0358ce423287b862d06f86636f1d3b00.ppt

- Количество слайдов: 21

SECURITIES AND EXCHANGE COMMISSION Public Issue of Securities: Mutual Fund Presented by Md. Anowarul Islam, Executive Director/ Md. Mahmoodul Hoque, Director Securities and Exchange Commission

What is Mutual Fund ? q q A Mutual Fund is a professionally managed collective investment scheme that pools money from many investors and invests typically in securities (stocks, bonds, short term money market instruments, other mutual funds and other securities) on behalf of the investors/unit holders and distributes the profits. In other words, a mutual fund allows an investor to indirectly take a position in a basket of assets.

How do mutual funds diversify their risks? q q According to basic financial theory an investor can reduce his risk by holding a portfolio of assets instead of only one asset. This is because by holding all your money in just one asset, the entire fortunes of your portfolio depends on this one asset. By creating a portfolio of a variety of assets, this risk is substantially reduced. Can mutual funds assumed to be risk-free investments? No. Mutual fund investments are not totally risk free. In fact, investing in mutual funds bears the same risk as investing in the equities, the only difference is that due to professional management of funds the controllable risks are substantially reduced.

What are the types of risks involved in investing in mutual funds? A very important risk involved in mutual fund investments is the market risk. When the market is in doldrums, most of the equity funds will also experience a downturn. However, the company specific risks are largely eliminated due to professional fund management.

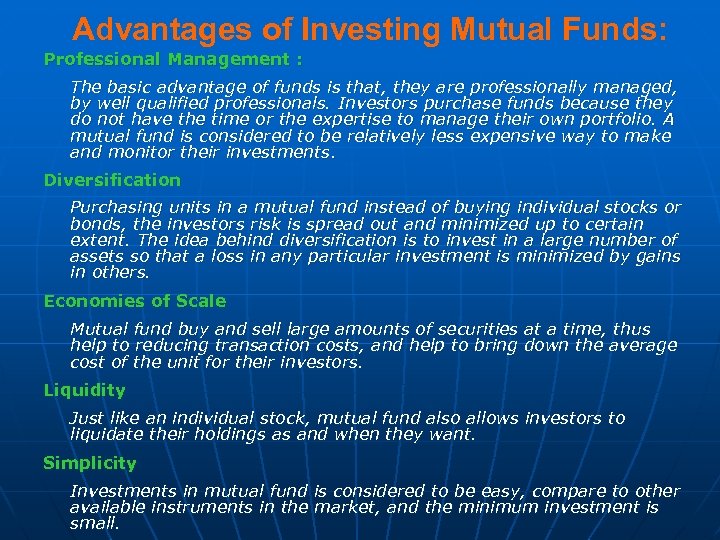

Advantages of Investing Mutual Funds: Professional Management : The basic advantage of funds is that, they are professionally managed, by well qualified professionals. Investors purchase funds because they do not have the time or the expertise to manage their own portfolio. A mutual fund is considered to be relatively less expensive way to make and monitor their investments. Diversification Purchasing units in a mutual fund instead of buying individual stocks or bonds, the investors risk is spread out and minimized up to certain extent. The idea behind diversification is to invest in a large number of assets so that a loss in any particular investment is minimized by gains in others. Economies of Scale Mutual fund buy and sell large amounts of securities at a time, thus help to reducing transaction costs, and help to bring down the average cost of the unit for their investors. Liquidity Just like an individual stock, mutual fund also allows investors to liquidate their holdings as and when they want. Simplicity Investments in mutual fund is considered to be easy, compare to other available instruments in the market, and the minimum investment is small.

What are the parameters on which a Mutual Fund scheme are evaluated? Performance indicators are: -total returns given by the fund on different schemes, -the returns on competing funds, -the objective of the fund and -the promoter’s image These are some of the key factors to be considered while taking an investment decision regarding mutual funds.

