011ab6eed00be28a226e0a72d0406044.ppt

- Количество слайдов: 22

Seminar on Inter-regional Cooperation ESCAP Presentation 8 June 2007 Santiago

Seminar on Inter-regional Cooperation ESCAP Presentation 8 June 2007 Santiago

Trade & Financial Integration in Asia: Role of Public-Private Alliances Kim Hak-Su UN Under-Secretary-General & Executive Secretary, UNESCAP

Trade & Financial Integration in Asia: Role of Public-Private Alliances Kim Hak-Su UN Under-Secretary-General & Executive Secretary, UNESCAP

Overview • • Background Trade integration: achievements & future challenges Financial integration & PPA linkages Way forward

Overview • • Background Trade integration: achievements & future challenges Financial integration & PPA linkages Way forward

Background: Asymmetric integration • Success in economic integration: asymmetric in Asia • Intraregional trade: grown substantially • Financial integration: lagging behind

Background: Asymmetric integration • Success in economic integration: asymmetric in Asia • Intraregional trade: grown substantially • Financial integration: lagging behind

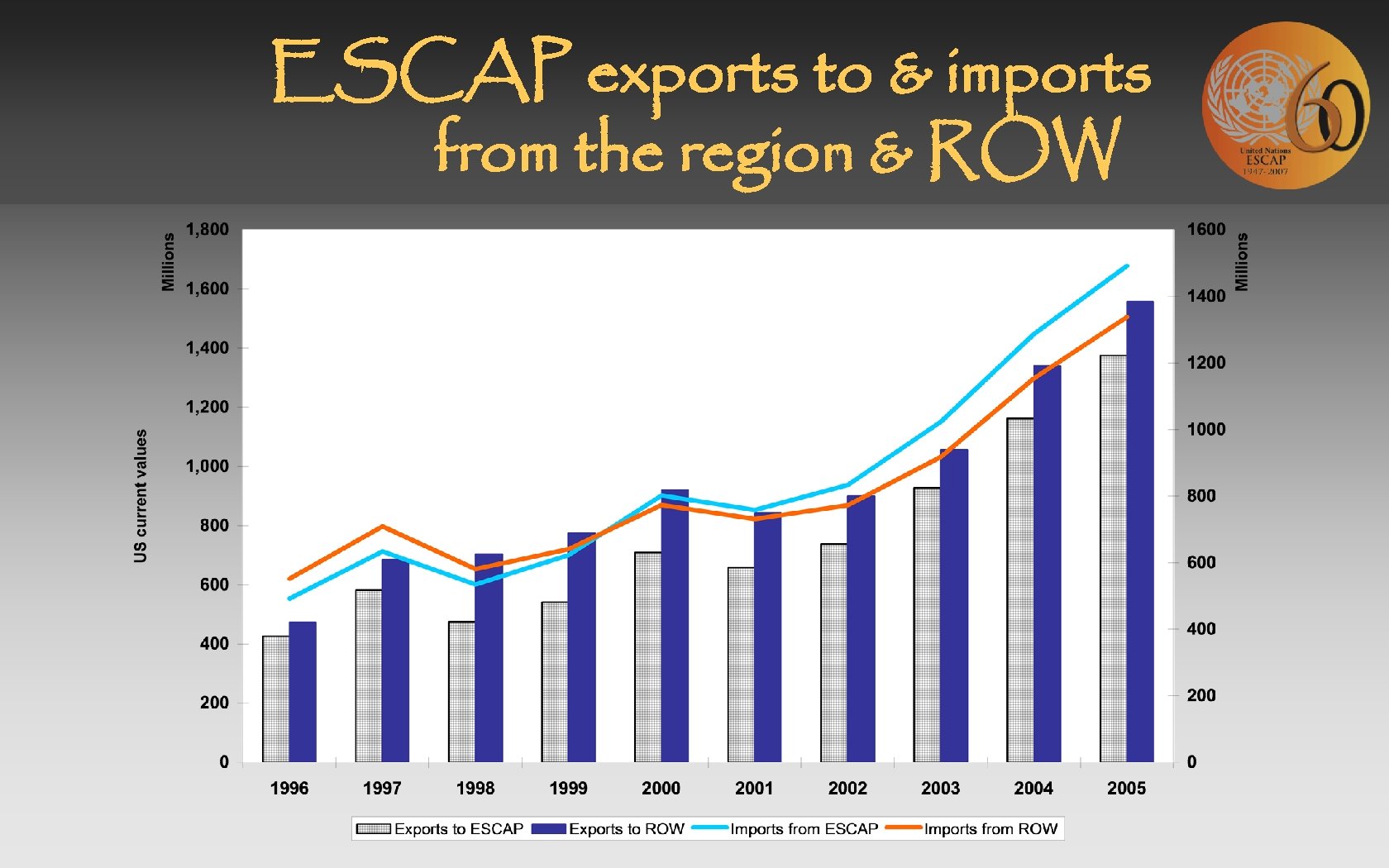

Trade Increases • ESCAP members account for about 30% of world trade • Half of their exports: intra-regional • • Imports: more from the region than rest of the world (Ro. W); however Ro. W imports continue to grow Large trade surplus

Trade Increases • ESCAP members account for about 30% of world trade • Half of their exports: intra-regional • • Imports: more from the region than rest of the world (Ro. W); however Ro. W imports continue to grow Large trade surplus

