5a9794f77006b2dfaabab1c9f71d828f.ppt

- Количество слайдов: 39

Securitisation Summit A Case Study by Simon Stockley 29 th November 2001

Presentation Summary… Overview : SAHL • What is SAHL? • Activities since launch Securitisation • Defined • Global growth • Structure • Strategic advantages Case Study • Product • Positioning • Funding • Way forward

“Banking establishments are more dangerous than standing armies” Thomas Jefferson “Except for con-men borrowing money they shouldn’t get, and widows who have to visit with handsome men in the trust department, no sane person ever enjoyed visiting a bank” Martin Mayer

What is SA Home Loans? l The first South African company to discount home loans on a national basis. l The first South African company to fund its loan book through the internationally recognised practice of “securitisation. ” l The first South African company to operate with a transparent pricing policy with regard to home loans.

What is SA Home Loans? l It is a management organisation that links institutional investors with borrowers. l The company is owned by Peregrine Holdings Limited, Chase JP Morgan, Standard Bank, International Finance Corporation (the commercial arm of the World Bank), International Bank of SA (co-owned by Banque Nationale de Paris & Dresdner Bank), and Management.

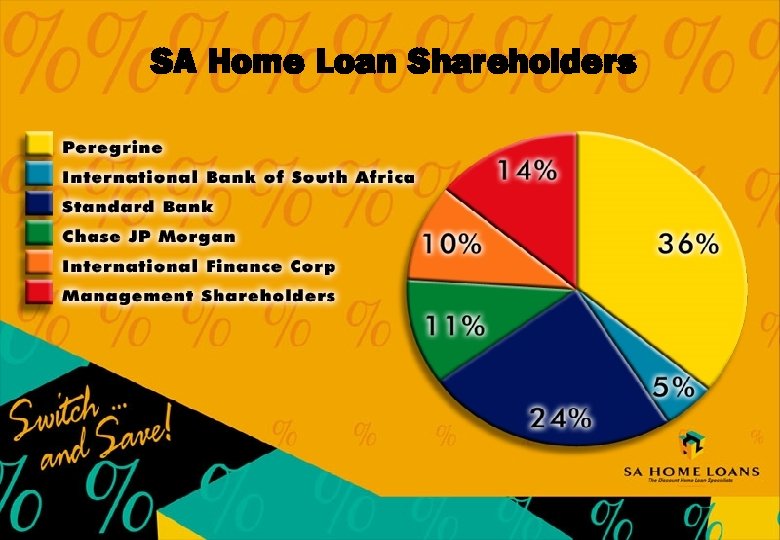

SA Home Loan Shareholders

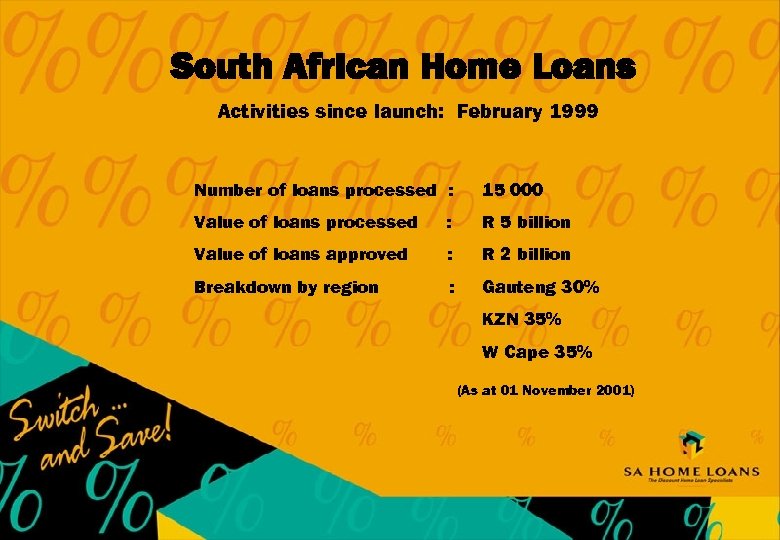

South African Home Loans Activities since launch: February 1999 Number of loans processed : 15 000 Value of loans processed : R 5 billion Value of loans approved : R 2 billion Breakdown by region : Gauteng 30% KZN 35% W Cape 35% (As at 01 November 2001)

Securitisation Defined Definition… “The packing of individual loans and other debt instruments, converting the package into a security, enhancing its credit for the further sale to a third party. ” Kendall

Securitisation Defined The effect then is ……. The conversion of illiquid individual loans to marketable securities, which are generally asset backed.

