57aca3330027898f9a033f439b413cc2.ppt

- Количество слайдов: 64

Securities Markets in China Prof. Stephen Y. L. Cheung Department of Economics & Finance City University of Hong Kong February 2003 Stephen Cheung Securities Markets in China

Securities Markets in China Prof. Stephen Y. L. Cheung Department of Economics & Finance City University of Hong Kong February 2003 Stephen Cheung Securities Markets in China

Content § § Brief on Economic Development in China Private Sector Development Stock Markets in China’s Listed Companies • Problems and Regulation • Case Studies § Corporate Governance • Case Studies Stephen Cheung Securities Markets in China 2

Content § § Brief on Economic Development in China Private Sector Development Stock Markets in China’s Listed Companies • Problems and Regulation • Case Studies § Corporate Governance • Case Studies Stephen Cheung Securities Markets in China 2

Country Profile: National Flag Stephen Cheung Securities Markets in China 3

Country Profile: National Flag Stephen Cheung Securities Markets in China 3

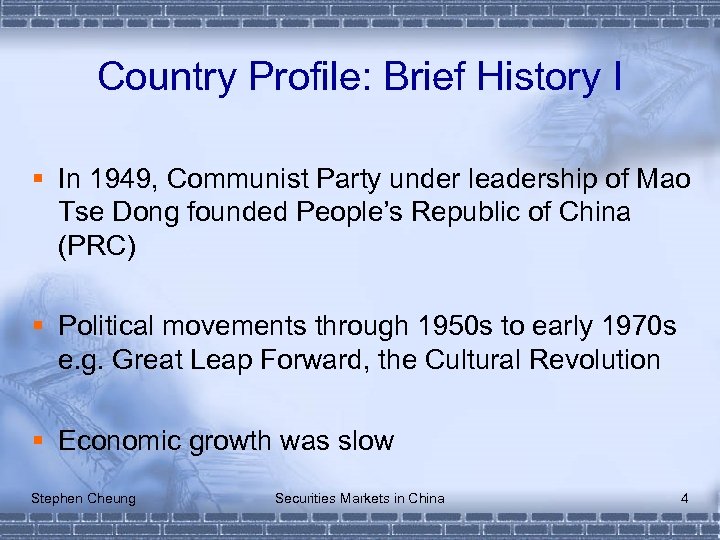

Country Profile: Brief History I § In 1949, Communist Party under leadership of Mao Tse Dong founded People’s Republic of China (PRC) § Political movements through 1950 s to early 1970 s e. g. Great Leap Forward, the Cultural Revolution § Economic growth was slow Stephen Cheung Securities Markets in China 4

Country Profile: Brief History I § In 1949, Communist Party under leadership of Mao Tse Dong founded People’s Republic of China (PRC) § Political movements through 1950 s to early 1970 s e. g. Great Leap Forward, the Cultural Revolution § Economic growth was slow Stephen Cheung Securities Markets in China 4

Country Profile: Brief History II § Deng Xiao Ping came to power and introduced a number of economic liberalization programmes • “No matter whether it is a black cat or a white black, it is a good cat as long as it catches mice. ” • Reform in agricultural sector • Open-door policy to foreign investors • Special economic zones • Rapid economic growth which led to overheating and social unrest Stephen Cheung Securities Markets in China 5

Country Profile: Brief History II § Deng Xiao Ping came to power and introduced a number of economic liberalization programmes • “No matter whether it is a black cat or a white black, it is a good cat as long as it catches mice. ” • Reform in agricultural sector • Open-door policy to foreign investors • Special economic zones • Rapid economic growth which led to overheating and social unrest Stephen Cheung Securities Markets in China 5

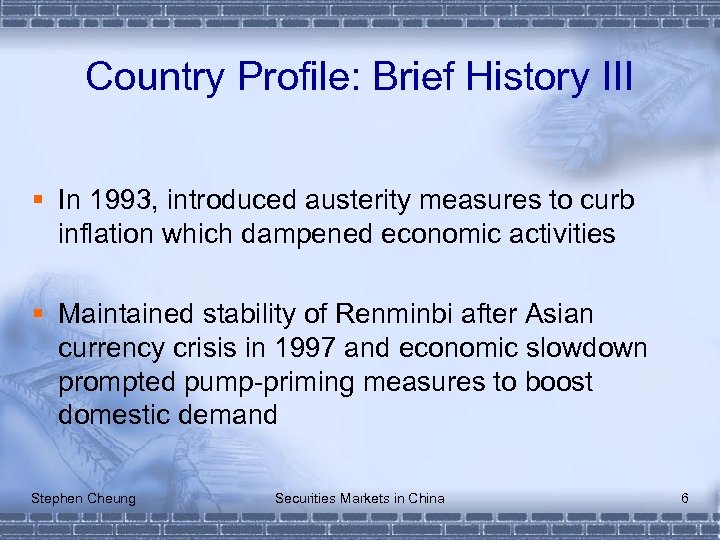

Country Profile: Brief History III § In 1993, introduced austerity measures to curb inflation which dampened economic activities § Maintained stability of Renminbi after Asian currency crisis in 1997 and economic slowdown prompted pump-priming measures to boost domestic demand Stephen Cheung Securities Markets in China 6

Country Profile: Brief History III § In 1993, introduced austerity measures to curb inflation which dampened economic activities § Maintained stability of Renminbi after Asian currency crisis in 1997 and economic slowdown prompted pump-priming measures to boost domestic demand Stephen Cheung Securities Markets in China 6

