5d23ba359ca4e0de8764184cb76bbd1d.ppt

- Количество слайдов: 32

SEE Regional Investment Climate Dr. Edilberto Segura Director and Chief Economist Sigma. Bleyzer/The Bleyzer Foundation Where Opportunities Emerge

Recent developments in the SEE region with a significant impact on investment climate § Improving prospects of closer association or EU membership for several countries in the region. § Good progress in fighting corruption and accelerated modernization of judiciary - two reform areas which were identified as the most urgent issues for improvement in Bulgaria and Romania to ensure EU membership. § Liberalization of business regulations and cross-boarder capital movements. § Reduced tax burden (i. e. , downward revisions of the corporate profit tax and personal income tax in Bulgaria and Romania). § Significant decrease in the level of political risks and improving image of the region. § Investment ratings of many countries have been recently upgraded. Where Opportunities Emerge

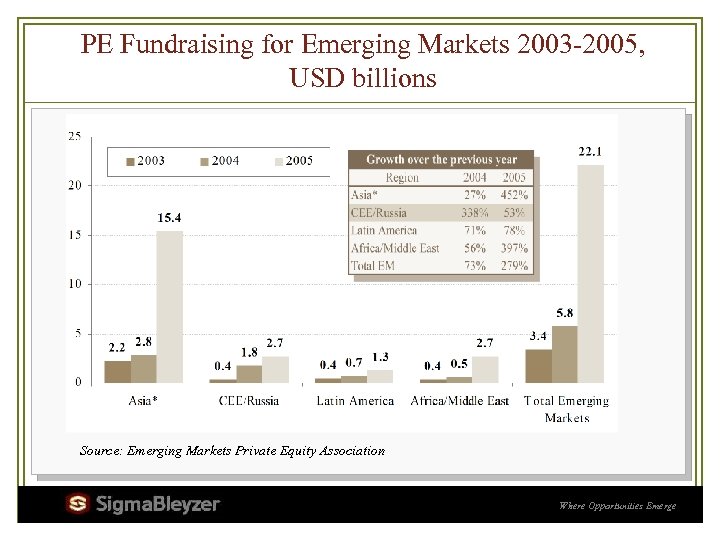

PE Fundraising for Emerging Markets 2003 -2005, USD billions Source: Emerging Markets Private Equity Association Where Opportunities Emerge

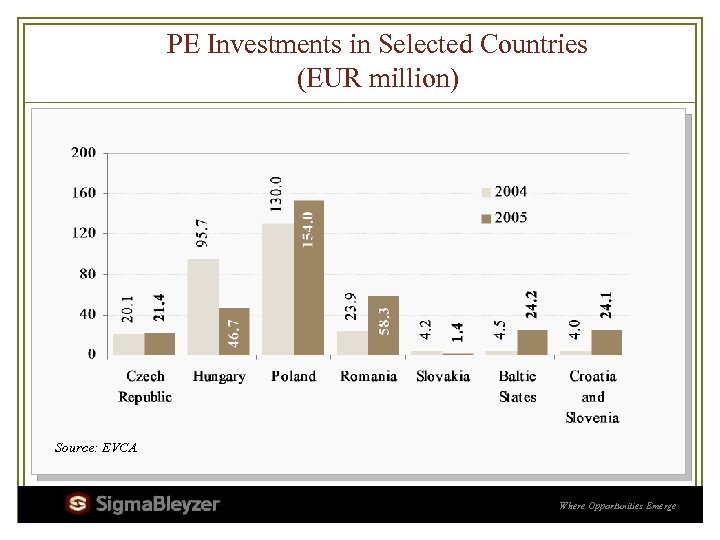

PE Investments in Selected Countries (EUR million) Source: EVCA Where Opportunities Emerge