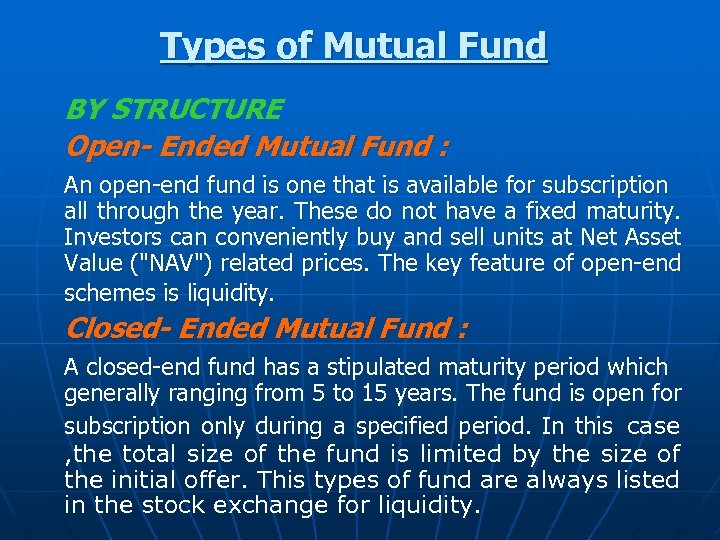

Types of Mutual Fund BY STRUCTURE Open- Ended Mutual Fund : An open-end fund is one that is available for subscription all through the year. These do not have a fixed maturity. Investors can conveniently buy and sell units at Net Asset Value ("NAV") related prices. The key feature of open-end schemes is liquidity. Closed- Ended Mutual Fund : A closed-end fund has a stipulated maturity period which generally ranging from 5 to 15 years. The fund is open for subscription only during a specified period. In this case , the total size of the fund is limited by the size of the initial offer. This types of fund are always listed in the stock exchange for liquidity.

Types of Mutual Fund (Cont’d) Equity Mutual Fund Categories: Growth Fund Capital Appreciation Fund Growth and Income Fund International and Global Fund Specialty Fund Index Fund of the Fund Bond Mutual Fund Categories: Income Fund Tax Free fund High-yield Bond Fund International and Global Bond Fund

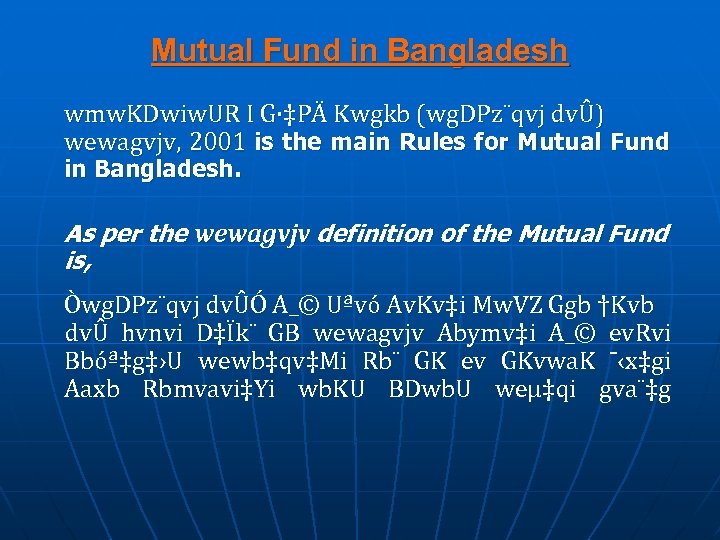

Mutual Fund in Bangladesh wmw. KDwiw. UR I G·‡PÄ Kwgkb (wg. DPz¨qvj dvÛ) wewagvjv, 2001 is the main Rules for Mutual Fund in Bangladesh. As per the wewagvjv definition of the Mutual Fund is, Òwg. DPz¨qvj dvÛÓ A_© Uªvó Av. Kv‡i Mw. VZ Ggb †Kvb dvÛ hvnvi D‡Ïk¨ GB wewagvjv Abymv‡i A_© ev. Rvi Bbóª‡g‡›U wewb‡qv‡Mi Rb¨ GK ev GKvwa. K ¯‹x‡gi Aaxb Rbmvavi‡Yi wb. KU BDwb. U weµ‡qi gva¨‡g

