28a33f10d643c5899f738760eae9c184.ppt

- Количество слайдов: 8

September 2010 Reporting of Complex & Bespoke Derivatives Progress Update and Forward Perspectives February 12, 2013 ®ISDA is a registered trademark of the International Swaps and Derivatives Association, Inc. Copyright © 2013 International Swaps and Derivatives Association, Inc.

Reporting of Complex & Bespoke Derivatives - Progress Update and Forward Perspectives – February 2013 Meeting Agenda Ø The implementation approach to comply with CFTC Part 43 and Part 45 for bespoke and complex products by June 30, 2013 Ø The path forward to further standardize the data representation for OTC derivatives 1

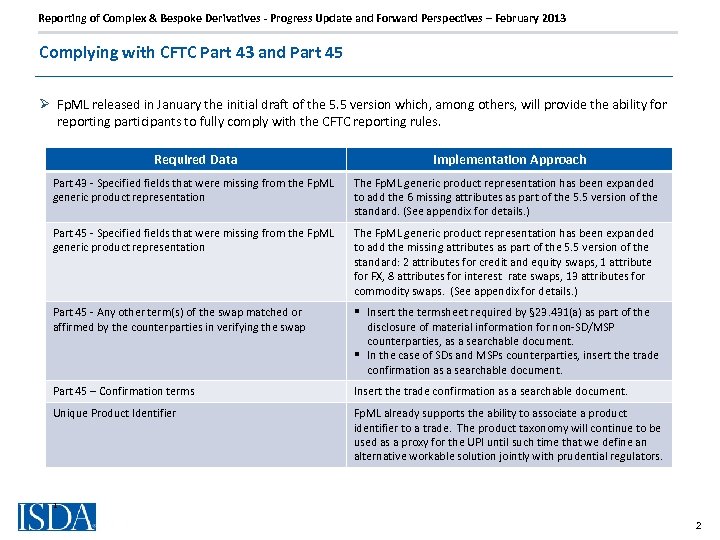

Reporting of Complex & Bespoke Derivatives - Progress Update and Forward Perspectives – February 2013 Complying with CFTC Part 43 and Part 45 Ø Fp. ML released in January the initial draft of the 5. 5 version which, among others, will provide the ability for reporting participants to fully comply with the CFTC reporting rules. Required Data Implementation Approach Part 43 - Specified fields that were missing from the Fp. ML generic product representation The Fp. ML generic product representation has been expanded to add the 6 missing attributes as part of the 5. 5 version of the standard. (See appendix for details. ) Part 45 - Specified fields that were missing from the Fp. ML generic product representation The Fp. ML generic product representation has been expanded to add the missing attributes as part of the 5. 5 version of the standard: 2 attributes for credit and equity swaps, 1 attribute for FX, 8 attributes for interest rate swaps, 13 attributes for commodity swaps. (See appendix for details. ) Part 45 - Any other term(s) of the swap matched or affirmed by the counterparties in verifying the swap § Insert the termsheet required by § 23. 431(a) as part of the disclosure of material information for non-SD/MSP counterparties, as a searchable document. § In the case of SDs and MSPs counterparties, insert the trade confirmation as a searchable document. Part 45 – Confirmation terms Insert the trade confirmation as a searchable document. Unique Product Identifier Fp. ML already supports the ability to associate a product identifier to a trade. The product taxonomy will continue to be used as a proxy for the UPI until such time that we define an alternative workable solution jointly with prudential regulators. 1 2

