7481045ea03173b9385847e1c1479ea7.ppt

- Количество слайдов: 40

Session 48 Financial Literacy Matters Elizabeth Coogan | Dec. 2015 U. S. Department of Education 2015 FSA Training Conference for Financial Aid Professionals

AGENDA • • FSA resources • Research on financial wellness and programming • Best practices from higher education institutions • Questions/Comments • 2 Benefits of financial literacy Appendix

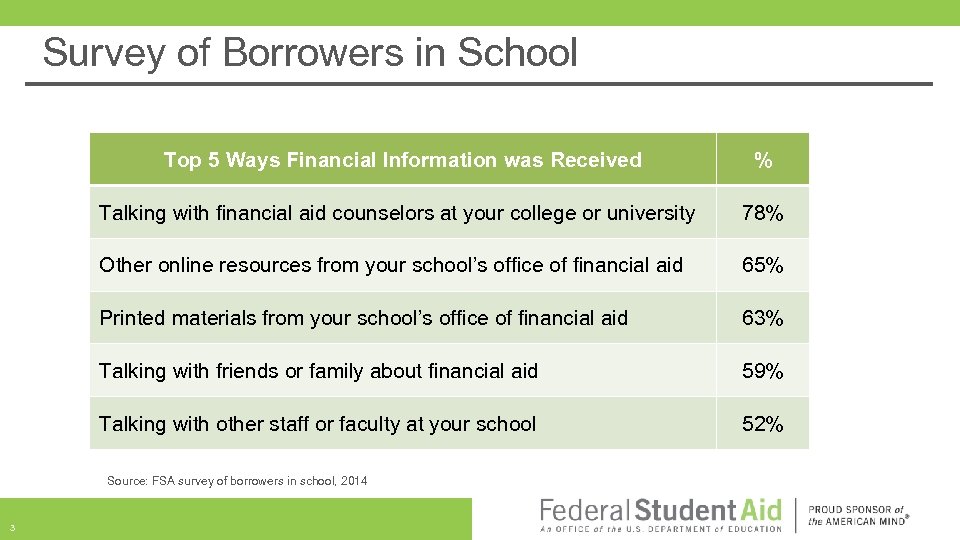

Survey of Borrowers in School Top 5 Ways Financial Information was Received % Talking with financial aid counselors at your college or university 78% Other online resources from your school’s office of financial aid 65% Printed materials from your school’s office of financial aid 63% Talking with friends or family about financial aid 59% Talking with other staff or faculty at your school 52% Source: FSA survey of borrowers in school, 2014 3

Financial Literacy Matters Successful financial literacy programs benefit students, families, communities, and schools • • Reduce loan default • Improve retention and graduation rates • Build a base of active and engaged alumni • 4 Equip students to make sound financial decisions Build strong community relationships

FSA’s Support of Financial Literacy • • Promote Buy In from School Leadership • Reviewing Entrance and Exit Counseling • New Resources • 5 Hosting Community College Financial Capability Roundtable Sharing Best Practices

Treasury Postsecondary Opportunities Report Opportunities to Improve the Financial Capability and Financial Well-being of Postsecondary Students 6

Summary of Financial Literacy Resources Federal Student Aid Financial Literacy Resources 7

FINANCIAL LITERACY GUIDANCE Financial Literacy Guidance From Federal Student Aid 8

