Seminar on Emerging M&A Trends in Israel: Using a Professional Shareholder Representative and M&A Insurance Products Dr. Ayal Shenhav November 2010

Seminar on Emerging M&A Trends in Israel: Using a Professional Shareholder Representative and M&A Insurance Products Dr. Ayal Shenhav November 2010

Israeli Hi-Tech - M&A Scene 2010 • As of October 27 th - 65 deals announced of which 41 had disclosed amounts (IVC). • This compares to 63 deals in all of 2009. • Total value of disclosed transactions - $1. 8 billion. (compared to $2. 5 billion in 2009) • Transaction range: – 4 transactions in the range of $100 m-$250 m – 10 transactions in the range of $50 m-$100 m – 8 transactions in the range of $20 m-$50 m – 19 transactions in the range of up to $20 m

Israeli Hi-Tech - M&A Scene 2010 • As of October 27 th - 65 deals announced of which 41 had disclosed amounts (IVC). • This compares to 63 deals in all of 2009. • Total value of disclosed transactions - $1. 8 billion. (compared to $2. 5 billion in 2009) • Transaction range: – 4 transactions in the range of $100 m-$250 m – 10 transactions in the range of $50 m-$100 m – 8 transactions in the range of $20 m-$50 m – 19 transactions in the range of up to $20 m

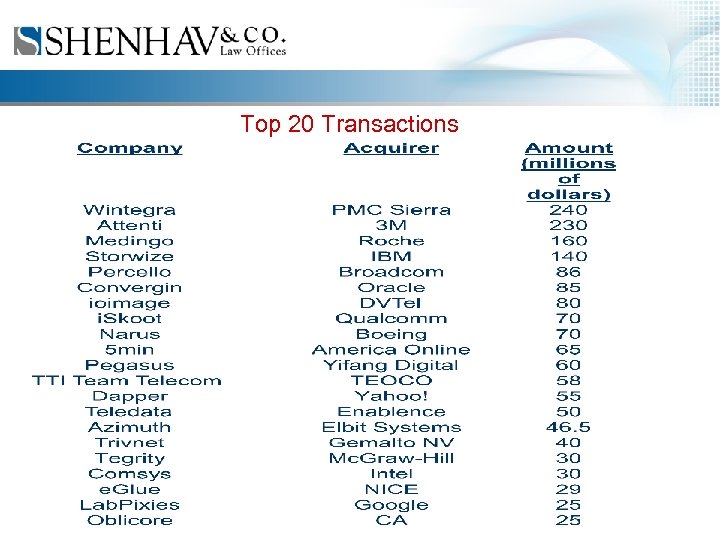

Top 20 Transactions

Top 20 Transactions

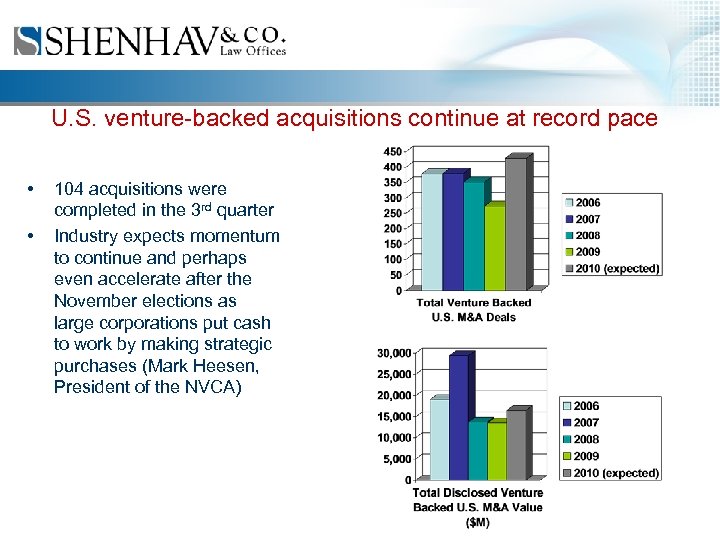

U. S. venture-backed acquisitions continue at record pace • • 104 acquisitions were completed in the 3 rd quarter Industry expects momentum to continue and perhaps even accelerate after the November elections as large corporations put cash to work by making strategic purchases (Mark Heesen, President of the NVCA)

U. S. venture-backed acquisitions continue at record pace • • 104 acquisitions were completed in the 3 rd quarter Industry expects momentum to continue and perhaps even accelerate after the November elections as large corporations put cash to work by making strategic purchases (Mark Heesen, President of the NVCA)

What are the underlying reasons for M&A Activity • IPO market is practically shut: – (IPOs outside of TASE in 2010: Media. Mind (Eye. Blaster), Vringo) • Increased Global M&A • Funds nearing end of term (1999 – 2000 Funds are 1011 years old) and seeking returns for Limited Partners • Founders seeking liquidity • Employees seeking liquidity

What are the underlying reasons for M&A Activity • IPO market is practically shut: – (IPOs outside of TASE in 2010: Media. Mind (Eye. Blaster), Vringo) • Increased Global M&A • Funds nearing end of term (1999 – 2000 Funds are 1011 years old) and seeking returns for Limited Partners • Founders seeking liquidity • Employees seeking liquidity

To Date Focus Has Been on Pre Closing • • • Structure Scope of Reps and Indemnities Tax Rulings Disclosure Allocation of Proceeds among Selling Shareholders

To Date Focus Has Been on Pre Closing • • • Structure Scope of Reps and Indemnities Tax Rulings Disclosure Allocation of Proceeds among Selling Shareholders

Number of Deals is Resulting in De Facto Standards • • Structure (Merger / Share Purchase) Scope of Indemnification Tax Withholding with respect selling shareholders Employee Options

Number of Deals is Resulting in De Facto Standards • • Structure (Merger / Share Purchase) Scope of Indemnification Tax Withholding with respect selling shareholders Employee Options

Time to Improve the Execution of Post Closing • Using a Professional Shareholders Representative • Using Insurance Products

Time to Improve the Execution of Post Closing • Using a Professional Shareholders Representative • Using Insurance Products