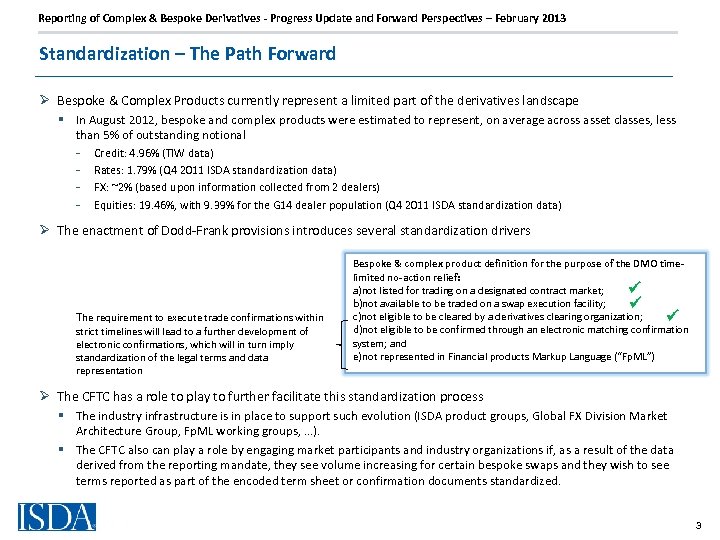

Reporting of Complex & Bespoke Derivatives - Progress Update and Forward Perspectives – February 2013 Standardization – The Path Forward Ø Bespoke & Complex Products currently represent a limited part of the derivatives landscape § In August 2012, bespoke and complex products were estimated to represent, on average across asset classes, less than 5% of outstanding notional - Credit: 4. 96% (TIW data) Rates: 1. 79% (Q 4 2011 ISDA standardization data) FX: ~2% (based upon information collected from 2 dealers) Equities: 19. 46%, with 9. 39% for the G 14 dealer population (Q 4 2011 ISDA standardization data) Ø The enactment of Dodd-Frank provisions introduces several standardization drivers The requirement to execute trade confirmations within strict timelines will lead to a further development of electronic confirmations, which will in turn imply standardization of the legal terms and data representation Bespoke & complex product definition for the purpose of the DMO timelimited no-action relief: a)not listed for trading on a designated contract market; b)not available to be traded on a swap execution facility; c)not eligible to be cleared by a derivatives clearing organization; d)not eligible to be confirmed through an electronic matching confirmation system; and e)not represented in Financial products Markup Language (“Fp. ML”) Ø The CFTC has a role to play to further facilitate this standardization process § The industry infrastructure is in place to support such evolution (ISDA product groups, Global FX Division Market Architecture Group, Fp. ML working groups, …). § The CFTC also can play a role by engaging market participants and industry organizations if, as a result of the data derived from the reporting mandate, they see volume increasing for certain bespoke swaps and they wish to see terms reported as part of the encoded term sheet or confirmation documents standardized. 3

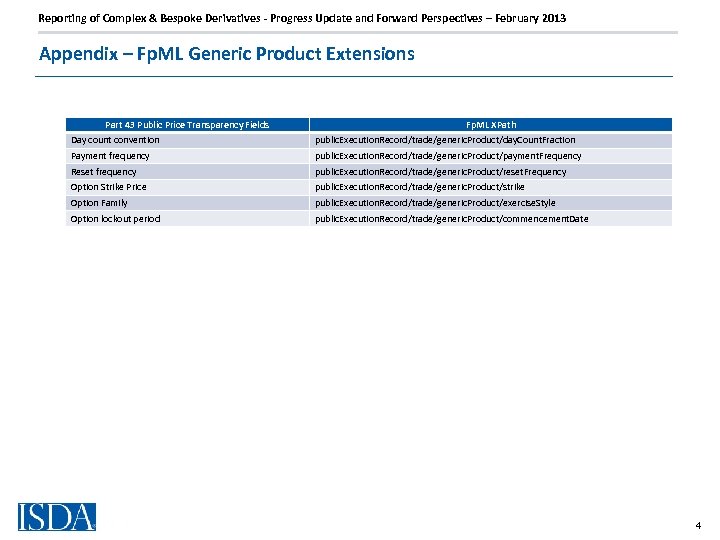

Reporting of Complex & Bespoke Derivatives - Progress Update and Forward Perspectives – February 2013 Appendix – Fp. ML Generic Product Extensions Part 43 Public Price Transparency Fields Fp. ML XPath Day count convention public. Execution. Record/trade/generic. Product/day. Count. Fraction Payment frequency public. Execution. Record/trade/generic. Product/payment. Frequency Reset frequency public. Execution. Record/trade/generic. Product/reset. Frequency Option Strike Price public. Execution. Record/trade/generic. Product/strike Option Family public. Execution. Record/trade/generic. Product/exercise. Style Option lockout period public. Execution. Record/trade/generic. Product/commencement. Date 4

