3c8325e020db37703002981a7f793c53.ppt

- Количество слайдов: 37

Session #32 The EFC Expected Family Contribution Marianna Deeken Claire Micki Roemer

EFC Expected Family Contribution • Measure of what the student and family can be expected to contribute to student’s cost of education 2

Expected Family Contribution • Calculated from data collected on the FAFSA • Formula is in statute Ø Designed to measure the family’s financial strength • ED publishes updated tables each year in the Federal Register 3

Principles of Need Analysis • Family has primary responsibility to pay for educational costs • Student and parents are expected to contribute to the extent they are able • Families should be evaluated in an equitable and consistent manner 4

Need Analysis Concepts • Need-based funds are available to assist with educational costs that exceed the family’s ability to pay • Assesses strength at the time of application • Family resources are devoted first to basic subsistence 5

Need Analysis Concepts • FM measures discretionary resources Ø Protects resources needed for basic living Ø Establishes a portion available for education 6

Factors that affect EFC • Taxable and untaxed income • Taxes paid • Number in Household • Number in College • Assets • Age of the older parent • Number of wage earners 7

EFC Calculations • EFC result on ISIR reflects a 9 month EFC Ø Law specifies how an EFC must be calculated for periods of other than nine months Ø Results show on ISIR by number of months Ø 9 month EFC must be used for Pell Grant eligibility 8

How is EFC Determined? • Three distinct FM formulas § Regular § Simplified § Automatic zero 9

Regular Formula • Three versions of regular formula Ø Dependent students Ø Independent students without dependents other than a spouse Ø Independent students with dependents other than a spouse 10

Alternate EFC Formulas • Simplified formula Ø Assets are not considered in the calculation • Automatic Zero EFC formula Ø Untaxed income and assets are not considered in the calculation 11

Simplified Formula For dependent students • Parents’ AGI or earnings from work < $50, 000 and • Parents are not required to file IRS form 1040 OR • Member of FAFSA household received federal means-test benefit 12

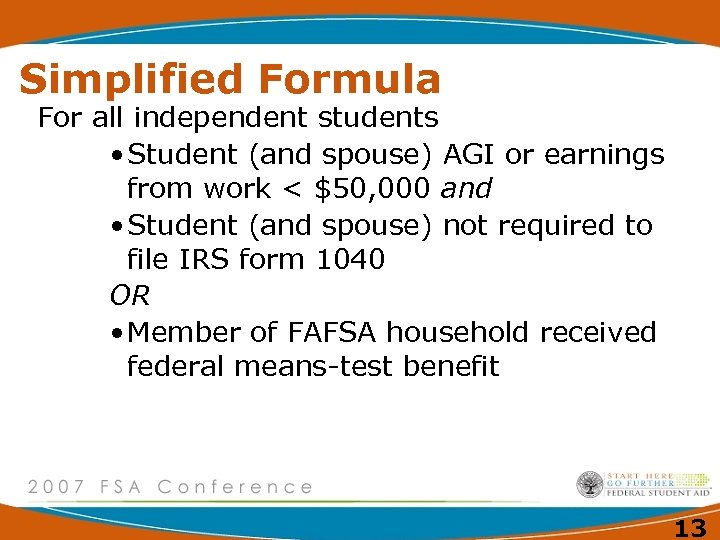

Simplified Formula For all independent students • Student (and spouse) AGI or earnings from work < $50, 000 and • Student (and spouse) not required to file IRS form 1040 OR • Member of FAFSA household received federal means-test benefit 13

