0ab1b51826e5ab49ab14eb1ac9de757a.ppt

- Количество слайдов: 67

Securities Regulations • Federal Law • State Law (c) 2004 West Legal Studies in Business A Division of Thomson 1

Securities Regulations • Federal Law • State Law (c) 2004 West Legal Studies in Business A Division of Thomson 1

Federal Securities Laws and Regulations • 1933 Act – Regulates the first issue of any security in interstate commerce • 1934 Act – Regulates the sales after the first issue (secondary trading) of any security in interstate commerce – Created the Securities and Exchange Commission (SEC) – Regulates the stock exchanges, brokers, and dealers • Many more federal laws regulating investment banks, companies, etc. See text p. 225 (c) 2004 West Legal Studies in Business A Division of Thomson 2

Federal Securities Laws and Regulations • 1933 Act – Regulates the first issue of any security in interstate commerce • 1934 Act – Regulates the sales after the first issue (secondary trading) of any security in interstate commerce – Created the Securities and Exchange Commission (SEC) – Regulates the stock exchanges, brokers, and dealers • Many more federal laws regulating investment banks, companies, etc. See text p. 225 (c) 2004 West Legal Studies in Business A Division of Thomson 2

Securities and Exchange Commission (SEC) • Agency created in the 1934 Securities Act to administer the federal securities laws: – Legislate rules and regulations to implement broad law: Commission in Wash. , D. C. • These are published first in the Fed. Register and then finally in the Code of Federal Regulations (CFR) – Investigate: investigators in SEC branch offices around the U. S. – Adjudicate the violations of these laws: administrative law judges in SEC branch offices around the U. S. (c) 2004 West Legal Studies in Business A Division of Thomson 3

Securities and Exchange Commission (SEC) • Agency created in the 1934 Securities Act to administer the federal securities laws: – Legislate rules and regulations to implement broad law: Commission in Wash. , D. C. • These are published first in the Fed. Register and then finally in the Code of Federal Regulations (CFR) – Investigate: investigators in SEC branch offices around the U. S. – Adjudicate the violations of these laws: administrative law judges in SEC branch offices around the U. S. (c) 2004 West Legal Studies in Business A Division of Thomson 3

State Securities Laws • Called “Blue Sky laws” • Modeled after the federal laws • Both federal and state laws must be followed, not one or the other – Unless either law says an issuer is exempt (c) 2004 West Legal Studies in Business A Division of Thomson 4

State Securities Laws • Called “Blue Sky laws” • Modeled after the federal laws • Both federal and state laws must be followed, not one or the other – Unless either law says an issuer is exempt (c) 2004 West Legal Studies in Business A Division of Thomson 4

What is a security? • U. S. Supreme Court: Securities & Exchange Commission v. W. J. Howey Co. 1946 – Any time person, A, gives his money to person, B, in the hopes of making a profit mostly from the management efforts of person B • See broad definition in text = courts interpret the definition very broadly (c) 2004 West Legal Studies in Business A Division of Thomson 5

What is a security? • U. S. Supreme Court: Securities & Exchange Commission v. W. J. Howey Co. 1946 – Any time person, A, gives his money to person, B, in the hopes of making a profit mostly from the management efforts of person B • See broad definition in text = courts interpret the definition very broadly (c) 2004 West Legal Studies in Business A Division of Thomson 5

New definition • Reves v. Ernst & Young 1990 – Even uncollateralized and uninsured promissory notes were securities – Used a new test: the family resemblance test • Presume that they are securities • Can rebut this presumption by showing they more closely resemble the family of instruments found not to be securities (c) 2004 West Legal Studies in Business A Division of Thomson 6

New definition • Reves v. Ernst & Young 1990 – Even uncollateralized and uninsured promissory notes were securities – Used a new test: the family resemblance test • Presume that they are securities • Can rebut this presumption by showing they more closely resemble the family of instruments found not to be securities (c) 2004 West Legal Studies in Business A Division of Thomson 6

Factors Court Will Consider Since Reves • • Motivation of buyer and seller Plan of distribution of the note The reasonable expectations of the buyer/investor Whethere were other laws regulating the transaction, rendering application of the Securities Act unnecessary (c) 2004 West Legal Studies in Business A Division of Thomson 7

Factors Court Will Consider Since Reves • • Motivation of buyer and seller Plan of distribution of the note The reasonable expectations of the buyer/investor Whethere were other laws regulating the transaction, rendering application of the Securities Act unnecessary (c) 2004 West Legal Studies in Business A Division of Thomson 7

Examples of Securities • • Stock in Exxon, IBM, etc Bonds Limited Partnerships Limited Liability Memberships (c) 2004 West Legal Studies in Business A Division of Thomson 8

Examples of Securities • • Stock in Exxon, IBM, etc Bonds Limited Partnerships Limited Liability Memberships (c) 2004 West Legal Studies in Business A Division of Thomson 8

Securities and Exchange Commission v. SG Ltd. (1 st Circuit 2001) • Stockgeneration Web site: opportunity to purchase shares in eleven different “virtual companies” • Pushed “privileged” companies in which they had an interest • SEC said transaction in securities, SG said transaction was a game, fantasy, not security (c) 2004 West Legal Studies in Business A Division of Thomson 9

Securities and Exchange Commission v. SG Ltd. (1 st Circuit 2001) • Stockgeneration Web site: opportunity to purchase shares in eleven different “virtual companies” • Pushed “privileged” companies in which they had an interest • SEC said transaction in securities, SG said transaction was a game, fantasy, not security (c) 2004 West Legal Studies in Business A Division of Thomson 9

Securities Act of 1933 • Regulates the first issue of all securities for the first time • Only if sold in interstate commerce • Calls for the issuer to disclose: reveal all the important information about itself to the public – By filing a registration statement containing “everything about the issuer” with the SEC – By supplying a prospectus of “everything about the issuer in simplified form” to every purchaser (c) 2004 West Legal Studies in Business A Division of Thomson 10

Securities Act of 1933 • Regulates the first issue of all securities for the first time • Only if sold in interstate commerce • Calls for the issuer to disclose: reveal all the important information about itself to the public – By filing a registration statement containing “everything about the issuer” with the SEC – By supplying a prospectus of “everything about the issuer in simplified form” to every purchaser (c) 2004 West Legal Studies in Business A Division of Thomson 10