RESEARCH ON FINANCIAL WELLNESS 9

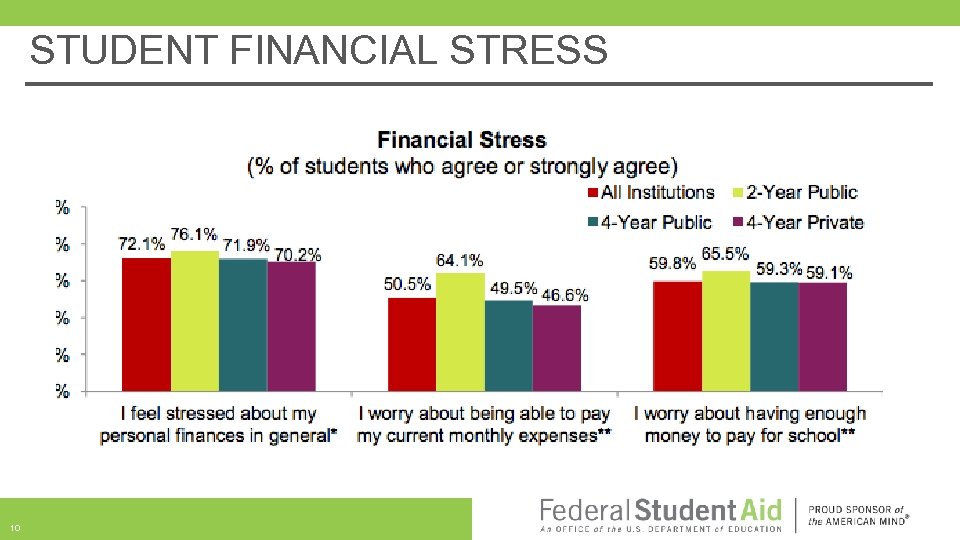

STUDENT FINANCIAL STRESS 10

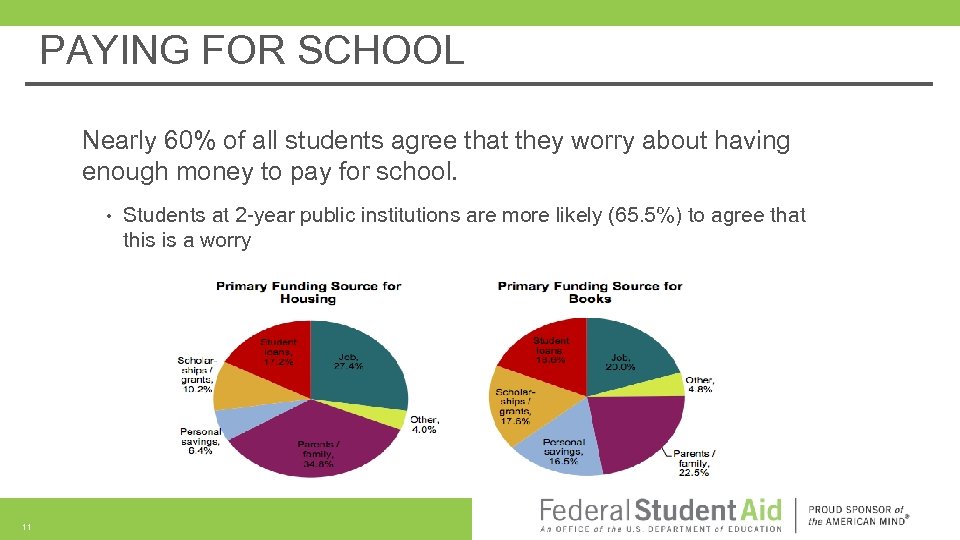

PAYING FOR SCHOOL Nearly 60% of all students agree that they worry about having enough money to pay for school. • 11 Students at 2 -year public institutions are more likely (65. 5%) to agree that this is a worry