Securitisation Defined In practical terms … Securitisation pulls apart financial transactions and allocates the risk and rewards to those entities that are best able to accept and therefore price for them.

Securitisation Defined But what does securitisation actually do ……. l Gets more money into the economy to lend. l Gets more money into the country to lend. l Allows for cheaper funding so consumers benefit. l Allows for diversified funding options and pricing for risk so investors benefit.

Securitisation Defined Continued …. . . l Bypasses the traditional intermediaries and links borrowers directly to money and capital markets. l Disintermediates the entire financial market and encourages competitive forces.

Securitisation Some Facts l Securitisation is America’s most reliable source of low cost finance. l In the USA, half of all home loans are presently funded through securitisation and one fifth of motor and credit card receivables. l In 1998 half of Chryslers corporate debt was funded through securitisation.

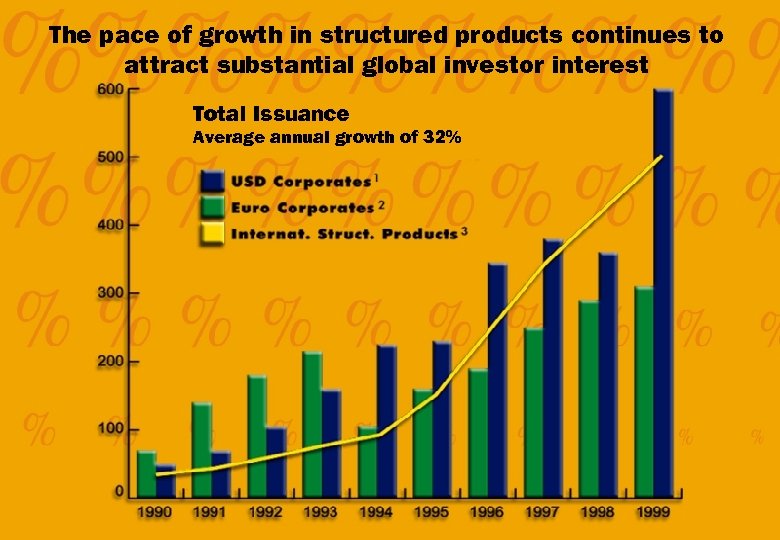

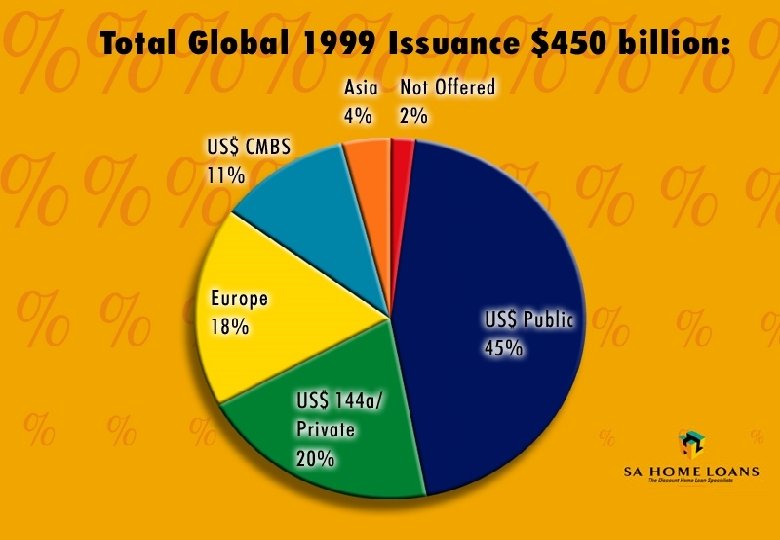

The pace of growth in structured products continues to attract substantial global investor interest Total Issuance Average annual growth of 32%

Securitisation Market Size Western Europe $31 billion Asia $9 billion Latin America $1 billion Non-US Asset Backed $41 billion in 1997

