b3dcab13a791c58a655add58c7cba6c8.ppt

- Количество слайдов: 108

Secured Transactions Assignment 21 Characterizing Collateral and Transactions 1

Secured Transactions Assignment 21 Characterizing Collateral and Transactions 1

The Big Picture Part Two: The Creditor Third Party Relationship Chapter 6 -7: Perfection Assignment 16: Personal Property Filing Systems Assignment 17: Financing Statements: The Debtor’s Name Assignment 18: Financing Statements: Other Information Assignment 19: Exceptions to Filing Assignment 20: Real Estate Recording Systems Assignment 21: Characterizing Collateral and Transactions 2

The Big Picture Part Two: The Creditor Third Party Relationship Chapter 6 -7: Perfection Assignment 16: Personal Property Filing Systems Assignment 17: Financing Statements: The Debtor’s Name Assignment 18: Financing Statements: Other Information Assignment 19: Exceptions to Filing Assignment 20: Real Estate Recording Systems Assignment 21: Characterizing Collateral and Transactions 2

Characterizing Promises to Pay Money § 9 -102(a)(11). “Chattel paper” means. . . records that evidence both a monetary obligation and a security interest in specific goods. . ” 3

Characterizing Promises to Pay Money § 9 -102(a)(11). “Chattel paper” means. . . records that evidence both a monetary obligation and a security interest in specific goods. . ” 3

Characterizing Promises to Pay Money § 9 -102(a)(11). “Chattel paper” means. . . records that evidence both a monetary obligation and a security interest in specific goods. . ” Chattel Paper Chattel paper is chattel paper 4

Characterizing Promises to Pay Money § 9 -102(a)(11). “Chattel paper” means. . . records that evidence both a monetary obligation and a security interest in specific goods. . ” Chattel Paper Chattel paper is chattel paper 4

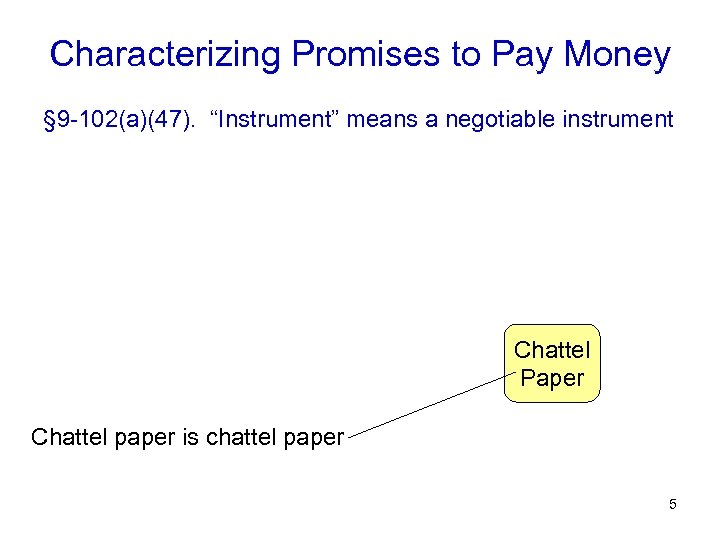

Characterizing Promises to Pay Money § 9 -102(a)(47). “Instrument” means a negotiable instrument Chattel Paper Chattel paper is chattel paper 5

Characterizing Promises to Pay Money § 9 -102(a)(47). “Instrument” means a negotiable instrument Chattel Paper Chattel paper is chattel paper 5

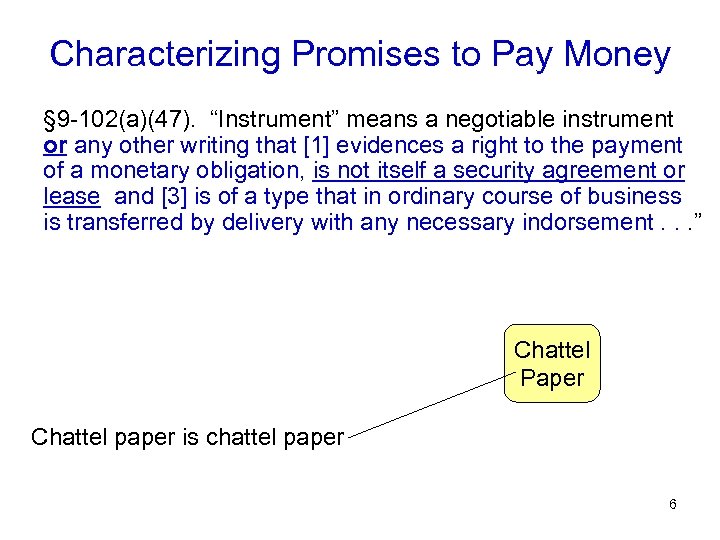

Characterizing Promises to Pay Money § 9 -102(a)(47). “Instrument” means a negotiable instrument or any other writing that [1] evidences a right to the payment of a monetary obligation, is not itself a security agreement or lease and [3] is of a type that in ordinary course of business is transferred by delivery with any necessary indorsement. . . ” Chattel Paper Chattel paper is chattel paper 6

Characterizing Promises to Pay Money § 9 -102(a)(47). “Instrument” means a negotiable instrument or any other writing that [1] evidences a right to the payment of a monetary obligation, is not itself a security agreement or lease and [3] is of a type that in ordinary course of business is transferred by delivery with any necessary indorsement. . . ” Chattel Paper Chattel paper is chattel paper 6

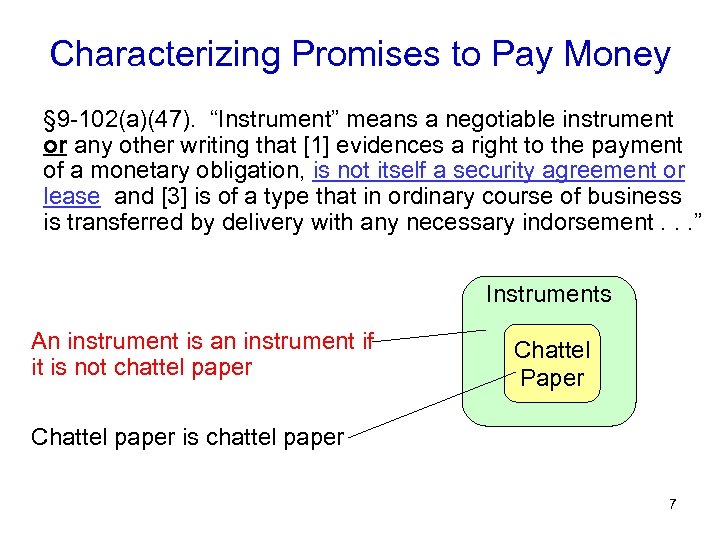

Characterizing Promises to Pay Money § 9 -102(a)(47). “Instrument” means a negotiable instrument or any other writing that [1] evidences a right to the payment of a monetary obligation, is not itself a security agreement or lease and [3] is of a type that in ordinary course of business is transferred by delivery with any necessary indorsement. . . ” Instruments An instrument is an instrument if it is not chattel paper Chattel Paper Chattel paper is chattel paper 7

Characterizing Promises to Pay Money § 9 -102(a)(47). “Instrument” means a negotiable instrument or any other writing that [1] evidences a right to the payment of a monetary obligation, is not itself a security agreement or lease and [3] is of a type that in ordinary course of business is transferred by delivery with any necessary indorsement. . . ” Instruments An instrument is an instrument if it is not chattel paper Chattel Paper Chattel paper is chattel paper 7

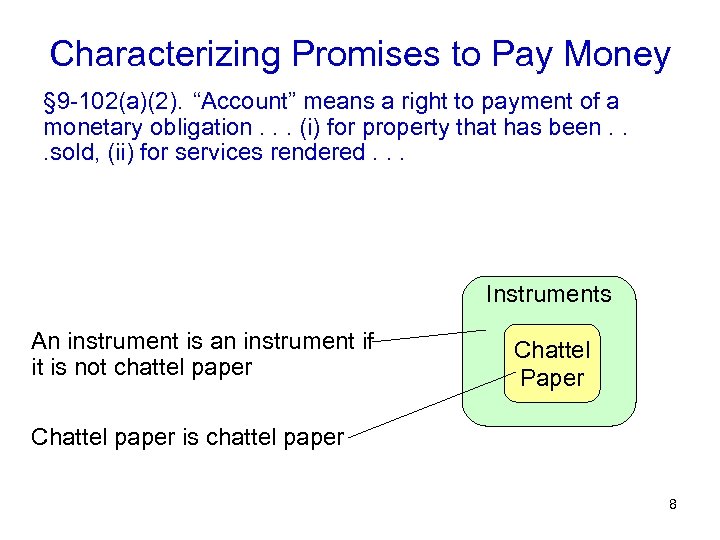

Characterizing Promises to Pay Money § 9 -102(a)(2). “Account” means a right to payment of a monetary obligation. . . (i) for property that has been. . . sold, (ii) for services rendered. . . Instruments An instrument is an instrument if it is not chattel paper Chattel Paper Chattel paper is chattel paper 8

Characterizing Promises to Pay Money § 9 -102(a)(2). “Account” means a right to payment of a monetary obligation. . . (i) for property that has been. . . sold, (ii) for services rendered. . . Instruments An instrument is an instrument if it is not chattel paper Chattel Paper Chattel paper is chattel paper 8

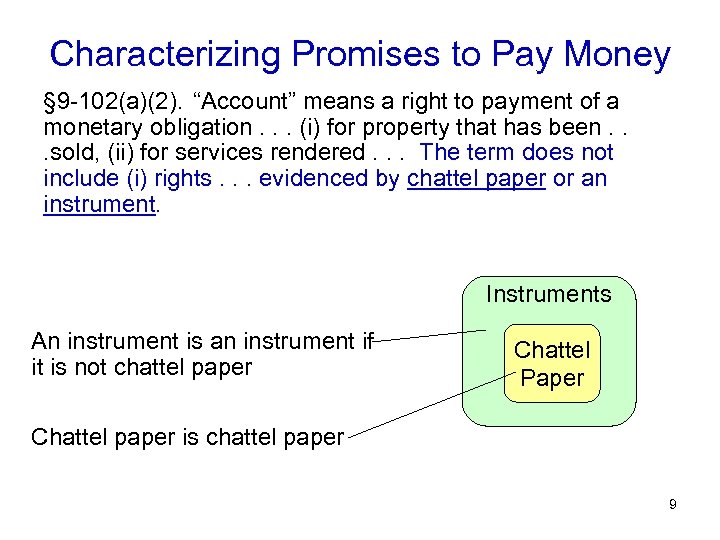

Characterizing Promises to Pay Money § 9 -102(a)(2). “Account” means a right to payment of a monetary obligation. . . (i) for property that has been. . . sold, (ii) for services rendered. . . The term does not include (i) rights. . . evidenced by chattel paper or an instrument. Instruments An instrument is an instrument if it is not chattel paper Chattel Paper Chattel paper is chattel paper 9

Characterizing Promises to Pay Money § 9 -102(a)(2). “Account” means a right to payment of a monetary obligation. . . (i) for property that has been. . . sold, (ii) for services rendered. . . The term does not include (i) rights. . . evidenced by chattel paper or an instrument. Instruments An instrument is an instrument if it is not chattel paper Chattel Paper Chattel paper is chattel paper 9

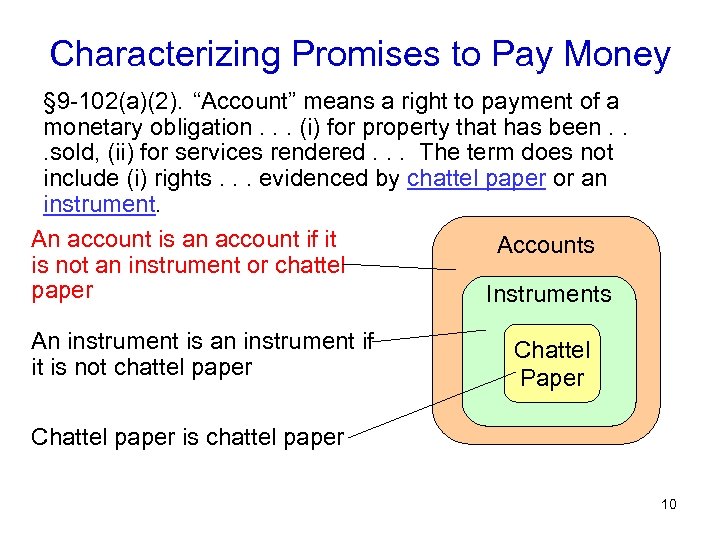

Characterizing Promises to Pay Money § 9 -102(a)(2). “Account” means a right to payment of a monetary obligation. . . (i) for property that has been. . . sold, (ii) for services rendered. . . The term does not include (i) rights. . . evidenced by chattel paper or an instrument. An account is an account if it Accounts is not an instrument or chattel paper Instruments An instrument is an instrument if it is not chattel paper Chattel Paper Chattel paper is chattel paper 10

Characterizing Promises to Pay Money § 9 -102(a)(2). “Account” means a right to payment of a monetary obligation. . . (i) for property that has been. . . sold, (ii) for services rendered. . . The term does not include (i) rights. . . evidenced by chattel paper or an instrument. An account is an account if it Accounts is not an instrument or chattel paper Instruments An instrument is an instrument if it is not chattel paper Chattel Paper Chattel paper is chattel paper 10

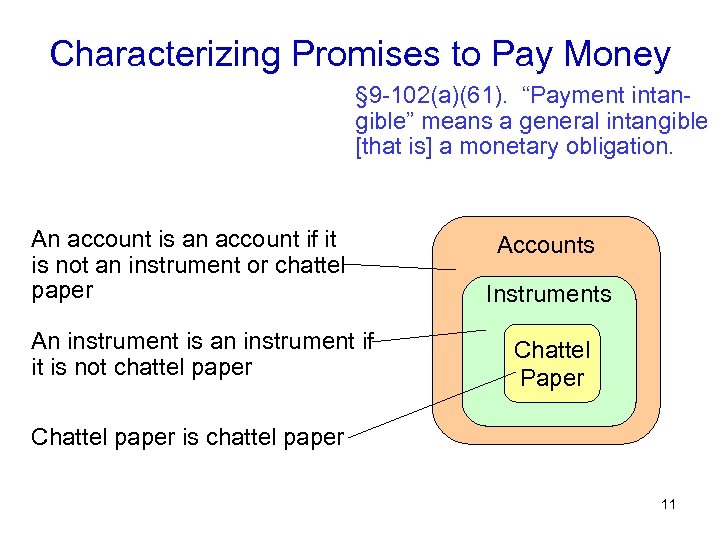

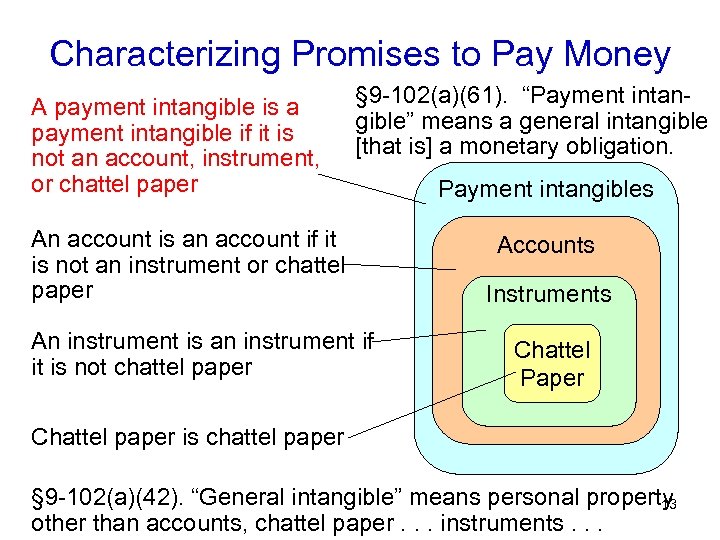

Characterizing Promises to Pay Money § 9 -102(a)(61). “Payment intangible” means a general intangible [that is] a monetary obligation. An account is an account if it is not an instrument or chattel paper An instrument is an instrument if it is not chattel paper Accounts Instruments Chattel Paper Chattel paper is chattel paper 11

Characterizing Promises to Pay Money § 9 -102(a)(61). “Payment intangible” means a general intangible [that is] a monetary obligation. An account is an account if it is not an instrument or chattel paper An instrument is an instrument if it is not chattel paper Accounts Instruments Chattel Paper Chattel paper is chattel paper 11

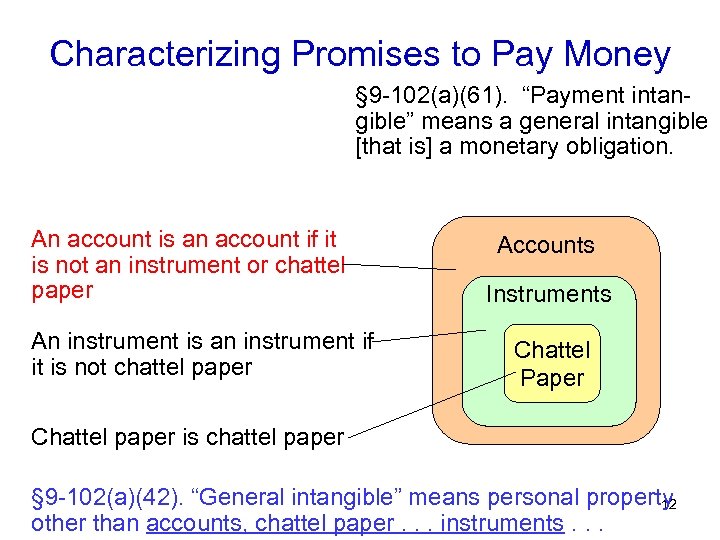

Characterizing Promises to Pay Money § 9 -102(a)(61). “Payment intangible” means a general intangible [that is] a monetary obligation. An account is an account if it is not an instrument or chattel paper An instrument is an instrument if it is not chattel paper Accounts Instruments Chattel Paper Chattel paper is chattel paper § 9 -102(a)(42). “General intangible” means personal property 12 other than accounts, chattel paper. . . instruments. . .

