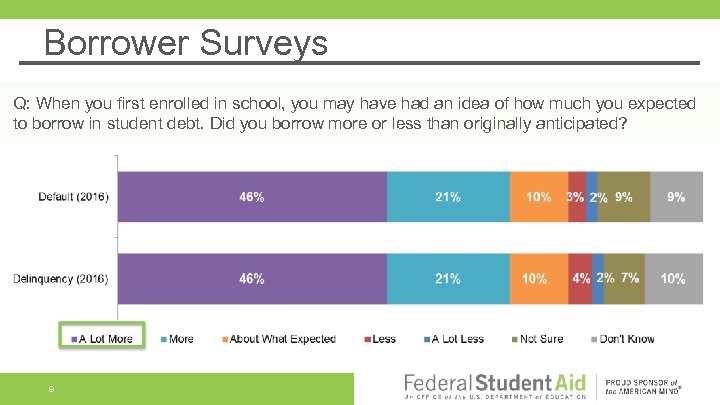

Borrower Surveys Q: When you first enrolled in school, you may have had an idea of how much you expected to borrow in student debt. Did you borrow more or less than originally anticipated? 9

Borrower Surveys If I could do it all over again I would • • • • Begin paying my loans during my studies Find out exactly how much I am borrowing Borrow less, and have a better understanding of loan repayment options Take out just enough and not the maximum amount 10 … • Find other resources and research how much education would cost • Rethink how to spend my loan • Not accept refund checks to make my loan smaller

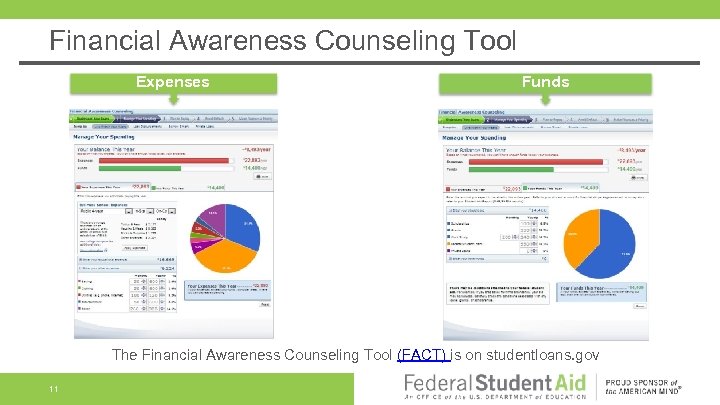

Financial Awareness Counseling Tool Expenses Funds The Financial Awareness Counseling Tool (FACT) is on studentloans. gov 11

Repaying Student Loans The Student Loan Repayment Questionnaire (https: //studentloans. gov/repay) is a quick and easy tool for student loan borrowers to learn more about their repayment options based on 3 simple questions! 12

Financial Literacy Guidance Federal Student Aid Financial Literacy Guidance 13

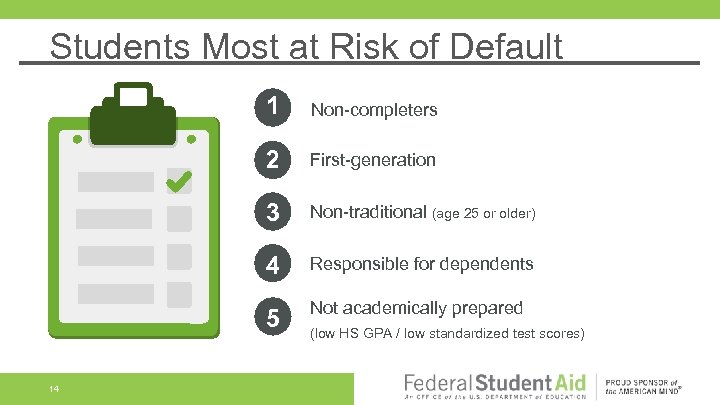

Students Most at Risk of Default 1 2 First-generation 3 Non-traditional (age 25 or older) 4 Responsible for dependents 5 14 Non-completers Not academically prepared (low HS GPA / low standardized test scores)

Federal Student Aid – Financial Literacy Virtual Intern • • • 15 Virtual Student Foreign Service (VSFS) Program Background and Experience Research Student Money Management Programming Best Practices

Student Money Management - It Just Makes Cents • Seven out of 10 students feel stressed about their money • Financial stress is linked to: – Lower academic performance – Course load reduction – Increased withdrawal from college to pursue full-time employment – Increased time to graduation • Students participating in academically supported financial education programs demonstrate: – – 16 Increased financial knowledge Decreased financial risk More responsible financial behaviors Increased college completion rates

WHEN CHIEF ACADEMIC OFFICERS ARE ASKED WHY STUDENTS WITHDRAW, THEY CITE: LACK OF ACADEMIC PREPAREDNESS 17 ADEQUACY OF PERSONAL FINANCIAL RESOURCES

Retention Initiatives Academic Support Financial Assistance • 97 percent of colleges offer tutoring services • 83 percent have pre-enrollment financial aid advising • 90 percent have a writing center/lab • 63 percent give short-term loans • 84 percent have a library orientation • + 16 more 18 • 53 percent of universities report providing money management workshops to their students

Why Do Students Say They Leave College? • • 19 70 percent report leaving college in order to “work to support themselves. ” 52 percent report leaving because they cannot afford the tuition and fees.

