Segmentation. Habits & Practice s Concept Test ORS

- Размер: 5.7 Mегабайта

- Количество слайдов: 30

Описание презентации Segmentation. Habits & Practice s Concept Test ORS по слайдам

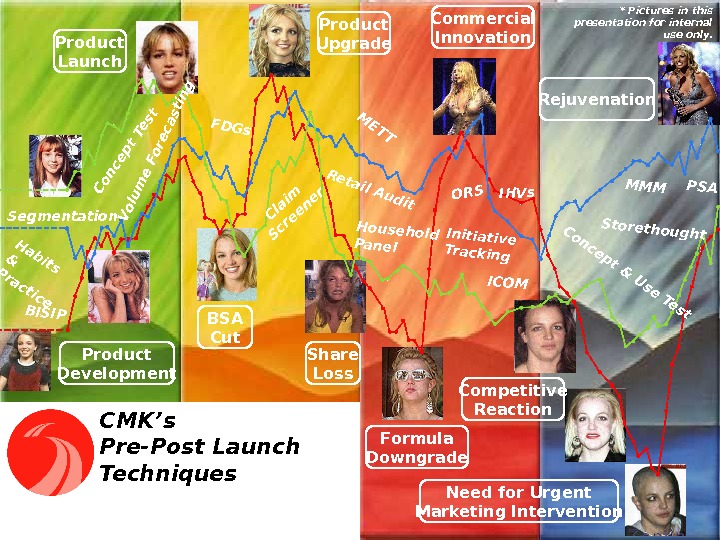

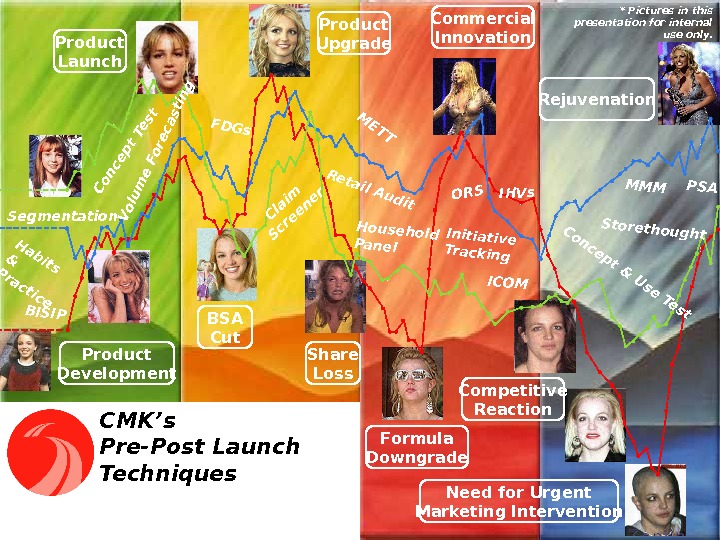

Segmentation. Habits & Practice s Concept Test ORS METT Retail Audit FDGs IHVs Volum e Forecasting BISIP PSA Household. Panel Concept & Use Test ICOM Initiative. Tracking MMM Storethought Claim Screener Product Development. Product Launch Product Upgrade Commercial Innovation Rejuvenation BSA Cut Share Loss Formula Downgrade Competitive Reaction Need for Urgent Marketing Intervention. CMK’s Pre-Post Launch Techniques * Pictures in this presentation for internal use only.

Segmentation. Habits & Practice s Concept Test ORS METT Retail Audit FDGs IHVs Volum e Forecasting BISIP PSA Household. Panel Concept & Use Test ICOM Initiative. Tracking MMM Storethought Claim Screener Product Development. Product Launch Product Upgrade Commercial Innovation Rejuvenation BSA Cut Share Loss Formula Downgrade Competitive Reaction Need for Urgent Marketing Intervention. CMK’s Pre-Post Launch Techniques * Pictures in this presentation for internal use only.