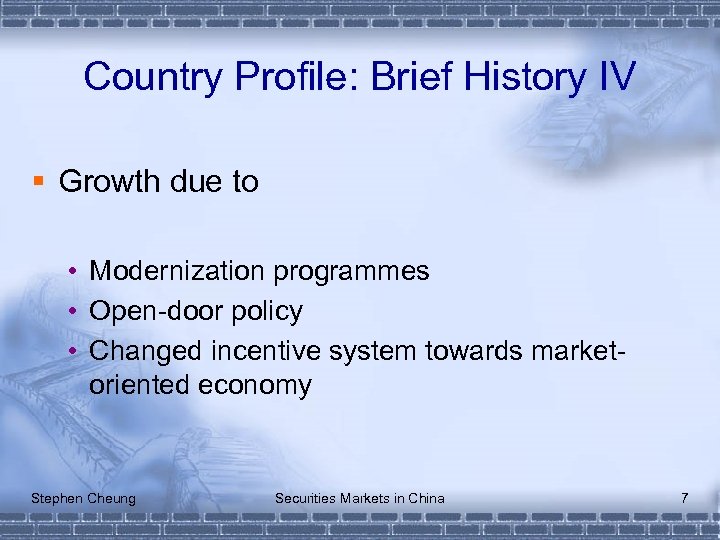

Country Profile: Brief History IV § Growth due to • Modernization programmes • Open-door policy • Changed incentive system towards marketoriented economy Stephen Cheung Securities Markets in China 7

Country Profile: Brief History IV § Growth due to • Modernization programmes • Open-door policy • Changed incentive system towards marketoriented economy Stephen Cheung Securities Markets in China 7

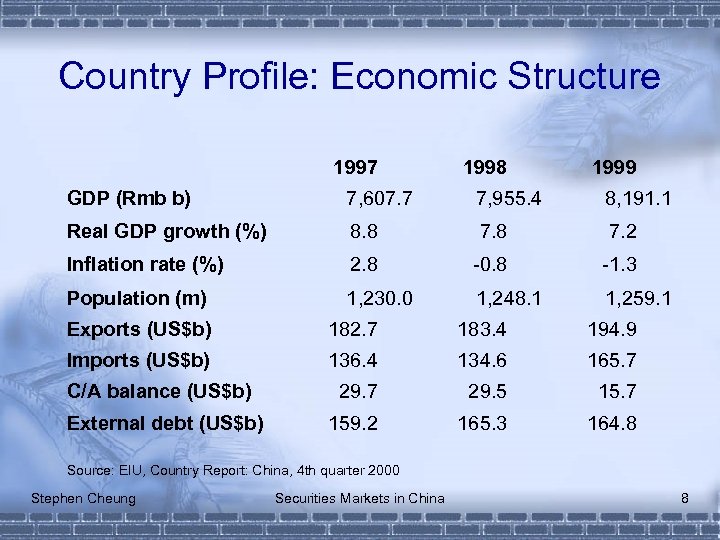

Country Profile: Economic Structure 1997 1998 1999 GDP (Rmb b) 7, 607. 7 7, 955. 4 8, 191. 1 Real GDP growth (%) 8. 8 7. 2 Inflation rate (%) 2. 8 -0. 8 -1. 3 Population (m) 1, 230. 0 1, 248. 1 1, 259. 1 Exports (US$b) 182. 7 183. 4 194. 9 Imports (US$b) 136. 4 134. 6 165. 7 29. 5 15. 7 159. 2 165. 3 164. 8 C/A balance (US$b) External debt (US$b) Source: EIU, Country Report: China, 4 th quarter 2000 Stephen Cheung Securities Markets in China 8

Country Profile: Economic Structure 1997 1998 1999 GDP (Rmb b) 7, 607. 7 7, 955. 4 8, 191. 1 Real GDP growth (%) 8. 8 7. 2 Inflation rate (%) 2. 8 -0. 8 -1. 3 Population (m) 1, 230. 0 1, 248. 1 1, 259. 1 Exports (US$b) 182. 7 183. 4 194. 9 Imports (US$b) 136. 4 134. 6 165. 7 29. 5 15. 7 159. 2 165. 3 164. 8 C/A balance (US$b) External debt (US$b) Source: EIU, Country Report: China, 4 th quarter 2000 Stephen Cheung Securities Markets in China 8

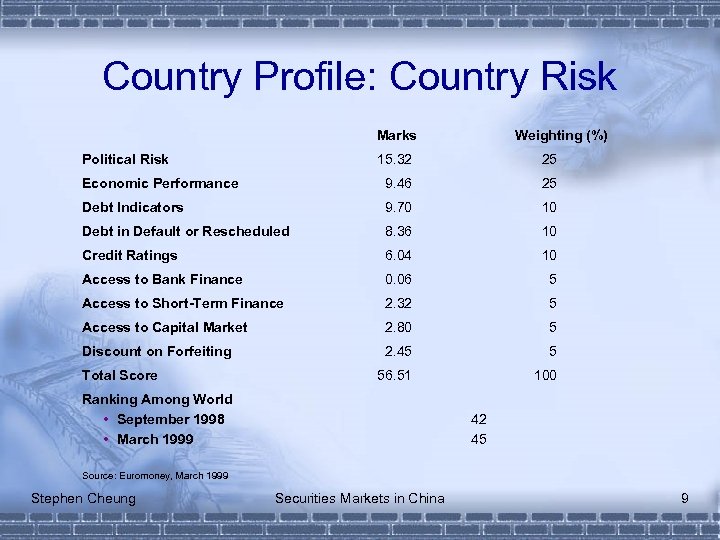

Country Profile: Country Risk Marks Political Risk Weighting (%) 15. 32 25 Economic Performance 9. 46 25 Debt Indicators 9. 70 10 Debt in Default or Rescheduled 8. 36 10 Credit Ratings 6. 04 10 Access to Bank Finance 0. 06 5 Access to Short-Term Finance 2. 32 5 Access to Capital Market 2. 80 5 Discount on Forfeiting 2. 45 5 56. 51 100 Total Score Ranking Among World • September 1998 • March 1999 42 45 Source: Euromoney, March 1999 Stephen Cheung Securities Markets in China 9

