bc4e4d64ddb2d785b5a2e87f58e7b0ed.ppt

- Количество слайдов: 34

Service Tax Negative List & Reverse Charge Concepts

Service Tax Negative List & Reverse Charge Concepts

TOPICS COVERED • Jurisdiction • Negative list • Declared service • Mega Exemption • Reverse Charge

TOPICS COVERED • Jurisdiction • Negative list • Declared service • Mega Exemption • Reverse Charge

• Services constitute more than 50% of GDP • The growth in service sector is an indicator of economic development • However, till 1994 the burden of taxation was on goods only • Furthere was no sound reasoning for not taxing the service sector Introduction

• Services constitute more than 50% of GDP • The growth in service sector is an indicator of economic development • However, till 1994 the burden of taxation was on goods only • Furthere was no sound reasoning for not taxing the service sector Introduction

Jurisdiction • The Concept of Taxable Territory • The levy extends to whole of India except the state of Jammu and Kashmir • It extended to designated area in the continental shelf and Exclusive Economic Zone of India • Under Negative list regime the jurisdiction is well defined – Section 65 B (27)

Jurisdiction • The Concept of Taxable Territory • The levy extends to whole of India except the state of Jammu and Kashmir • It extended to designated area in the continental shelf and Exclusive Economic Zone of India • Under Negative list regime the jurisdiction is well defined – Section 65 B (27)

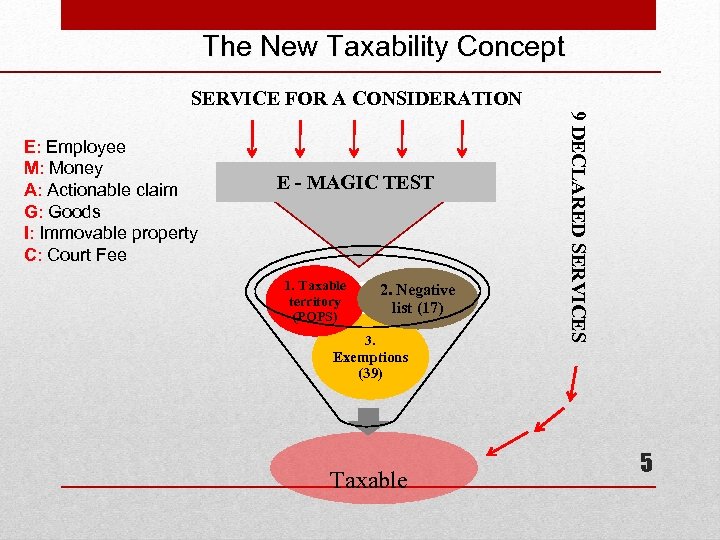

The New Taxability Concept SERVICE FOR A CONSIDERATION E - MAGIC TEST 1. Taxable territory (POPS) 2. Negative list (17) 3. 9 DECLARED SERVICES E: Employee M: Money A: Actionable claim G: Goods I: Immovable property C: Court Fee Exemptions (39) Taxable 5

The New Taxability Concept SERVICE FOR A CONSIDERATION E - MAGIC TEST 1. Taxable territory (POPS) 2. Negative list (17) 3. 9 DECLARED SERVICES E: Employee M: Money A: Actionable claim G: Goods I: Immovable property C: Court Fee Exemptions (39) Taxable 5

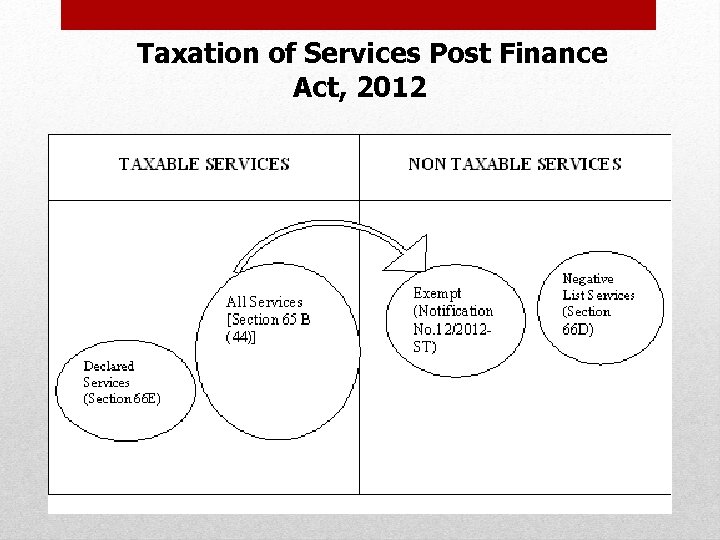

Taxation of Services Post Finance Act, 2012 6

Taxation of Services Post Finance Act, 2012 6

![Taxability of Services (1 -7 -2015) All services [section 65 B (44)] Taxable • Taxability of Services (1 -7 -2015) All services [section 65 B (44)] Taxable •](https://present5.com/presentation/bc4e4d64ddb2d785b5a2e87f58e7b0ed/image-7.jpg) Taxability of Services (1 -7 -2015) All services [section 65 B (44)] Taxable • Declared services (section 66 E) Taxable • Services covered under negative list of services (section 66 D) Not Taxable • Services exempt under Mega Notification No. 25/2012 -ST dated 20. 6. 2012 Exempted • Other specified Exemptions Exempted •