Agenda • Research Basics – CMK’s Roles and Responsibilities – Research Process – Decision to Conduct a Research Study – Qualitative and Quantitative Techniques – Sampling – Statistical Significance

Agenda • Research Basics – CMK’s Roles and Responsibilities – Research Process – Decision to Conduct a Research Study – Qualitative and Quantitative Techniques – Sampling – Statistical Significance

Agenda • Researches in Initiative Life Cycle – Idea Generation – Concept Development – Concept Screening & Evaluating – Packaging Development – Pricing – Communication – In-Market Tracking • On-line Resources

Agenda • Researches in Initiative Life Cycle – Idea Generation – Concept Development – Concept Screening & Evaluating – Packaging Development – Pricing – Communication – In-Market Tracking • On-line Resources

RESEARCH BASICS

RESEARCH BASICS

Roles and Responsibilities

Roles and Responsibilities

P&G’s Mission & CMK Aspiration Improve the Lives of the World’s Consumers. CMK is the voice of the world’s consumers and shoppers, successfully articulating their needs and dreams to profitably grow the brands they love.

P&G’s Mission & CMK Aspiration Improve the Lives of the World’s Consumers. CMK is the voice of the world’s consumers and shoppers, successfully articulating their needs and dreams to profitably grow the brands they love.

AWARDED CMK QUESTION Best answer to win P&G formed first market research department in 1924. We talk to about 4 million consumers in a year.

AWARDED CMK QUESTION Best answer to win P&G formed first market research department in 1924. We talk to about 4 million consumers in a year.

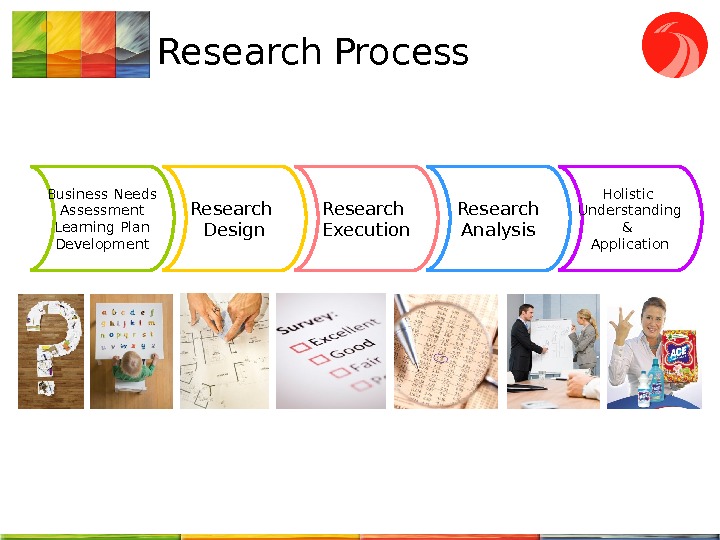

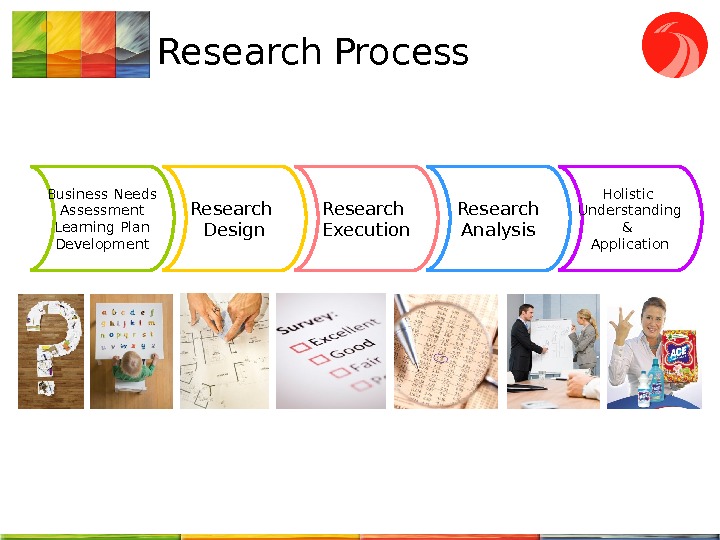

Research Process Business Needs Assessment Learning Plan Development Research Design Research Execution Research Analysis Holistic Understanding & Application

Research Process Business Needs Assessment Learning Plan Development Research Design Research Execution Research Analysis Holistic Understanding & Application

Decision to Do a Research • When it is actionable : – Several alternative ways available to pursue. – Business question can be answered via research findings. • When there is no alternative way of learning : – Added value from the research will be higher than alternative learning ways. • When the research investment is substantially lower than the $ opportunity at risk.

