4ab378c99bf9d784b0682f14ffd649cd.ppt

- Количество слайдов: 67

Session 5: Decision Making Workshop on Management Accounting for non -finance executives BY: ABDUL RAHIM SURIYA FCA, FCMA

Session 5: Decision Making Workshop on Management Accounting for non -finance executives BY: ABDUL RAHIM SURIYA FCA, FCMA

BUSINESS DECISSION MAKING o Making decisions is one of the basic functions of a manager. o Managers are constantly faced with problems of deciding what products to sell, what services to offer, what price to quote, whether to make or buy component parts, what channels of distribution to use, whether to accept special assignment at special prices, whether to out-source any extra services required or hire staff and so forth. 2

BUSINESS DECISSION MAKING o Making decisions is one of the basic functions of a manager. o Managers are constantly faced with problems of deciding what products to sell, what services to offer, what price to quote, whether to make or buy component parts, what channels of distribution to use, whether to accept special assignment at special prices, whether to out-source any extra services required or hire staff and so forth. 2

BUSINESS DECISSION MAKING o Decision making is often a difficult task that is complicated by the existence of numerous alternatives and massive amounts of data, only some of which may be relevant. o Every decision involves choosing from among at least two alternatives. o In making a decision, the costs and benefits of one alternative must be compared to the costs and benefits of other alternatives. 3

BUSINESS DECISSION MAKING o Decision making is often a difficult task that is complicated by the existence of numerous alternatives and massive amounts of data, only some of which may be relevant. o Every decision involves choosing from among at least two alternatives. o In making a decision, the costs and benefits of one alternative must be compared to the costs and benefits of other alternatives. 3

WHAT IS DECISION MAKING? o Decision making is defined as the process of: o identifying problems, o considering and evaluating the alternatives, o arriving at a decision, o taking action, and o assessing the outcome. 4

WHAT IS DECISION MAKING? o Decision making is defined as the process of: o identifying problems, o considering and evaluating the alternatives, o arriving at a decision, o taking action, and o assessing the outcome. 4

STEPS IN AN EFFECTIVE DECISION MAKING PROCESS o Decision-making experts note that managers are more like to be effective decision makers if they follow the general approach as detailed below. Identify the problem 1. Generate alternative solutions 2. Evaluate and choose an alternative 3. Implement and monitor the chosen solution o Although these steps do not guarantee all decisions will have the outcomes desired, they do increase the likelihood of success. 5

STEPS IN AN EFFECTIVE DECISION MAKING PROCESS o Decision-making experts note that managers are more like to be effective decision makers if they follow the general approach as detailed below. Identify the problem 1. Generate alternative solutions 2. Evaluate and choose an alternative 3. Implement and monitor the chosen solution o Although these steps do not guarantee all decisions will have the outcomes desired, they do increase the likelihood of success. 5

PROBLEMS CLASSIFICATION o For decision making it is important to understand the types of problems , decisions and conditions that managers face. o Problem can be classified into : o Crisis problem o Non crisis problems, or o Opportunity problems 6

PROBLEMS CLASSIFICATION o For decision making it is important to understand the types of problems , decisions and conditions that managers face. o Problem can be classified into : o Crisis problem o Non crisis problems, or o Opportunity problems 6

TYPE OF DECISION o Programmed Decisions A manager makes a programmed decision when a situation occurs so often or is so wellstructured that it can be handled through the use of preset decision rules. o Non-Programmed Decisions for which predetermined decision rules are impractical due to novel and/or ill-structured situations. 7

TYPE OF DECISION o Programmed Decisions A manager makes a programmed decision when a situation occurs so often or is so wellstructured that it can be handled through the use of preset decision rules. o Non-Programmed Decisions for which predetermined decision rules are impractical due to novel and/or ill-structured situations. 7

DAY TO DAY BUSINESS DECISION o Managers come across various situations in day to day business activities where decision are required. o Decision making require accurate data which of course need to be analyzed and evaluated properly by decision maker before reaching at a decision. 8

DAY TO DAY BUSINESS DECISION o Managers come across various situations in day to day business activities where decision are required. o Decision making require accurate data which of course need to be analyzed and evaluated properly by decision maker before reaching at a decision. 8

DECISION MAKING RELEAVANT AND IRRELEVANT COST o Distinguishing between relevant and irrelevant cost is critical for two reasons : o First, irrelevant data can be ignored and need not be analyzed. This can save decision maker’s tremendous amounts of time and effort. o Second, bad decisions result from erroneously including irrelevant cost and benefit data when analyzing alternatives. o To be successful in decision making, managers must be able to recognize the difference between relevant and irrelevant data and must be able to correctly use the relevant data in analyzing alternatives. 9

DECISION MAKING RELEAVANT AND IRRELEVANT COST o Distinguishing between relevant and irrelevant cost is critical for two reasons : o First, irrelevant data can be ignored and need not be analyzed. This can save decision maker’s tremendous amounts of time and effort. o Second, bad decisions result from erroneously including irrelevant cost and benefit data when analyzing alternatives. o To be successful in decision making, managers must be able to recognize the difference between relevant and irrelevant data and must be able to correctly use the relevant data in analyzing alternatives. 9

DECISION MAKING NON-QUANTATIVE FACTORS Financial and quantitative information is used as a basis for decision making. It should not be used exclusively. However, in most decisions there a number of factors which need to be balanced and weighed before the final point is reached and the decision actually made. Most of the factors are qualitative ones that are not easily expressed in terms of money. Example A decision to close a department or a factory the cost of making staff redundant can be calculated quite easily. But the effect in terms of loss of morale of other staff , decrease in productivity etc cannot be easily measured. 10

DECISION MAKING NON-QUANTATIVE FACTORS Financial and quantitative information is used as a basis for decision making. It should not be used exclusively. However, in most decisions there a number of factors which need to be balanced and weighed before the final point is reached and the decision actually made. Most of the factors are qualitative ones that are not easily expressed in terms of money. Example A decision to close a department or a factory the cost of making staff redundant can be calculated quite easily. But the effect in terms of loss of morale of other staff , decrease in productivity etc cannot be easily measured. 10

Different costs for differing purposes o We need to recognise that cost are relevant in one decision situation are not necessarily relevant in another. o For one purpose , a particular group of cost may be relevant; for another purpose , an entirely different group cost may be irrelevant. o Thus , in each decision situation the manager must examine the data at hand isolate the relevant costs. Otherwise , the manager runs the risk of being misled by irrelevant data. o Nearly 70 years ago, eminent economist J. Maurice Clarke stated that “Accountants use different costs because of their differing objectives. ” 11

Different costs for differing purposes o We need to recognise that cost are relevant in one decision situation are not necessarily relevant in another. o For one purpose , a particular group of cost may be relevant; for another purpose , an entirely different group cost may be irrelevant. o Thus , in each decision situation the manager must examine the data at hand isolate the relevant costs. Otherwise , the manager runs the risk of being misled by irrelevant data. o Nearly 70 years ago, eminent economist J. Maurice Clarke stated that “Accountants use different costs because of their differing objectives. ” 11

Different costs for differing purposes o The concept of “different cost for different purposes” is basic to managerial accounting. o The business world has certainly become a lot more complicated since Professor Clarke’s insightful comment. Management accountants today are expected to be a lot more conversant and knowledgeable about business operations. They are expected to add value to their company by their ability to bring the right information to bear on a decision. To do that, management accountants must be able to identify, analyze, and help solve problems. 12

Different costs for differing purposes o The concept of “different cost for different purposes” is basic to managerial accounting. o The business world has certainly become a lot more complicated since Professor Clarke’s insightful comment. Management accountants today are expected to be a lot more conversant and knowledgeable about business operations. They are expected to add value to their company by their ability to bring the right information to bear on a decision. To do that, management accountants must be able to identify, analyze, and help solve problems. 12

DIFFERENCIAL COST o Differential cost is the difference in the cost of alternative choices. o It deal with the determination of incremental revenue, cost, and margins. o Historical costs drawn from the financial accounting records generally do not give management the differential cost information needed to evaluate alternative courses of action. 13

DIFFERENCIAL COST o Differential cost is the difference in the cost of alternative choices. o It deal with the determination of incremental revenue, cost, and margins. o Historical costs drawn from the financial accounting records generally do not give management the differential cost information needed to evaluate alternative courses of action. 13

DIFFERENCIAL COST o Differential cost is often referred to as marginal or incremental cost. o The term “marginal cost” is widely used by economists. o Engineers generally speak of “incremental costs” as the added cost incurred when a project or an undertaking is extended beyond its originally intended goal. 14

DIFFERENCIAL COST o Differential cost is often referred to as marginal or incremental cost. o The term “marginal cost” is widely used by economists. o Engineers generally speak of “incremental costs” as the added cost incurred when a project or an undertaking is extended beyond its originally intended goal. 14

OPPORTUNITY COSTS o Opportunity costs are the measurable value of an opportunity or potential benefits given up when one alternative is selected over another. o The opportunity cost is not the usual outlay of cash rather they represent economic benefits that are foregone as a result of pursing another course of action. 15

OPPORTUNITY COSTS o Opportunity costs are the measurable value of an opportunity or potential benefits given up when one alternative is selected over another. o The opportunity cost is not the usual outlay of cash rather they represent economic benefits that are foregone as a result of pursing another course of action. 15

OPPORTUNITY COSTS o Opportunity costs require the measurement of sacrifices associated with alternatives. If a decision requires no sacrifice, there is no opportunity cost. Example 1 o Miss Monica has a part-time job that pays her Rs. 1000 per week while attending college. She would like to spend a week at the beach during spring break, and her employer has agreed to give her the time off, but without pay. The lost wages of Rs 1000 would be an opportunity cost of taking the week off to be at the beach. 16

OPPORTUNITY COSTS o Opportunity costs require the measurement of sacrifices associated with alternatives. If a decision requires no sacrifice, there is no opportunity cost. Example 1 o Miss Monica has a part-time job that pays her Rs. 1000 per week while attending college. She would like to spend a week at the beach during spring break, and her employer has agreed to give her the time off, but without pay. The lost wages of Rs 1000 would be an opportunity cost of taking the week off to be at the beach. 16

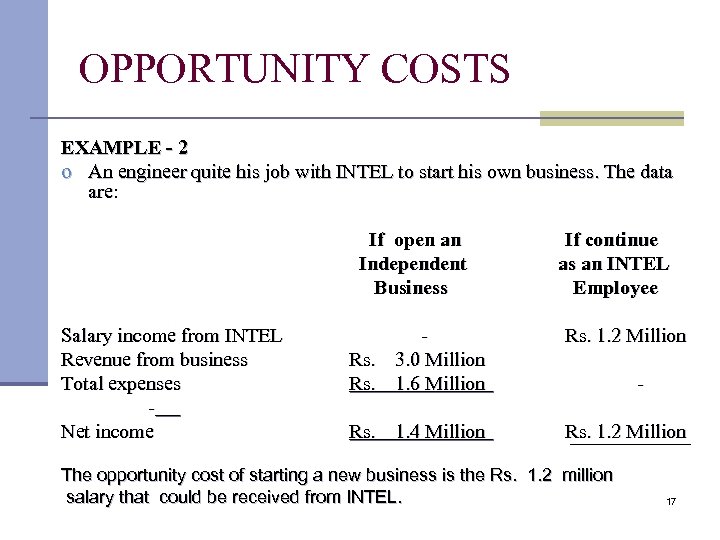

OPPORTUNITY COSTS EXAMPLE - 2 o An engineer quite his job with INTEL to start his own business. The data are: If open an Independent Business Salary income from INTEL Revenue from business Total expenses Net income If continue as an INTEL Employee Rs. 3. 0 Million Rs. 1. 6 Million Rs. 1. 2 Million Rs. 1. 4 Million Rs. 1. 2 Million - The opportunity cost of starting a new business is the Rs. 1. 2 million salary that could be received from INTEL. 17