SEC v. Abacus International Holding Corp. and Arthur Agustin • SEC alleged that Agustin had sold nonexistent securities, violating the 1933 Act (c) 2004 West Legal Studies in Business A Division of Thomson 11

SEC v. Abacus International Holding Corp. and Arthur Agustin • SEC alleged that Agustin had sold nonexistent securities, violating the 1933 Act (c) 2004 West Legal Studies in Business A Division of Thomson 11

SEC Act of 1934 • • Regulates secondary trading National Security Exchanges have to register Proxy solicitations Insider Trading – Manipulating Price of Security – Aiding and Abetting • • • Private Securities Litigation Reform Act of 1995 Securities Litigation Uniform Standards Act of 1998 Williams Act = Tender Offers Act Commodity Exchange Act Foreign Corrupt Practices Act Electronic Records and Signatures Under Federal Securities Law (c) 2004 West Legal Studies in Business A Division of Thomson 12

SEC Act of 1934 • • Regulates secondary trading National Security Exchanges have to register Proxy solicitations Insider Trading – Manipulating Price of Security – Aiding and Abetting • • • Private Securities Litigation Reform Act of 1995 Securities Litigation Uniform Standards Act of 1998 Williams Act = Tender Offers Act Commodity Exchange Act Foreign Corrupt Practices Act Electronic Records and Signatures Under Federal Securities Law (c) 2004 West Legal Studies in Business A Division of Thomson 12

1934 Act to Regulate • Regulates Secondary Trading (after the first issue) – – Registration and reporting by big companies Insider Trading Regulations: 16 B and 10 B Proxy Regulations Take-over Regulations • Stock Exchanges must register and follow certain rules and regs. • Brokers, Dealers must get licensed and follow certain rules and regs. (c) 2004 West Legal Studies in Business A Division of Thomson 13

1934 Act to Regulate • Regulates Secondary Trading (after the first issue) – – Registration and reporting by big companies Insider Trading Regulations: 16 B and 10 B Proxy Regulations Take-over Regulations • Stock Exchanges must register and follow certain rules and regs. • Brokers, Dealers must get licensed and follow certain rules and regs. (c) 2004 West Legal Studies in Business A Division of Thomson 13

How Does it Regulate Secondary Trading? • A domestic company must continue to disclose info about itself to the SEC and the public – register itself with the SEC if it: • Has $10 million in assets, 500 or more shareholders and • Lists its securities on a national stock exchange – File annual reports, quarterly reports, and maybe monthly reports with the SEC – Give its shareholders annual reports – Follow certain accounting and record-keeping procedures (Foreign Corrupt Practices Act) (c) 2004 West Legal Studies in Business A Division of Thomson 14

How Does it Regulate Secondary Trading? • A domestic company must continue to disclose info about itself to the SEC and the public – register itself with the SEC if it: • Has $10 million in assets, 500 or more shareholders and • Lists its securities on a national stock exchange – File annual reports, quarterly reports, and maybe monthly reports with the SEC – Give its shareholders annual reports – Follow certain accounting and record-keeping procedures (Foreign Corrupt Practices Act) (c) 2004 West Legal Studies in Business A Division of Thomson 14

Haack v. Max Internet Communications, Inc. • Company sued for fraud in the selling of securities (c) 2004 West Legal Studies in Business A Division of Thomson 15

Haack v. Max Internet Communications, Inc. • Company sued for fraud in the selling of securities (c) 2004 West Legal Studies in Business A Division of Thomson 15

Investment Company Act • Regulates companies ( mutual fund companies) that – Invest, reinvest, trade in securities, whose own securities are publicly offered • Attempts to minimize conflicts of interest (c) 2004 West Legal Studies in Business A Division of Thomson 16

Investment Company Act • Regulates companies ( mutual fund companies) that – Invest, reinvest, trade in securities, whose own securities are publicly offered • Attempts to minimize conflicts of interest (c) 2004 West Legal Studies in Business A Division of Thomson 16

1933 Act Exemptions From Registration – Certain types of issuers – Certain types of transactions (c) 2004 West Legal Studies in Business A Division of Thomson 17

1933 Act Exemptions From Registration – Certain types of issuers – Certain types of transactions (c) 2004 West Legal Studies in Business A Division of Thomson 17

Certain Types of Issuers are Exempt • If issuer is regulated by another federal law – Banks and Investment Companies – Railroads – Insurance Companies • If issuer is a nonprofit – Charities – Religious groups (c) 2004 West Legal Studies in Business A Division of Thomson 18

Certain Types of Issuers are Exempt • If issuer is regulated by another federal law – Banks and Investment Companies – Railroads – Insurance Companies • If issuer is a nonprofit – Charities – Religious groups (c) 2004 West Legal Studies in Business A Division of Thomson 18

Certain types of transactions are exempt • Small • Private (only sell to “sophisticated” investors who can get info elsewhere and don’t need registration statement to get info) • Casual Sales (you and I selling & buying) • Brokers and Dealers after the “first allotment of that security” is sold (c) 2004 West Legal Studies in Business A Division of Thomson 19

Certain types of transactions are exempt • Small • Private (only sell to “sophisticated” investors who can get info elsewhere and don’t need registration statement to get info) • Casual Sales (you and I selling & buying) • Brokers and Dealers after the “first allotment of that security” is sold (c) 2004 West Legal Studies in Business A Division of Thomson 19