Taxability of Services (1 -7 -2015) All services [section 65 B (44)] Taxable • Declared services (section 66 E) Taxable • Services covered under negative list of services (section 66 D) Not Taxable • Services exempt under Mega Notification No. 25/2012 -ST dated 20. 6. 2012 Exempted • Other specified Exemptions Exempted •

Negative list • Various committees constituted by Government suggested for comprehensive coverage • Govinda Rao committee • Kelkar Committee • The suggestion were not implemented immediately for various reasons • Finally in the year 2012 comprehensive approach was opted for levy of service tax

Negative list • Various committees constituted by Government suggested for comprehensive coverage • Govinda Rao committee • Kelkar Committee • The suggestion were not implemented immediately for various reasons • Finally in the year 2012 comprehensive approach was opted for levy of service tax

Negative list ( contd ) • Finally in the year 2012 comprehensive approach was opted for levy of service tax • All Services other than the services specified in the negative list are taxable. • 3 Steps to ascertain the taxability • Activity covered within the ambit of “Service” • It is not specified in the negative list –Section 66 D • It is not exempted under Notfn. No. 25/2012 -ST

Negative list ( contd ) • Finally in the year 2012 comprehensive approach was opted for levy of service tax • All Services other than the services specified in the negative list are taxable. • 3 Steps to ascertain the taxability • Activity covered within the ambit of “Service” • It is not specified in the negative list –Section 66 D • It is not exempted under Notfn. No. 25/2012 -ST

Charging section – 66 B • There shall be levied a tax (hereinafter referred to as the service tax) at the rate of fourteen per cent on the value of all services, other than those services specified in the negative list, provided or agreed to be provided in the taxable territory by one person to another and collected in such manner as may be prescribed.

Charging section – 66 B • There shall be levied a tax (hereinafter referred to as the service tax) at the rate of fourteen per cent on the value of all services, other than those services specified in the negative list, provided or agreed to be provided in the taxable territory by one person to another and collected in such manner as may be prescribed.

Definition of Service • Any activity (Sec 65 B(44) ) • By a person for another person • For consideration • Includes declared service • Excludes certain activity

Definition of Service • Any activity (Sec 65 B(44) ) • By a person for another person • For consideration • Includes declared service • Excludes certain activity

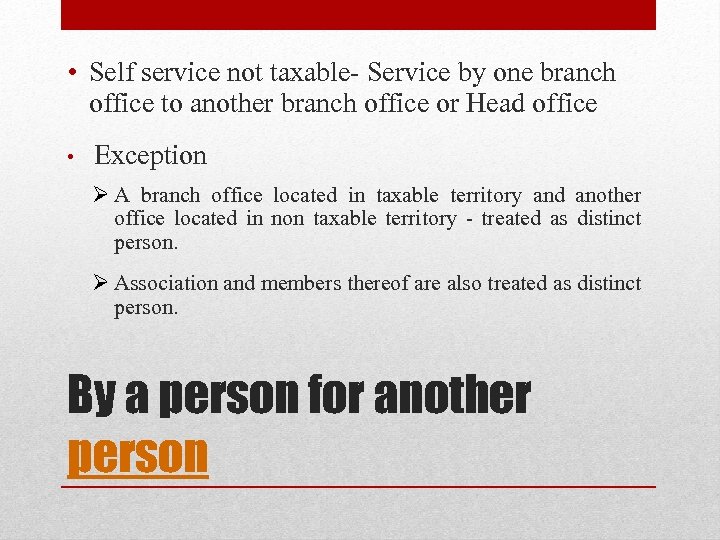

• Self service not taxable- Service by one branch office to another branch office or Head office • Exception Ø A branch office located in taxable territory and another office located in non taxable territory - treated as distinct person. Ø Association and members thereof are also treated as distinct person. By a person for another person

• Self service not taxable- Service by one branch office to another branch office or Head office • Exception Ø A branch office located in taxable territory and another office located in non taxable territory - treated as distinct person. Ø Association and members thereof are also treated as distinct person. By a person for another person

What is an activity Not defined in the Activity includes – - An act done, A work done, A deed done - An operation carried out - Execution of an act - Provision of a facility • Activity could be active or passive § It includes refraining from an act (Non compete fee) • Situation as described under declared service

What is an activity Not defined in the Activity includes – - An act done, A work done, A deed done - An operation carried out - Execution of an act - Provision of a facility • Activity could be active or passive § It includes refraining from an act (Non compete fee) • Situation as described under declared service

• Self service not taxable- Service by one branch office to another branch office or Head office • Exception Ø A branch office located in taxable territory and another office located in non taxable territory - treated as distinct person. Ø Association and members thereof are also treated as distinct person. By a person for another person

• Self service not taxable- Service by one branch office to another branch office or Head office • Exception Ø A branch office located in taxable territory and another office located in non taxable territory - treated as distinct person. Ø Association and members thereof are also treated as distinct person. By a person for another person

