bc8ee26c533857e5c9a477444de0dc70.ppt

- Количество слайдов: 19

Services Of the CAribbean SOCA Creating the conditions for greater services trade between CARICOM and the USA Members: ……………. .

2 Outline ¡ Overview ¡ Regional Services ¡ Work Plan ¡ US Services Regime and Agreements ¡ US in GATS ¡ The Way Forward

3 Overview ¡ Aim: To advance new trade and investment opportunities between the US and CARICOM service sectors and industries ¡ Launched November 20, 2013 in Washington, DC. ¡ Focus: - CBI Enhancement - Trade Facilitation

4 Rationale ¡ CARICOM countries only CBI beneficiaries with goods-based preference regime with the US ¡ CARICOM region has dominated economy become a services- ¡ US-CARICOM trade policy and business discourse should be expanded to reflect services ¡ US involvement in Ti. SA negotiations means CARICOM will face a more competitive services trade environment

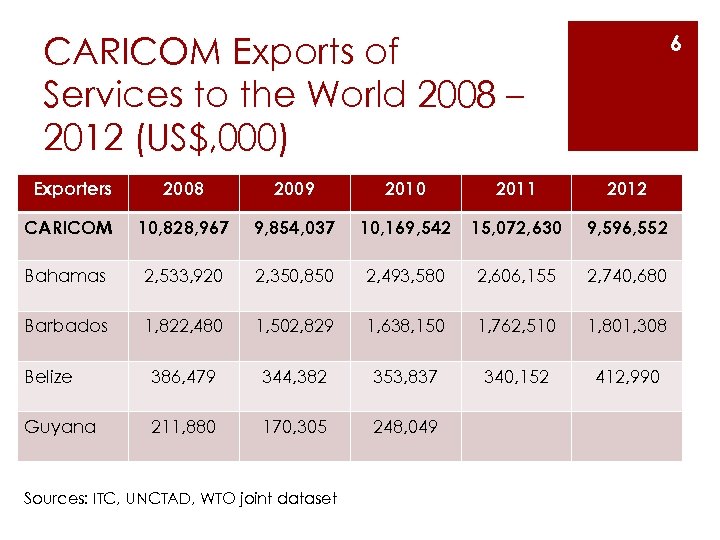

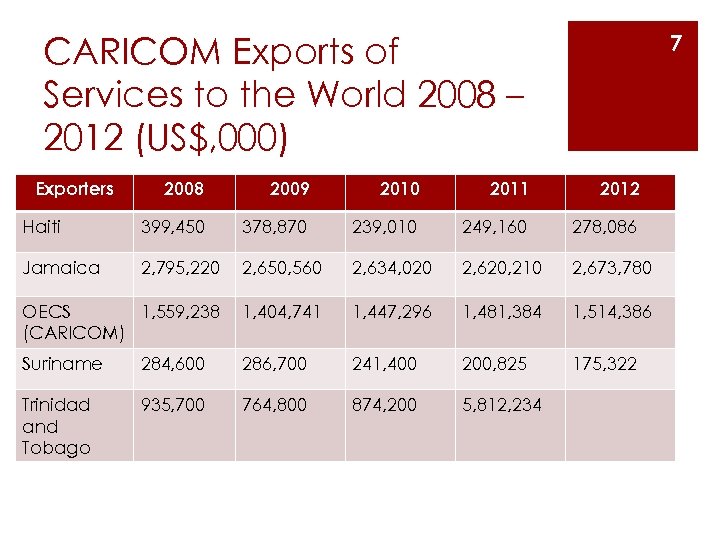

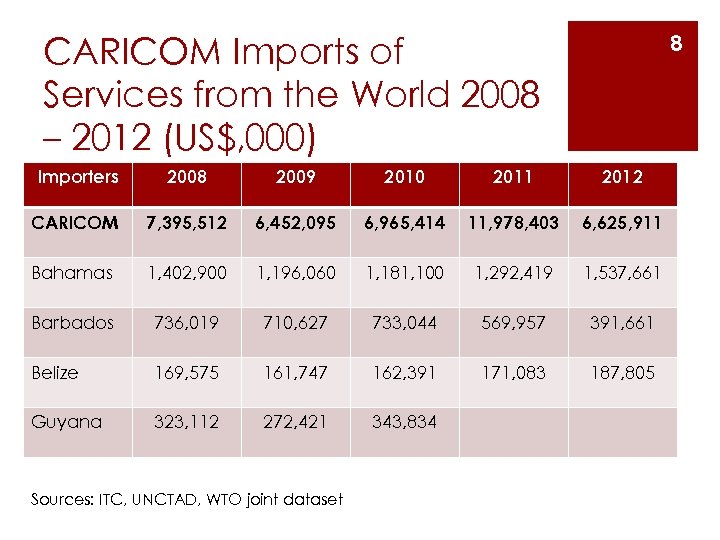

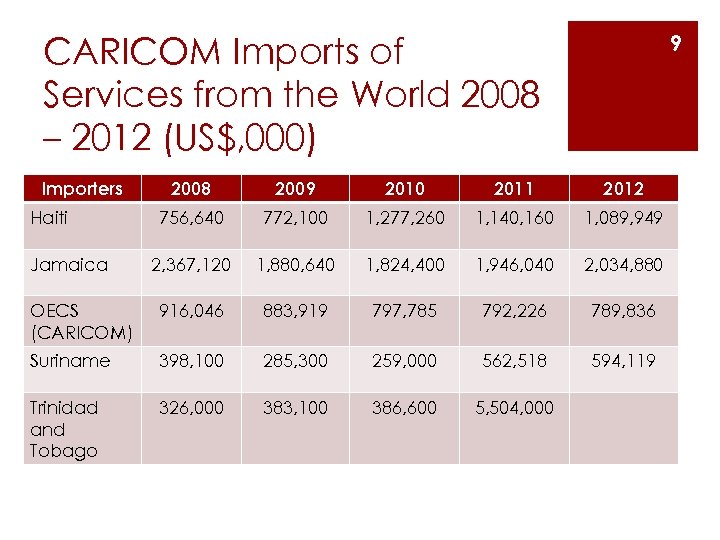