Country Profile: Country Risk Marks Political Risk Weighting (%) 15. 32 25 Economic Performance 9. 46 25 Debt Indicators 9. 70 10 Debt in Default or Rescheduled 8. 36 10 Credit Ratings 6. 04 10 Access to Bank Finance 0. 06 5 Access to Short-Term Finance 2. 32 5 Access to Capital Market 2. 80 5 Discount on Forfeiting 2. 45 5 56. 51 100 Total Score Ranking Among World • September 1998 • March 1999 42 45 Source: Euromoney, March 1999 Stephen Cheung Securities Markets in China 9

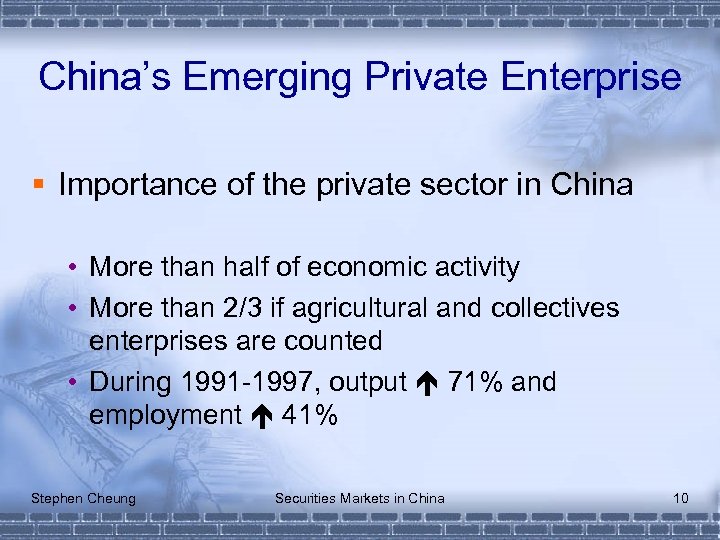

China’s Emerging Private Enterprise § Importance of the private sector in China • More than half of economic activity • More than 2/3 if agricultural and collectives enterprises are counted • During 1991 -1997, output 71% and employment 41% Stephen Cheung Securities Markets in China 10

China’s Emerging Private Enterprise § Importance of the private sector in China • More than half of economic activity • More than 2/3 if agricultural and collectives enterprises are counted • During 1991 -1997, output 71% and employment 41% Stephen Cheung Securities Markets in China 10

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 11

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 11

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 12

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 12

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 13

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 13

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 14

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 14

China’s Emerging Private Enterprise § Major turning points in private sector development • Phase I – 1978 -1983 § Individual business (getihu) • Phase II – 1984 -1992 § Privately run enterprises (siyingqiye) • Phase III – 1993 -Present § After Deng’s famous southern tour in September 1992 Stephen Cheung Securities Markets in China 15

China’s Emerging Private Enterprise § Major turning points in private sector development • Phase I – 1978 -1983 § Individual business (getihu) • Phase II – 1984 -1992 § Privately run enterprises (siyingqiye) • Phase III – 1993 -Present § After Deng’s famous southern tour in September 1992 Stephen Cheung Securities Markets in China 15

China’s Emerging Private Enterprise § China’s Trade Reforms in Preparation for Accession to the WTO • • The elimination of import quotas by 2006 The elimination of import tariffs on computers, semiconductors and related products by 2005 Reduction in import tariffs on agricultural products from 22% to 17. 5% Reduction in import tariffs on industrial products from an average of 24. 6% to an average of 9. 4% A reduction in import tariffs on motor vehicles from 80 -100% to 25% by 2006 and 10% for parts Permission for up to 50% foreign ownership of telecoms and insurance Permission for importers to own domestic distribution networks Full market access foreign banks within 5 years of accession; foreign banks will be able to conduct local currency business with Chinese enterprises 2 years after accession Stephen Cheung Securities Markets in China 16

China’s Emerging Private Enterprise § China’s Trade Reforms in Preparation for Accession to the WTO • • The elimination of import quotas by 2006 The elimination of import tariffs on computers, semiconductors and related products by 2005 Reduction in import tariffs on agricultural products from 22% to 17. 5% Reduction in import tariffs on industrial products from an average of 24. 6% to an average of 9. 4% A reduction in import tariffs on motor vehicles from 80 -100% to 25% by 2006 and 10% for parts Permission for up to 50% foreign ownership of telecoms and insurance Permission for importers to own domestic distribution networks Full market access foreign banks within 5 years of accession; foreign banks will be able to conduct local currency business with Chinese enterprises 2 years after accession Stephen Cheung Securities Markets in China 16

China’s Emerging Private Enterprise § Problems • • Unclear property rights Hybrid forms of ownership Rent-seeking activities Collusion between local government and enterprises Stephen Cheung Securities Markets in China 17

China’s Emerging Private Enterprise § Problems • • Unclear property rights Hybrid forms of ownership Rent-seeking activities Collusion between local government and enterprises Stephen Cheung Securities Markets in China 17

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 18

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 18

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 19

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 19

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 20

China’s Emerging Private Enterprise Stephen Cheung Securities Markets in China 20

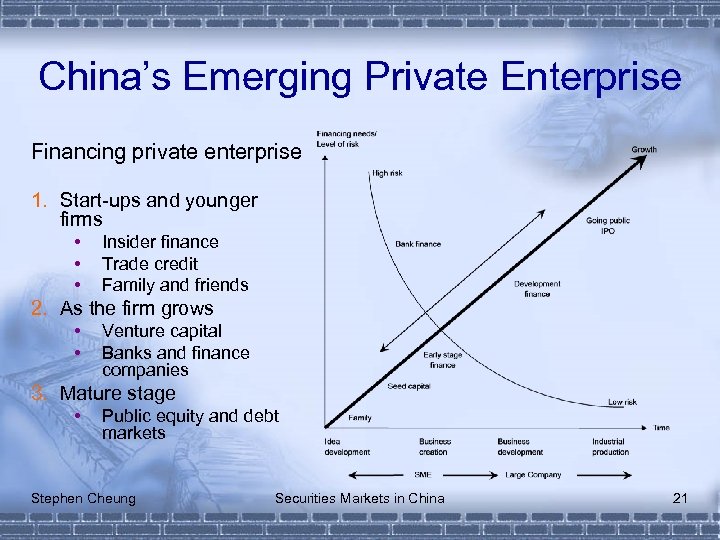

China’s Emerging Private Enterprise Financing private enterprise 1. Start-ups and younger firms • • • Insider finance Trade credit Family and friends 2. As the firm grows • • Venture capital Banks and finance companies 3. Mature stage • Public equity and debt markets Stephen Cheung Securities Markets in China 21