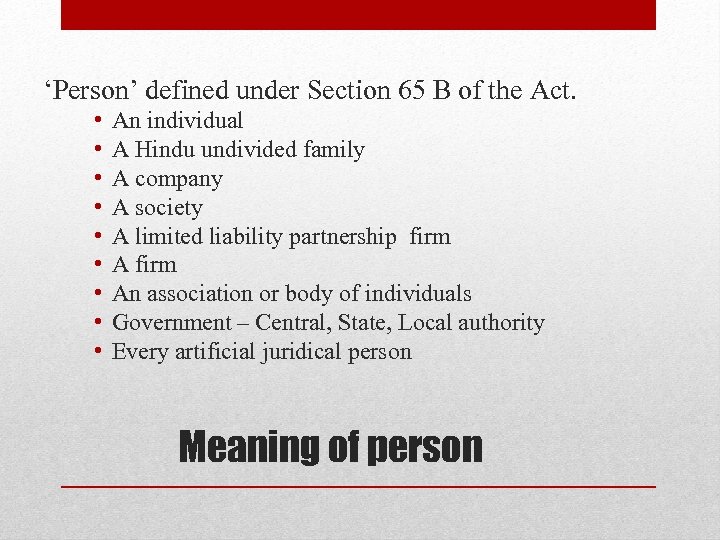

‘Person’ defined under Section 65 B of the Act. • • • An individual A Hindu undivided family A company A society A limited liability partnership firm An association or body of individuals Government – Central, State, Local authority Every artificial juridical person Meaning of person

‘Person’ defined under Section 65 B of the Act. • • • An individual A Hindu undivided family A company A society A limited liability partnership firm An association or body of individuals Government – Central, State, Local authority Every artificial juridical person Meaning of person

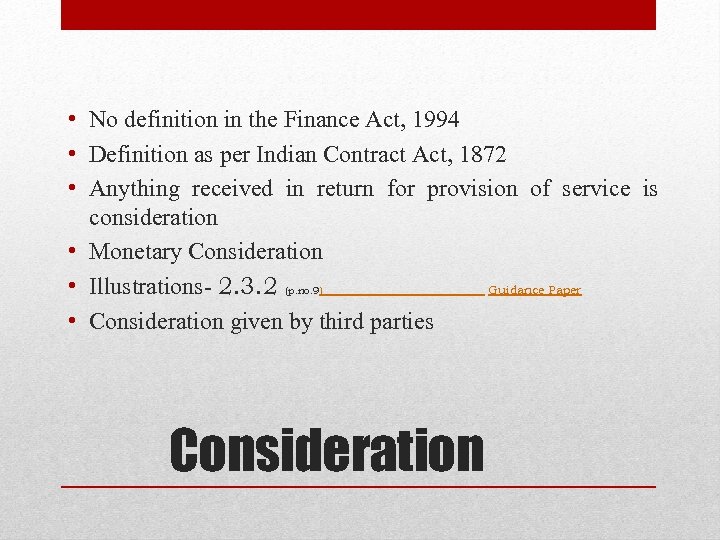

• No definition in the Finance Act, 1994 • Definition as per Indian Contract Act, 1872 • Anything received in return for provision of service is consideration • Monetary Consideration • Illustrations- 2. 3. 2 (p. no. 9) Guidance Paper • Consideration given by third parties Consideration

• No definition in the Finance Act, 1994 • Definition as per Indian Contract Act, 1872 • Anything received in return for provision of service is consideration • Monetary Consideration • Illustrations- 2. 3. 2 (p. no. 9) Guidance Paper • Consideration given by third parties Consideration

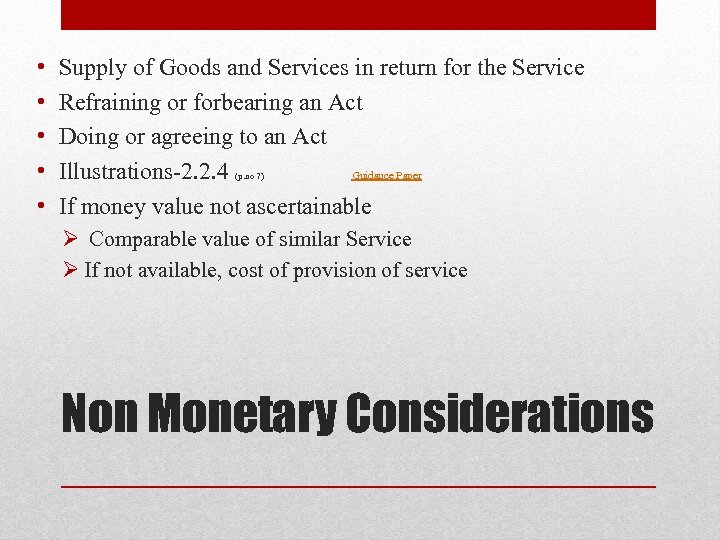

• • • Supply of Goods and Services in return for the Service Refraining or forbearing an Act Doing or agreeing to an Act Illustrations-2. 2. 4 Guidance Paper If money value not ascertainable (p. no 7) Ø Comparable value of similar Service Ø If not available, cost of provision of service Non Monetary Considerations

• • • Supply of Goods and Services in return for the Service Refraining or forbearing an Act Doing or agreeing to an Act Illustrations-2. 2. 4 Guidance Paper If money value not ascertainable (p. no 7) Ø Comparable value of similar Service Ø If not available, cost of provision of service Non Monetary Considerations