5 Regional Services ¡ CARICOM Services Trade with the world (2012) - Exports: $9. 6 billion - Imports: $6. 6 billion ¡ Services sector CARICOM. fastest growing sector in ¡ Services accounts for more than 60% GDP of CARICOM countries

CARICOM Exports of Services to the World 2008 – 2012 (US$, 000) 6 Exporters 2008 2009 2010 2011 2012 CARICOM 10, 828, 967 9, 854, 037 10, 169, 542 15, 072, 630 9, 596, 552 Bahamas 2, 533, 920 2, 350, 850 2, 493, 580 2, 606, 155 2, 740, 680 Barbados 1, 822, 480 1, 502, 829 1, 638, 150 1, 762, 510 1, 801, 308 Belize 386, 479 344, 382 353, 837 340, 152 412, 990 Guyana 211, 880 170, 305 248, 049 Sources: ITC, UNCTAD, WTO joint dataset

CARICOM Exports of Services to the World 2008 – 2012 (US$, 000) Exporters 7 2008 2009 2010 2011 2012 Haiti 399, 450 378, 870 239, 010 249, 160 278, 086 Jamaica 2, 795, 220 2, 650, 560 2, 634, 020 2, 620, 210 2, 673, 780 OECS 1, 559, 238 (CARICOM) 1, 404, 741 1, 447, 296 1, 481, 384 1, 514, 386 Suriname 284, 600 286, 700 241, 400 200, 825 175, 322 Trinidad and Tobago 935, 700 764, 800 874, 200 5, 812, 234