China’s Emerging Private Enterprise Financing private enterprise 1. Start-ups and younger firms • • • Insider finance Trade credit Family and friends 2. As the firm grows • • Venture capital Banks and finance companies 3. Mature stage • Public equity and debt markets Stephen Cheung Securities Markets in China 21

China’s Emerging Private Enterprise Financing Private Enterprise 1. Access to bank lending § As of 1998, private sector’s loan <1% of total lending § The figure is low, compared with the sector’s contribution to employment and GDP § Policy lending Stephen Cheung Securities Markets in China 22

China’s Emerging Private Enterprise Financing Private Enterprise 1. Access to bank lending § As of 1998, private sector’s loan <1% of total lending § The figure is low, compared with the sector’s contribution to employment and GDP § Policy lending Stephen Cheung Securities Markets in China 22

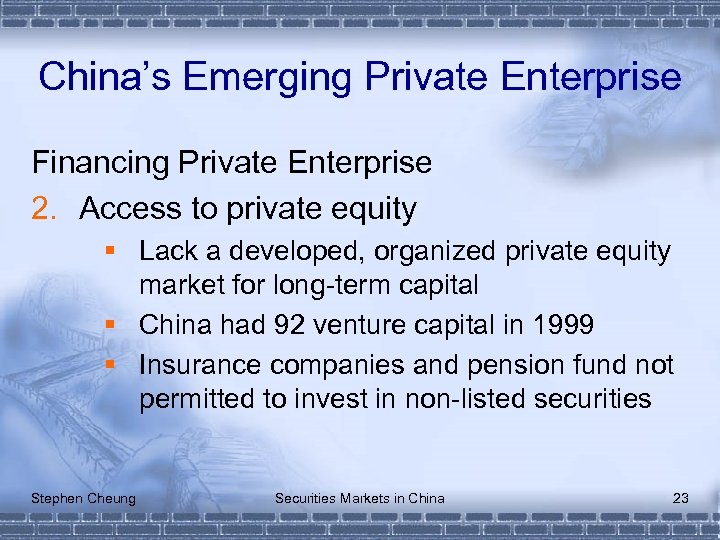

China’s Emerging Private Enterprise Financing Private Enterprise 2. Access to private equity § Lack a developed, organized private equity market for long-term capital § China had 92 venture capital in 1999 § Insurance companies and pension fund not permitted to invest in non-listed securities Stephen Cheung Securities Markets in China 23

China’s Emerging Private Enterprise Financing Private Enterprise 2. Access to private equity § Lack a developed, organized private equity market for long-term capital § China had 92 venture capital in 1999 § Insurance companies and pension fund not permitted to invest in non-listed securities Stephen Cheung Securities Markets in China 23

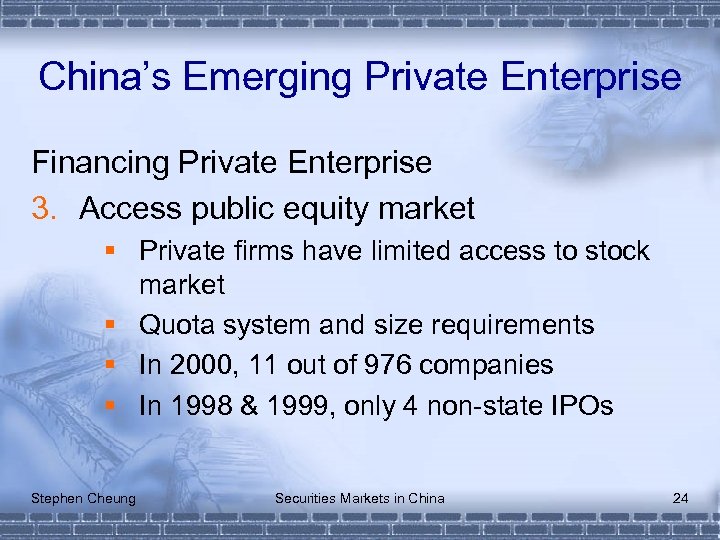

China’s Emerging Private Enterprise Financing Private Enterprise 3. Access public equity market § Private firms have limited access to stock market § Quota system and size requirements § In 2000, 11 out of 976 companies § In 1998 & 1999, only 4 non-state IPOs Stephen Cheung Securities Markets in China 24

China’s Emerging Private Enterprise Financing Private Enterprise 3. Access public equity market § Private firms have limited access to stock market § Quota system and size requirements § In 2000, 11 out of 976 companies § In 1998 & 1999, only 4 non-state IPOs Stephen Cheung Securities Markets in China 24

Stock Markets in China: History I § Foreign securities houses in 1869 and Chinese securities dealers appeared in 1880 § Stock Association of Shanghai established in 1891 § Issue of bonds in 1894 § Commercial Association of Stocks established in 1914 in Shanghai § Shanghai market opened officially in 1920 , which mainly dealt with government bonds; thereafter stock markets established in Beijing, Tianjin, Guangzhou, Nanjing, Suzhou, Ningpo Stephen Cheung Securities Markets in China 25

Stock Markets in China: History I § Foreign securities houses in 1869 and Chinese securities dealers appeared in 1880 § Stock Association of Shanghai established in 1891 § Issue of bonds in 1894 § Commercial Association of Stocks established in 1914 in Shanghai § Shanghai market opened officially in 1920 , which mainly dealt with government bonds; thereafter stock markets established in Beijing, Tianjin, Guangzhou, Nanjing, Suzhou, Ningpo Stephen Cheung Securities Markets in China 25