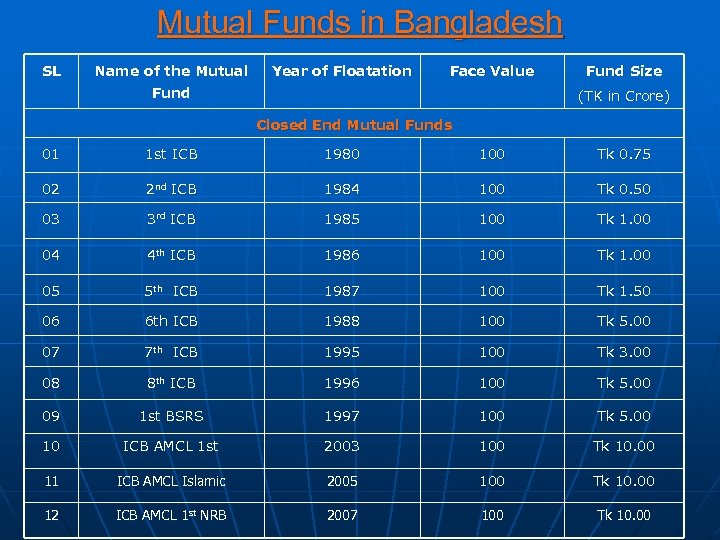

Mutual Funds in Bangladesh SL Name of the Mutual Year of Floatation Face Value Fund Size (TK in Crore) Closed End Mutual Funds 01 1 st ICB 1980 100 Tk 0. 75 02 2 nd ICB 1984 100 Tk 0. 50 03 3 rd ICB 1985 100 Tk 1. 00 04 4 th ICB 1986 100 Tk 1. 00 05 5 th ICB 1987 100 Tk 1. 50 06 6 th ICB 1988 100 Tk 5. 00 07 7 th ICB 1995 100 Tk 3. 00 08 8 th ICB 1996 100 Tk 5. 00 09 1 st BSRS 1997 100 Tk 5. 00 10 ICB AMCL 1 st 2003 100 Tk 10. 00 11 ICB AMCL Islamic 2005 100 Tk 10. 00 12 ICB AMCL 1 st NRB 2007 100 Tk 10. 00

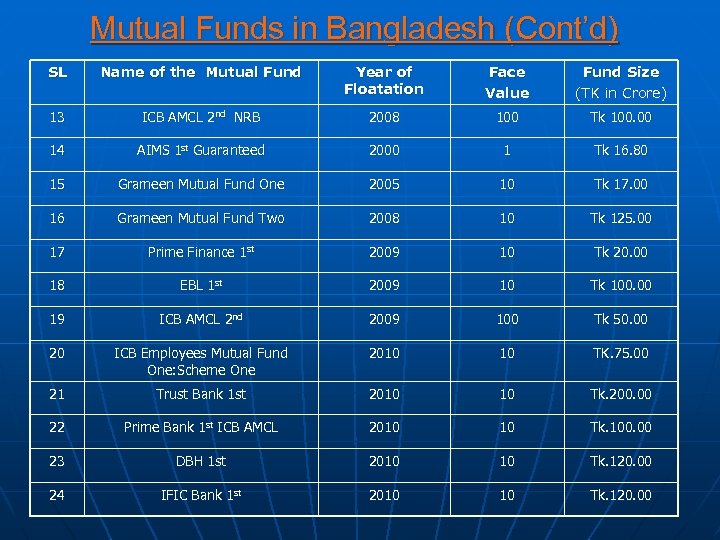

Mutual Funds in Bangladesh (Cont’d) SL Name of the Mutual Fund Year of Floatation Face Value Fund Size (TK in Crore) 13 ICB AMCL 2 nd NRB 2008 100 Tk 100. 00 14 AIMS 1 st Guaranteed 2000 1 Tk 16. 80 15 Grameen Mutual Fund One 2005 10 Tk 17. 00 16 Grameen Mutual Fund Two 2008 10 Tk 125. 00 17 Prime Finance 1 st 2009 10 Tk 20. 00 18 EBL 1 st 2009 10 Tk 100. 00 19 ICB AMCL 2 nd 2009 100 Tk 50. 00 20 ICB Employees Mutual Fund One: Scheme One 2010 10 TK. 75. 00 21 Trust Bank 1 st 2010 10 Tk. 200. 00 22 Prime Bank 1 st ICB AMCL 2010 10 Tk. 100. 00 23 DBH 1 st 2010 10 Tk. 120. 00 24 IFIC Bank 1 st 2010 10 Tk. 120. 00

