7fa8243c0bc62f58c146dfabdb19d43d.ppt

- Количество слайдов: 86

SERVICE CONTRACT 2008 Training U. S. Department of Labor Employment Standards Administration

SERVICE CONTRACT 2008 Training U. S. Department of Labor Employment Standards Administration

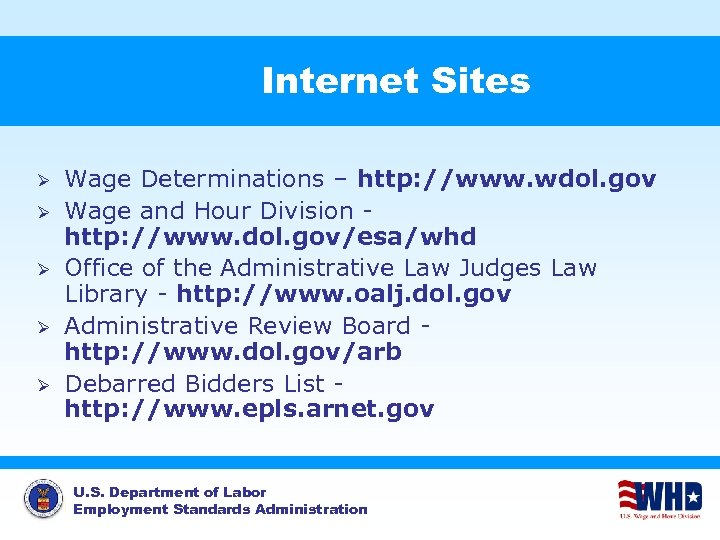

Internet Sites Ø Ø Ø Wage Determinations – http: //www. wdol. gov Wage and Hour Division http: //www. dol. gov/esa/whd Office of the Administrative Law Judges Law Library - http: //www. oalj. dol. gov Administrative Review Board http: //www. dol. gov/arb Debarred Bidders List http: //www. epls. arnet. gov U. S. Department of Labor Employment Standards Administration

Internet Sites Ø Ø Ø Wage Determinations – http: //www. wdol. gov Wage and Hour Division http: //www. dol. gov/esa/whd Office of the Administrative Law Judges Law Library - http: //www. oalj. dol. gov Administrative Review Board http: //www. dol. gov/arb Debarred Bidders List http: //www. epls. arnet. gov U. S. Department of Labor Employment Standards Administration

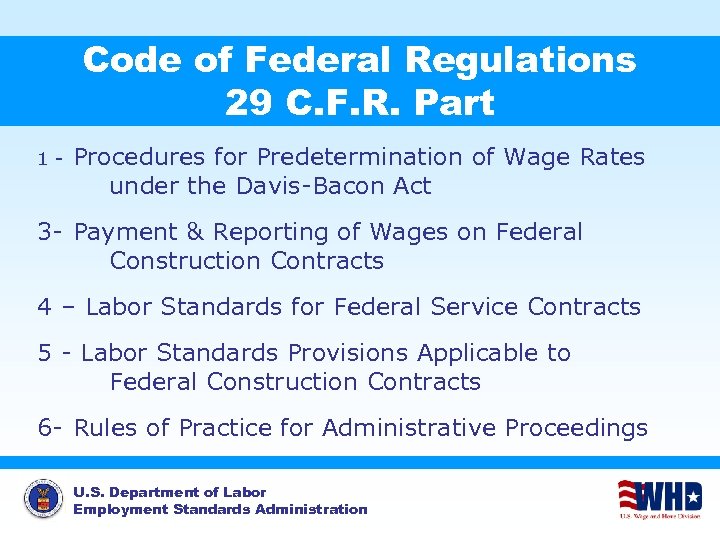

Code of Federal Regulations 29 C. F. R. Part 1 - Procedures for Predetermination of Wage Rates under the Davis-Bacon Act 3 - Payment & Reporting of Wages on Federal Construction Contracts 4 – Labor Standards for Federal Service Contracts 5 - Labor Standards Provisions Applicable to Federal Construction Contracts 6 - Rules of Practice for Administrative Proceedings U. S. Department of Labor Employment Standards Administration

Code of Federal Regulations 29 C. F. R. Part 1 - Procedures for Predetermination of Wage Rates under the Davis-Bacon Act 3 - Payment & Reporting of Wages on Federal Construction Contracts 4 – Labor Standards for Federal Service Contracts 5 - Labor Standards Provisions Applicable to Federal Construction Contracts 6 - Rules of Practice for Administrative Proceedings U. S. Department of Labor Employment Standards Administration

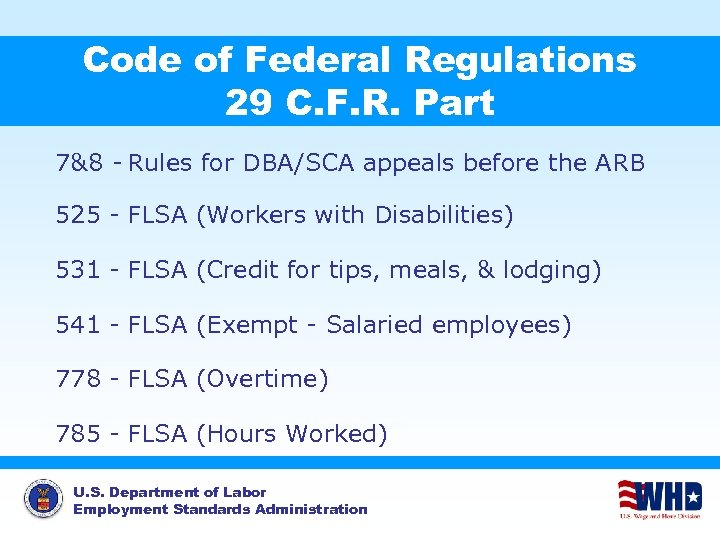

Code of Federal Regulations 29 C. F. R. Part 7&8 - Rules for DBA/SCA appeals before the ARB 525 - FLSA (Workers with Disabilities) 531 - FLSA (Credit for tips, meals, & lodging) 541 - FLSA (Exempt - Salaried employees) 778 - FLSA (Overtime) 785 - FLSA (Hours Worked) U. S. Department of Labor Employment Standards Administration

Code of Federal Regulations 29 C. F. R. Part 7&8 - Rules for DBA/SCA appeals before the ARB 525 - FLSA (Workers with Disabilities) 531 - FLSA (Credit for tips, meals, & lodging) 541 - FLSA (Exempt - Salaried employees) 778 - FLSA (Overtime) 785 - FLSA (Hours Worked) U. S. Department of Labor Employment Standards Administration

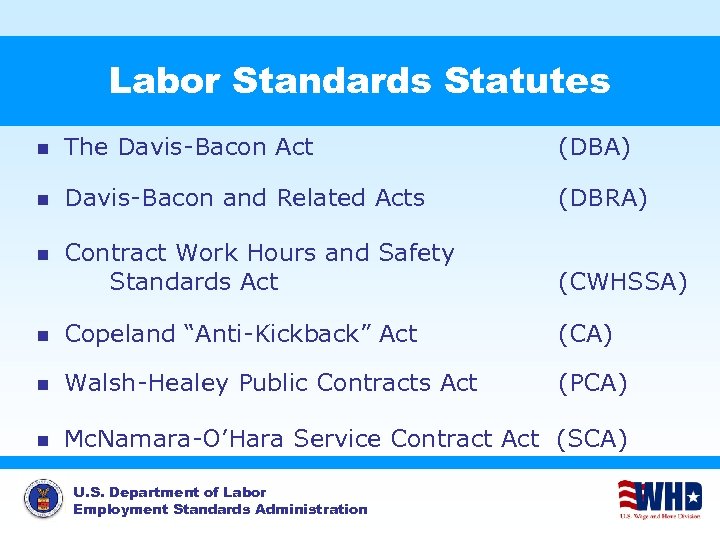

Labor Standards Statutes n The Davis-Bacon Act (DBA) n Davis-Bacon and Related Acts (DBRA) n Contract Work Hours and Safety Standards Act (CWHSSA) n Copeland “Anti-Kickback” Act (CA) n Walsh-Healey Public Contracts Act (PCA) n Mc. Namara-O’Hara Service Contract Act (SCA) U. S. Department of Labor Employment Standards Administration

Labor Standards Statutes n The Davis-Bacon Act (DBA) n Davis-Bacon and Related Acts (DBRA) n Contract Work Hours and Safety Standards Act (CWHSSA) n Copeland “Anti-Kickback” Act (CA) n Walsh-Healey Public Contracts Act (PCA) n Mc. Namara-O’Hara Service Contract Act (SCA) U. S. Department of Labor Employment Standards Administration

Three Major Statutes n Services - SCA (41 U. S. C. §§ 351 -358) n Construction - DBA (40 U. S. C. §§ 3141 -3144 and 3146 -3148) & DBRA n Supplies - PCA (41 U. S. C. §§ 35 -45) n All have a prevailing wage concept U. S. Department of Labor Employment Standards Administration

Three Major Statutes n Services - SCA (41 U. S. C. §§ 351 -358) n Construction - DBA (40 U. S. C. §§ 3141 -3144 and 3146 -3148) & DBRA n Supplies - PCA (41 U. S. C. §§ 35 -45) n All have a prevailing wage concept U. S. Department of Labor Employment Standards Administration

Three Major Statutes (Cont’d. ) n Similar Underlying Purposes Ø Ø Wage Protection to Employees Bidders on Federal and Federally assisted contracts placed on equal competitive basis with regard to labor costs U. S. Department of Labor Employment Standards Administration

Three Major Statutes (Cont’d. ) n Similar Underlying Purposes Ø Ø Wage Protection to Employees Bidders on Federal and Federally assisted contracts placed on equal competitive basis with regard to labor costs U. S. Department of Labor Employment Standards Administration

Three Major Statutes (Cont’d. ) n n n Application limited to Federal contractors & some Federally-Assisted construction contractors Labor Standards requirements included in contract Wage Rates specified by contract U. S. Department of Labor Employment Standards Administration

Three Major Statutes (Cont’d. ) n n n Application limited to Federal contractors & some Federally-Assisted construction contractors Labor Standards requirements included in contract Wage Rates specified by contract U. S. Department of Labor Employment Standards Administration

Mc. Namara-O’Hara Service Contract Act (SCA) U. S. Department of Labor Employment Standards Administration

Mc. Namara-O’Hara Service Contract Act (SCA) U. S. Department of Labor Employment Standards Administration