ESCAP exports to & imports from the region & ROW

ESCAP exports to & imports from the region & ROW

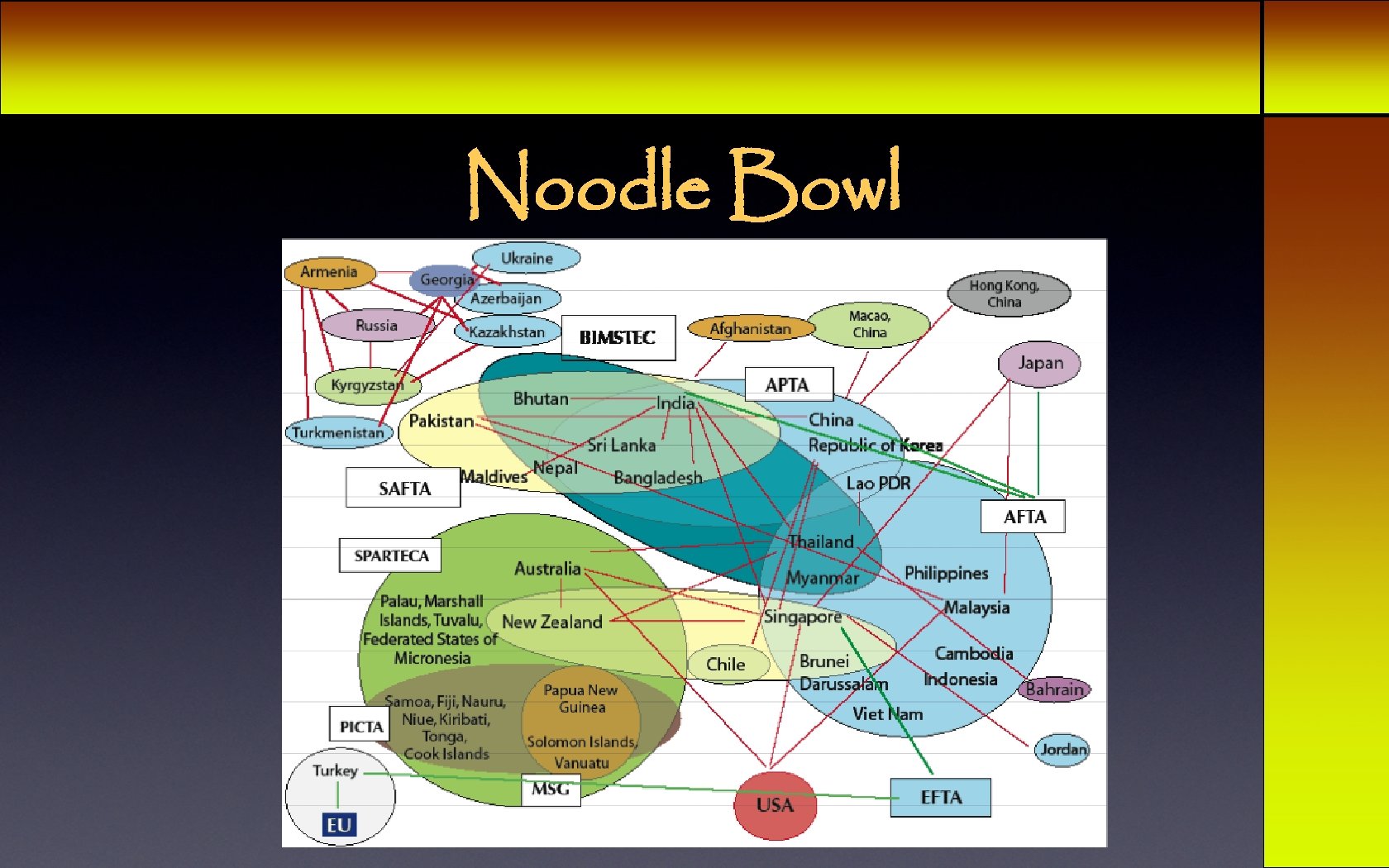

PTA Proliferation • • 89 PTAs: Currently implemented More: under negotiation & consideration Most agreements are bilateral, only 11 functioning RTAs Business sector’s rising participation: critical for consolidating & rationalizing Asian regionalism

PTA Proliferation • • 89 PTAs: Currently implemented More: under negotiation & consideration Most agreements are bilateral, only 11 functioning RTAs Business sector’s rising participation: critical for consolidating & rationalizing Asian regionalism