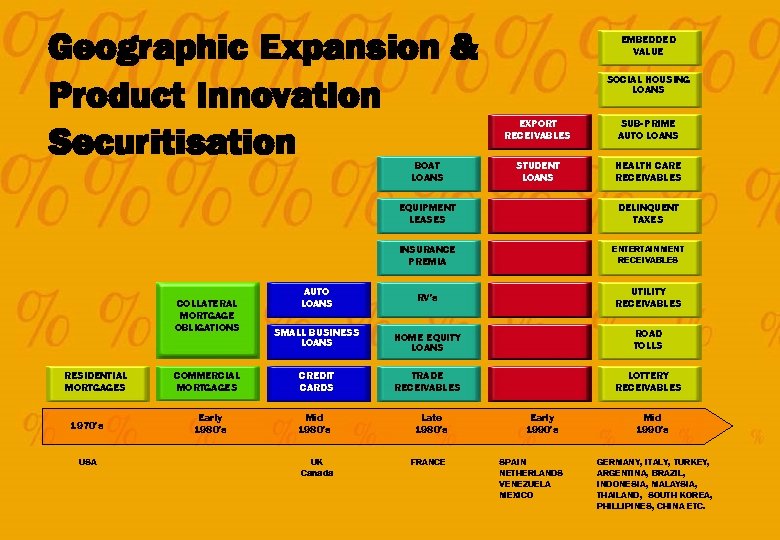

Geographic Expansion & Product Innovation Securitisation BOAT LOANS EMBEDDED VALUE SOCIAL HOUSING LOANS EXPORT RECEIVABLES SUB-PRIME AUTO LOANS STUDENT LOANS HEALTH CARE RECEIVABLES EQUIPMENT LEASES INSURANCE PREMIA COLLATERAL MORTGAGE OBLIGATIONS RESIDENTIAL MORTGAGES 1970’s USA COMMERCIAL MORTGAGES Early 1980’s DELINQUENT TAXES ENTERTAINMENT RECEIVABLES RV’s UTILITY RECEIVABLES SMALL BUSINESS LOANS HOME EQUITY LOANS ROAD TOLLS CREDIT CARDS TRADE RECEIVABLES LOTTERY RECEIVABLES AUTO LOANS Mid 1980’s Late 1980’s UK Canada FRANCE Early 1990’s SPAIN NETHERLANDS VENEZUELA MEXICO Mid 1990’s GERMANY, ITALY, TURKEY, ARGENTINA, BRAZIL, INDONESIA, MALAYSIA, THAILAND, SOUTH KOREA, PHILLIPINES, CHINA ETC.

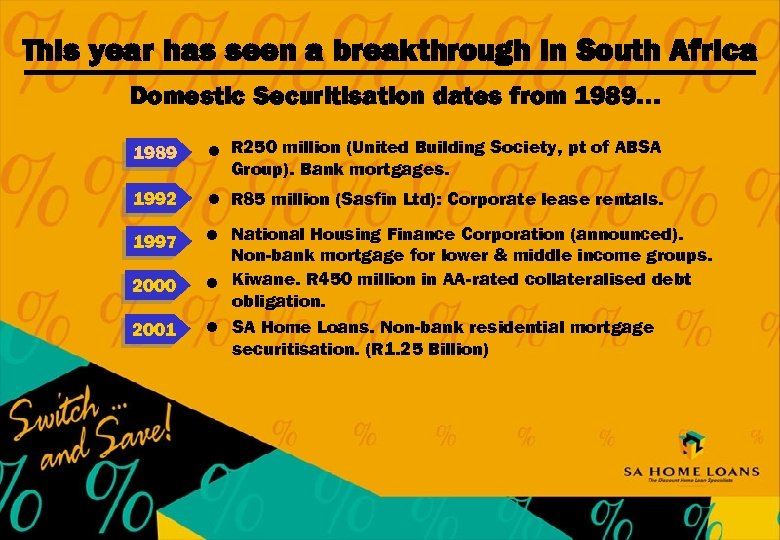

This year has seen a breakthrough in South Africa Domestic Securitisation dates from 1989… 1989 l R 250 million (United Building Society, pt of ABSA Group). Bank mortgages. 1992 l R 85 million (Sasfin Ltd): Corporate lease rentals. 1997 l National Housing Finance Corporation (announced). Non-bank mortgage for lower & middle income groups. l Kiwane. R 450 million in AA-rated collateralised debt obligation. l SA Home Loans. Non-bank residential mortgage securitisation. (R 1. 25 Billion) 2000 2001