Decision to Do a Research • When it is actionable : – Several alternative ways available to pursue. – Business question can be answered via research findings. • When there is no alternative way of learning : – Added value from the research will be higher than alternative learning ways. • When the research investment is substantially lower than the $ opportunity at risk.

Decision to Do a Research • Whatever research learning is, course of action won’t change. • Unfortunately, research does not replace doing our own homework ! – We shouldn’t ask consumers for ideas… • We don’t really know what we’re looking for… • It’s just too late.

Decision to Do a Research • Whatever research learning is, course of action won’t change. • Unfortunately, research does not replace doing our own homework ! – We shouldn’t ask consumers for ideas… • We don’t really know what we’re looking for… • It’s just too late.

Research Methods Qualitative • Why? How? • Few people • Detailed • Free discussion flow • Insights, consumer inputs • Explanatory – Vague Quantitative • How Many? • Many People • Brief • Structured discussion flow • Numerical conclusions • Conclusive — Precise

Research Methods Qualitative • Why? How? • Few people • Detailed • Free discussion flow • Insights, consumer inputs • Explanatory – Vague Quantitative • How Many? • Many People • Brief • Structured discussion flow • Numerical conclusions • Conclusive — Precise

Qualitative Research • Answers: “Why? ” and “How? ” – Attitudes – Beliefs – Motivations – Feelings – Behaviors – Life Styles • Allows to stay close to consumers & consumer language. • Does not answer: How Many? • It is explanatory, only helps judgement. never call it a qualification

Qualitative Research • Answers: “Why? ” and “How? ” – Attitudes – Beliefs – Motivations – Feelings – Behaviors – Life Styles • Allows to stay close to consumers & consumer language. • Does not answer: How Many? • It is explanatory, only helps judgement. never call it a qualification

Qualitative Research • Sample size is small. • Does not reflect a demographic structure never say x% of respondents. . . • Not representative. • Respondents influence each other. • Not comparable vs. other studies DON’T MAKE ANY DECISIONS BASED ON A QUALITATIVE RESEARCH OR DRAW CONCLUSIONS ABOUT THE WHOLE POPULATION!

Qualitative Research • Sample size is small. • Does not reflect a demographic structure never say x% of respondents. . . • Not representative. • Respondents influence each other. • Not comparable vs. other studies DON’T MAKE ANY DECISIONS BASED ON A QUALITATIVE RESEARCH OR DRAW CONCLUSIONS ABOUT THE WHOLE POPULATION!

When Qualitative Research? • Basic Category Assessment / Idea generation tool : – To provide first hand experience about what consumers think/feel and how they behave

When Qualitative Research? • Basic Category Assessment / Idea generation tool : – To provide first hand experience about what consumers think/feel and how they behave

When Qualitative Research? • Preliminary step for quantitative research : – To develop hypothesis on how consumers think/feel/decide – To explore consumer issues related to a subject – To learn about new target groups – To learn consumer language – To build and improve concepts – To reduce number of concept alternatives before concept test.

When Qualitative Research? • Preliminary step for quantitative research : – To develop hypothesis on how consumers think/feel/decide – To explore consumer issues related to a subject – To learn about new target groups – To learn consumer language – To build and improve concepts – To reduce number of concept alternatives before concept test.

When Qualitative Research? • To understand the results of quantitative research : – To understand unexpected findings – To understand the reasons for certain trends – To explore why a product/copy is performing different vs. expectations.

When Qualitative Research? • To understand the results of quantitative research : – To understand unexpected findings – To understand the reasons for certain trends – To explore why a product/copy is performing different vs. expectations.