Financial Education Methods: Practices that Work: • Outreach Education • Developmentally appropriate • Targeted Outreach Efforts • Just-in-time • Online Education • Active or project-based learning • As Part of an Academic Course • Destigmatizing • Peer-to-Peer Financial Counseling 20 • Cross-campus partnerships

Partnering on Providing Financial Education • • • 21 Orientation Junior or Senior Days FYE courses and events Office for Student Money Management Career Services Student Involvement Office TRIO Programs Counseling Center Academic Programs: Business, Social Work, Psychology, Counseling, etc. Other Student Support Offices

Money Management Programs Although 53 percent of universities report providing money management workshops: • Half of them have no funding to do so Of the 50 percent who do receive funding: • 31 percent receive less than $5, 000 22

Free Financial Education Resources: • • 23 Indiana University Money Smarts Podcasts NEA Teaching Financial Literacy Tools Econlowdown. org Financial. Workshop. Kits. org Annual. Credit. Report. com My. College. Money. Plan. org My. Money. gov

Financial Counseling Programs • May be supported by trained student volunteers, student employees, work-study positions, through internships or with university staff. • Provide financial education and counseling. 24

Benefits to Peer Counseling • Psychological Benefits: intellectual & emotional development • More effective teaching- peers are closer to the learning process • Have close personal contacts in an otherwise remote environment • Students tend to see themselves as users, rather than recipients of education • Increased student participation • Feedback loop to administrators 25

Budgeting/Student Loan Workshop Ideas Are You Spring Broke? Build Your Nest Egg Cap Your Spending Cash Cab Date Night on a Dime Don’t Let Money Make a Fool Out of You Game of Life Homemade for the Holidays Managing Your Money Doesn’t Have to be Scary • The Price is Right • Toss Your Debt Away • Who Wants to Be a Millionaire • • • 26

Debt Management Education in College • Positively impacts alumni giving • Increases alumni’s positive regard for the university • Increases financial knowledge, attitudes and behaviors 27

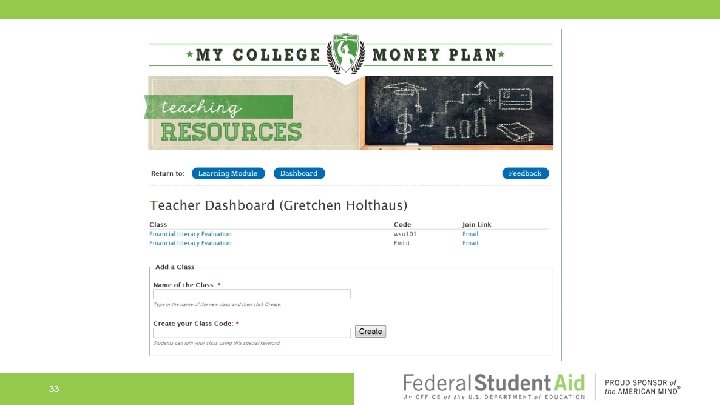

My. College. Money. Plan. org The Financial Literacy Project at Wichita State University was funded by a College Access Challenge Grant from 2011 -2016 My. College. Money. Plan. org is now maintained within the Office of Student Success at WSU 28

Free Online Resource • • Realistic • No advertisements • 29 Personalized FREE to everyone and developed for current or college-bound students

30

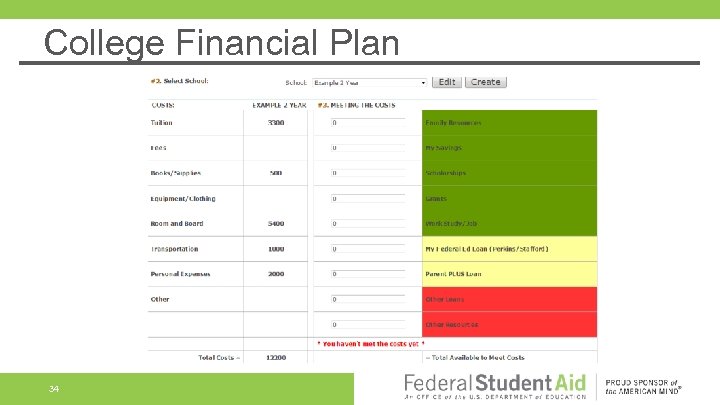

Learn How To: • Create a monthly spending plan • Develop a college financial plan • Build credit • Find additional financial resources • Manage student loan debt 31

32

33

College Financial Plan 34

Selecting the Best College You Can Afford Financial and other success factors: • • 35 Getting involved Picking a major Time management And more