Stock Markets in China: History II § All stock markets were closed when Communist Party came into power in 1949 § In couple with open-door policy, Third Plenary Session of 11 th Central Committee of Communist Party of China got idea of reestablishing securities markets in 1978 § Revised securities markets with issue of state Treasury bills in 1981 § Local enterprise bonds followed suit in 1982 Stephen Cheung Securities Markets in China 26

Stock Markets in China: History II § All stock markets were closed when Communist Party came into power in 1949 § In couple with open-door policy, Third Plenary Session of 11 th Central Committee of Communist Party of China got idea of reestablishing securities markets in 1978 § Revised securities markets with issue of state Treasury bills in 1981 § Local enterprise bonds followed suit in 1982 Stephen Cheung Securities Markets in China 26

Stock Markets in China: History III § State-owned financial enterprises issued financial bonds and development of primary share market began in 1984 § State enterprise corporate bonds issued and PBOC initiated and authorized over-the-counter market for secondary trading in Shanghai in 1986 § Developed market for trading state Treasury bills in Shanghai and Wuhan in 1988 § Stock Exchange Executive established to formulate development of a national stock exchange in 1989 Stephen Cheung Securities Markets in China 27

Stock Markets in China: History III § State-owned financial enterprises issued financial bonds and development of primary share market began in 1984 § State enterprise corporate bonds issued and PBOC initiated and authorized over-the-counter market for secondary trading in Shanghai in 1986 § Developed market for trading state Treasury bills in Shanghai and Wuhan in 1988 § Stock Exchange Executive established to formulate development of a national stock exchange in 1989 Stephen Cheung Securities Markets in China 27

Stock Markets in China: History IV § Securities Trading Automated Quotation System (STAQ) commenced operations in 1990 § Shanghai Stock Exchange opened in 1990 and Shenzhen Stock Exchange opened in 1991 § B shares first listed and traded in 1992 § National Electronic Trading System (NET) started operations and H shares issued in Hong Kong, and N shares listed in New York as American Depositary Receipts (ADRs) in 1993 Stephen Cheung Securities Markets in China 28

Stock Markets in China: History IV § Securities Trading Automated Quotation System (STAQ) commenced operations in 1990 § Shanghai Stock Exchange opened in 1990 and Shenzhen Stock Exchange opened in 1991 § B shares first listed and traded in 1992 § National Electronic Trading System (NET) started operations and H shares issued in Hong Kong, and N shares listed in New York as American Depositary Receipts (ADRs) in 1993 Stephen Cheung Securities Markets in China 28

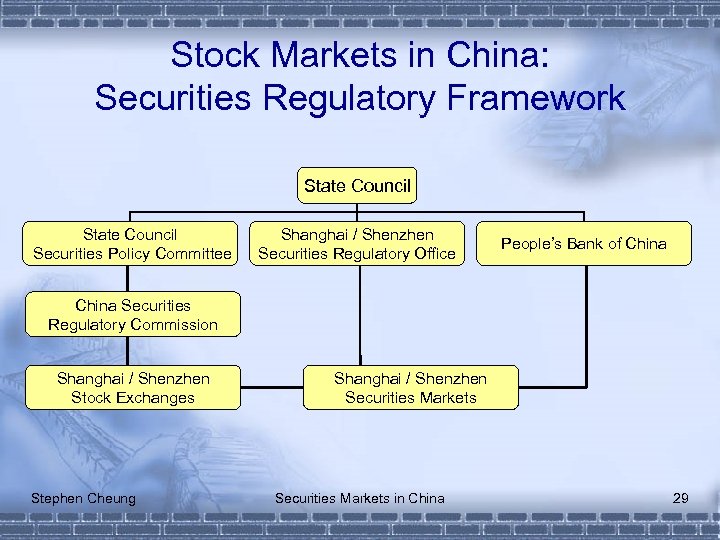

Stock Markets in China: Securities Regulatory Framework State Council Securities Policy Committee Shanghai / Shenzhen Securities Regulatory Office People’s Bank of China Securities Regulatory Commission Shanghai / Shenzhen Stock Exchanges Stephen Cheung Shanghai / Shenzhen Securities Markets in China 29

Stock Markets in China: Securities Regulatory Framework State Council Securities Policy Committee Shanghai / Shenzhen Securities Regulatory Office People’s Bank of China Securities Regulatory Commission Shanghai / Shenzhen Stock Exchanges Stephen Cheung Shanghai / Shenzhen Securities Markets in China 29

Stock Markets in China: Index Performance (Mainland) Stephen Cheung Securities Markets in China 30

Stock Markets in China: Index Performance (Mainland) Stephen Cheung Securities Markets in China 30

Stock Markets in China: Index Performance (Hong Kong) Stephen Cheung Securities Markets in China 31

Stock Markets in China: Index Performance (Hong Kong) Stephen Cheung Securities Markets in China 31

Stock Markets in China: Shanghai I Summary Statistics 1999 2000 2001 Market Capitalization (Rmb$b) 1, 458. 1 2, 693. 1 2, 759. 1 Market Turnover (Rmb$b) 424. 97 848. 13 838. 21 Number of Company Listed 484 572 646 Market P/E (%) • A Shares • B Shares NA 38. 13 NA Shanghai Composite Index Shanghai B-Share Index Stephen Cheung 1, 366. 6 NA Securities Markets in China 32. 95 58. 22 6. 04 37. 12 37. 71 10. 04 2, 073. 5 1, 646. 0 28. 71 37. 91 32

Stock Markets in China: Shanghai I Summary Statistics 1999 2000 2001 Market Capitalization (Rmb$b) 1, 458. 1 2, 693. 1 2, 759. 1 Market Turnover (Rmb$b) 424. 97 848. 13 838. 21 Number of Company Listed 484 572 646 Market P/E (%) • A Shares • B Shares NA 38. 13 NA Shanghai Composite Index Shanghai B-Share Index Stephen Cheung 1, 366. 6 NA Securities Markets in China 32. 95 58. 22 6. 04 37. 12 37. 71 10. 04 2, 073. 5 1, 646. 0 28. 71 37. 91 32