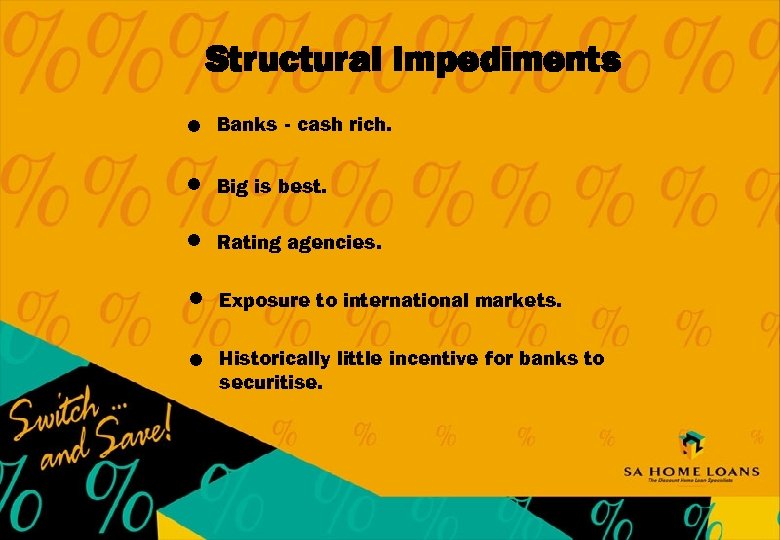

Structural Impediments l Banks - cash rich. l Big is best. l Rating agencies. l Exposure to international markets. l Historically little incentive for banks to securitise.

Origination Impediments l Need to originate. l Time to originate. l Cost associated with origination. l Registration process. Costs of transferring assets.

Information Technology Impediments l Lack of silver bullet applications. l Costs. l Integration.

SA Home Loans A case study l The product. l Its positioning. l Funding.

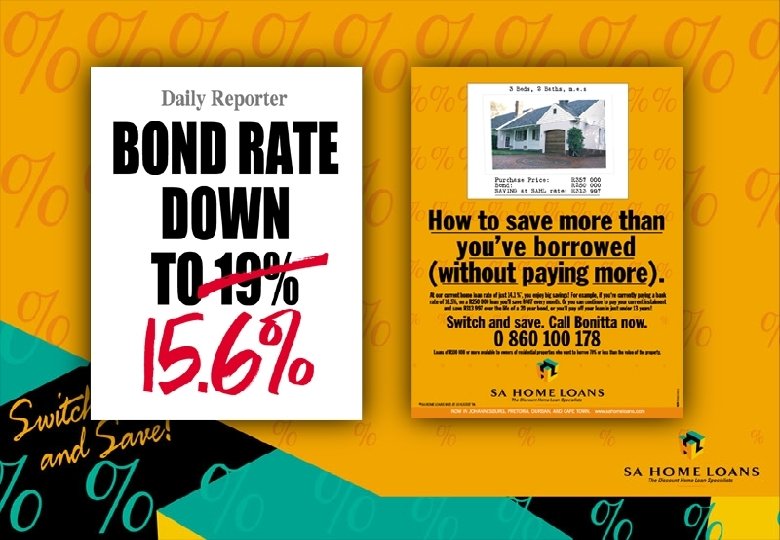

The Product l 20 year, variable rate, reducing term mortgage. l No prepayment or redemption penalties. l Discounted legal and administrative fees. l No ongoing administrative charges. l Re-advance facility twelve times a year. l Fixed margin above cost of money.