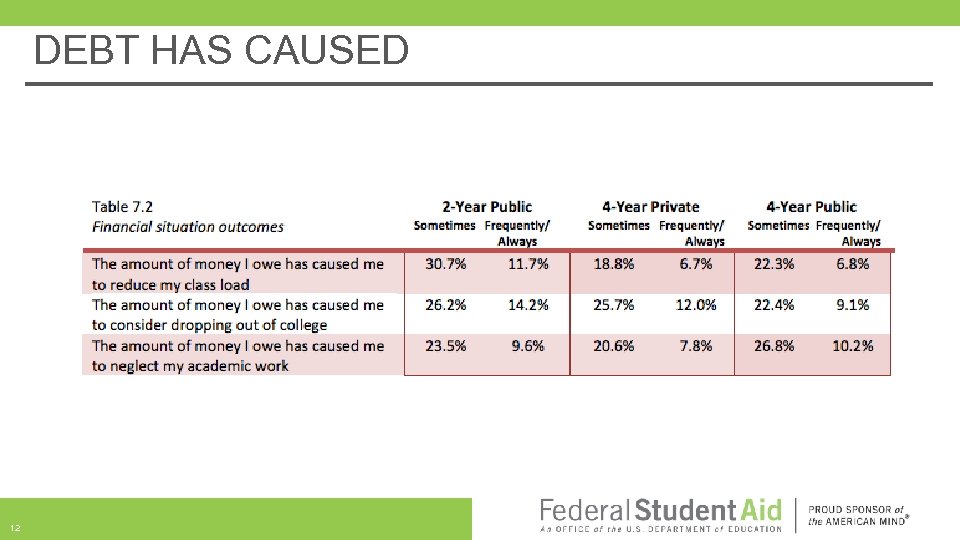

DEBT HAS CAUSED 12

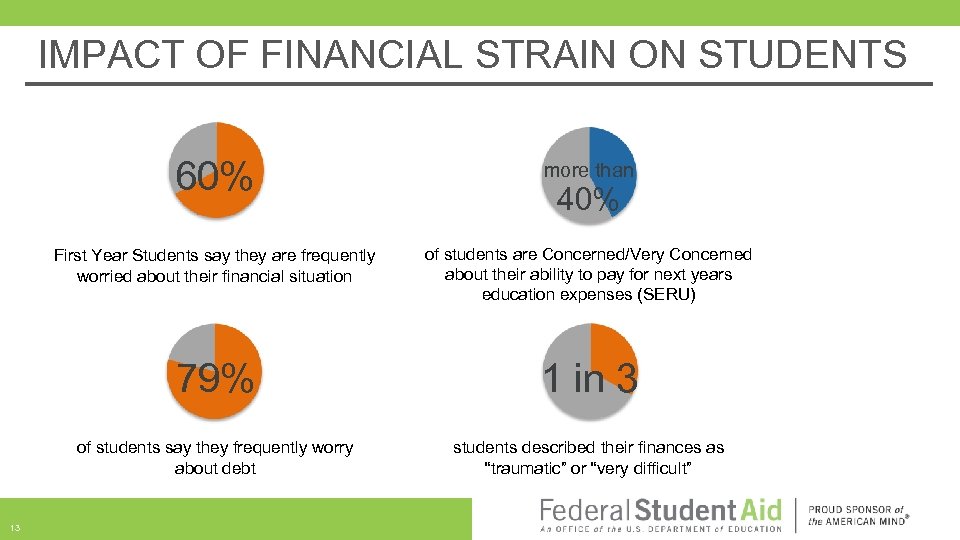

IMPACT OF FINANCIAL STRAIN ON STUDENTS 60% First Year Students say they are frequently worried about their financial situation of students are Concerned/Very Concerned about their ability to pay for next years education expenses (SERU) 79% 1 in 3 of students say they frequently worry about debt 13 more than students described their finances as “traumatic” or “very difficult” 40%