OPPORTUNITY COSTS EXAMPLE - 2 o An engineer quite his job with INTEL to start his own business. The data are: If open an Independent Business Salary income from INTEL Revenue from business Total expenses Net income If continue as an INTEL Employee Rs. 3. 0 Million Rs. 1. 6 Million Rs. 1. 2 Million Rs. 1. 4 Million Rs. 1. 2 Million - The opportunity cost of starting a new business is the Rs. 1. 2 million salary that could be received from INTEL. 17

SUNK COSTS o A sunk cost is a cost that has already been incurred and that cannot be changed by any decision made now or in the future. o Sunk cost are irrelevant cost for decision making and should be ignored. 18

SUNK COSTS o A sunk cost is a cost that has already been incurred and that cannot be changed by any decision made now or in the future. o Sunk cost are irrelevant cost for decision making and should be ignored. 18

CASE STUDY SUNK COSTS o Management of the Shaheen Chemical Company is reviewing a research project that was initiated for the purpose of developing a new product. o Expenditures to date on the project total Rs. 252, 000. o The Research and Development Department now estimates that an additional Rs. 48, 000 will be required to produce a marketable product. o Current market estimates indicate a lifetime profit potential having a present value of Rs. 80, 000 for the product, excluding research and development expenditure. o Q- Advise Management for spending additional Rs. 48, 000. 19

CASE STUDY SUNK COSTS o Management of the Shaheen Chemical Company is reviewing a research project that was initiated for the purpose of developing a new product. o Expenditures to date on the project total Rs. 252, 000. o The Research and Development Department now estimates that an additional Rs. 48, 000 will be required to produce a marketable product. o Current market estimates indicate a lifetime profit potential having a present value of Rs. 80, 000 for the product, excluding research and development expenditure. o Q- Advise Management for spending additional Rs. 48, 000. 19

SUNK COSTS o An understanding of the distinction between future costs and sunk costs can help avoid confusion and possible error when management is faced with a decision involving two material amount of cost that has been incurred in the past. o This question typically arises in deciding whether to continue or to terminate a project already in progress. 20

SUNK COSTS o An understanding of the distinction between future costs and sunk costs can help avoid confusion and possible error when management is faced with a decision involving two material amount of cost that has been incurred in the past. o This question typically arises in deciding whether to continue or to terminate a project already in progress. 20

MODULES OF DIFFERENCIAL COSTS o Various Situations where Differential Cost Analysis is used by management for decision making: o o Pricing decision for a special order. Price cut in a competitive market. Pricing in case of full capacity. Increasing, curtailing, or stopping production of certain products. 21

MODULES OF DIFFERENCIAL COSTS o Various Situations where Differential Cost Analysis is used by management for decision making: o o Pricing decision for a special order. Price cut in a competitive market. Pricing in case of full capacity. Increasing, curtailing, or stopping production of certain products. 21

MODULES OF DIFFERENCIAL COSTS o Evaluating make-or-buy alternatives. o Expanding or reducing plant capacity. o Cost benefit analyses- spending additional amounts for sales promotion. o Selecting new sales territories. o Further processing decision o Addition of new machinery vs. putting plant on double shift/OT. o Utilization of spare capacity o Replacing present equipment with new machinery. o Decision to shut down plant. 22

MODULES OF DIFFERENCIAL COSTS o Evaluating make-or-buy alternatives. o Expanding or reducing plant capacity. o Cost benefit analyses- spending additional amounts for sales promotion. o Selecting new sales territories. o Further processing decision o Addition of new machinery vs. putting plant on double shift/OT. o Utilization of spare capacity o Replacing present equipment with new machinery. o Decision to shut down plant. 22

SPEICAL PRICING FOR SPECIAL ORDERS o The differential cost aids management in deciding at the price the company can afford to accept an additional order for sale of goods or services. o These additional orders may be for o Government institutions or o Export etc 23

SPEICAL PRICING FOR SPECIAL ORDERS o The differential cost aids management in deciding at the price the company can afford to accept an additional order for sale of goods or services. o These additional orders may be for o Government institutions or o Export etc 23

CASE STUDY- 1 SPEICAL PRICING FOR SPECIAL ORDERS o A company manufactures 450, 000 units. The fixed factory overhead is Rs. 335, 000. The variable cost is Rs. 3. 7 per unit. Each unit sells for Rs. 5. o The sales department reports that a customer has offered to pay Rs. 4. 25 per unit for an additional 100, 000 units. To make the additional units, an annual rental cost of Rs. 10, 000 for new equipment would be incurred. o Q- Advise Management to accept the order or not. 24

CASE STUDY- 1 SPEICAL PRICING FOR SPECIAL ORDERS o A company manufactures 450, 000 units. The fixed factory overhead is Rs. 335, 000. The variable cost is Rs. 3. 7 per unit. Each unit sells for Rs. 5. o The sales department reports that a customer has offered to pay Rs. 4. 25 per unit for an additional 100, 000 units. To make the additional units, an annual rental cost of Rs. 10, 000 for new equipment would be incurred. o Q- Advise Management to accept the order or not. 24

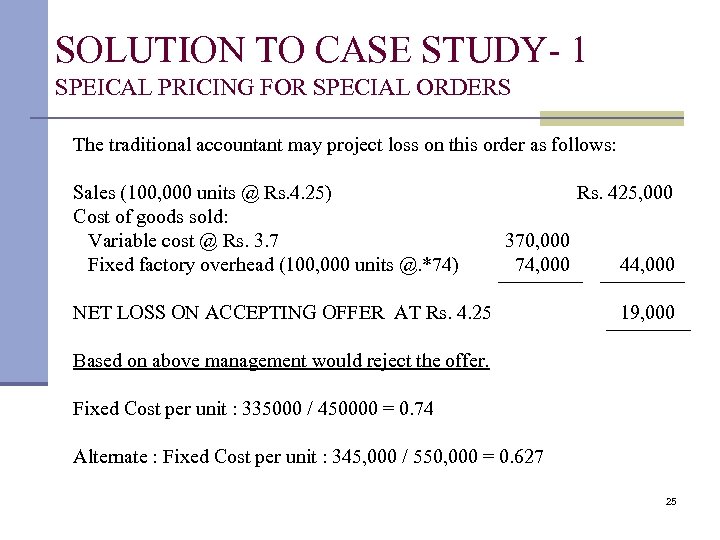

SOLUTION TO CASE STUDY- 1 SPEICAL PRICING FOR SPECIAL ORDERS The traditional accountant may project loss on this order as follows: Sales (100, 000 units @ Rs. 4. 25) Cost of goods sold: Variable cost @ Rs. 3. 7 Fixed factory overhead (100, 000 units @. *74) Rs. 425, 000 370, 000 74, 000 NET LOSS ON ACCEPTING OFFER AT Rs. 4. 25 44, 000 19, 000 Based on above management would reject the offer. Fixed Cost per unit : 335000 / 450000 = 0. 74 Alternate : Fixed Cost per unit : 345, 000 / 550, 000 = 0. 627 25

SOLUTION TO CASE STUDY- 1 SPEICAL PRICING FOR SPECIAL ORDERS The traditional accountant may project loss on this order as follows: Sales (100, 000 units @ Rs. 4. 25) Cost of goods sold: Variable cost @ Rs. 3. 7 Fixed factory overhead (100, 000 units @. *74) Rs. 425, 000 370, 000 74, 000 NET LOSS ON ACCEPTING OFFER AT Rs. 4. 25 44, 000 19, 000 Based on above management would reject the offer. Fixed Cost per unit : 335000 / 450000 = 0. 74 Alternate : Fixed Cost per unit : 345, 000 / 550, 000 = 0. 627 25

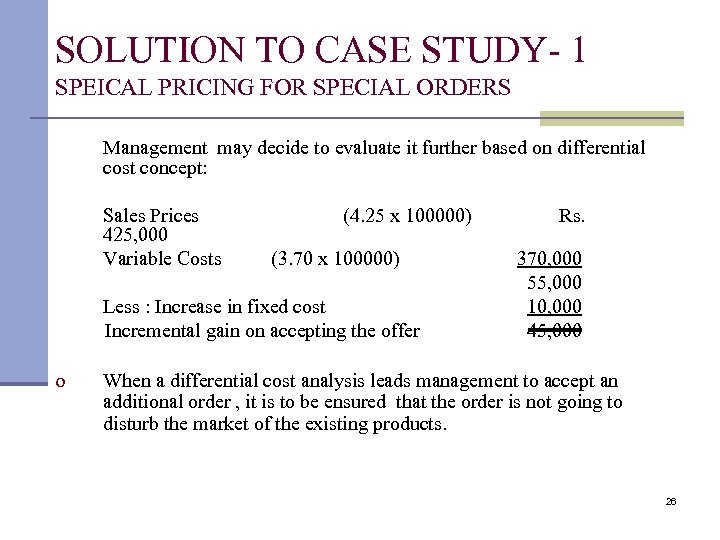

SOLUTION TO CASE STUDY- 1 SPEICAL PRICING FOR SPECIAL ORDERS Management may decide to evaluate it further based on differential cost concept: Sales Prices 425, 000 Variable Costs (4. 25 x 100000) (3. 70 x 100000) Less : Increase in fixed cost Incremental gain on accepting the offer o Rs. 370, 000 55, 000 10, 000 45, 000 When a differential cost analysis leads management to accept an additional order , it is to be ensured that the order is not going to disturb the market of the existing products. 26

SOLUTION TO CASE STUDY- 1 SPEICAL PRICING FOR SPECIAL ORDERS Management may decide to evaluate it further based on differential cost concept: Sales Prices 425, 000 Variable Costs (4. 25 x 100000) (3. 70 x 100000) Less : Increase in fixed cost Incremental gain on accepting the offer o Rs. 370, 000 55, 000 10, 000 45, 000 When a differential cost analysis leads management to accept an additional order , it is to be ensured that the order is not going to disturb the market of the existing products. 26

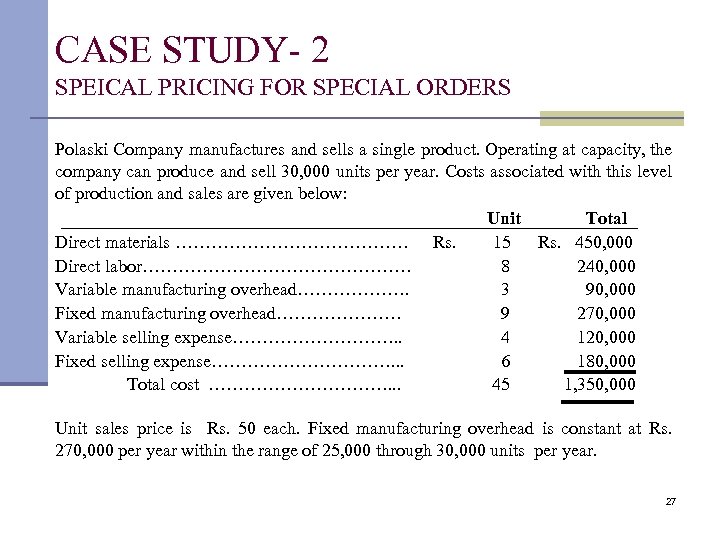

CASE STUDY- 2 SPEICAL PRICING FOR SPECIAL ORDERS Polaski Company manufactures and sells a single product. Operating at capacity, the company can produce and sell 30, 000 units per year. Costs associated with this level of production and sales are given below: Unit Total Direct materials ………………… Rs. 15 Rs. 450, 000 Direct labor…………………… 8 240, 000 Variable manufacturing overhead………………. 3 90, 000 Fixed manufacturing overhead………………… 9 270, 000 Variable selling expense……………. . 4 120, 000 Fixed selling expense……………. . . 6 180, 000 Total cost ……………. . . 45 1, 350, 000 Unit sales price is Rs. 50 each. Fixed manufacturing overhead is constant at Rs. 270, 000 per year within the range of 25, 000 through 30, 000 units per year. 27