Stock Markets in China: Shanghai II Number of Listed Securities 2002 A Shares 701 B Shares 54 Funds 25 Treasury Bonds • Spot • Repurchase 16 9 Others 14 Source: Shanghai Stock Exchange: www. sse. com. cn Stephen Cheung Securities Markets in China 33

Stock Markets in China: Shanghai II Number of Listed Securities 2002 A Shares 701 B Shares 54 Funds 25 Treasury Bonds • Spot • Repurchase 16 9 Others 14 Source: Shanghai Stock Exchange: www. sse. com. cn Stephen Cheung Securities Markets in China 33

Stock Markets in China: Shenzhen I Summary Statistics 1999 2000 2001 Market Capitalization (Rmb$b) 1, 189. 07 2, 116. 01 Market Turnover (Rmb$b) 396. 43 760. 62 608. 11 Number of Company Listed 463 514 508 Market P/E (%) • A Shares • B Shares 41. 14 37. 56 NA 30. 59 56. 03 5. 71 36. 30 39. 79 10. 38 Shenzhen Composite Index 402. 18 635. 73 475. 94 NA 53. 58 84. 66 Shenzhen B-Share Index Stephen Cheung Securities Markets in China 1, 593. 2 34

Stock Markets in China: Shenzhen I Summary Statistics 1999 2000 2001 Market Capitalization (Rmb$b) 1, 189. 07 2, 116. 01 Market Turnover (Rmb$b) 396. 43 760. 62 608. 11 Number of Company Listed 463 514 508 Market P/E (%) • A Shares • B Shares 41. 14 37. 56 NA 30. 59 56. 03 5. 71 36. 30 39. 79 10. 38 Shenzhen Composite Index 402. 18 635. 73 475. 94 NA 53. 58 84. 66 Shenzhen B-Share Index Stephen Cheung Securities Markets in China 1, 593. 2 34

Stock Markets in China: Shenzhen II Number of Listed Securities 2002 A Shares 450 B Shares 54 Funds 16 Corporate Bonds 3 Treasury Bonds • Spot • Repurchase 15 2 Source: Shenzhen Stock Exchange Stephen Cheung Securities Markets in China 35

Stock Markets in China: Shenzhen II Number of Listed Securities 2002 A Shares 450 B Shares 54 Funds 16 Corporate Bonds 3 Treasury Bonds • Spot • Repurchase 15 2 Source: Shenzhen Stock Exchange Stephen Cheung Securities Markets in China 35

Stock Markets in China: Market Capitalization Stephen Cheung Securities Markets in China 36

Stock Markets in China: Market Capitalization Stephen Cheung Securities Markets in China 36

Stock Markets in China: Number of Listed Company Stephen Cheung Securities Markets in China 37

Stock Markets in China: Number of Listed Company Stephen Cheung Securities Markets in China 37

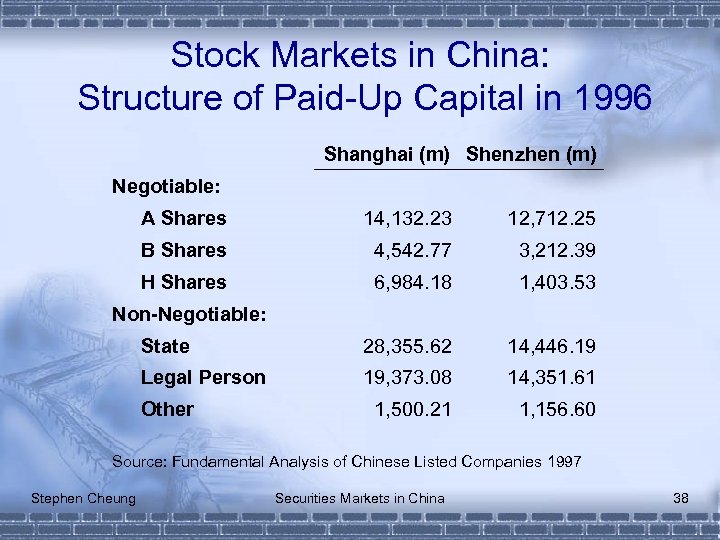

Stock Markets in China: Structure of Paid-Up Capital in 1996 Shanghai (m) Shenzhen (m) Negotiable: A Shares 14, 132. 23 12, 712. 25 B Shares 4, 542. 77 3, 212. 39 H Shares 6, 984. 18 1, 403. 53 State 28, 355. 62 14, 446. 19 Legal Person 19, 373. 08 14, 351. 61 1, 500. 21 1, 156. 60 Non-Negotiable: Other Source: Fundamental Analysis of Chinese Listed Companies 1997 Stephen Cheung Securities Markets in China 38

Stock Markets in China: Structure of Paid-Up Capital in 1996 Shanghai (m) Shenzhen (m) Negotiable: A Shares 14, 132. 23 12, 712. 25 B Shares 4, 542. 77 3, 212. 39 H Shares 6, 984. 18 1, 403. 53 State 28, 355. 62 14, 446. 19 Legal Person 19, 373. 08 14, 351. 61 1, 500. 21 1, 156. 60 Non-Negotiable: Other Source: Fundamental Analysis of Chinese Listed Companies 1997 Stephen Cheung Securities Markets in China 38

Stock Markets in China: Categories of Shares § Shares held by the State • Nation • State enterprises which own company § Shares held by legal person • Companies, unit or communities Stephen Cheung Securities Markets in China 39

Stock Markets in China: Categories of Shares § Shares held by the State • Nation • State enterprises which own company § Shares held by legal person • Companies, unit or communities Stephen Cheung Securities Markets in China 39