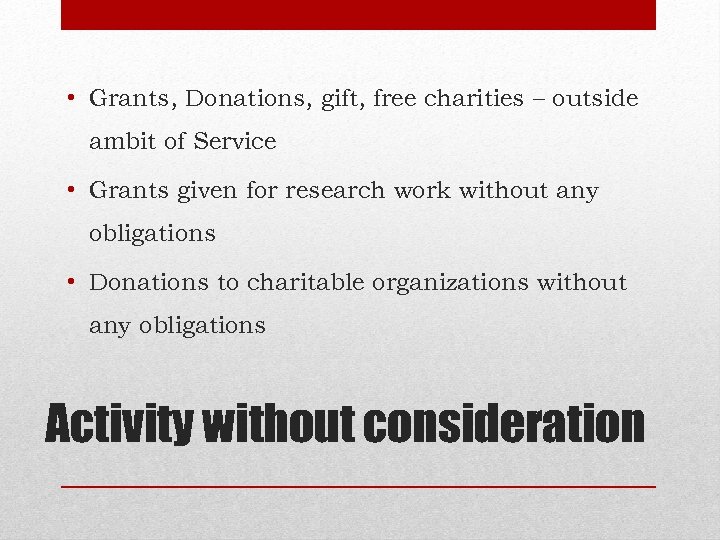

• Grants, Donations, gift, free charities – outside ambit of Service • Grants given for research work without any obligations • Donations to charitable organizations without any obligations Activity without consideration

• Grants, Donations, gift, free charities – outside ambit of Service • Grants given for research work without any obligations • Donations to charitable organizations without any obligations Activity without consideration

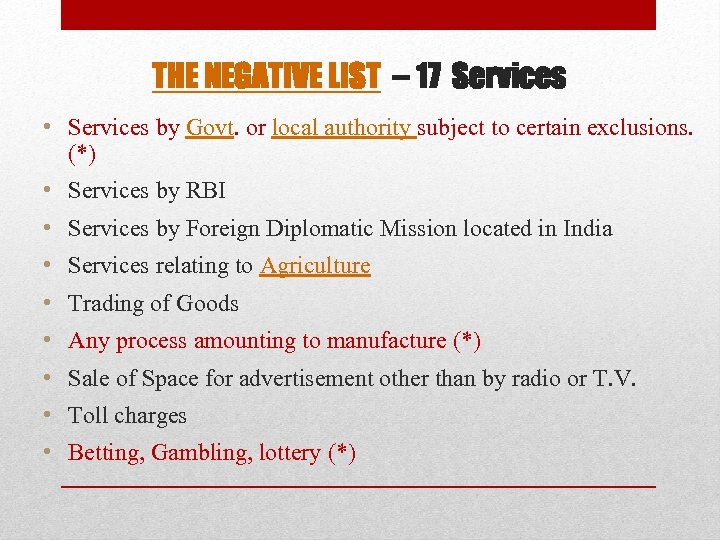

THE NEGATIVE LIST -- 17 Services • Services by Govt. or local authority subject to certain exclusions. (*) • Services by RBI • Services by Foreign Diplomatic Mission located in India • Services relating to Agriculture • Trading of Goods • Any process amounting to manufacture (*) • Sale of Space for advertisement other than by radio or T. V. • Toll charges • Betting, Gambling, lottery (*)

THE NEGATIVE LIST -- 17 Services • Services by Govt. or local authority subject to certain exclusions. (*) • Services by RBI • Services by Foreign Diplomatic Mission located in India • Services relating to Agriculture • Trading of Goods • Any process amounting to manufacture (*) • Sale of Space for advertisement other than by radio or T. V. • Toll charges • Betting, Gambling, lottery (*)

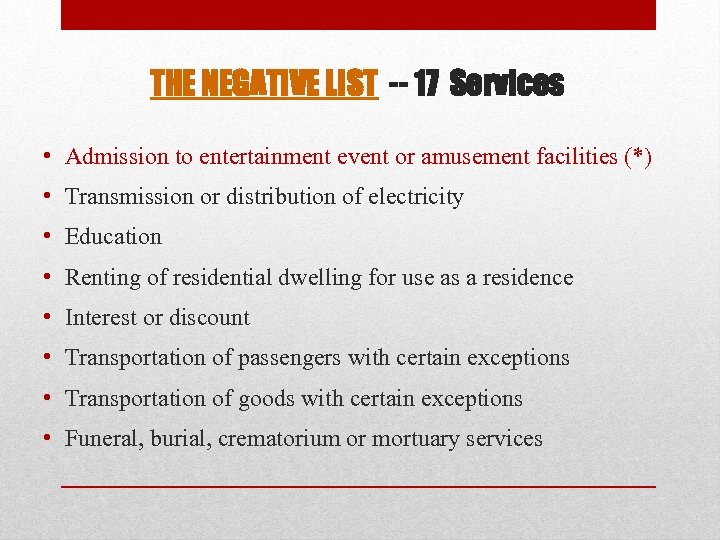

THE NEGATIVE LIST -- 17 Services • Admission to entertainment event or amusement facilities (*) • Transmission or distribution of electricity • Education • Renting of residential dwelling for use as a residence • Interest or discount • Transportation of passengers with certain exceptions • Transportation of goods with certain exceptions • Funeral, burial, crematorium or mortuary services

THE NEGATIVE LIST -- 17 Services • Admission to entertainment event or amusement facilities (*) • Transmission or distribution of electricity • Education • Renting of residential dwelling for use as a residence • Interest or discount • Transportation of passengers with certain exceptions • Transportation of goods with certain exceptions • Funeral, burial, crematorium or mortuary services