Requirements of SCA (29 C. F. R. § 4. 6) n Contracts in excess of $2, 500 must contain labor standards clauses and: Ø Ø Minimum monetary wages and fringe benefits determined by Department of Labor (DOL) Record keeping - Posting requirements Safety and health provisions Statement of rates paid to Federal employees U. S. Department of Labor Employment Standards Administration

Requirements of SCA (29 C. F. R. § 4. 6) n Contracts in excess of $2, 500 must contain labor standards clauses and: Ø Ø Minimum monetary wages and fringe benefits determined by Department of Labor (DOL) Record keeping - Posting requirements Safety and health provisions Statement of rates paid to Federal employees U. S. Department of Labor Employment Standards Administration

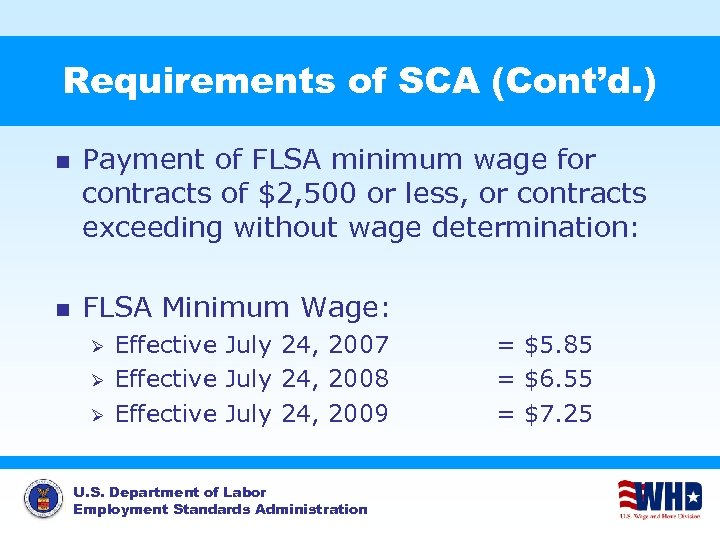

Requirements of SCA (Cont’d. ) n n Payment of FLSA minimum wage for contracts of $2, 500 or less, or contracts exceeding without wage determination: FLSA Minimum Wage: Ø Ø Ø Effective July 24, 2007 Effective July 24, 2008 Effective July 24, 2009 U. S. Department of Labor Employment Standards Administration = $5. 85 = $6. 55 = $7. 25

Requirements of SCA (Cont’d. ) n n Payment of FLSA minimum wage for contracts of $2, 500 or less, or contracts exceeding without wage determination: FLSA Minimum Wage: Ø Ø Ø Effective July 24, 2007 Effective July 24, 2008 Effective July 24, 2009 U. S. Department of Labor Employment Standards Administration = $5. 85 = $6. 55 = $7. 25

Elements of SCA Coverage (29 C. F. R. §§ 4. 107, 4. 108 & 4. 110) n Contracts entered into by U. S. Government and District of Columbia n Contracts principally for services n Contracts performed in the U. S. n Contracts performed through the use of service employees U. S. Department of Labor Employment Standards Administration

Elements of SCA Coverage (29 C. F. R. §§ 4. 107, 4. 108 & 4. 110) n Contracts entered into by U. S. Government and District of Columbia n Contracts principally for services n Contracts performed in the U. S. n Contracts performed through the use of service employees U. S. Department of Labor Employment Standards Administration

Contracts to Furnish Services (29 C. F. R. §§ 4. 111 & 4. 130) n Examples of service contracts: Ø Security and guard services Ø Janitorial services Ø Cafeteria and food services Ø Support services at Government installations U. S. Department of Labor Employment Standards Administration

Contracts to Furnish Services (29 C. F. R. §§ 4. 111 & 4. 130) n Examples of service contracts: Ø Security and guard services Ø Janitorial services Ø Cafeteria and food services Ø Support services at Government installations U. S. Department of Labor Employment Standards Administration

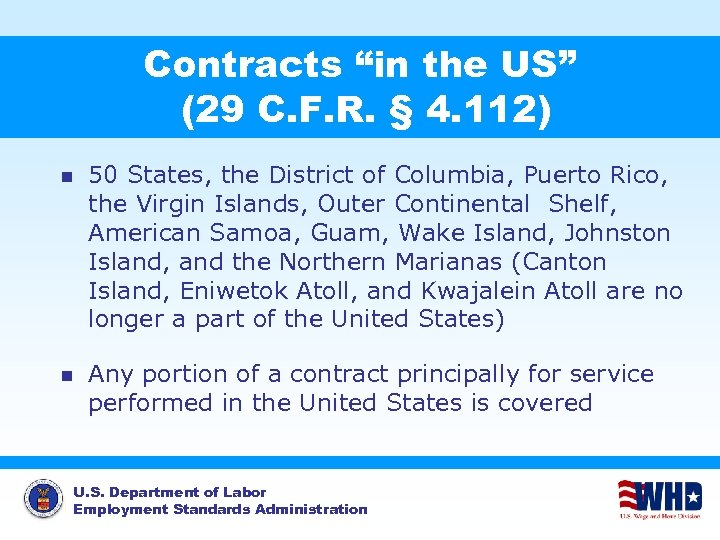

Contracts “in the US” (29 C. F. R. § 4. 112) n 50 States, the District of Columbia, Puerto Rico, the Virgin Islands, Outer Continental Shelf, American Samoa, Guam, Wake Island, Johnston Island, and the Northern Marianas (Canton Island, Eniwetok Atoll, and Kwajalein Atoll are no longer a part of the United States) n Any portion of a contract principally for service performed in the United States is covered U. S. Department of Labor Employment Standards Administration

Contracts “in the US” (29 C. F. R. § 4. 112) n 50 States, the District of Columbia, Puerto Rico, the Virgin Islands, Outer Continental Shelf, American Samoa, Guam, Wake Island, Johnston Island, and the Northern Marianas (Canton Island, Eniwetok Atoll, and Kwajalein Atoll are no longer a part of the United States) n Any portion of a contract principally for service performed in the United States is covered U. S. Department of Labor Employment Standards Administration

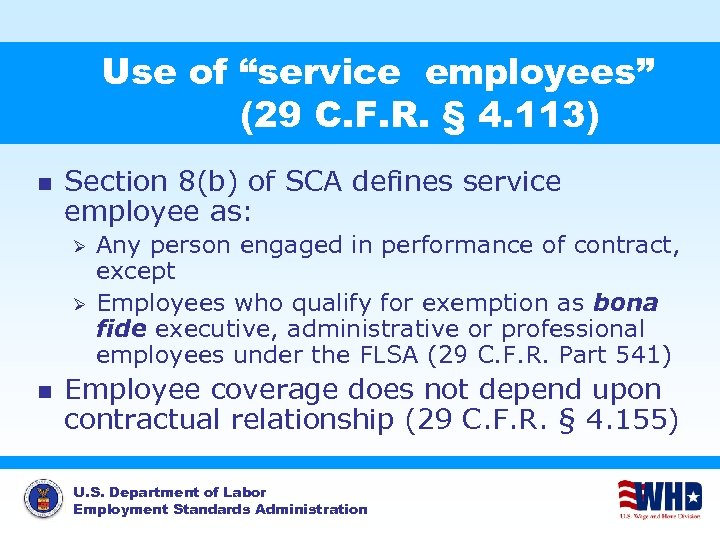

Use of “service employees” (29 C. F. R. § 4. 113) n Section 8(b) of SCA defines service employee as: Ø Ø n Any person engaged in performance of contract, except Employees who qualify for exemption as bona fide executive, administrative or professional employees under the FLSA (29 C. F. R. Part 541) Employee coverage does not depend upon contractual relationship (29 C. F. R. § 4. 155) U. S. Department of Labor Employment Standards Administration

Use of “service employees” (29 C. F. R. § 4. 113) n Section 8(b) of SCA defines service employee as: Ø Ø n Any person engaged in performance of contract, except Employees who qualify for exemption as bona fide executive, administrative or professional employees under the FLSA (29 C. F. R. Part 541) Employee coverage does not depend upon contractual relationship (29 C. F. R. § 4. 155) U. S. Department of Labor Employment Standards Administration

Contracts Not SCA Covered (29 C. F. R. § 4. 134) • Contracts primarily for something other than services, e. g. , construction • Contracts for leasing of space • Contracts for professional services • Federally-assisted contracts for services entered into by State governments, e. g. , Medicaid and Medicare programs U. S. Department of Labor Employment Standards Administration

Contracts Not SCA Covered (29 C. F. R. § 4. 134) • Contracts primarily for something other than services, e. g. , construction • Contracts for leasing of space • Contracts for professional services • Federally-assisted contracts for services entered into by State governments, e. g. , Medicaid and Medicare programs U. S. Department of Labor Employment Standards Administration

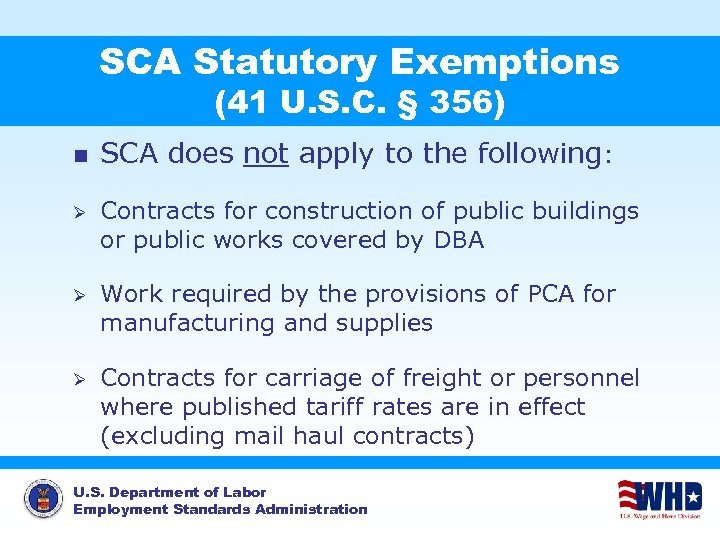

SCA Statutory Exemptions (41 U. S. C. § 356) n SCA does not apply to the following: Ø Contracts for construction of public buildings or public works covered by DBA Ø Work required by the provisions of PCA for manufacturing and supplies Ø Contracts for carriage of freight or personnel where published tariff rates are in effect (excluding mail haul contracts) U. S. Department of Labor Employment Standards Administration