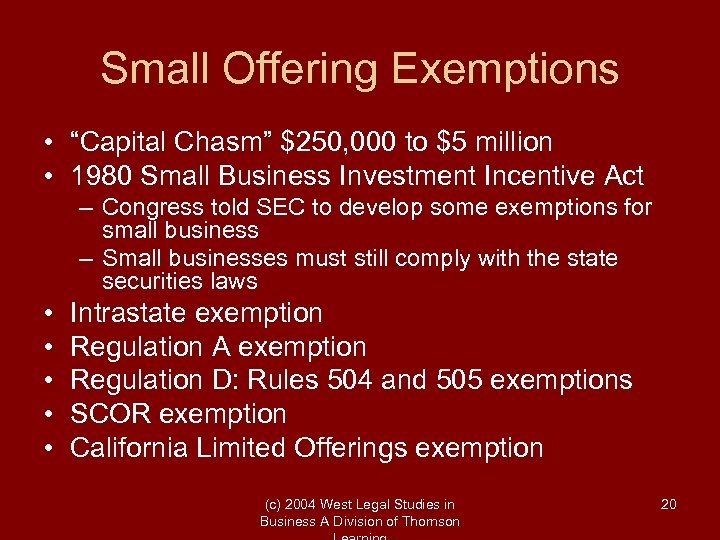

Small Offering Exemptions • “Capital Chasm” $250, 000 to $5 million • 1980 Small Business Investment Incentive Act – Congress told SEC to develop some exemptions for small business – Small businesses must still comply with the state securities laws • • • Intrastate exemption Regulation A exemption Regulation D: Rules 504 and 505 exemptions SCOR exemption California Limited Offerings exemption (c) 2004 West Legal Studies in Business A Division of Thomson 20

Small Offering Exemptions • “Capital Chasm” $250, 000 to $5 million • 1980 Small Business Investment Incentive Act – Congress told SEC to develop some exemptions for small business – Small businesses must still comply with the state securities laws • • • Intrastate exemption Regulation A exemption Regulation D: Rules 504 and 505 exemptions SCOR exemption California Limited Offerings exemption (c) 2004 West Legal Studies in Business A Division of Thomson 20

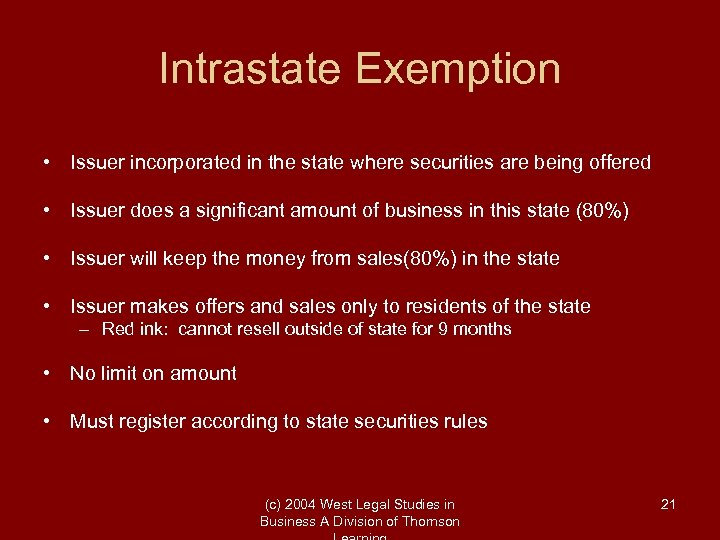

Intrastate Exemption • Issuer incorporated in the state where securities are being offered • Issuer does a significant amount of business in this state (80%) • Issuer will keep the money from sales(80%) in the state • Issuer makes offers and sales only to residents of the state – Red ink: cannot resell outside of state for 9 months • No limit on amount • Must register according to state securities rules (c) 2004 West Legal Studies in Business A Division of Thomson 21

Intrastate Exemption • Issuer incorporated in the state where securities are being offered • Issuer does a significant amount of business in this state (80%) • Issuer will keep the money from sales(80%) in the state • Issuer makes offers and sales only to residents of the state – Red ink: cannot resell outside of state for 9 months • No limit on amount • Must register according to state securities rules (c) 2004 West Legal Studies in Business A Division of Thomson 21

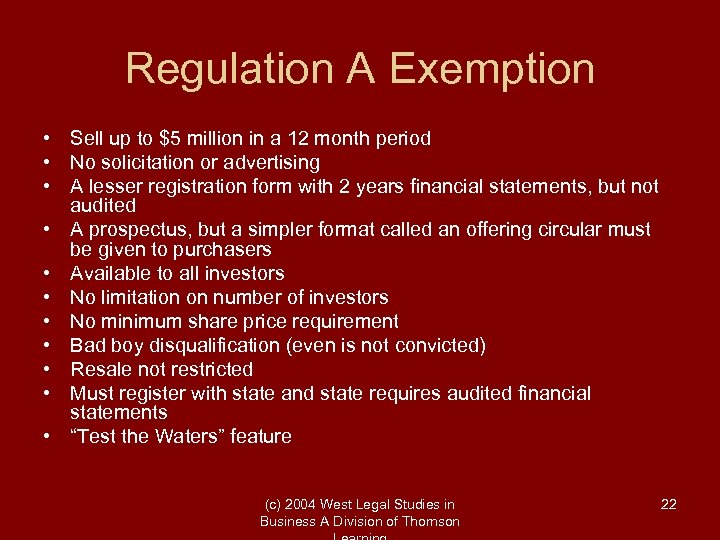

Regulation A Exemption • Sell up to $5 million in a 12 month period • No solicitation or advertising • A lesser registration form with 2 years financial statements, but not audited • A prospectus, but a simpler format called an offering circular must be given to purchasers • Available to all investors • No limitation on number of investors • No minimum share price requirement • Bad boy disqualification (even is not convicted) • Resale not restricted • Must register with state and state requires audited financial statements • “Test the Waters” feature (c) 2004 West Legal Studies in Business A Division of Thomson 22

Regulation A Exemption • Sell up to $5 million in a 12 month period • No solicitation or advertising • A lesser registration form with 2 years financial statements, but not audited • A prospectus, but a simpler format called an offering circular must be given to purchasers • Available to all investors • No limitation on number of investors • No minimum share price requirement • Bad boy disqualification (even is not convicted) • Resale not restricted • Must register with state and state requires audited financial statements • “Test the Waters” feature (c) 2004 West Legal Studies in Business A Division of Thomson 22