Qualitative Research Methods Interaction between participants In-depth understanding Focus Groups Mini Group Paired Interview One-on-One In-home Visit

Qualitative Research Methods Interaction between participants In-depth understanding Focus Groups Mini Group Paired Interview One-on-One In-home Visit

Focus Groups (6 -8 interviewees) Used to: – Generate ideas /insight s for new concepts / products. – Check general appeal of concepts/product ideas. ( NOT to measure trial generated by concept ) – R educe number of concepts/ideas. Learn about: – Likes/dislikes – Perceptions – Behavior – Motivations – Needs – Frustrations

Focus Groups (6 -8 interviewees) Used to: – Generate ideas /insight s for new concepts / products. – Check general appeal of concepts/product ideas. ( NOT to measure trial generated by concept ) – R educe number of concepts/ideas. Learn about: – Likes/dislikes – Perceptions – Behavior – Motivations – Needs – Frustrations

Focus Groups • Group Dynamics (reactions to other consumers’ ideas, discussion support) • Relatively cheap • Not time consuming • Opinions are influenced by each other • Consumers help each other to understand things

Focus Groups • Group Dynamics (reactions to other consumers’ ideas, discussion support) • Relatively cheap • Not time consuming • Opinions are influenced by each other • Consumers help each other to understand things

Mini Groups (3 -5 Interviewees) Used to: – R educe negatives of standard FGDs , – Increase possibility of going in-depth behind more time allocated per respondent • More readiness to talk • Less controlled attitude • Less interaction among participants • May not be suitable for developing creative ideas due to fewer respondents

Mini Groups (3 -5 Interviewees) Used to: – R educe negatives of standard FGDs , – Increase possibility of going in-depth behind more time allocated per respondent • More readiness to talk • Less controlled attitude • Less interaction among participants • May not be suitable for developing creative ideas due to fewer respondents

Individual In-Depth Interview Used to: – Gain in-depth learning – Understand sensitive topics – Have specialists ’ opinions on certain subjects – Check clarity of message • More spontaneous information • More in-depth information • Respondents are not influenced by others • Needs more time and effort • Not creative

Individual In-Depth Interview Used to: – Gain in-depth learning – Understand sensitive topics – Have specialists ’ opinions on certain subjects – Check clarity of message • More spontaneous information • More in-depth information • Respondents are not influenced by others • Needs more time and effort • Not creative

Paired Interview (2 interviewees) • Can be considered instead of individual interviews/one-on-ones • It’s a compromise between group and one-on-one • It’s not very often used (in comparison with individual interviews) • Additional stimulus by a second person • Less monotonous than individuals

Paired Interview (2 interviewees) • Can be considered instead of individual interviews/one-on-ones • It’s a compromise between group and one-on-one • It’s not very often used (in comparison with individual interviews) • Additional stimulus by a second person • Less monotonous than individuals

In-Home Visits Used to: – Be in consumers’ shoes – G et information that we can’t get in a studio (HOW do respondents perform their habits, how apply products etc) • More relaxed atmosphere • First hand information • Helps your empathy • Needs more time and effort

In-Home Visits Used to: – Be in consumers’ shoes – G et information that we can’t get in a studio (HOW do respondents perform their habits, how apply products etc) • More relaxed atmosphere • First hand information • Helps your empathy • Needs more time and effort

Quantitative Research Methods • Answers : HOW MANY? • Large s ample • Reflects the demographic structure of the society. • Representative You can say x% of respondents… • Comparable b / t legs, groups, over time and countries, in case key research methodology is not changed. • Provides “hard” data to support a decision!

Quantitative Research Methods • Answers : HOW MANY? • Large s ample • Reflects the demographic structure of the society. • Representative You can say x% of respondents… • Comparable b / t legs, groups, over time and countries, in case key research methodology is not changed. • Provides “hard” data to support a decision!

Quantitative Research Methods • Do not give deep info rmation on: W hy ? , H ow ? • Question n i a re is structured, limited possibility to: – G o into details on motivations, attitudes ( as in qualitative research ) – Give answers beyond proposed alternatives (closed questions) • Provides numbers, hard to see the real life person behind the data. • Followed up with a qualitative research to explain deeper reasons behind findings.

Quantitative Research Methods • Do not give deep info rmation on: W hy ? , H ow ? • Question n i a re is structured, limited possibility to: – G o into details on motivations, attitudes ( as in qualitative research ) – Give answers beyond proposed alternatives (closed questions) • Provides numbers, hard to see the real life person behind the data. • Followed up with a qualitative research to explain deeper reasons behind findings.