Positioning

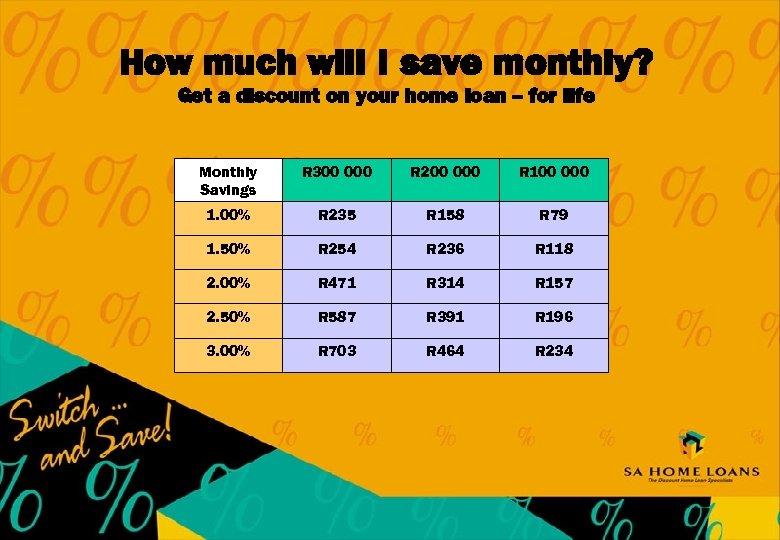

How much will I save monthly? Get a discount on your home loan – for life Monthly Savings R 300 000 R 200 000 R 100 000 1. 00% R 235 R 158 R 79 1. 50% R 254 R 236 R 118 2. 00% R 471 R 314 R 157 2. 50% R 587 R 391 R 196 3. 00% R 703 R 464 R 234

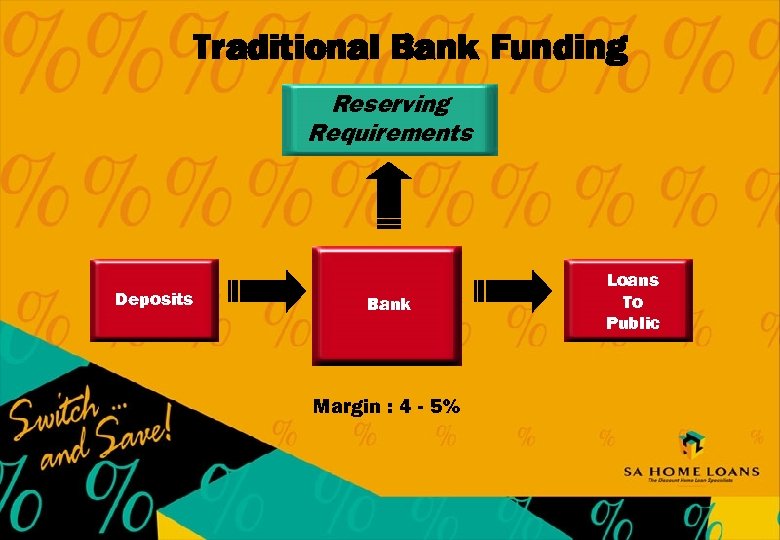

Traditional Bank Funding Reserving Requirements Deposits Bank Margin : 4 - 5% Loans To Public

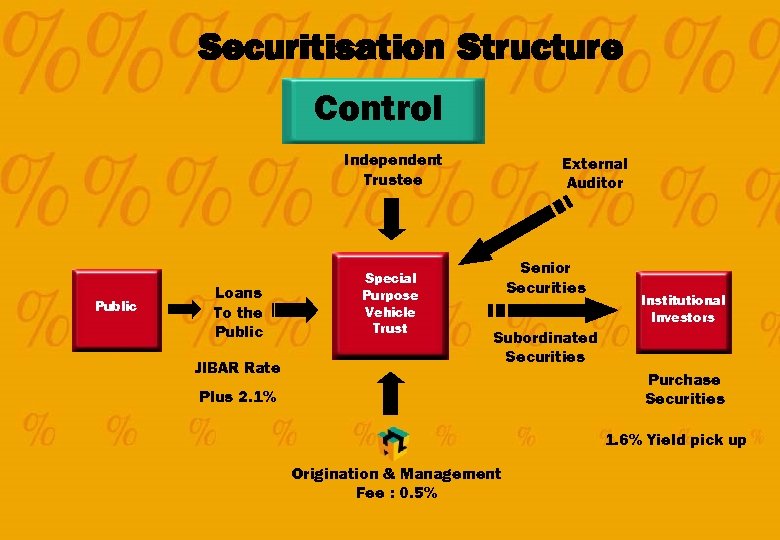

Securitisation Structure Control Independent Trustee Public Loans To the Public JIBAR Rate Special Purpose Vehicle Trust External Auditor Senior Securities Institutional Investors Subordinated Securities Purchase Securities Plus 2. 1% 1. 6% Yield pick up Origination & Management Fee : 0. 5%