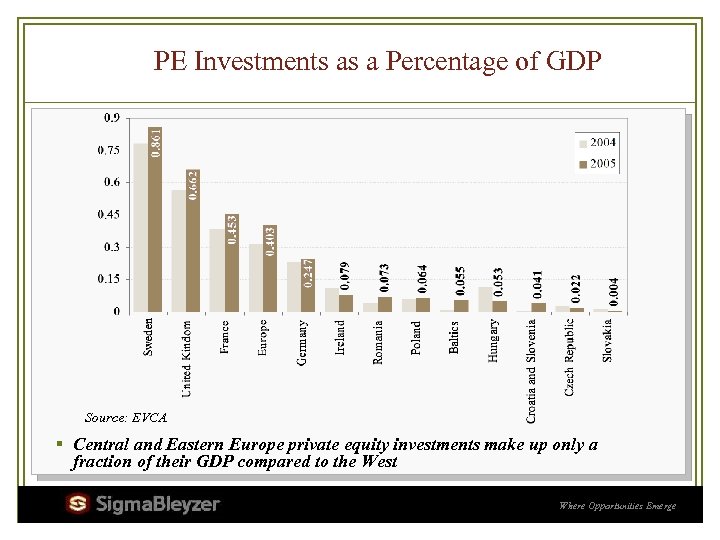

PE Investments as a Percentage of GDP Source: EVCA § Central and Eastern Europe private equity investments make up only a fraction of their GDP compared to the West Where Opportunities Emerge

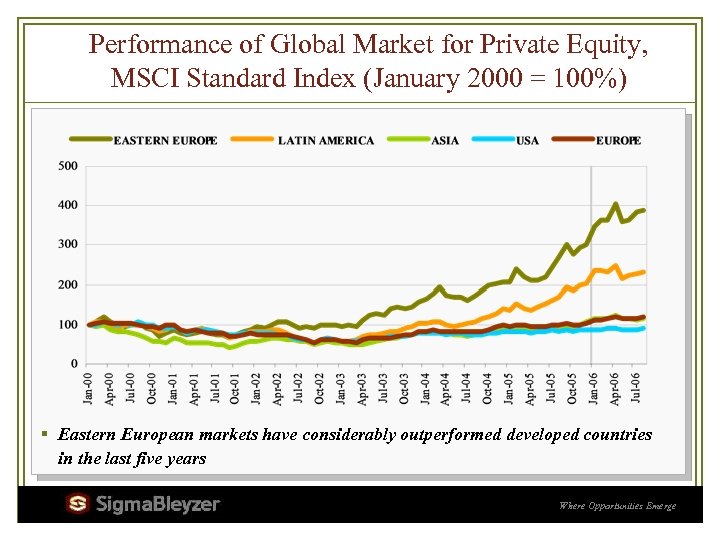

Performance of Global Market for Private Equity, MSCI Standard Index (January 2000 = 100%) § Eastern European markets have considerably outperformed developed countries in the last five years Where Opportunities Emerge

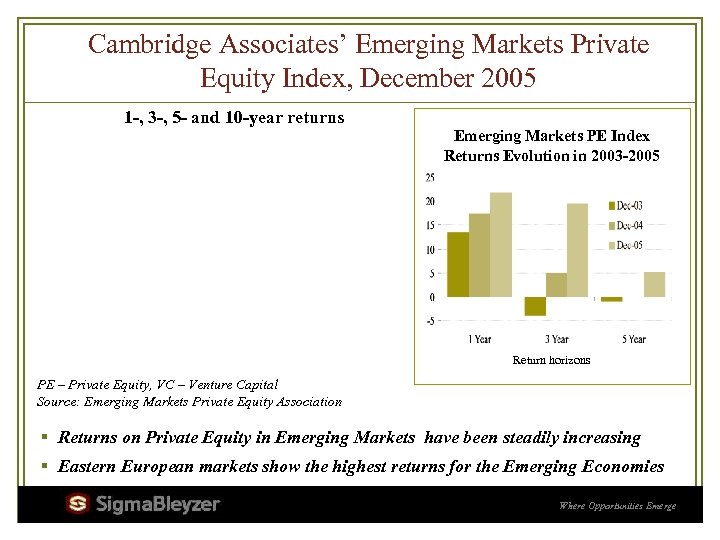

Cambridge Associates’ Emerging Markets Private Equity Index, December 2005 1 -, 3 -, 5 - and 10 -year returns Emerging Markets PE Index Returns Evolution in 2003 -2005 Return horizons PE – Private Equity, VC – Venture Capital Source: Emerging Markets Private Equity Association § Returns on Private Equity in Emerging Markets have been steadily increasing § Eastern European markets show the highest returns for the Emerging Economies Where Opportunities Emerge