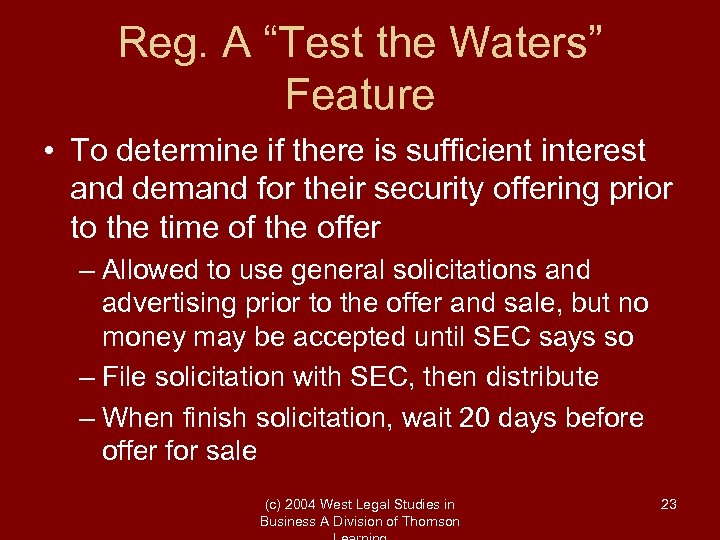

Reg. A “Test the Waters” Feature • To determine if there is sufficient interest and demand for their security offering prior to the time of the offer – Allowed to use general solicitations and advertising prior to the offer and sale, but no money may be accepted until SEC says so – File solicitation with SEC, then distribute – When finish solicitation, wait 20 days before offer for sale (c) 2004 West Legal Studies in Business A Division of Thomson 23

Reg. A “Test the Waters” Feature • To determine if there is sufficient interest and demand for their security offering prior to the time of the offer – Allowed to use general solicitations and advertising prior to the offer and sale, but no money may be accepted until SEC says so – File solicitation with SEC, then distribute – When finish solicitation, wait 20 days before offer for sale (c) 2004 West Legal Studies in Business A Division of Thomson 23

Small Offerings Exemptions Under Regulation D • No registration or prospectus required • Rule 504 • Rule 505 (c) 2004 West Legal Studies in Business A Division of Thomson 24

Small Offerings Exemptions Under Regulation D • No registration or prospectus required • Rule 504 • Rule 505 (c) 2004 West Legal Studies in Business A Division of Thomson 24

Regulation D Rule 504 • $1 million in a 12 month period • No limitation on solicitation or advertising to public investors • Available to all investors • No limitation on number of investors • No specific disclosure requirements • No audited financial statements (still have to register with state) • No restrictions on resales (c) 2004 West Legal Studies in Business A Division of Thomson 25

Regulation D Rule 504 • $1 million in a 12 month period • No limitation on solicitation or advertising to public investors • Available to all investors • No limitation on number of investors • No specific disclosure requirements • No audited financial statements (still have to register with state) • No restrictions on resales (c) 2004 West Legal Studies in Business A Division of Thomson 25

Accredited investors: • Insurance, Investment companies, employee benefit plans, Bus. Devl. Company, charity or educational institution with assets of $5 million, any director, executive officer or general partner of issuer, person who bought at least $150, 000 of the securities offered, if purchase did not exceed 20% of the person’s net worth, any person with a net worth of over $1 million; and any person with an annual income of more that $200, 000. (c) 2004 West Legal Studies in Business A Division of Thomson 26

Accredited investors: • Insurance, Investment companies, employee benefit plans, Bus. Devl. Company, charity or educational institution with assets of $5 million, any director, executive officer or general partner of issuer, person who bought at least $150, 000 of the securities offered, if purchase did not exceed 20% of the person’s net worth, any person with a net worth of over $1 million; and any person with an annual income of more that $200, 000. (c) 2004 West Legal Studies in Business A Division of Thomson 26

Regulation D Rule 505 • $5 million in a 12 month period • No solicitation or advertising • Unlimited number of accredited investors and up to 35 non-accredited investors • Bad-boy disqualification • Audited financial information • Resale restriction (c) 2004 West Legal Studies in Business A Division of Thomson 27

Regulation D Rule 505 • $5 million in a 12 month period • No solicitation or advertising • Unlimited number of accredited investors and up to 35 non-accredited investors • Bad-boy disqualification • Audited financial information • Resale restriction (c) 2004 West Legal Studies in Business A Division of Thomson 27

SCOR Small Corporate Offering Registration 1992 • Uniform Limited Offering registration or the “seed capital exemption “ – $1 million in 12 month – No resales – Use Regis. Form U-7 (simplified) – Not available to all investors – No testing the waters – Minimum share price – Audited financial statements are required (c) 2004 West Legal Studies in Business A Division of Thomson 28

SCOR Small Corporate Offering Registration 1992 • Uniform Limited Offering registration or the “seed capital exemption “ – $1 million in 12 month – No resales – Use Regis. Form U-7 (simplified) – Not available to all investors – No testing the waters – Minimum share price – Audited financial statements are required (c) 2004 West Legal Studies in Business A Division of Thomson 28

California Limited Offering Exemption • SEC said that other states could do this also • No state registration for up to $5 million • General solicitation is allowed • Available to qualified investors (accredited) (c) 2004 West Legal Studies in Business A Division of Thomson 29

California Limited Offering Exemption • SEC said that other states could do this also • No state registration for up to $5 million • General solicitation is allowed • Available to qualified investors (accredited) (c) 2004 West Legal Studies in Business A Division of Thomson 29

Other exemptions • Regulation S – Exempts certain international offerings • Regulation E – Exempts securities of small business investment companies • SEC Rule 701 – Exempts sales of securities through employee benefit plans of nonpublic companies (c) 2004 West Legal Studies in Business A Division of Thomson 30

Other exemptions • Regulation S – Exempts certain international offerings • Regulation E – Exempts securities of small business investment companies • SEC Rule 701 – Exempts sales of securities through employee benefit plans of nonpublic companies (c) 2004 West Legal Studies in Business A Division of Thomson 30

Private Offerings Exemptions • Regulation D Rule 506 • Section 4(6) (c) 2004 West Legal Studies in Business A Division of Thomson 31

Private Offerings Exemptions • Regulation D Rule 506 • Section 4(6) (c) 2004 West Legal Studies in Business A Division of Thomson 31

Regulation D Rule 506 – – Any amount Any time period No solicitation or advertising Unlimited number of accredited and up to 35 nonaccredited investors, BUT • The non-accredited investors must be sophisticated – “In the know” or – Rich – – No bad-boy disqualification Audited financial information is required Resale restrictions National securities Markets Improvement Act of 1996: Some relief from state registration (c) 2004 West Legal Studies in Business A Division of Thomson 32