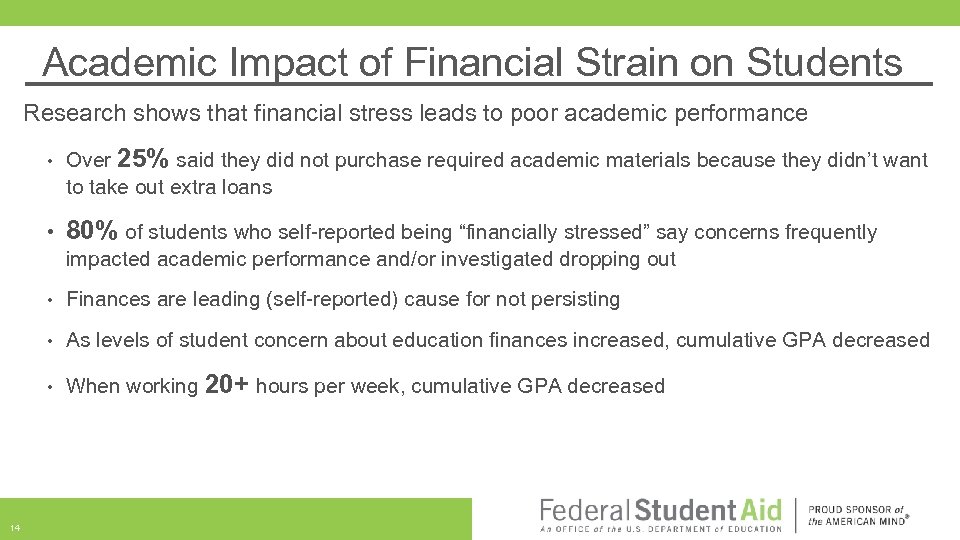

Academic Impact of Financial Strain on Students Research shows that financial stress leads to poor academic performance • • Over 25% said they did not purchase required academic materials because they didn’t want to take out extra loans 80% of students who self-reported being “financially stressed” say concerns frequently impacted academic performance and/or investigated dropping out • • As levels of student concern about education finances increased, cumulative GPA decreased • 14 Finances are leading (self-reported) cause for not persisting When working 20+ hours per week, cumulative GPA decreased

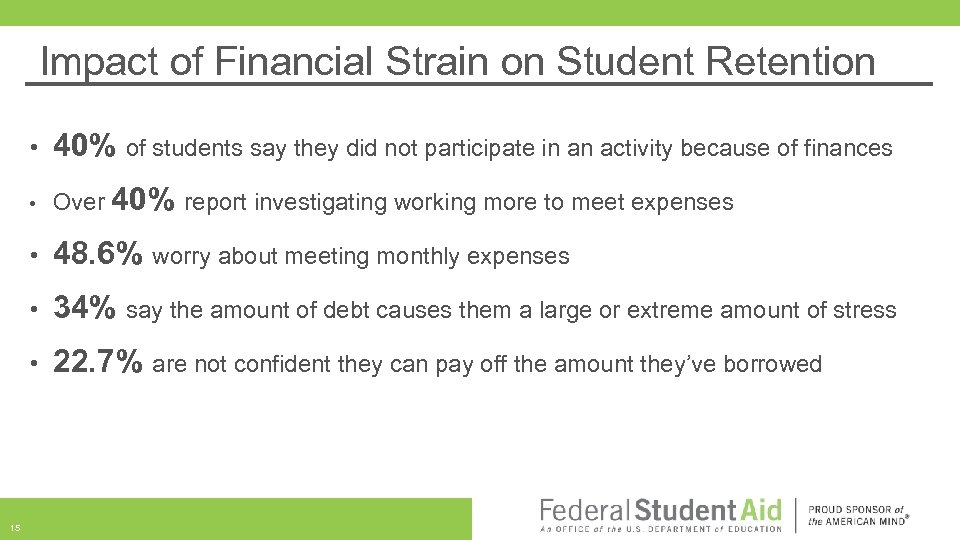

Impact of Financial Strain on Student Retention • • Over 40% report investigating working more to meet expenses • 48. 6% worry about meeting monthly expenses • 34% say the amount of debt causes them a large or extreme amount of stress • 15 40% of students say they did not participate in an activity because of finances 22. 7% are not confident they can pay off the amount they’ve borrowed