INVESTMENT DRIVERS IN SEE § Three main drivers of value creation in South Eastern Europe: • Macroeconomic expansion (5% to 10% annual GDP growth) – top line business expansion; • Inefficiently run Eastern European companies provide significant opportunity for value creation through improved operations, marketing, finances, customer and quality focus – bottom line growth; • Valuations expected to rise when Bulgaria and Romania join EU in 2007 – multiples expansion. Where Opportunities Emerge

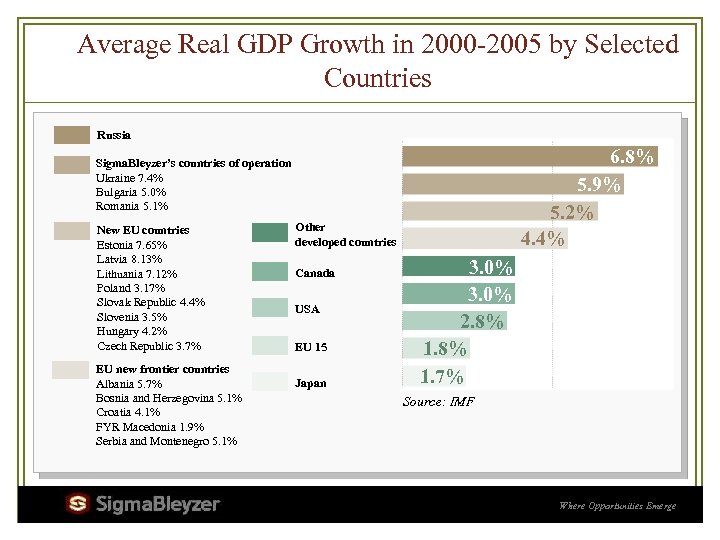

Average Real GDP Growth in 2000 -2005 by Selected Countries Russia 6. 8% 5. 9% 5. 2% 4. 4% Sigma. Bleyzer’s countries of operation Ukraine 7. 4% Bulgaria 5. 0% Romania 5. 1% New EU countries Estonia 7. 65% Latvia 8. 13% Lithuania 7. 12% Poland 3. 17% Slovak Republic 4. 4% Slovenia 3. 5% Hungary 4. 2% Czech Republic 3. 7% EU new frontier countries Albania 5. 7% Bosnia and Herzegovina 5. 1% Croatia 4. 1% FYR Macedonia 1. 9% Serbia and Montenegro 5. 1% Other developed countries Canada USA EU 15 Japan 3. 0% 2. 8% 1. 7% Source: IMF Where Opportunities Emerge

SEE is one of the fastest growing regions in Europe Real GDP growth, % year-over-year Sigma. Bleyzer’s countries of operation EU new frontier countries New EU countries * IMF projections Source: IMF, National Statistical Offices Where Opportunities Emerge