SCA Statutory Exemptions (41 U. S. C. § 356) n SCA does not apply to the following: Ø Contracts for construction of public buildings or public works covered by DBA Ø Work required by the provisions of PCA for manufacturing and supplies Ø Contracts for carriage of freight or personnel where published tariff rates are in effect (excluding mail haul contracts) U. S. Department of Labor Employment Standards Administration

SCA Statutory Exemptions (Cont’d. ) Ø Contracts for services of communications companies (e. g. , radio, telephone) subject to the Communications Act of 1934 Ø Contracts for public utility services, including electric light and power, water, steam, and gas Ø Employment contracts providing for direct services to a Federal agency by individuals Ø Contracts with the U. S. Postal Service for operation of postal contract stations U. S. Department of Labor Employment Standards Administration

SCA Statutory Exemptions (Cont’d. ) Ø Contracts for services of communications companies (e. g. , radio, telephone) subject to the Communications Act of 1934 Ø Contracts for public utility services, including electric light and power, water, steam, and gas Ø Employment contracts providing for direct services to a Federal agency by individuals Ø Contracts with the U. S. Postal Service for operation of postal contract stations U. S. Department of Labor Employment Standards Administration

Authority to Grant Exemptions (41 U. S. C. § 353(b)(3)) n Standard Ø Necessary and proper in the public interest or to avoid serious impairment of government business; and Ø In accord with remedial purpose to protect prevailing labor standards U. S. Department of Labor Employment Standards Administration

Authority to Grant Exemptions (41 U. S. C. § 353(b)(3)) n Standard Ø Necessary and proper in the public interest or to avoid serious impairment of government business; and Ø In accord with remedial purpose to protect prevailing labor standards U. S. Department of Labor Employment Standards Administration

Regulatory Exemptions (29 C. F. R. §§ 4. 123(d)-(e)) n SCA does not apply to the following: Ø Postal Service contracts with common carriers Ø Postal Service mail contracts with owneroperators (i. e. , individuals, not partnerships) Ø Certain items for “commercial services” U. S. Department of Labor Employment Standards Administration

Regulatory Exemptions (29 C. F. R. §§ 4. 123(d)-(e)) n SCA does not apply to the following: Ø Postal Service contracts with common carriers Ø Postal Service mail contracts with owneroperators (i. e. , individuals, not partnerships) Ø Certain items for “commercial services” U. S. Department of Labor Employment Standards Administration

“Commercial Services” (29 C. F. R. § 4. 123(e)(1)) Ø Contracts and subcontracts for maintenance, calibration, and repair of: üADP & office information/word processing systems üScientific & medical apparatus or equipment where the application of microelectronic circuitry or other technology of at least similar sophistication üOffice/business machines where services performed by supplier or manufacturer U. S. Department of Labor Employment Standards Administration

“Commercial Services” (29 C. F. R. § 4. 123(e)(1)) Ø Contracts and subcontracts for maintenance, calibration, and repair of: üADP & office information/word processing systems üScientific & medical apparatus or equipment where the application of microelectronic circuitry or other technology of at least similar sophistication üOffice/business machines where services performed by supplier or manufacturer U. S. Department of Labor Employment Standards Administration

“Commercial Services” (29 C. F. R. § 4. 123(e)(2)) For the following seven services: n Maintenance and servicing of motorized vehicles owned by Federal agencies n Issuance and servicing of credit, debit, or similar cards by Federal employees n Lodging, meals, and space in hotels/motels for conferences U. S. Department of Labor Employment Standards Administration

“Commercial Services” (29 C. F. R. § 4. 123(e)(2)) For the following seven services: n Maintenance and servicing of motorized vehicles owned by Federal agencies n Issuance and servicing of credit, debit, or similar cards by Federal employees n Lodging, meals, and space in hotels/motels for conferences U. S. Department of Labor Employment Standards Administration

“Commercial Services” (Cont’d) n Real estate services n Transportation on regularly scheduled routes n Relocation services n Maintenance services for all types of equipment obtained from manufacturer or supplier under a “sole source” contract U. S. Department of Labor Employment Standards Administration

“Commercial Services” (Cont’d) n Real estate services n Transportation on regularly scheduled routes n Relocation services n Maintenance services for all types of equipment obtained from manufacturer or supplier under a “sole source” contract U. S. Department of Labor Employment Standards Administration

“Commercial Services” Criteria to Apply Exemption n Services offered and sold regularly Contract awarded on “sole source basis” or on basis of factors in addition to price Services furnished at “market” or “catalog” prices U. S. Department of Labor Employment Standards Administration

“Commercial Services” Criteria to Apply Exemption n Services offered and sold regularly Contract awarded on “sole source basis” or on basis of factors in addition to price Services furnished at “market” or “catalog” prices U. S. Department of Labor Employment Standards Administration

“Commercial Services” Criteria (Cont’d. ) Employee spends small portion of available hours servicing government contract n Employee receives same compensation plan n n Contracting officer and prime contractor certify that criteria can be met and complied with U. S. Department of Labor Employment Standards Administration

“Commercial Services” Criteria (Cont’d. ) Employee spends small portion of available hours servicing government contract n Employee receives same compensation plan n n Contracting officer and prime contractor certify that criteria can be met and complied with U. S. Department of Labor Employment Standards Administration

Coverage Determination SCA/DBA/PCA n n n Contracting agency has initial responsibility for determining coverage DOL has authority for final determination on coverage Final rulings may be appealed to the Administrative Review Board (ARB) U. S. Department of Labor Employment Standards Administration

Coverage Determination SCA/DBA/PCA n n n Contracting agency has initial responsibility for determining coverage DOL has authority for final determination on coverage Final rulings may be appealed to the Administrative Review Board (ARB) U. S. Department of Labor Employment Standards Administration

Introduction to SCA Wage Determinations U. S. Department of Labor Employment Standards Administration

Introduction to SCA Wage Determinations U. S. Department of Labor Employment Standards Administration

Basic Statutory Requirement Sections 2(a)(1) and (2) of SCA provide that covered contracts in excess of $2, 500 contain a wage determination Ø 2(a)(1) – Wages Ø 2(a)(2) – Fringe Benefits U. S. Department of Labor Employment Standards Administration

Basic Statutory Requirement Sections 2(a)(1) and (2) of SCA provide that covered contracts in excess of $2, 500 contain a wage determination Ø 2(a)(1) – Wages Ø 2(a)(2) – Fringe Benefits U. S. Department of Labor Employment Standards Administration

Two Types of Wage Determinations • Prevailing – includes union dominance wage determinations • 4(c) – based on the previous contractors collective bargaining agreement (CBA). U. S. Department of Labor Employment Standards Administration

Two Types of Wage Determinations • Prevailing – includes union dominance wage determinations • 4(c) – based on the previous contractors collective bargaining agreement (CBA). U. S. Department of Labor Employment Standards Administration

Applying Wage Determinations (29 C. F. R. §§ 4. 143 – 4. 145) • Agencies must obtain new WD at least once every two years • New WD may be required each year if: Ø Contract subject to annual appropriations Ø Annual contract option being exercised • Most contract extensions, even if shorter than one year, require a new WD U. S. Department of Labor Employment Standards Administration

Applying Wage Determinations (29 C. F. R. §§ 4. 143 – 4. 145) • Agencies must obtain new WD at least once every two years • New WD may be required each year if: Ø Contract subject to annual appropriations Ø Annual contract option being exercised • Most contract extensions, even if shorter than one year, require a new WD U. S. Department of Labor Employment Standards Administration

Obtaining an SCA WD (29 C. F. R. § 4. 4) • Regulations no longer require Agencies to submit Standard Form (SF-98) or an Electronic (e) 98 • Agencies have option to download WD directly from website, or submitting an e 98 to DOL, at www. wdol. gov • Other approaches no longer utilized include the Blanket WD program, MOUs with agencies, and Paper Standard Form (SF)-98 and 98 a U. S. Department of Labor Employment Standards Administration

Obtaining an SCA WD (29 C. F. R. § 4. 4) • Regulations no longer require Agencies to submit Standard Form (SF-98) or an Electronic (e) 98 • Agencies have option to download WD directly from website, or submitting an e 98 to DOL, at www. wdol. gov • Other approaches no longer utilized include the Blanket WD program, MOUs with agencies, and Paper Standard Form (SF)-98 and 98 a U. S. Department of Labor Employment Standards Administration

WDOL. GOV Provides access to: Ø SCA Wage Determinations (WDs) Ø Davis-Bacon Act (DBA) Wage Decisions Ø Archived SCA and DBA WDs U. S. Department of Labor Employment Standards Administration

WDOL. GOV Provides access to: Ø SCA Wage Determinations (WDs) Ø Davis-Bacon Act (DBA) Wage Decisions Ø Archived SCA and DBA WDs U. S. Department of Labor Employment Standards Administration

WDOL. GOV Access (Cont’d. ) Ø 5 th Edition of the Service Contract Directory of Occupations Ø e 98 Ø Agency Labor Advisors Ø DOL and FAR regulation cites Ø Users guide Ø AAMs U. S. Department of Labor Employment Standards Administration

WDOL. GOV Access (Cont’d. ) Ø 5 th Edition of the Service Contract Directory of Occupations Ø e 98 Ø Agency Labor Advisors Ø DOL and FAR regulation cites Ø Users guide Ø AAMs U. S. Department of Labor Employment Standards Administration

WDOL. GOV Ø The system is menu driven Ø Reduces WD processing time Ø Ensures consistent application of labor standards Ø Provides an “alert” service to notify users of the latest update U. S. Department of Labor Employment Standards Administration

WDOL. GOV Ø The system is menu driven Ø Reduces WD processing time Ø Ensures consistent application of labor standards Ø Provides an “alert” service to notify users of the latest update U. S. Department of Labor Employment Standards Administration

SCA Prevailing Wage Determinations U. S. Department of Labor Employment Standards Administration

SCA Prevailing Wage Determinations U. S. Department of Labor Employment Standards Administration

Basis for Prevailing WDs • The best available data – usually Bureau of Labor Statistics (BLS) surveys. • WDs may also be based on: Ø Non-appropriated Fund (NAF) surveys Ø Wage Board surveys and rates Ø GS locality pay schedules U. S. Department of Labor Employment Standards Administration

Basis for Prevailing WDs • The best available data – usually Bureau of Labor Statistics (BLS) surveys. • WDs may also be based on: Ø Non-appropriated Fund (NAF) surveys Ø Wage Board surveys and rates Ø GS locality pay schedules U. S. Department of Labor Employment Standards Administration

