67cbfc67b040463385e6ba0abf8296bb.ppt

- Количество слайдов: 7

September 2008 Accord™ SWIFT’s Solution for Trade Confirmation Matching Slide 1

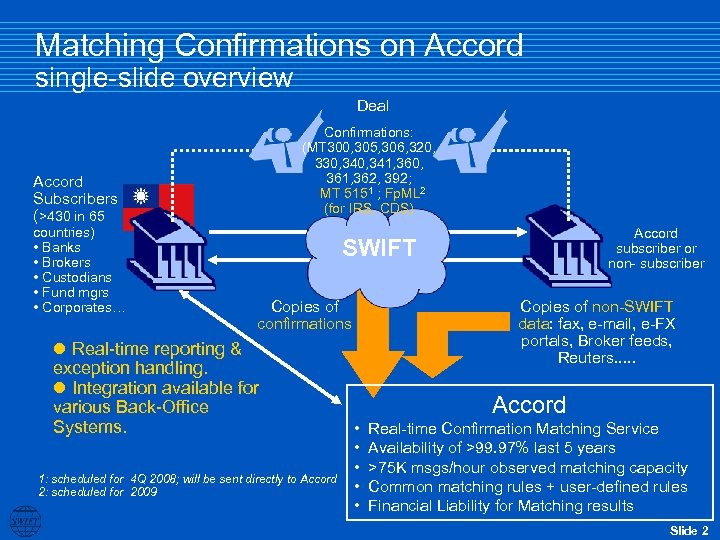

Matching Confirmations on Accord single-slide overview Deal Confirmations: (MT 300, 305, 306, 320, 330, 341, 360, 361, 362, 392; MT 5151 ; Fp. ML 2 (for IRS, CDS) Accord Subscribers (>430 in 65 countries) • Banks • Brokers • Custodians • Fund mgrs • Corporates… Accord subscriber or non- subscriber SWIFT Copies of confirmations l Real-time reporting & exception handling. l Integration available for various Back-Office Systems. 1: scheduled for 4 Q 2008; will be sent directly to Accord 2: scheduled for 2009 Copies of non-SWIFT data: fax, e-mail, e-FX portals, Broker feeds, Reuters. . . Accord • • • Real-time Confirmation Matching Service Availability of >99. 97% last 5 years >75 K msgs/hour observed matching capacity Common matching rules + user-defined rules Financial Liability for Matching results Slide 2

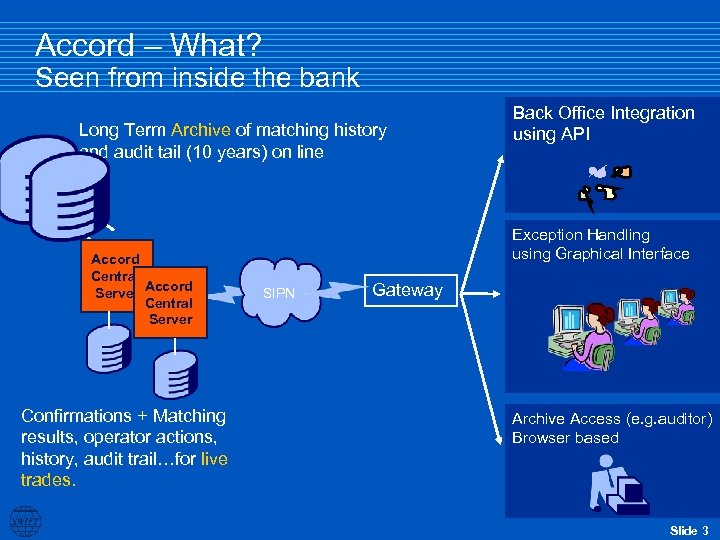

Accord – What? Seen from inside the bank Long Term Archive of matching history and audit tail (10 years) on line Accord Central Accord Server Central Server Confirmations + Matching results, operator actions, history, audit trail…for live trades. Back Office Integration using API Exception Handling using Graphical Interface SIPN Gateway Archive Access (e. g. auditor) Browser based Slide 3