Characterizing Promises to Pay Money § 9 -102(a)(61). “Payment intangible” means a general intangible [that is] a monetary obligation. An account is an account if it is not an instrument or chattel paper An instrument is an instrument if it is not chattel paper Accounts Instruments Chattel Paper Chattel paper is chattel paper § 9 -102(a)(42). “General intangible” means personal property 12 other than accounts, chattel paper. . . instruments. . .

Characterizing Promises to Pay Money A payment intangible is a payment intangible if it is not an account, instrument, or chattel paper § 9 -102(a)(61). “Payment intangible” means a general intangible [that is] a monetary obligation. An account is an account if it is not an instrument or chattel paper An instrument is an instrument if it is not chattel paper Payment intangibles Accounts Instruments Chattel Paper Chattel paper is chattel paper § 9 -102(a)(42). “General intangible” means personal property 13 other than accounts, chattel paper. . . instruments. . .

Characterizing Promises to Pay Money A payment intangible is a payment intangible if it is not an account, instrument, or chattel paper § 9 -102(a)(61). “Payment intangible” means a general intangible [that is] a monetary obligation. An account is an account if it is not an instrument or chattel paper An instrument is an instrument if it is not chattel paper Payment intangibles Accounts Instruments Chattel Paper Chattel paper is chattel paper § 9 -102(a)(42). “General intangible” means personal property 13 other than accounts, chattel paper. . . instruments. . .

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” This box represents the category of “all goods. ” 14

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” This box represents the category of “all goods. ” 14

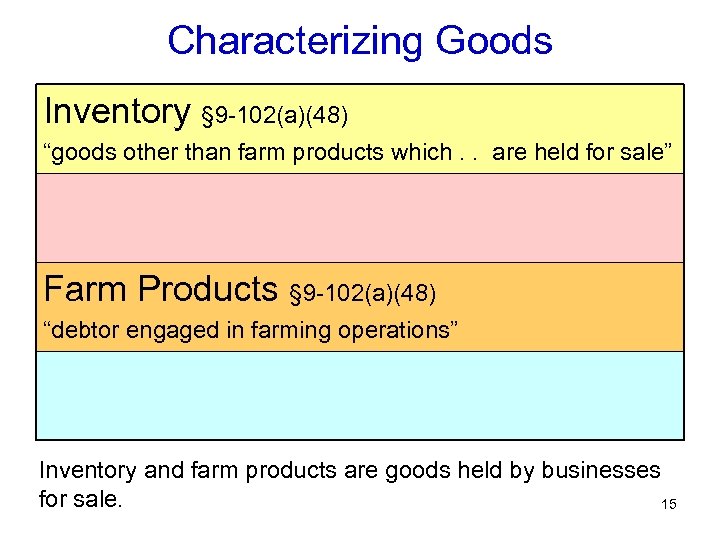

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” Inventory and farm products are goods held by businesses for sale. 15

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” Inventory and farm products are goods held by businesses for sale. 15

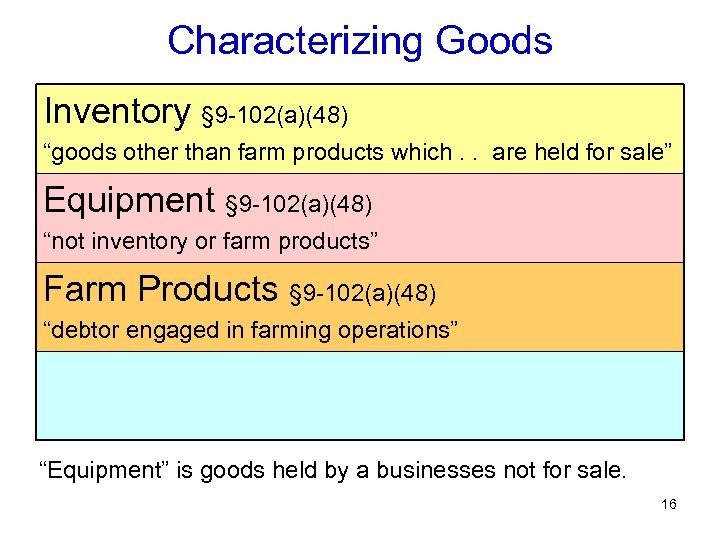

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” “Equipment” is goods held by a businesses not for sale. 16

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” “Equipment” is goods held by a businesses not for sale. 16

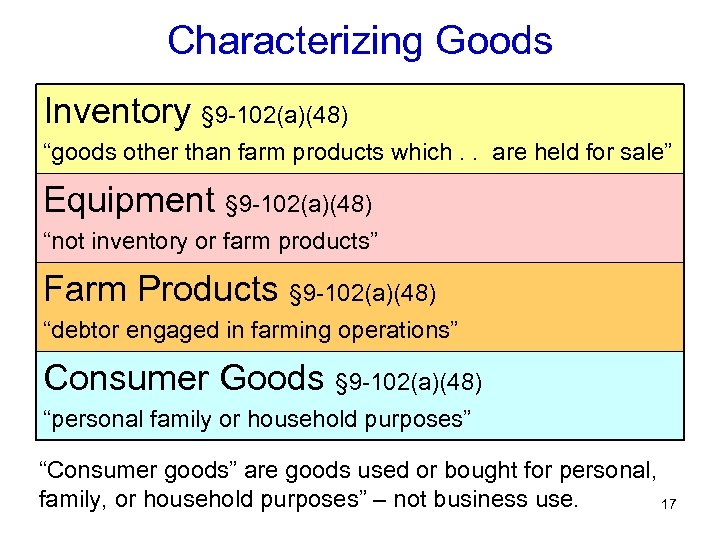

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” “Consumer goods” are goods used or bought for personal, family, or household purposes” – not business use. 17

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” “Consumer goods” are goods used or bought for personal, family, or household purposes” – not business use. 17

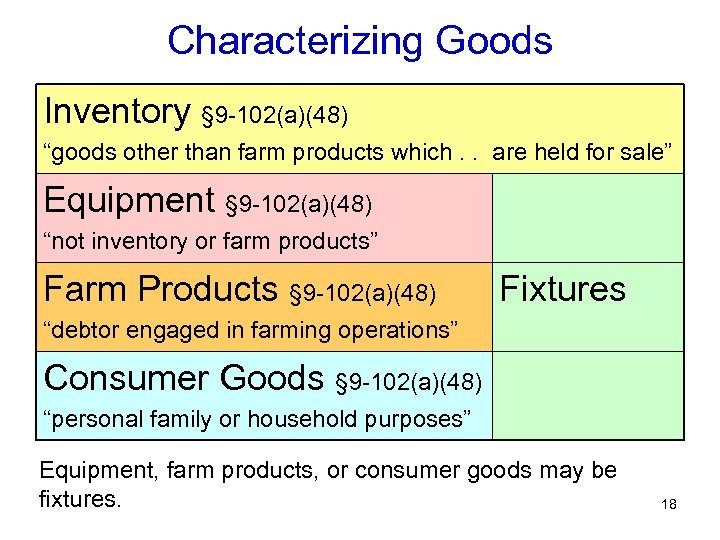

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) Fixtures “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” Equipment, farm products, or consumer goods may be fixtures. 18

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) Fixtures “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” Equipment, farm products, or consumer goods may be fixtures. 18

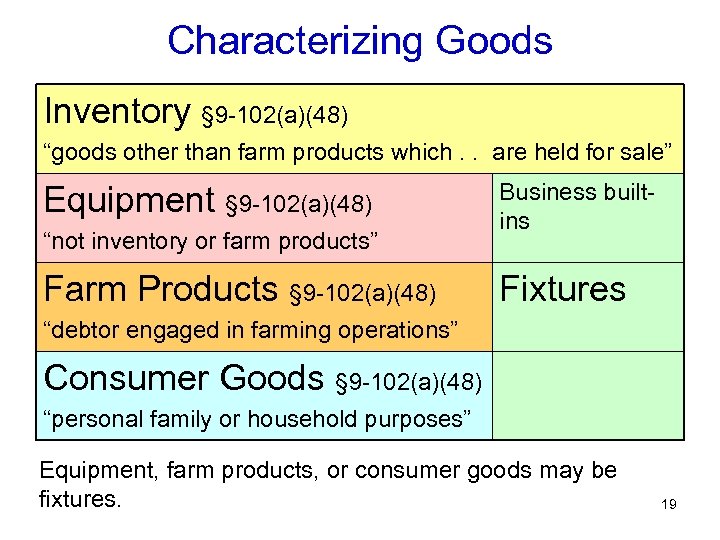

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) Business builtins Fixtures “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” Equipment, farm products, or consumer goods may be fixtures. 19

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Farm Products § 9 -102(a)(48) Business builtins Fixtures “debtor engaged in farming operations” Consumer Goods § 9 -102(a)(48) “personal family or household purposes” Equipment, farm products, or consumer goods may be fixtures. 19

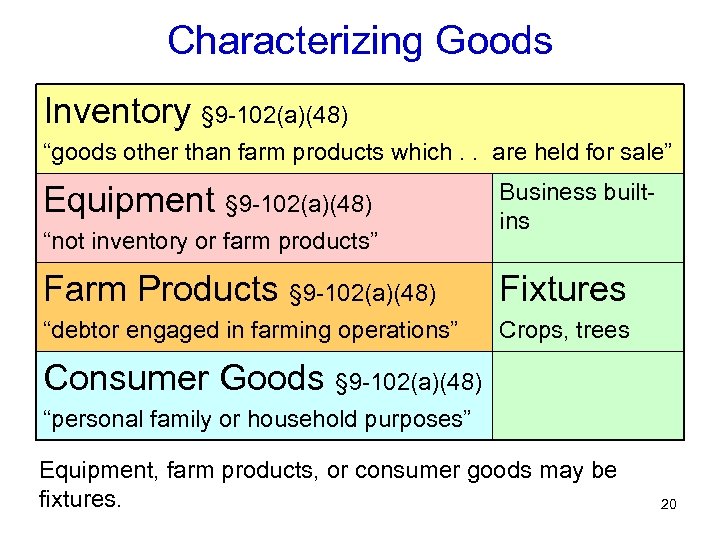

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Business builtins Farm Products § 9 -102(a)(48) Fixtures “debtor engaged in farming operations” Crops, trees Consumer Goods § 9 -102(a)(48) “personal family or household purposes” Equipment, farm products, or consumer goods may be fixtures. 20

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Business builtins Farm Products § 9 -102(a)(48) Fixtures “debtor engaged in farming operations” Crops, trees Consumer Goods § 9 -102(a)(48) “personal family or household purposes” Equipment, farm products, or consumer goods may be fixtures. 20

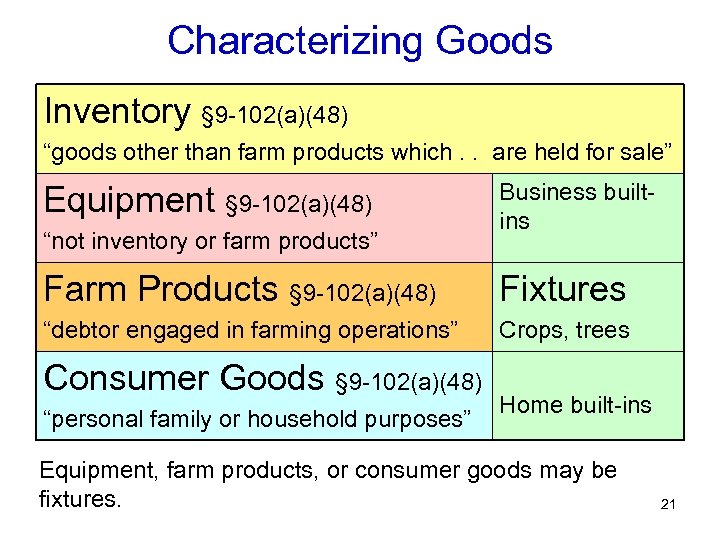

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Business builtins Farm Products § 9 -102(a)(48) Fixtures “debtor engaged in farming operations” Crops, trees Consumer Goods § 9 -102(a)(48) “personal family or household purposes” Home built-ins Equipment, farm products, or consumer goods may be fixtures. 21

Characterizing Goods Inventory § 9 -102(a)(48) “goods other than farm products which. . are held for sale” Equipment § 9 -102(a)(48) “not inventory or farm products” Business builtins Farm Products § 9 -102(a)(48) Fixtures “debtor engaged in farming operations” Crops, trees Consumer Goods § 9 -102(a)(48) “personal family or household purposes” Home built-ins Equipment, farm products, or consumer goods may be fixtures. 21

![Basic Concepts § 9 -109(a)(3). [Article 9] applies to. . . a sale of Basic Concepts § 9 -109(a)(3). [Article 9] applies to. . . a sale of](https://present5.com/presentation/b3dcab13a791c58a655add58c7cba6c8/image-22.jpg) Basic Concepts § 9 -109(a)(3). [Article 9] applies to. . . a sale of accounts, chattel paper, payment intangibles, or promissory notes § 1 -201(b)(35). “‘Security interest’ includes any interest of a buyer of accounts. . ” § 9 -102(a)(72). “Secured party’ means. . . a person to which accounts. . . have been sold” § 9 -102(a)(28). “Debtor’ means. . . a seller of accounts. . . ” Comment 5. “The principal effect. . . is to apply this article’s perfection and priority rules to these sales transaction” 22

Basic Concepts § 9 -109(a)(3). [Article 9] applies to. . . a sale of accounts, chattel paper, payment intangibles, or promissory notes § 1 -201(b)(35). “‘Security interest’ includes any interest of a buyer of accounts. . ” § 9 -102(a)(72). “Secured party’ means. . . a person to which accounts. . . have been sold” § 9 -102(a)(28). “Debtor’ means. . . a seller of accounts. . . ” Comment 5. “The principal effect. . . is to apply this article’s perfection and priority rules to these sales transaction” 22

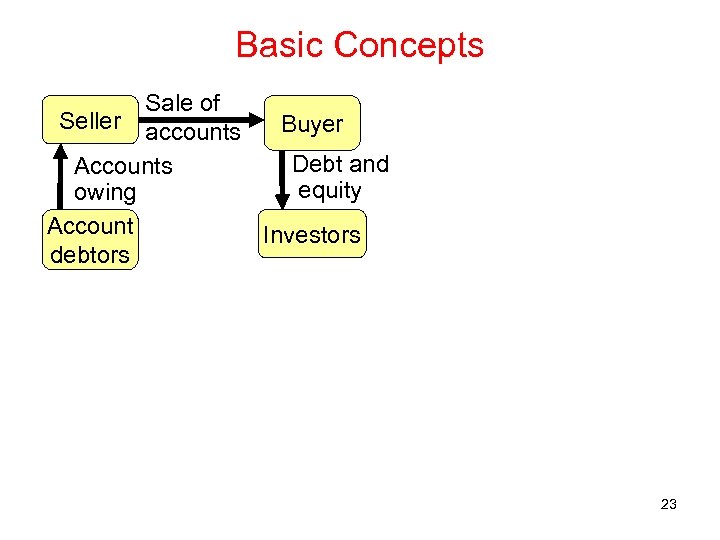

Basic Concepts Sale of Seller accounts Buyer Debt and Accounts equity owing Account Investors debtors 23