Locality Basis of WDs • Locality has an elastic and variable meaning under SCA • Most WDs are based on data for a MSA or group of MSAs • CMSA vs. PMSA data • Regionwide and Nationwide WDs U. S. Department of Labor Employment Standards Administration

Locality Basis of WDs • Locality has an elastic and variable meaning under SCA • Most WDs are based on data for a MSA or group of MSAs • CMSA vs. PMSA data • Regionwide and Nationwide WDs U. S. Department of Labor Employment Standards Administration

Consolidated (Standard) Prevailing WDs • 2005 -2000 or 2005 -3000 WD numbers • Wage rates for approximately 400 occupations grouped by several broad occupational categories • Based primarily on BLS cross-industry survey data • Occupations are defined in the SCA Directory of Occupations U. S. Department of Labor Employment Standards Administration

Consolidated (Standard) Prevailing WDs • 2005 -2000 or 2005 -3000 WD numbers • Wage rates for approximately 400 occupations grouped by several broad occupational categories • Based primarily on BLS cross-industry survey data • Occupations are defined in the SCA Directory of Occupations U. S. Department of Labor Employment Standards Administration

SCA Directory of Occupations • Contains standard position descriptions for most SCA occupations listed on prevailing WDs • Contains Federal Grade equivalencies • If WD occupation is not listed in the Directory, the position description may be included on WD U. S. Department of Labor Employment Standards Administration

SCA Directory of Occupations • Contains standard position descriptions for most SCA occupations listed on prevailing WDs • Contains Federal Grade equivalencies • If WD occupation is not listed in the Directory, the position description may be included on WD U. S. Department of Labor Employment Standards Administration

Non-Standard Prevailing WDs • Usually based on different data sources • Data sources may be industry specific • Often cover broader geographic areas • May or may not cover occupations listed in SCA Directory of Occupations U. S. Department of Labor Employment Standards Administration

Non-Standard Prevailing WDs • Usually based on different data sources • Data sources may be industry specific • Often cover broader geographic areas • May or may not cover occupations listed in SCA Directory of Occupations U. S. Department of Labor Employment Standards Administration

Examples of Non-Standard WDs • • Union Dominance Food & Lodging Halfway House Nursing Home Moving & Storage Fast Food Forestry • • U. S. Department of Labor Employment Standards Administration Forest Firefighting Elevator Maintenance Maritime Mail hauling Debt Collection Barber & Beautician Diving services

Examples of Non-Standard WDs • • Union Dominance Food & Lodging Halfway House Nursing Home Moving & Storage Fast Food Forestry • • U. S. Department of Labor Employment Standards Administration Forest Firefighting Elevator Maintenance Maritime Mail hauling Debt Collection Barber & Beautician Diving services

Fringe Benefits (Most Prevailing WDs) • Health & Welfare (H&W) Benefits: Ø 1996 Rulemaking -- Variance to permit nationwide benefits Ø Updated every June 1 Ø Based on: üBLS Employer Costs for Employee Compensation üUse data for all workers in Private Industry U. S. Department of Labor Employment Standards Administration

Fringe Benefits (Most Prevailing WDs) • Health & Welfare (H&W) Benefits: Ø 1996 Rulemaking -- Variance to permit nationwide benefits Ø Updated every June 1 Ø Based on: üBLS Employer Costs for Employee Compensation üUse data for all workers in Private Industry U. S. Department of Labor Employment Standards Administration

Fringe Benefits (Cont’d. ) ØH&W rate is the total üOf all benefits not legally required, üExcept vacation & holiday ØH&W rate - two different methods of compliance ü“Fixed cost” per employee ü“Average cost” ü(Discussed in Compliance Principles session) U. S. Department of Labor Employment Standards Administration

Fringe Benefits (Cont’d. ) ØH&W rate is the total üOf all benefits not legally required, üExcept vacation & holiday ØH&W rate - two different methods of compliance ü“Fixed cost” per employee ü“Average cost” ü(Discussed in Compliance Principles session) U. S. Department of Labor Employment Standards Administration

Other Fringe Benefits (Most Prevailing WDs • Vacation pay • Holiday pay U. S. Department of Labor Employment Standards Administration

Other Fringe Benefits (Most Prevailing WDs • Vacation pay • Holiday pay U. S. Department of Labor Employment Standards Administration

Review and Reconsideration of Prevailing WDs • Must be timely submitted Ø Prior to the Opening of Bids for an IFB Ø No later than 10 days before üCommencement of a negotiated contract üExercise of contract option, or üExtension • Administrator within 30 days will render decision or notify that more time is needed U. S. Department of Labor Employment Standards Administration

Review and Reconsideration of Prevailing WDs • Must be timely submitted Ø Prior to the Opening of Bids for an IFB Ø No later than 10 days before üCommencement of a negotiated contract üExercise of contract option, or üExtension • Administrator within 30 days will render decision or notify that more time is needed U. S. Department of Labor Employment Standards Administration

SCA Section 4(c) Wage Determinations U. S. Department of Labor Employment Standards Administration

SCA Section 4(c) Wage Determinations U. S. Department of Labor Employment Standards Administration

Section 4(c) WDS Incumbent CBA • Part of 1972 Amendments to SCA • Statutory requirement • Does not depend on issuance of WD Ø Short-form WD should be issued Ø Based on incumbent CBA Ø Includes accrued, as well as prospective, wages and fringe benefits • A contractor may be its own successor U. S. Department of Labor Employment Standards Administration

Section 4(c) WDS Incumbent CBA • Part of 1972 Amendments to SCA • Statutory requirement • Does not depend on issuance of WD Ø Short-form WD should be issued Ø Based on incumbent CBA Ø Includes accrued, as well as prospective, wages and fringe benefits • A contractor may be its own successor U. S. Department of Labor Employment Standards Administration

Application • The CBA must be applicable to work performed on the predecessor contract in order to have application to the successor contract • The successor contract must be for substantially the same services being provided in the same contract locations U. S. Department of Labor Employment Standards Administration

Application • The CBA must be applicable to work performed on the predecessor contract in order to have application to the successor contract • The successor contract must be for substantially the same services being provided in the same contract locations U. S. Department of Labor Employment Standards Administration

Provisions • Successor contractor must pay CBA rates Ø whether or not predecessor’s employees are hired Ø whether or not signatory to CBA • Obligations of Section 4(c) are selfexecuting • Interpretation of CBA is based on intent of parties signatory to CBA U. S. Department of Labor Employment Standards Administration

Provisions • Successor contractor must pay CBA rates Ø whether or not predecessor’s employees are hired Ø whether or not signatory to CBA • Obligations of Section 4(c) are selfexecuting • Interpretation of CBA is based on intent of parties signatory to CBA U. S. Department of Labor Employment Standards Administration

Limitations of Section 4(c) does not extend to other items of the CBA such as: ØSeniority ØGrievance procedures ØWork rules ØOvertime U. S. Department of Labor Employment Standards Administration

Limitations of Section 4(c) does not extend to other items of the CBA such as: ØSeniority ØGrievance procedures ØWork rules ØOvertime U. S. Department of Labor Employment Standards Administration

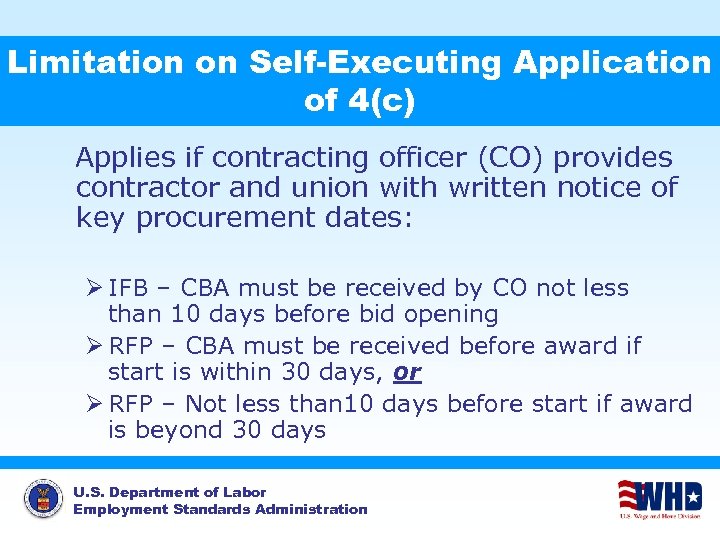

Limitation on Self-Executing Application of 4(c) Applies if contracting officer (CO) provides contractor and union with written notice of key procurement dates: Ø IFB – CBA must be received by CO not less than 10 days before bid opening Ø RFP – CBA must be received before award if start is within 30 days, or Ø RFP – Not less than 10 days before start if award is beyond 30 days U. S. Department of Labor Employment Standards Administration

Limitation on Self-Executing Application of 4(c) Applies if contracting officer (CO) provides contractor and union with written notice of key procurement dates: Ø IFB – CBA must be received by CO not less than 10 days before bid opening Ø RFP – CBA must be received before award if start is within 30 days, or Ø RFP – Not less than 10 days before start if award is beyond 30 days U. S. Department of Labor Employment Standards Administration

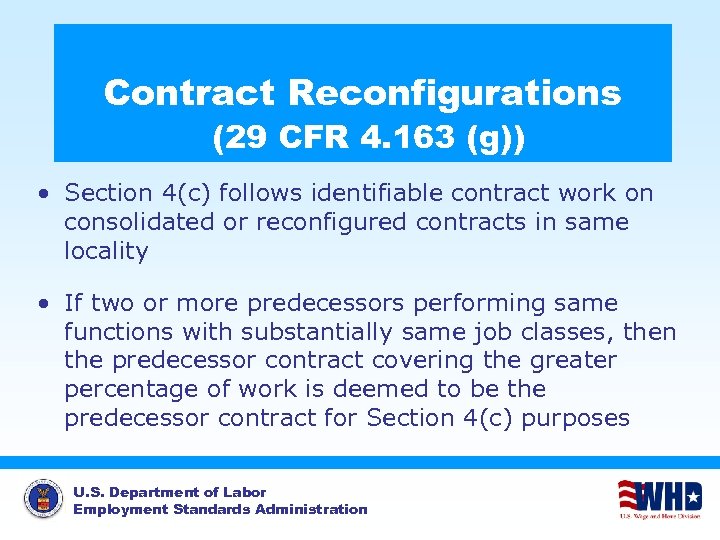

Contract Reconfigurations (29 CFR 4. 163 (g)) • Section 4(c) follows identifiable contract work on consolidated or reconfigured contracts in same locality • If two or more predecessors performing same functions with substantially same job classes, then the predecessor contract covering the greater percentage of work is deemed to be the predecessor contract for Section 4(c) purposes U. S. Department of Labor Employment Standards Administration