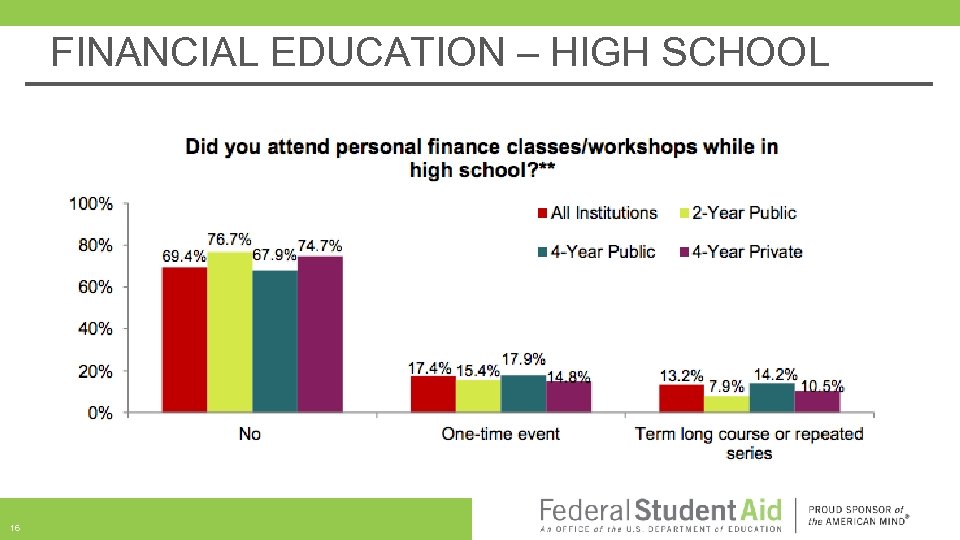

FINANCIAL EDUCATION – HIGH SCHOOL 16

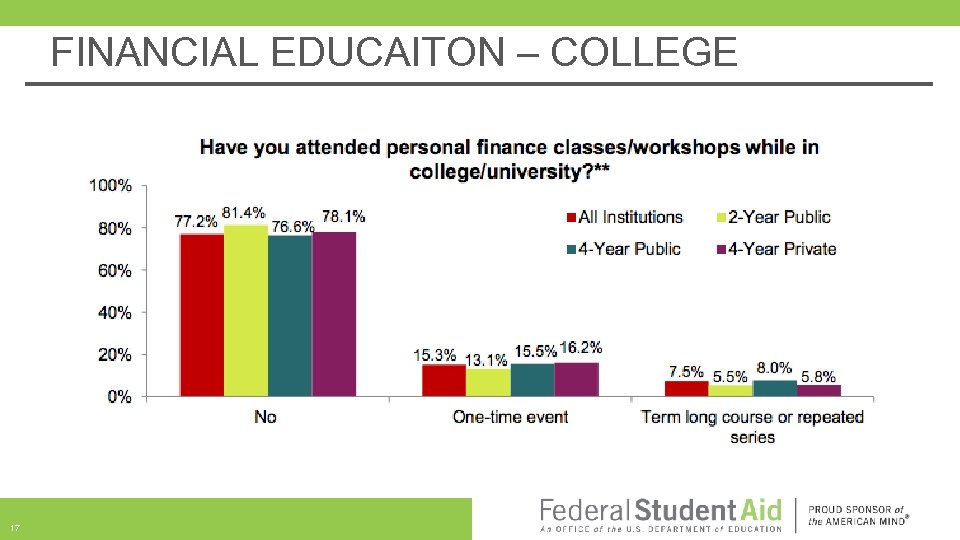

FINANCIAL EDUCAITON – COLLEGE 17

PEER TO PEER FINANCIAL EDUCATION Peer leaders, educators, and mentors have been shown to positively influence: • Student engagement (Black & Voelker, 2008) • Feelings of support & belonging (Colvin & Ashman, 2010; Light, 2011; Yazedjian, Purswell, Toews, & Sevin, 2007) • Academic performance (Astin, 1993; Landrum & Nelsen, 2002; Lewis & Lewis, 2005) • Retention and persistence (Cuseo, 2010; Schwitzer & Thomas, 1998; Tinto, 2006) 18