Basic Concepts Sale of Seller accounts Buyer Debt and Accounts equity owing Account Investors debtors 23

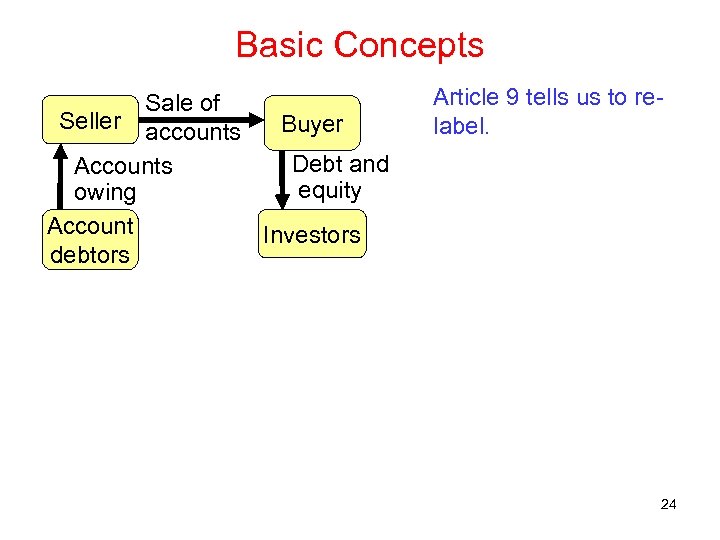

Basic Concepts Sale of Seller accounts Buyer Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. 24

Basic Concepts Sale of Seller accounts Buyer Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. 24

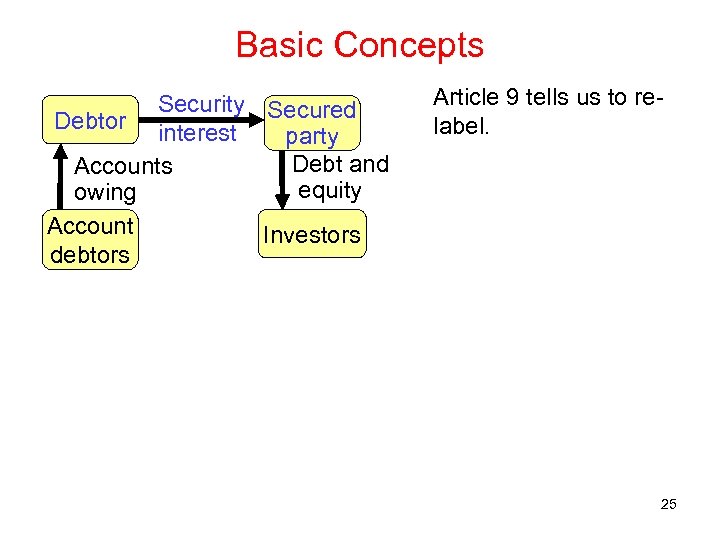

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. 25

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. 25

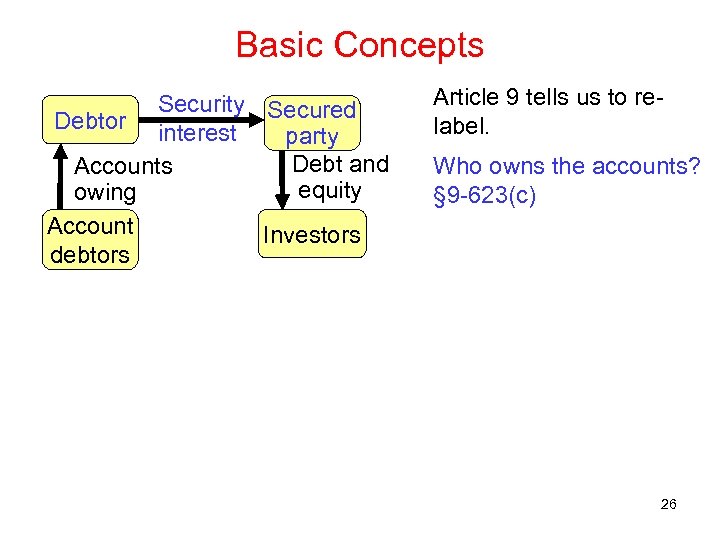

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) 26

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) 26

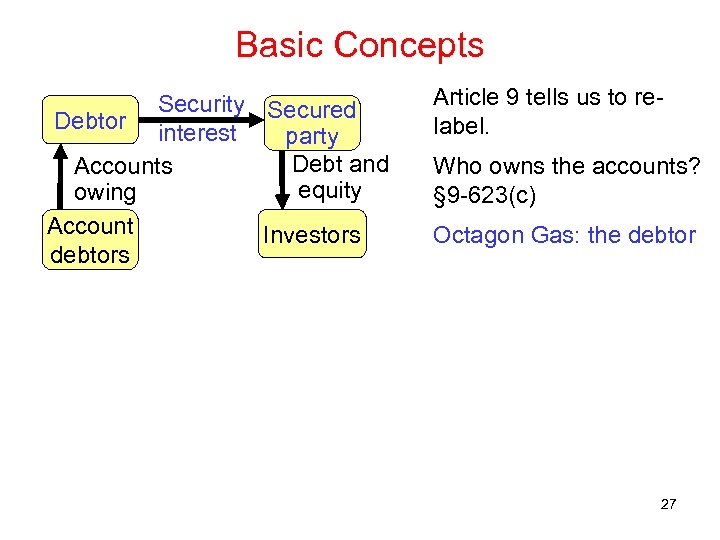

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) Octagon Gas: the debtor 27

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) Octagon Gas: the debtor 27

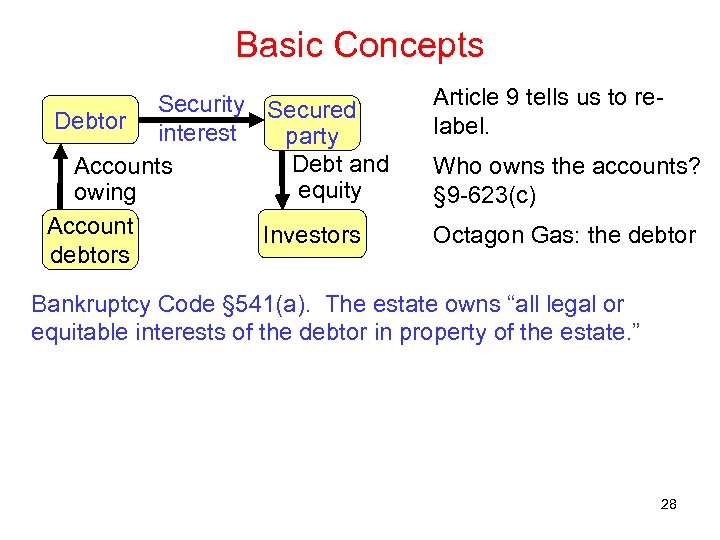

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) Octagon Gas: the debtor Bankruptcy Code § 541(a). The estate owns “all legal or equitable interests of the debtor in property of the estate. ” 28

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) Octagon Gas: the debtor Bankruptcy Code § 541(a). The estate owns “all legal or equitable interests of the debtor in property of the estate. ” 28

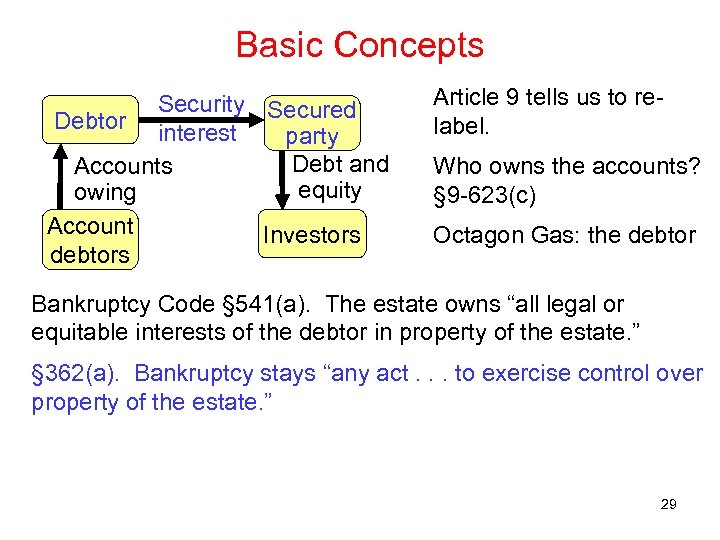

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) Octagon Gas: the debtor Bankruptcy Code § 541(a). The estate owns “all legal or equitable interests of the debtor in property of the estate. ” § 362(a). Bankruptcy stays “any act. . . to exercise control over property of the estate. ” 29

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) Octagon Gas: the debtor Bankruptcy Code § 541(a). The estate owns “all legal or equitable interests of the debtor in property of the estate. ” § 362(a). Bankruptcy stays “any act. . . to exercise control over property of the estate. ” 29

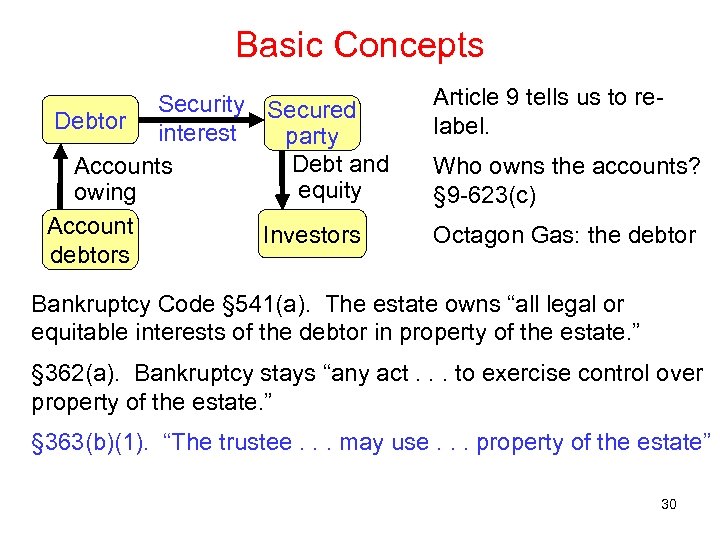

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) Octagon Gas: the debtor Bankruptcy Code § 541(a). The estate owns “all legal or equitable interests of the debtor in property of the estate. ” § 362(a). Bankruptcy stays “any act. . . to exercise control over property of the estate. ” § 363(b)(1). “The trustee. . . may use. . . property of the estate” 30

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) Octagon Gas: the debtor Bankruptcy Code § 541(a). The estate owns “all legal or equitable interests of the debtor in property of the estate. ” § 362(a). Bankruptcy stays “any act. . . to exercise control over property of the estate. ” § 363(b)(1). “The trustee. . . may use. . . property of the estate” 30

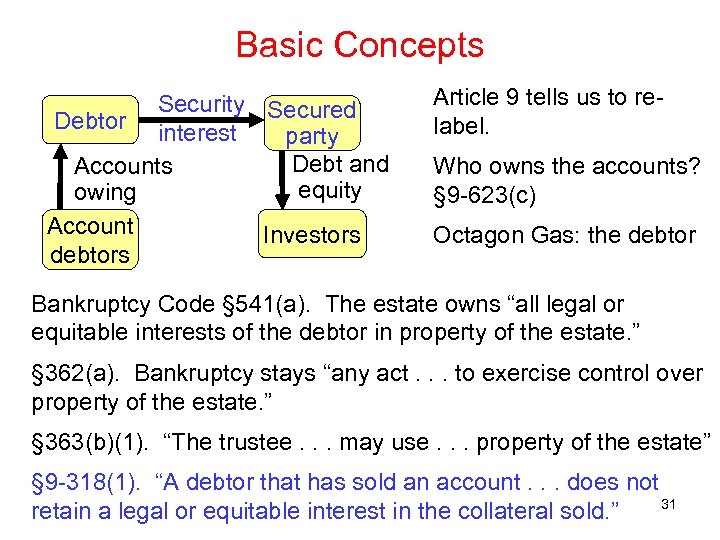

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) Octagon Gas: the debtor Bankruptcy Code § 541(a). The estate owns “all legal or equitable interests of the debtor in property of the estate. ” § 362(a). Bankruptcy stays “any act. . . to exercise control over property of the estate. ” § 363(b)(1). “The trustee. . . may use. . . property of the estate” § 9 -318(1). “A debtor that has sold an account. . . does not 31 retain a legal or equitable interest in the collateral sold. ”

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors Article 9 tells us to relabel. Who owns the accounts? § 9 -623(c) Octagon Gas: the debtor Bankruptcy Code § 541(a). The estate owns “all legal or equitable interests of the debtor in property of the estate. ” § 362(a). Bankruptcy stays “any act. . . to exercise control over property of the estate. ” § 363(b)(1). “The trustee. . . may use. . . property of the estate” § 9 -318(1). “A debtor that has sold an account. . . does not 31 retain a legal or equitable interest in the collateral sold. ”

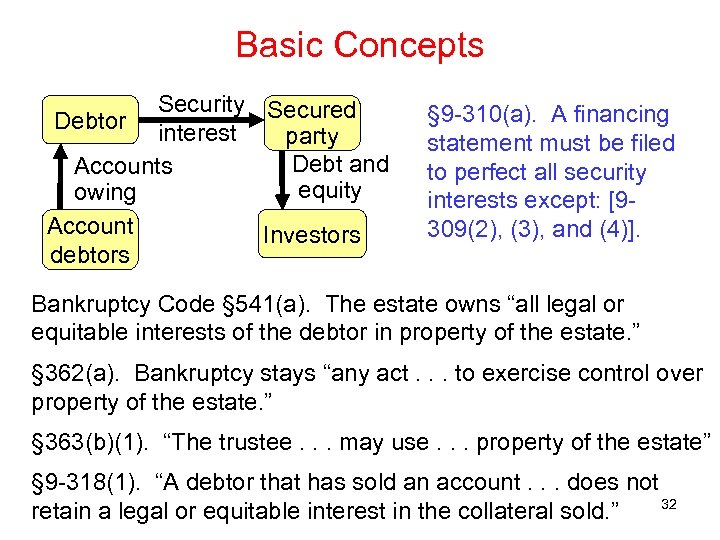

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors § 9 -310(a). A financing statement must be filed to perfect all security interests except: [9309(2), (3), and (4)]. Bankruptcy Code § 541(a). The estate owns “all legal or equitable interests of the debtor in property of the estate. ” § 362(a). Bankruptcy stays “any act. . . to exercise control over property of the estate. ” § 363(b)(1). “The trustee. . . may use. . . property of the estate” § 9 -318(1). “A debtor that has sold an account. . . does not 32 retain a legal or equitable interest in the collateral sold. ”

Basic Concepts Security Secured Debtor interest party Debt and Accounts equity owing Account Investors debtors § 9 -310(a). A financing statement must be filed to perfect all security interests except: [9309(2), (3), and (4)]. Bankruptcy Code § 541(a). The estate owns “all legal or equitable interests of the debtor in property of the estate. ” § 362(a). Bankruptcy stays “any act. . . to exercise control over property of the estate. ” § 363(b)(1). “The trustee. . . may use. . . property of the estate” § 9 -318(1). “A debtor that has sold an account. . . does not 32 retain a legal or equitable interest in the collateral sold. ”

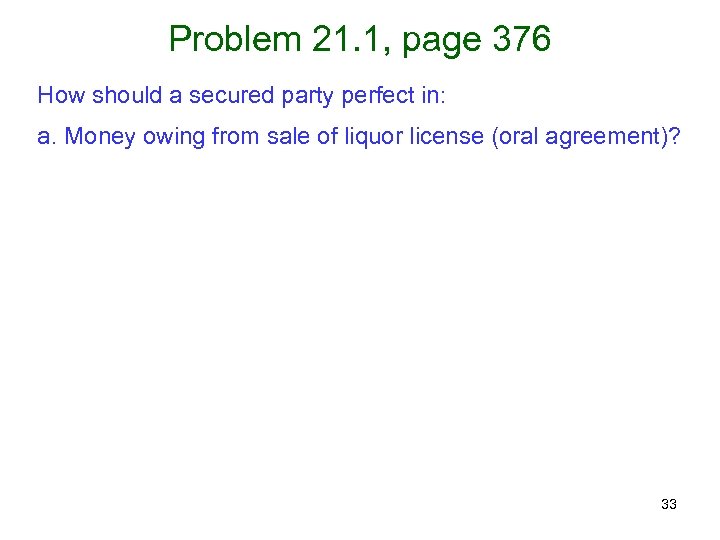

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? 33

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? 33

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). 34

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). 34

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. 35

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. 35

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). 36

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). 36

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. 37

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. 37

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? 38

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? 38

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? § 9 -102(a)(2) “right to payment of a monetary obligation (i) for property that has been sold. ” 39