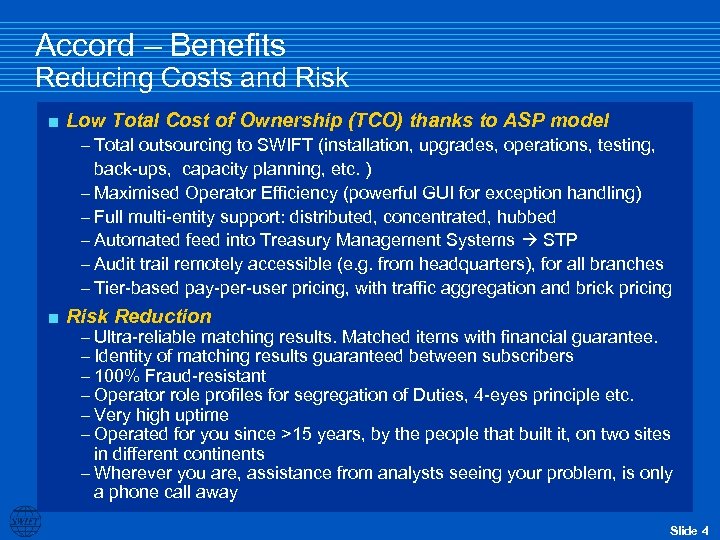

Accord – Benefits Reducing Costs and Risk < Low Total Cost of Ownership (TCO) thanks to ASP model – Total outsourcing to SWIFT (installation, upgrades, operations, testing, back-ups, capacity planning, etc. ) – Maximised Operator Efficiency (powerful GUI for exception handling) – Full multi-entity support: distributed, concentrated, hubbed – Automated feed into Treasury Management Systems STP – Audit trail remotely accessible (e. g. from headquarters), for all branches – Tier-based pay-per-user pricing, with traffic aggregation and brick pricing < Risk Reduction – Ultra-reliable matching results. Matched items with financial guarantee. – Identity of matching results guaranteed between subscribers – 100% Fraud-resistant – Operator role profiles for segregation of Duties, 4 -eyes principle etc. – Very high uptime – Operated for you since >15 years, by the people that built it, on two sites in different continents – Wherever you are, assistance from analysts seeing your problem, is only a phone call away Slide 4

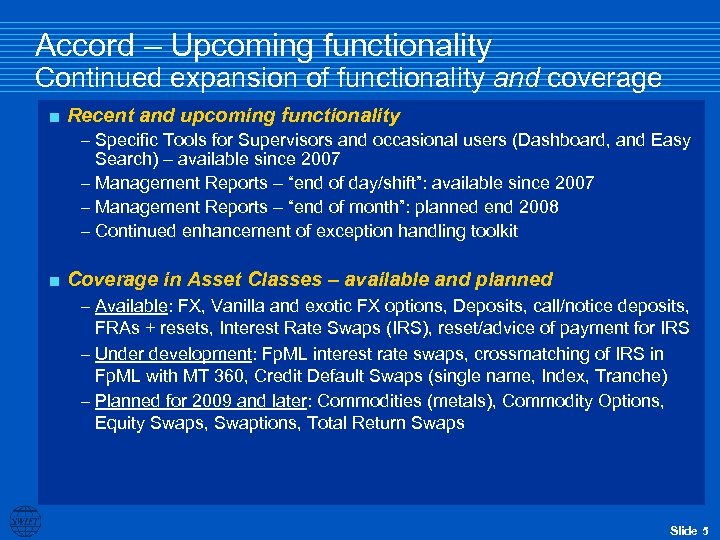

Accord – Upcoming functionality Continued expansion of functionality and coverage < Recent and upcoming functionality – Specific Tools for Supervisors and occasional users (Dashboard, and Easy Search) – available since 2007 – Management Reports – “end of day/shift”: available since 2007 – Management Reports – “end of month”: planned end 2008 – Continued enhancement of exception handling toolkit < Coverage in Asset Classes – available and planned – Available: FX, Vanilla and exotic FX options, Deposits, call/notice deposits, FRAs + resets, Interest Rate Swaps (IRS), reset/advice of payment for IRS – Under development: Fp. ML interest rate swaps, crossmatching of IRS in Fp. ML with MT 360, Credit Default Swaps (single name, Index, Tranche) – Planned for 2009 and later: Commodities (metals), Commodity Options, Equity Swaps, Swaptions, Total Return Swaps Slide 5