Becoming Financially Independent in College • Financial Goals • Importance of Checking/Savings Accounts • Measuring and Tracking Income and Expense • Getting More for Your Money • Loans, Debt • Credit Reports and Scores • Identity Theft 36

Website Use • My. College. Money. Plan. org has been shown to effectively increase financial literacy among students in as little as one week when implemented in a First Year Experience Course • Teaching resources may be implemented in as little as a 5 minute exercise at an outreach event or in up to a two week curriculum in an academic course • You may link to My. College. Money. Plan. org on your website or distribute information on the resource with other educational materials provided to students 37

What can you do to improve financial literacy at your institution? 38

QUESTIONS? 39

Contact Information Elizabeth Coogan, Federal Student Aid elizabeth. coogan@ed. gov 202 -377 -3825 Gretchen Holthaus, Indiana University gholthau@indiana. edu 812 -856 -8217 40

Appendix Resources • Appendix A Financial Literacy Research • Appendix B Student Money Management Job Descriptions 41

Appendix A: Financial Literacy Research EFFECTIVENESS AND BEST PRACTICE RESEARCH • COHEAO. (2014). Financial Literacy in Higher Education: The Most Successful Models and Methods for Gaining Traction. Retrieved from http: //www. coheao. com/wp-content/uploads/2014/03/2014 -COHEAO-Financial-Literacy-Whitepaper. pdf • Federal Reserve Bank of Boston. (2015). Promoting Pathways to Financial Stability. A Resource Handbook on Building Financial Capabilities of Community College Students. Retrieved from http: //www. bostonfed. org/education/financialcapabilities/handbook/financial-capabilities-handbook. pdf • Fernandes, D. , Lynch J. G. , Netemeyer, R. G. (2013). The Effect of Financial Literacy and Financial Education on Downstream Financial Behaviors. Retrieved from http: //www. nefe. org/Portals/0/What. We. Provide/Primary. Research/PDF/CU%20 Final%20 Report. pdf • Financial Literacy and Education Commission. (2015). Opportunities to Improve the Financial Capability and Financial Wellbeing of Postsecondary Students. Retrieved from http: //www. treasury. gov/resource-center/financialeducation/Documents/Opportunities%20 to%20 Improve%20 the%20 Financial%20 Capability%20 and%20 Financial%20 Wellbeing%20 of%20 Postsecondary%20 Students. pdf • Fox, J. , Bartholomae, S. , & Lee, J. (2005). Building the case for financial education. Journal of Consumer Affairs, 39(1), 195209. doi: 10. 1111/j. 1745 -6606. 2005. 00009. x. • Goetz, J. , Cude, B. J. , Nielsen, R. B. , Chatterjee, S. , & Mimura, Y. (2011). College-based personal Finance education: Student interest in three delivery methods. Journal of Financial Counseling and Planning, 22(1), 27 -42. • i. Grad. (2014). Financial Literacy Compendium: Colleges Setting the Bar for Financial Literacy. Retrieved from http: //schools. igrad. com/blog/best-college-financial-literacy-programs • Lumina Foundation. (2015). Beyond Financial Aid How Colleges Can Strengthen the Financial Stability of Low-Income Students and Improve Outcomes. Retrieved from https: //www. luminafoundation. org/beyond-financial-aid 42

Appendix A: Financial Literacy Research • • Mandell, L. , & Klein, L. S. (2009). The Impact of Financial Literacy Education on Subsequent Financial Behavior. Journal of Financial Counseling and Planning, 20(1), 15 -24. President’s Advisory Council on Financial Capability (2012). Key Themes for President’s Advisory Council on Financial Capability. Retrieved from http: //www. treasury. gov/resource-center/financial-education/Documents/Key_Themes. pdf TG Research and Analytical Services. (2015). Above and Beyond: What Eight Colleges Are Doing to Improve Student Loan Counseling. Retrieved from http: //www. tgslc. org/pdf/Above-and-Beyond. pdf Trombitas, K. (2012, March). Snapshot of financial education programming: How schools approach student success. Inceptia. 1 -9. Retrieved from: https: //www. cgsnet. org/ckfinder/userfiles/Inceptia_Fin. Ed. Survey_Whitepaper. pdf [cited 20 April 2015]. EMERGENCY AID PROGRAMS • Cady, C. , Dubick, J & Mathews, B. (2016). Report: Hunger on Campus. Retrieved from: http: //studentsagainsthunger. org/wpcontent/uploads/2016/10/Hunger_On_Campus. pdf • Dachelet, K. , & Goldrick-Rab, S. (2015). Investing in Student Completion: Overcoming Financial Barriers to Retention Through Small-Dollar Grants and Emergency Aid Programs. Wisconsin Hope Lab. Retrieved from: http: //wihopelab. com/publications/Investing-in-Student-Completion-WI-Hope_Lab. pdf. • National Association of Student Personnel Administrators (NASPA. ) (2016). Landscape Analysis of Emergency Aid Programs. Retrieved from: https: //www. naspa. org/rpi/reports/landscape-analysis-of-emergency-aid-programs. 43