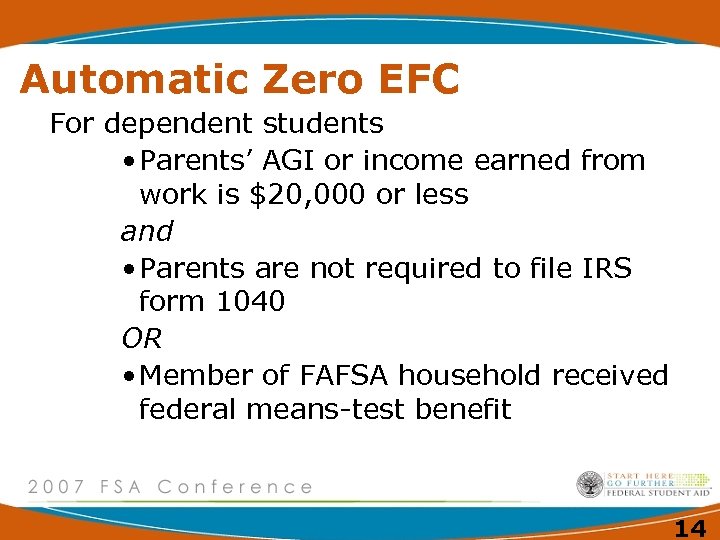

Automatic Zero EFC For dependent students • Parents’ AGI or income earned from work is $20, 000 or less and • Parents are not required to file IRS form 1040 OR • Member of FAFSA household received federal means-test benefit 14

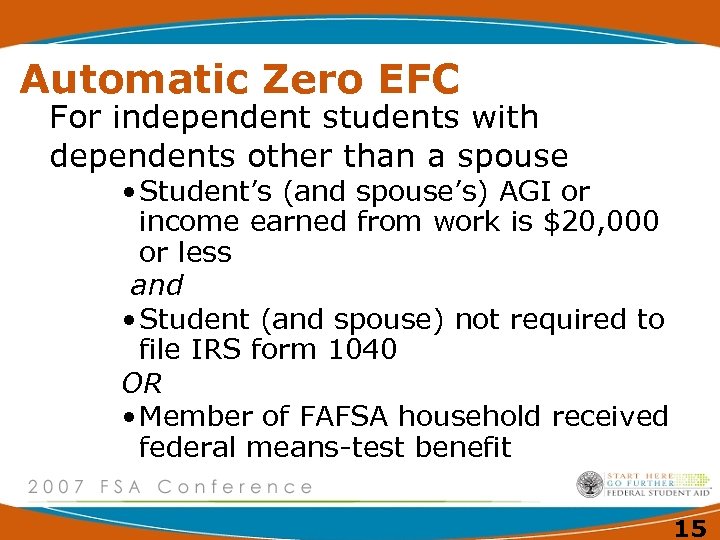

Automatic Zero EFC For independent students with dependents other than a spouse • Student’s (and spouse’s) AGI or income earned from work is $20, 000 or less and • Student (and spouse) not required to file IRS form 1040 OR • Member of FAFSA household received federal means-test benefit 15

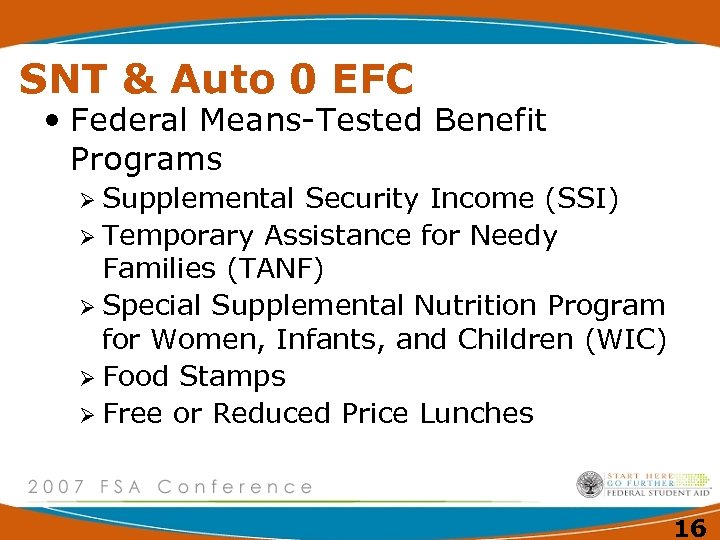

SNT & Auto 0 EFC • Federal Means-Tested Benefit Programs Ø Supplemental Security Income (SSI) Ø Temporary Assistance for Needy Families (TANF) Ø Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) Ø Food Stamps Ø Free or Reduced Price Lunches 16

The Web Family • Two parents with one working • Two children in family • One child in college • Live in Illinois • Older parent is age 46 17

Treatment of Income Total Income (TI) Base year income from all taxable and untaxable sources - Exclusions on FAFSA Worksheet C =Total Income 18

Treatment of Income Available Income (AI) is portion of income remaining for discretionary Spending Total income - Total Allowances =Available Income 19