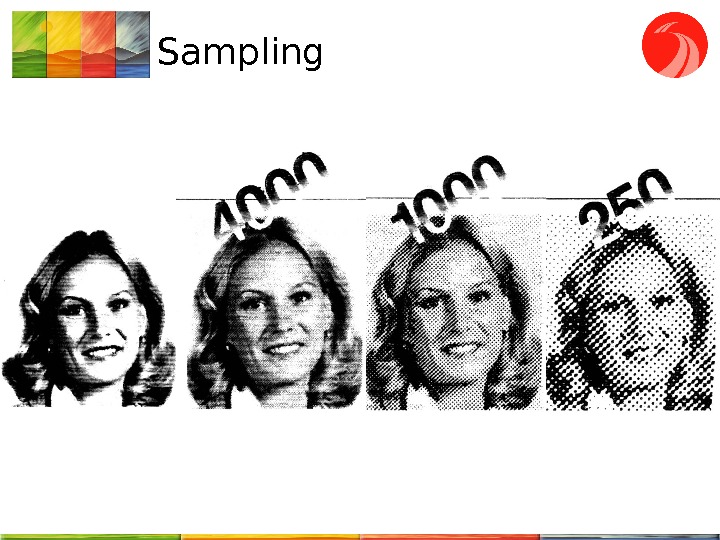

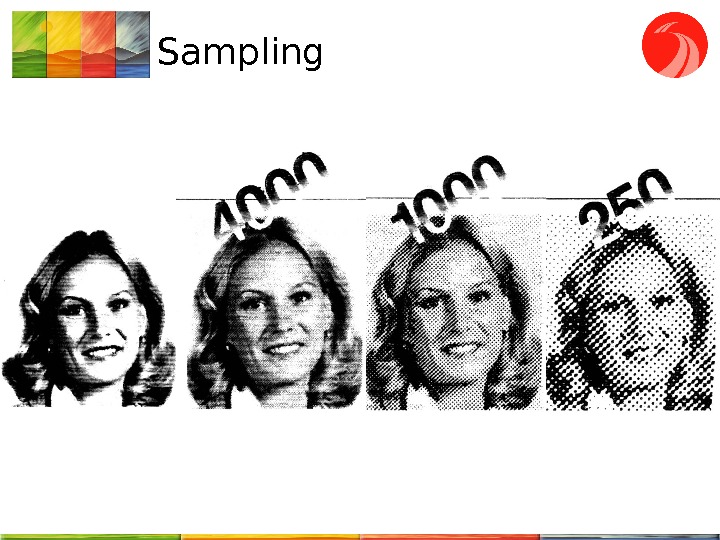

Sampling

Sampling

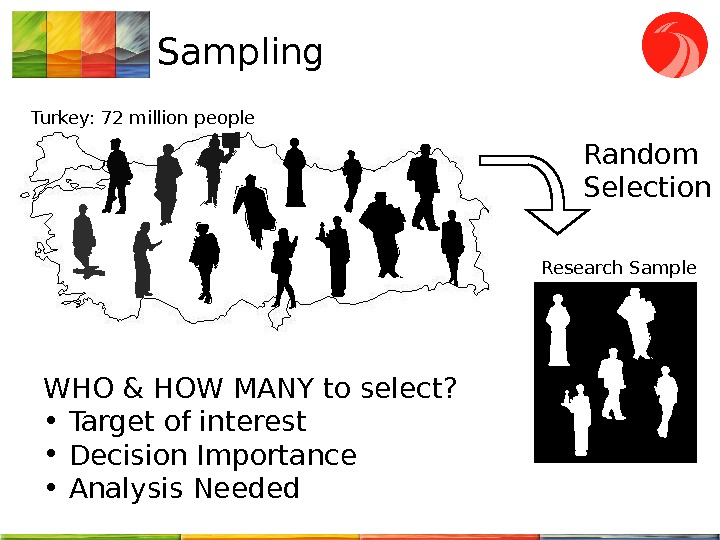

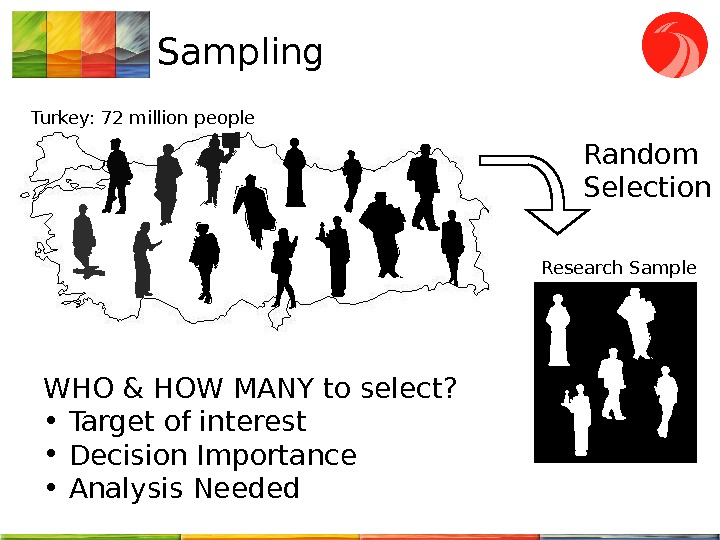

Sampling Turkey: 72 million people Random Selection Research Sample WHO & HOW MANY to select? • Target of interest • Decision Importance • Analysis Needed

Sampling Turkey: 72 million people Random Selection Research Sample WHO & HOW MANY to select? • Target of interest • Decision Importance • Analysis Needed