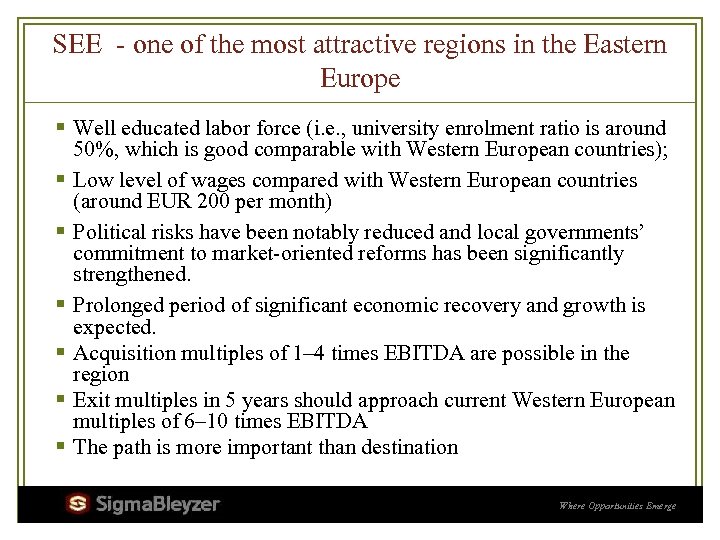

SEE - one of the most attractive regions in the Eastern Europe § Well educated labor force (i. e. , university enrolment ratio is around 50%, which is good comparable with Western European countries); § Low level of wages compared with Western European countries (around EUR 200 per month) § Political risks have been notably reduced and local governments’ commitment to market-oriented reforms has been significantly strengthened. § Prolonged period of significant economic recovery and growth is expected. § Acquisition multiples of 1– 4 times EBITDA are possible in the region § Exit multiples in 5 years should approach current Western European multiples of 6– 10 times EBITDA § The path is more important than destination Where Opportunities Emerge

Low Labor Costs in Eastern Europe Create Investment Opportunities for Europe Hourly labor costs in 2004, € Source: Eurostat, ILO, National Statistical Offices Where Opportunities Emerge

SBF IV – Sigma. Bleyzer Southeast European Fund IV § Fund IV in a family of funds § Regional fund • Focusing on Bulgaria, Romania, Ukraine • Other Balkan countries (exceptional opportunities only) § Based on proven business model of investing in emerging markets • Successful track record of creating value § Regional fund taking advantage of regional synergies and country diversification § Opportunities in new EC Frontier countries § Target size: € 200 million § Focus: Private Equity Transactions (control or near control) Where Opportunities Emerge

Adding Value to PE Investments § Double inefficiency play: • Macro-economic inefficiency • Micro (Market and Business) inefficiency § Must have: • Improving business environment • The right team of local and western professionals In the next 10 years EM PE will provide a unique opportunity to achieve superior returns while making socially responsible investments Where Opportunities Emerge

Adding Value at the Macro Level Where Opportunities Emerge

The Bleyzer Foundation Investment Drivers 1. Macroeconomic Stability 2. Liberalization and Deregulation of Business Activities 3. Stable and Predictable Legal Environment 4. Privatization, Public Administration reform and Corporate Governance 5. Removal of International Capital & Foreign Trade Restrictions 6. Facilitation of Business Financing by the Financial Sector 7. Reducing Corruption levels 8. Minimization of Political Risks 9. Improving Country Promotion and Image Where Opportunities Emerge

Country Ratings: Macroeconomic stability Recent Developments: ▪ Strong economic growth ▪ Strengthened fiscal discipline ▪ Stable national currencies and low inflation ▪ Declining public debt and prudent debt service Where Opportunities Emerge

Country Ratings: Business Liberalization and Deregulation Recent Developments: ▪ Liberalized business regulations ▪ Enhanced bankruptcy procedures ▪ Reduced tax burden Where Opportunities Emerge

Country Ratings: Stability and Predictability of Legal Environment Recent Developments: ▪ Accelerated judicial reforms ▪ Deeper integration of EU laws into national legislation of accessing countries ▪ Lower corruption in courts Where Opportunities Emerge

Country Ratings: Corporate and Public Governance Recent Developments: ▪ Improved regulation and supervision of public companies ▪ Better disclosure procedures ▪ Deeper public administration reforms and better privatization practices Where Opportunities Emerge

Country Ratings: Liberalization of Foreign Trade and Capital Movements Recent Developments: ▪ Liberalization of foreign trade regulations and enhanced efficiency of customs administrations ▪ More flexible foreign exchange markets ▪ Accelerated liberalization of capital accounts Where Opportunities Emerge

Country Ratings: Financial Sector Development Recent Developments: ▪ Fast expansion of the banking sector with increasing foreign participation ▪ Improved efficiency of local Stock Exchanges ▪ Rapidly growing capitalization of the listed companies Where Opportunities Emerge

Country Ratings: Corruption Level Recent Developments: ▪ Significantly lower corruption levels in the region ▪ Improved capacity of authorities to fight high-level corruption ▪ Better transparency of government’s activities Where Opportunities Emerge