Stock Markets in China: Comparison Between A and B Shares Differences Currency-Denominated Listing Approval Investors Offerings A Share B Share Rmb Foreign CSRC SPC or SC Local Chinese Nationals Non-local Chinese Nationals Public / Private through Offshore Brokerage Firms Local Authorized Local / Foreign Trading Volumes High Low Volatility High Low Settlement T+1 T+3 Stephen Cheung Securities Markets in China 40

Stock Markets in China: Comparison Between A and B Shares Differences Currency-Denominated Listing Approval Investors Offerings A Share B Share Rmb Foreign CSRC SPC or SC Local Chinese Nationals Non-local Chinese Nationals Public / Private through Offshore Brokerage Firms Local Authorized Local / Foreign Trading Volumes High Low Volatility High Low Settlement T+1 T+3 Stephen Cheung Securities Markets in China 40

Stock Markets in China: Future Development § Developing regulation and securities markets § Active stock market § Active government bonds and overseas issues § Active in commodity futures but weak in financial derivatives products § QFII § QDII § CDR Stephen Cheung Securities Markets in China 41

Stock Markets in China: Future Development § Developing regulation and securities markets § Active stock market § Active government bonds and overseas issues § Active in commodity futures but weak in financial derivatives products § QFII § QDII § CDR Stephen Cheung Securities Markets in China 41

China’s Listed Companies § Problems and Regulation • • • Fall of the stock market Most have forecast warning and losses ‘Changing faces’ Newly listed companies recorded losses Examples: 銀廣廈、猴王、關百文等 Stephen Cheung Securities Markets in China 42

China’s Listed Companies § Problems and Regulation • • • Fall of the stock market Most have forecast warning and losses ‘Changing faces’ Newly listed companies recorded losses Examples: 銀廣廈、猴王、關百文等 Stephen Cheung Securities Markets in China 42

China’s Listed Companies § Fast growing market in 2000 • 139 newly listed companies • Market capitalization to GDP is 54% § In mid 2001 • 169 companies have forecast warning and losses in July 2001 • 45 were IPOs or just issued additional shares Stephen Cheung Securities Markets in China 43

China’s Listed Companies § Fast growing market in 2000 • 139 newly listed companies • Market capitalization to GDP is 54% § In mid 2001 • 169 companies have forecast warning and losses in July 2001 • 45 were IPOs or just issued additional shares Stephen Cheung Securities Markets in China 43

China’s Listed Companies § Causes of the problem • • • Unsound corporate governance structure Inadequacy of accounting standards Poor accounting and auditing services Lack of proper litigation system Poor law enforcement Stephen Cheung Securities Markets in China 44

China’s Listed Companies § Causes of the problem • • • Unsound corporate governance structure Inadequacy of accounting standards Poor accounting and auditing services Lack of proper litigation system Poor law enforcement Stephen Cheung Securities Markets in China 44

China’s Listed Companies Main problems with listed companies 1. Information disclosure is untrue § Prospectus, listing, right issue, and annual reports; major left-outs, false statements, and misguiding information § Change the purpose of the funds raised § False appraisal, financial, and manipulation of share prices Stephen Cheung Securities Markets in China 45

China’s Listed Companies Main problems with listed companies 1. Information disclosure is untrue § Prospectus, listing, right issue, and annual reports; major left-outs, false statements, and misguiding information § Change the purpose of the funds raised § False appraisal, financial, and manipulation of share prices Stephen Cheung Securities Markets in China 45

China’s Listed Companies Main problems with listed companies 2. High-risk companies § Until April 2001, 62 ST and PT companies, 6% of all listed companies § Some companies with good financial data, but very risky, example 銀廣廈 Stephen Cheung Securities Markets in China 46

China’s Listed Companies Main problems with listed companies 2. High-risk companies § Until April 2001, 62 ST and PT companies, 6% of all listed companies § Some companies with good financial data, but very risky, example 銀廣廈 Stephen Cheung Securities Markets in China 46

China’s Listed Companies Main problems with listed companies 3. Controlling shareholders § Connected parties transactions § Listed companies provide loan guarantee for controlling shareholders § ‘ATM’ machine for controlling shareholders, example 猴王事件 Stephen Cheung Securities Markets in China 47

China’s Listed Companies Main problems with listed companies 3. Controlling shareholders § Connected parties transactions § Listed companies provide loan guarantee for controlling shareholders § ‘ATM’ machine for controlling shareholders, example 猴王事件 Stephen Cheung Securities Markets in China 47

Corporate Governance § Characteristics of Asian Equity Markets • • • Single majority shareholder Family control Lack of institutional investors CEO and chairman are not separated Underdeveloped corporate control market Stephen Cheung Corporate Governance in Hong Kong 48

Corporate Governance § Characteristics of Asian Equity Markets • • • Single majority shareholder Family control Lack of institutional investors CEO and chairman are not separated Underdeveloped corporate control market Stephen Cheung Corporate Governance in Hong Kong 48

Corporate Governance § A Successful Market Depends On: • ‘Good’ Regulatory Framework • Quality Listed Companies • Quality Intermediaries Stephen Cheung Securities Markets in China 49

Corporate Governance § A Successful Market Depends On: • ‘Good’ Regulatory Framework • Quality Listed Companies • Quality Intermediaries Stephen Cheung Securities Markets in China 49

Corporate Governance: ‘Good’ Regulatory Framework I § Small Shareholders • Look for short-term capital gain • Ignore issues of corporate governance • Do not pay attention to shareholder’s right • Inadequate shareholder protection Stephen Cheung Securities Markets in China 50

Corporate Governance: ‘Good’ Regulatory Framework I § Small Shareholders • Look for short-term capital gain • Ignore issues of corporate governance • Do not pay attention to shareholder’s right • Inadequate shareholder protection Stephen Cheung Securities Markets in China 50

Corporate Governance: ‘Good’ Regulatory Framework II § Example • Hong Kong listed companies § 75% registered overseas § Different requirements • Class Action • Contingency Fee Stephen Cheung Securities Markets in China 51