Contract Reconfigurations (29 CFR 4. 163 (g)) • Section 4(c) follows identifiable contract work on consolidated or reconfigured contracts in same locality • If two or more predecessors performing same functions with substantially same job classes, then the predecessor contract covering the greater percentage of work is deemed to be the predecessor contract for Section 4(c) purposes U. S. Department of Labor Employment Standards Administration

Reconfigured Contract – Awarded to Larger Contract • ABC Co. P Contract 1 – Cleaning P Class – Janitors P No. of Workers = 15 P Value of Contract = $500, 000 P WD – Prevailing U. S. Department of Labor Employment Standards Administration • XYZ Co. P Contract 2 – Cleaning P Class – Janitors P No. of Workers = 20 P Value of Contract = $750, 000 P WD – § 4(c) CBA with JWC Union

Reconfigured Contract – Awarded to Larger Contract • ABC Co. P Contract 1 – Cleaning P Class – Janitors P No. of Workers = 15 P Value of Contract = $500, 000 P WD – Prevailing U. S. Department of Labor Employment Standards Administration • XYZ Co. P Contract 2 – Cleaning P Class – Janitors P No. of Workers = 20 P Value of Contract = $750, 000 P WD – § 4(c) CBA with JWC Union

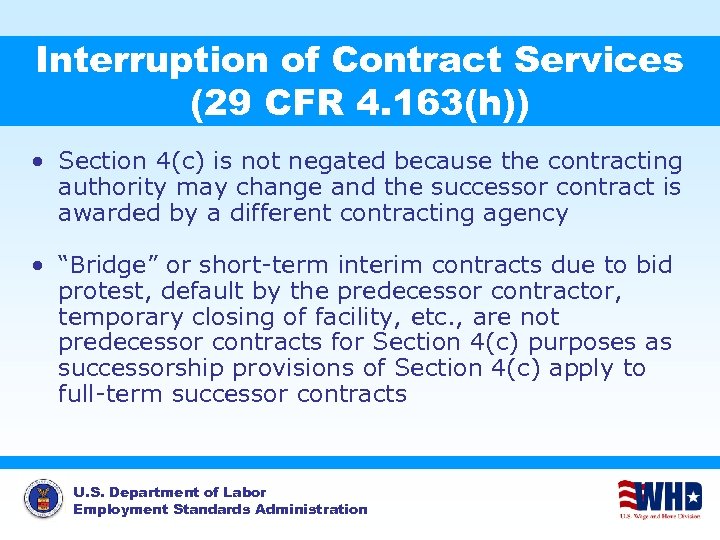

Interruption of Contract Services (29 CFR 4. 163(h)) • Section 4(c) is not negated because the contracting authority may change and the successor contract is awarded by a different contracting agency • “Bridge” or short-term interim contracts due to bid protest, default by the predecessor contractor, temporary closing of facility, etc. , are not predecessor contracts for Section 4(c) purposes as successorship provisions of Section 4(c) apply to full-term successor contracts U. S. Department of Labor Employment Standards Administration

Interruption of Contract Services (29 CFR 4. 163(h)) • Section 4(c) is not negated because the contracting authority may change and the successor contract is awarded by a different contracting agency • “Bridge” or short-term interim contracts due to bid protest, default by the predecessor contractor, temporary closing of facility, etc. , are not predecessor contracts for Section 4(c) purposes as successorship provisions of Section 4(c) apply to full-term successor contracts U. S. Department of Labor Employment Standards Administration

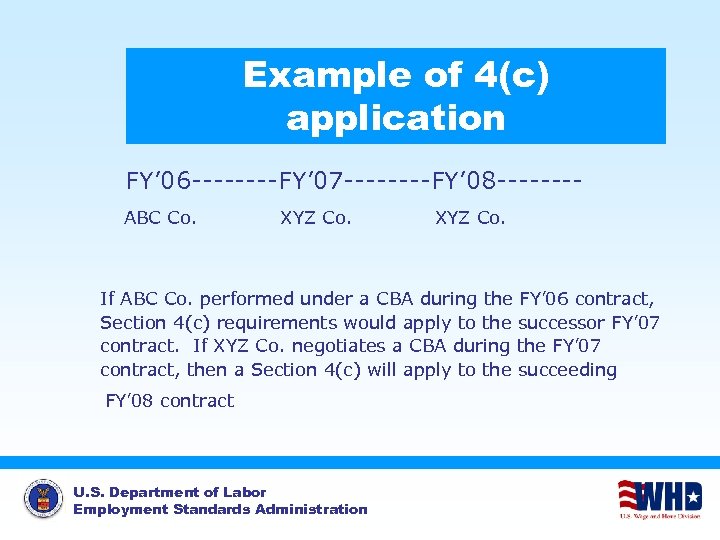

Example of 4(c) application FY’ 06 ----FY’ 07 ----FY’ 08 -------ABC Co. XYZ Co. If ABC Co. performed under a CBA during the FY’ 06 contract, Section 4(c) requirements would apply to the successor FY’ 07 contract. If XYZ Co. negotiates a CBA during the FY’ 07 contract, then a Section 4(c) will apply to the succeeding FY’ 08 contract U. S. Department of Labor Employment Standards Administration

Example of 4(c) application FY’ 06 ----FY’ 07 ----FY’ 08 -------ABC Co. XYZ Co. If ABC Co. performed under a CBA during the FY’ 06 contract, Section 4(c) requirements would apply to the successor FY’ 07 contract. If XYZ Co. negotiates a CBA during the FY’ 07 contract, then a Section 4(c) will apply to the succeeding FY’ 08 contract U. S. Department of Labor Employment Standards Administration

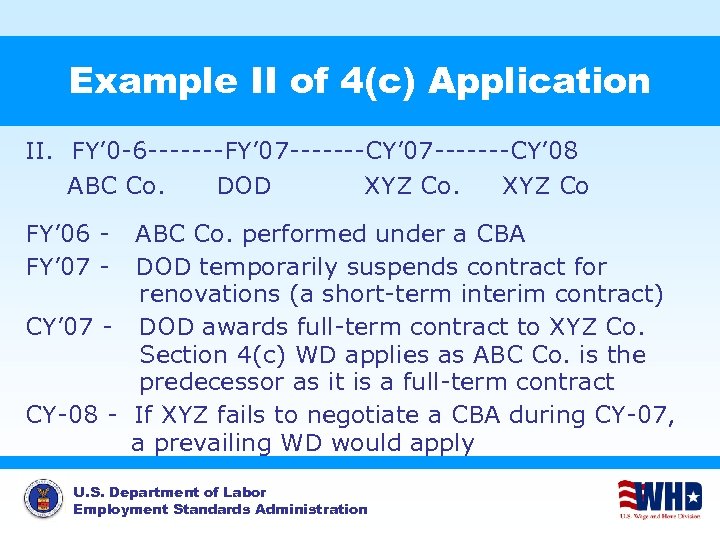

Example II of 4(c) Application II. FY’ 0 -6 -------FY’ 07 -------CY’ 08 ABC Co. DOD XYZ Co FY’ 06 FY’ 07 - ABC Co. performed under a CBA DOD temporarily suspends contract for renovations (a short-term interim contract) CY’ 07 - DOD awards full-term contract to XYZ Co. Section 4(c) WD applies as ABC Co. is the predecessor as it is a full-term contract CY-08 - If XYZ fails to negotiate a CBA during CY-07, a prevailing WD would apply U. S. Department of Labor Employment Standards Administration

Example II of 4(c) Application II. FY’ 0 -6 -------FY’ 07 -------CY’ 08 ABC Co. DOD XYZ Co FY’ 06 FY’ 07 - ABC Co. performed under a CBA DOD temporarily suspends contract for renovations (a short-term interim contract) CY’ 07 - DOD awards full-term contract to XYZ Co. Section 4(c) WD applies as ABC Co. is the predecessor as it is a full-term contract CY-08 - If XYZ fails to negotiate a CBA during CY-07, a prevailing WD would apply U. S. Department of Labor Employment Standards Administration

Exception to the Application of Section 4(c) Requirement Successor contractor is statutorily obligated to pay the CBA rates until such time as the CBA is determined to be: Ø “Substantially at variance” with locally prevailing rates (29 C. F. R. § 4. 10), or Ø Not reached as a result of “arm’s-length” negotiations (29 C. F. R. § 4. 11) U. S. Department of Labor Employment Standards Administration

Exception to the Application of Section 4(c) Requirement Successor contractor is statutorily obligated to pay the CBA rates until such time as the CBA is determined to be: Ø “Substantially at variance” with locally prevailing rates (29 C. F. R. § 4. 10), or Ø Not reached as a result of “arm’s-length” negotiations (29 C. F. R. § 4. 11) U. S. Department of Labor Employment Standards Administration

SCA Conformance Procedures SCA Regulations 29 C. F. R. § 4. 6(b)(2) U. S. Department of Labor Employment Standards Administration

SCA Conformance Procedures SCA Regulations 29 C. F. R. § 4. 6(b)(2) U. S. Department of Labor Employment Standards Administration

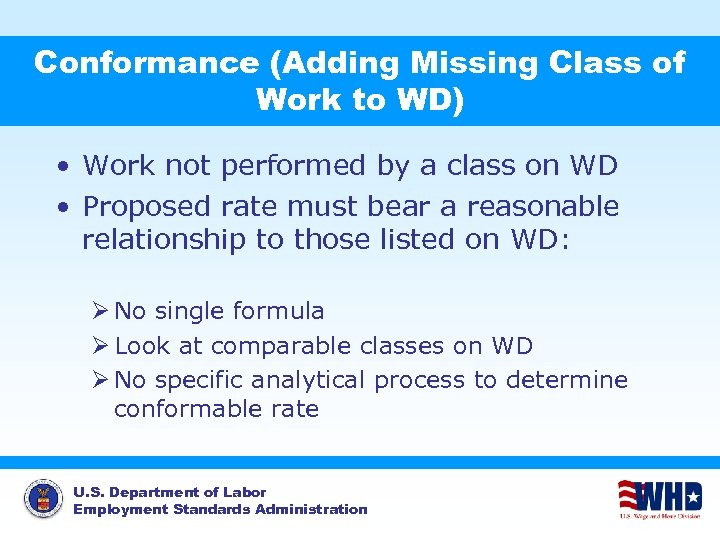

Conformance (Adding Missing Class of Work to WD) • Work not performed by a class on WD • Proposed rate must bear a reasonable relationship to those listed on WD: Ø No single formula Ø Look at comparable classes on WD Ø No specific analytical process to determine conformable rate U. S. Department of Labor Employment Standards Administration