Country Ratings: Political Risk Recent Developments: ▪ Lower political instability ▪ Strengthened commitment of national authorities to advance with market oriented reforms that improve investment climate and establish business-friendly environment Where Opportunities Emerge

Country Ratings: Country Promotion and Image Recent Developments: ▪ Improved investment ratings of the countries ▪ Many countries were granted a status of market economy by US Senate and EU ▪ Higher prospects of EU accession Where Opportunities Emerge

Sigma. Bleyzer's Aggregate Investment Climate Index – Country Ratings Where Opportunities Emerge

Adding Value at the Micro Level Where Opportunities Emerge

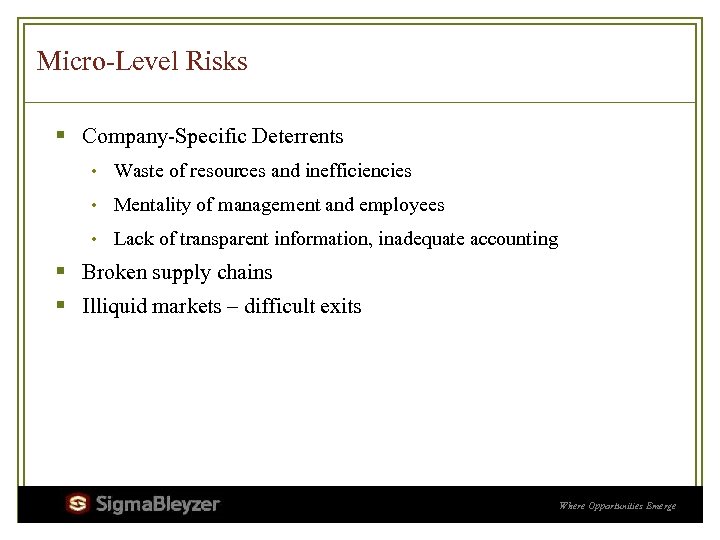

Micro-Level Risks § Company-Specific Deterrents • Waste of resources and inefficiencies • Mentality of management and employees • Lack of transparent information, inadequate accounting § Broken supply chains § Illiquid markets – difficult exits Where Opportunities Emerge

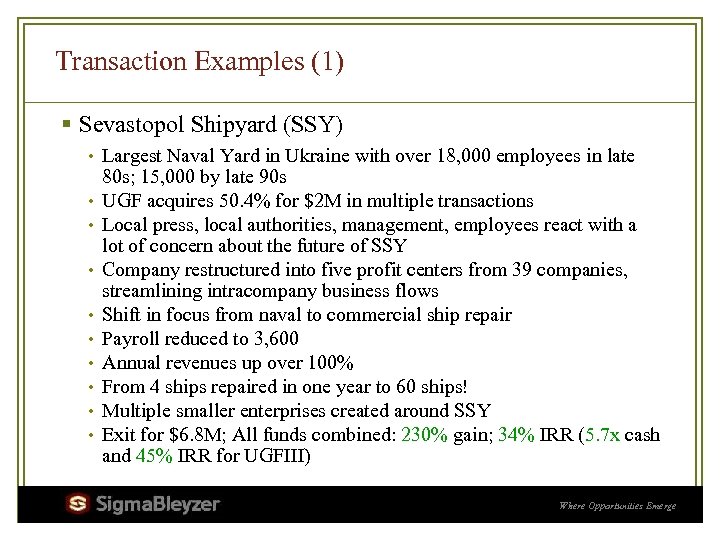

Transaction Examples (1) § Sevastopol Shipyard (SSY) • Largest Naval Yard in Ukraine with over 18, 000 employees in late • • • 80 s; 15, 000 by late 90 s UGF acquires 50. 4% for $2 M in multiple transactions Local press, local authorities, management, employees react with a lot of concern about the future of SSY Company restructured into five profit centers from 39 companies, streamlining intracompany business flows Shift in focus from naval to commercial ship repair Payroll reduced to 3, 600 Annual revenues up over 100% From 4 ships repaired in one year to 60 ships! Multiple smaller enterprises created around SSY Exit for $6. 8 M; All funds combined: 230% gain; 34% IRR (5. 7 x cash and 45% IRR for UGFIII) Where Opportunities Emerge