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? § 9 -102(a)(2) “right to payment of a monetary obligation (i) for property that has been sold. ” 39

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? § 9 -102(a)(2) “right to payment of a monetary obligation (i) for property that has been sold. ” Payment intangible? 40

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? § 9 -102(a)(2) “right to payment of a monetary obligation (i) for property that has been sold. ” Payment intangible? 40

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? § 9 -102(a)(2) “right to payment of a monetary obligation (i) for property that has been sold. ” Payment intangible? Not if it is an account. § 9 -102(a)(42) 41

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? § 9 -102(a)(2) “right to payment of a monetary obligation (i) for property that has been sold. ” Payment intangible? Not if it is an account. § 9 -102(a)(42) 41

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? § 9 -102(a)(2) “right to payment of a monetary obligation (i) for property that has been sold. ” Payment intangible? Not if it is an account. § 9 -102(a)(42) How does one perfect in an account? § 9 -310(a) and (b). 42

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? § 9 -102(a)(2) “right to payment of a monetary obligation (i) for property that has been sold. ” Payment intangible? Not if it is an account. § 9 -102(a)(42) How does one perfect in an account? § 9 -310(a) and (b). 42

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? § 9 -102(a)(2) “right to payment of a monetary obligation (i) for property that has been sold. ” Payment intangible? Not if it is an account. § 9 -102(a)(42) How does one perfect in an account? § 9 -310(a) and (b). File. 43

Problem 21. 1, page 376 How should a secured party perfect in: a. Money owing from sale of liquor license (oral agreement)? Chattel paper? § 9 -102(a)(11). No record. Instrument? § 9 -102(a)(47). No writing. Account? § 9 -102(a)(2) “right to payment of a monetary obligation (i) for property that has been sold. ” Payment intangible? Not if it is an account. § 9 -102(a)(42) How does one perfect in an account? § 9 -310(a) and (b). File. 43

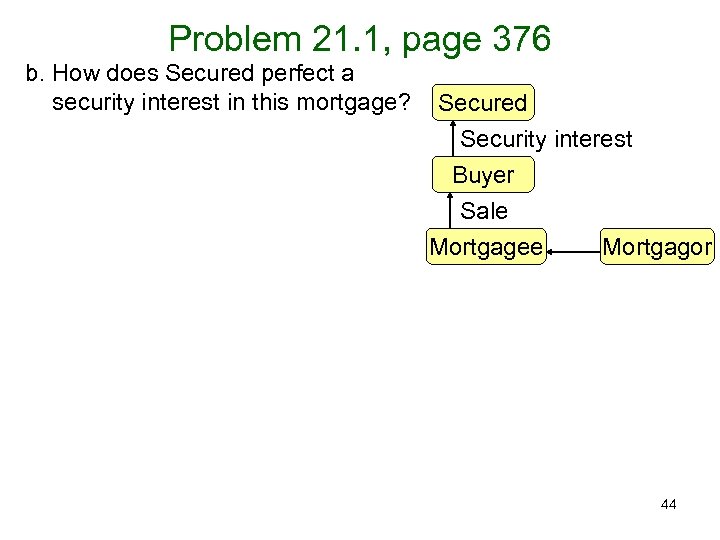

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Secured Security interest Buyer Sale Mortgagee Mortgagor 44

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Secured Security interest Buyer Sale Mortgagee Mortgagor 44

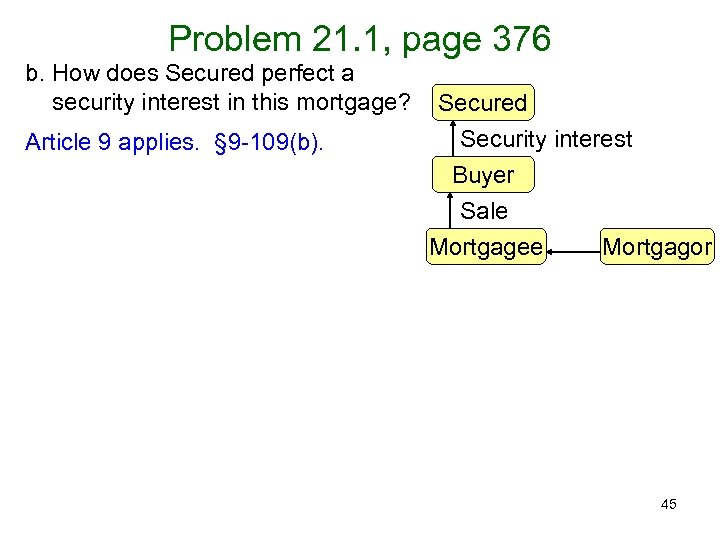

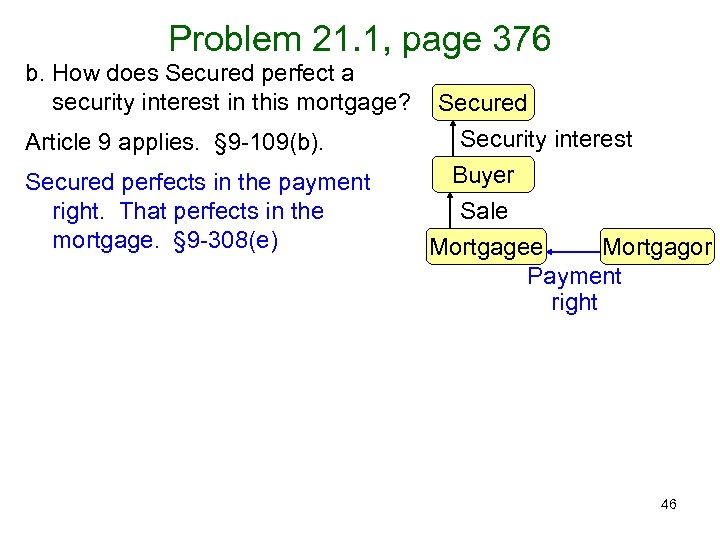

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured Security interest Buyer Sale Mortgagee Mortgagor 45

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured Security interest Buyer Sale Mortgagee Mortgagor 45

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Sale Mortgagee Mortgagor Payment right 46

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Sale Mortgagee Mortgagor Payment right 46

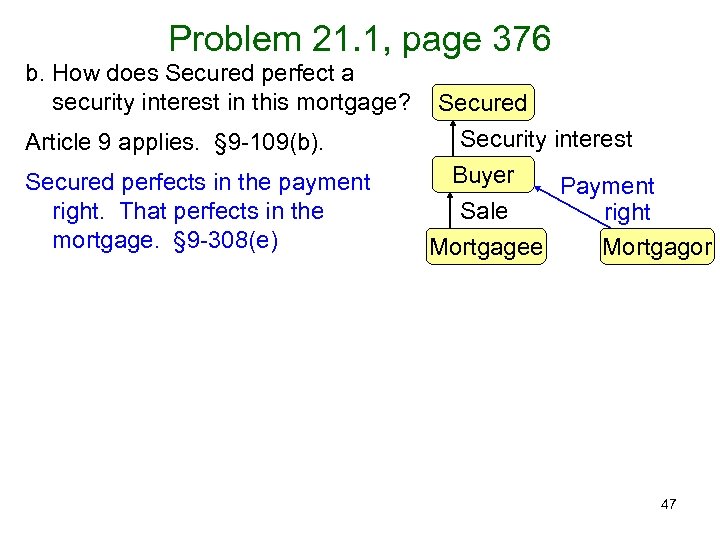

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Payment Sale Mortgagee right Mortgagor 47

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Payment Sale Mortgagee right Mortgagor 47

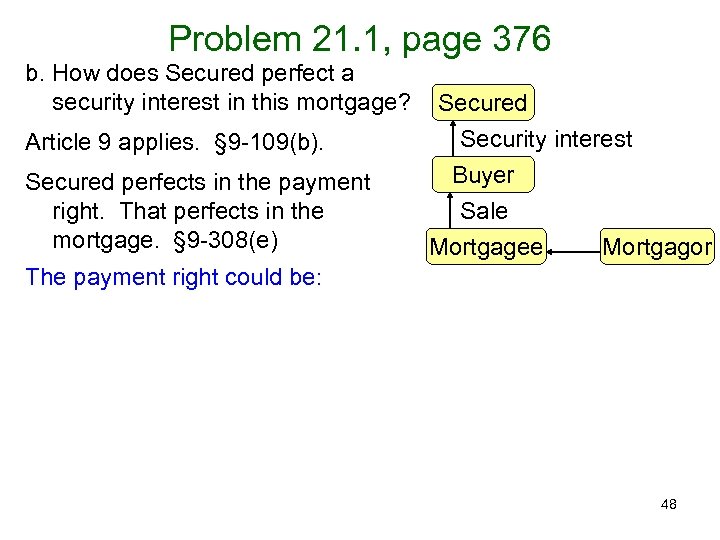

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Sale Mortgagee Mortgagor The payment right could be: 48

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Sale Mortgagee Mortgagor The payment right could be: 48

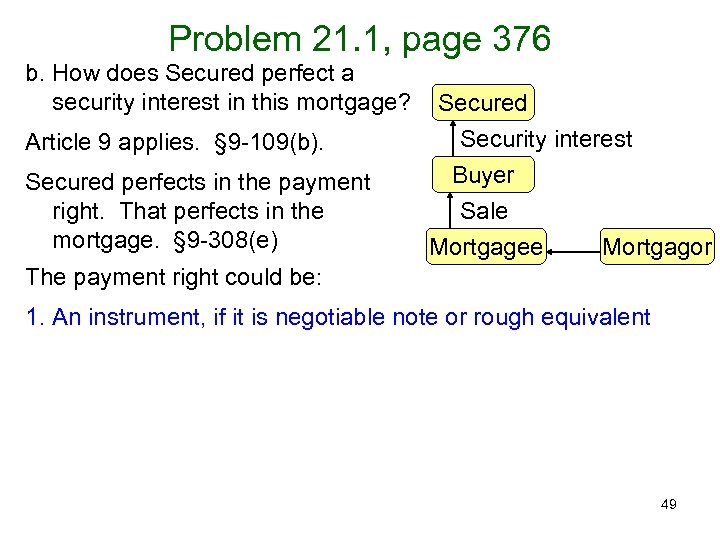

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Sale Mortgagee Mortgagor The payment right could be: 1. An instrument, if it is negotiable note or rough equivalent 49

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Sale Mortgagee Mortgagor The payment right could be: 1. An instrument, if it is negotiable note or rough equivalent 49

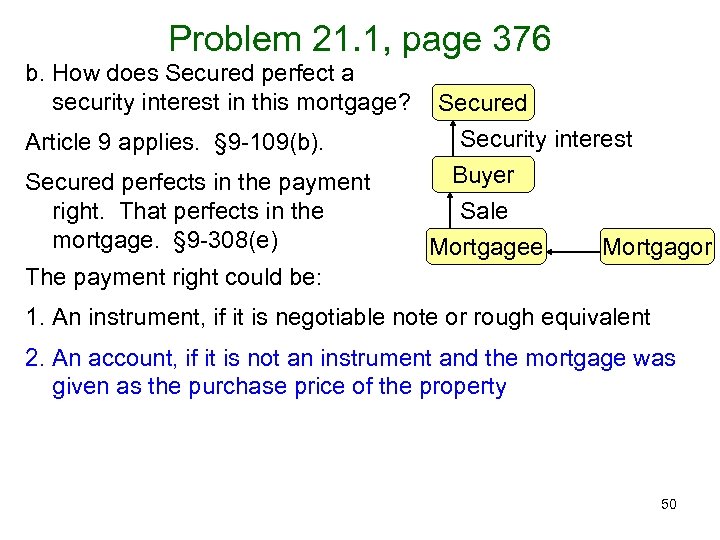

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Sale Mortgagee Mortgagor The payment right could be: 1. An instrument, if it is negotiable note or rough equivalent 2. An account, if it is not an instrument and the mortgage was given as the purchase price of the property 50

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Sale Mortgagee Mortgagor The payment right could be: 1. An instrument, if it is negotiable note or rough equivalent 2. An account, if it is not an instrument and the mortgage was given as the purchase price of the property 50

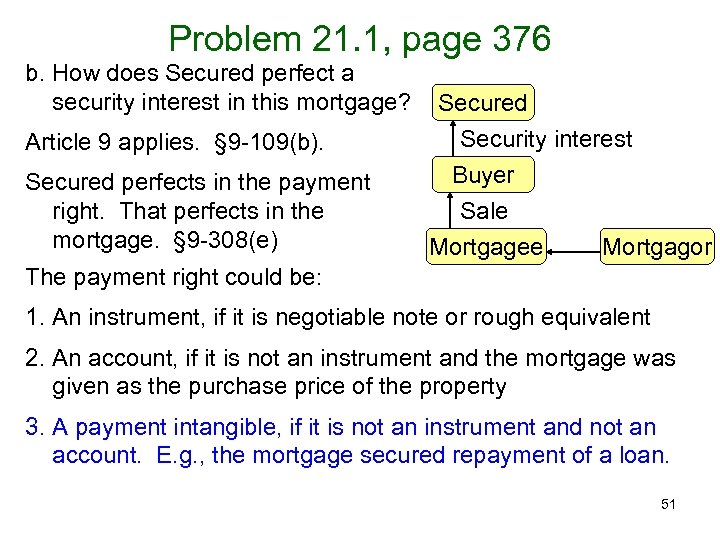

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Sale Mortgagee Mortgagor The payment right could be: 1. An instrument, if it is negotiable note or rough equivalent 2. An account, if it is not an instrument and the mortgage was given as the purchase price of the property 3. A payment intangible, if it is not an instrument and not an account. E. g. , the mortgage secured repayment of a loan. 51

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Sale Mortgagee Mortgagor The payment right could be: 1. An instrument, if it is negotiable note or rough equivalent 2. An account, if it is not an instrument and the mortgage was given as the purchase price of the property 3. A payment intangible, if it is not an instrument and not an account. E. g. , the mortgage secured repayment of a loan. 51

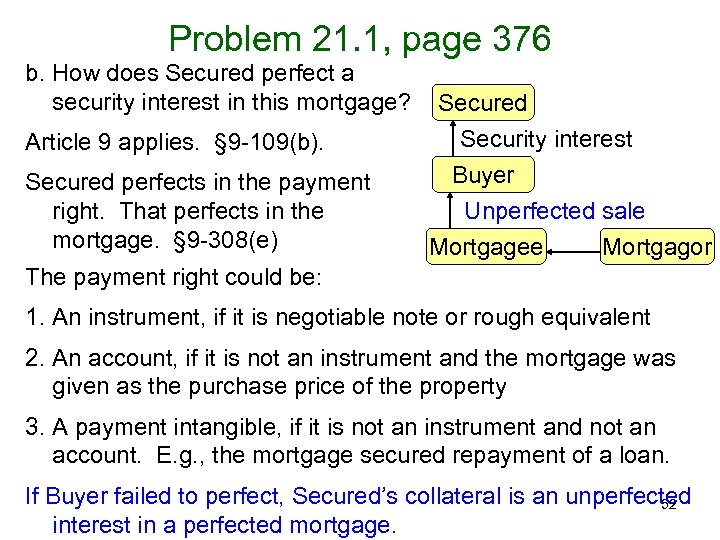

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Unperfected sale Mortgagee Mortgagor The payment right could be: 1. An instrument, if it is negotiable note or rough equivalent 2. An account, if it is not an instrument and the mortgage was given as the purchase price of the property 3. A payment intangible, if it is not an instrument and not an account. E. g. , the mortgage secured repayment of a loan. If Buyer failed to perfect, Secured’s collateral is an unperfected 52 interest in a perfected mortgage.

Problem 21. 1, page 376 b. How does Secured perfect a security interest in this mortgage? Article 9 applies. § 9 -109(b). Secured perfects in the payment right. That perfects in the mortgage. § 9 -308(e) Secured Security interest Buyer Unperfected sale Mortgagee Mortgagor The payment right could be: 1. An instrument, if it is negotiable note or rough equivalent 2. An account, if it is not an instrument and the mortgage was given as the purchase price of the property 3. A payment intangible, if it is not an instrument and not an account. E. g. , the mortgage secured repayment of a loan. If Buyer failed to perfect, Secured’s collateral is an unperfected 52 interest in a perfected mortgage.