Conformance (Adding Missing Class of Work to WD) • Work not performed by a class on WD • Proposed rate must bear a reasonable relationship to those listed on WD: Ø No single formula Ø Look at comparable classes on WD Ø No specific analytical process to determine conformable rate U. S. Department of Labor Employment Standards Administration

Conformance (Cont’d. ) • Contractor prepares conformance request (SF 1444) or other format: Ø Proposes class of worker and job description Ø Proposes hourly rate and rationale Ø Submits to contracting agency no later than 30 days after employee performance Ø Request form (SF 1444) on WDOL. gov U. S. Department of Labor Employment Standards Administration

Conformance (Cont’d. ) • Contractor prepares conformance request (SF 1444) or other format: Ø Proposes class of worker and job description Ø Proposes hourly rate and rationale Ø Submits to contracting agency no later than 30 days after employee performance Ø Request form (SF 1444) on WDOL. gov U. S. Department of Labor Employment Standards Administration

Conformance (Cont’d. ) • Contracting agency reviews request Ø Makes recommendation Ø Submits to DOL for final action • DOL should respond within 30 days U. S. Department of Labor Employment Standards Administration

Conformance (Cont’d. ) • Contracting agency reviews request Ø Makes recommendation Ø Submits to DOL for final action • DOL should respond within 30 days U. S. Department of Labor Employment Standards Administration

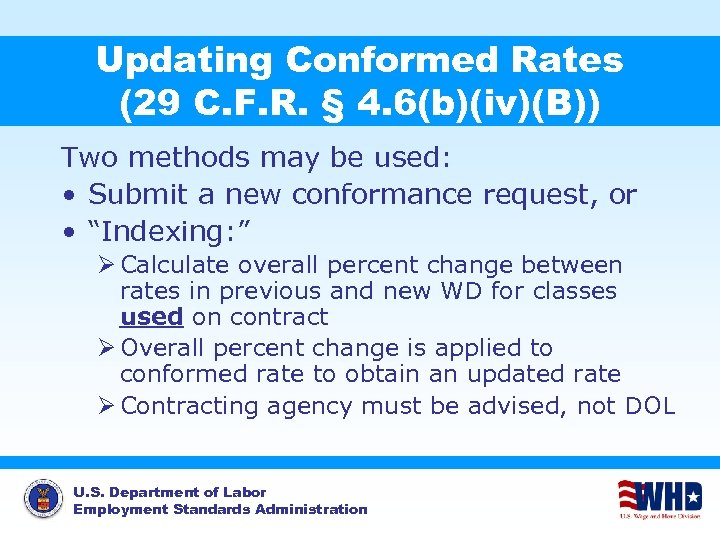

Updating Conformed Rates (29 C. F. R. § 4. 6(b)(iv)(B)) Two methods may be used: • Submit a new conformance request, or • “Indexing: ” Ø Calculate overall percent change between rates in previous and new WD for classes used on contract Ø Overall percent change is applied to conformed rate to obtain an updated rate Ø Contracting agency must be advised, not DOL U. S. Department of Labor Employment Standards Administration

Updating Conformed Rates (29 C. F. R. § 4. 6(b)(iv)(B)) Two methods may be used: • Submit a new conformance request, or • “Indexing: ” Ø Calculate overall percent change between rates in previous and new WD for classes used on contract Ø Overall percent change is applied to conformed rate to obtain an updated rate Ø Contracting agency must be advised, not DOL U. S. Department of Labor Employment Standards Administration

SCA Compliance Principles U. S. Department of Labor Employment Standards Administration

SCA Compliance Principles U. S. Department of Labor Employment Standards Administration

SCA Compliance Principles n n n n Payment of wages and fringe benefits Bona fide Fringe Benefit Plans Health & Welfare Fringe Benefits Paid Vacation Fringe Benefits Paid Holiday Fringe Benefits Equivalent Fringe Benefits Temporary & Part-time employment U. S. Department of Labor Employment Standards Administration

SCA Compliance Principles n n n n Payment of wages and fringe benefits Bona fide Fringe Benefit Plans Health & Welfare Fringe Benefits Paid Vacation Fringe Benefits Paid Holiday Fringe Benefits Equivalent Fringe Benefits Temporary & Part-time employment U. S. Department of Labor Employment Standards Administration

Payment of Wages (29 C. F. R. § 4. 165) Wages established by wage determination, otherwise FLSA minimum wage n Calculated on fixed and regularly recurring workweek of 7 consecutive 24 -hour workday periods n ØPayroll records kept on this basis ØBi-weekly or semi-monthly pay periods if advance notice U. S. Department of Labor Employment Standards Administration

Payment of Wages (29 C. F. R. § 4. 165) Wages established by wage determination, otherwise FLSA minimum wage n Calculated on fixed and regularly recurring workweek of 7 consecutive 24 -hour workday periods n ØPayroll records kept on this basis ØBi-weekly or semi-monthly pay periods if advance notice U. S. Department of Labor Employment Standards Administration

Payment of Fringe Benefits Cash payments in lieu of fringe benefits (FBs) must be paid on regular pay date (29 C. F. R. § 4. 165(a)) n Payments into bona fide FB plans must be made no less often than quarterly (29 C. F. R. § 4. 175(d)) n FB costs may not be credited toward wage requirements (29 C. F. R. § 4. 167) n U. S. Department of Labor Employment Standards Administration

Payment of Fringe Benefits Cash payments in lieu of fringe benefits (FBs) must be paid on regular pay date (29 C. F. R. § 4. 165(a)) n Payments into bona fide FB plans must be made no less often than quarterly (29 C. F. R. § 4. 175(d)) n FB costs may not be credited toward wage requirements (29 C. F. R. § 4. 167) n U. S. Department of Labor Employment Standards Administration

Discharging Minimum Wage & Fringe Benefit Obligations Under SCA, the contractor may not credit excess wage payment against the FB obligation: Wage Determination: Wage $10. 25 FB $ 3. 16 Total $13. 41 U. S. Department of Labor Employment Standards Administration Employee Paid: Wage $11. 00 FB $ 2. 41 Total $13. 41

Discharging Minimum Wage & Fringe Benefit Obligations Under SCA, the contractor may not credit excess wage payment against the FB obligation: Wage Determination: Wage $10. 25 FB $ 3. 16 Total $13. 41 U. S. Department of Labor Employment Standards Administration Employee Paid: Wage $11. 00 FB $ 2. 41 Total $13. 41

Wage Payments for Work Subject to Different Rates n n Employee must be paid Ø Highest rate for all hours worked, unless Ø Employer’s payroll records or other affirmative proof show periods spent in each class of work Applies when employee works part of workweek on SCA-covered and non-SCA-covered work U. S. Department of Labor Employment Standards Administration

Wage Payments for Work Subject to Different Rates n n Employee must be paid Ø Highest rate for all hours worked, unless Ø Employer’s payroll records or other affirmative proof show periods spent in each class of work Applies when employee works part of workweek on SCA-covered and non-SCA-covered work U. S. Department of Labor Employment Standards Administration

Fringe Benefits Plans (29 C. F. R. § 4. 171(a)(2)) n Provide benefits to employees on account of: Ø Death Ø Disability Ø Advanced age Ø Retirement Ø Illness Ø Medical expenses Ø Hospitalization Ø Supplemental unemployment benefits U. S. Department of Labor Employment Standards Administration

Fringe Benefits Plans (29 C. F. R. § 4. 171(a)(2)) n Provide benefits to employees on account of: Ø Death Ø Disability Ø Advanced age Ø Retirement Ø Illness Ø Medical expenses Ø Hospitalization Ø Supplemental unemployment benefits U. S. Department of Labor Employment Standards Administration

Bona Fide Fringe Benefits (29 C. F. R. § 4. 171(a)) Constitute a legally enforceable obligation that n Ø Ø Ø Is communicated in writing to employees Provides payment of benefits to employees Contains a definite formula for determining amount of contribution and benefits provided Is paid irrevocably to an independent trustee or third person pursuant to a fund, trust, or plan Meets criteria set forth by IRS, ERISA and FLSA U. S. Department of Labor Employment Standards Administration

Bona Fide Fringe Benefits (29 C. F. R. § 4. 171(a)) Constitute a legally enforceable obligation that n Ø Ø Ø Is communicated in writing to employees Provides payment of benefits to employees Contains a definite formula for determining amount of contribution and benefits provided Is paid irrevocably to an independent trustee or third person pursuant to a fund, trust, or plan Meets criteria set forth by IRS, ERISA and FLSA U. S. Department of Labor Employment Standards Administration

Health and Welfare (H&W) Fringe Benefits n Three types of FB requirements: Ø Ø Ø “Fixed cost” per employee benefits “Average cost” benefits Collectively bargained (CBA) benefits • Types and amounts of benefits and eligibility requirements are contractor’s prerogative U. S. Department of Labor Employment Standards Administration

Health and Welfare (H&W) Fringe Benefits n Three types of FB requirements: Ø Ø Ø “Fixed cost” per employee benefits “Average cost” benefits Collectively bargained (CBA) benefits • Types and amounts of benefits and eligibility requirements are contractor’s prerogative U. S. Department of Labor Employment Standards Administration

“Fixed Cost” Benefits (29 C. F. R. § 4. 175(a)) n Increased to $3. 16 per hour June 1, 2007 ØIncluded in all “invitations for bids” opened, or ØOther service contracts awarded on or after June 1, 2007 n Required to be paid “per employee” basis ØFor ALL HOURS PAID FOR up to 40 hours a workweek, and 2, 080 hours a year ØIncludes paid leave and holidays U. S. Department of Labor Employment Standards Administration in

“Fixed Cost” Benefits (29 C. F. R. § 4. 175(a)) n Increased to $3. 16 per hour June 1, 2007 ØIncluded in all “invitations for bids” opened, or ØOther service contracts awarded on or after June 1, 2007 n Required to be paid “per employee” basis ØFor ALL HOURS PAID FOR up to 40 hours a workweek, and 2, 080 hours a year ØIncludes paid leave and holidays U. S. Department of Labor Employment Standards Administration in