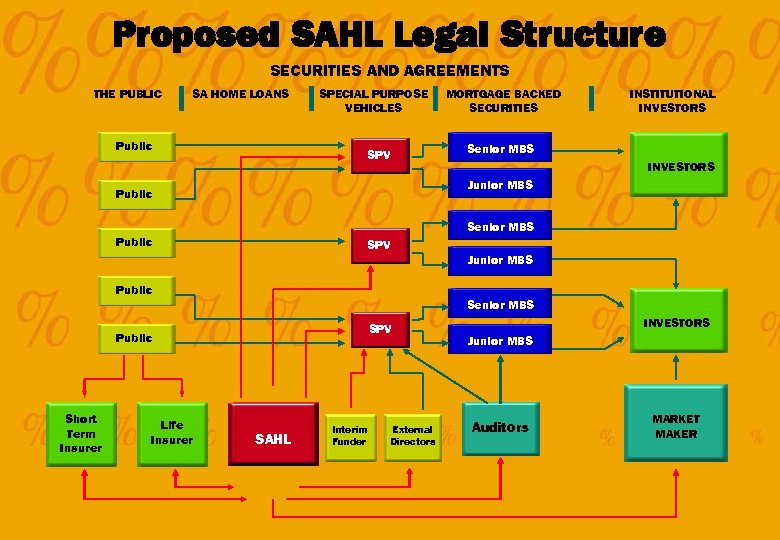

Proposed SAHL Legal Structure SECURITIES AND AGREEMENTS THE PUBLIC SA HOME LOANS Public SPECIAL PURPOSE VEHICLES SPV MORTGAGE BACKED SECURITIES INSTITUTIONAL INVESTORS Senior MBS INVESTORS Junior MBS Public Senior MBS Public SPV Junior MBS Public Senior MBS SPV Public Short Term Insurer Life Insurer SAHL Interim Funder External Directors INVESTORS Junior MBS Auditors MARKET MAKER

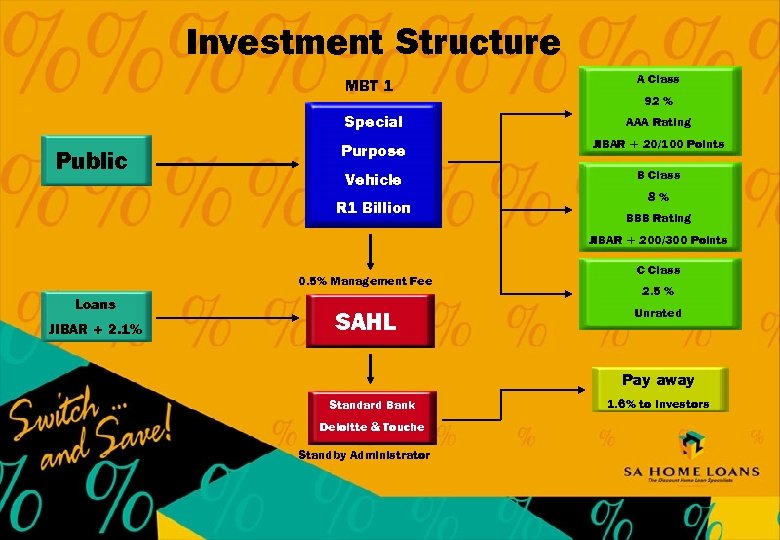

Investment Structure MBT 1 A Class 92 % Special Public AAA Rating Purpose JIBAR + 20/100 Points Vehicle B Class R 1 Billion 8% BBB Rating JIBAR + 200/300 Points 0. 5% Management Fee Loans JIBAR + 2. 1% SAHL C Class 2. 5 % Unrated Pay away Standard Bank Deloitte & Touche Standby Administrator 1. 6% to investors