Noodle Bowl

Noodle Bowl

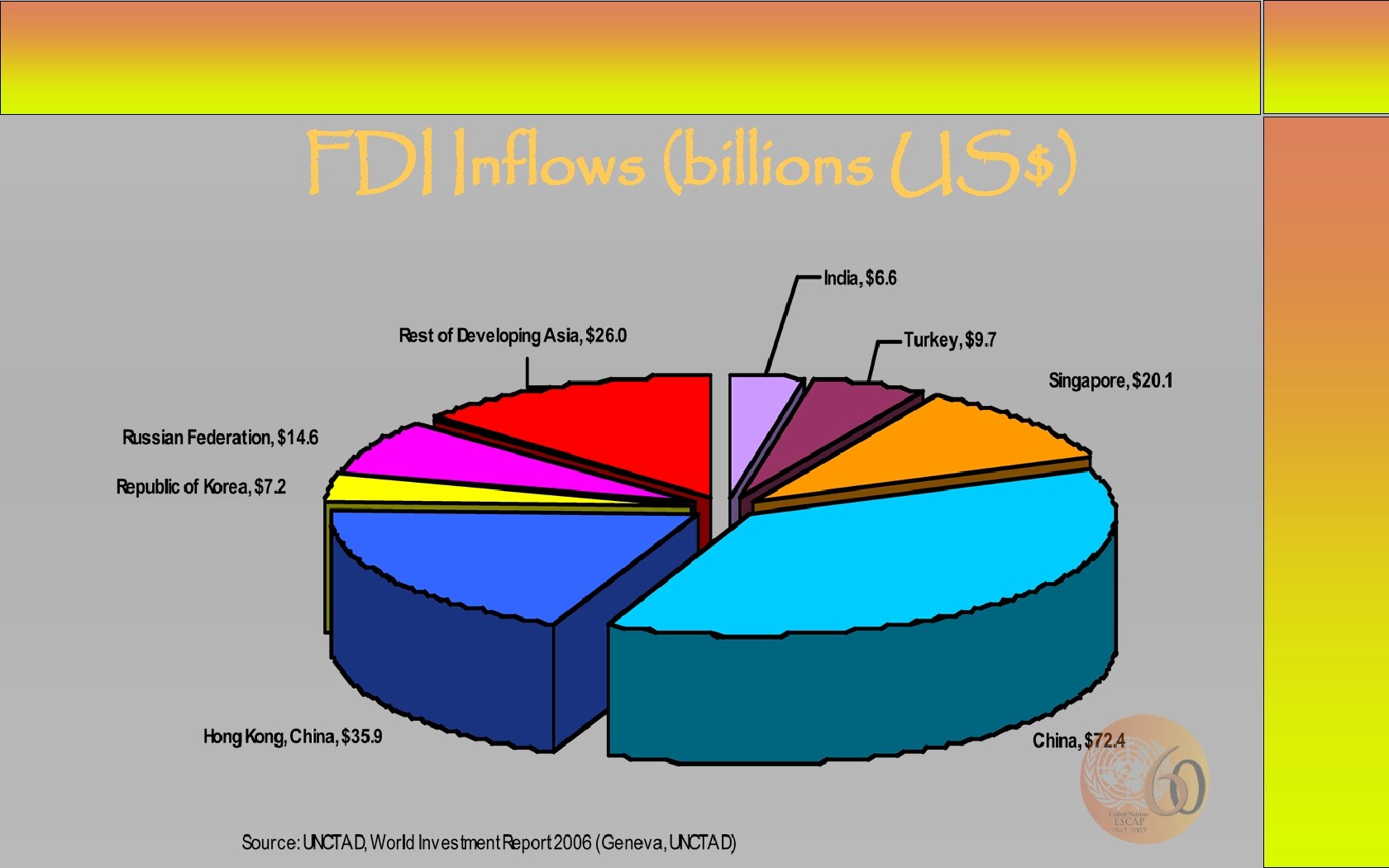

Strong Regional Growth & FDI • • • Around 17% outflows from the region Around 20% of world total FDI inflows to the region Top destinations: China, Viet Nam & India

Strong Regional Growth & FDI • • • Around 17% outflows from the region Around 20% of world total FDI inflows to the region Top destinations: China, Viet Nam & India

FDI Inflows (billions US$)

FDI Inflows (billions US$)

Rising Regional TNC Investments • TNCs lead FDI: - TNCs employed some 6 million workers, with sales of $2 trillion (2005) - Asia: HQs of 77 of world’s top 100 TNCs • Need continuous sound public sector policies to facilitate FDI

Rising Regional TNC Investments • TNCs lead FDI: - TNCs employed some 6 million workers, with sales of $2 trillion (2005) - Asia: HQs of 77 of world’s top 100 TNCs • Need continuous sound public sector policies to facilitate FDI

PPAs in Trade Facilitation • National Trade/Transport Facilitation Committees • Single-window facilities • Trade financing mechanisms

PPAs in Trade Facilitation • National Trade/Transport Facilitation Committees • Single-window facilities • Trade financing mechanisms

Trade Integration: Challenges & PPA Role Lingering Doha round A solution: Stronger government-business partnership

Trade Integration: Challenges & PPA Role Lingering Doha round A solution: Stronger government-business partnership

Trade Integration: Challenges & PPA Role Loss of PTA effectiveness (noodle bowl effect) A solution: Inclusive trade policy making on PTAs

Trade Integration: Challenges & PPA Role Loss of PTA effectiveness (noodle bowl effect) A solution: Inclusive trade policy making on PTAs

Trade Integration: Challenges & PPA Role Lesser share of trade-related assistance to the region A solution: More private sector participation in trade capacity building & advocacy

Trade Integration: Challenges & PPA Role Lesser share of trade-related assistance to the region A solution: More private sector participation in trade capacity building & advocacy