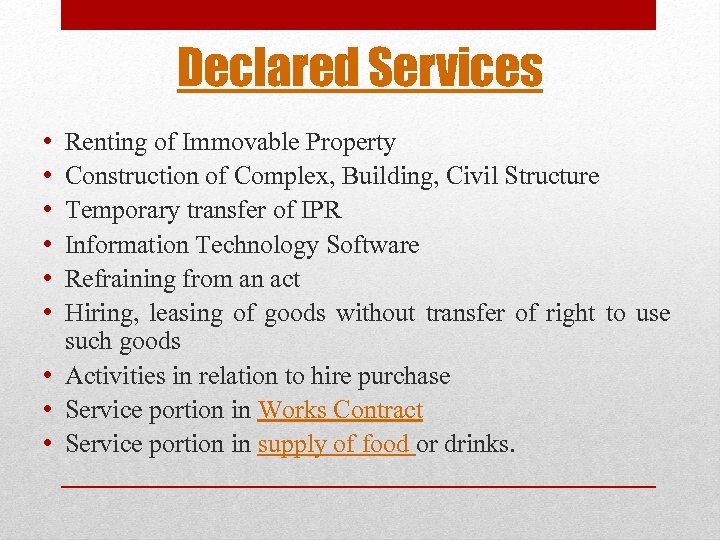

Declared Services • • • Renting of Immovable Property Construction of Complex, Building, Civil Structure Temporary transfer of IPR Information Technology Software Refraining from an act Hiring, leasing of goods without transfer of right to use such goods • Activities in relation to hire purchase • Service portion in Works Contract • Service portion in supply of food or drinks.

Declared Services • • • Renting of Immovable Property Construction of Complex, Building, Civil Structure Temporary transfer of IPR Information Technology Software Refraining from an act Hiring, leasing of goods without transfer of right to use such goods • Activities in relation to hire purchase • Service portion in Works Contract • Service portion in supply of food or drinks.

Classification • Section 66 F • Need for classification even under negative list • Applicable in the following areas • • Negative list Exemption Place of provision of service Rules 2012 Cenvat Credit Rules, 2004

Classification • Section 66 F • Need for classification even under negative list • Applicable in the following areas • • Negative list Exemption Place of provision of service Rules 2012 Cenvat Credit Rules, 2004

Reverse charge

Reverse charge

Reverse Charge § Generally service provider is liable to pay service tax – Section 68(1) § For specified Services, Service Receiver is liable to pay service tax – Section 68(2) § Reasons for reverse charge method – § Administrative convenience, § service provider in non taxable territory, § Service provider in unorganized sector

Reverse Charge § Generally service provider is liable to pay service tax – Section 68(1) § For specified Services, Service Receiver is liable to pay service tax – Section 68(2) § Reasons for reverse charge method – § Administrative convenience, § service provider in non taxable territory, § Service provider in unorganized sector

§ Major changes introduced in 2012 at the time of introduction of negative list based levy § Both the service provider and service receiver liable to pay service tax § More number of services added to reverse charge method of levy Partial Reverse Charge

§ Major changes introduced in 2012 at the time of introduction of negative list based levy § Both the service provider and service receiver liable to pay service tax § More number of services added to reverse charge method of levy Partial Reverse Charge

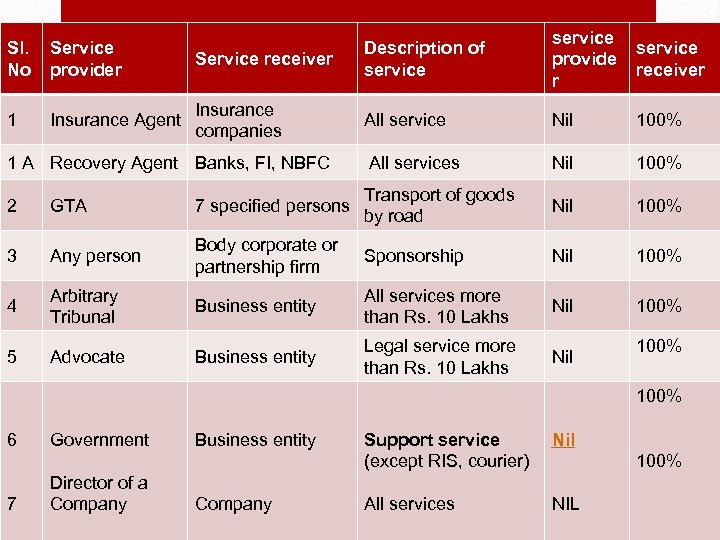

Service receiver Description of service provide r service receiver Insurance companies All service Nil 100% 1 A Recovery Agent Banks, FI, NBFC All services Nil 100% 2 GTA 7 specified persons Transport of goods by road Nil 100% 3 Any person Body corporate or partnership firm Sponsorship Nil 100% 4 Arbitrary Tribunal Business entity All services more than Rs. 10 Lakhs Nil 100% 5 Advocate Business entity Legal service more than Rs. 10 Lakhs Nil Sl. No Service provider 1 Insurance Agent 100% 6 7 Government Director of a Company Business entity Company Support service (except RIS, courier) Nil All services NIL 100%