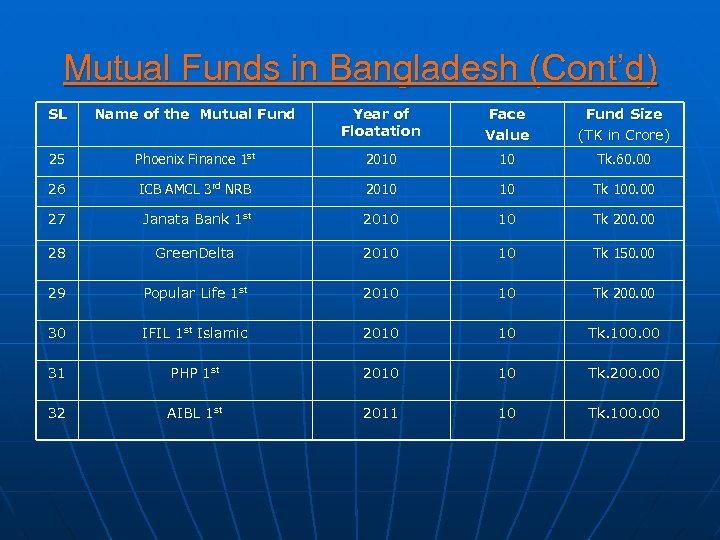

Mutual Funds in Bangladesh (Cont’d) SL Name of the Mutual Fund Year of Floatation Face Value Fund Size (TK in Crore) 25 Phoenix Finance 1 st 2010 10 Tk. 60. 00 26 ICB AMCL 3 rd NRB 2010 10 Tk 100. 00 27 Janata Bank 1 st 2010 10 Tk 200. 00 28 Green. Delta 2010 10 Tk 150. 00 29 Popular Life 1 st 2010 10 Tk 200. 00 30 IFIL 1 st Islamic 2010 10 Tk. 100. 00 31 PHP 1 st 2010 10 Tk. 200. 00 32 AIBL 1 st 2011 10 Tk. 100. 00

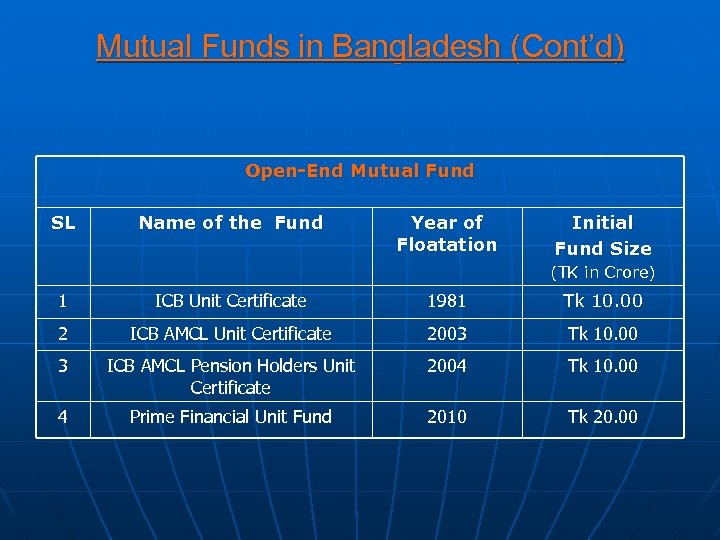

Mutual Funds in Bangladesh (Cont’d) Open-End Mutual Fund SL Name of the Fund Year of Floatation Initial Fund Size (TK in Crore) 1 ICB Unit Certificate 1981 Tk 10. 00 2 ICB AMCL Unit Certificate 2003 Tk 10. 00 3 ICB AMCL Pension Holders Unit Certificate 2004 Tk 10. 00 4 Prime Financial Unit Fund 2010 Tk 20. 00