Regulation D Rule 506 – – Any amount Any time period No solicitation or advertising Unlimited number of accredited and up to 35 nonaccredited investors, BUT • The non-accredited investors must be sophisticated – “In the know” or – Rich – – No bad-boy disqualification Audited financial information is required Resale restrictions National securities Markets Improvement Act of 1996: Some relief from state registration (c) 2004 West Legal Studies in Business A Division of Thomson 32

The Process of Conducting a Securities Offering • Prefiling period • Waiting period • Post filing period (c) 2004 West Legal Studies in Business A Division of Thomson 33

The Process of Conducting a Securities Offering • Prefiling period • Waiting period • Post filing period (c) 2004 West Legal Studies in Business A Division of Thomson 33

What is Required in Registration Statement and Prospectus? • Regis. Statement details in text on p. 155 • Prospectus (preliminary prospectus called a “red herring”) with red ink warnings that it has not been registered (c) 2004 West Legal Studies in Business A Division of Thomson 34

What is Required in Registration Statement and Prospectus? • Regis. Statement details in text on p. 155 • Prospectus (preliminary prospectus called a “red herring”) with red ink warnings that it has not been registered (c) 2004 West Legal Studies in Business A Division of Thomson 34

File registration statement (S-1) – 15 day waiting period, if SEC does not issue “stop letter”, then issuer may sell • Before file – no offering or sale • During 15 days – only face to face offering in writing (red herring and tombstone ad) ROAD SHOWS • After 15 days – offer and sell to public • There are modified, simpler registration statements for certain circumstances (S-2, S-3, etc. ) (c) 2004 West Legal Studies in Business A Division of Thomson 35

File registration statement (S-1) – 15 day waiting period, if SEC does not issue “stop letter”, then issuer may sell • Before file – no offering or sale • During 15 days – only face to face offering in writing (red herring and tombstone ad) ROAD SHOWS • After 15 days – offer and sell to public • There are modified, simpler registration statements for certain circumstances (S-2, S-3, etc. ) (c) 2004 West Legal Studies in Business A Division of Thomson 35

Civil and Criminal Penalties for • Not filing when should • Filing with material misstatements or omissions • Material misstatement or omission does not have to be intentional • Material misstatement or omission does not have to be relied upon by purchaser (c) 2004 West Legal Studies in Business A Division of Thomson 36

Civil and Criminal Penalties for • Not filing when should • Filing with material misstatements or omissions • Material misstatement or omission does not have to be intentional • Material misstatement or omission does not have to be relied upon by purchaser (c) 2004 West Legal Studies in Business A Division of Thomson 36

Presumption of Liability (Burden on Defendant) • Against all who worked on or signed the registration statement • Issuer and Underwriter • Professionals: appraisers, geologists, CPAs lawyers • Directors & Officers • Anyone else who signed (c) 2004 West Legal Studies in Business A Division of Thomson 37

Presumption of Liability (Burden on Defendant) • Against all who worked on or signed the registration statement • Issuer and Underwriter • Professionals: appraisers, geologists, CPAs lawyers • Directors & Officers • Anyone else who signed (c) 2004 West Legal Studies in Business A Division of Thomson 37

Internet Securities Offerings (ISOs) or Direct Public Offerings (DPOs) • Traditional Marketing and Sales of Securities was through Investment banking: screened the security before the public could get to it • Now Direct Solicitation, Advertising and Sales has opened up the securities world to the public without the middleman • Information now available to the public has leveled the playing field – EDGAR: electronic database of corporate information – Insider. Scores. com market-influencing transactions previously only available to large institutions (c) 2004 West Legal Studies in Business A Division of Thomson 38

Internet Securities Offerings (ISOs) or Direct Public Offerings (DPOs) • Traditional Marketing and Sales of Securities was through Investment banking: screened the security before the public could get to it • Now Direct Solicitation, Advertising and Sales has opened up the securities world to the public without the middleman • Information now available to the public has leveled the playing field – EDGAR: electronic database of corporate information – Insider. Scores. com market-influencing transactions previously only available to large institutions (c) 2004 West Legal Studies in Business A Division of Thomson 38

DPOs are Good and Bad • Greater access to new offerings at a cheaper cost • Greater risk because no layers of sellers and no secondary market (c) 2004 West Legal Studies in Business A Division of Thomson 39

DPOs are Good and Bad • Greater access to new offerings at a cheaper cost • Greater risk because no layers of sellers and no secondary market (c) 2004 West Legal Studies in Business A Division of Thomson 39

1933 and 1934 Securities Laws Still Apply • Some Cases • SEC has issued: advice, interpretive releases, enforcement actions, final rules, No-Action Letters (c) 2004 West Legal Studies in Business A Division of Thomson 40

1933 and 1934 Securities Laws Still Apply • Some Cases • SEC has issued: advice, interpretive releases, enforcement actions, final rules, No-Action Letters (c) 2004 West Legal Studies in Business A Division of Thomson 40

1995 SEC Gave Its OK to Electronic Delivery of Materials • 1995: SEC Release 33 -7233: SEC encourages further technological research, development, and application of the use of electronic media to paper-based media • Brown & Wood on behalf of its clients Merrill Lynch and Goldman Sachs – Inquired whether prospectus delivery requirements were met by providing it via computer on a proprietary system for investors to download – SEC issued a No-Action Letter concluding that it was OK if certain conditions are met (c) 2004 West Legal Studies in Business A Division of Thomson 41

1995 SEC Gave Its OK to Electronic Delivery of Materials • 1995: SEC Release 33 -7233: SEC encourages further technological research, development, and application of the use of electronic media to paper-based media • Brown & Wood on behalf of its clients Merrill Lynch and Goldman Sachs – Inquired whether prospectus delivery requirements were met by providing it via computer on a proprietary system for investors to download – SEC issued a No-Action Letter concluding that it was OK if certain conditions are met (c) 2004 West Legal Studies in Business A Division of Thomson 41