Service receiver Description of service provide r service receiver Insurance companies All service Nil 100% 1 A Recovery Agent Banks, FI, NBFC All services Nil 100% 2 GTA 7 specified persons Transport of goods by road Nil 100% 3 Any person Body corporate or partnership firm Sponsorship Nil 100% 4 Arbitrary Tribunal Business entity All services more than Rs. 10 Lakhs Nil 100% 5 Advocate Business entity Legal service more than Rs. 10 Lakhs Nil Sl. No Service provider 1 Insurance Agent 100% 6 7 Government Director of a Company Business entity Company Support service (except RIS, courier) Nil All services NIL 100%

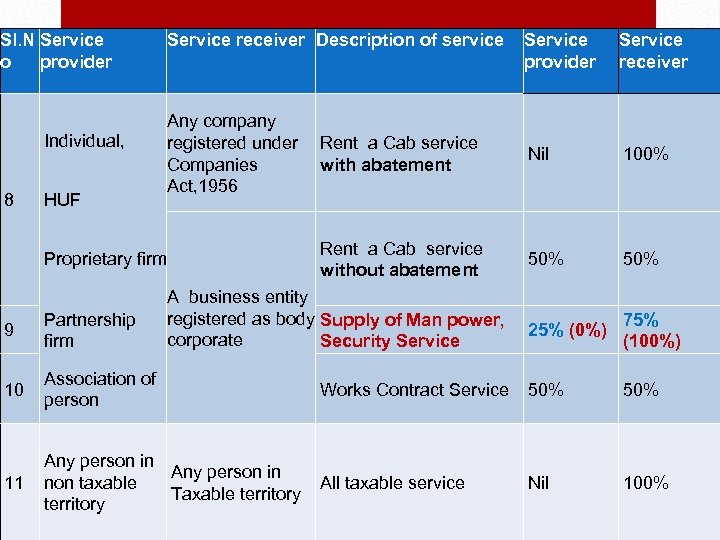

Sl. N Service o provider Individual, 8 HUF Service receiver Description of service Proprietary firm Service receiver Rent a Cab service with abatement Nil 100% Rent a Cab service without abatement Any company registered under Companies Act, 1956 Service provider 50% 25% (0%) 75% (100%) A business entity registered as body Supply of Man power, corporate Security Service 9 Partnership firm 10 Association of person Works Contract Service 50% 11 Any person in non taxable Taxable territory All taxable service Nil 100%

Sl. N Service o provider Individual, 8 HUF Service receiver Description of service Proprietary firm Service receiver Rent a Cab service with abatement Nil 100% Rent a Cab service without abatement Any company registered under Companies Act, 1956 Service provider 50% 25% (0%) 75% (100%) A business entity registered as body Supply of Man power, corporate Security Service 9 Partnership firm 10 Association of person Works Contract Service 50% 11 Any person in non taxable Taxable territory All taxable service Nil 100%

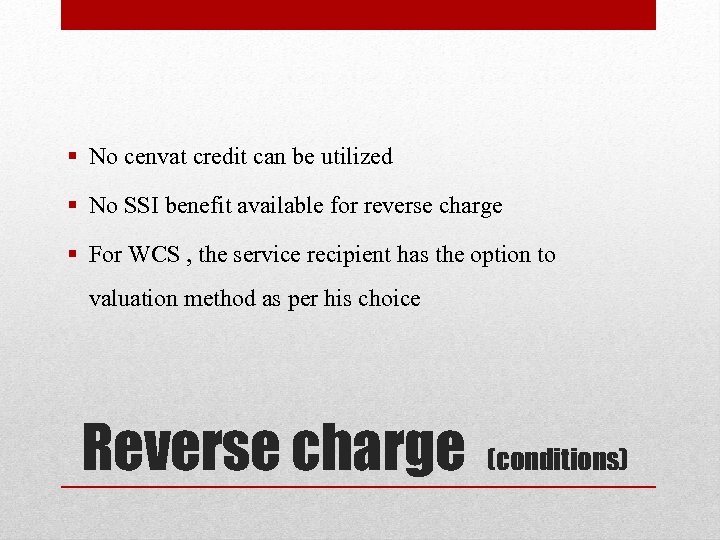

§ No cenvat credit can be utilized § No SSI benefit available for reverse charge § For WCS , the service recipient has the option to valuation method as per his choice Reverse charge (conditions)

§ No cenvat credit can be utilized § No SSI benefit available for reverse charge § For WCS , the service recipient has the option to valuation method as per his choice Reverse charge (conditions)