CASE STUDY- 2 SPEICAL PRICING FOR SPECIAL ORDERS Polaski Company manufactures and sells a single product. Operating at capacity, the company can produce and sell 30, 000 units per year. Costs associated with this level of production and sales are given below: Unit Total Direct materials ………………… Rs. 15 Rs. 450, 000 Direct labor…………………… 8 240, 000 Variable manufacturing overhead………………. 3 90, 000 Fixed manufacturing overhead………………… 9 270, 000 Variable selling expense……………. . 4 120, 000 Fixed selling expense……………. . . 6 180, 000 Total cost ……………. . . 45 1, 350, 000 Unit sales price is Rs. 50 each. Fixed manufacturing overhead is constant at Rs. 270, 000 per year within the range of 25, 000 through 30, 000 units per year. 27

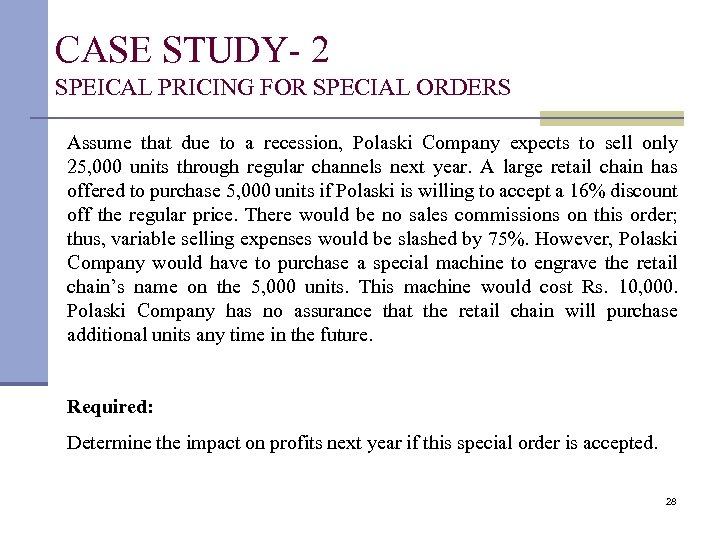

CASE STUDY- 2 SPEICAL PRICING FOR SPECIAL ORDERS Assume that due to a recession, Polaski Company expects to sell only 25, 000 units through regular channels next year. A large retail chain has offered to purchase 5, 000 units if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrave the retail chain’s name on the 5, 000 units. This machine would cost Rs. 10, 000. Polaski Company has no assurance that the retail chain will purchase additional units any time in the future. Required: Determine the impact on profits next year if this special order is accepted. 28

CASE STUDY- 2 SPEICAL PRICING FOR SPECIAL ORDERS Assume that due to a recession, Polaski Company expects to sell only 25, 000 units through regular channels next year. A large retail chain has offered to purchase 5, 000 units if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrave the retail chain’s name on the 5, 000 units. This machine would cost Rs. 10, 000. Polaski Company has no assurance that the retail chain will purchase additional units any time in the future. Required: Determine the impact on profits next year if this special order is accepted. 28

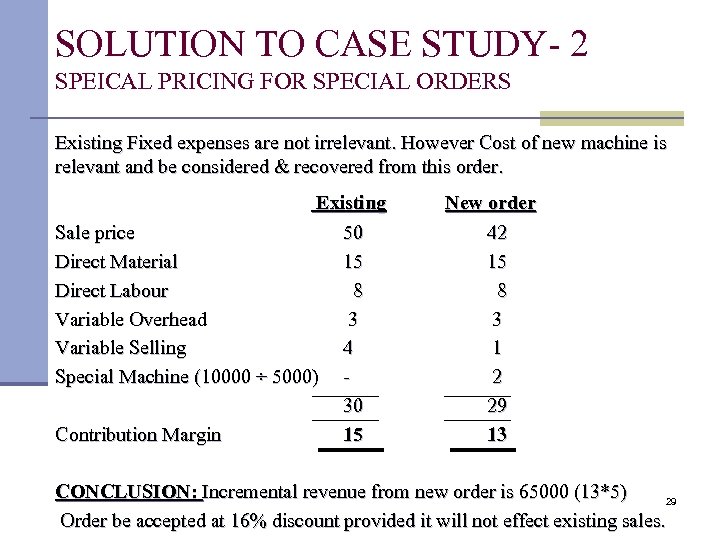

SOLUTION TO CASE STUDY- 2 SPEICAL PRICING FOR SPECIAL ORDERS Existing Fixed expenses are not irrelevant. However Cost of new machine is relevant and be considered & recovered from this order. Existing Sale price 50 Direct Material 15 Direct Labour 8 Variable Overhead 3 Variable Selling 4 Special Machine (10000 ÷ 5000) 30 Contribution Margin 15 New order 42 15 8 3 1 2 29 13 CONCLUSION: Incremental revenue from new order is 65000 (13*5) 29 Order be accepted at 16% discount provided it will not effect existing sales.

SOLUTION TO CASE STUDY- 2 SPEICAL PRICING FOR SPECIAL ORDERS Existing Fixed expenses are not irrelevant. However Cost of new machine is relevant and be considered & recovered from this order. Existing Sale price 50 Direct Material 15 Direct Labour 8 Variable Overhead 3 Variable Selling 4 Special Machine (10000 ÷ 5000) 30 Contribution Margin 15 New order 42 15 8 3 1 2 29 13 CONCLUSION: Incremental revenue from new order is 65000 (13*5) 29 Order be accepted at 16% discount provided it will not effect existing sales.

UTILIZATION OF SPARE CAPACITY o In cases where production is below capacity, opportunities may arise for. o o o sales at a specially reduced price , introducing new products , manufacturing under another brand name. tolling options biding for Government or export for bulk supplies 30

UTILIZATION OF SPARE CAPACITY o In cases where production is below capacity, opportunities may arise for. o o o sales at a specially reduced price , introducing new products , manufacturing under another brand name. tolling options biding for Government or export for bulk supplies 30

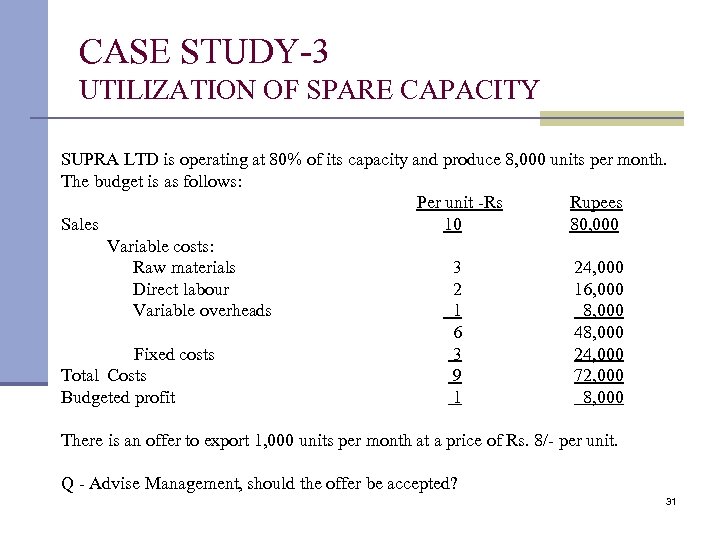

CASE STUDY-3 UTILIZATION OF SPARE CAPACITY SUPRA LTD is operating at 80% of its capacity and produce 8, 000 units per month. The budget is as follows: Per unit -Rs Rupees Sales 10 80, 000 Variable costs: Raw materials 3 24, 000 Direct labour 2 16, 000 Variable overheads 1 8, 000 6 48, 000 Fixed costs 3 24, 000 Total Costs 9 72, 000 Budgeted profit 1 8, 000 There is an offer to export 1, 000 units per month at a price of Rs. 8/- per unit. Q - Advise Management, should the offer be accepted? 31

CASE STUDY-3 UTILIZATION OF SPARE CAPACITY SUPRA LTD is operating at 80% of its capacity and produce 8, 000 units per month. The budget is as follows: Per unit -Rs Rupees Sales 10 80, 000 Variable costs: Raw materials 3 24, 000 Direct labour 2 16, 000 Variable overheads 1 8, 000 6 48, 000 Fixed costs 3 24, 000 Total Costs 9 72, 000 Budgeted profit 1 8, 000 There is an offer to export 1, 000 units per month at a price of Rs. 8/- per unit. Q - Advise Management, should the offer be accepted? 31

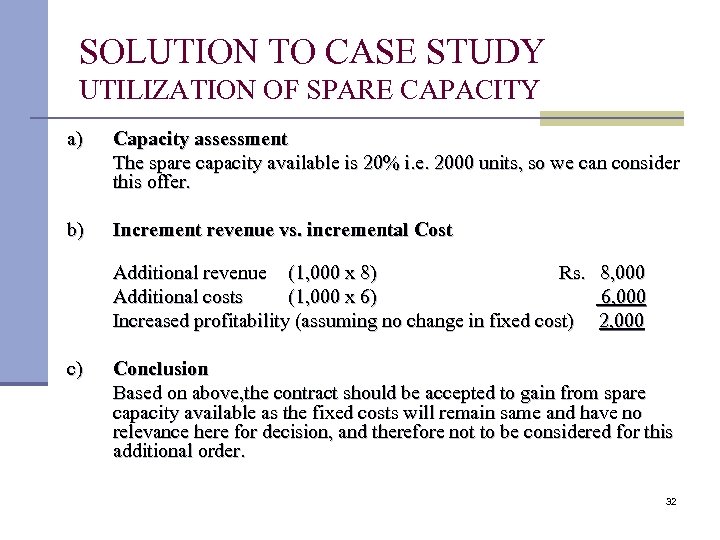

SOLUTION TO CASE STUDY UTILIZATION OF SPARE CAPACITY a) Capacity assessment The spare capacity available is 20% i. e. 2000 units, so we can consider this offer. b) Increment revenue vs. incremental Cost Additional revenue (1, 000 x 8) Rs. Additional costs (1, 000 x 6) Increased profitability (assuming no change in fixed cost) c) 8, 000 6, 000 2, 000 Conclusion Based on above, the contract should be accepted to gain from spare capacity available as the fixed costs will remain same and have no relevance here for decision, and therefore not to be considered for this additional order. 32

SOLUTION TO CASE STUDY UTILIZATION OF SPARE CAPACITY a) Capacity assessment The spare capacity available is 20% i. e. 2000 units, so we can consider this offer. b) Increment revenue vs. incremental Cost Additional revenue (1, 000 x 8) Rs. Additional costs (1, 000 x 6) Increased profitability (assuming no change in fixed cost) c) 8, 000 6, 000 2, 000 Conclusion Based on above, the contract should be accepted to gain from spare capacity available as the fixed costs will remain same and have no relevance here for decision, and therefore not to be considered for this additional order. 32