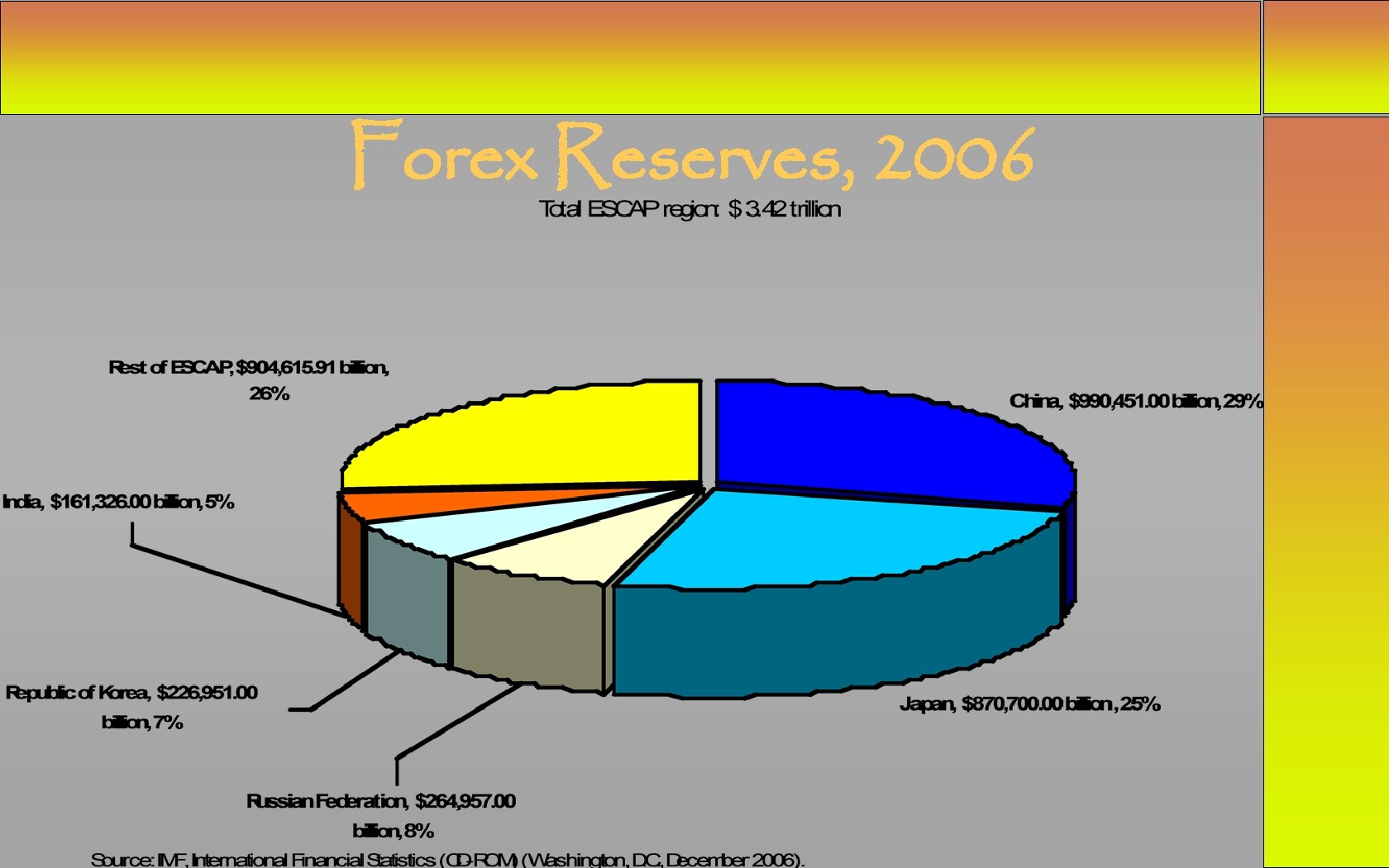

• Financial Integration Large trade surplus, high forex build-up (over $ 3 trillion) • Resources not utilized for development • Financial integration weakest in Asia • • May adversely affect region’s growth momentum PPAs could help reverse the trend

• Financial Integration Large trade surplus, high forex build-up (over $ 3 trillion) • Resources not utilized for development • Financial integration weakest in Asia • • May adversely affect region’s growth momentum PPAs could help reverse the trend

Forex Reserves, 2006

Forex Reserves, 2006

Financial Integration: Little Progress ESCAP region initiatives: - Chiang Mai Initiative - Asian Bond Fund initiatives - Financial market surveillance - Financial liberalization efforts

Financial Integration: Little Progress ESCAP region initiatives: - Chiang Mai Initiative - Asian Bond Fund initiatives - Financial market surveillance - Financial liberalization efforts

Financial Integration: Little Progress Constraints: - Capital controls: - Foreign bank entry: Tight Restricted - Exchange rate regimes: Limited flexibility - Trade in financial services: Limited

Financial Integration: Little Progress Constraints: - Capital controls: - Foreign bank entry: Tight Restricted - Exchange rate regimes: Limited flexibility - Trade in financial services: Limited

• PPAs to Strengthen Financial Integration Enough financial resources, but need facilitation mechanism (resource mobilization): - Set up Asian investment bank - Set up regional special purpose vehicle - Expand Asian Development Bank - Expand Asian Bond Fund - Reinvigorate sub-regional banks & funds

• PPAs to Strengthen Financial Integration Enough financial resources, but need facilitation mechanism (resource mobilization): - Set up Asian investment bank - Set up regional special purpose vehicle - Expand Asian Development Bank - Expand Asian Bond Fund - Reinvigorate sub-regional banks & funds

Way forward: Build on Strengths • Public sector: ü Provide regulatory, institutional & regional cooperation mechanisms ü Help private sector grow • Private sector: Efficiency & innovation • PPAs: Combine strengths for trade integration & financial integration

Way forward: Build on Strengths • Public sector: ü Provide regulatory, institutional & regional cooperation mechanisms ü Help private sector grow • Private sector: Efficiency & innovation • PPAs: Combine strengths for trade integration & financial integration

Thank you www. unescap. org

Thank you www. unescap. org