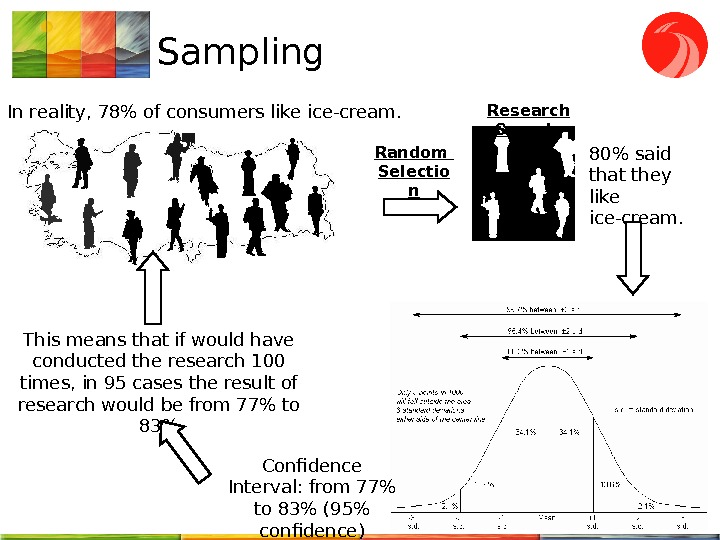

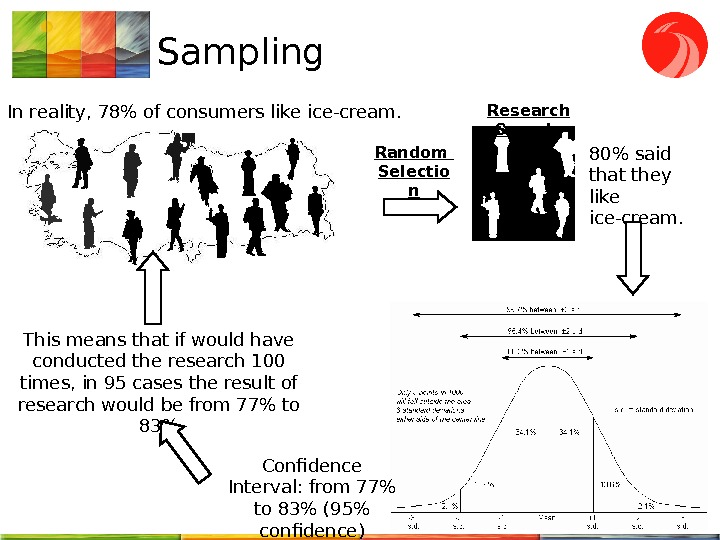

Sampling In reality, 78% of consumers like ice-cream. Random Selectio n Research Sample 80% said that they like ice-cream. Confidence Interval: from 77% to 83% (95% confidence)This means that if would have conducted the research 100 times, in 95 cases the result of research would be from 77% to 83%