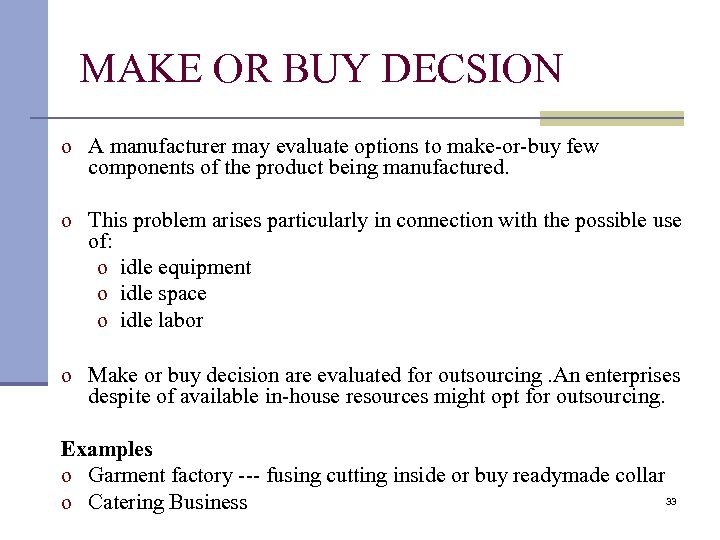

MAKE OR BUY DECSION o A manufacturer may evaluate options to make-or-buy few components of the product being manufactured. o This problem arises particularly in connection with the possible use of: o idle equipment o idle space o idle labor o Make or buy decision are evaluated for outsourcing. An enterprises despite of available in-house resources might opt for outsourcing. Examples o Garment factory --- fusing cutting inside or buy readymade collar 33 o Catering Business

MAKE OR BUY DECSION o A manufacturer may evaluate options to make-or-buy few components of the product being manufactured. o This problem arises particularly in connection with the possible use of: o idle equipment o idle space o idle labor o Make or buy decision are evaluated for outsourcing. An enterprises despite of available in-house resources might opt for outsourcing. Examples o Garment factory --- fusing cutting inside or buy readymade collar 33 o Catering Business

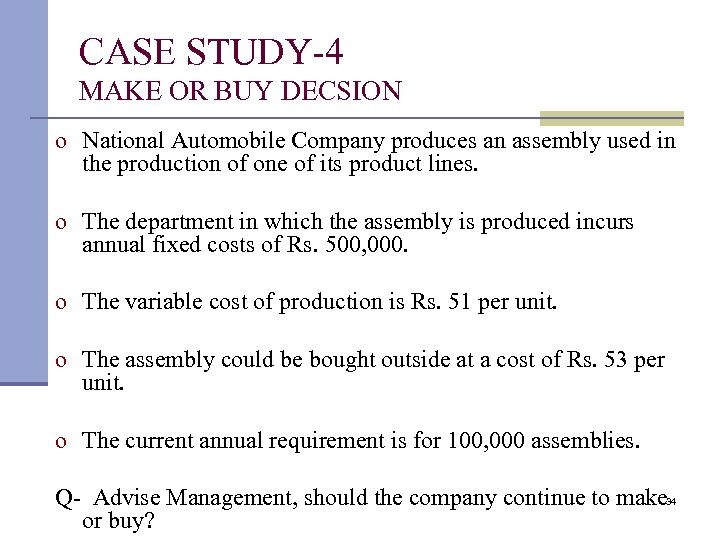

CASE STUDY-4 MAKE OR BUY DECSION o National Automobile Company produces an assembly used in the production of one of its product lines. o The department in which the assembly is produced incurs annual fixed costs of Rs. 500, 000. o The variable cost of production is Rs. 51 per unit. o The assembly could be bought outside at a cost of Rs. 53 per unit. o The current annual requirement is for 100, 000 assemblies. Q- Advise Management, should the company continue to make 34 or buy?

CASE STUDY-4 MAKE OR BUY DECSION o National Automobile Company produces an assembly used in the production of one of its product lines. o The department in which the assembly is produced incurs annual fixed costs of Rs. 500, 000. o The variable cost of production is Rs. 51 per unit. o The assembly could be bought outside at a cost of Rs. 53 per unit. o The current annual requirement is for 100, 000 assemblies. Q- Advise Management, should the company continue to make 34 or buy?

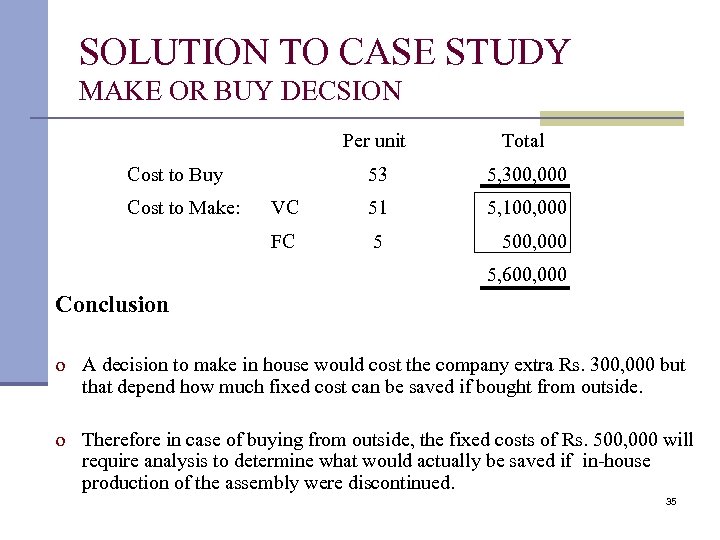

SOLUTION TO CASE STUDY MAKE OR BUY DECSION Per unit Total 53 5, 300, 000 VC 51 5, 100, 000 FC 5 500, 000 Cost to Buy Cost to Make: 5, 600, 000 Conclusion o A decision to make in house would cost the company extra Rs. 300, 000 but that depend how much fixed cost can be saved if bought from outside. o Therefore in case of buying from outside, the fixed costs of Rs. 500, 000 will require analysis to determine what would actually be saved if in-house production of the assembly were discontinued. 35

SOLUTION TO CASE STUDY MAKE OR BUY DECSION Per unit Total 53 5, 300, 000 VC 51 5, 100, 000 FC 5 500, 000 Cost to Buy Cost to Make: 5, 600, 000 Conclusion o A decision to make in house would cost the company extra Rs. 300, 000 but that depend how much fixed cost can be saved if bought from outside. o Therefore in case of buying from outside, the fixed costs of Rs. 500, 000 will require analysis to determine what would actually be saved if in-house production of the assembly were discontinued. 35

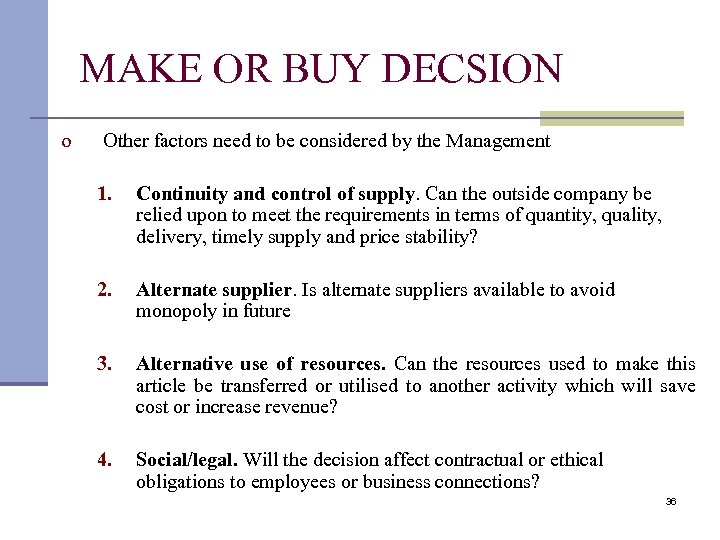

MAKE OR BUY DECSION o Other factors need to be considered by the Management 1. Continuity and control of supply. Can the outside company be relied upon to meet the requirements in terms of quantity, quality, delivery, timely supply and price stability? 2. Alternate supplier. Is alternate suppliers available to avoid monopoly in future 3. Alternative use of resources. Can the resources used to make this article be transferred or utilised to another activity which will save cost or increase revenue? 4. Social/legal. Will the decision affect contractual or ethical obligations to employees or business connections? 36

MAKE OR BUY DECSION o Other factors need to be considered by the Management 1. Continuity and control of supply. Can the outside company be relied upon to meet the requirements in terms of quantity, quality, delivery, timely supply and price stability? 2. Alternate supplier. Is alternate suppliers available to avoid monopoly in future 3. Alternative use of resources. Can the resources used to make this article be transferred or utilised to another activity which will save cost or increase revenue? 4. Social/legal. Will the decision affect contractual or ethical obligations to employees or business connections? 36

DECISION TO SHUT DOWN o Differential cost analysis is also used when a business is confronted with the possibility of a shutdown of manufacturing and/or marketing facilities. o In the recent years few companies have experienced shut down of their marketing department and entered into outsourcing contract to perform its marketing function and in some cases companies despite of own manufacturing facilities have preferred to go for Tolling options. 37

DECISION TO SHUT DOWN o Differential cost analysis is also used when a business is confronted with the possibility of a shutdown of manufacturing and/or marketing facilities. o In the recent years few companies have experienced shut down of their marketing department and entered into outsourcing contract to perform its marketing function and in some cases companies despite of own manufacturing facilities have preferred to go for Tolling options. 37

EXAMPLES DECISION TO SHUT DOWN o Orgnon and Reckitt have shut down their pharmaceuticals plant completely and are concentrating on marketing function. Their products are being manufactured by ABBOT AND MECTOR/GETZ respectively. o Some companies are getting their few products toll through other pharmaceutical companies like : o o WYTH for SPENCER and MECTOR PHARM EVO for ASIAN PHARMA SANTE from ELKO ICI and BYER from GETZ PHARMA 38

EXAMPLES DECISION TO SHUT DOWN o Orgnon and Reckitt have shut down their pharmaceuticals plant completely and are concentrating on marketing function. Their products are being manufactured by ABBOT AND MECTOR/GETZ respectively. o Some companies are getting their few products toll through other pharmaceutical companies like : o o WYTH for SPENCER and MECTOR PHARM EVO for ASIAN PHARMA SANTE from ELKO ICI and BYER from GETZ PHARMA 38

DECISION TO SHUT DOWN o A shutdown of facilities or a project or a department does not eliminate all costs. Some expenses like depreciation, interest, and insurance may continue during complete inactivity. o If operations continues (even in loss situation), certain expenses connected with the shutting down of the facilities would be saved such as costs that would have to be incurred on shut down when a closed facility is reopened. 39

DECISION TO SHUT DOWN o A shutdown of facilities or a project or a department does not eliminate all costs. Some expenses like depreciation, interest, and insurance may continue during complete inactivity. o If operations continues (even in loss situation), certain expenses connected with the shutting down of the facilities would be saved such as costs that would have to be incurred on shut down when a closed facility is reopened. 39

DECISION TO SHUT DOWN o Other aspect of shutdown: 1. 2. 3. 4. o the loss of established markets. morale of other employees, danger of plant obsolescence training of new employees when project will restart. In periods of trading difficulty, a business can continue to operate while marginal contribution equals fixed expenses i. e. in Breakeven situations. 40

DECISION TO SHUT DOWN o Other aspect of shutdown: 1. 2. 3. 4. o the loss of established markets. morale of other employees, danger of plant obsolescence training of new employees when project will restart. In periods of trading difficulty, a business can continue to operate while marginal contribution equals fixed expenses i. e. in Breakeven situations. 40