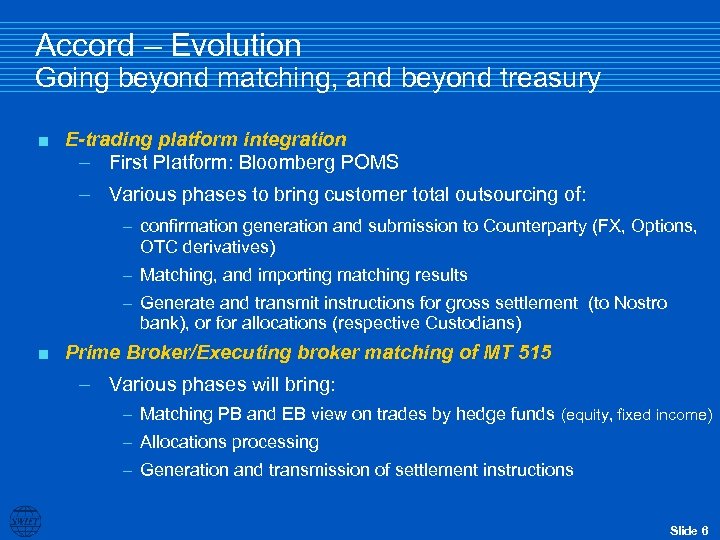

Accord – Evolution Going beyond matching, and beyond treasury < E-trading platform integration – First Platform: Bloomberg POMS – Various phases to bring customer total outsourcing of: – confirmation generation and submission to Counterparty (FX, Options, OTC derivatives) – Matching, and importing matching results – Generate and transmit instructions for gross settlement (to Nostro bank), or for allocations (respective Custodians) < Prime Broker/Executing broker matching of MT 515 – Various phases will bring: – Matching PB and EB view on trades by hedge funds (equity, fixed income) – Allocations processing – Generation and transmission of settlement instructions Slide 6

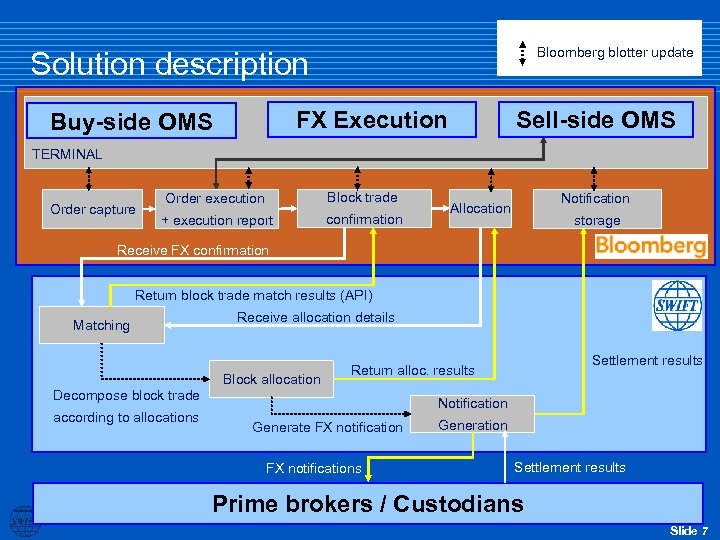

Bloomberg blotter update Solution description Sell-side OMS FX Execution Buy-side OMS TERMINAL Order capture Order execution Block trade + execution report confirmation Notification Allocation storage Receive FX confirmation Return block trade match results (API) Matching Receive allocation details Block allocation Decompose block trade according to allocations Settlement results Return alloc. results Notification Generate FX notifications Generation Settlement results Prime brokers / Custodians Slide 7

67cbfc67b040463385e6ba0abf8296bb.ppt