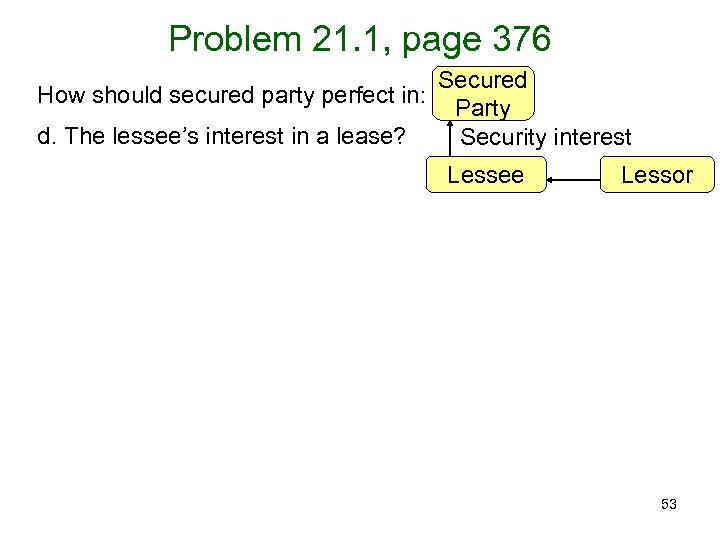

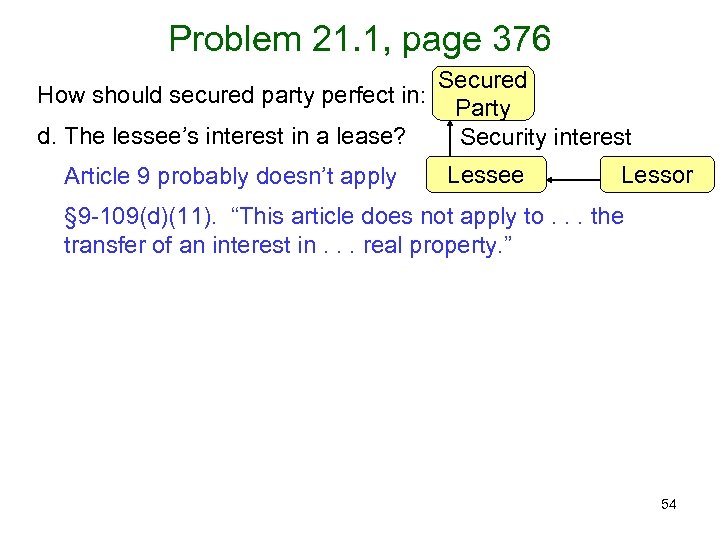

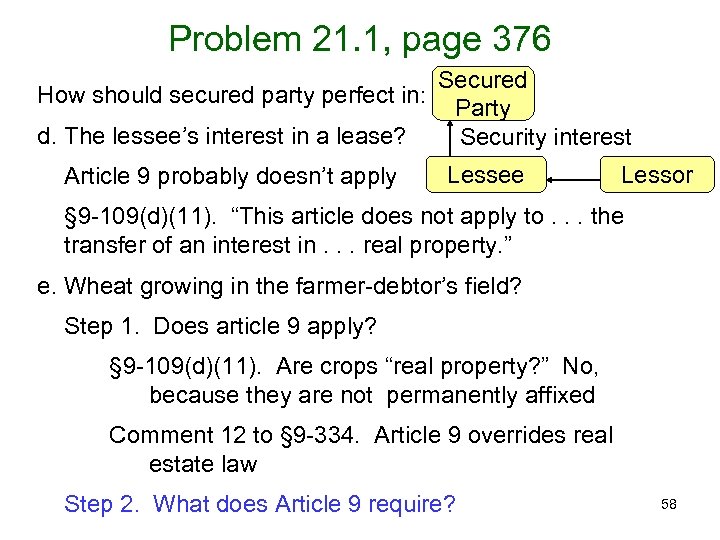

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Lessee Lessor 53

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Lessee Lessor 53

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” 54

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” 54

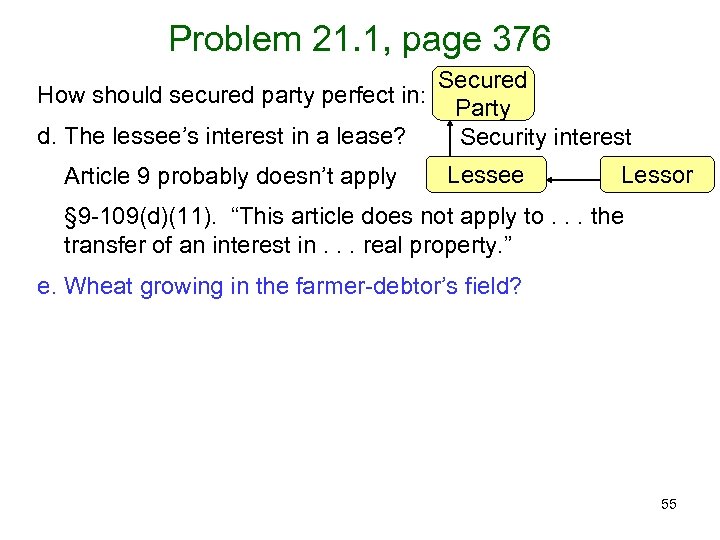

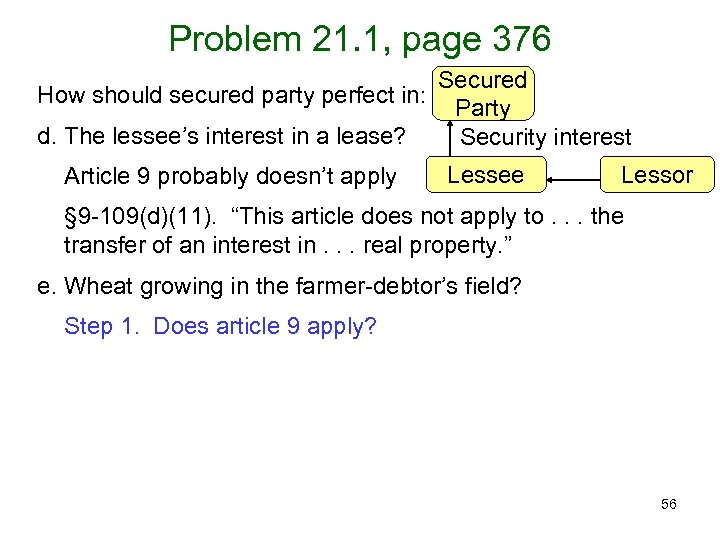

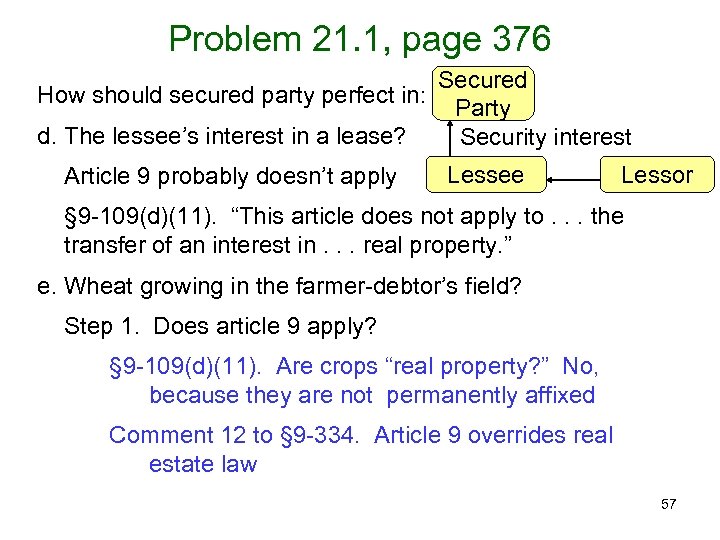

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” e. Wheat growing in the farmer-debtor’s field? 55

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” e. Wheat growing in the farmer-debtor’s field? 55

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” e. Wheat growing in the farmer-debtor’s field? Step 1. Does article 9 apply? 56

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” e. Wheat growing in the farmer-debtor’s field? Step 1. Does article 9 apply? 56

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” e. Wheat growing in the farmer-debtor’s field? Step 1. Does article 9 apply? § 9 -109(d)(11). Are crops “real property? ” No, because they are not permanently affixed Comment 12 to § 9 -334. Article 9 overrides real estate law 57

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” e. Wheat growing in the farmer-debtor’s field? Step 1. Does article 9 apply? § 9 -109(d)(11). Are crops “real property? ” No, because they are not permanently affixed Comment 12 to § 9 -334. Article 9 overrides real estate law 57

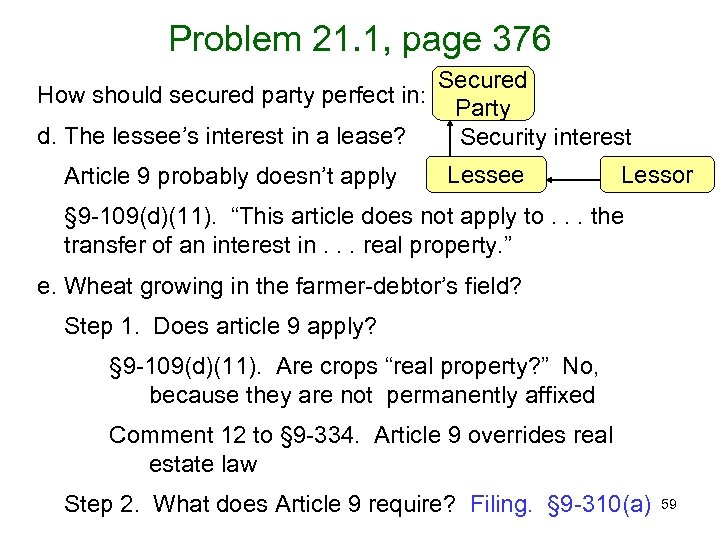

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” e. Wheat growing in the farmer-debtor’s field? Step 1. Does article 9 apply? § 9 -109(d)(11). Are crops “real property? ” No, because they are not permanently affixed Comment 12 to § 9 -334. Article 9 overrides real estate law Step 2. What does Article 9 require? 58

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” e. Wheat growing in the farmer-debtor’s field? Step 1. Does article 9 apply? § 9 -109(d)(11). Are crops “real property? ” No, because they are not permanently affixed Comment 12 to § 9 -334. Article 9 overrides real estate law Step 2. What does Article 9 require? 58

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” e. Wheat growing in the farmer-debtor’s field? Step 1. Does article 9 apply? § 9 -109(d)(11). Are crops “real property? ” No, because they are not permanently affixed Comment 12 to § 9 -334. Article 9 overrides real estate law Step 2. What does Article 9 require? Filing. § 9 -310(a) 59

Problem 21. 1, page 376 Secured How should secured party perfect in: Party d. The lessee’s interest in a lease? Security interest Article 9 probably doesn’t apply Lessee Lessor § 9 -109(d)(11). “This article does not apply to. . . the transfer of an interest in. . . real property. ” e. Wheat growing in the farmer-debtor’s field? Step 1. Does article 9 apply? § 9 -109(d)(11). Are crops “real property? ” No, because they are not permanently affixed Comment 12 to § 9 -334. Article 9 overrides real estate law Step 2. What does Article 9 require? Filing. § 9 -310(a) 59

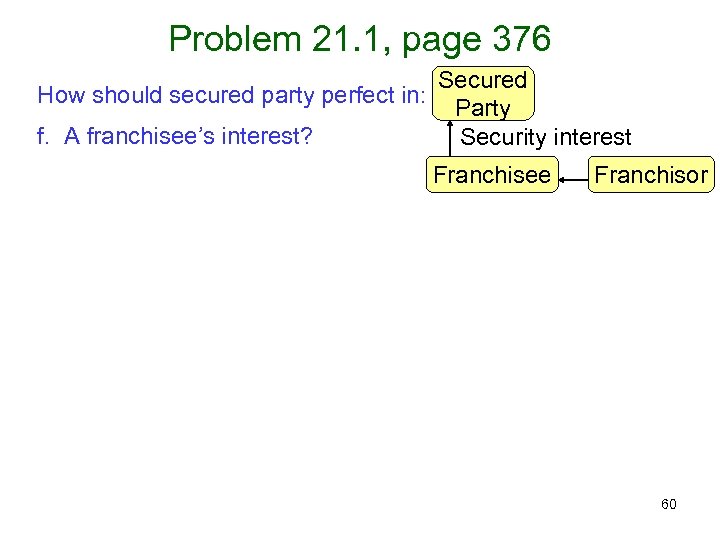

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor 60

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor 60

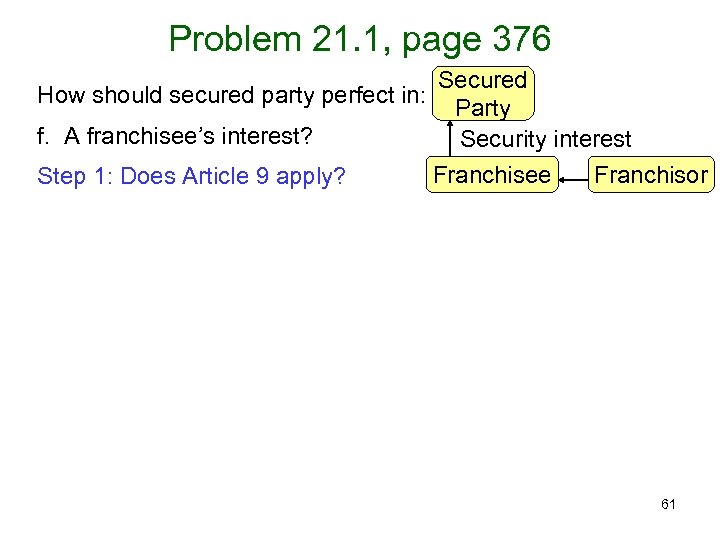

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor Step 1: Does Article 9 apply? 61

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor Step 1: Does Article 9 apply? 61

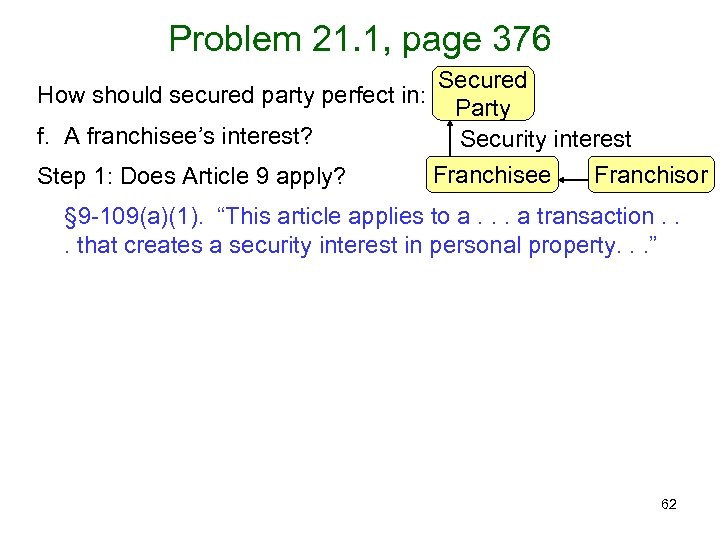

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor Step 1: Does Article 9 apply? § 9 -109(a)(1). “This article applies to a. . . a transaction. . . that creates a security interest in personal property. . . ” 62

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor Step 1: Does Article 9 apply? § 9 -109(a)(1). “This article applies to a. . . a transaction. . . that creates a security interest in personal property. . . ” 62

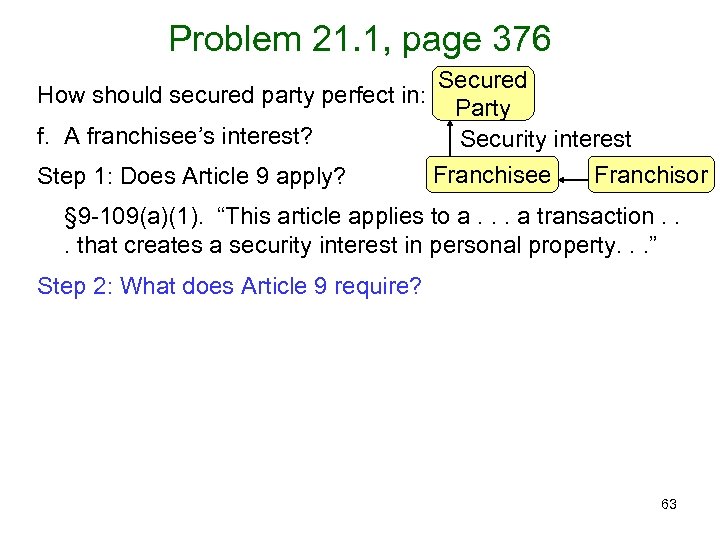

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor Step 1: Does Article 9 apply? § 9 -109(a)(1). “This article applies to a. . . a transaction. . . that creates a security interest in personal property. . . ” Step 2: What does Article 9 require? 63