Appendix A: Financial Literacy Research FINANCIAL COACHING • Asset Funders Network (CFPB. (2016). Financial coaching: A strategy to improve financial well-being. Retrieved from http: //s 3. amazonaws. com/files. consumerfinance. gov/f/documents/102016_cfpb_Financial_Coaching_Strategy_to_Improve_Fi nancial_Well-Being. pdf. • CFED. (2014). Financial Coaching Leads to Long-Term financial Stability. Retrieved from http: //cfed. org/blog/inclusiveeconomy/Financial_Coaching_Policy_Proposal_FINAL. pdf • Collins, J Michael. Financial Coaching : An Asset Building Strategy. Retrieved from http: //assetfunders. org/images/pages/AFN_Finacial. Coaching(WEB_version). pdf • Neighborhood Works America. (2013). Scaling Financial Coaching: Critical Lessons and Effective Practice. Retrieved from http: //www. neighborworks. org/Documents/Homeand. Finance_Docs/Financial. Security_Docs/Financial. Coaching_Docs/Executiv e-Summary. SURVEYS • Lin, J. T. , Bumcrot, C. , Ulicny, T. , Lusardi, A. , Mottola, G. , Kieffer, C. , & Walsh, G. (2016). Financial Capability in the United States. FINRA Investor Education. Retrieved from: http: //www. usfinancialcapability. org/downloads/NFCS_2015_Report_Natl_Findings. pdf. • Center for the Study of Student Life. (2011). Ohio Student Financial Wellness Survey: Student Loans, Credit Cards and Stress. Retrieved from http: //cssl. osu. edu/posts/documents/09 -01 -11 -ohio-financial-wellness-report-final-no-watermark. pdf • Center for the Study of Student Life. (2015). National Student Financial Wellness Study: National Descriptive Report. Retrieved from http: //cssl. osu. edu/posts/documents/nsfws-national-descriptive-report. pdf 44

Appendix A: Financial Literacy Research NEED FOR FINANCIAL LITERACY • Complete College America. (2014, December 1). 1 New Report: 4 -Year Degrees Now a Myth in American Higher Education. Retrieved from: http: //completecollege. org/new-report-4 -year-degrees/ [cited 20 April 2015]. • Complete College America. (2014). 2 Four-Year Myth: Make College More Affordable. Restore the Promise of Graduating on Time. 1 -82. Retrieved from: http: //completecollege. org/wp-content/uploads/2014/11/4 -Year-Myth. pdf [cited 20 April 2015]. • Consumer Finance Protection Bureau [CFPB]. (2013). Financial literacy annual report. Retrieved from http: //files. consumerfinance. gov/f/201307_cfpb_report_financial-literacy-annual. pdf • Council for Economic Education. (2012). Economic and Personal Finance Education in our Nation’s Schools. Retrieved from http: //www. councilforeconed. org/policy-and-advocacy/survey-of-the-states/#findings • Harnish, T. L. (2010). Boosting financial literacy in America: A role for state colleges and universities. Perspectives. Retrieved from http: //www. aascu. org/policy/publications/perspectives/financialliteracy. pdf • Hodson, R. , & Dwyer, R. (2014, June 30). Financial behavior, debt, and early life transitions: Insights from the national longitudinal survey of youth, 1997 Cohort. National Endowment for Financial Education. 1 -43. Retrieved from: http: //www. nefe. org/Portals/0/What. We. Provide/Primary. Research/PDF/Financial%20 Behavior%20 Debt%20 and%20 Early%20 Lif e%20 Transitions-Final%20 Report. pdf [cited 20 April 2015]. • Johnson, J. , Rochkind, J. , Ott, A. N. , & Du. Pont, S. (n. d). With their whole lives ahead of them. Public Agenda. 1 -48. Retrieved from: http: //www. publicagenda. org/files/theirwholelivesaheadofthem. pdf [cited 20 April 2015]. • Money Matters on Campus. (2013). Everfi. 1 -25. Retrieved from: https: //www. cgsnet. org/ckfinder/userfiles/Money-Matterson-Campus-Final-Report. pdf [cited 20 April 2015]. • Yang, H. , & Kezar, A. (2009). Financial education in TRIO programs. The Pell Institute for the Study of Opportunity in Higher Education. Retrieved from: http: //files. eric. ed. gov/fulltext/ED 508922. pdf. 45