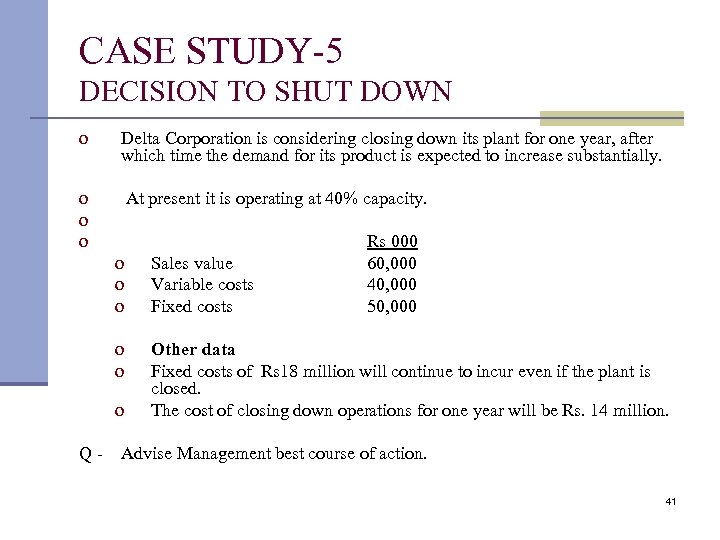

CASE STUDY-5 DECISION TO SHUT DOWN o Delta Corporation is considering closing down its plant for one year, after which time the demand for its product is expected to increase substantially. o o o At present it is operating at 40% capacity. Rs 000 60, 000 40, 000 50, 000 o o o Sales value Variable costs Fixed costs o o Other data Fixed costs of Rs 18 million will continue to incur even if the plant is closed. The cost of closing down operations for one year will be Rs. 14 million. o Q- Advise Management best course of action. 41

CASE STUDY-5 DECISION TO SHUT DOWN o Delta Corporation is considering closing down its plant for one year, after which time the demand for its product is expected to increase substantially. o o o At present it is operating at 40% capacity. Rs 000 60, 000 40, 000 50, 000 o o o Sales value Variable costs Fixed costs o o Other data Fixed costs of Rs 18 million will continue to incur even if the plant is closed. The cost of closing down operations for one year will be Rs. 14 million. o Q- Advise Management best course of action. 41

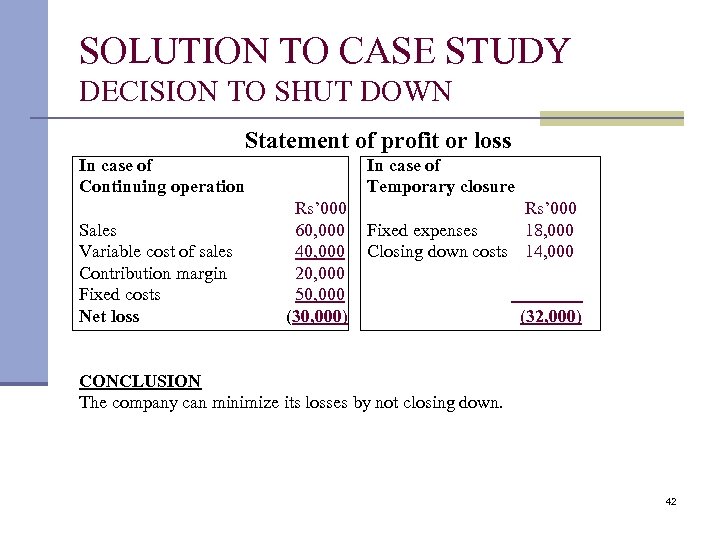

SOLUTION TO CASE STUDY DECISION TO SHUT DOWN Statement of profit or loss In case of Continuing operation Sales Variable cost of sales Contribution margin Fixed costs Net loss In case of Temporary closure Rs’ 000 60, 000 40, 000 20, 000 50, 000 (30, 000) Rs’ 000 Fixed expenses 18, 000 Closing down costs 14, 000 (32, 000) CONCLUSION The company can minimize its losses by not closing down. 42

SOLUTION TO CASE STUDY DECISION TO SHUT DOWN Statement of profit or loss In case of Continuing operation Sales Variable cost of sales Contribution margin Fixed costs Net loss In case of Temporary closure Rs’ 000 60, 000 40, 000 20, 000 50, 000 (30, 000) Rs’ 000 Fixed expenses 18, 000 Closing down costs 14, 000 (32, 000) CONCLUSION The company can minimize its losses by not closing down. 42

DISCONTINUE PRODUCT/ SEGMENT o There may arise circumstances where management decide to discontinue certain products or department or segment divisions or types of customer in case they are yielding o net loss or o an inadequate profit. 43

DISCONTINUE PRODUCT/ SEGMENT o There may arise circumstances where management decide to discontinue certain products or department or segment divisions or types of customer in case they are yielding o net loss or o an inadequate profit. 43

FOCUS ON CURRENT PRACTICE A bakery distributed its products through route salespersons, each of whom loaded a truck with an assortment of products in the morning and spent the day calling on customers in an assigned territory. Believing that some items were more profitable than others, management asked for an analysis of product costs and sales. The accountants to whom the task was assigned allocated all manufacturing and marketing costs to products to obtain a net profit for each product. 44

FOCUS ON CURRENT PRACTICE A bakery distributed its products through route salespersons, each of whom loaded a truck with an assortment of products in the morning and spent the day calling on customers in an assigned territory. Believing that some items were more profitable than others, management asked for an analysis of product costs and sales. The accountants to whom the task was assigned allocated all manufacturing and marketing costs to products to obtain a net profit for each product. 44

FOCUS ON CURRENT PRACTICE The resulting figures indicated that some of the products were being sold at a loss, and management discontinued these products. However, when this change was put into effect, the company’s overall profit declined. It was then seen that by dropping some products, sales revenues had been reduced without commensurate reduction in costs because the common manufacturing costs and route sales costs had to be continued in order to make and sell the remaining products. 45

FOCUS ON CURRENT PRACTICE The resulting figures indicated that some of the products were being sold at a loss, and management discontinued these products. However, when this change was put into effect, the company’s overall profit declined. It was then seen that by dropping some products, sales revenues had been reduced without commensurate reduction in costs because the common manufacturing costs and route sales costs had to be continued in order to make and sell the remaining products. 45

DISCONTINUE PRODUCT/ SEGMENT IMPACT ON OTHER PRODUCTS o In case financial data suggest to discontinue a product or division it is important to analyze and evaluate the extent to which sales of other products will be adversely affected. o Example i. a life saving drug if discontinued may directly effect entrance of Sales officers in doctors’ clinic, which of course will effect sales of other products and overall image of the company. ii. Angised and Digixon of GLAXOWELLCOME iii. Hospital: If one unit like X Ray not yielding profit even then management may continue so that business of high yield division like Laboratory may not be effected. 46

DISCONTINUE PRODUCT/ SEGMENT IMPACT ON OTHER PRODUCTS o In case financial data suggest to discontinue a product or division it is important to analyze and evaluate the extent to which sales of other products will be adversely affected. o Example i. a life saving drug if discontinued may directly effect entrance of Sales officers in doctors’ clinic, which of course will effect sales of other products and overall image of the company. ii. Angised and Digixon of GLAXOWELLCOME iii. Hospital: If one unit like X Ray not yielding profit even then management may continue so that business of high yield division like Laboratory may not be effected. 46

DISCONTINUE PRODUCT/ SEGMENT o Classification of fixed cost o Separable fixed cost It exists only because the segment exists; it will be eliminated if the segment is discontinued. For example salary of a branch manager or a department. o Joint fixed costs It remain after the disposal or discontinuing segment and be absorbed by the remaining segments. For example Depreciation of factory building, salaries of security and head office cost etc. 47

DISCONTINUE PRODUCT/ SEGMENT o Classification of fixed cost o Separable fixed cost It exists only because the segment exists; it will be eliminated if the segment is discontinued. For example salary of a branch manager or a department. o Joint fixed costs It remain after the disposal or discontinuing segment and be absorbed by the remaining segments. For example Depreciation of factory building, salaries of security and head office cost etc. 47

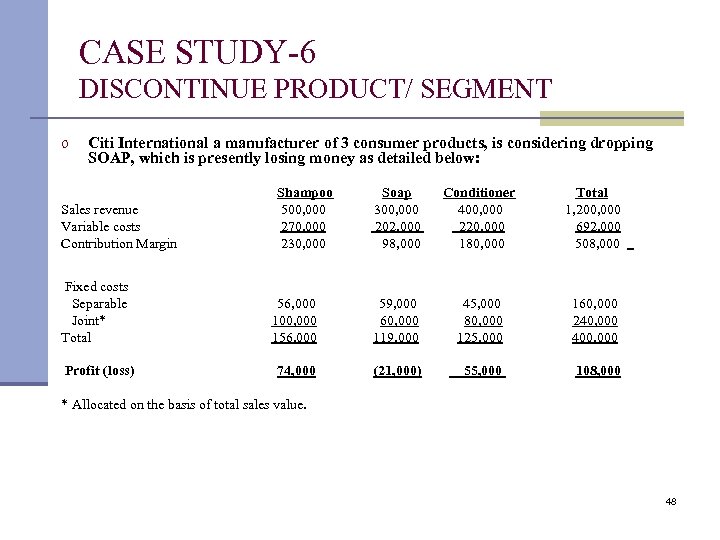

CASE STUDY-6 DISCONTINUE PRODUCT/ SEGMENT o Citi International a manufacturer of 3 consumer products, is considering dropping SOAP, which is presently losing money as detailed below: Sales revenue Variable costs Contribution Margin Fixed costs Separable Joint* Total Profit (loss) Shampoo 500, 000 270, 000 230, 000 Soap 300, 000 202, 000 98, 000 Conditioner 400, 000 220, 000 180, 000 Total 1, 200, 000 692, 000 508, 000 56, 000 100, 000 156, 000 59, 000 60, 000 119, 000 45, 000 80, 000 125, 000 160, 000 240, 000 400, 000 74, 000 (21, 000) 55, 000 108, 000 * Allocated on the basis of total sales value. 48

CASE STUDY-6 DISCONTINUE PRODUCT/ SEGMENT o Citi International a manufacturer of 3 consumer products, is considering dropping SOAP, which is presently losing money as detailed below: Sales revenue Variable costs Contribution Margin Fixed costs Separable Joint* Total Profit (loss) Shampoo 500, 000 270, 000 230, 000 Soap 300, 000 202, 000 98, 000 Conditioner 400, 000 220, 000 180, 000 Total 1, 200, 000 692, 000 508, 000 56, 000 100, 000 156, 000 59, 000 60, 000 119, 000 45, 000 80, 000 125, 000 160, 000 240, 000 400, 000 74, 000 (21, 000) 55, 000 108, 000 * Allocated on the basis of total sales value. 48

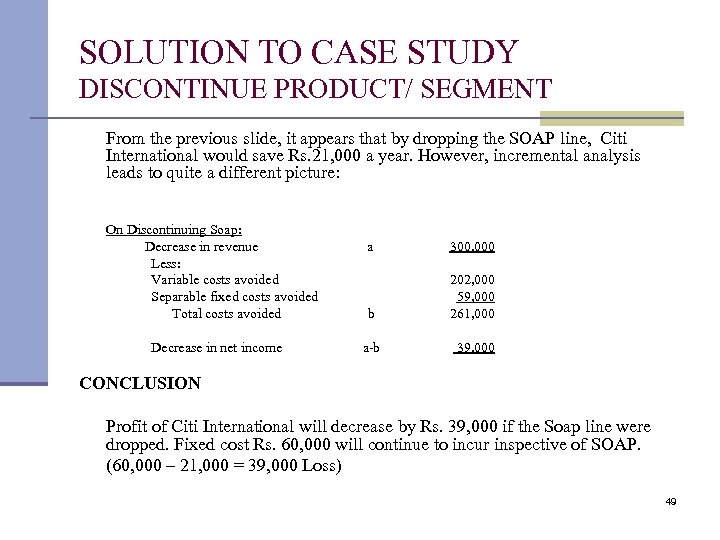

SOLUTION TO CASE STUDY DISCONTINUE PRODUCT/ SEGMENT From the previous slide, it appears that by dropping the SOAP line, Citi International would save Rs. 21, 000 a year. However, incremental analysis leads to quite a different picture: On Discontinuing Soap: Decrease in revenue Less: Variable costs avoided Separable fixed costs avoided Total costs avoided Decrease in net income a 300, 000 b 202, 000 59, 000 261, 000 a-b 39, 000 CONCLUSION Profit of Citi International will decrease by Rs. 39, 000 if the Soap line were dropped. Fixed cost Rs. 60, 000 will continue to incur inspective of SOAP. (60, 000 – 21, 000 = 39, 000 Loss) 49