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor Step 1: Does Article 9 apply? § 9 -109(a)(1). “This article applies to a. . . a transaction. . . that creates a security interest in personal property. . . ” Step 2: What does Article 9 require? 63

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor Step 1: Does Article 9 apply? § 9 -109(a)(1). “This article applies to a. . . a transaction. . . that creates a security interest in personal property. . . ” Step 2: What does Article 9 require? Filing for a general intangible (contract rights). 64

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor Step 1: Does Article 9 apply? § 9 -109(a)(1). “This article applies to a. . . a transaction. . . that creates a security interest in personal property. . . ” Step 2: What does Article 9 require? Filing for a general intangible (contract rights). 64

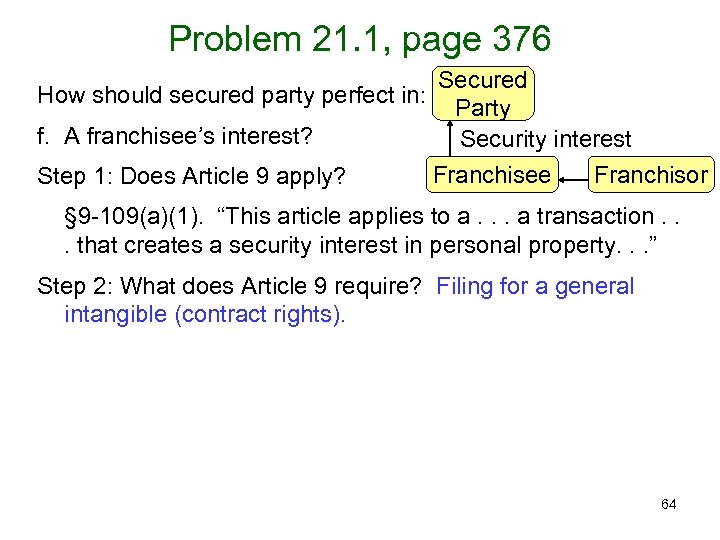

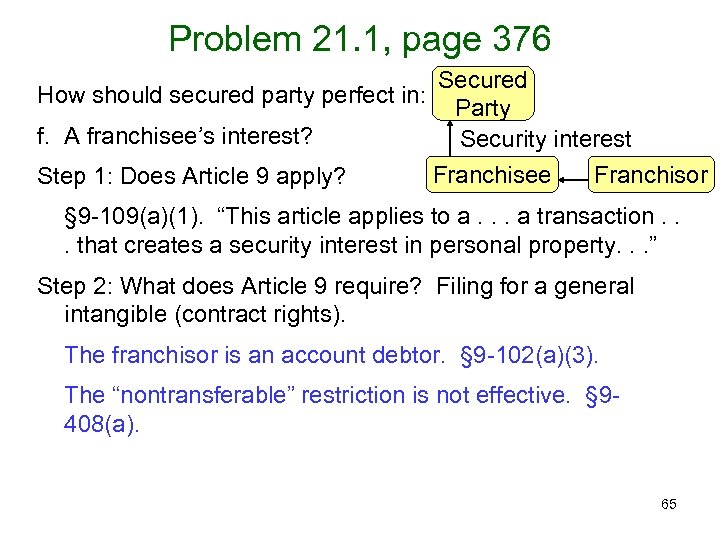

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor Step 1: Does Article 9 apply? § 9 -109(a)(1). “This article applies to a. . . a transaction. . . that creates a security interest in personal property. . . ” Step 2: What does Article 9 require? Filing for a general intangible (contract rights). The franchisor is an account debtor. § 9 -102(a)(3). The “nontransferable” restriction is not effective. § 9408(a). 65

Problem 21. 1, page 376 Secured How should secured party perfect in: Party f. A franchisee’s interest? Security interest Franchisee Franchisor Step 1: Does Article 9 apply? § 9 -109(a)(1). “This article applies to a. . . a transaction. . . that creates a security interest in personal property. . . ” Step 2: What does Article 9 require? Filing for a general intangible (contract rights). The franchisor is an account debtor. § 9 -102(a)(3). The “nontransferable” restriction is not effective. § 9408(a). 65

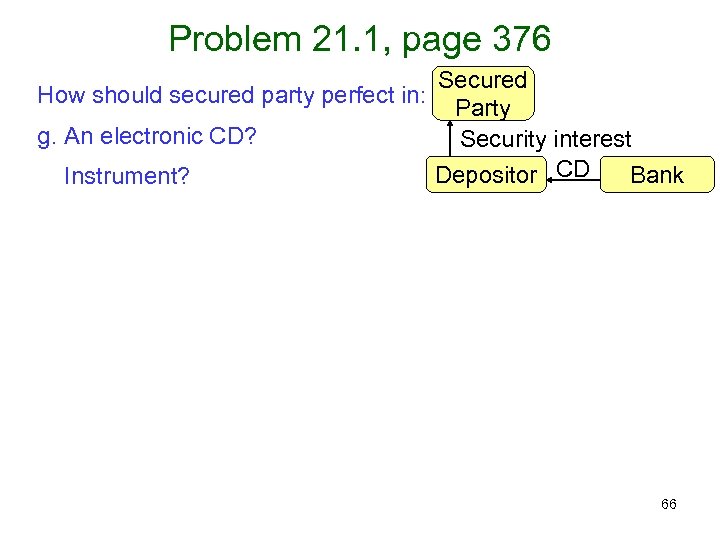

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? 66

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? 66

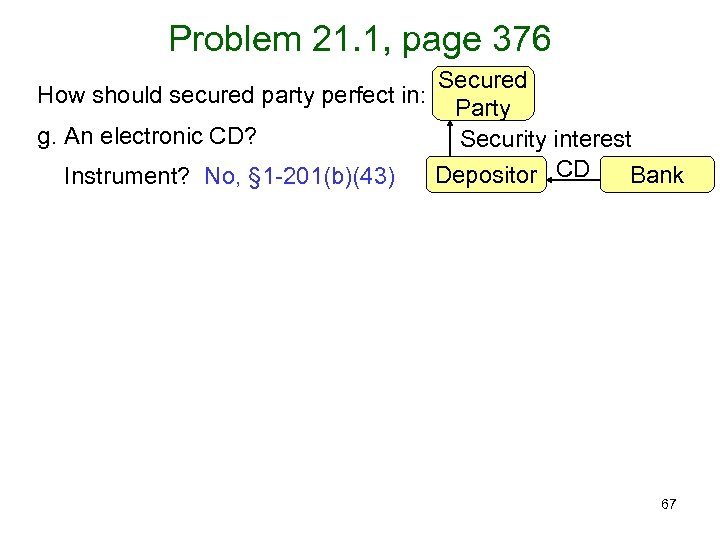

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) 67

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) 67

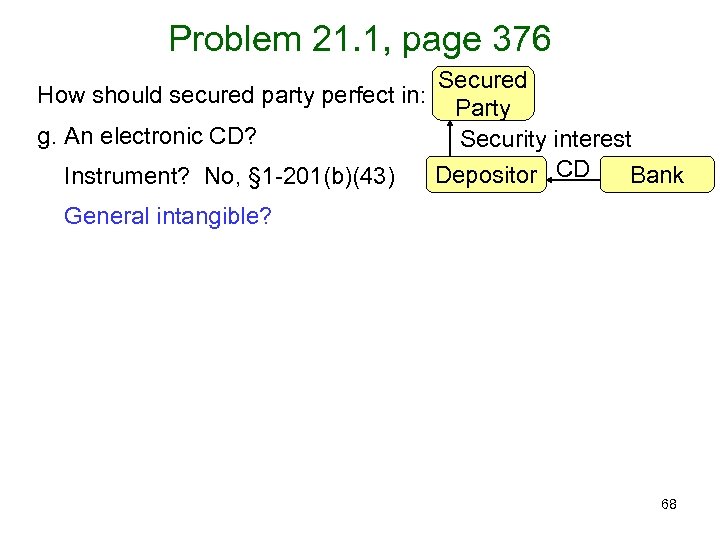

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? 68

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? 68

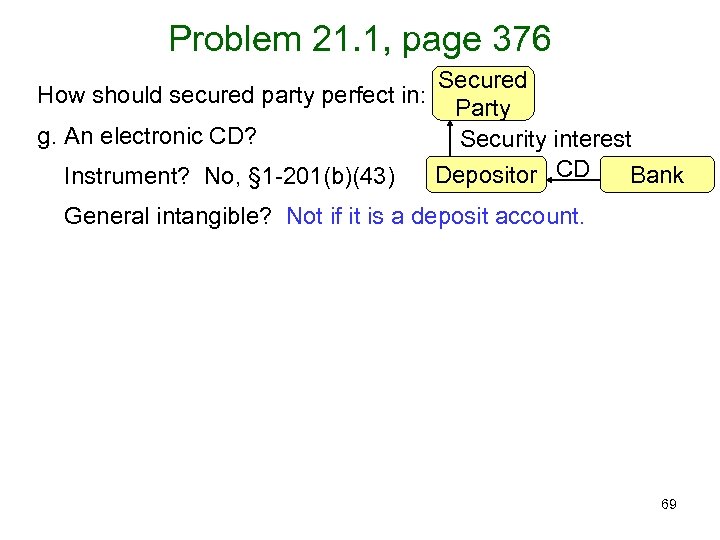

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? Not if it is a deposit account. 69

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? Not if it is a deposit account. 69

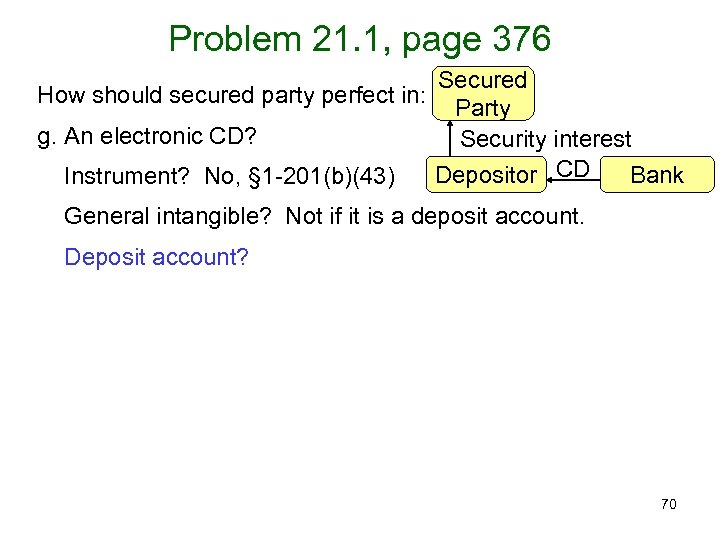

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? Not if it is a deposit account. Deposit account? 70

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? Not if it is a deposit account. Deposit account? 70

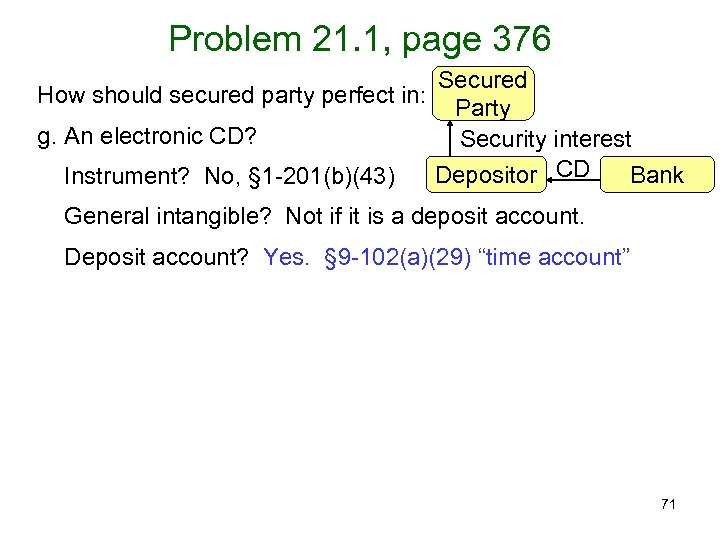

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? Not if it is a deposit account. Deposit account? Yes. § 9 -102(a)(29) “time account” 71

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? Not if it is a deposit account. Deposit account? Yes. § 9 -102(a)(29) “time account” 71

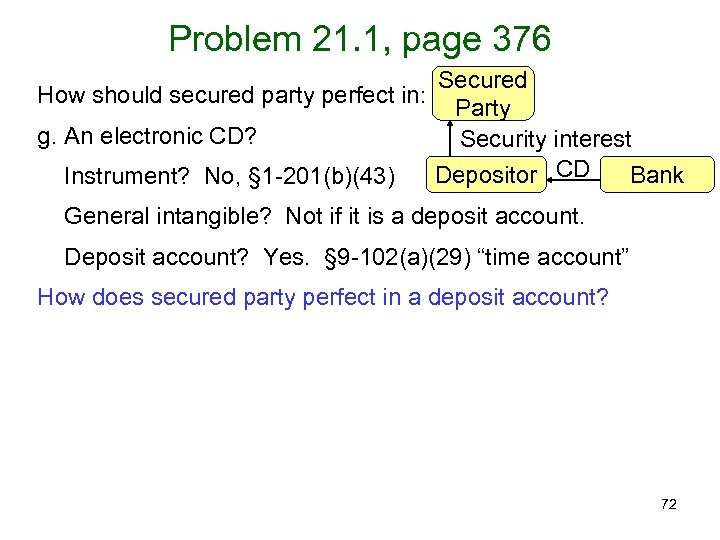

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? Not if it is a deposit account. Deposit account? Yes. § 9 -102(a)(29) “time account” How does secured party perfect in a deposit account? 72

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? Not if it is a deposit account. Deposit account? Yes. § 9 -102(a)(29) “time account” How does secured party perfect in a deposit account? 72

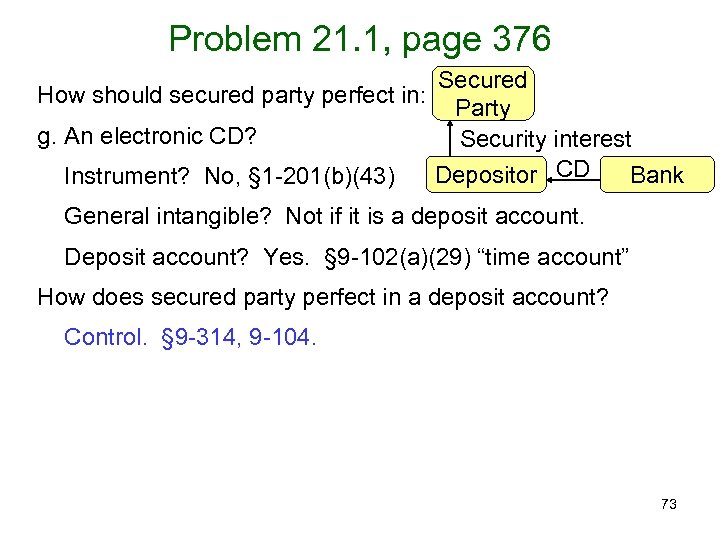

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? Not if it is a deposit account. Deposit account? Yes. § 9 -102(a)(29) “time account” How does secured party perfect in a deposit account? Control. § 9 -314, 9 -104. 73

Problem 21. 1, page 376 Secured How should secured party perfect in: Party g. An electronic CD? Security interest Depositor CD Bank Instrument? No, § 1 -201(b)(43) General intangible? Not if it is a deposit account. Deposit account? Yes. § 9 -102(a)(29) “time account” How does secured party perfect in a deposit account? Control. § 9 -314, 9 -104. 73