Appendix A: Financial Literacy Research UNDERSTANDING STUDENT FINANCES • Ever. Fi, Inc. (2015). Money matters on campus: How early attitudes and behaviors affect the financial decisions of first-year college students. Retrieved from http: //moneymattersoncampus. org/wpcontent/uploads/2013/02/Money. Matters_White. Paper_2015_FINAL. pdf • Fosnacht, K. (2013). Undergraduate coping with financial stress: A latent class analysis. Paper presented at the annual meeting of the American College Personnel Association, Las Vegas, NV, March 2013. Retrieved from http: //cpr. iub. edu/uploads/Fosnacht%20 -%20 ACPA%20 -%20 Financial%20 Stress. pdf • Gutter, M. , Copur, Z. (2011). Financial Behaviors and Financial Well-Being of College Students: Evidence from a National Survey. Journal of Family Economics iss, 32, 699 -714. • Shim, S. , Barber, B. , Card, N. , Xiao, S. , Serido, J. (2009). Financial Socialization of First-Year College Students: The Roles of Parents, Work, and Education. J Youth Adolescence, 1007 (10), 10964 -10978 • Trombitas, K. (2012). College students are put to the test: The attitudes, behaviors, and knowledge levels of financial education. Inceptia. Retrieved from https: //www. inceptia. org/about/resources/college-students-are-put-to-the-test/ WORKPLACE FINANCES • Pw. C. (2015). Employee Financial Wellness Survey: 2015 Results. Retrieved from http: //www. pwc. com/us/en/private-companyservices/publications/assets/pwc-employee-financial-wellness-survey-2015. pdf 46

Appendix A: Financial Literacy Research PEER TO PEER EDUCATION • Black, K. , Voelker, J. (2008). The role of preceptors in first-year student engagement in introductory courses. Retrieved from http: //www. ingentaconnect. com/content/fyesit/2008/00000020/00000002/art 00002 • Colvin, J. W. , Ashman, M. (2010). Roles, risks, and benefits of peer mentoring relationships in higher education. Retrieved from http: //www. tandfonline. com/doi/abs/10. 1080/13611261003678879 • Cuseo, J. B. , Fecas, V. S. , Thompson, A. (2010). Thriving in College and Beyond: Research-Based Strategies for Academic Success and Personal Development • Landrum, R. E. , Nelsen, L. R. (2002). The Undergraduate Research Assistanceship: An Analysis of the Benefits. Retrieved from http: //www. tandfonline. com/doi/abs/10. 1207/S 15328023 TOP 2901_04#. Vjos. Fber. TIU • Schweitzer, A. , Thomas, C. (1998). Implementation, Utilization, and Outcomes of a Minority Freshman Peer Mentor Program at a Predominantly White University. Retrieved from http: //www. ingentaconnect. com/content/fyesit/1998/00000010/00000001/art 00002 • Tinto, V. (2006). Research and Practice of Student Retention: What Next? Retrieved from http: //csr. sagepub. com/content/8/1/1. short • Yazedjian, A. , Purswell, K. , Toews, M. , Sevin, T. . (2007). Adjusting to the First Year of College: Students’ Perceptions of the Importance of Parental, Peer, and Institutional Support. Retrieved from http: //www. ingentaconnect. com/content/fyesit/2007/00000019/00000002/art 00002 47

Appendix A: Financial Literacy Research TERMINOLOGY • Huston, S. J. (2010). Measuring Financial Literacy. Retrieved from http: //onlinelibrary. wiley. com/doi/10. 1111/j. 17456606. 2010. 01170. x/pdf NATIONAL STRATEGY FOR FINANCIAL LITERACY • Financial Literacy & Education Commission (2016). Promoting Financial Success in the United States. Retrieved from: https: //www. treasury. gov/resource-center/financialeducation/Documents/National%20 Strategy%20 for%20 Financial%20 Literacy%202016%20 Update. pdf. 48

Appendix B: Student Money Management Job Descriptions Cornell Big Red Barn Financial Literacy Fellow The BRB Financial Literacy Fellow is one of six Fellows that is designed to offer graduate and professional students an opportunity to work with the Office of Graduate Student Life and the student and professional management staff of the BRB to provide additional programs for the general graduate student community. The BRB Financial Literacy Fellow works to increase the number and quality of events supporting financial literacy, which may be centered at the Big Red Barn Graduate and Professional Student Center or cross-campus. Specific Responsibilities for the BRB Financial Literacy Fellow will include but not be limited to: • Assess the needs of Cornell Graduate students in your area of programming. • Plan, coordinate, market and implement a minimum of one and preferably two programs per month in the specific topic area. One program per semester must include a Cornell Faculty member. • Report to and meet regularly with the Director of the Big Red Barn and Assistant Dean for Student Life • Serve on the Financial Literacy Steering Committee to be informed of campus-wide efforts for financial literacy. • Meet regularly with the other Fellows as a programming group to plan & coordinate programming for the semester. • Be an active member of the BRB Staff – attend meetings of the staff at the beginning of each semester, and staff celebrations at semester’s end; train in the operations and policies of the BRB so as to be able to offer help or information to our customers and be a familiar face at the Barn. . 49

Appendix B: Student Money Management Job Descriptions Cornell Big Red Barn Financial Literacy Fellow Work with the staff at the large annual programs – Holiday Party, Chocolate Fest & Year End BBQ. • Each Fellow will oversee a $1, 000 budget to use for support of their programming efforts. • Each Fellow will submit a semester-end report complete with details on each event including contacts, number in attendance and costs per program Preferred Qualifications: Reliable Creative Familiar with Cornell resources Experience working with groups of people as a team Able to work some evenings and weekends Understand education, research, and service missions of the Graduate School Remuneration: The Financial Literacy Fellow will be paid $1, 000/Spring 2015 semester for 5 -8 hours of work per week while classes are in session. • 50