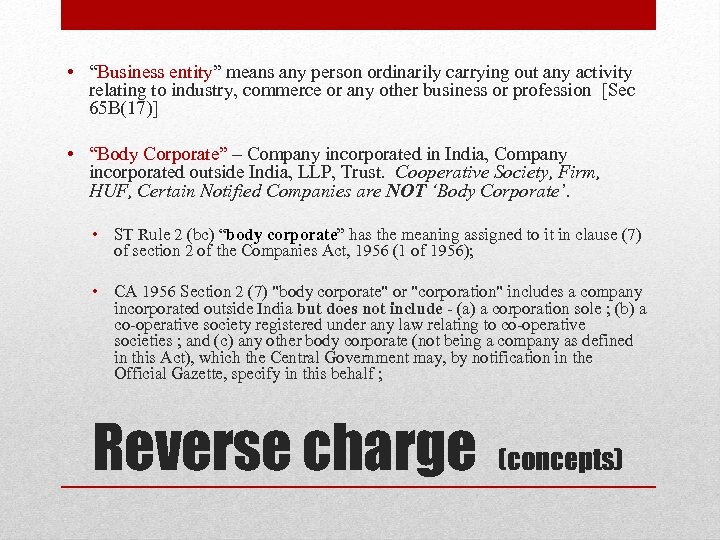

• “Business entity” means any person ordinarily carrying out any activity relating to industry, commerce or any other business or profession [Sec 65 B(17)] • “Body Corporate” – Company incorporated in India, Company incorporated outside India, LLP, Trust. Cooperative Society, Firm, HUF, Certain Notified Companies are NOT ‘Body Corporate’. • ST Rule 2 (bc) “body corporate” has the meaning assigned to it in clause (7) of section 2 of the Companies Act, 1956 (1 of 1956); • CA 1956 Section 2 (7) "body corporate" or "corporation" includes a company incorporated outside India but does not include - (a) a corporation sole ; (b) a co-operative society registered under any law relating to co-operative societies ; and (c) any other body corporate (not being a company as defined in this Act), which the Central Government may, by notification in the Official Gazette, specify in this behalf ; Reverse charge (concepts)

• “Business entity” means any person ordinarily carrying out any activity relating to industry, commerce or any other business or profession [Sec 65 B(17)] • “Body Corporate” – Company incorporated in India, Company incorporated outside India, LLP, Trust. Cooperative Society, Firm, HUF, Certain Notified Companies are NOT ‘Body Corporate’. • ST Rule 2 (bc) “body corporate” has the meaning assigned to it in clause (7) of section 2 of the Companies Act, 1956 (1 of 1956); • CA 1956 Section 2 (7) "body corporate" or "corporation" includes a company incorporated outside India but does not include - (a) a corporation sole ; (b) a co-operative society registered under any law relating to co-operative societies ; and (c) any other body corporate (not being a company as defined in this Act), which the Central Government may, by notification in the Official Gazette, specify in this behalf ; Reverse charge (concepts)

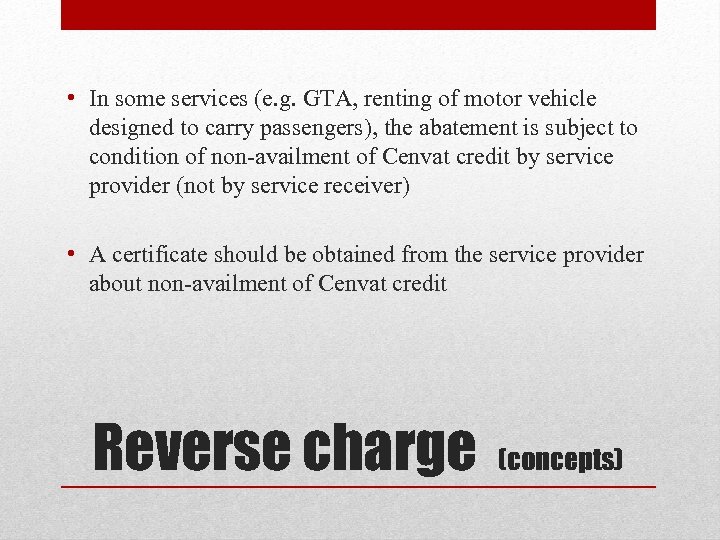

• In some services (e. g. GTA, renting of motor vehicle designed to carry passengers), the abatement is subject to condition of non-availment of Cenvat credit by service provider (not by service receiver) • A certificate should be obtained from the service provider about non-availment of Cenvat credit Reverse charge (concepts)

• In some services (e. g. GTA, renting of motor vehicle designed to carry passengers), the abatement is subject to condition of non-availment of Cenvat credit by service provider (not by service receiver) • A certificate should be obtained from the service provider about non-availment of Cenvat credit Reverse charge (concepts)

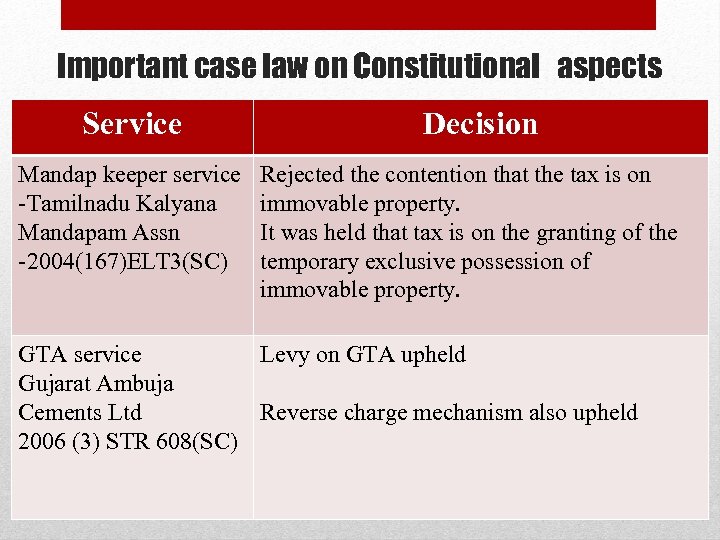

Important case law on Constitutional aspects Service Mandap keeper service -Tamilnadu Kalyana Mandapam Assn -2004(167)ELT 3(SC) Decision Rejected the contention that the tax is on immovable property. It was held that tax is on the granting of the temporary exclusive possession of immovable property. GTA service Levy on GTA upheld Gujarat Ambuja Cements Ltd Reverse charge mechanism also upheld 2006 (3) STR 608(SC)