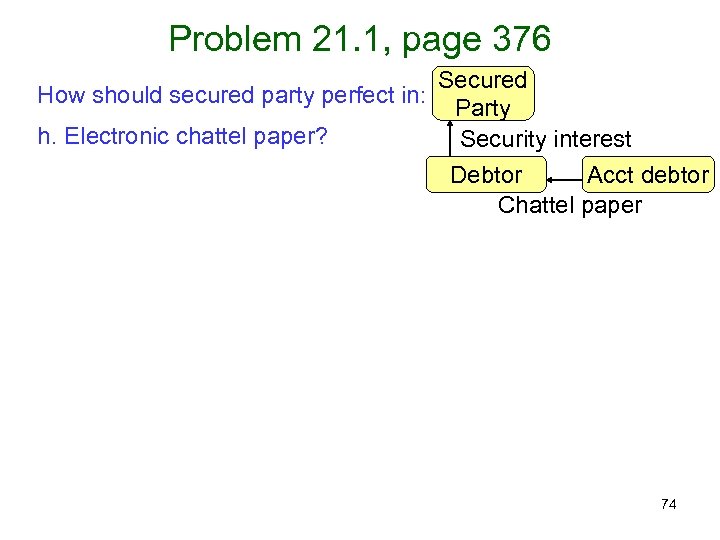

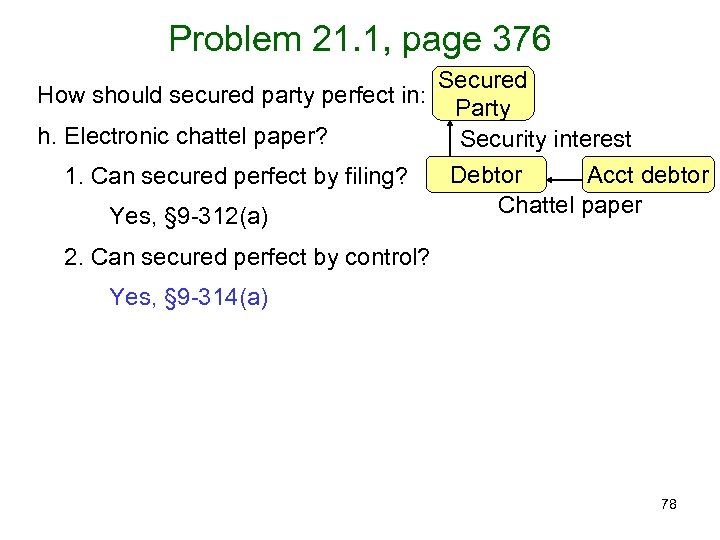

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor Chattel paper 74

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor Chattel paper 74

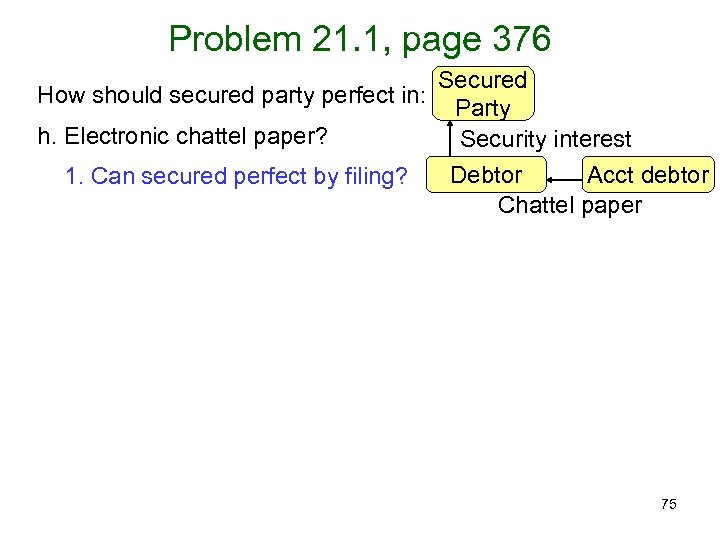

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper 75

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper 75

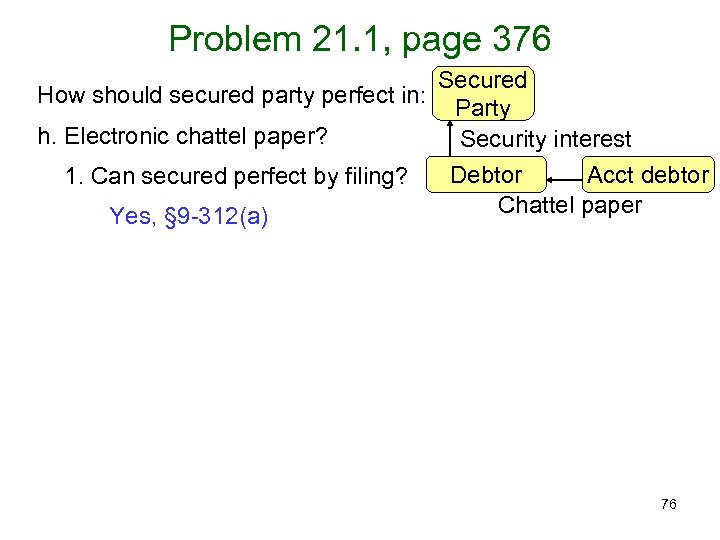

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper Yes, § 9 -312(a) 76

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper Yes, § 9 -312(a) 76

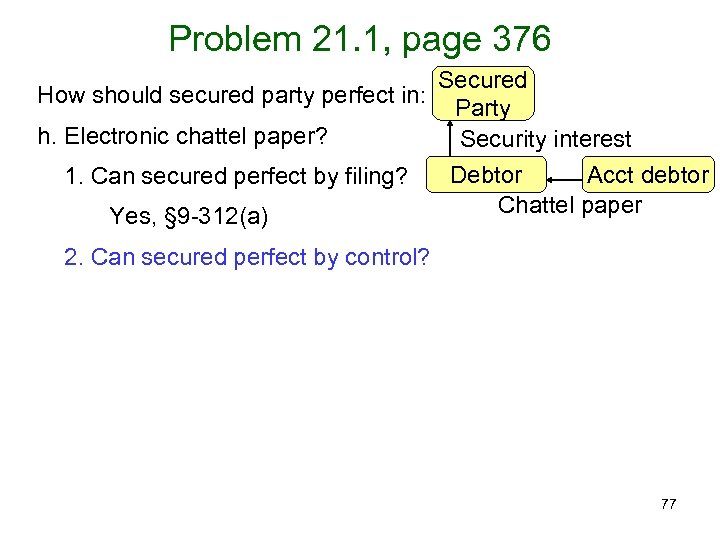

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper Yes, § 9 -312(a) 2. Can secured perfect by control? 77

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper Yes, § 9 -312(a) 2. Can secured perfect by control? 77

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper Yes, § 9 -312(a) 2. Can secured perfect by control? Yes, § 9 -314(a) 78

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper Yes, § 9 -312(a) 2. Can secured perfect by control? Yes, § 9 -314(a) 78

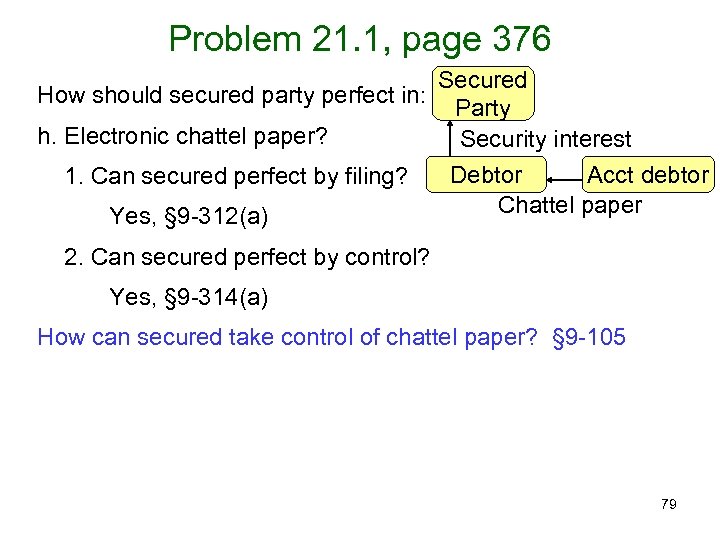

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper Yes, § 9 -312(a) 2. Can secured perfect by control? Yes, § 9 -314(a) How can secured take control of chattel paper? § 9 -105 79

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper Yes, § 9 -312(a) 2. Can secured perfect by control? Yes, § 9 -314(a) How can secured take control of chattel paper? § 9 -105 79

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper Yes, § 9 -312(a) 2. Can secured perfect by control? Yes, § 9 -314(a) How can secured take control of chattel paper? § 9 -105 Create the authoritative copy and keep possession 80

Problem 21. 1, page 376 Secured How should secured party perfect in: Party h. Electronic chattel paper? Security interest Debtor Acct debtor 1. Can secured perfect by filing? Chattel paper Yes, § 9 -312(a) 2. Can secured perfect by control? Yes, § 9 -314(a) How can secured take control of chattel paper? § 9 -105 Create the authoritative copy and keep possession 80

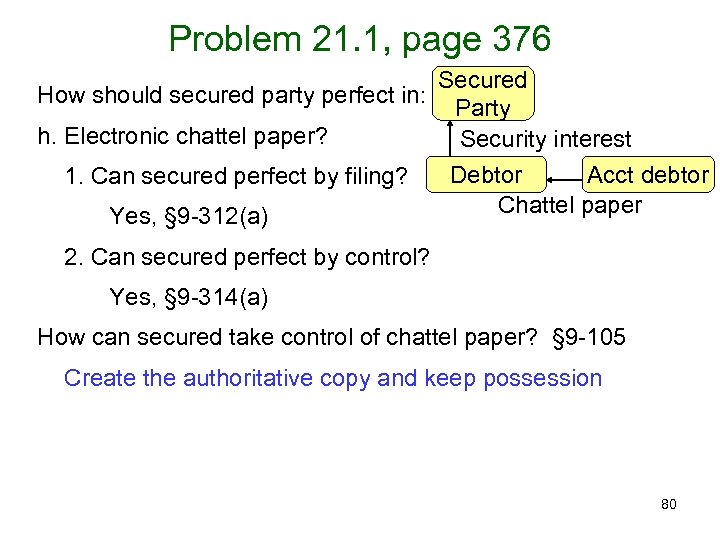

Problem 21. 1, page 376 How should a secured party perfect in: i. Software on a consumer debtor’s computer? Is this goods? Software? General intangible? 81

Problem 21. 1, page 376 How should a secured party perfect in: i. Software on a consumer debtor’s computer? Is this goods? Software? General intangible? 81

Problem 21. 1, page 376 How should a secured party perfect in: i. Software on a consumer debtor’s computer? Is this goods? Software? General intangible? Not goods. Comment 4. a to § 9 -102 General intangibles includes software: § 9 -102(a)(75), § 9 -102(a)(42). 82

Problem 21. 1, page 376 How should a secured party perfect in: i. Software on a consumer debtor’s computer? Is this goods? Software? General intangible? Not goods. Comment 4. a to § 9 -102 General intangibles includes software: § 9 -102(a)(75), § 9 -102(a)(42). 82

Problem 21. 1, page 376 How should a secured party perfect in: i. Software on a consumer debtor’s computer? Is this goods? Software? General intangible? Not goods. Comment 4. a to § 9 -102 General intangibles includes software: § 9 -102(a)(75), § 9 -102(a)(42). File a financing statement. § 9 -310(a) 83

Problem 21. 1, page 376 How should a secured party perfect in: i. Software on a consumer debtor’s computer? Is this goods? Software? General intangible? Not goods. Comment 4. a to § 9 -102 General intangibles includes software: § 9 -102(a)(75), § 9 -102(a)(42). File a financing statement. § 9 -310(a) 83

Problem 21. 1, page 376 How should a secured party perfect in: i. Software on a consumer debtor’s computer? Is this goods? Software? General intangible? Not goods. Comment 4. a to § 9 -102 General intangibles includes software: § 9 -102(a)(75), § 9 -102(a)(42). File a financing statement. § 9 -310(a) j. Documentation and manuals for software? 84

Problem 21. 1, page 376 How should a secured party perfect in: i. Software on a consumer debtor’s computer? Is this goods? Software? General intangible? Not goods. Comment 4. a to § 9 -102 General intangibles includes software: § 9 -102(a)(75), § 9 -102(a)(42). File a financing statement. § 9 -310(a) j. Documentation and manuals for software? 84

Problem 21. 1, page 376 How should a secured party perfect in: i. Software on a consumer debtor’s computer? Is this goods? Software? General intangible? Not goods. Comment 4. a to § 9 -102 General intangibles includes software: § 9 -102(a)(75), § 9 -102(a)(42). File a financing statement. § 9 -310(a) j. Documentation and manuals for software? Probably included in the software, § 9 -102(a)(75) 85

Problem 21. 1, page 376 How should a secured party perfect in: i. Software on a consumer debtor’s computer? Is this goods? Software? General intangible? Not goods. Comment 4. a to § 9 -102 General intangibles includes software: § 9 -102(a)(75), § 9 -102(a)(42). File a financing statement. § 9 -310(a) j. Documentation and manuals for software? Probably included in the software, § 9 -102(a)(75) 85

![Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its](https://present5.com/presentation/b3dcab13a791c58a655add58c7cba6c8/image-86.jpg) Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property 86

Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property 86

![Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its](https://present5.com/presentation/b3dcab13a791c58a655add58c7cba6c8/image-87.jpg) Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee 87

Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee 87

![Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its](https://present5.com/presentation/b3dcab13a791c58a655add58c7cba6c8/image-88.jpg) Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods Security interest Economic life Lease term 88

Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods Security interest Economic life Lease term 88

![Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its](https://present5.com/presentation/b3dcab13a791c58a655add58c7cba6c8/image-89.jpg) Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods by 1. Original term Security interest Economic life Lease term 89

Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods by 1. Original term Security interest Economic life Lease term 89

![Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its](https://present5.com/presentation/b3dcab13a791c58a655add58c7cba6c8/image-90.jpg) Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods by 1. Original term 2. Required renewal or purchase Security interest Economic life Lease term Mandatory renewal 90

Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods by 1. Original term 2. Required renewal or purchase Security interest Economic life Lease term Mandatory renewal 90

![Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its](https://present5.com/presentation/b3dcab13a791c58a655add58c7cba6c8/image-91.jpg) Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods by 1. Original term 2. Required renewal or purchase 3. Renewal term for no (or nominal) additional consideration Security interest Economic life Lease term Free renewal 91

Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods by 1. Original term 2. Required renewal or purchase 3. Renewal term for no (or nominal) additional consideration Security interest Economic life Lease term Free renewal 91

![Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its](https://present5.com/presentation/b3dcab13a791c58a655add58c7cba6c8/image-92.jpg) Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods by 1. Original term 2. Required renewal or purchase 3. Renewal term for no (or nominal) additional consideration 4. Option to buy for no (or nominal) additional consideration]” Security interest Economic life Lease term Option to buy for free 92

Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods by 1. Original term 2. Required renewal or purchase 3. Renewal term for no (or nominal) additional consideration 4. Option to buy for no (or nominal) additional consideration]” Security interest Economic life Lease term Option to buy for free 92

![Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its](https://present5.com/presentation/b3dcab13a791c58a655add58c7cba6c8/image-93.jpg) Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods by 1. Original term 2. Required renewal or purchase 3. Renewal term for no (or nominal) additional consideration 4. Option to buy for no (or nominal) additional consideration]” Lease Economic life Lease term “Meaningful reversion” 93

Sale-Lease Distinction § 9 -109(a)(1) [T]his article applies to a transaction, regardless of its form, that creates a security interest in personal property § 1 -203. “[A] transaction in the form of a lease creates a security interest if the consideration. . . is an obligation for the term of the lease not subject to termination by the lessee, and. . . [the lease is for the remaining economic life of the goods by 1. Original term 2. Required renewal or purchase 3. Renewal term for no (or nominal) additional consideration 4. Option to buy for no (or nominal) additional consideration]” Lease Economic life Lease term “Meaningful reversion” 93

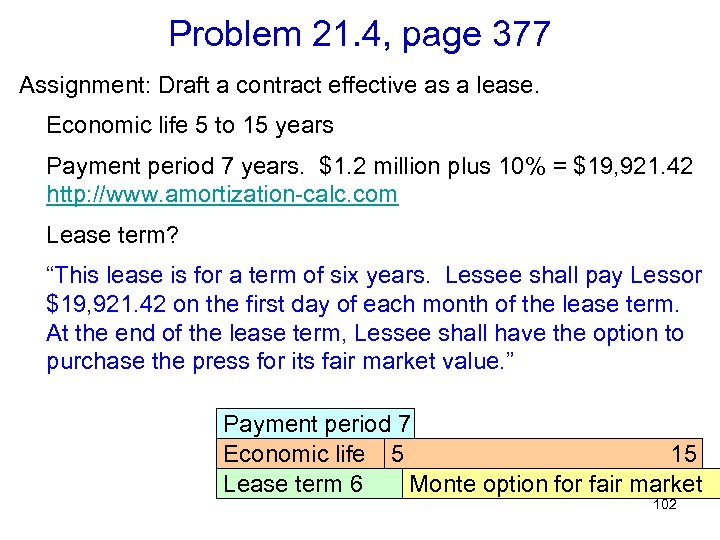

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. 94

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. 94

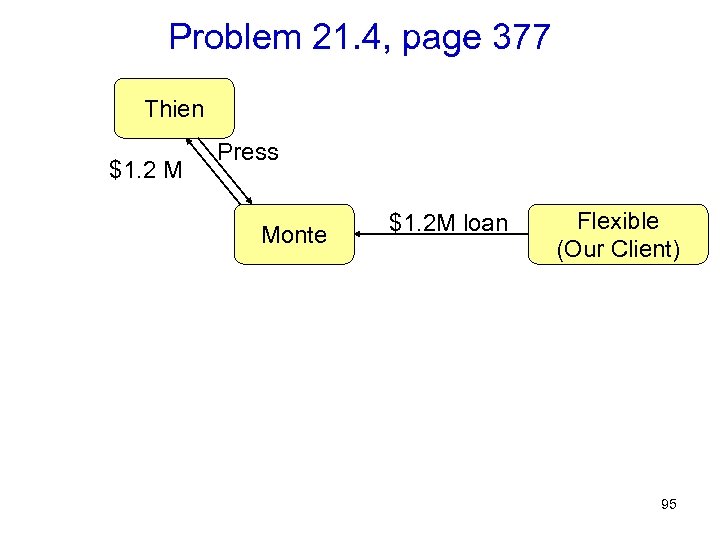

Problem 21. 4, page 377 Thien $1. 2 M Press Monte $1. 2 M loan Flexible (Our Client) 95