Total Allowances • Allowances for taxes Ø U. S. Income tax paid Ø Estimate of state and other taxes § State of residence § Amount of total income Ø FICA 20

Total Allowances • Income Protection Allowance (IPA) Ø Estimates amount needed for basic needs Ø Based on Bureau of Labor Statistics lower budget expenditures adjusted for CPI Ø Increases with each household member Ø Decreases with each member in college 21

Total Allowances • Employment expense allowance Ø Represents additional costs when both parents work Ø Applies to working single parent families 22

Treatment of Assets defined Ø Cash, savings, checking Ø Investments and trusts Ø Real estate equity Ø Business/farm equity (not family owned) • Protects first 60% of equity up to $105 K • Decreases protection percentage after $105 K 23

Treatment of Assets Cash, savings, checking +Net worth of real estate and investments +Adjusted net worth of business/farm =Total Net Worth 24

Treatment of Parents’ Assets Total Net Worth - Education Savings and Asset Protection Allowance =Discretionary Net Worth 25

Treatment of Parents’ Assets • Education Savings and Asset Protection Allowance Ø Protects assets for retirement and future education costs Ø Applies > age 25 • Increases with age • Adjusted for marital status Ø No protection for dependent students 26

Treatment of Parents’ Assets Discretionary Net Worth X 12% asset conversion rate =Contribution from Assets 27

Adjusted Available Income Parents’ Available Income (+/-) +Parents’ contribution from assets (+/0) =Total Adjusted Available Income (+/-) 28

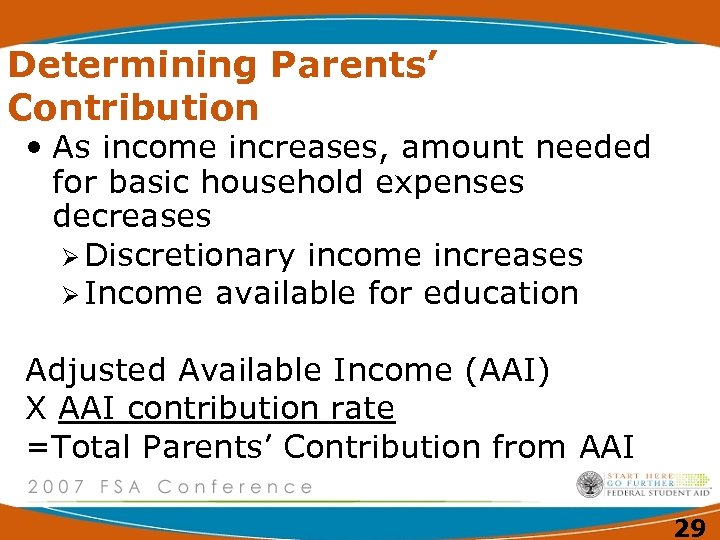

Determining Parents’ Contribution • As income increases, amount needed for basic household expenses decreases Ø Discretionary income increases Ø Income available for education Adjusted Available Income (AAI) X AAI contribution rate =Total Parents’ Contribution from AAI 29

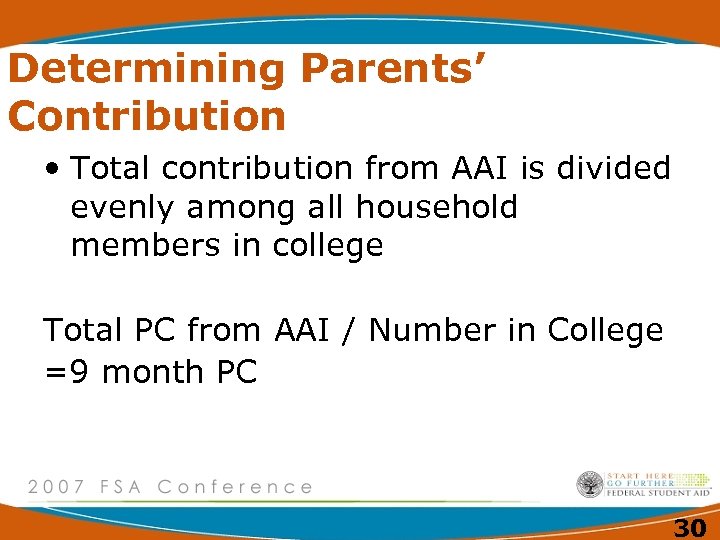

Determining Parents’ Contribution • Total contribution from AAI is divided evenly among all household members in college Total PC from AAI / Number in College =9 month PC 30