Appendix B: Student Money Management Job Descriptions Wichita State University Peer Financial Coaches Job Description for Peer Financial Coaches (PFCs) PFCs are WSU undergraduates who are paid to help other students with questions about personal money management. PFCs do marketing for the Office for Student Money Management (OSMM), offer workshops on student financial matters, meet one-on-one with other students who request financial coaching, and help create online materials to educate WSU students about wise money habits. The Senior PFC will have additional responsibilities: scheduling/keeping track of PFC hours, managing and delegating outreach tasks, and working to develop campus and community partnerships regarding student money management. Qualifications - A passion for financial education and teaching others how to be financially successful -Strong communication and interpersonal skills - Active and empathetic listener - Have a non-judgmental attitude toward others, especially those from other cultures and backgrounds than your own - Self-starter with the ability to work in an unsupervised environment as well as within a group - Practiced at time management - Completion of the OSMM peer educator training program; Agreement to OSMM Privacy and Confidentiality Policy 51

Appendix B: Student Money Management Job Descriptions Wichita State University Peer Financial Coaches Cont. Benefits • - Experience in financial counseling - Gain management and HR experience - Gain excellent teamwork skills - Develop written and oral communication skills - Be a part of a team of enthusiastic peers 52

Appendix B: Student Money Management Job Descriptions Wichita State University Head of the Office for Student Money Management Job Title: Graduate Assistant/Head of the Office for Student Money Management Work Schedule: Flexible weekday hours. Some evenings and weekends required. 12 month appointment. Hours per Week: 20 hours a week Job Description: The graduate assistant for the Office for Student Money Management will develop training for peer financial coaches, lead outreach and education events, oversee marketing of the center, engage in research and evaluation of the center, and work to develop campus and community partnerships regarding student money management. Qualifications for the Head of Office are the same as for the Peer Financial Coaches except for the training responsibility. 53

Appendix B: Student Money Management Job Descriptions Wichita State University Tax Intern Tax interns augment WSU’s Office for Student Money Management during income tax time. They assist people in the WSU community in completing the federal and state income tax returns using the free website www. myfreetaxes. com. This is part of a nationwide United Way/IRS initiative and is called a Facilitated Self Assistance site under IRS guidelines regarding the Volunteer Income Tax Assistance (VITA) program. The Head of the Office coordinates with the local VITA program office (e. g. United Way, County Extension office, etc. ) to insure the program meets IRS standards which are minimal for an FSA. PFCs/Tax Interns or other volunteers must pass online IRS VITA training to be part of the FSA and assist people in filing their income taxes. Income tax completion is important so that students can accomplish their FAFSA. The purpose of this internship is to provide free tax help to qualifying students, staff, and community members. This opportunity will assist students in obtaining real-world tax experience. 54

Appendix B: Student Money Management Job Descriptions Indiana University Peer Financial Educator Position Title: IU Money. Smarts Team Peer Financial Educator (PFE) Department: Office of Financial Literacy Term: The Peer Financial Educator position is a 3 -5 hours/week unpaid, volunteer position for the 2017 -2018 academic year, with the potential for renewal as a paid position in the following school year contingent upon level of performance. Start Date: Money. Smarts Spring Basic Training Course begins the week of January 30, 2017 • Mandatory All-Staff Overnight Orientation: August 18 -19, 2017. • Attendance at this training is required and non-negotiable Additional Hours: weekly hours based on individual and Team’s schedules • Office hours and on-call hours to conduct student appointments and presentations. • Weekly all-Team training 55

Appendix B: Student Money Management Job Descriptions Indiana University Peer Financial Educator Cont. Position Description: IU Money. Smarts is a University system-wide program (extending to all 9 IU campuses) and is a product of the IU Office of Financial Literacy within the department of the Vice President and University Chief Financial Officer. Money. Smarts provides multiple opportunities for students to gain and enhance their personal financial skills and navigate the world of money management during college and after college. One of the most effective ways we provide education unique to the needs of IU college students on all campuses is through peer financial education. Our peer to peer program, The IU Money. Smarts Team, currently exists on 2 campuses and is continually growing. It consists primarily of undergraduate students who conduct one-toone appointments and group presentations for other students on a variety of personal finance topics. The Peer Financial Educator role reports to the Assistant Director of Financial Literacy. The role of the PFE is to assist other students with everyday money matters including, but not limited to establishing budgets, understanding credit, and managing student loan debt and repayment. Applicants should submit three components in order to be considered for application to mnysmrt@iu. edu: 56

