baa8994208ff77e0811bbab133baf419.ppt

- Количество слайдов: 24

SERVICE TAX by s. jaikumar advocate

Basic Features Ø Statutory provisions. Ø Levy on service provider - Exceptions. Ø Levy on realisation.

Classification of Service Ø Specific description than general description. Ø Essential character. Ø Which occurs first in the definition.

Valuation… Ø Gross amount. Ø Cum - tax. Ø Abatements. Ø Notification 12/2003.

Valuation… Ø Services rendered free. Ø Consideration in kind. Ø Reimbursement of expenses. Upto 18. 04. 2006 – No liability. Judgements and circulars. From 19. 04. 2006 – Concept of pure agent. Malabar Management Services VS CCE 2008(9) STR 483

Proceedings in Service Tax Ø Issue of show cause notice. Ø Adjudication. Ø Appellate remedies. Commissioner (Appeals) CESTAT High Court / Supreme Court

Procedures in Service Tax… Ø Registration – Centralised Registration. Ø Issue of invoice. Ø Maintenance of records.

Procedures in Service Tax. Ø Payment of service tax. - Due date. Advance payment. Self adjustment – if service not rendered. Provisional payment. Self adjustment of excess payments. Ø Filing of return – ST 3. - Due date / Half yearly. - Revised return. - Fine for delayed return.

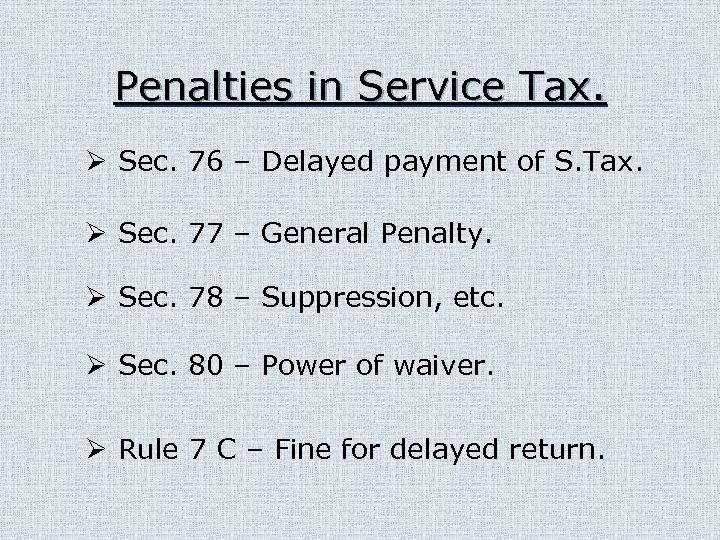

Penalties in Service Tax. Ø Sec. 76 – Delayed payment of S. Tax. Ø Sec. 77 – General Penalty. Ø Sec. 78 – Suppression, etc. Ø Sec. 80 – Power of waiver. Ø Rule 7 C – Fine for delayed return.

Certain important services.

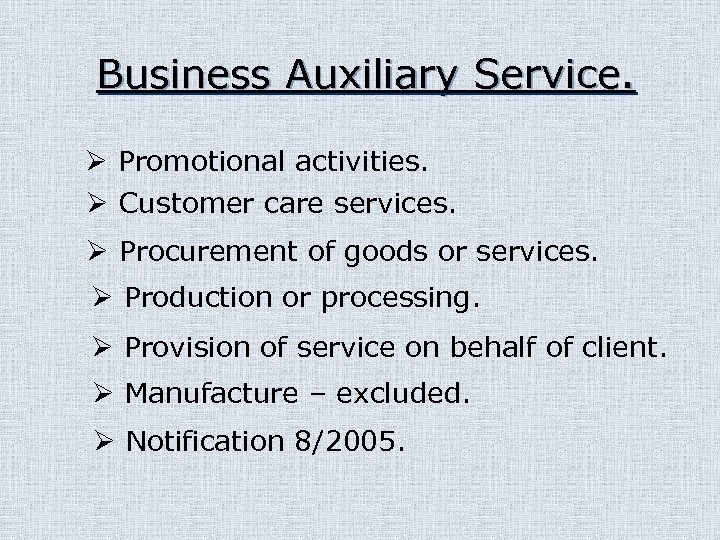

Business Auxiliary Service. Ø Promotional activities. Ø Customer care services. Ø Procurement of goods or services. Ø Production or processing. Ø Provision of service on behalf of client. Ø Manufacture – excluded. Ø Notification 8/2005.