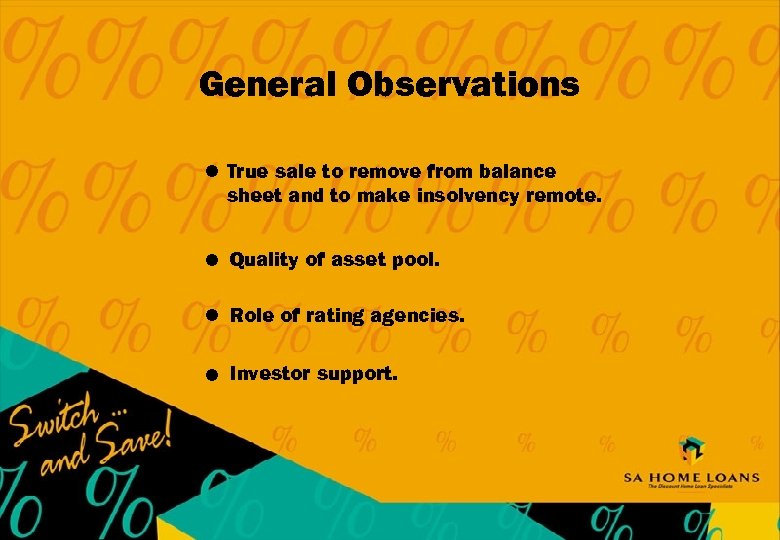

General Observations l True sale to remove from balance sheet and to make insolvency remote. l Quality of asset pool. l Role of rating agencies. l Investor support.

Will Investors buy? l Yield enhancement. l Portfolio diversification. l Rating. l Liquidity. l Privatisation/shortage of quality script.

The Strategic Advantages l Diversify funding base – access to new sources of funding – less reliance on bank lending. l Lower cost of funding to originator and consumer. l Off balance sheet treatment/Capital relief. l Allows unrated / poorly rated originators to access capital markets.

The Strategic Advantages Continued. . . l Optimises the use of scarce capital resources. l Transcend the sovereign risk ceiling. l Allows pricing for risk.

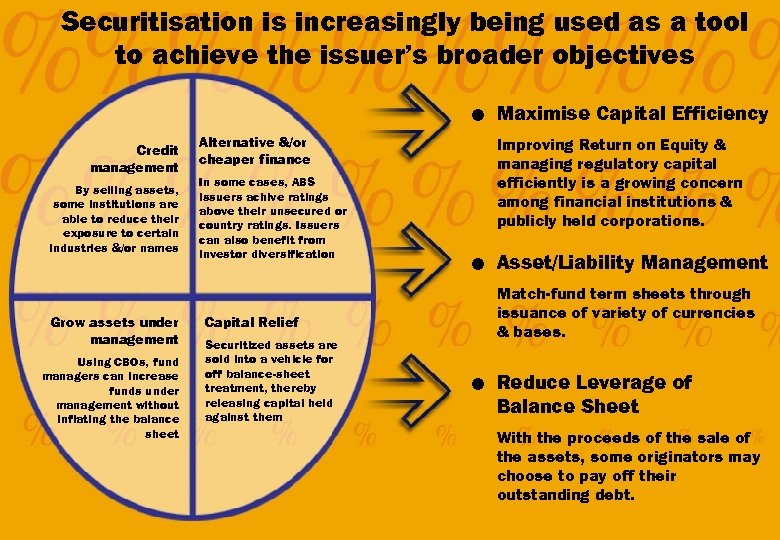

Securitisation is increasingly being used as a tool to achieve the issuer’s broader objectives l Maximise Capital Efficiency Credit management By selling assets, some institutions are able to reduce their exposure to certain industries &/or names Grow assets under management Using CBOs, fund managers can increase funds under management without inflating the balance sheet Alternative &/or cheaper finance In some cases, ABS issuers achive ratings above their unsecured or country ratings. Issuers can also benefit from investor diversification Capital Relief Securitized assets are sold into a vehicle for off balance-sheet treatment, thereby releasing capital held against them Improving Return on Equity & managing regulatory capital efficiently is a growing concern among financial institutions & publicly held corporations. l Asset/Liability Management Match-fund term sheets through issuance of variety of currencies & bases. l Reduce Leverage of Balance Sheet With the proceeds of the sale of the assets, some originators may choose to pay off their outstanding debt.

Why the Securitisation Model? l Ability to access capital markets directly. l “Unbank lending”. l Pricing for risk. l Funding diversification.

The Way Forward l Increased activity MBS market – placements. l Investor education. l Growth secondary market – listing bond exchange. l Cross border applications – ability to bridge sovereign risk ceilings. l Expansion to other asset classes. l Greater product diversification.

Thank you. Simon Stockley CEO - SA Homeloans (Pty) Ltd Phone : (031) 560 5392 Fax : (031) 562 4266 Cell no : 083 276 0068 e-mail : simons@sahomeloans. com

5a9794f77006b2dfaabab1c9f71d828f.ppt