2000 - SEC Updated this Information • Addressed three areas of concern – E-Deliver – Issuer’s liability for Web site content – Conduct of Issuers and Market Intermediaries (c) 2004 West Legal Studies in Business A Division of Thomson 42

2000 - SEC Updated this Information • Addressed three areas of concern – E-Deliver – Issuer’s liability for Web site content – Conduct of Issuers and Market Intermediaries (c) 2004 West Legal Studies in Business A Division of Thomson 42

1996 Spring Street Brewing Company • Posted a “Regulation A” IPO prospectus on its web site with the approval of the SEC and raised $1. 6 million – But, if e-mail, have to have purchaser’s consent in advance to receive it by email and then an acknowledgement back from the purchaser that he received the e-mail (c) 2004 West Legal Studies in Business A Division of Thomson 43

1996 Spring Street Brewing Company • Posted a “Regulation A” IPO prospectus on its web site with the approval of the SEC and raised $1. 6 million – But, if e-mail, have to have purchaser’s consent in advance to receive it by email and then an acknowledgement back from the purchaser that he received the e-mail (c) 2004 West Legal Studies in Business A Division of Thomson 43

Delivery of Offering Materials – SEC’s three basic guidelines: • Notice: having it just “sit on the website” is not enough, but accompanied by an e-mail or posted mail to potential investors that it is on the site • Access: easy to use electronic communication system available for public to ask questions, get material • Evidence of delivery of the electronic prospectus – Receipt is presumed if sent by postal mail or facsimile – Must have receipt if delivered over Internet (c) 2004 West Legal Studies in Business A Division of Thomson 44

Delivery of Offering Materials – SEC’s three basic guidelines: • Notice: having it just “sit on the website” is not enough, but accompanied by an e-mail or posted mail to potential investors that it is on the site • Access: easy to use electronic communication system available for public to ask questions, get material • Evidence of delivery of the electronic prospectus – Receipt is presumed if sent by postal mail or facsimile – Must have receipt if delivered over Internet (c) 2004 West Legal Studies in Business A Division of Thomson 44

SEC Gave Examples of Notice Requirement • Hyperlink on page with sales pitch that brings up open prospectus is OK because it is the same as if the prospectus was in the same envelope • Sales pitch with letter that says prospectus is at a particular location on the Internet is not OK because not all investors would know how to get access to the prospectus (c) 2004 West Legal Studies in Business A Division of Thomson 45

SEC Gave Examples of Notice Requirement • Hyperlink on page with sales pitch that brings up open prospectus is OK because it is the same as if the prospectus was in the same envelope • Sales pitch with letter that says prospectus is at a particular location on the Internet is not OK because not all investors would know how to get access to the prospectus (c) 2004 West Legal Studies in Business A Division of Thomson 45

Hyperlinks Can be a Source of Liability if: • The issuer does not keep them CURRENT – Linking prospectus with newspaper articles or other “good publicity” is not a good idea because these articles get outdated and it looks like you are still trying to say good things about your security when it is not true any longer – don’t link to these. (c) 2004 West Legal Studies in Business A Division of Thomson 46

Hyperlinks Can be a Source of Liability if: • The issuer does not keep them CURRENT – Linking prospectus with newspaper articles or other “good publicity” is not a good idea because these articles get outdated and it looks like you are still trying to say good things about your security when it is not true any longer – don’t link to these. (c) 2004 West Legal Studies in Business A Division of Thomson 46

1996 SEC Issued “How to” Guide to Formatting Electronic Delivery – 1997 Great Plains Software, Inc. : first to post a Web site prospectus with audio and video components: streaming of audio, could not be copied – 1997 the first CD-ROM prospectus was delivered to investors in an offering by Ameritrade – SEC’s position: electronic prospecti must be fairly and accurately described on paper to be be filed with EDGAR: a graph, a transcript, an explanation of graphics or whatever. (c) 2004 West Legal Studies in Business A Division of Thomson 47

1996 SEC Issued “How to” Guide to Formatting Electronic Delivery – 1997 Great Plains Software, Inc. : first to post a Web site prospectus with audio and video components: streaming of audio, could not be copied – 1997 the first CD-ROM prospectus was delivered to investors in an offering by Ameritrade – SEC’s position: electronic prospecti must be fairly and accurately described on paper to be be filed with EDGAR: a graph, a transcript, an explanation of graphics or whatever. (c) 2004 West Legal Studies in Business A Division of Thomson 47

Private Placement Offering • If the offering is a private offering under Reg. D = no general solicitation is allowed and having offering on web is general solicitation • Is “password protected” enough online? (c) 2004 West Legal Studies in Business A Division of Thomson 48

Private Placement Offering • If the offering is a private offering under Reg. D = no general solicitation is allowed and having offering on web is general solicitation • Is “password protected” enough online? (c) 2004 West Legal Studies in Business A Division of Thomson 48

In Re: Iponet • Query to SEC: – Will the posting of a Notice of a Private Offering in a Password-protected Page of IPONET accessible only to IPONET members who have previously qualified as Accredited Investors Involve any General Solicitation or General Advertising Within the Meaning Of Regulation D? (c) 2004 West Legal Studies in Business A Division of Thomson 49

In Re: Iponet • Query to SEC: – Will the posting of a Notice of a Private Offering in a Password-protected Page of IPONET accessible only to IPONET members who have previously qualified as Accredited Investors Involve any General Solicitation or General Advertising Within the Meaning Of Regulation D? (c) 2004 West Legal Studies in Business A Division of Thomson 49

In Re: Iponet cont…. • SEC: No Action Letter = means OK – OK for investors to show interest in an upcoming sale, announced by tombstone ad and red herring prospectus on the web, by sending in a coupon or card either by email, fax or posted mail. – When the offering is private (no general solicitation or advertising), it is OK to have the potential investors apply to qualify themselves as accredited or sophisticated by sending in information about themselves on a card, and then, upon showing the proper qualifications, being issued a password to get to a certain part of the site where the private offering is shown. (c) 2004 West Legal Studies in Business A Division of Thomson 50