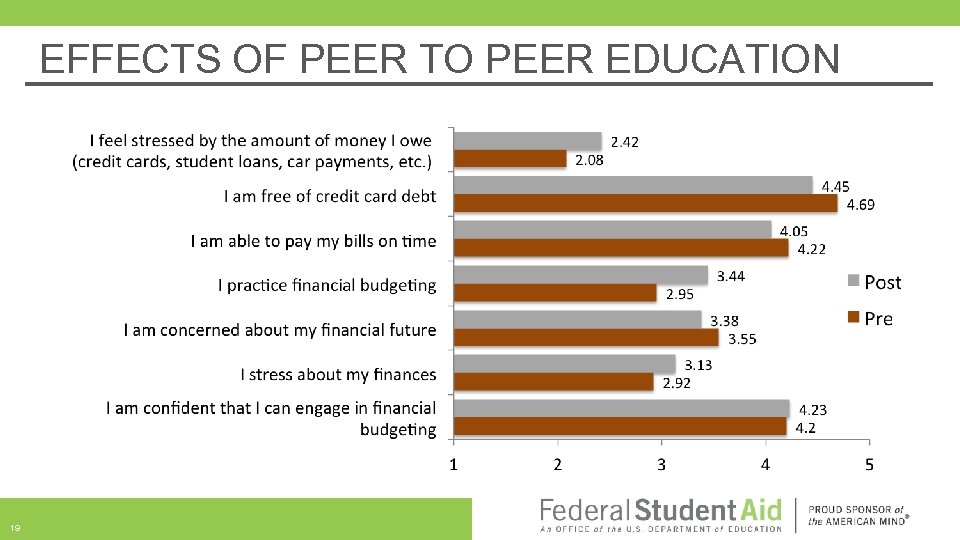

EFFECTS OF PEER TO PEER EDUCATION 19

PEER COACHING • Fall participants were more likely to have a plan to pay back debt than their peers who had not yet completed the intervention (p<. 05) • A mandatory one-on-one coaching session contributes to a significant decrease in financial stress for STEP participants (p<. 05) • Increased financial awareness and slight increase in financial knowledge (pilot data) • Increased financial efficacy (pilot data) 20

NSCFW • The National Summit on Collegiate Financial Wellness • Over 200 attendees • 120 Institutions • 39 States • Connecting practitioners, researchers and policy makers in a growing field • Sessions on: – – – 21 How to start a program Effective practices Assessing Interventions Curriculum Gamification More

BEST PRACTICES 22

Indiana University Office of Financial Literacy • Provide financial education for students to help them improve decision-making during and after college • Goal to get students to afford their careers and not be influenced by debt • Focus on providing multiple options for interaction with program to reach all learning types • • 23 Improve Financial Aid Business Processes $44 Million reduction in student debt

Indiana University Money. Smarts Moneysmarts. iu. edu • Portal to all things financial literacy at IU Podcasts • How Not to Move Back in With Your Parents (9/13 – 5/15) Lesson on financial topic every week • Designed to educate on basics • • Money. Smarts U Interview students every week • Designed to make finances relevant to students by talking with students facing similar crises • Created for national audience • 24

Indiana University Money. Smarts Moneysmarts. iu. edu • Portal to all things financial literacy at IU Podcasts • How Not to Move Back in With Your Parents (9/13 – 5/15) Lesson on financial topic every week • Designed to educate on basics • • Money. Smarts U Interview student every week • Designed to make finances relevant to students by talking with students facing similar crises • Created for national audience • 25

Indiana University Money. Smarts • Required Financial Literacy • • • New students to University 80% completion rate One Credit-Hour Courses • • • Split three credit-hour class Required for some business students IU Money. Smarts Team • • 26 Implemented on three of IU campuses Partnership with School of Public Health

The Ohio State University • • Strong partnerships with Student Financial Aid, Bursar’s Office, One Stop Center • Two Colleges help to contribute to the base of student volunteer peer educators • 27 Financial Wellness Advisory Board helps to formalize partnership with over 32 departments Research partnership with the Center for the Study of Student Life and College of Education and Human Ecology

The Ohio State University 1: 1 Financial Coaching Appointments • • • Proactive Reactive Help Seeking Group Workshops • Classes, Student Organizations, Residence Halls, Student Athletes etc. Online Interventions • • • 28 Knowledge Modules ITunes U Course Interventions

The Ohio State University Second Year Transformational Experience Program Requirement • • Holistic Second Year Experience for Students 1, 400 students currently enrolled in a pilot program All students must complete a financial wellness requirement to receive their fellowship 1 st Part: Online Module (Knowledge Gain) and 2 nd Part: In Person Appointment (Attitudes and Behaviors) • Students receiving emergency loans/grants • Students on the University payment plan • Collaboration between our office and the Graduate School • 29 Better targeting resources to graduate students

Champlain College Part of LEAD Program • • • Financial Sophistication Lifelong Career Management Engaged Citizenship Participate in financial literacy all four years • • Menu of programs on website Awesome Island Community involvement for K-12 and adults 30 Champlain LEAD Website

Cuyahoga Community College • Redefined financial aid beyond grants, loans, and scholarships • Integrated benefits access services (applying for SNAP, utility assistance, cash assistance, etc. ) into financial aid application processes and financial education initiatives • • 31 aligns with college’s initiative to reduce student loan debt by obtaining other financial resources Target potentially eligible students by “flagging” financial aid records to encourage students to complete “quick check” for public benefits eligibility Cuyahoga Community College Project Go Website

University of California, Berkeley Peer-to-peer financial wellness program Workshops: • • • Creating a spending plan Managing Debt Understanding Credit Cards Savings Banking Identity Theft One-on-One consultations (coming soon) Website resources 32 Bears for Financial Success Website