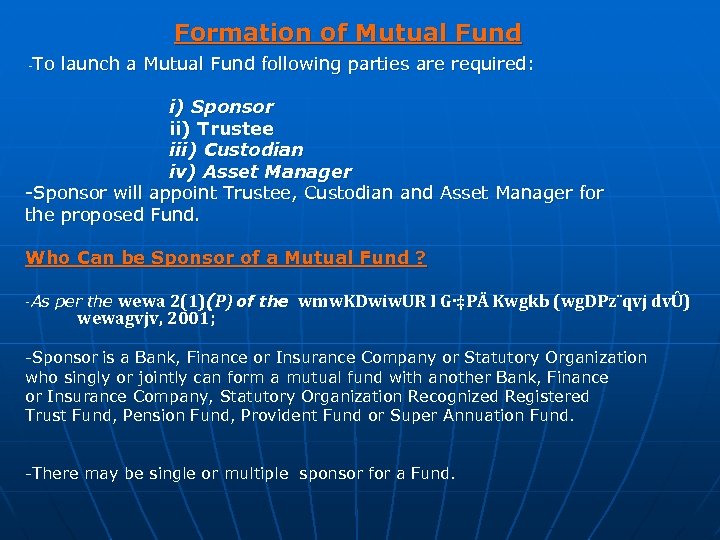

Formation of Mutual Fund To launch a Mutual Fund following parties are required: - i) Sponsor ii) Trustee iii) Custodian iv) Asset Manager -Sponsor will appoint Trustee, Custodian and Asset Manager for the proposed Fund. Who Can be Sponsor of a Mutual Fund ? -As per the wewa 2(1)(P) of the wmw. KDwiw. UR I G·‡PÄ Kwgkb (wg. DPz¨qvj dvÛ) wewagvjv, 2001; -Sponsor is a Bank, Finance or Insurance Company or Statutory Organization who singly or jointly can form a mutual fund with another Bank, Finance or Insurance Company, Statutory Organization Recognized Registered Trust Fund, Pension Fund, Provident Fund or Super Annuation Fund. -There may be single or multiple sponsor for a Fund.

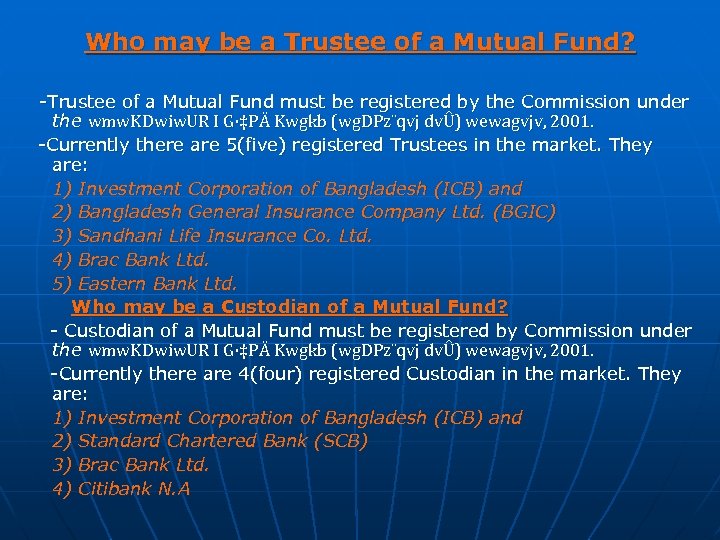

Who may be a Trustee of a Mutual Fund? -Trustee of a Mutual Fund must be registered by the Commission under the wmw. KDwiw. UR I G·‡PÄ Kwgkb (wg. DPz¨qvj dvÛ) wewagvjv, 2001. -Currently there are 5(five) registered Trustees in the market. They are: 1) Investment Corporation of Bangladesh (ICB) and 2) Bangladesh General Insurance Company Ltd. (BGIC) 3) Sandhani Life Insurance Co. Ltd. 4) Brac Bank Ltd. 5) Eastern Bank Ltd. Who may be a Custodian of a Mutual Fund? - Custodian of a Mutual Fund must be registered by Commission under the wmw. KDwiw. UR I G·‡PÄ Kwgkb (wg. DPz¨qvj dvÛ) wewagvjv, 2001. -Currently there are 4(four) registered Custodian in the market. They are: 1) Investment Corporation of Bangladesh (ICB) and 2) Standard Chartered Bank (SCB) 3) Brac Bank Ltd. 4) Citibank N. A