In Re: Iponet cont…. • SEC: No Action Letter = means OK – OK for investors to show interest in an upcoming sale, announced by tombstone ad and red herring prospectus on the web, by sending in a coupon or card either by email, fax or posted mail. – When the offering is private (no general solicitation or advertising), it is OK to have the potential investors apply to qualify themselves as accredited or sophisticated by sending in information about themselves on a card, and then, upon showing the proper qualifications, being issued a password to get to a certain part of the site where the private offering is shown. (c) 2004 West Legal Studies in Business A Division of Thomson 50

Electronic Roadshows • Traditionally were held during the 15 day waiting period to elaborate on and answer questions about the filed prospectus and registration statement – During 15 days, only written material allowed is prospectus and tombstone ad, but may have oral communication with potential investors to explain and answer questions about prospectus • Traditionally were live presentations to small groups of high net-worth, sophisticated investors and institutional clients such as managers of mutual and pension funds • Then started having them at central points and through conference calls (c) 2004 West Legal Studies in Business A Division of Thomson 51

Electronic Roadshows • Traditionally were held during the 15 day waiting period to elaborate on and answer questions about the filed prospectus and registration statement – During 15 days, only written material allowed is prospectus and tombstone ad, but may have oral communication with potential investors to explain and answer questions about prospectus • Traditionally were live presentations to small groups of high net-worth, sophisticated investors and institutional clients such as managers of mutual and pension funds • Then started having them at central points and through conference calls (c) 2004 West Legal Studies in Business A Division of Thomson 51

Can an Issuer Put Roadshow on a Website? • 1996 Primary Care Centers of America did one using video, slides with audio, interviews and online offering circular (c) 2004 West Legal Studies in Business A Division of Thomson 52

Can an Issuer Put Roadshow on a Website? • 1996 Primary Care Centers of America did one using video, slides with audio, interviews and online offering circular (c) 2004 West Legal Studies in Business A Division of Thomson 52

1997: Net. Roadshow, Inc. asked SEC • SEC: Roadshow presentations over the Internet for the purposes and pursuant to the procedures described in your letter in reliance on your counsel’s opinion that such transmissions are not prospectuses with the meaning of Section 2(a) (10) of the Securities Act of 1933. • OK after the registration statement is filed with the SEC (c) 2004 West Legal Studies in Business A Division of Thomson 53

1997: Net. Roadshow, Inc. asked SEC • SEC: Roadshow presentations over the Internet for the purposes and pursuant to the procedures described in your letter in reliance on your counsel’s opinion that such transmissions are not prospectuses with the meaning of Section 2(a) (10) of the Securities Act of 1933. • OK after the registration statement is filed with the SEC (c) 2004 West Legal Studies in Business A Division of Thomson 53

Allocation of Shares • SEC found online sellers abused the allocation of shares – Laddering is illegal (c) 2004 West Legal Studies in Business A Division of Thomson 54

Allocation of Shares • SEC found online sellers abused the allocation of shares – Laddering is illegal (c) 2004 West Legal Studies in Business A Division of Thomson 54

Consolidation of Web Sites for Marketing Offerings and Secondary Sales • DPOs had no secondary markets, so made their own markets online – Issuer-based Bulletin Board where issuers could put links to their own websites to give people a chance to see what was being offered for sale “out there” • “Wit-Trade” was created by Spring Street Brewing Company – Third Part-based Bulletin Board where the website was a host for many issuers • Digicap, elysiangroup, ibchannel, dpousa, millcapquest, venturea, financialweb, dsm, ipoalley, diretipo, rule 506, firstrade, ipo, biz. yahoo (c) 2004 West Legal Studies in Business A Division of Thomson 55

Consolidation of Web Sites for Marketing Offerings and Secondary Sales • DPOs had no secondary markets, so made their own markets online – Issuer-based Bulletin Board where issuers could put links to their own websites to give people a chance to see what was being offered for sale “out there” • “Wit-Trade” was created by Spring Street Brewing Company – Third Part-based Bulletin Board where the website was a host for many issuers • Digicap, elysiangroup, ibchannel, dpousa, millcapquest, venturea, financialweb, dsm, ipoalley, diretipo, rule 506, firstrade, ipo, biz. yahoo (c) 2004 West Legal Studies in Business A Division of Thomson 55

Now There Exist Websites to Compare and Rate These Bulletin Boards: • • E*Trade Group, Inc. Merrill Lynch & Company Morgan Staley Dean Witter Powerstreet (c) 2004 West Legal Studies in Business A Division of Thomson 56

Now There Exist Websites to Compare and Rate These Bulletin Boards: • • E*Trade Group, Inc. Merrill Lynch & Company Morgan Staley Dean Witter Powerstreet (c) 2004 West Legal Studies in Business A Division of Thomson 56

Virtual Stock Markets • Portfolio System for Institutional Trading (POSIT) • The Arizona Stock Exchange • Niphix Investments, Inc. • Pacific Stock Exchange (c) 2004 West Legal Studies in Business A Division of Thomson 57

Virtual Stock Markets • Portfolio System for Institutional Trading (POSIT) • The Arizona Stock Exchange • Niphix Investments, Inc. • Pacific Stock Exchange (c) 2004 West Legal Studies in Business A Division of Thomson 57

SEC Guidelines for Online Secondary Markets • Still a problem in causing a lack of liquidity for the DPOs • SEC says with these DPOs: – Keep records of all quotes entered into the system and make these available – Abide by all securities laws on advertising – Don’t advise on transactions – Don’t deal in these securities (c) 2004 West Legal Studies in Business A Division of Thomson 58

SEC Guidelines for Online Secondary Markets • Still a problem in causing a lack of liquidity for the DPOs • SEC says with these DPOs: – Keep records of all quotes entered into the system and make these available – Abide by all securities laws on advertising – Don’t advise on transactions – Don’t deal in these securities (c) 2004 West Legal Studies in Business A Division of Thomson 58

SEC Enforcement of Securities Laws • Same fraudulent schemes on Internet as off of Internet – Ponzi schemes – Scalping – Pyrimid Schemes • Created the Office of Internet Enforcement 1998 • Use same laws: 10 -b (Rule 10 b-5) Fraud Provision of the 1934 Act and 17(a) of the 1933 Act (c) 2004 West Legal Studies in Business A Division of Thomson 59