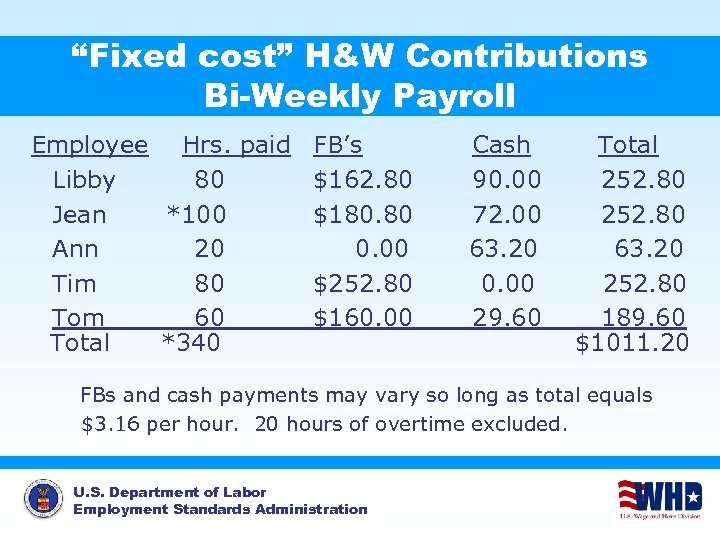

“Fixed cost” H&W Contributions Bi-Weekly Payroll Employee Hrs. paid FB’s Libby 80 $162. 80 Jean *100 $180. 80 Ann 20 0. 00 Tim 80 $252. 80 Tom 60 $160. 00 Total *340 Cash 90. 00 72. 00 63. 20 0. 00 29. 60 Total 252. 80 63. 20 252. 80 189. 60 $1011. 20 FBs and cash payments may vary so long as total equals $3. 16 per hour. 20 hours of overtime excluded. U. S. Department of Labor Employment Standards Administration

“Fixed cost” H&W Contributions Bi-Weekly Payroll Employee Hrs. paid FB’s Libby 80 $162. 80 Jean *100 $180. 80 Ann 20 0. 00 Tim 80 $252. 80 Tom 60 $160. 00 Total *340 Cash 90. 00 72. 00 63. 20 0. 00 29. 60 Total 252. 80 63. 20 252. 80 189. 60 $1011. 20 FBs and cash payments may vary so long as total equals $3. 16 per hour. 20 hours of overtime excluded. U. S. Department of Labor Employment Standards Administration

“Average Cost” Benefits (29 C. F. R. § 4. 175(b)) n Contributions may vary depending upon employee’s marital or employment status n Total contributions must average at least $3. 16 per hour per employee: ØExcludes paid leave time and holidays ØFor all “HOURS WORKED” n Compliance determined on a group basis, not an individual basis U. S. Department of Labor Employment Standards Administration

“Average Cost” Benefits (29 C. F. R. § 4. 175(b)) n Contributions may vary depending upon employee’s marital or employment status n Total contributions must average at least $3. 16 per hour per employee: ØExcludes paid leave time and holidays ØFor all “HOURS WORKED” n Compliance determined on a group basis, not an individual basis U. S. Department of Labor Employment Standards Administration

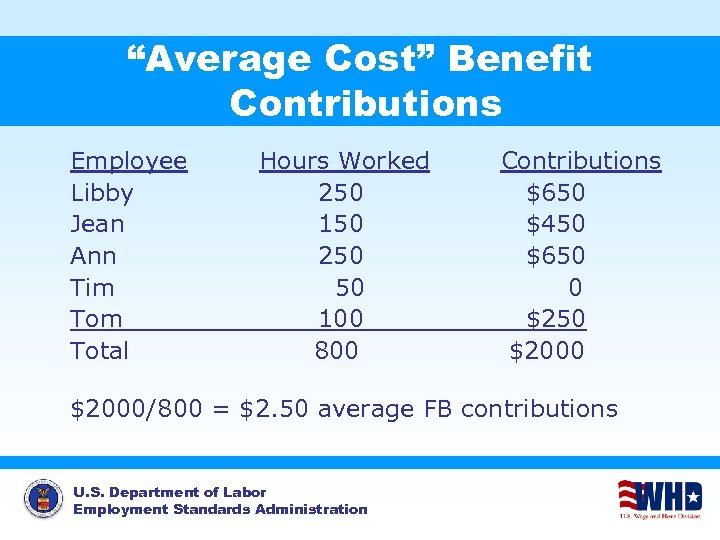

“Average Cost” Benefit Contributions Employee Libby Jean Ann Tim Total Hours Worked 250 150 250 50 100 800 Contributions $650 $450 $650 0 $250 $2000/800 = $2. 50 average FB contributions U. S. Department of Labor Employment Standards Administration

“Average Cost” Benefit Contributions Employee Libby Jean Ann Tim Total Hours Worked 250 150 250 50 100 800 Contributions $650 $450 $650 0 $250 $2000/800 = $2. 50 average FB contributions U. S. Department of Labor Employment Standards Administration

“Average Cost” Benefits Contributions Employee Libby Jean Ann Tim Total Hours 250 150 250 50 100 800 Shortfall $. 66 Total $165. 00 $ 99. 00 $165. 00 $ 33. 00 $ 66. 00 $528. 00 $2000 + $528 = $2528/800 hours = $3. 16 Payments in equal amounts per hour worked. U. S. Department of Labor Employment Standards Administration

“Average Cost” Benefits Contributions Employee Libby Jean Ann Tim Total Hours 250 150 250 50 100 800 Shortfall $. 66 Total $165. 00 $ 99. 00 $165. 00 $ 33. 00 $ 66. 00 $528. 00 $2000 + $528 = $2528/800 hours = $3. 16 Payments in equal amounts per hour worked. U. S. Department of Labor Employment Standards Administration

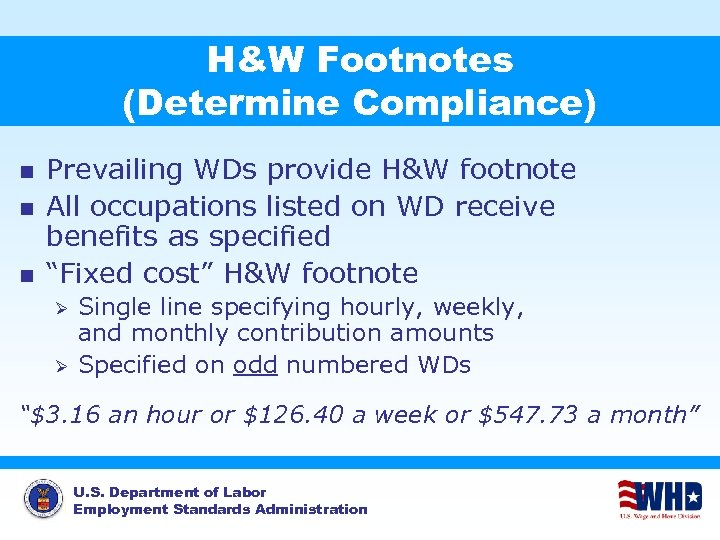

H&W Footnotes (Determine Compliance) n n n Prevailing WDs provide H&W footnote All occupations listed on WD receive benefits as specified “Fixed cost” H&W footnote Ø Ø Single line specifying hourly, weekly, and monthly contribution amounts Specified on odd numbered WDs “$3. 16 an hour or $126. 40 a week or $547. 73 a month” U. S. Department of Labor Employment Standards Administration

H&W Footnotes (Determine Compliance) n n n Prevailing WDs provide H&W footnote All occupations listed on WD receive benefits as specified “Fixed cost” H&W footnote Ø Ø Single line specifying hourly, weekly, and monthly contribution amounts Specified on odd numbered WDs “$3. 16 an hour or $126. 40 a week or $547. 73 a month” U. S. Department of Labor Employment Standards Administration

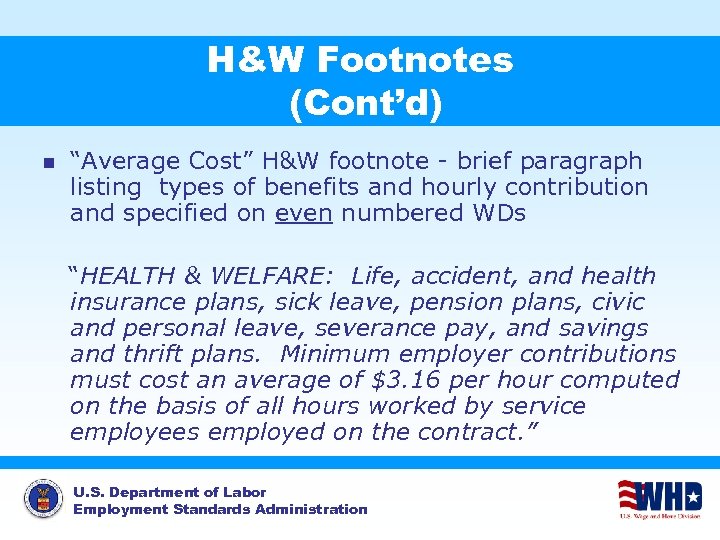

H&W Footnotes (Cont’d) n “Average Cost” H&W footnote - brief paragraph listing types of benefits and hourly contribution and specified on even numbered WDs “HEALTH & WELFARE: Life, accident, and health insurance plans, sick leave, pension plans, civic and personal leave, severance pay, and savings and thrift plans. Minimum employer contributions must cost an average of $3. 16 per hour computed on the basis of all hours worked by service employees employed on the contract. ” U. S. Department of Labor Employment Standards Administration

H&W Footnotes (Cont’d) n “Average Cost” H&W footnote - brief paragraph listing types of benefits and hourly contribution and specified on even numbered WDs “HEALTH & WELFARE: Life, accident, and health insurance plans, sick leave, pension plans, civic and personal leave, severance pay, and savings and thrift plans. Minimum employer contributions must cost an average of $3. 16 per hour computed on the basis of all hours worked by service employees employed on the contract. ” U. S. Department of Labor Employment Standards Administration