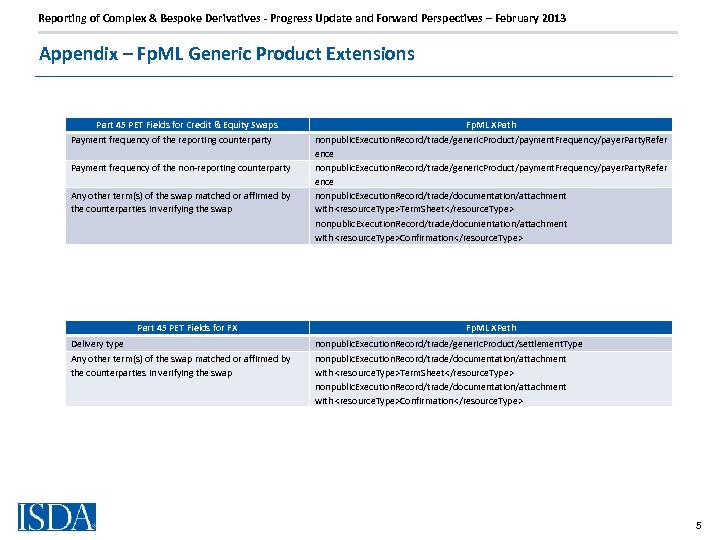

Reporting of Complex & Bespoke Derivatives - Progress Update and Forward Perspectives – February 2013 Appendix – Fp. ML Generic Product Extensions Part 45 PET Fields for Credit & Equity Swaps Payment frequency of the reporting counterparty Payment frequency of the non-reporting counterparty Any other term(s) of the swap matched or affirmed by the counterparties in verifying the swap Part 45 PET Fields for FX Fp. ML XPath nonpublic. Execution. Record/trade/generic. Product/payment. Frequency/payer. Party. Refer ence nonpublic. Execution. Record/trade/documentation/attachment with <resource. Type>Term. Sheet</resource. Type> nonpublic. Execution. Record/trade/documentation/attachment with <resource. Type>Confirmation</resource. Type> Fp. ML XPath Delivery type nonpublic. Execution. Record/trade/generic. Product/settlement. Type Any other term(s) of the swap matched or affirmed by the counterparties in verifying the swap nonpublic. Execution. Record/trade/documentation/attachment with <resource. Type>Term. Sheet</resource. Type> nonpublic. Execution. Record/trade/documentation/attachment with <resource. Type>Confirmation</resource. Type> 5

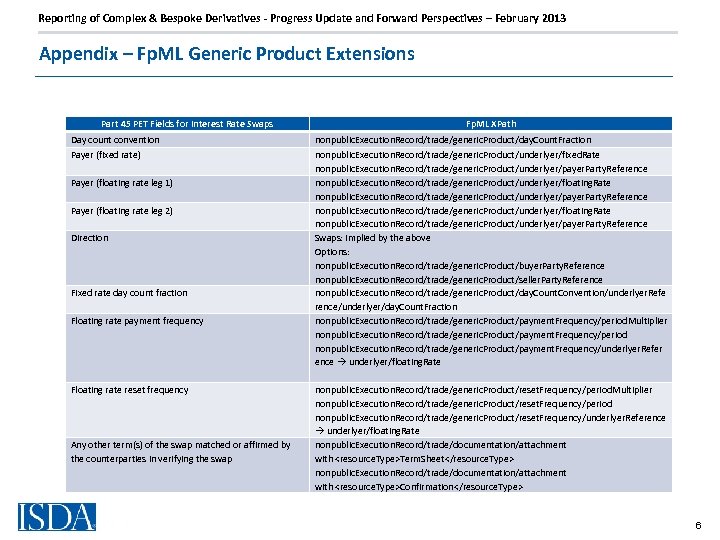

Reporting of Complex & Bespoke Derivatives - Progress Update and Forward Perspectives – February 2013 Appendix – Fp. ML Generic Product Extensions Part 45 PET Fields for Interest Rate Swaps Fp. ML XPath Day count convention nonpublic. Execution. Record/trade/generic. Product/day. Count. Fraction Payer (fixed rate) nonpublic. Execution. Record/trade/generic. Product/underlyer/fixed. Rate nonpublic. Execution. Record/trade/generic. Product/underlyer/payer. Party. Reference nonpublic. Execution. Record/trade/generic. Product/underlyer/floating. Rate nonpublic. Execution. Record/trade/generic. Product/underlyer/payer. Party. Reference Swaps: implied by the above Options: nonpublic. Execution. Record/trade/generic. Product/buyer. Party. Reference nonpublic. Execution. Record/trade/generic. Product/seller. Party. Reference nonpublic. Execution. Record/trade/generic. Product/day. Count. Convention/underlyer. Refe rence/underlyer/day. Count. Fraction nonpublic. Execution. Record/trade/generic. Product/payment. Frequency/period. Multiplier nonpublic. Execution. Record/trade/generic. Product/payment. Frequency/period nonpublic. Execution. Record/trade/generic. Product/payment. Frequency/underlyer. Refer ence underlyer/floating. Rate Payer (floating rate leg 1) Payer (floating rate leg 2) Direction Fixed rate day count fraction Floating rate payment frequency Floating rate reset frequency Any other term(s) of the swap matched or affirmed by the counterparties in verifying the swap nonpublic. Execution. Record/trade/generic. Product/reset. Frequency/period. Multiplier nonpublic. Execution. Record/trade/generic. Product/reset. Frequency/period nonpublic. Execution. Record/trade/generic. Product/reset. Frequency/underlyer. Reference underlyer/floating. Rate nonpublic. Execution. Record/trade/documentation/attachment with <resource. Type>Term. Sheet</resource. Type> nonpublic. Execution. Record/trade/documentation/attachment with <resource. Type>Confirmation</resource. Type> 6