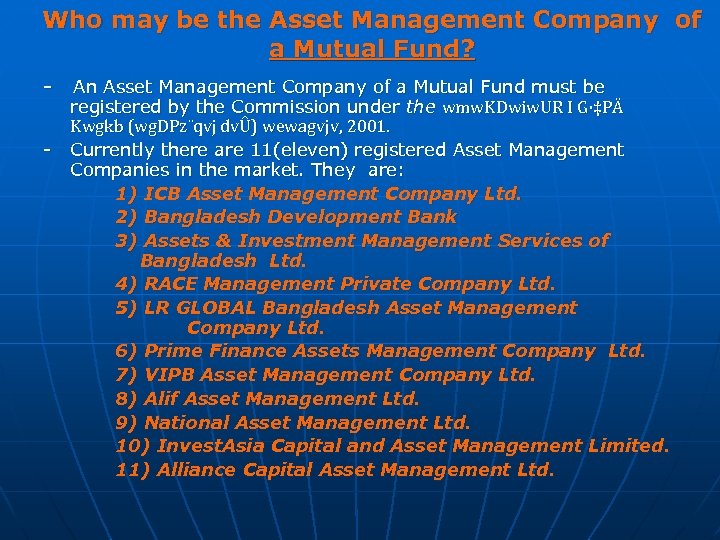

Who may be the Asset Management Company of a Mutual Fund? - An Asset Management Company of a Mutual Fund must be registered by the Commission under the wmw. KDwiw. UR I G·‡PÄ Kwgkb (wg. DPz¨qvj dvÛ) wewagvjv, 2001. Currently there are 11(eleven) registered Asset Management Companies in the market. They are: 1) ICB Asset Management Company Ltd. 2) Bangladesh Development Bank 3) Assets & Investment Management Services of Bangladesh Ltd. 4) RACE Management Private Company Ltd. 5) LR GLOBAL Bangladesh Asset Management Company Ltd. 6) Prime Finance Assets Management Company Ltd. 7) VIPB Asset Management Company Ltd. 8) Alif Asset Management Ltd. 9) National Asset Management Ltd. 10) Invest. Asia Capital and Asset Management Limited. 11) Alliance Capital Asset Management Ltd.