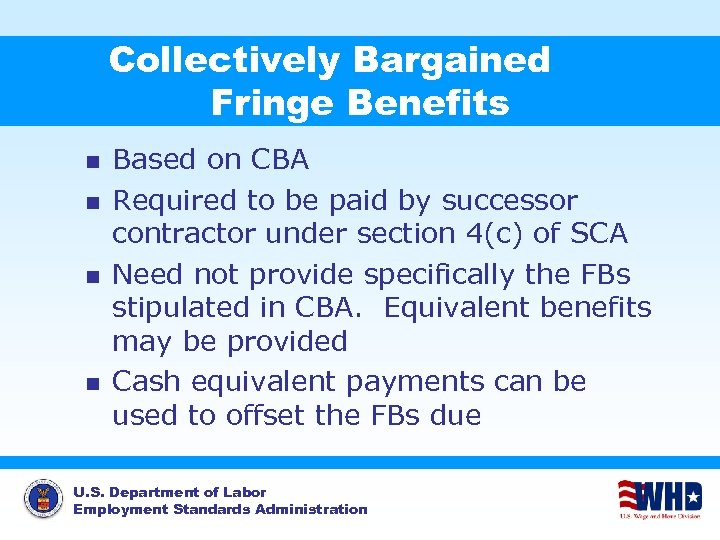

Collectively Bargained Fringe Benefits n n Based on CBA Required to be paid by successor contractor under section 4(c) of SCA Need not provide specifically the FBs stipulated in CBA. Equivalent benefits may be provided Cash equivalent payments can be used to offset the FBs due U. S. Department of Labor Employment Standards Administration

Collectively Bargained Fringe Benefits n n Based on CBA Required to be paid by successor contractor under section 4(c) of SCA Need not provide specifically the FBs stipulated in CBA. Equivalent benefits may be provided Cash equivalent payments can be used to offset the FBs due U. S. Department of Labor Employment Standards Administration

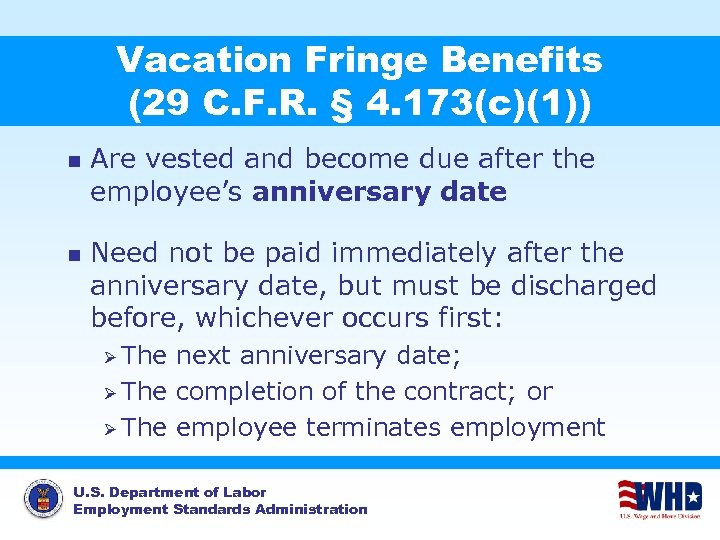

Vacation Fringe Benefits (29 C. F. R. § 4. 173(c)(1)) n n Are vested and become due after the employee’s anniversary date Need not be paid immediately after the anniversary date, but must be discharged before, whichever occurs first: Ø The next anniversary date; Ø The completion of the contract; or Ø The employee terminates employment U. S. Department of Labor Employment Standards Administration

Vacation Fringe Benefits (29 C. F. R. § 4. 173(c)(1)) n n Are vested and become due after the employee’s anniversary date Need not be paid immediately after the anniversary date, but must be discharged before, whichever occurs first: Ø The next anniversary date; Ø The completion of the contract; or Ø The employee terminates employment U. S. Department of Labor Employment Standards Administration

Anniversary Date (12 -months of Service) P P Employee eligible for vacation benefits Contractor who employs employee on anniversary date owes vacation Paid at hourly rate in effect in workweek vacation is taken H&W benefits due under “fixed cost” requirements U. S. Department of Labor Employment Standards Administration JJ starts work on 7/01/07 12 -month 6/30/08 7/01/08 JJ entitled to vacation

Anniversary Date (12 -months of Service) P P Employee eligible for vacation benefits Contractor who employs employee on anniversary date owes vacation Paid at hourly rate in effect in workweek vacation is taken H&W benefits due under “fixed cost” requirements U. S. Department of Labor Employment Standards Administration JJ starts work on 7/01/07 12 -month 6/30/08 7/01/08 JJ entitled to vacation

“Continuous Service” (29 C. F. R. § 4. 173(a)-(b)) n n Determines employee’s eligibility for vacation benefits Is determined by total length of time: Ø Present contractor in any capacity, and/or Ø Predecessor contractors in performance of similar contract functions at same facility n Contractor’s liability determined by WD U. S. Department of Labor Employment Standards Administration

“Continuous Service” (29 C. F. R. § 4. 173(a)-(b)) n n Determines employee’s eligibility for vacation benefits Is determined by total length of time: Ø Present contractor in any capacity, and/or Ø Predecessor contractors in performance of similar contract functions at same facility n Contractor’s liability determined by WD U. S. Department of Labor Employment Standards Administration

Holiday Fringe Benefits (29 C. F. R. § 4. 174) n Employee entitled to holiday pay if works in the holiday workweek n Employee not entitled to holiday pay if holiday not named in WD (i. e. , government closed by proclamation) n Paid holidays can be traded for another day off if communicated to employees U. S. Department of Labor Employment Standards Administration

Holiday Fringe Benefits (29 C. F. R. § 4. 174) n Employee entitled to holiday pay if works in the holiday workweek n Employee not entitled to holiday pay if holiday not named in WD (i. e. , government closed by proclamation) n Paid holidays can be traded for another day off if communicated to employees U. S. Department of Labor Employment Standards Administration

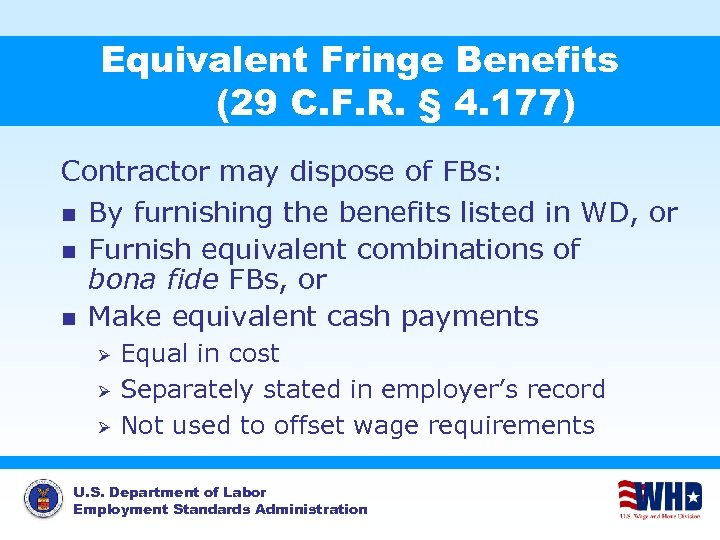

Equivalent Fringe Benefits (29 C. F. R. § 4. 177) Contractor may dispose of FBs: n By furnishing the benefits listed in WD, or n Furnish equivalent combinations of bona fide FBs, or n Make equivalent cash payments Ø Ø Ø Equal in cost Separately stated in employer’s record Not used to offset wage requirements U. S. Department of Labor Employment Standards Administration

Equivalent Fringe Benefits (29 C. F. R. § 4. 177) Contractor may dispose of FBs: n By furnishing the benefits listed in WD, or n Furnish equivalent combinations of bona fide FBs, or n Make equivalent cash payments Ø Ø Ø Equal in cost Separately stated in employer’s record Not used to offset wage requirements U. S. Department of Labor Employment Standards Administration

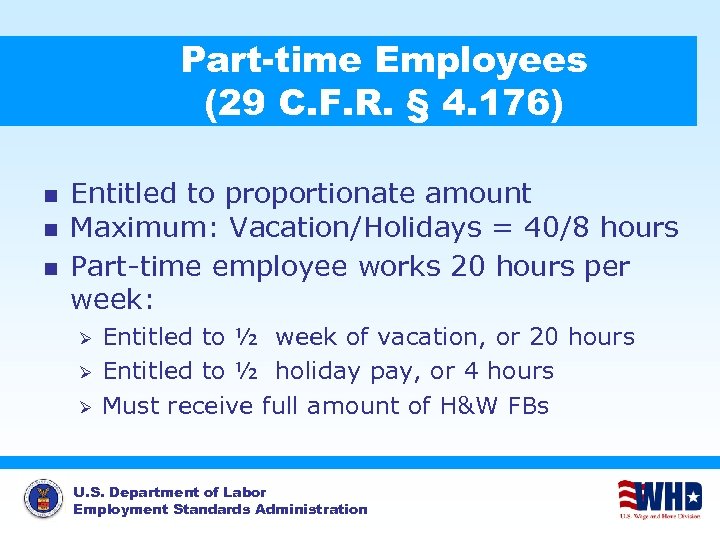

Part-time Employees (29 C. F. R. § 4. 176) n n n Entitled to proportionate amount Maximum: Vacation/Holidays = 40/8 hours Part-time employee works 20 hours per week: Ø Ø Ø Entitled to ½ week of vacation, or 20 hours Entitled to ½ holiday pay, or 4 hours Must receive full amount of H&W FBs U. S. Department of Labor Employment Standards Administration

Part-time Employees (29 C. F. R. § 4. 176) n n n Entitled to proportionate amount Maximum: Vacation/Holidays = 40/8 hours Part-time employee works 20 hours per week: Ø Ø Ø Entitled to ½ week of vacation, or 20 hours Entitled to ½ holiday pay, or 4 hours Must receive full amount of H&W FBs U. S. Department of Labor Employment Standards Administration

Disclaimer v This presentation is intended as general information only and does not carry the force of legal opinion. v The Department of Labor is providing this information as a public service. This information and related materials are presented to give the public access to information on Department of Labor programs. You should be aware that, while we try to keep the information timely and accurate, there will often be a delay between official publications of the materials and the modification of these pages. Therefore, we make no express or implied guarantees. The Federal Register and the Code of Federal Regulations remain the official source for regulatory information published by the Department of Labor. We will make every effort to keep this information current and to correct errors brought to our attention. U. S. Department of Labor Employment Standards Administration

Disclaimer v This presentation is intended as general information only and does not carry the force of legal opinion. v The Department of Labor is providing this information as a public service. This information and related materials are presented to give the public access to information on Department of Labor programs. You should be aware that, while we try to keep the information timely and accurate, there will often be a delay between official publications of the materials and the modification of these pages. Therefore, we make no express or implied guarantees. The Federal Register and the Code of Federal Regulations remain the official source for regulatory information published by the Department of Labor. We will make every effort to keep this information current and to correct errors brought to our attention. U. S. Department of Labor Employment Standards Administration