Best Practices Strengths commonly found in successful programs • • Prioritizing students who need it most • Outcome tracking and measurement • Networking and partnerships • Positioning and infrastructure • Peer-to-peer coaching • Student-initiated and funded • 33 Accessibility and ease of use Focus on success of student

QUESTIONS? 34

Contact Us Phil Schuman Director of Financial Literacy Bryan Ashton Indiana University Assistant Director, Student Wellness Center phaschum@iu. edu The Ohio State University ashton. 53@osu. edu 317 -274 -7430 614 -230 -8190 35 Elizabeth Coogan Phil Schuman Senior Advisor, Customer Experience Office Federal Student Aid elizabeth. coogan@ed. gov 202 -377 -3825 Director of Financial Literacy Indiana University phaschum@iu. edu 317 -274 -7430

Appendix Effectiveness and Best Practices Research • • Federal Reserve Bank of Boston. (2015). Promoting Pathways to Financial Stability. A Resource Handbook on Building Financial Capabilities of Community College Students. Retrieved from http: //www. bostonfed. org/education/financial-capabilities/handbook/financial-capabilities-handbook. pdf • Fernandes, D. , Lynch J. G. , Netemeyer, R. G. (2013). The Effect of Financial Literacy and Financial Education on Downstream Financial Behaviors. Retrieved from http: //www. nefe. org/Portals/0/What. We. Provide/Primary. Research/PDF/CU%20 Final%20 Report. pdf • Financial Literacy and Education Commission. (2015). Opportunities to Improve the Financial Capability and Financial Well-being of Postsecondary Students. Retrieved from http: //www. treasury. gov/resource-center/financialeducation/Documents/Opportunities%20 to%20 Improve%20 the%20 Financial%20 Capability%20 and%20 Financial%20 Wellbeing%20 of%20 Postsecondary%20 Students. pdf • Goetz, J. , Cude, B. J. , Nielsen, R. B. , Chatterjee, S. , & Mimura, Y. (2011). College-based personal Finance education: Student interest in three delivery methods. Journal of Financial Counseling and Planning, 22(1), 27 -42. • 36 COHEAO. (2014). Financial Literacy in Higher Education: The Most Successful Models and Methods for Gaining Traction. Retrieved from http: //www. coheao. com/wp-content/uploads/2014/03/2014 -COHEAO-Financial-Literacy-Whitepaper. pdf i. Grad. (2014). Financial Literacy Compendium: Colleges Setting the Bar for Financial Literacy. Retrieved from http: //schools. igrad. com/blog/bestcollege-financial-literacy-programs

Appendix Effectiveness and Best Practices Research • Lumina Foundation. (2015). Beyond Financial Aid How Colleges Can Strengthen the Financial Stability of Low-Income Students and Improve Outcomes. Retrieved from https: //www. luminafoundation. org/beyond-financial-aid • Mandell, L. , & Klein, L. S. (2009). The impact of financial literacy education on subsequent financial behavior. Journal of Financial Counseling and Planning, 20(1), 15 -24. • President’s Advisory Council on Financial Capability (2012). Key Themes for President’s Advisory Council on Financial Capability. Retrieved from http: //www. treasury. gov/resource-center/financial-education/Documents/Key_Themes. pdf • TG Research and Analytical Services. (2015). Above and Beyond: What Eight Colleges Are Doing to Improve Student Loan Counseling. Retrieved from http: //www. tgslc. org/pdf/Above-and-Beyond. pdf Need for Financial Literacy • • Council for Economic Education. (2012). Economic and Personal Finance Education in our Nation’s Schools. Retrieved from http: //www. councilforeconed. org/policy-and-advocacy/survey-of-the-states/#findings • 37 Consumer Finance Protection Bureau [CFPB]. (2013). Financial literacy annual report. Retrieved from http: //files. consumerfinance. gov/f/201307_cfpb_report_financial-literacy-annual. pdf Harnish, T. L. (2010). Boosting financial literacy in America: A role for state colleges and universities. Perspectives. Retrieved from http: //www. aascu. org/policy/publications/perspectives/financialliteracy. pdf