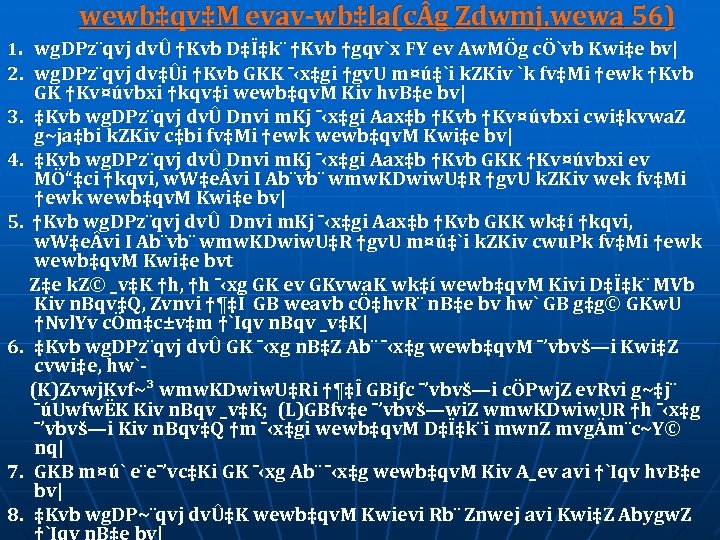

wewb‡qv‡M evav wb‡la(c g Zdwmj, wewa 56) 1. wg. DPz¨qvj dvÛ †Kvb D‡Ï‡k¨ †Kvb †gqv`x FY ev Aw. MÖg cÖ`vb Kwi‡e bv| 2. wg. DPz¨qvj dv‡Ûi †Kvb GKK ¯‹x‡gi †gv. U m¤ú‡`i k. ZKiv `k fv‡Mi †ewk †Kvb GK †Kv¤úvbxi †kqv‡i wewb‡qv. M Kiv hv. B‡e bv| 3. ‡Kvb wg. DPz¨qvj dvÛ Dnvi m. Kj ¯‹x‡gi Aax‡b †Kv¤úvbxi cwi‡kvwa. Z g~ja‡bi k. ZKiv c‡bi fv‡Mi †ewk wewb‡qv. M Kwi‡e bv| 4. ‡Kvb wg. DPz¨qvj dvÛ Dnvi m. Kj ¯‹x‡gi Aax‡b †Kvb GKK †Kv¤úvbxi ev MÖ“‡ci †kqvi, w. W‡e vi I Ab¨vb¨ wmw. KDwiw. U‡R †gv. U k. ZKiv wek fv‡Mi †ewk wewb‡qv. M Kwi‡e bv| 5. †Kvb wg. DPz¨qvj dvÛ Dnvi m. Kj ¯‹x‡gi Aax‡b †Kvb GKK wk‡í †kqvi, w. W‡e vi I Ab¨vb¨ wmw. KDwiw. U‡R †gv. U m¤ú‡`i k. ZKiv cwu. Pk fv‡Mi †ewk wewb‡qv. M Kwi‡e bvt Z‡e k. Z© _v‡K †h, †h ¯‹xg GK ev GKvwa. K wk‡í wewb‡qv. M Kivi D‡Ï‡k¨ MVb Kiv n. Bqv‡Q, Zvnvi †¶‡Î GB weavb cÖ‡hv. R¨ n. B‡e bv hw` GB g‡g© GKw. U †Nvl. Yv cÖm‡c±v‡m †`Iqv n. Bqv _v‡K| 6. ‡Kvb wg. DPz¨qvj dvÛ GK ¯‹xg n. B‡Z Ab¨ ¯‹x‡g wewb‡qv. M ¯’vbvš—i Kwi‡Z cvwi‡e, hw` (K)Zvwj. Kvf~³ wmw. KDwiw. U‡Ri †¶‡Î GBiƒc ¯’vbvš—i cÖPwj. Z ev. Rvi g~‡j¨ ¯úUwfwËK Kiv n. Bqv _v‡K; (L)GBfv‡e ¯’vbvš—wi. Z wmw. KDwiw. UR †h ¯‹x‡g ¯’vbvš—i Kiv n. Bqv‡Q †m ¯‹x‡gi wewb‡qv. M D‡Ï‡k¨i mwn. Z mvgÄm¨c~Y© nq| 7. GKB m¤ú` e¨e¯’vc‡Ki GK ¯‹xg Ab¨ ¯‹x‡g wewb‡qv. M Kiv A_ev avi †`Iqv hv. B‡e bv| 8. ‡Kvb wg. DP~¨qvj dvÛ‡K wewb‡qv. M Kwievi Rb¨ Znwej avi Kwi‡Z Abygw. Z †`Iqv n. B‡e bv|