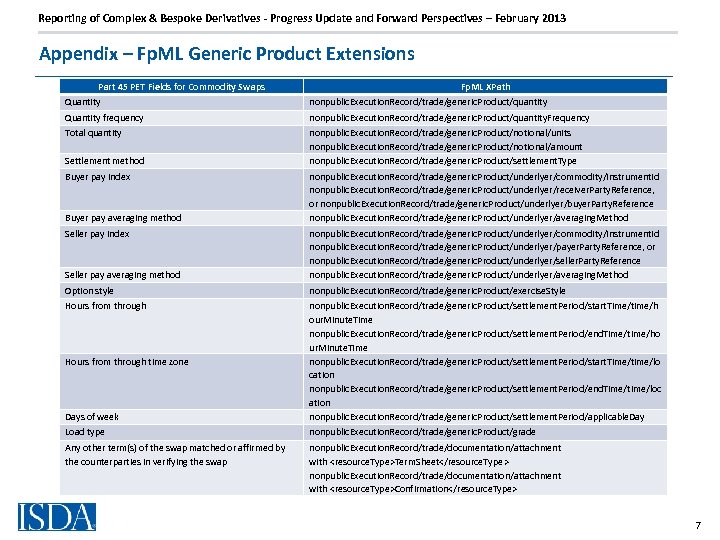

Reporting of Complex & Bespoke Derivatives - Progress Update and Forward Perspectives – February 2013 Appendix – Fp. ML Generic Product Extensions Part 45 PET Fields for Commodity Swaps Fp. ML XPath Quantity nonpublic. Execution. Record/trade/generic. Product/quantity Quantity frequency nonpublic. Execution. Record/trade/generic. Product/quantity. Frequency Total quantity nonpublic. Execution. Record/trade/generic. Product/notional/units nonpublic. Execution. Record/trade/generic. Product/notional/amount nonpublic. Execution. Record/trade/generic. Product/settlement. Type Settlement method Buyer pay index Buyer pay averaging method Seller pay index nonpublic. Execution. Record/trade/generic. Product/underlyer/commodity/instrument. Id nonpublic. Execution. Record/trade/generic. Product/underlyer/receiver. Party. Reference, or nonpublic. Execution. Record/trade/generic. Product/underlyer/buyer. Party. Reference nonpublic. Execution. Record/trade/generic. Product/underlyer/averaging. Method Seller pay averaging method nonpublic. Execution. Record/trade/generic. Product/underlyer/commodity/instrument. Id nonpublic. Execution. Record/trade/generic. Product/underlyer/payer. Party. Reference, or nonpublic. Execution. Record/trade/generic. Product/underlyer/seller. Party. Reference nonpublic. Execution. Record/trade/generic. Product/underlyer/averaging. Method Option style nonpublic. Execution. Record/trade/generic. Product/exercise. Style Hours from through Days of week nonpublic. Execution. Record/trade/generic. Product/settlement. Period/start. Time/time/h our. Minute. Time nonpublic. Execution. Record/trade/generic. Product/settlement. Period/end. Time/time/ho ur. Minute. Time nonpublic. Execution. Record/trade/generic. Product/settlement. Period/start. Time/time/lo cation nonpublic. Execution. Record/trade/generic. Product/settlement. Period/end. Time/time/loc ation nonpublic. Execution. Record/trade/generic. Product/settlement. Period/applicable. Day Load type nonpublic. Execution. Record/trade/generic. Product/grade Any other term(s) of the swap matched or affirmed by the counterparties in verifying the swap nonpublic. Execution. Record/trade/documentation/attachment with <resource. Type>Term. Sheet</resource. Type> nonpublic. Execution. Record/trade/documentation/attachment with <resource. Type>Confirmation</resource. Type> Hours from through time zone 7

28a33f10d643c5899f738760eae9c184.ppt