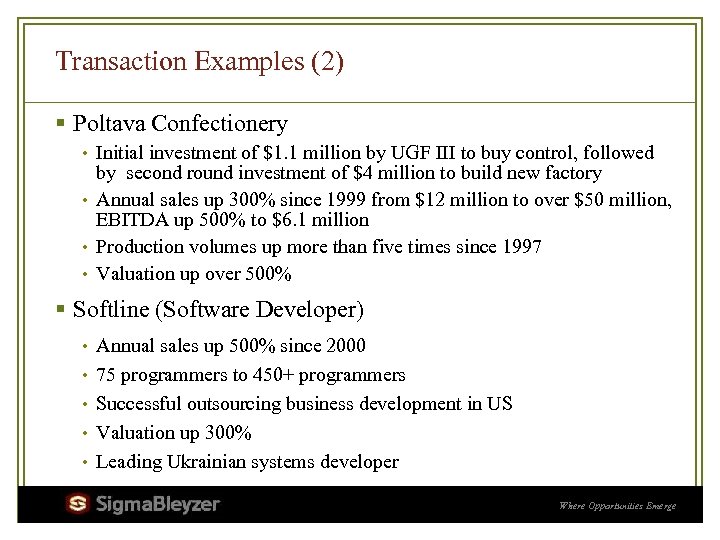

Transaction Examples (2) § Poltava Confectionery • Initial investment of $1. 1 million by UGF III to buy control, followed by second round investment of $4 million to build new factory • Annual sales up 300% since 1999 from $12 million to over $50 million, EBITDA up 500% to $6. 1 million • Production volumes up more than five times since 1997 • Valuation up over 500% § Softline (Software Developer) • Annual sales up 500% since 2000 • 75 programmers to 450+ programmers • Successful outsourcing business development in US • Valuation up 300% • Leading Ukrainian systems developer Where Opportunities Emerge

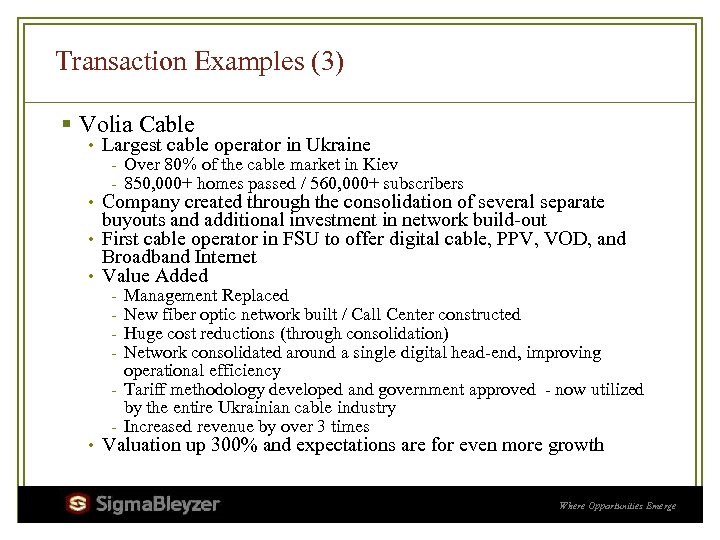

Transaction Examples (3) § Volia Cable • Largest cable operator in Ukraine - Over 80% of the cable market in Kiev - 850, 000+ homes passed / 560, 000+ subscribers • Company created through the consolidation of several separate buyouts and additional investment in network build-out • First cable operator in FSU to offer digital cable, PPV, VOD, and Broadband Internet • Value Added - Management Replaced New fiber optic network built / Call Center constructed Huge cost reductions (through consolidation) Network consolidated around a single digital head-end, improving operational efficiency - Tariff methodology developed and government approved - now utilized by the entire Ukrainian cable industry - Increased revenue by over 3 times • Valuation up 300% and expectations are for even more growth Where Opportunities Emerge

SEE Regional Investment Climate more information on www. sigmableyzer. com Where Opportunities Emerge

5d23ba359ca4e0de8764184cb76bbd1d.ppt