Appendix B: Student Money Management Job Descriptions Indiana University Peer Financial Educator Cont. 1. A current resume 2. A cover letter that addresses the following questions: • What do you know about the IU Money. Smarts program? • What will you bring to the IU Money. Smarts Team? • How do you define financial wellness and its effect on college students? 3. Preference for group interview times Application Instructions and Contact Information • Applicants who have passed the resume and cover letter screening process will be notified via email and invited for a group interview with our current Peer Financial Educators • Those who are selected to advance beyond the group interview will have individual interviews with our Administrative Team the week of November 14 Responsibilities and Qualifications Applicants need not be experts in personal finance but should be willing to learn and apply skills around budgeting concepts, credit, savings, and other finance topics as they relate to college student financial wellness. 57

Appendix B: Student Money Management Job Descriptions Indiana University Peer Financial Educator Cont. Applicants should be able to… • Demonstrate enthusiasm in working one-on-one and in groups with other students • Demonstrate empathy, active listening and communication, and presence in coaching environments • Demonstrate ability to work with others from different backgrounds and levels of understanding of personal finance • Demonstrate desire to hone public speaking and presentation skills • Maintain confidentiality of student data • Make sound decisions with ambiguous resources Applicants should expect to… • Engage in Money. Smarts training, both online and in-person, and complete the Money. Smarts training certification process • Weekly Money. Smarts Spring Training begins the week of January 30, 2017 • Mandatory Overnight Orientation: August 18 -19, 2017 • Weekly Money. Smarts Training will continue Fall 2017 58

Appendix B: Student Money Management Job Descriptions Indiana University Peer Financial Educator Cont. • • 59 Adhere to a weekly schedule that entails holding office hours, being available for student appointments, fair tabling, attending trainings, and/or delivering presentations • Weekly office hours may include evenings and weekends Conduct appointments and presentations professionally with student-clients, and provide non-biased, nonjudgmental information and resources to assist students to make informed financial decisions Develop a working knowledge of resources available on the IU Money. Smarts website, on campus, and on similar sites relevant to financial education Promote IU Bloomington Money. Smarts Team resources and services across campus

Appendix B: Student Money Management Job Descriptions George Mason University Financial Literacy Counselor The George Mason University Office of Student Financial Aid (OSFA) invites applications for a Financial Literacy Counselor. This is a full-time administrative faculty position. George Mason University has a strong institutional commitment to the achievement of excellence and diversity among its faculty and staff, and strongly encourages candidates to apply who will enrich Masons academic and culturally inclusive environment. Responsibilities: The primary responsibility of this position is to develop, implement and manage a comprehensive Financial Literacy and Outreach program at Mason. This program would serve students, faculty and alumni; as well as fulfill the Financial Literacy requirement of students who apply for the Stay Mason Student Support Fund. Position duties and responsibilities will be performed in support of the OSFAs vision, mission, and values, as well as institutional mission and goals. Additional responsibilities include: * Develop, implement and manage a comprehensive Financial Literacy and Outreach program for Mason students and the local community, including a Loan Default Management Program; * Design program content and deliver presentations and webinars for Mason students, parents, and alumni, including new student orientation and financial aid workshops; * Research federal and state guidelines and recommendations for financial literacy programs as well as university regulations, guidelines, and requirements to ensure Masons program is compliant with governmental and university standards; * Evaluate individual Financial Literacy and Outreach events and assess effectiveness, student need and student satisfaction; 60

Appendix B: Student Money Management Job Descriptions George Mason University Financial Literacy Counselor Cont. * Evaluate the effectiveness of a financial literacy virtual platform and provide future recommendations; * Research best options for a financial literacy virtual platform and make recommendations; * Manage, collect and analyze data pertaining to Web site and/or virtual platform for the program; * Research and incorporate new ways to promote financial literacy on campus; * Collect and report data on student participation and performance in financial literacy use of a virtual platform; * Develop a peer education model focused on financial literacy and wellness, including recruiting, hiring, training, and supervising the Financial Literacy Peer Education Team as they provide money management consultation and support of fellow students as requested; * Design and implement curriculum for Financial Literacy Peer Education Team and provide assistance in designing and teaching a UNIV course on personal finance; * Research needs of various student populations on campus, and develop new topics for workshops and presentations by creating new collaborations on campus; * Provide ongoing research and implementation of new delivery modes through technology; * Collaborate with campus partners in delivering financial literacy information to students (i. e. , Residence Life, Financial Aid, Student Involvement, Alumni Affairs, etc. ); * Develop learning outcomes and assessment tools; * Write analysis based on data generated by the assessments and suggests improvements to existing programs; * Counsel students in groups and in one-on-one settings; * Actively search for ways to integrate existing components of Financial Literacy program into campus life; * Serve on the Stay Mason Support Fund Implementation Team; * Plan a calendar of Financial Literacy and Outreach events for the academic year; * Design marketing and outreach strategies for program events and resources; * Utilize institutional social media outlets to market and disseminate key information; and * Perform additional responsibilities as assigned by supervisors. 61