SOLUTION TO CASE STUDY DISCONTINUE PRODUCT/ SEGMENT From the previous slide, it appears that by dropping the SOAP line, Citi International would save Rs. 21, 000 a year. However, incremental analysis leads to quite a different picture: On Discontinuing Soap: Decrease in revenue Less: Variable costs avoided Separable fixed costs avoided Total costs avoided Decrease in net income a 300, 000 b 202, 000 59, 000 261, 000 a-b 39, 000 CONCLUSION Profit of Citi International will decrease by Rs. 39, 000 if the Soap line were dropped. Fixed cost Rs. 60, 000 will continue to incur inspective of SOAP. (60, 000 – 21, 000 = 39, 000 Loss) 49

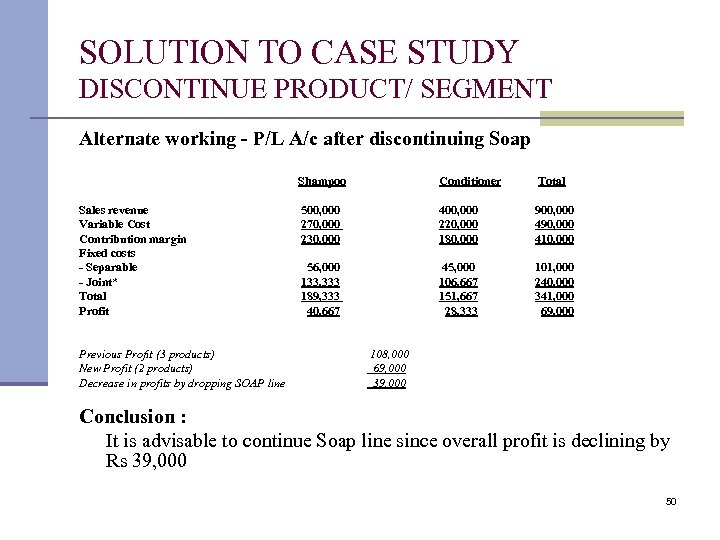

SOLUTION TO CASE STUDY DISCONTINUE PRODUCT/ SEGMENT Alternate working - P/L A/c after discontinuing Soap Shampoo Sales revenue Variable Cost Contribution margin Fixed costs - Separable - Joint* Total Profit Previous Profit (3 products) New Profit (2 products) Decrease in profits by dropping SOAP line Conditioner Total 500, 000 270, 000 230, 000 400, 000 220, 000 180, 000 900, 000 490, 000 410, 000 56, 000 133, 333 189, 333 40, 667 45, 000 106, 667 151, 667 28, 333 101, 000 240, 000 341, 000 69, 000 108, 000 69, 000 39, 000 Conclusion : It is advisable to continue Soap line since overall profit is declining by Rs 39, 000 50

SOLUTION TO CASE STUDY DISCONTINUE PRODUCT/ SEGMENT Alternate working - P/L A/c after discontinuing Soap Shampoo Sales revenue Variable Cost Contribution margin Fixed costs - Separable - Joint* Total Profit Previous Profit (3 products) New Profit (2 products) Decrease in profits by dropping SOAP line Conditioner Total 500, 000 270, 000 230, 000 400, 000 220, 000 180, 000 900, 000 490, 000 410, 000 56, 000 133, 333 189, 333 40, 667 45, 000 106, 667 151, 667 28, 333 101, 000 240, 000 341, 000 69, 000 108, 000 69, 000 39, 000 Conclusion : It is advisable to continue Soap line since overall profit is declining by Rs 39, 000 50

DISCONTINUE PRODUCT/ SEGMENT o Other non-financial factors o On elimination of the SOAP line there be may considerable effect on the sales of the other products. o Few consumer may stop buying the shampoo and conditioner if the Soap is not available and may switch to competitor’s products. 51

DISCONTINUE PRODUCT/ SEGMENT o Other non-financial factors o On elimination of the SOAP line there be may considerable effect on the sales of the other products. o Few consumer may stop buying the shampoo and conditioner if the Soap is not available and may switch to competitor’s products. 51

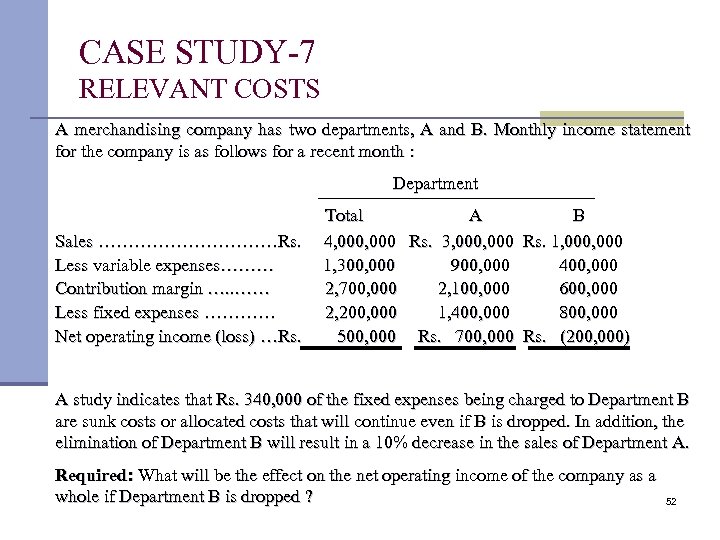

CASE STUDY-7 RELEVANT COSTS A merchandising company has two departments, A and B. Monthly income statement for the company is as follows for a recent month : Department Sales ……………Rs. Less variable expenses……… Contribution margin …. . …… Less fixed expenses ………… Net operating income (loss) …Rs. Total A B 4, 000 Rs. 3, 000 Rs. 1, 000 1, 300, 000 900, 000 400, 000 2, 700, 000 2, 100, 000 600, 000 2, 200, 000 1, 400, 000 800, 000 500, 000 Rs. 700, 000 Rs. (200, 000) A study indicates that Rs. 340, 000 of the fixed expenses being charged to Department B are sunk costs or allocated costs that will continue even if B is dropped. In addition, the elimination of Department B will result in a 10% decrease in the sales of Department A. Required: What will be the effect on the net operating income of the company as a whole if Department B is dropped ? 52

CASE STUDY-7 RELEVANT COSTS A merchandising company has two departments, A and B. Monthly income statement for the company is as follows for a recent month : Department Sales ……………Rs. Less variable expenses……… Contribution margin …. . …… Less fixed expenses ………… Net operating income (loss) …Rs. Total A B 4, 000 Rs. 3, 000 Rs. 1, 000 1, 300, 000 900, 000 400, 000 2, 700, 000 2, 100, 000 600, 000 2, 200, 000 1, 400, 000 800, 000 500, 000 Rs. 700, 000 Rs. (200, 000) A study indicates that Rs. 340, 000 of the fixed expenses being charged to Department B are sunk costs or allocated costs that will continue even if B is dropped. In addition, the elimination of Department B will result in a 10% decrease in the sales of Department A. Required: What will be the effect on the net operating income of the company as a whole if Department B is dropped ? 52

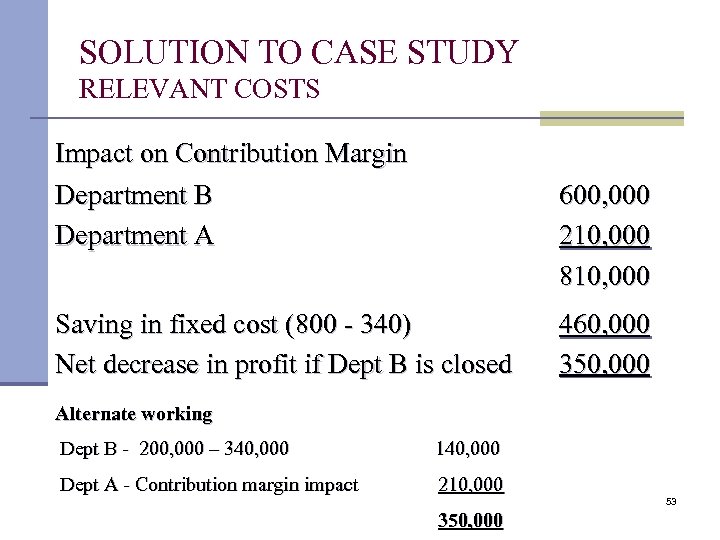

SOLUTION TO CASE STUDY RELEVANT COSTS Impact on Contribution Margin Department B Department A 600, 000 210, 000 810, 000 Saving in fixed cost (800 - 340) Net decrease in profit if Dept B is closed 460, 000 350, 000 Alternate working Dept B - 200, 000 – 340, 000 140, 000 Dept A - Contribution margin impact 210, 000 53 350, 000

SOLUTION TO CASE STUDY RELEVANT COSTS Impact on Contribution Margin Department B Department A 600, 000 210, 000 810, 000 Saving in fixed cost (800 - 340) Net decrease in profit if Dept B is closed 460, 000 350, 000 Alternate working Dept B - 200, 000 – 340, 000 140, 000 Dept A - Contribution margin impact 210, 000 53 350, 000

nt CASE STUDY PRODUCT PROCESS EFFICIENCY o It is often possible to elevate the constraint at very cost. low o Textile Westernwaistbands, Products and makes pockets, other clothing components. The constraint at the company’s plant in Greenville, South Carolina, was the slitting machines. These large machines slit huge rolls of textiles into appropriate widths for use on other machines. o to elevate the constraint. However, investigation revealed that the slitting machines were actually being run only one hour in a nine-hour shift. 54

nt CASE STUDY PRODUCT PROCESS EFFICIENCY o It is often possible to elevate the constraint at very cost. low o Textile Westernwaistbands, Products and makes pockets, other clothing components. The constraint at the company’s plant in Greenville, South Carolina, was the slitting machines. These large machines slit huge rolls of textiles into appropriate widths for use on other machines. o to elevate the constraint. However, investigation revealed that the slitting machines were actually being run only one hour in a nine-hour shift. 54

CASE STUDY PRODUCT PROCESS EFFICIENCY s other o ght The s o and unload the machine, and do setups. Instead of adding a second shift, a second person was assigned to each machine to fetch materials and do as much of the setting up as possible off-line while the machine was running. ” hours. If another shift had be added without any improvement in how the machines were being used, the cost would have been much higher and there would have been only a one-hour increase in run time. 55

CASE STUDY PRODUCT PROCESS EFFICIENCY s other o ght The s o and unload the machine, and do setups. Instead of adding a second shift, a second person was assigned to each machine to fetch materials and do as much of the setting up as possible off-line while the machine was running. ” hours. If another shift had be added without any improvement in how the machines were being used, the cost would have been much higher and there would have been only a one-hour increase in run time. 55