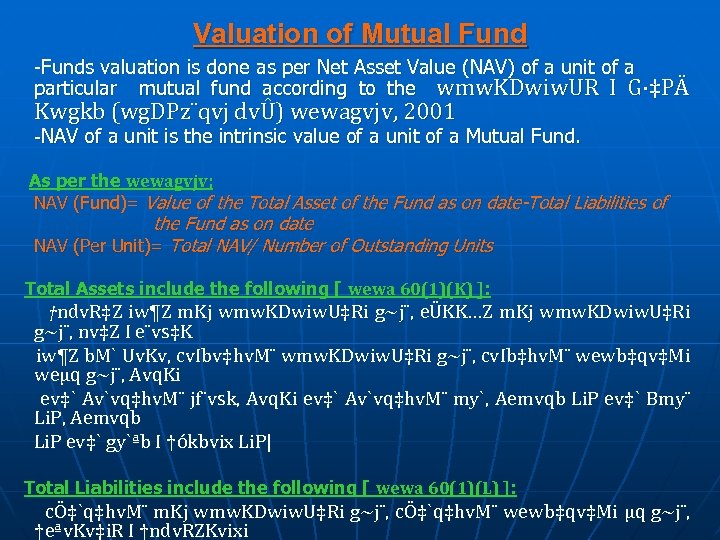

Valuation of Mutual Fund -Funds valuation is done as per Net Asset Value (NAV) of a unit of a particular mutual fund according to the wmw. KDwiw. UR I G·‡PÄ Kwgkb (wg. DPz¨qvj dvÛ) wewagvjv, 2001 -NAV of a unit is the intrinsic value of a unit of a Mutual Fund. As per the wewagvjv; NAV (Fund)= Value of the Total Asset of the Fund as on date-Total Liabilities of the Fund as on date NAV (Per Unit)= Total NAV/ Number of Outstanding Units Total Assets include the following [ wewa 60(1)(K) ]: †ndv. R‡Z iw¶Z m. Kj wmw. KDwiw. U‡Ri g~j¨, eÜKK…Z m. Kj wmw. KDwiw. U‡Ri g~j¨, nv‡Z I e¨vs‡K iw¶Z b. M` Uv. Kv, cv. Ibv‡hv. M¨ wmw. KDwiw. U‡Ri g~j¨, cv. Ib‡hv. M¨ wewb‡qv‡Mi weµq g~j¨, Avq. Ki ev‡` Av`vq‡hv. M¨ jf¨vsk, Avq. Ki ev‡` Av`vq‡hv. M¨ my`, Aemvqb Li. P ev‡` Bmy¨ Li. P, Aemvqb Li. P ev‡` gy`ªb I †ókbvix Li. P| Total Liabilities include the following [ wewa 60(1)(L) ]: cÖ‡`q‡hv. M¨ m. Kj wmw. KDwiw. U‡Ri g~j¨, cÖ‡`q‡hv. M¨ wewb‡qv‡Mi µq g~j¨, †eªv. Kv‡i. R I †ndv. RZKvixi

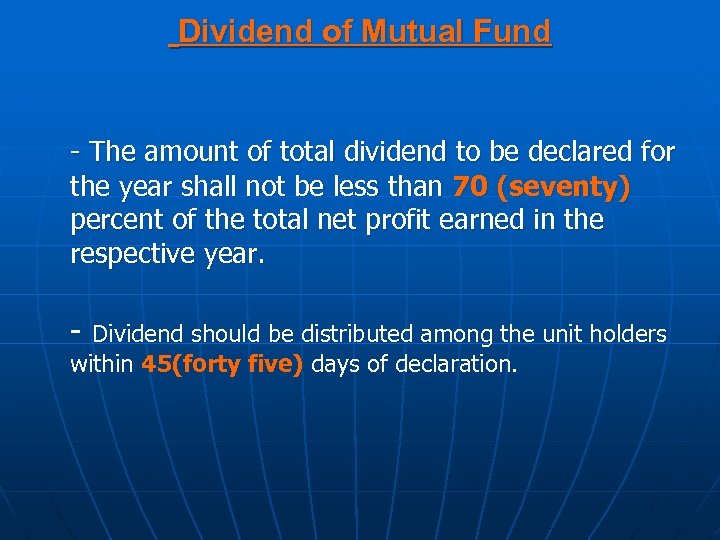

Dividend of Mutual Fund - The amount of total dividend to be declared for the year shall not be less than 70 (seventy) percent of the total net profit earned in the respective year. - Dividend should be distributed among the unit holders within 45(forty five) days of declaration.

Rights of the Unit Holder -Dividend -Tax Benefit -Transferebility -Right to Vote -Reports and Accounts -Beneficial Interest

Question ?

0358ce423287b862d06f86636f1d3b00.ppt