e8e852378fb4d10dfd07c838751e2096.ppt

- Количество слайдов: 5

September 2010 S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L Private Equ. Ity Contact: Ryan J. Shih (施君徽) Partner One Equity Partners 20 F Chater House 8 Connaught Road Central Hong Kong

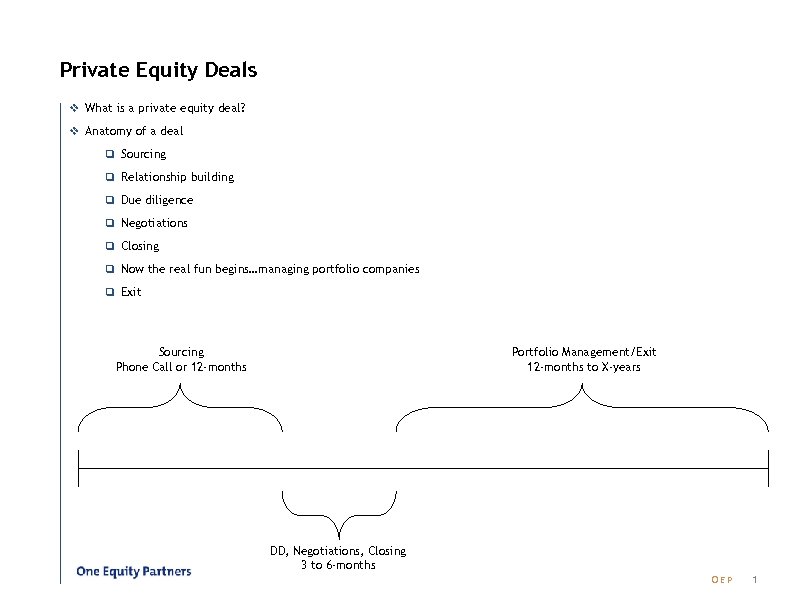

Private Equity Deals v What is a private equity deal? v Anatomy of a deal q Sourcing q Relationship building q Due diligence q Negotiations q Closing q Now the real fun begins…managing portfolio companies q Exit Sourcing Phone Call or 12 -months Portfolio Management/Exit 12 -months to X-years DD, Negotiations, Closing 3 to 6 -months O E P 1

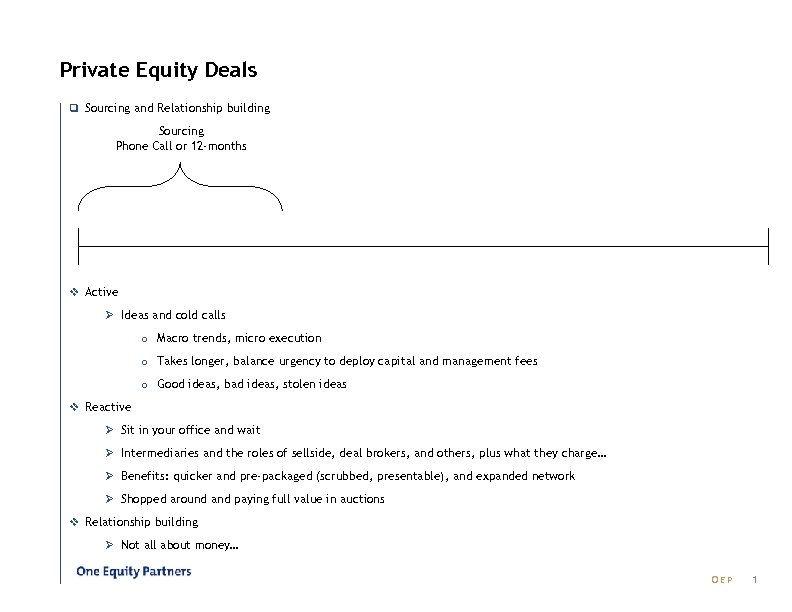

Private Equity Deals q Sourcing and Relationship building Sourcing Phone Call or 12 -months v Active Ø Ideas and cold calls o Macro trends, micro execution o Takes longer, balance urgency to deploy capital and management fees o Good ideas, bad ideas, stolen ideas v Reactive Ø Sit in your office and wait Ø Intermediaries and the roles of sellside, deal brokers, and others, plus what they charge… Ø Benefits: quicker and pre-packaged (scrubbed, presentable), and expanded network Ø Shopped around and paying full value in auctions v Relationship building Ø Not all about money… O E P 1

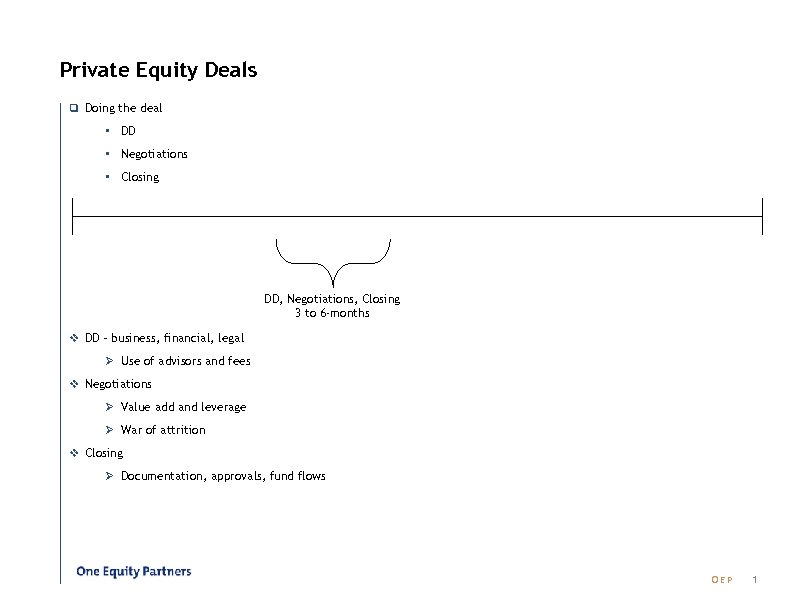

Private Equity Deals q Doing the deal § DD § Negotiations § Closing DD, Negotiations, Closing 3 to 6 -months v DD – business, financial, legal Ø Use of advisors and fees v Negotiations Ø Value add and leverage Ø War of attrition v Closing Ø Documentation, approvals, fund flows O E P 1

Private Equity Deals q Now the real fun begins…managing portfolio companies q Exits Portfolio Management/Exit 12 -months to X-years v Strategy setting Ø Actually the fun part… v Monitoring and board meetings, plus what relationship building means v Fire-fighting Ø Personnel changes, business changes, reacting to special situations v Internal portfolio management Ø Reports, reports, and more reports v Exits Ø Strategic trade sale (best of both – valuation and timeliness) Ø Sponsors (also good, but less value) Ø Public markets (IPO or secondary) – (can take time to fully exit) Ø When all else fails…recap (leakages and more) O E P 1

e8e852378fb4d10dfd07c838751e2096.ppt