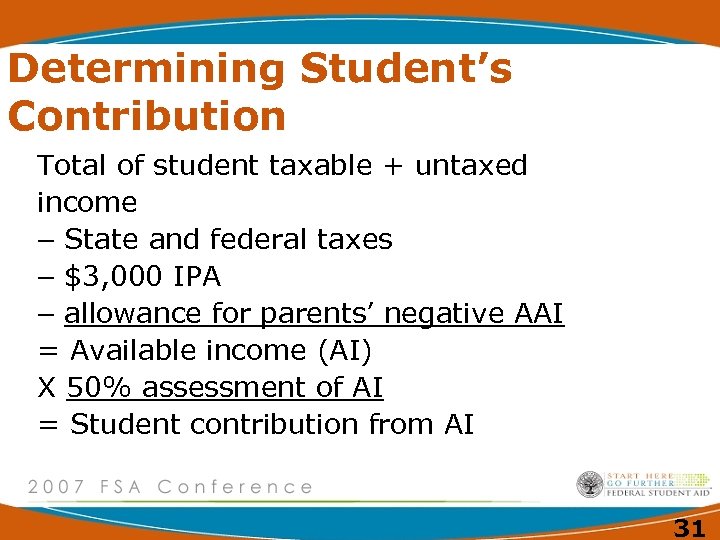

Determining Student’s Contribution Total of student taxable + untaxed income - State and federal taxes - $3, 000 IPA - allowance for parents’ negative AAI = Available income (AI) X 50% assessment of AI = Student contribution from AI 31

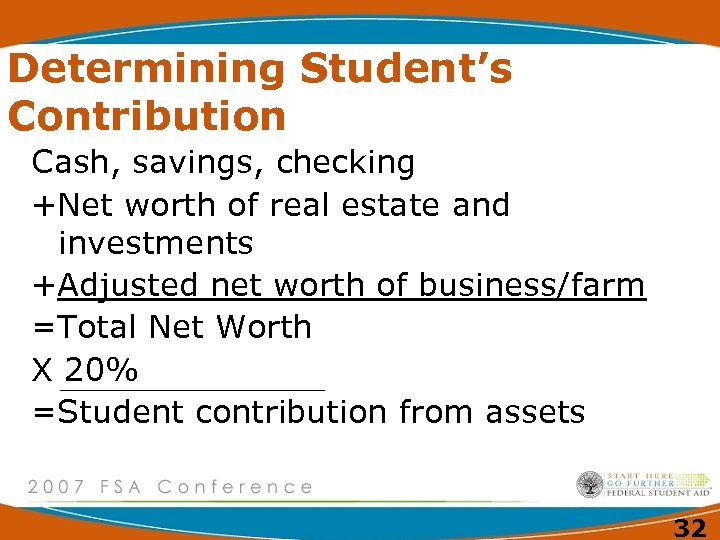

Determining Student’s Contribution Cash, savings, checking +Net worth of real estate and investments +Adjusted net worth of business/farm =Total Net Worth X 20% =Student contribution from assets 32

Determining EFC Parents’ Contribution +Student’s contribution from AI +Student’s contribution from assets = 9 month EFC 33

What if? • If there were two in the household in college: ØIPA is $20, 510 ØTotal allowances are $28, 014 ØNew AI is $14, 713 ØNew PC is $3, 276 • New EFC is 3286 34

Resources • 2007 -2008 FSA Handbook, Application & Verification Guide, Chapter 3 • EFC Formula Guide on IFAP 35

Contacts We appreciate your feedback and comments. We can be reached at: Marianna Deeken • Phone: (206) 615 -2583 • Email: marianna. deeken@ed. gov Claire Micki Roemer • Phone: 202 -377 -3452 • Email: claire. roemer@ed. gov 36

Please provide any comments regarding this training or the trainers to: Jo Ann Borel Title IV Training Supervisor joann. borel@ed. gov 202 -377 -3930 37

3c8325e020db37703002981a7f793c53.ppt