Appendix B: Student Money Management Job Descriptions Berkeley College Financial Literacy Advocate Description: Engage directly with students to provide information and counseling services related to financial literacy and proper student loan repayment management. RESPONSIBILITIES: • Conduct entrance and exit student loan interviews, both in groups and individually, to provide information to students on loan rights and responsibilities and answer questions related to loan management. • Deliver information sessions, both in groups and individually, to educate students on concepts related to financial literacy and debt management. • Perform outbound telephone calls and letters to delinquent loan borrowers with the goal of finding and assisting delinquent borrowers, thus averting defaults. Advocate is responsible for tracking, call follow-up and working with borrowers and lenders to provide solutions to cure delinquencies. • Other duties as assigned by unit Director 62

Appendix B: Student Money Management Job Descriptions Berkeley College Financial Literacy Advocate • Develop and maintain individual relationships with students with the goal of providing financial literacy and loan management resources to better prepare students for responsible financial management. • Provide information to students on loan consolidation. Work with borrowers to simplify repayment via single billing. • Work with supervisor to challenge institutional cohort default rates on an annual basis. Verify cohort borrower data to ensure accurate reporting to the Department of Education. • Monitor student enrollment data on an ongoing basis to ensure accuracy of NSLDS data. • Maintain professional expertise through participation and attendance at conferences, seminars and workshops • Travel to Berkeley campuses to meet with students and answer questions and provide information related to loan management and financial literacy. 63

Appendix B: Student Money Management Job Descriptions Financial Literacy Coordinator: The Financial Literacy Coordinator will provide comprehensive financial literacy counseling to students regarding financial aid eligibility through in-person, phone and email conversations. Perform daily outreach activities to students. The Financial Literacy Coordinator will also assist in the research and design and implementation of best practices for managing student loan borrowing, default and delinquency. The coordinator will participate in student recruitment and retention activities including attending open house events, information sessions, and other events as requested to offer guidance to prospective student staff. This position will work on various on-going projects for loan portfolio reviews, online webinars, analyzing Salesforce reports and working on weekly/monthly social media posts. Occasional travel may be required. Specific Responsibilities Include • Provide comprehensive financial literacy counseling to students regarding financial aid eligibility through in-person, phone and email conversations. Perform daily outreach activities to students. • Work extensively on various on-going projects for loan portfolio reviews, online webinars, analyzing Salesforce reports and working on weekly/monthly social media posts. • Create computerized reports, run queries, merge and evaluate complex data from multiple sources, change award amounts, maintain statistical data and generate communications to students. 64

Appendix B: Student Money Management Job Descriptions Financial Literacy Coordinator Serve as a member of the university's Default Prevention Committee and assist in coordination with all related efforts. Participate in student recruitment and retention activities including attending open house events, information sessions, and other events as requested to offer guidance to prospective student staff. Develop and utilize knowledge of skip trace process to update third party institutions of student up-to-date demographic information. • • • Required Education And Experience • Bachelor's degree from an accredited institution of higher learning • Two (2) years of experience in financial aid • Customer service experience • Strong communications skills, written and verbal • Ability to interpret and apply laws, policies, and procedures • Demonstrated ability to prioritize and manage multiple administrative tasks with minimal oversight 65

Appendix B: Student Money Management Job Descriptions University of Maryland University College Financial Literacy Coordinator Cont. Demonstrated experience with computerized office systems including, but no limited to, Microsoft Office applications such as Word, Excel and Power. Point Analytical and problem solving skills Attention to detail • • • Preferred Education And Experience • Experience with People. Soft • Experience using Salesforce. com • Ability to relate to a diverse population of students, parents, and staff 66

Appendix B: Student Money Management Job Descriptions The Ohio State University Assistant Director of Financial Wellness Assistant Director- Financial Wellness The Ohio State University, Columbus, OH The Opportunity • The Ohio State University Student Life Student Wellness Center is seeking an Assistant Director to lead programming, coaching, and assessment efforts and advance initiatives addressing collegiate financial wellness. • The Assistant Director performs a critical role for SLSWC. Specifically, creatively managing efforts of Scarlet and Gray financial (SGF) which is a nationally recognized financial wellness program that works to support students in managing their financial lives while at Ohio State. SGF is supported by over 50 volunteer peer financial coaches who work with thousands of students each year to better understand manage their financial situation. • In addition, the Assistant Director provides wide-ranging leadership in the field for the advancement of financial education programming and assessment. The Assistant Director provides consultations on best practices to institutions of higher education across the country while serving as a liaison on government.

Appendix B: Student Money Management Job Descriptions The Ohio State University Assistant Director of Financial Wellness The successful candidate for this position will have demonstrated success in several areas, including: • Considerable experience working in financial wellness or related area • Proven ability to build relationships, collaborate, and work in an agile environment to build consensus for decision making and issue resolution • Experience in program planning, administration, and implementation of wellness issues and initiatives. • Excellent written and verbal communication skills • Master’s Degree or an equivalent combination of education and experience • Experience working on a large, urban campus • Commitment to college student wellness and advancing evidenced-based practices. • Supervision of staff and volunteers.

1097b2c16dda2aed99cad317b24d4d5d.ppt