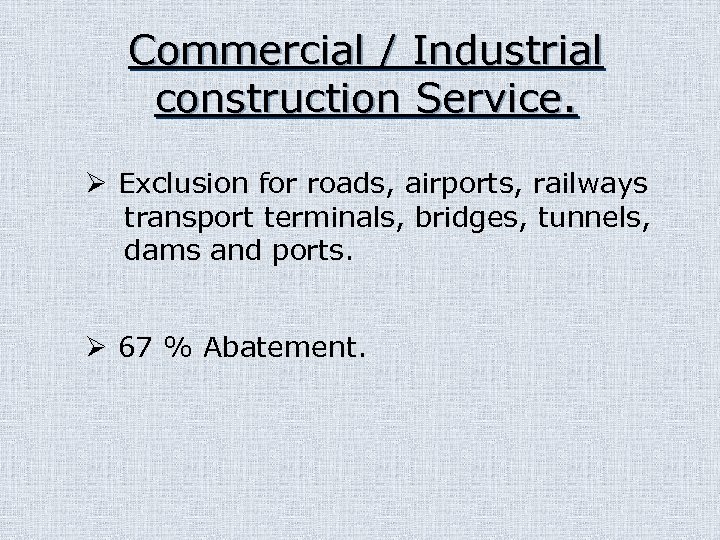

Commercial / Industrial construction Service. Ø Exclusion for roads, airports, railways transport terminals, bridges, tunnels, dams and ports. Ø 67 % Abatement.

Construction of Residential Complex Service. Ø More than 12 units. . Ø Personal use - exempted.

Consulting Engineering Service. Ø Foreign Technological transfers. Novinon Ltd. VS CCE 2006 (3) STR 397 Ø To cover software too. Customs House Agents Service.

Erection, Commissioning and Installation Service. Franchise Service.

Intellectual Property Service. Management Consultant Service. Manpower recruitment / Supply agencies.

Goods Transport Agency Service. Ø Reverse Charge. Ø Abatement. Ø Exemption. Ø Payment mode. Ø No SSI exemption.

Renting of immovable property. Support Services for business.

Works Contract Service. Ø Re-classification. Ø Composition Scheme. Ø Vice of Notification 1/2006. Ø Diebold Systems (P) Ltd Vs CCE 2008 (9) STR 546. Air Liquide Engg. India (P) Ltd. Vs CCE 2008 (9) STR 486.

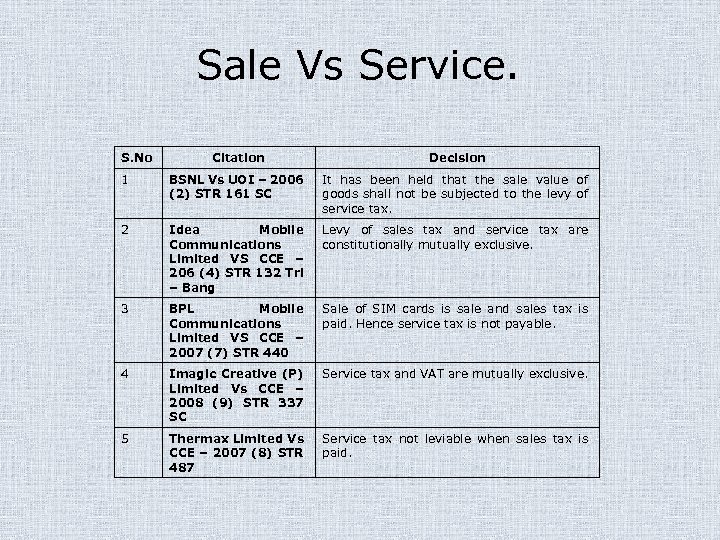

Sale Vs Service. S. No Citation Decision 1 BSNL Vs UOI – 2006 (2) STR 161 SC It has been held that the sale value of goods shall not be subjected to the levy of service tax. 2 Idea Mobile Communications Limited VS CCE – 206 (4) STR 132 Tri – Bang Levy of sales tax and service tax are constitutionally mutually exclusive. 3 BPL Mobile Communications Limited VS CCE – 2007 (7) STR 440 Sale of SIM cards is sale and sales tax is paid. Hence service tax is not payable. 4 Imagic Creative (P) Limited Vs CCE – 2008 (9) STR 337 SC Service tax and VAT are mutually exclusive. 5 Thermax Limited Vs CCE – 2007 (8) STR 487 Service tax not leviable when sales tax is paid.

Small Scale exemption. Ø Threshold limit. Ø Conditions.

Commercial Concern Vs Any person.

Export of Service and Import of Service.

THANKS

baa8994208ff77e0811bbab133baf419.ppt