CARICOM Imports of Services from the World 2008 – 2012 (US$, 000) 8 Importers 2008 2009 2010 2011 2012 CARICOM 7, 395, 512 6, 452, 095 6, 965, 414 11, 978, 403 6, 625, 911 Bahamas 1, 402, 900 1, 196, 060 1, 181, 100 1, 292, 419 1, 537, 661 Barbados 736, 019 710, 627 733, 044 569, 957 391, 661 Belize 169, 575 161, 747 162, 391 171, 083 187, 805 Guyana 323, 112 272, 421 343, 834 Sources: ITC, UNCTAD, WTO joint dataset

CARICOM Imports of Services from the World 2008 – 2012 (US$, 000) Importers 9 2008 2009 2010 2011 2012 756, 640 772, 100 1, 277, 260 1, 140, 160 1, 089, 949 2, 367, 120 1, 880, 640 1, 824, 400 1, 946, 040 2, 034, 880 OECS (CARICOM) 916, 046 883, 919 797, 785 792, 226 789, 836 Suriname 398, 100 285, 300 259, 000 562, 518 594, 119 Trinidad and Tobago 326, 000 383, 100 386, 600 5, 504, 000 Haiti Jamaica

10 Work Plan ¡ Legislative initiatives in US Congress to address CBI expansion: - CBI goods preferences are unilateral, as per US law. Providing similar services preferences can be proposed and secured in a unilateral manner per act of Congress - Service incentives in US market access for CBI CARICOM firms would enhance their ability to participate in the US services market - To date, discussions have taken place with traderelated Committees in Congress with request for specific proposals to be advanced to Congress

11 Work Plan ¡ Executive action via the 2013 US-CARICOM Trade and Investment Framework Agreement (TIFA) - TIFA can encourage more investment in region in services growth - TIFA agenda and work plan for 2014 is currently being discussed and SOCA initiative can fit in the discussion - Room for growth, for example the US-Uruguay TIC/TIFA 2007 where preference arrangements for services, e-commerce and ICT, and investment, resulted in doubling US-Uruguay trade and investment flows to $2. 2 billion in 2013

12 Work Plan ¡ Business-to-Business (B 2 B) Partnerships - Can stimulate US services investment and trade across the region - Areas such as education, medical services, and ICTs have a real market need for stimulating and supporting new business efforts between US and regional firms - Discussions to advance services focus on CBI CARICOM markets to their US services member companies already underway by groups such as the US Chamber of Commerce and the Association of American Chambers of Commerce in Latin America and the Caribbean (AACCLA)

13 US Services Regime and Agreements ¡ US FTAs are reciprocal and binding ¡ US services trade highly competitive. Example: ICT, Express Delivery Services, Professional Services, Financial Services ¡ US market contains few barriers to services imports ¡ US trade surplus in services is 25% higher with trade agreement partners than with other countries therefore FTA alternatives should be priority for accessing services market

14 US in WTO GATS ¡ No specific commitments: - Medical and dental services - Maritime transportation ¡ Conditional commitments: - Services auxiliary to financial administration - Movement of natural persons - Services auxiliary to insurance and pension funding - Offshore banking

15 Constraints ¡ Dearth of services data in region - International agencies do not track small country services data - Hinders specific sector focus - Collaborate with regional governments as per their priority

16 Possible services preferences focus ¡ Financial and Insurance Services ¡ Education and Training Medical and Nursing Services; including ¡ Health / Medical Tourism and Sports-Fitness Services ¡ Entertainment and Film/Music/Audiovisual and Creative Industries Services ¡ Tourism and Travel Services

17 Possible services preferences focus ¡ ICT and Telecommunications Services ¡ BPO/Call Centres and e-commerce Services ¡ Energy Services ¡ Logistics and Transportation Services

18 THANK YOU

19 Contact SOCA Secretariat c/o Trinidad and Tobago Coalition of Services Industries 45 Cornelio Street, Woodbrook Port of Spain Trinidad and Tobago Tele: (868) 622 -9229 ; Fax: (868) 622 -8985 Email: info@ttcsi. org ; Website: www. ttcsi. org

bc8ee26c533857e5c9a477444de0dc70.ppt