Corporate Governance: ‘Good’ Regulatory Framework II § Example • Hong Kong listed companies § 75% registered overseas § Different requirements • Class Action • Contingency Fee Stephen Cheung Securities Markets in China 51

Corporate Governance: Quality Listed Companies I § A successful market does not depend on: • Number of listed companies • Market capitalization § Depends on: • Number of good listed companies • Liquidity • Ability to attract funds Stephen Cheung Securities Markets in China 52

Corporate Governance: Quality Listed Companies I § A successful market does not depend on: • Number of listed companies • Market capitalization § Depends on: • Number of good listed companies • Liquidity • Ability to attract funds Stephen Cheung Securities Markets in China 52

Corporate Governance: Quality Listed Companies II § Relation between director’s pay and company’s performance • Sample period: 1991 -1995 • 10% director’s pay > company’s earnings • No relation Stephen Cheung Securities Markets in China 53

Corporate Governance: Quality Listed Companies II § Relation between director’s pay and company’s performance • Sample period: 1991 -1995 • 10% director’s pay > company’s earnings • No relation Stephen Cheung Securities Markets in China 53

Corporate Governance: Quality Listed Companies III § Corporate governance • Independence of the Board • Problem § Connected parties transactions § Information disclosure Stephen Cheung Securities Markets in China 54

Corporate Governance: Quality Listed Companies III § Corporate governance • Independence of the Board • Problem § Connected parties transactions § Information disclosure Stephen Cheung Securities Markets in China 54

Corporate Governance: Quality Listed Companies IV § Enhance independence of the Board • Recruitment details of independent nonexecutive directors • Greater transparency § Financial § Non-Financial • Performance evaluation Stephen Cheung Securities Markets in China 55

Corporate Governance: Quality Listed Companies IV § Enhance independence of the Board • Recruitment details of independent nonexecutive directors • Greater transparency § Financial § Non-Financial • Performance evaluation Stephen Cheung Securities Markets in China 55

Corporate Governance: Quality Listed Companies V § Suggestions • Licensing for directors • Director’s education • Scorecard for corporate governance § Investors § Pressure Stephen Cheung Securities Markets in China 56

Corporate Governance: Quality Listed Companies V § Suggestions • Licensing for directors • Director’s education • Scorecard for corporate governance § Investors § Pressure Stephen Cheung Securities Markets in China 56

Corporate Governance: Quality Intermediaries I § Intermediaries • Accountants • Auditors • Lawyers • Financial Analysts Stephen Cheung Securities Markets in China 57

Corporate Governance: Quality Intermediaries I § Intermediaries • Accountants • Auditors • Lawyers • Financial Analysts Stephen Cheung Securities Markets in China 57

Corporate Governance: Quality Intermediaries II § Example • A News on 23 December 2002 • 3 listed companies were involved over a suspected scam of making bogus business transactions and inflated revenue • Arrested by the ICAC • Including accountants and financial consultants • Inflated turnover Stephen Cheung Securities Markets in China 58

Corporate Governance: Quality Intermediaries II § Example • A News on 23 December 2002 • 3 listed companies were involved over a suspected scam of making bogus business transactions and inflated revenue • Arrested by the ICAC • Including accountants and financial consultants • Inflated turnover Stephen Cheung Securities Markets in China 58

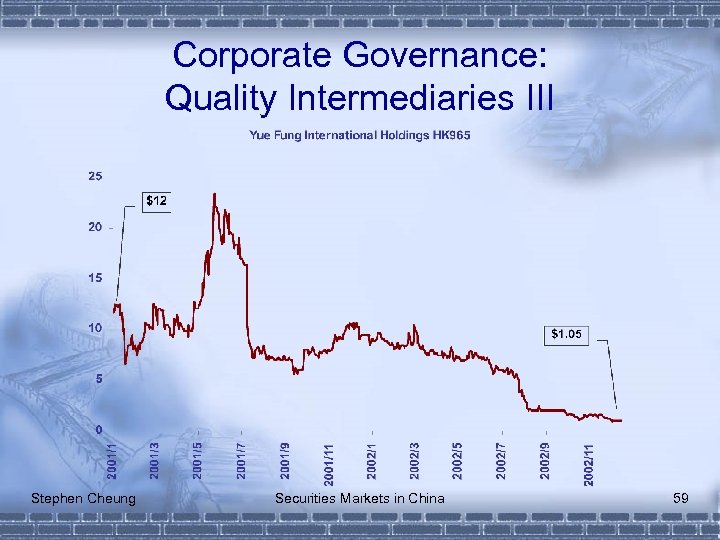

Corporate Governance: Quality Intermediaries III Stephen Cheung Securities Markets in China 59

Corporate Governance: Quality Intermediaries III Stephen Cheung Securities Markets in China 59

Corporate Governance: Quality Intermediaries IV Stephen Cheung Securities Markets in China 60

Corporate Governance: Quality Intermediaries IV Stephen Cheung Securities Markets in China 60

Corporate Governance: Quality Intermediaries V Stephen Cheung Securities Markets in China 61

Corporate Governance: Quality Intermediaries V Stephen Cheung Securities Markets in China 61

Corporate Governance: Quality Intermediaries VI § Self-Regulation • Effectiveness? § Independent Investigation Committee Stephen Cheung Securities Markets in China 62

Corporate Governance: Quality Intermediaries VI § Self-Regulation • Effectiveness? § Independent Investigation Committee Stephen Cheung Securities Markets in China 62

Conclusion § Market creditability § Investor confidence § Ability for further funding § Ability to attract quality companies Stephen Cheung Securities Markets in China 63

Conclusion § Market creditability § Investor confidence § Ability for further funding § Ability to attract quality companies Stephen Cheung Securities Markets in China 63

~ The End ~ Thank you Stephen Cheung Securities Markets in China

~ The End ~ Thank you Stephen Cheung Securities Markets in China