Problem 21. 4, page 377 Thien $1. 2 M Press Monte $1. 2 M loan Flexible (Our Client) 95

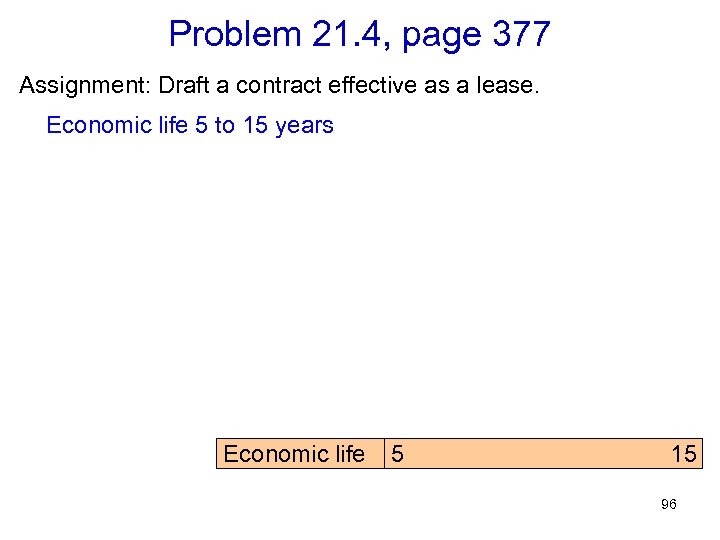

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Economic life 5 15 96

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Economic life 5 15 96

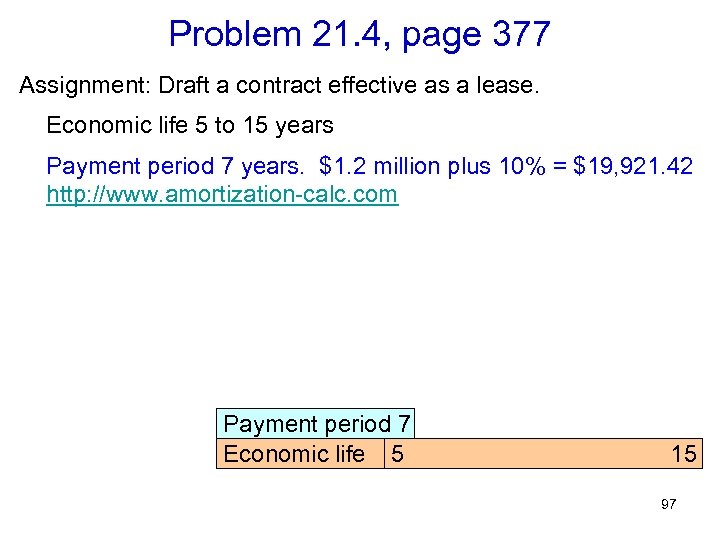

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Payment period 7 Economic life 5 15 97

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Payment period 7 Economic life 5 15 97

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Lease term? Payment period 7 Economic life 5 15 98

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Lease term? Payment period 7 Economic life 5 15 98

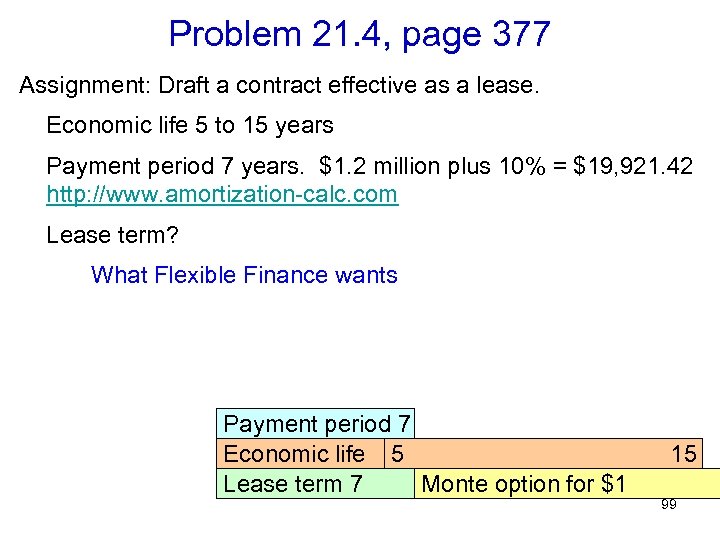

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Lease term? What Flexible Finance wants Payment period 7 Economic life 5 Lease term 7 Monte option for $1 15 99

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Lease term? What Flexible Finance wants Payment period 7 Economic life 5 Lease term 7 Monte option for $1 15 99

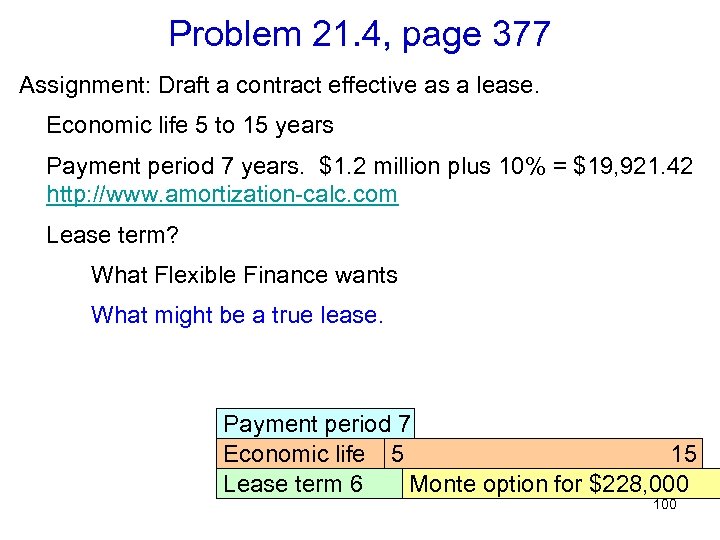

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Lease term? What Flexible Finance wants What might be a true lease. Payment period 7 Economic life 5 15 Lease term 6 Monte option for $228, 000 100

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Lease term? What Flexible Finance wants What might be a true lease. Payment period 7 Economic life 5 15 Lease term 6 Monte option for $228, 000 100

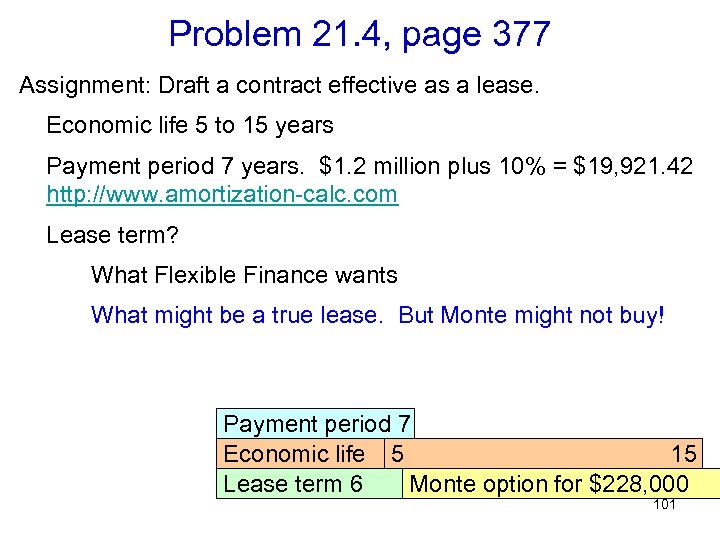

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Lease term? What Flexible Finance wants What might be a true lease. But Monte might not buy! Payment period 7 Economic life 5 15 Lease term 6 Monte option for $228, 000 101

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Lease term? What Flexible Finance wants What might be a true lease. But Monte might not buy! Payment period 7 Economic life 5 15 Lease term 6 Monte option for $228, 000 101

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Lease term? “This lease is for a term of six years. Lessee shall pay Lessor $19, 921. 42 on the first day of each month of the lease term. At the end of the lease term, Lessee shall have the option to purchase the press for its fair market value. ” Payment period 7 Economic life 5 15 Lease term 6 Monte option for fair market 102

Problem 21. 4, page 377 Assignment: Draft a contract effective as a lease. Economic life 5 to 15 years Payment period 7 years. $1. 2 million plus 10% = $19, 921. 42 http: //www. amortization-calc. com Lease term? “This lease is for a term of six years. Lessee shall pay Lessor $19, 921. 42 on the first day of each month of the lease term. At the end of the lease term, Lessee shall have the option to purchase the press for its fair market value. ” Payment period 7 Economic life 5 15 Lease term 6 Monte option for fair market 102

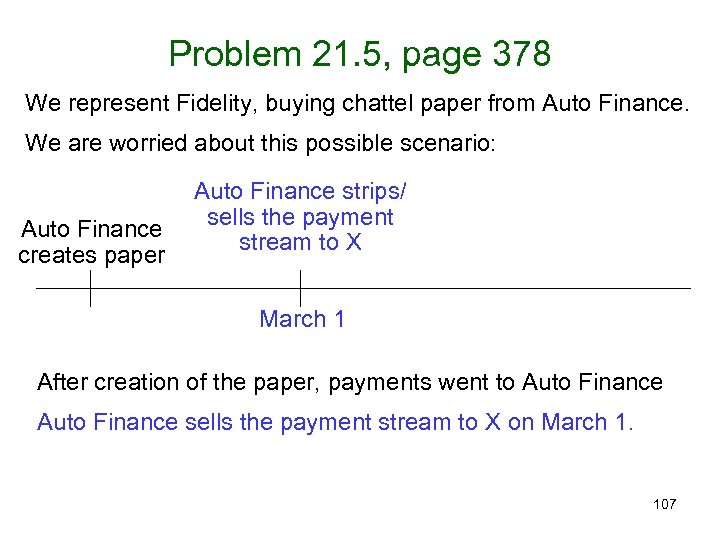

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. 104

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. 104

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. We are worried about this possible scenario: 105

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. We are worried about this possible scenario: 105

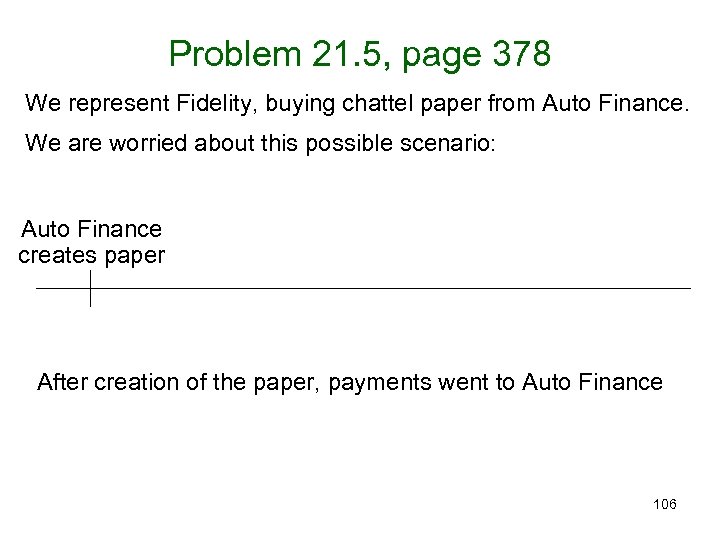

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. We are worried about this possible scenario: Auto Finance creates paper After creation of the paper, payments went to Auto Finance 106

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. We are worried about this possible scenario: Auto Finance creates paper After creation of the paper, payments went to Auto Finance 106

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. We are worried about this possible scenario: Auto Finance creates paper Auto Finance strips/ sells the payment stream to X March 1 After creation of the paper, payments went to Auto Finance sells the payment stream to X on March 1. 107

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. We are worried about this possible scenario: Auto Finance creates paper Auto Finance strips/ sells the payment stream to X March 1 After creation of the paper, payments went to Auto Finance sells the payment stream to X on March 1. 107

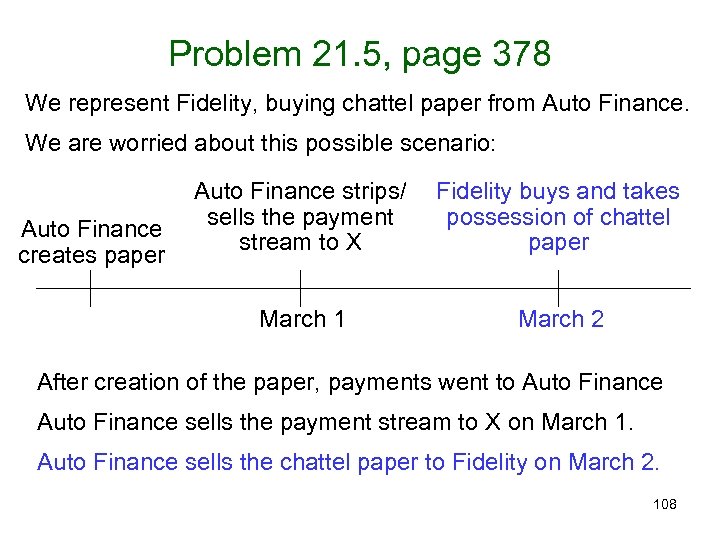

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. We are worried about this possible scenario: Fidelity buys and takes possession of chattel paper March 1 Auto Finance creates paper Auto Finance strips/ sells the payment stream to X March 2 After creation of the paper, payments went to Auto Finance sells the payment stream to X on March 1. Auto Finance sells the chattel paper to Fidelity on March 2. 108

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. We are worried about this possible scenario: Fidelity buys and takes possession of chattel paper March 1 Auto Finance creates paper Auto Finance strips/ sells the payment stream to X March 2 After creation of the paper, payments went to Auto Finance sells the payment stream to X on March 1. Auto Finance sells the chattel paper to Fidelity on March 2. 108

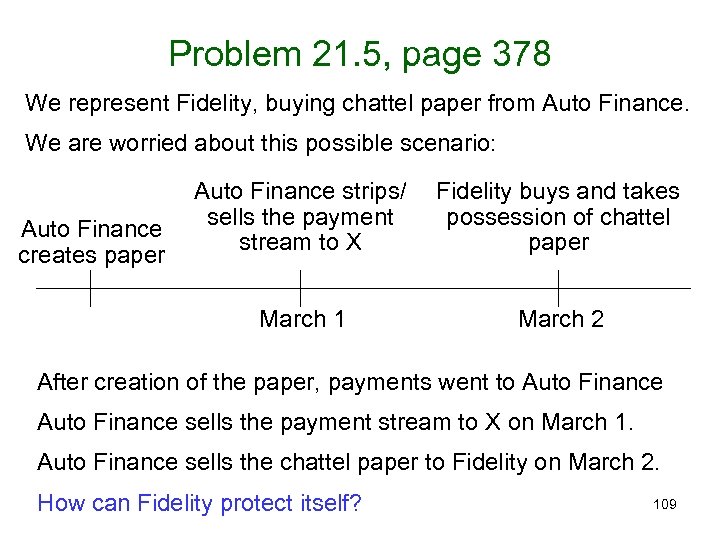

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. We are worried about this possible scenario: Fidelity buys and takes possession of chattel paper March 1 Auto Finance creates paper Auto Finance strips/ sells the payment stream to X March 2 After creation of the paper, payments went to Auto Finance sells the payment stream to X on March 1. Auto Finance sells the chattel paper to Fidelity on March 2. How can Fidelity protect itself? 109

Problem 21. 5, page 378 We represent Fidelity, buying chattel paper from Auto Finance. We are worried about this possible scenario: Fidelity buys and takes possession of chattel paper March 1 Auto Finance creates paper Auto Finance strips/ sells the payment stream to X March 2 After creation of the paper, payments went to Auto Finance sells the payment stream to X on March 1. Auto Finance sells the chattel paper to Fidelity on March 2. How can Fidelity protect itself? 109