Important case law on Constitutional aspects Service Mandap keeper service -Tamilnadu Kalyana Mandapam Assn -2004(167)ELT 3(SC) Decision Rejected the contention that the tax is on immovable property. It was held that tax is on the granting of the temporary exclusive possession of immovable property. GTA service Levy on GTA upheld Gujarat Ambuja Cements Ltd Reverse charge mechanism also upheld 2006 (3) STR 608(SC)

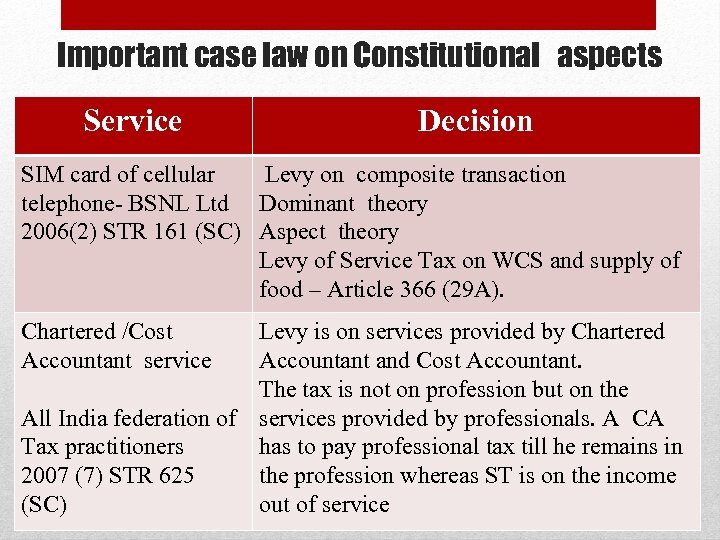

Important case law on Constitutional aspects Service Decision SIM card of cellular Levy on composite transaction telephone- BSNL Ltd Dominant theory 2006(2) STR 161 (SC) Aspect theory Levy of Service Tax on WCS and supply of food – Article 366 (29 A). Chartered /Cost Accountant service Levy is on services provided by Chartered Accountant and Cost Accountant. The tax is not on profession but on the All India federation of services provided by professionals. A CA Tax practitioners has to pay professional tax till he remains in 2007 (7) STR 625 the profession whereas ST is on the income (SC) out of service

Important case law on Constitutional aspects Service Decision SIM card of cellular Levy on composite transaction telephone- BSNL Ltd Dominant theory 2006(2) STR 161 (SC) Aspect theory Levy of Service Tax on WCS and supply of food – Article 366 (29 A). Chartered /Cost Accountant service Levy is on services provided by Chartered Accountant and Cost Accountant. The tax is not on profession but on the All India federation of services provided by professionals. A CA Tax practitioners has to pay professional tax till he remains in 2007 (7) STR 625 the profession whereas ST is on the income (SC) out of service

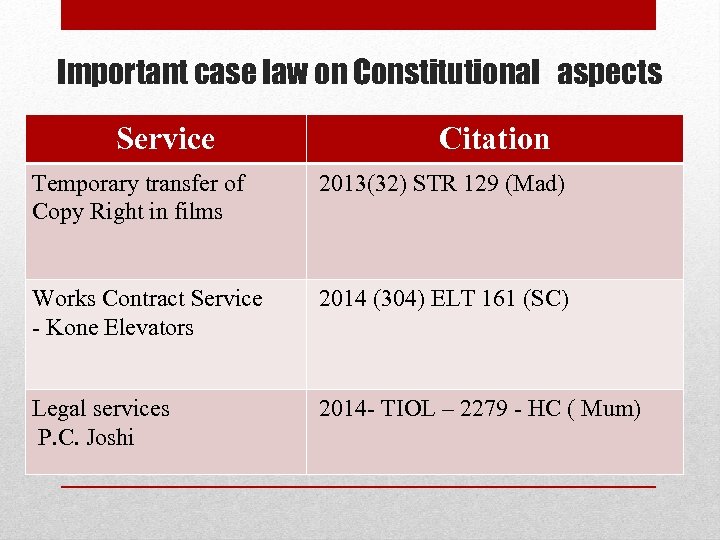

Important case law on Constitutional aspects Service Citation Temporary transfer of Copy Right in films 2013(32) STR 129 (Mad) Works Contract Service - Kone Elevators 2014 (304) ELT 161 (SC) Legal services P. C. Joshi 2014 - TIOL – 2279 - HC ( Mum)

Important case law on Constitutional aspects Service Citation Temporary transfer of Copy Right in films 2013(32) STR 129 (Mad) Works Contract Service - Kone Elevators 2014 (304) ELT 161 (SC) Legal services P. C. Joshi 2014 - TIOL – 2279 - HC ( Mum)

Nothing is impossible, the word itself says, “I’m possible!” Contact: facooper@gmail. com

Nothing is impossible, the word itself says, “I’m possible!” Contact: facooper@gmail. com