SEC Enforcement of Securities Laws • Same fraudulent schemes on Internet as off of Internet – Ponzi schemes – Scalping – Pyrimid Schemes • Created the Office of Internet Enforcement 1998 • Use same laws: 10 -b (Rule 10 b-5) Fraud Provision of the 1934 Act and 17(a) of the 1933 Act (c) 2004 West Legal Studies in Business A Division of Thomson 59

Cases • Hart v. Internet Wire, Inc. & Bloomberg L. P. (S. D. N. Y. 2001) no intent • Sec v. Interactive Products and Services, Inc. , Phony public offering of stock conducted over the Internet – Raised approximately $190, 000 from about 150 investors nationwide from Nov. 96 to July 97 – Issuer said that he would return money if a certain amount of capital was not raised • He pocketed the money and told them they would be getting stock certificates – Other misrepresentations about his company – Found him liable under 10 b-5 and 17 (a) (c) 2004 West Legal Studies in Business A Division of Thomson 60

Cases • Hart v. Internet Wire, Inc. & Bloomberg L. P. (S. D. N. Y. 2001) no intent • Sec v. Interactive Products and Services, Inc. , Phony public offering of stock conducted over the Internet – Raised approximately $190, 000 from about 150 investors nationwide from Nov. 96 to July 97 – Issuer said that he would return money if a certain amount of capital was not raised • He pocketed the money and told them they would be getting stock certificates – Other misrepresentations about his company – Found him liable under 10 b-5 and 17 (a) (c) 2004 West Legal Studies in Business A Division of Thomson 60

Suspicious Activity reports (SARs) • After 9/11 • Financial services companies must file SAR with the Treasury Department whenever the conduct of clients or even potential clients indicates possible money laundering activities (c) 2004 West Legal Studies in Business A Division of Thomson 61

Suspicious Activity reports (SARs) • After 9/11 • Financial services companies must file SAR with the Treasury Department whenever the conduct of clients or even potential clients indicates possible money laundering activities (c) 2004 West Legal Studies in Business A Division of Thomson 61

International aspects of Online Securities Offerings • Organization for Economic Cooperation and Development (OECD) intergovernmental organization taken the lead in international movement of capital – Code of Liberalization of Capital Movements 1961, 1989 • Country members must abolish restrictions on the movement of capital • Council of Europe – 1989 Convention on Insider Trading • Regulatory agencies in different countries work together (c) 2004 West Legal Studies in Business A Division of Thomson 62

International aspects of Online Securities Offerings • Organization for Economic Cooperation and Development (OECD) intergovernmental organization taken the lead in international movement of capital – Code of Liberalization of Capital Movements 1961, 1989 • Country members must abolish restrictions on the movement of capital • Council of Europe – 1989 Convention on Insider Trading • Regulatory agencies in different countries work together (c) 2004 West Legal Studies in Business A Division of Thomson 62

International Cooperation and Securities Law Enforcement • International Organization of Securities Commissions and the SEC (IOSCO) – Multinational body of governmental and nongovernmental organizations concerned with regulation of securities fraud on a global scale – 100 countries – Articulated 5 principles • • Don’t inhibit legitimate uses of Internet Strive for transparency and consistency in application of laws Cooperate with one another Maintain flexible approach to applying laws accounting for changes in technology • Ensure fundamental policies – protection of investors, etc. (c) 2004 West Legal Studies in Business A Division of Thomson 63

International Cooperation and Securities Law Enforcement • International Organization of Securities Commissions and the SEC (IOSCO) – Multinational body of governmental and nongovernmental organizations concerned with regulation of securities fraud on a global scale – 100 countries – Articulated 5 principles • • Don’t inhibit legitimate uses of Internet Strive for transparency and consistency in application of laws Cooperate with one another Maintain flexible approach to applying laws accounting for changes in technology • Ensure fundamental policies – protection of investors, etc. (c) 2004 West Legal Studies in Business A Division of Thomson 63

International Securities Enforcement • Internet Surf Days - Securities enforcements sweeps • Fraud enforcement – SEC v. Gold-Ventures Club (N. D. Ga 2002) (c) 2004 West Legal Studies in Business A Division of Thomson 64

International Securities Enforcement • Internet Surf Days - Securities enforcements sweeps • Fraud enforcement – SEC v. Gold-Ventures Club (N. D. Ga 2002) (c) 2004 West Legal Studies in Business A Division of Thomson 64

Offshore Offerings? How does this work with the U. S. law? • Regulation S – Exempts securities offers and sales that occur outside the U. S. – Basic Reg. S Requirements • No directed selling efforts must be made into the U. S. • Offer or sale must be for an offshore transaction – Not made to buyer in U. S. – Buy order is originated, buyer is outside the U. S. ( or seller reasonably believes buyer is outside of U. S. ) (c) 2004 West Legal Studies in Business A Division of Thomson 65

Offshore Offerings? How does this work with the U. S. law? • Regulation S – Exempts securities offers and sales that occur outside the U. S. – Basic Reg. S Requirements • No directed selling efforts must be made into the U. S. • Offer or sale must be for an offshore transaction – Not made to buyer in U. S. – Buy order is originated, buyer is outside the U. S. ( or seller reasonably believes buyer is outside of U. S. ) (c) 2004 West Legal Studies in Business A Division of Thomson 65

Reg. S Safe Harbors • Occurs on the physical trading floor of an established foreign securities exchange • Secondary sale is through a designated offshore securities market • Disclaimers or Proclamations, No Enticements for U. S. buyers (tax breaks) (c) 2004 West Legal Studies in Business A Division of Thomson 66

Reg. S Safe Harbors • Occurs on the physical trading floor of an established foreign securities exchange • Secondary sale is through a designated offshore securities market • Disclaimers or Proclamations, No Enticements for U. S. buyers (tax breaks) (c) 2004 West Legal Studies in Business A Division of Thomson 66

International offerings and “Blue Sky” Laws • North American Securities Administrators Association (NASAA) developed a model rule based on disclaimers by seller and checking of buyers address (c) 2004 West Legal Studies in Business A Division of Thomson 67

International offerings and “Blue Sky” Laws • North American Securities Administrators Association (NASAA) developed a model rule based on disclaimers by seller and checking of buyers address (c) 2004 West Legal Studies in Business A Division of Thomson 67