Appendix Peer to Peer Education • • Black, K. , Voelker, J. (2008). The role of preceptors in first-year student engagement in introductory courses. Retrieved from http: //www. ingentaconnect. com/content/fyesit/2008/00000020/00000002/art 00002 • Colvin, J. W. , Ashman, M. (2010). Roles, risks, and benefits of peer mentoring relationships in higher education. Retrieved from http: //www. tandfonline. com/doi/abs/10. 1080/13611261003678879 • Cuseo, J. B. , Fecas, V. S. , Thompson, A. (2010). Thriving in College and Beyond: Research-Based Strategies for Academic Success and Personal Development • Landrum, R. E. , Nelsen, L. R. (2002). The Undergraduate Research Assistanceship: An Analysis of the Benefits. Retrieved from http: //www. tandfonline. com/doi/abs/10. 1207/S 15328023 TOP 2901_04#. Vjos. Fber. TIU • Schweitzer, A. , Thomas, C. (1998). Implementation, Utilization, and Outcomes of a Minority Freshman Peer Mentor Program at a Predominantly White University. Retrieved from http: //www. ingentaconnect. com/content/fyesit/1998/00000010/00000001/art 00002 • Tinto, V. (2006). Research and Practice of Student Retention: What Next? Retrieved from http: //csr. sagepub. com/content/8/1/1. short • 38 Astin, A. W. (1993). What Matters in College? Four Critical Years Revisited. Retrieved from http: //www. researchgate. net/profile/Alexander_Astin/publication/242362064_What_Matters_in_College_Four_Critical_Years_Revisited/links/00 b 7 d 52 d 094 be 57582000000. pdf Yazedjian, A. , Purswell, K. , Toews, M. , Sevin, T. . (2007). Adjusting to the First Year of College: Students’ Perceptions of the Importance of Parental, Peer, and Institutional Support. Retrieved from http: //www. ingentaconnect. com/content/fyesit/2007/00000019/00000002/art 00002

Appendix Terminology • Huston, S. J. (2010). Measuring financial literacy. Retrieved from http: //onlinelibrary. wiley. com/doi/10. 1111/j. 1745 -6606. 2010. 01170. x/pdf Understanding Student Finances • • Center for the Study of Student Life. (2015). National Student Financial Wellness Study: National Descriptive Report. Retrieved from http: //cssl. osu. edu/posts/documents/nsfws-national-descriptive-report. pdf • Ever. Fi, Inc. (2015). Money matters on campus: How early attitudes and behaviors affect the financial decisions of first-year college students. Retrieved from http: //moneymattersoncampus. org/wp-content/uploads/2013/02/Money. Matters_White. Paper_2015_FINAL. pdf • Fosnacht, K. (2013). Undergraduate coping with financial stress: A latent class analysis. Paper presented at the annual meeting of the American College Personnel Association, Las Vegas, NV, March 2013. Retrieved from http: //cpr. iub. edu/uploads/Fosnacht%20 -%20 ACPA%20%20 Financial%20 Stress. pdf • 39 Center for the Study of Student Life. (2011). Ohio Student Financial Wellness Survey: Student Loans, Credit Cards and Stress. Retrieved from http: //cssl. osu. edu/posts/documents/09 -01 -11 -ohio-financial-wellness-report-final-no-watermark. pdf Gutter, M. , Copur, Z. (2011). Financial Behaviors and Financial Well-Being of College Students: Evidence from a National Survey. Journal of Family Economics iss, 32, 699 -714.

Appendix Understanding Student Finances • Shim, S. , Barber, B. , Card, N. , Xiao, S. , Serido, J. (2009). Financial Socialization of First-Year College Students: The Roles of Parents, Work, and Education. J Youth Adolescence, 1007 (10), 10964 -10978 • Trombitas, K. (2012). College students are put to the test: The attitudes, behaviors, and knowledge levels of financial education. Inceptia. Retrieved from https: //www. inceptia. org/about/resources/college-students-are-put-to-the-test/ Workplace Finances • 40 Pw. C. (2015). Employee Financial Wellness Survey: 2015 Results. Retrieved from http: //www. pwc. com/us/en/private-companyservices/publications/assets/pwc-employee-financial-wellness-survey-2015. pdf

7481045ea03173b9385847e1c1479ea7.ppt