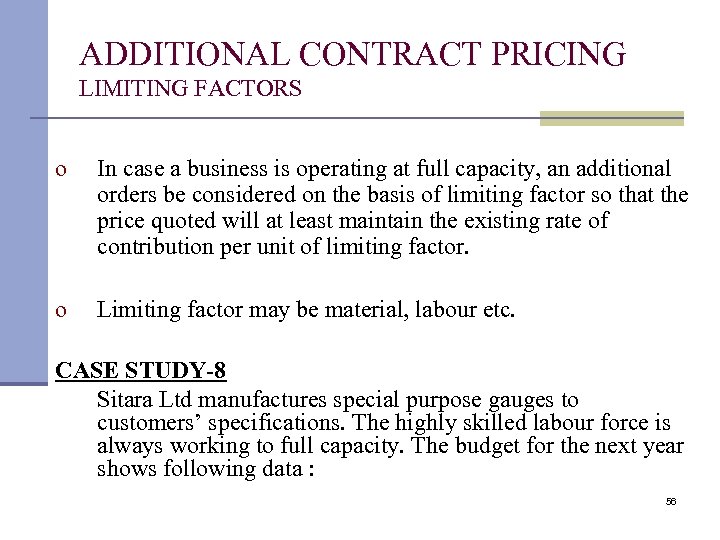

ADDITIONAL CONTRACT PRICING LIMITING FACTORS o In case a business is operating at full capacity, an additional orders be considered on the basis of limiting factor so that the price quoted will at least maintain the existing rate of contribution per unit of limiting factor. o Limiting factor may be material, labour etc. CASE STUDY-8 Sitara Ltd manufactures special purpose gauges to customers’ specifications. The highly skilled labour force is always working to full capacity. The budget for the next year shows following data : 56

ADDITIONAL CONTRACT PRICING LIMITING FACTORS o In case a business is operating at full capacity, an additional orders be considered on the basis of limiting factor so that the price quoted will at least maintain the existing rate of contribution per unit of limiting factor. o Limiting factor may be material, labour etc. CASE STUDY-8 Sitara Ltd manufactures special purpose gauges to customers’ specifications. The highly skilled labour force is always working to full capacity. The budget for the next year shows following data : 56

CASE STUDY ADDITIONAL CONTRACT PRICING Sitara Ltd manufactures special purpose gauges to customers’ specifications. The highly skilled labour force is always working to full capacity. The budget for the next year shows following data : 57

CASE STUDY ADDITIONAL CONTRACT PRICING Sitara Ltd manufactures special purpose gauges to customers’ specifications. The highly skilled labour force is always working to full capacity. The budget for the next year shows following data : 57

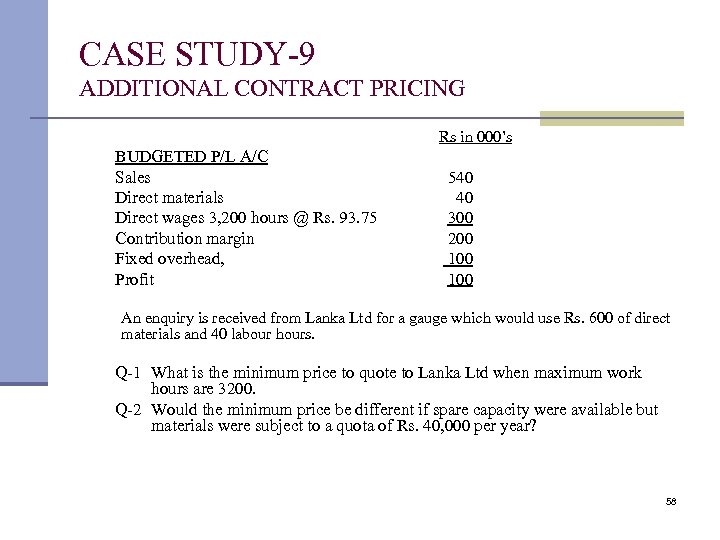

CASE STUDY-9 ADDITIONAL CONTRACT PRICING Rs in 000’s BUDGETED P/L A/C Sales Direct materials Direct wages 3, 200 hours @ Rs. 93. 75 Contribution margin Fixed overhead, Profit 540 40 300 200 100 An enquiry is received from Lanka Ltd for a gauge which would use Rs. 600 of direct materials and 40 labour hours. Q-1 What is the minimum price to quote to Lanka Ltd when maximum work hours are 3200. Q-2 Would the minimum price be different if spare capacity were available but materials were subject to a quota of Rs. 40, 000 per year? 58

CASE STUDY-9 ADDITIONAL CONTRACT PRICING Rs in 000’s BUDGETED P/L A/C Sales Direct materials Direct wages 3, 200 hours @ Rs. 93. 75 Contribution margin Fixed overhead, Profit 540 40 300 200 100 An enquiry is received from Lanka Ltd for a gauge which would use Rs. 600 of direct materials and 40 labour hours. Q-1 What is the minimum price to quote to Lanka Ltd when maximum work hours are 3200. Q-2 Would the minimum price be different if spare capacity were available but materials were subject to a quota of Rs. 40, 000 per year? 58

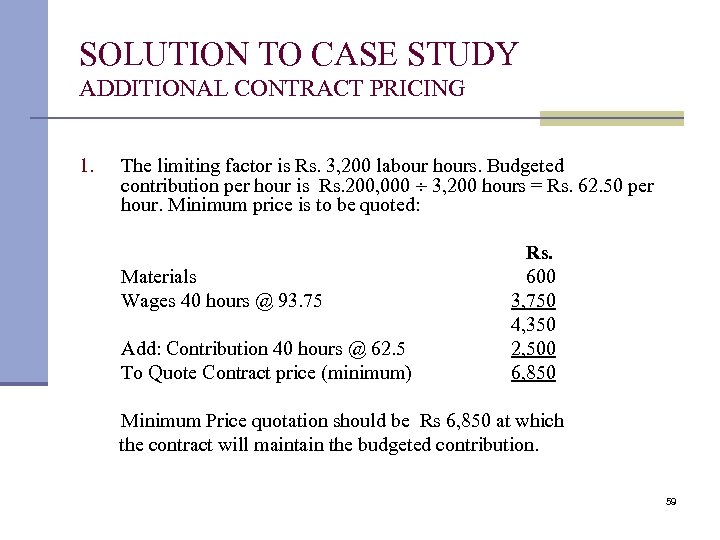

SOLUTION TO CASE STUDY ADDITIONAL CONTRACT PRICING 1. The limiting factor is Rs. 3, 200 labour hours. Budgeted contribution per hour is Rs. 200, 000 3, 200 hours = Rs. 62. 50 per hour. Minimum price is to be quoted: Materials Wages 40 hours @ 93. 75 Add: Contribution 40 hours @ 62. 5 To Quote Contract price (minimum) Rs. 600 3, 750 4, 350 2, 500 6, 850 Minimum Price quotation should be Rs 6, 850 at which the contract will maintain the budgeted contribution. 59

SOLUTION TO CASE STUDY ADDITIONAL CONTRACT PRICING 1. The limiting factor is Rs. 3, 200 labour hours. Budgeted contribution per hour is Rs. 200, 000 3, 200 hours = Rs. 62. 50 per hour. Minimum price is to be quoted: Materials Wages 40 hours @ 93. 75 Add: Contribution 40 hours @ 62. 5 To Quote Contract price (minimum) Rs. 600 3, 750 4, 350 2, 500 6, 850 Minimum Price quotation should be Rs 6, 850 at which the contract will maintain the budgeted contribution. 59

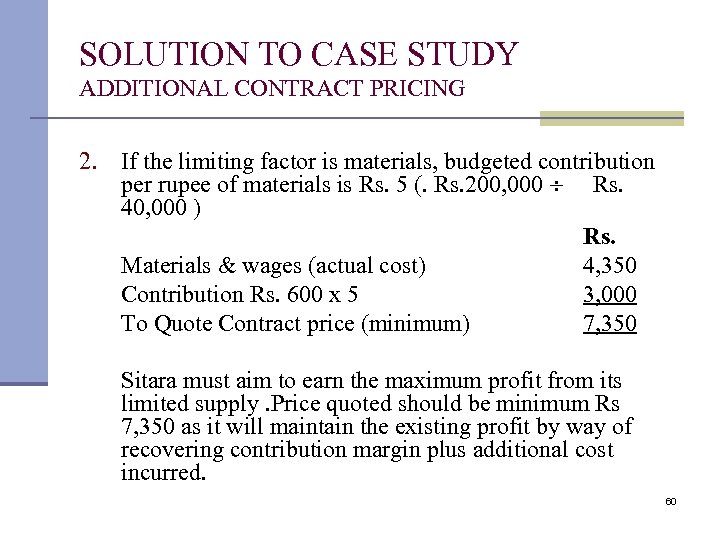

SOLUTION TO CASE STUDY ADDITIONAL CONTRACT PRICING 2. If the limiting factor is materials, budgeted contribution per rupee of materials is Rs. 5 (. Rs. 200, 000 Rs. 40, 000 ) Rs. Materials & wages (actual cost) 4, 350 Contribution Rs. 600 x 5 3, 000 To Quote Contract price (minimum) 7, 350 Sitara must aim to earn the maximum profit from its limited supply. Price quoted should be minimum Rs 7, 350 as it will maintain the existing profit by way of recovering contribution margin plus additional cost incurred. 60

SOLUTION TO CASE STUDY ADDITIONAL CONTRACT PRICING 2. If the limiting factor is materials, budgeted contribution per rupee of materials is Rs. 5 (. Rs. 200, 000 Rs. 40, 000 ) Rs. Materials & wages (actual cost) 4, 350 Contribution Rs. 600 x 5 3, 000 To Quote Contract price (minimum) 7, 350 Sitara must aim to earn the maximum profit from its limited supply. Price quoted should be minimum Rs 7, 350 as it will maintain the existing profit by way of recovering contribution margin plus additional cost incurred. 60

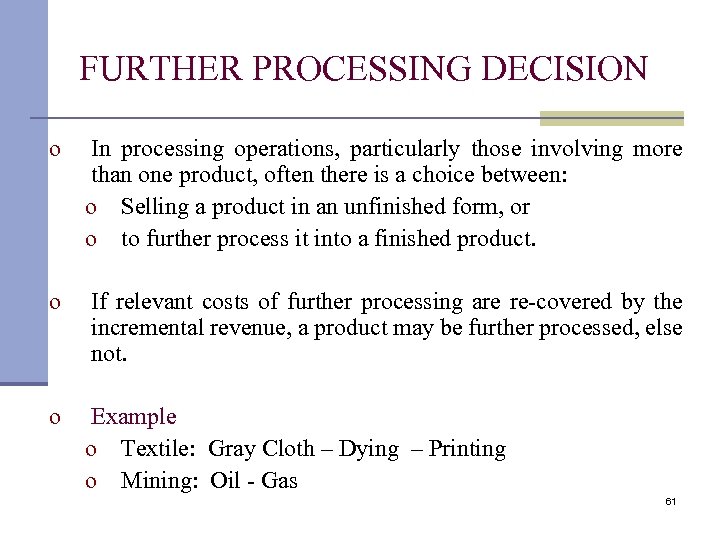

FURTHER PROCESSING DECISION o In processing operations, particularly those involving more than one product, often there is a choice between: o Selling a product in an unfinished form, or o to further process it into a finished product. o If relevant costs of further processing are re-covered by the incremental revenue, a product may be further processed, else not. o Example o Textile: Gray Cloth – Dying – Printing o Mining: Oil - Gas 61