Sampling In reality, 78% of consumers like ice-cream. Random Selectio n Research Sample 80% said that they like ice-cream. Confidence Interval: from 77% to 83% (95% confidence)This means that if would have conducted the research 100 times, in 95 cases the result of research would be from 77% to 83%

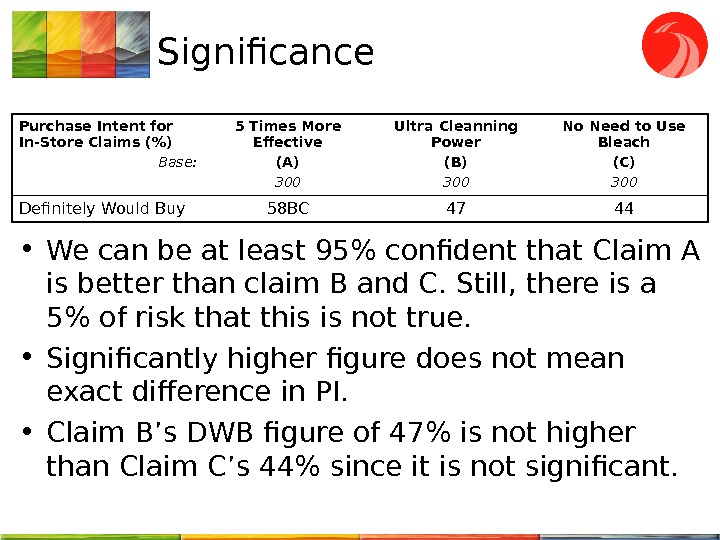

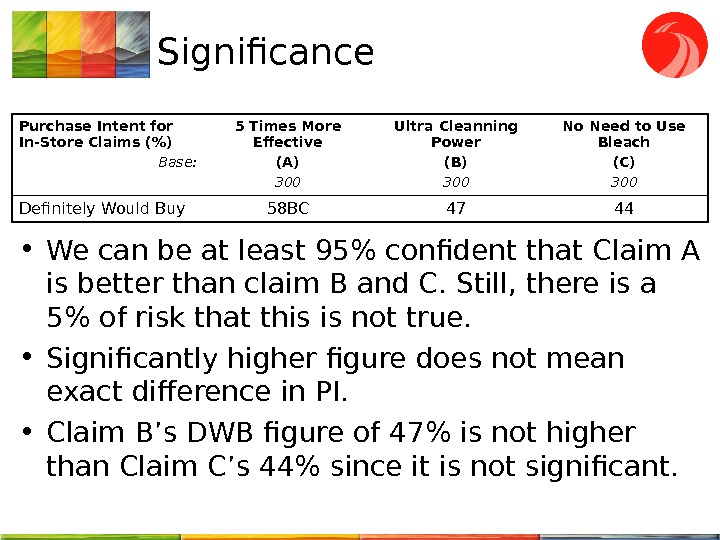

Significance • We can be at least 95% confident that Claim A is better than c laim B and C. Still, there is a 5% of risk that this is not true. • Significantly higher figure does not mean exact difference in PI. • Claim B’s DWB figure of 47% is not higher than Claim C’s 44% since it is not significant. Purchase Intent for In-Store Claims (%) Base: 5 Times More Effective (A) 300 Ultra Cleanning Power (B) 300 No Need to Use Bleach (C) 300 Definitely Would Buy

Significance • We can be at least 95% confident that Claim A is better than c laim B and C. Still, there is a 5% of risk that this is not true. • Significantly higher figure does not mean exact difference in PI. • Claim B’s DWB figure of 47% is not higher than Claim C’s 44% since it is not significant. Purchase Intent for In-Store Claims (%) Base: 5 Times More Effective (A) 300 Ultra Cleanning Power (B) 300 No Need to Use Bleach (C) 300 Definitely Would Buy

Quantitative Design • Survey (face-to-face) • Panel • Diary • At home (door-to-door) • Central Location • In-store • Outdoor (streets etc. ) • Phone, Internet

Quantitative Design • Survey (face-to-face) • Panel • Diary • At home (door-to-door) • Central Location • In-store • Outdoor (streets etc. ) • Phone, Internet