FURTHER PROCESSING DECISION o In processing operations, particularly those involving more than one product, often there is a choice between: o Selling a product in an unfinished form, or o to further process it into a finished product. o If relevant costs of further processing are re-covered by the incremental revenue, a product may be further processed, else not. o Example o Textile: Gray Cloth – Dying – Printing o Mining: Oil - Gas 61

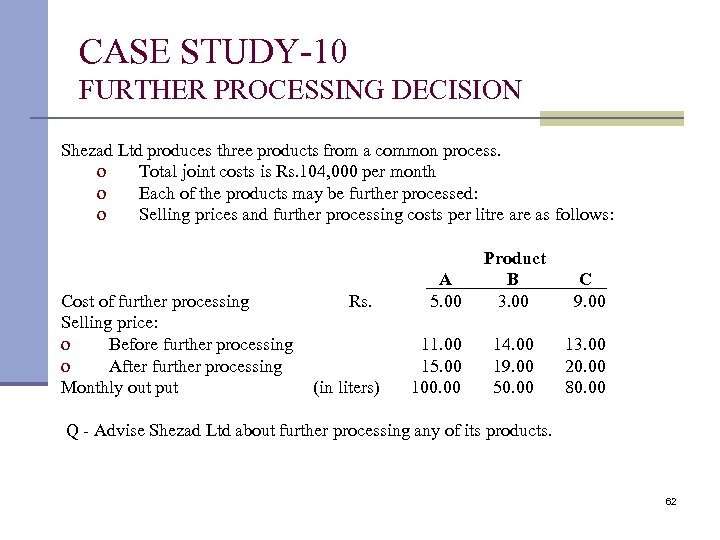

CASE STUDY-10 FURTHER PROCESSING DECISION Shezad Ltd produces three products from a common process. o Total joint costs is Rs. 104, 000 per month o Each of the products may be further processed: o Selling prices and further processing costs per litre as follows: Cost of further processing Selling price: o Before further processing o After further processing Monthly out put Rs. (in liters) A 5. 00 11. 00 15. 00 100. 00 Product B 3. 00 C 9. 00 14. 00 19. 00 50. 00 13. 00 20. 00 80. 00 Q - Advise Shezad Ltd about further processing any of its products. 62

CASE STUDY-10 FURTHER PROCESSING DECISION Shezad Ltd produces three products from a common process. o Total joint costs is Rs. 104, 000 per month o Each of the products may be further processed: o Selling prices and further processing costs per litre as follows: Cost of further processing Selling price: o Before further processing o After further processing Monthly out put Rs. (in liters) A 5. 00 11. 00 15. 00 100. 00 Product B 3. 00 C 9. 00 14. 00 19. 00 50. 00 13. 00 20. 00 80. 00 Q - Advise Shezad Ltd about further processing any of its products. 62

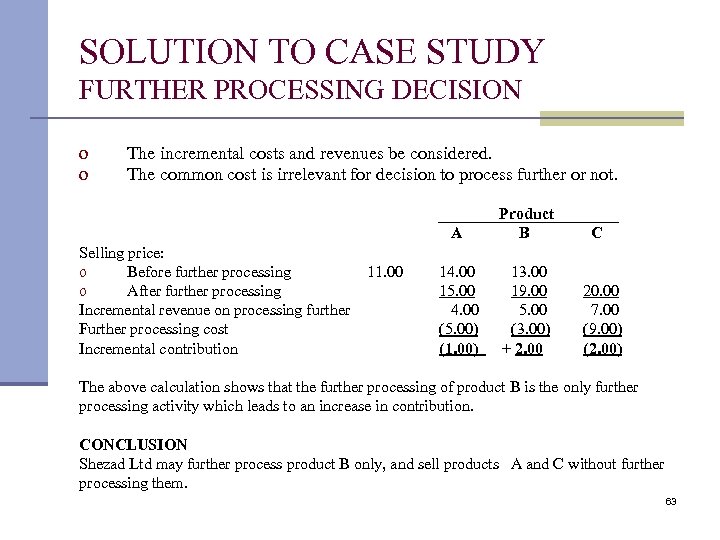

SOLUTION TO CASE STUDY FURTHER PROCESSING DECISION o o The incremental costs and revenues be considered. The common cost is irrelevant for decision to process further or not. A Selling price: o Before further processing o After further processing Incremental revenue on processing further Further processing cost Incremental contribution 11. 00 Product B 14. 00 15. 00 4. 00 (5. 00) (1. 00) 13. 00 19. 00 5. 00 (3. 00) + 2. 00 C 20. 00 7. 00 (9. 00) (2. 00) The above calculation shows that the further processing of product B is the only further processing activity which leads to an increase in contribution. CONCLUSION Shezad Ltd may further process product B only, and sell products A and C without further processing them. 63

SOLUTION TO CASE STUDY FURTHER PROCESSING DECISION o o The incremental costs and revenues be considered. The common cost is irrelevant for decision to process further or not. A Selling price: o Before further processing o After further processing Incremental revenue on processing further Further processing cost Incremental contribution 11. 00 Product B 14. 00 15. 00 4. 00 (5. 00) (1. 00) 13. 00 19. 00 5. 00 (3. 00) + 2. 00 C 20. 00 7. 00 (9. 00) (2. 00) The above calculation shows that the further processing of product B is the only further processing activity which leads to an increase in contribution. CONCLUSION Shezad Ltd may further process product B only, and sell products A and C without further processing them. 63

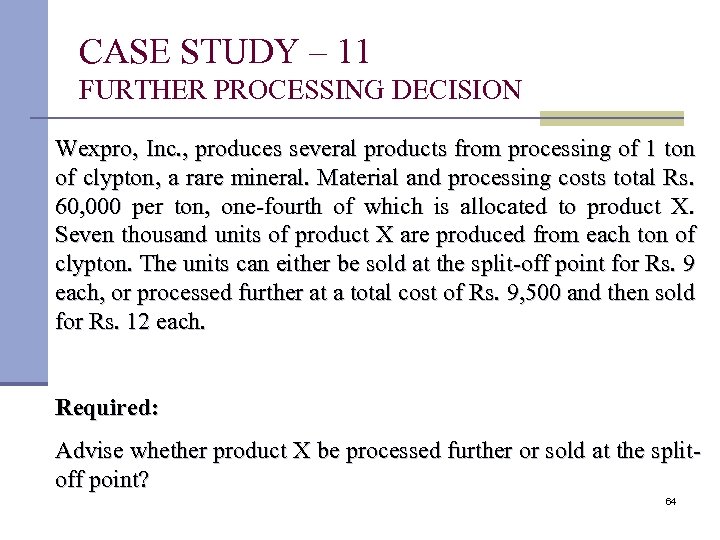

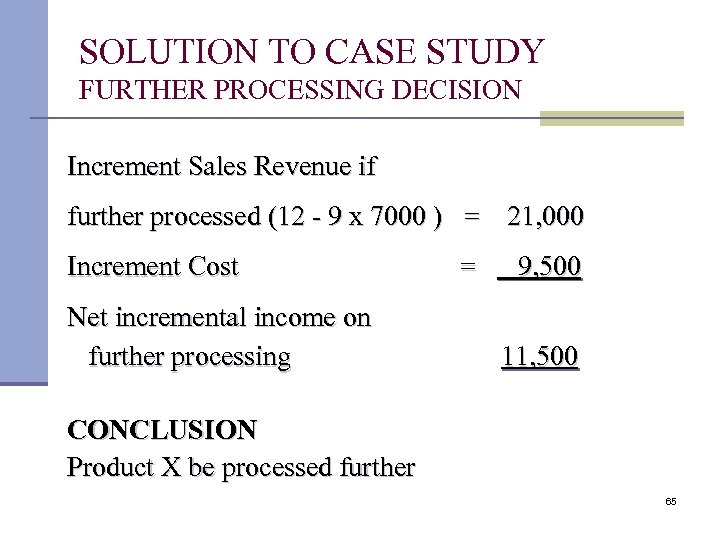

CASE STUDY – 11 FURTHER PROCESSING DECISION Wexpro, Inc. , produces several products from processing of 1 ton of clypton, a rare mineral. Material and processing costs total Rs. 60, 000 per ton, one-fourth of which is allocated to product X. Seven thousand units of product X are produced from each ton of clypton. The units can either be sold at the split-off point for Rs. 9 each, or processed further at a total cost of Rs. 9, 500 and then sold for Rs. 12 each. Required: Advise whether product X be processed further or sold at the splitoff point? 64

CASE STUDY – 11 FURTHER PROCESSING DECISION Wexpro, Inc. , produces several products from processing of 1 ton of clypton, a rare mineral. Material and processing costs total Rs. 60, 000 per ton, one-fourth of which is allocated to product X. Seven thousand units of product X are produced from each ton of clypton. The units can either be sold at the split-off point for Rs. 9 each, or processed further at a total cost of Rs. 9, 500 and then sold for Rs. 12 each. Required: Advise whether product X be processed further or sold at the splitoff point? 64

SOLUTION TO CASE STUDY FURTHER PROCESSING DECISION Increment Sales Revenue if further processed (12 - 9 x 7000 ) = 21, 000 Increment Cost Net incremental income on further processing = 9, 500 11, 500 CONCLUSION Product X be processed further 65

SOLUTION TO CASE STUDY FURTHER PROCESSING DECISION Increment Sales Revenue if further processed (12 - 9 x 7000 ) = 21, 000 Increment Cost Net incremental income on further processing = 9, 500 11, 500 CONCLUSION Product X be processed further 65

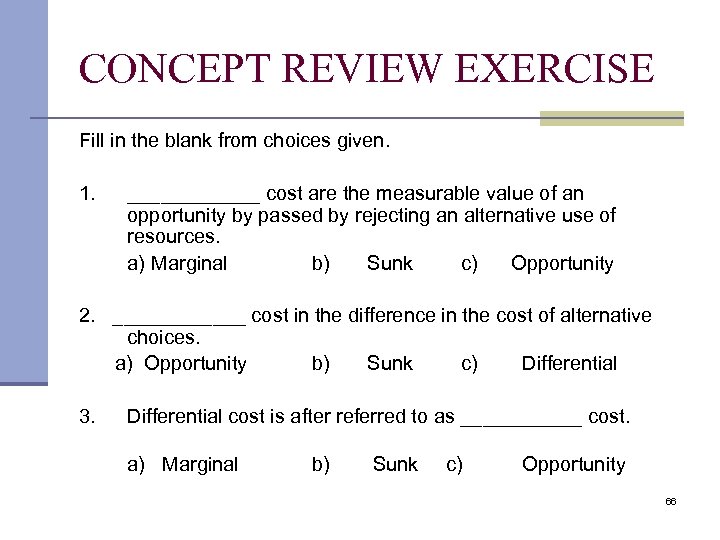

CONCEPT REVIEW EXERCISE Fill in the blank from choices given. 1. ______ cost are the measurable value of an opportunity by passed by rejecting an alternative use of resources. a) Marginal b) Sunk c) Opportunity 2. ______ cost in the difference in the cost of alternative choices. a) Opportunity b) Sunk c) Differential 3. Differential cost is after referred to as ______ cost. a) Marginal b) Sunk c) Opportunity 66

CONCEPT REVIEW EXERCISE Fill in the blank from choices given. 1. ______ cost are the measurable value of an opportunity by passed by rejecting an alternative use of resources. a) Marginal b) Sunk c) Opportunity 2. ______ cost in the difference in the cost of alternative choices. a) Opportunity b) Sunk c) Differential 3. Differential cost is after referred to as ______ cost. a) Marginal b) Sunk c) Opportunity 66

THE END 67

THE END 67